- Home

- »

- Food Safety & Processing

- »

-

Beverage Cans Market Size, Share And Growth Report, 2030GVR Report cover

![Beverage Cans Market Size, Share & Trends Report]()

Beverage Cans Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Aluminum, Steel), By Application (Carbonated Soft Drinks, Alcoholic Beverages), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-298-3

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beverage Cans Market Summary

The global beverage cans market size was estimated at USD 39.20 billion in 2023 and is projected to reach USD 59.61 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. An increasing consumption of beverages such as carbonated soft drinks, beer, and cider on a global level is driving the demand for beverage cans.

Key Market Trends & Insights

- The beverage cans market in North America held the largest revenue share of over 36.0% in 2023.

- U.S. beverage cans market is influenced by the high consumption of soft drinks and beer, which are increasingly made available in metal cans.

- Based on material, the global beverage cans market has been segmented into aluminum and steel.

- Based on the application, the beverage cans market is segmented into carbonated soft drinks, alcoholic beverages, fruits & vegetable juices, and other applications.

Market Size & Forecast

- 2023 Market Size: USD 39.20 Billion

- 2030 Projected Market Size: USD 59.61 Billion

- CAGR (2024-2030): 5.5%

- North America: Largest market in 2023

In addition, high recycling rate of aluminum cans and superior physical properties of metals over its alternatives is expected to drive the growth of beverage cans market during the forecast period.

Beverage cans offer exceptional convenience and portability, making them an attractive choice for on-the-go consumption. They are lightweight, easy to carry, and resealable, allowing consumers to enjoy their beverages at their convenience. This aspect is particularly appealing to urban populations with busy lifestyles and a preference for convenient packaging solutions. For instance, energy drink manufacturers have leveraged the portability of cans to cater to active consumers who demand readily available beverages during their workouts or outdoor activities.

In addition, the recyclability of beverage cans has become a significant driving factor due to the increasing environmental consciousness among consumers and companies. Aluminum cans are highly recyclable and can be recycled repeatedly without losing their quality, making them a sustainable packaging option. Many beverage companies are actively promoting their use of cans as part of their sustainability initiatives, appealing to eco-conscious consumers. For instance, in June 2023, Marlish Waters Ltd, a UK-based drinks company, launched a new 150 ml can format for its tonics and mixers beverage range. This new format is glass-free and made of aluminum, which is infinitely recyclable, cheaper, and easier to recycle than glass. The launch focused on four of the brand’s most popular SKUs including English Tonic Water, Premium Lemonade, Ginger Ale, and Soda Water.

Beverage cans offer a unique canvas for eye-catching designs and branding opportunities. Companies can leverage the 360-degree printable surface of cans to create visually appealing and distinctive packaging that stands out on retail shelves. This aspect is particularly important in the craft beer and flavored alcoholic beverage segments, where unique and creative can designs have become a key differentiator in the market.

Moreover, collaborations and agreements between raw material suppliers and beverage cans manufacturers are expected to foster innovation and drive new product development in the beverage cans market. For instance, in January 2024, Novelis, a major sustainable aluminum solutions provider and the global player in aluminum rolling and recycling, entered into a new agreement with Ardagh Group S.A., a global supplier in sustainable aluminum beverage packaging solutions. Under the contract, Novelis will supply aluminum beverage packaging sheets to Ardagh's metal production facilities in North America.

Market Concentration & Characteristics

Prominent beverage cans companies operating in market include Mahmood Saeed Can and End Industry Company Limited (MSCANCO), Kian Joo Can Factory Berhad, SWAN Industries (Thailand) Company Limited, GZI Industries Limited, Toyo Seikan Co., Ltd., Ball Corporation, Orora Packaging Australia Pty. Ltd., Olayan Group, Crown Holdings, Inc., Bangkok Can Manufacturing, CPMC Holdings Limited, CANPACK, Nampak Ltd., Ardagh Group S.A., Envases Group.

Companies are increasingly pursuing diversification strategies, expanding their product and service offerings to capitalize on cost and revenue synergies. This approach often involves strategic initiatives such as mergers and acquisitions among companies operating in the beverage cans market. For instance, in October 2023, Crown Holdings, Inc. completed the acquisition of Helvetia Packaging AG, a beverage can and end manufacturing facility in Saarlouis, Germany. Through the acquisition, Crown assumes Helvetia's existing customer base and accompanying contracts, as well as 200 current employees. The addition of the facility expands Crown's European beverage can platform into Germany and adds approximately one billion units of annual capacity, helping to serve the growing customer demand for infinitely recyclable beverage cans.

