- Home

- »

- Consumer F&B

- »

-

Beet Sugar Market Size And Share, Industry Report, 2030GVR Report cover

![Beet Sugar Market Size, Share & Trends Report]()

Beet Sugar Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (White, Brown, Liquid Sugar), By Application (Bakery, Beverages, Cosmetics), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-609-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Beet Sugar Market Summary

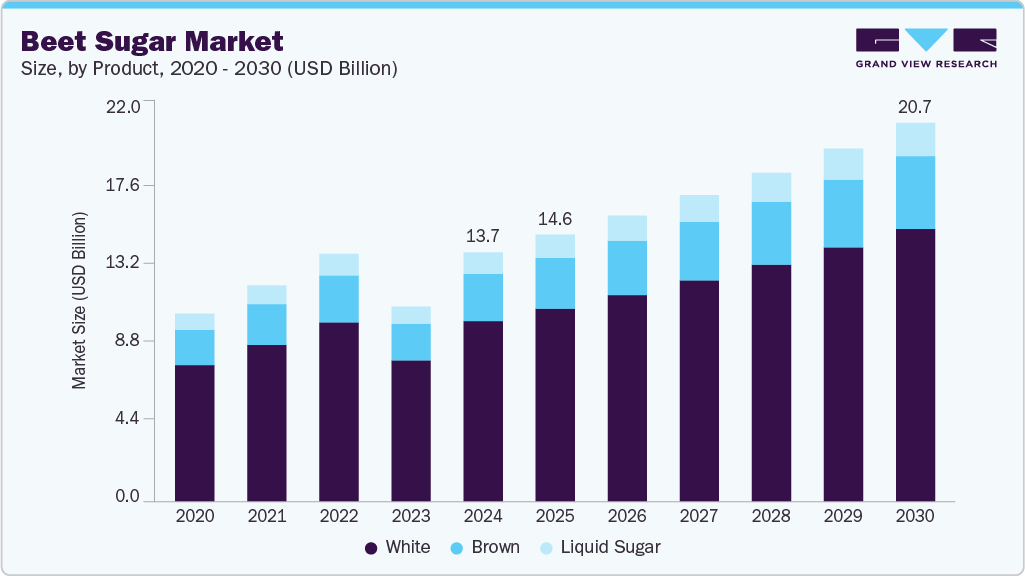

The global beet sugar market size was estimated at USD 13.65 billion in 2024 and is projected to reach USD 20.73 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. One primary reason is the rising consumer demand for natural and non-GMO sweeteners.

Key Market Trends & Insights

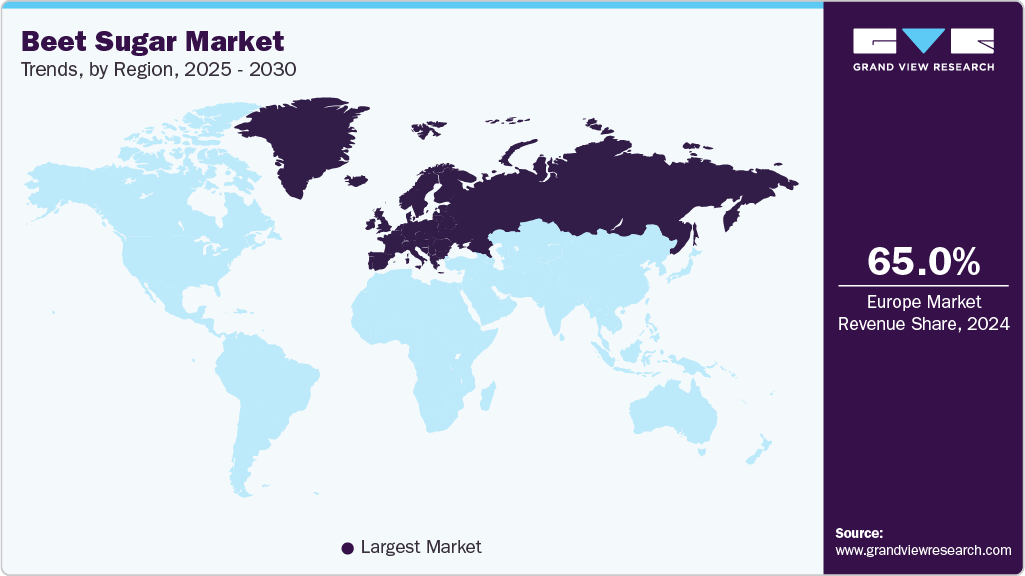

- Europe beet sugar market dominated the global market with a revenue share of about 65% in 2024.

- Russia beet sugar market is one of the largest producers and consumers of beet sugar, with revenue exceeding USD 3 billion in 2024.

- By product, the white beet sugar segment dominated with a revenue share of more than 72 % in 2024.