In August 2023, TricorBraun, a global packaging company, acquired CanSource, a provider of cans and custom packaging solutions for craft beverage makers. This acquisition strengthens TricorBraun's position in the North American beverage packaging market, expanding its offerings and services including more sustainable packaging options. CanSource started operating under the name CanSource, a TricorBraun company, with all team members remaining and working from existing locations.

Material Insights

Based on material, the global beverage cans market has been segmented into aluminum and steel. Aluminum is anticipated to dominate the overall market with a revenue market share of over 96.0% in 2023. The usage of aluminum as a raw material for packaging beverages has increased as it can be easily cooled and heated for sterilization, along with its property of maintaining the structure and integrity of packaged products.

On the other hand, steel has an ambient nature and cans made from it need not be cooled during packaging and shipping, which simplifies logistics and enables cost-saving storage. Steel cans are the most tamper-resistant choice for packaging beverages as they protect beverages from light, water, and air. Steel cans also extend the shelf life of beverages, thereby reducing wastage.

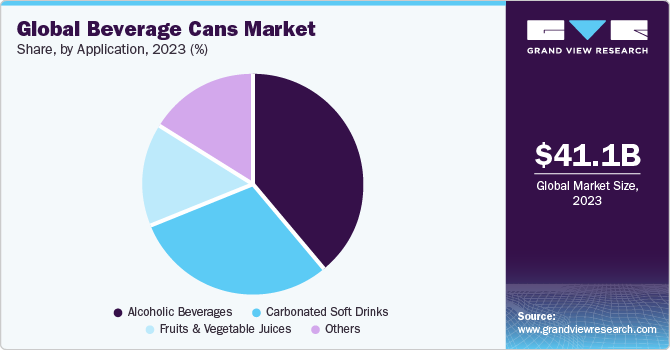

Application Insights

Based on the application, the beverage cans market is segmented into carbonated soft drinks, alcoholic beverages, fruits & vegetable juices, and other applications. Alcoholic beverages application accounted for largest revenue share of over 38.0% in 2023. The high share is attributable to increasing demand for alcoholic beverages among millennials, a surge in disposable income, and a rise in consumer demand for premium/high-quality alcoholic beverage products.

The fruit & vegetable juices application segment is anticipated to grow at a fastest CAGR of 6.1% during the forecast period. High demand for 100% real fruit juices by the young population coupled with increasing consumption of vegetable juices such as tomato juice in the U.S. is expected to drive the demand for fruit and vegetable juices. In addition, the growing consumption of vegetable juices for weight reduction with an increase in consumer consciousness toward weight management is further expected to drive the market growth.

Regional Insights

The beverage cans market in North America held the largest revenue share of over 36.0% in 2023. This positive outlook can be attributed to the high consumption of canned beverages during the Major League Baseball games and other sports events in the region, owing to their ease of portability, is expected to augment the market growth over the forecast period.

U.S. Beverage Cans Market Trends

U.S. beverage cans market is influenced by the high consumption of soft drinks and beer, which are increasingly made available in metal cans. The U.S. beverage cans market is characterized by the high consumption of beverages, such as cold coffee, fruit juices, frappes, iced teas, and flavored sodas, by the U.S. population. In addition, the regulations on single-use plastic packaging in the U.S. are likely to hamper the growth of plastic packaging in the country. The high penetration of organized retail across the country has significantly contributed to the large share of plastic packaging in the country. However, several U.S. states, including California, Connecticut, Delaware, Hawaii, Maine, New York, Oregon, and Vermont, have banned the use of single-use plastics to curb plastic pollution, thus benefiting the growth of metal cans market in the country.

The Canada beverage cans market is expected to witness growth, owing to the increase in the recycling rate of aluminum in the country. The efforts by the government to collect aluminum waste and the presence of a large number of aluminum recycling manufacturers in the country are expected to boost the availability of metal for manufacturing beverage cans. In December 2023, Rio Tinto and Giampaolo Group completed a transaction to form the Matalco joint venture, to meet the growing demand from manufacturers for low-carbon materials. The joint venture will enable Rio Tinto to provide a broader range of high-quality and low-carbon, primary, recycled, and blended aluminum products. The investment will expand Rio Tinto’s aluminum business into Canada, where the demand for recycled aluminum is increasing, driven by the transportation, construction, and packaging sectors. Hence, this positive outlook is expected to ensure the abundant availability of the metal for the production of beverage cans, thus benefiting market growth in the country.