- By distribution, offline sales segment held the revenue share of about 68% in 2024.

- By application, the bakery segment held a revenue share of 37% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13.65 Billion

- 2030 Projected Market Size: USD 20.73 Billion

- CAGR (2025-2030): 7.2%

- Europe: Largest market in 2024

As health awareness increases globally, consumers gravitate towards clean-label products and natural ingredients, making beet sugar a preferred alternative to cane sugar and synthetic sweeteners. This trend is powerful in regions like Europe and North America, where consumers emphasize ingredient traceability and environmental impact.Another significant driver is the expanding application of beet sugar in various food and beverage sectors. Beet sugar is increasingly used in bakery products, beverages, flavored dairy items such as yogurts and desserts, and infant nutrition. Its natural sweetness and compatibility with dairy products make it attractive for manufacturers aiming to enhance flavor profiles while meeting consumer demand for healthier, natural ingredients. The growth of processed and packaged foods in emerging markets further fuels this demand, supported by strategic partnerships between beet sugar producers and food companies.

Sustainability and environmental considerations also play a crucial role in the market’s expansion. Beet sugar production generally has a lower water footprint and a shorter supply chain than cane sugar, mainly in temperate climates like Europe. This environmental advantage appeals to eco-conscious consumers and aligns with regulatory support for sustainable agriculture. The organic food segment, particularly in countries like Germany, has embraced organic and Demeter-certified beet sugar, bolstering market growth through premium product lines.

Technological advancements and government support have further propelled the beet sugar market. Improvements in sugar beet farming techniques and processing technologies have enhanced yield and product quality, making beet sugar more competitive. Additionally, various countries' government subsidies and favorable policies encourage beet sugar cultivation and production, helping stabilize supply and reduce costs. These factors contribute to the steady increase in market size and value.

The growing demand for bioethanol and other sugar-derived industrial products supports beet sugar market growth. Beet sugar is a raw material for ethanol production, which is gaining importance as a renewable energy source. This industrial application adds a new dimension to beet sugar demand beyond food and beverage uses, diversifying revenue streams for producers and strengthening market resilience.

Demographic and economic shifts, especially in emerging markets across Asia Pacific, are significant growth catalysts. Urbanization, rising disposable incomes, and changing dietary habits in countries like China and India increase the consumption of sweetened processed foods and beverages. With its cleaner processing profile and perceived health benefits, Beet sugar is well-positioned to capture market share in these regions. Producers are expanding distribution networks and customizing products to meet local tastes, ensuring sustained growth in these high-potential markets.

One major issue is the environmental impact of beet sugar cultivation and processing. Traditional beet sugar processing generates large amounts of waste such as pulp, lime sludges, and vinasse, and consumes significant energy and water. These by-products and resource demands contribute to pollution and environmental degradation, including water contamination and air pollution, which complicate sustainable production efforts. Climate change introduces further uncertainty and risk. Sugar beet is moderately sensitive to drought and extreme weather events, which are becoming more frequent and severe due to global warming. Changes in rainfall patterns and temperature can reduce yields and increase production risks, making it harder for farmers to maintain stable output levels and meet market demand consistently.

Product Insights

The white beet sugar market dominated with a revenue share of more than 72 % in 2024, due to its high purity, neutral flavor, and versatility across various applications such as baking, confectionery, and beverages. Its refined, distribution channel quality and rapid dissolution make it especially suitable for industrial food production and consumer products where consistency and appearance are critical. The growth of white beet sugar is driven by increasing consumer demand for non-GMO, locally grown sweeteners with a lower carbon footprint than cane sugar, particularly in Europe and North America. Additionally, its compliance with food quality standards and suitability for nutritional supplements and infant foods further boost its market expansion.

The brown beet sugar demand is expected to grow at a CAGR of 7.4% over the forecast period. This segment is gaining traction primarily because of its perceived health benefits and natural appeal. Unlike white sugar, brown sugar retains molasses, which provides antioxidants, minerals like iron and calcium, and a lower glycemic index, contributing to more stable energy release and digestive health benefits. This has led to increased demand in the bakery and gourmet food sectors, as well as among health-conscious consumers seeking natural and organic sweeteners. The rising popularity of artisanal and organic products and expanding e-commerce distribution channels support the rapid growth of the brown sugar market globally, especially in regions with growing health awareness.

Liquid beet sugar is experiencing robust growth due to its functional advantages in the food and beverage industry. Its high solubility makes it ideal for use in processed foods and beverages, where it acts not only as a sweetener but also as a binder, thickener, and preservative. The increasing demand for liquid sugar in beverages, including energy drinks, flavored dairy products, and the ready-to-drink distribution channel, fuels this segment’s expansion. Moreover, the convenience of liquid sugar in manufacturing processes and its ability to enhance product quality and shelf life contribute to its rising adoption across diverse food sectors.

Distribution Channel Insights

Offline sales distribution channel held the revenue share of about 68% in 2024. This includes supermarkets, hypermarkets, convenience stores, and specialty stores. Segment’s growth is driven by the wide accessibility and convenience these physical retail outlets offer to consumers, especially in regions where traditional shopping habits prevail. Supermarkets and hypermarkets allow consumers to inspect products physically, compare brands, and purchase in bulk, which is particularly important for staple items like sugar. Additionally, private-label beet sugar products in these stores helps attract price-sensitive customers, further boosting offline sales. This channel benefits from established supply chains and strong retailer relationships, supporting steady market expansion.

The online channel for beet sugar sales is growing rapidly due to increasing internet penetration, e-commerce adoption, and changing consumer shopping preferences, especially among younger, urban populations. Online distribution channels offer convenience, home delivery, and access to a broader variety of products, including organic, specialty, and niche beet sugar variants that may not be available in local stores. The rise of health-conscious consumers seeking natural and organic sweeteners fuels online demand, as these shoppers often research and purchase products digitally. Moreover, online retail allows manufacturers and brands to engage directly with consumers through targeted marketing and promotions, accelerating growth in this channel. Expanding online grocery distribution channels and digital payment systems further support this trend.

Application Insights

The bakery segment held a revenue share of 37% in 2024. Beet sugar is widely used in bakery items such as breads, cakes, pastries, and cookies due to its excellent sweetness, texture-enhancing properties, and ability to improve shelf life. The growth in this segment is fueled by increasing consumer demand for natural, non-GMO, and clean-label ingredients. As consumers become more health-conscious, beet sugar’s appeal as a locally sourced, environmentally friendly alternative to cane sugar grows, especially in Europe and North America. Expanding the processed and convenience food market in emerging economies contributes to rising bakery product consumption, thereby boosting beet sugar demand.

In confectionery products such as chocolates, candies, and sweets, beet sugar is preferred for its consistent quality, purity, and ability to blend well with other ingredients. The growth in this segment is driven by the rising global demand for premium and organic confectionery products that emphasize natural ingredients and sustainability. Consumers’ increasing awareness of the environmental impact of cane sugar production and preference for traceable, fair-trade sources further enhance beet sugar’s market share in confectionery. Moreover, innovations in product distribution channels that highlight health benefits and clean-label claims contribute to expanding beet sugar use in this category.

Beet sugar is extensively utilized in soft drinks, energy drinks, flavored dairy beverages, and fruit juices, where its rapid dissolution and neutral flavor are highly valued. The beverage sector’s growth is driven by the rising consumer preference for natural sweeteners with a lower glycemic index and better nutritional profiles than refined cane sugar or artificial sweeteners. Increasing urbanization, rising disposable incomes, and health trends promoting natural and clean-label products encourage manufacturers to incorporate beet sugar in their distribution channel. The expanding demand for energy drinks and functional beverages, especially in the Asia Pacific, also supports this growth.

Regional Insights

The North America beet sugar market was estimated at USD 1.64 billion in 2024. The growth of the beet sugar market in North America is primarily driven by increasing consumer demand for natural, non-GMO, and sustainable sweeteners amid rising health consciousness. The region’s well-established food and beverage industry actively incorporates beet sugar into bakery, beverages, and clean-label food products to meet consumer preferences for natural ingredients and lower environmental impact. Additionally, advanced agricultural practices and sustainability initiatives support efficient beet sugar production. The rise of organic and plant-based product trends and strategic marketing and e-commerce penetration by smaller brands further fuel market expansion in North America.

U.S. Beet Sugar Market Trends

The U.S. beet sugar demand is expected to reach USD 2.3 billion by 2030, growing at a CAGR of 7.8% over the forecast period. In the U.S., the beet sugar market benefits from a rapidly expanding food and beverage sector that favors clean-label and healthier sweeteners. Consumer awareness about the health benefits of beet sugar, such as its lower glycemic index and richer nutritional profile compared to refined cane sugar, is increasing demand. Government support for sustainable agricultural practices and investments in modern processing technologies have improved production efficiency. The U.S. market also sees innovation in flavored beet sugar blends and natural sweetener products, catering to health-conscious consumers and home bakers, which drives steady growth.

Europe Beet Sugar Market Trends

Europe beet sugar market dominated the global market with a revenue share of about 65% in 2024, leading global beet sugar production, supported by major companies like British Sugar and Cosun Beet Company, and benefits from favorable temperate climates. The region’s growth is propelled by strong consumer preference for locally sourced, organic, and non-GMO ingredients, especially in countries like Germany with a robust organic food culture. Environmental concerns and regulatory support for sustainable farming encourage eco-friendly beet sugar production with a lower carbon footprint than cane sugar. Innovations such as organic and Demeter-certified beet sugar lines targeting premium segments in bakery, beverages, and infant nutrition further enhance market growth.