Europe Beverage Cans Market Trends

Europe is the second leading region in terms of value in the beverage cans market and accounted for a revenue share of 25.3% in 2023. The region has experienced increased demand for the personalization of beverages and beverage cans. Besides, the significant presence of many of the prominent beverage manufacturing companies in the region is positively influencing the beverage packaging industry, including the beverage cans market across Europe. Some of the major beverage-producing companies operating in Europe are AB InBev, Diageo, Heineken N.V., Pernod Ricard, Carlsberg Breweries A/S, The Coca-Cola Company, PepsiCo, Red Bull, and Nestlé.

The France beverage cans market is expected to grow at a value CAGR of 3.4% over the forecast period owing to increasing demand for sustainable and recyclable packaging solutions in the country. Several large-sized consumer brands, including beverage companies such as Auchan Retail, Bouvard Biscuits, Carrefour, Casino, Coca-Cola Europacific Partners, Danone, LSDH, Monoprix, Nestlé France, Système-U, and Unilever, have signed the aforementioned pact. Therefore, end-use companies are expected to opt for less plastic or focus more on recycled packaging products in order to ensure sustainability in packaging. This is expected to bolster the demand for metal packaging solutions such as aluminum and steel cans for the beverage industry in the country.

Asia Pacific Beverage Cans Market Trends

The Asia Pacific beverage cans market is anticipated to grow at a fastest CAGR of 7.0% during the forecast period. The region is particularly witnessing growth on account of the increasing demand for packaged beverages from the emerging economies of the region, including India and Australia, among others. In addition, changing consumer preferences plays a significant role in driving the beverage cans market in Asia Pacific.

The China beverage cans market is expected to grow during the forecast period.The presence of major aluminum manufacturers, such as Aluminum Corporation of China Limited, Luneng Jinbei - Yuanping Alumina Refinery, Shandong Weiqiao Aluminum and Power Co., Ltd., and Shandong Xinfa Aluminium Group, in the country has led to an abundance in the supply of the metal, thus making it available at affordable prices for the manufacturers of beverage cans. The recycling rate of metal in the country is quite low compared to that in developed economies; however, it does not have a considerable effect on the beverage cans market, as the demand is met by the production of low-cost virgin aluminum produced in the country.

Central & South America Beverage Cans Market Trends

Central & South America beverage cans market is projected to expand at a moderate CAGR from 2024 to 2030 due to the rising middle-class population, especially in countries such as Brazil, Argentina, and Chile. Moreover, sports such as football is widely followed in South American countries, particularly in Brazil, Argentina, Uruguay, Chile, and Colombia. During major tournaments and matches, fans often gather to watch the games in football arenas. These social gatherings lead to increased consumption of beverages, including carbonated soft drinks, beer, and energy drinks, which are commonly packaged in cans, driving the growth of the beverage cans market in the region.

The Brazil beverage cans market is expected to register a healthy growth rate over the forecast period. The growing middle-class population in the country has exhibited continuous demand for premium soft drink beverages and new flavored drinks, which translates into a huge potential market for beverage cans over the forecast period. The demand for beverage cans is also expected to be influenced by sports events such as the annual football leagues, CONCACAF Champions League, Copa Libertadores, and Big-League World Series.

Middle East & Africa Beverage Cans Market Trends

The beverage cans market in Middle East & Africa is influenced increasing disposable income of consumers in the Middle East and the presence of a large base of the middle-aged and young population. The emergence of food & beverages as a potential industry for foreign investments is further supported by the easy availability of workforce and low production capacity of food in African economies. In Africa, prevalent food production patterns, changing lifestyles of the masses, and existing marketing practices have led to the rising consumption of processed food & beverage items.

The South Africa Beverage Cans market growth can be attributed to an increasing demand for alcoholic beverages such as wines, beers, and ciders across the country. This outlook is driving alcoholic beverage manufacturers to launch new canned alcoholic beverages. For instance, in April 2023, Nice Beverage Company, a Cape Town-based alcoholic beverage manufacturer launched UNFLTRD canned wines with refreshing flavors. South Africa has witnessed a shift in consumer preferences wherein the younger populations are looking toward consuming low alcohol by volume (ABV) drinks, which can further create more growth opportunities for the beverage cans market in South Africa.

Key Beverage Cans Company Insights

The market consists of a significant number of companies producing beverage cans. Beverage Cans industry has been witnessing a significant number of new product developments and launches over the past few years in order to strengthen their market presence.