Russia beet sugar market is one of the largest producers and consumers of beet sugar, with revenue exceeding USD 3 billion in 2024. Russia’s beet sugar market growth is driven by strong government support through protective tariffs, subsidies, and agricultural programs to reduce import dependency and boost domestic production. These policies have encouraged modernization of processing facilities and expansion of beet cultivation, resulting in significant output increases. Despite challenges like outdated infrastructure and storage losses, consolidation and investment by major players are improving efficiency. High domestic sugar prices and continued state backing position Russia as a growing beet sugar producer with expanding market influence.

Key Beet Sugar Company Insights

The competitive landscape of the beet sugar market is characterized by a mix of large multinational companies and regional cooperatives that dominate production, processing, and distribution. Key global players include Südzucker AG, Nordzucker AG, and Pfeifer & Langen from Germany, Tereos Group from France, Associated British Foods plc (British Sugar) from the UK, and major U.S.-based cooperatives such as American Crystal Sugar Company, Michigan Sugar Company, Amalgamated Sugar Company, and The Western Sugar Cooperative. These companies benefit from vertically integrated operations, controlling the supply chain from cultivation to processing and distribution, which ensures consistent product quality and cost efficiency.

Key Beet Sugar Companies:

The following are the leading companies in the beet sugar market. These companies collectively hold the largest market share and dictate industry trends.

- Südzucker AG

- Nordzucker AG

- British Sugar (Associated British Foods plc)

- Tereos Group

- Cosun Beet Company

- American Crystal Sugar Company

- Michigan Sugar Company

- Amalgamated Sugar Company

- Western Sugar Cooperative

- Southern Minnesota Beet Sugar Cooperative

- COFCO International

- Mitr Phol Group

- Dalmia Bharat Sugar and Industries Limited

- E.I.D. - Parry

- Rusagro Group

- Thai Roong Ruang Sugar Group

- Louis Dreyfus Company

- Wilmar International Ltd.

- The Savola Group

- Agrana Beteiligungs-AG

Beet Sugar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.60 billion

Revenue forecast in 2030

USD 20.73 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Südzucker AG; Nordzucker AG; British Sugar (Associated British Foods plc); Tereos Group; Cosun Beet Company; American Crystal Sugar Company; Michigan Sugar Company; Amalgamated Sugar Company; Western Sugar Cooperative; Southern Minnesota Beet Sugar Cooperative; COFCO International; Mitr Phol Group; Dalmia Bharat Sugar and Industries Limited; E.I.D. - Parry; Rusagro Group; Thai Roong Ruang Sugar Group; Louis Dreyfus Company; Wilmar International Ltd.; The Savola Group; Agrana Beteiligungs-AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beet Sugar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global beet sugar market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

White Beet Sugar

-

Brown Beet Sugar

-

Liquid Beet Sugar

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bakery

-

Beverages

-

Confectionary

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global beet sugar market was valued at USD 13.65 billion in 2024.

b. The global beet sugar market is expected to grow at a CAGR of 7.2% from 2025 to 2030.

b. The white beet sugar market is expected to exceed USD 14.5 billion by 2030. White beet sugar is the most widely used distribution channel of beet sugar due to its high purity, neutral flavor, and versatility across various applications such as baking, confectionery, and beverages. Its refined, distribution channel quality and rapid dissolution make it especially suitable for industrial food production and consumer products where consistency and appearance are critical. The growth of white beet sugar is driven by increasing consumer demand for non-GMO, locally grown sweeteners with a lower carbon footprint than cane sugar, particularly in Europe and North America. Additionally, its compliance with food quality standards and suitability for nutritional supplements and infant foods further boost its market expansion.

b. Some of the key players operating in the market include: - • Südzucker AG • Nordzucker AG • British Sugar (Associated British Foods plc) • Tereos Group • Cosun Beet Company • American Crystal Sugar Company • Michigan Sugar Company • Amalgamated Sugar Company • Western Sugar Cooperative • Southern Minnesota Beet Sugar Cooperative • COFCO International • Mitr Phol Group • Dalmia Bharat Sugar and Industries Limited • E.I.D. – Parry • Rusagro Group • Thai Roong Ruang Sugar Group • Louis Dreyfus Company • Wilmar International Ltd. • The Savola Group • Agrana Beteiligungs-AG

b. One primary reason is the rising consumer demand for natural and non-GMO sweeteners. As health awareness increases globally, consumers gravitate towards clean-label products and natural ingredients, making beet sugar a preferred alternative to cane sugar and synthetic sweeteners. This trend is powerful in regions like Europe and North America, where consumers emphasize ingredient traceability and environmental impact.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.