-

In January 2024, NOMOQ, a pioneer and leading provider of digitally printed cans in Europe, launched its Blank Cans Service for European drink brands. This new offering includes blank (undecorated) aluminum beverage cans, which expands NOMOQ's product range beyond its core business of digitally printed cans. This initiative is expected to provide greater flexibility and customization options for European drink brands, allowing them to create unique and personalized packaging solutions for their products.

-

In June 2023, Ball Corporation showcased its latest aluminum can and bottle portfolio at the BevNET Live Summer 2023 event. This showcase included new supply locations for 6.8 oz, 8.4 oz, and 250 mL can sizes, as well as their exclusive Alumi-Tek aluminum bottles. In addition, the company sponsored the BevNET Live Official Happy Hour during the event, encouraging attendees to explore the latest innovations in beverage packaging.

Key Beverage Cans Companies:

The following are the leading companies in the Beverage Cans market. These companies collectively hold the largest market share and dictate industry trends.

- Ball Corporation

- Ardagh Group S.A.

- Toyo Seikan Co., Ltd.

- CPMC Holdings Limited

- Orora Packaging Australia Pty. Ltd.

- CANPACK

- Crown Holdings, Inc.

- Mahmood Saeed Can and End Industry Company Limited (MSCANCO)

- Kian Joo Can Factory Berhad

- SWAN Industries (Thailand) Company Limited

- GZI Industries Limited

- Olayan Group

- Bangkok Can Manufacturing

- Nampak Ltd.

- Envases Group

Beverage Cans Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 43.21 billion

Revenue forecast in 2030

USD 59.61 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, volume in billion units, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia, Belarus; Bulgaria; Czech Republic; Poland; Hungary; China; Japan; India; Australia; South Korea; Kazakhstan; Uzbekistan; Tajikistan; Brazil; Argentina; Peru; Chile; Colombia; South Africa; Ghana; Nigeria; Kenya; Mauritius; Egypt; Iran; Kuwait; Israel; Saudi Arabia; UAE

Key companies profiled

Mahmood Saeed Can and End Industry Company Limited (MSCANCO); Kian Joo Can Factory Berhad; SWAN Industries (Thailand) Company Limited; GZI Industries Limited; Toyo Seikan Co., Ltd.; Ball Corporation; Orora Packaging Australia Pty. Ltd.; Olayan Group; Crown Holdings, Inc.; Bangkok Can Manufacturing; CPMC Holdings Limited; CANPACK; Nampak Ltd.; Ardagh Group S.A.; Envases Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beverages Cans Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global beverage cans market report on the basis of material, application, and region:

-

Material Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

-

Aluminum

-

Steel

-

-

Application Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

-

Carbonated Soft Drinks

-

Alcoholic Beverages

-

Fruits & Vegetable Juices

-

Other Applications

-

-

Regional Outlook (Revenue, USD Billion; Volume, Billion Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Belarus

-

Bulgaria

-

Czech Republic

-

Poland

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Kazakhstan

-

Uzbekistan

-

Tajikistan

-

-

Central & South America

-

Brazil

-

Argentina

-

Peru

-

Chile

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Ghana

-

Nigeria

-

Kenya

-

Mauritius

-

Egypt

-

Iran

-

Kuwait

-

Israel

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global beverage cans market was estimated at USD 41.14 billion in the year 2023 and is expected to reach USD 43.21 billion in 2024.

b. The global beverage cans market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 59.61 billion by 2030.

b. Aluminum segment by material emerged as a dominating region with a revenue share of 96.0% in the year 2023. Aluminum is infinitely recyclable without losing its properties or quality. This characteristic aligns with the growing emphasis on sustainability and environmental consciousness in the beverage industry.

b. The key market player in the global beverage cans market includes Mahmood Saeed Can and End Industry Company Limited (MSCANCO), Kian Joo Can Factory Berhad, SWAN Industries (Thailand) Company Limited, GZI Industries Limited, Toyo Seikan Co., Ltd., Ball Corporation, Orora Packaging Australia Pty. Ltd., Olayan Group, Crown Holdings, Inc., Bangkok Can Manufacturing, CPMC Holdings Limited, CANPACK, Nampak Ltd., Ardagh Group S.A., and Envases Group.

b. Increasing consumption of alcoholic beverages, increasing ban on plastic packaging, and increasing government initiatives for recycling of aluminum material is expected to drive the beverage can market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.