- Home

- »

- Homecare & Decor

- »

-

Bike Market Size, Share And Trends, Industry Report, 2033GVR Report cover

![Bike Market Size, Share & Trends Report]()

Bike Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Conventional, Electric), By Product (City/Commuter Bikes, Road Bikes), By Price Range, By End-use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-628-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bike Market Summary

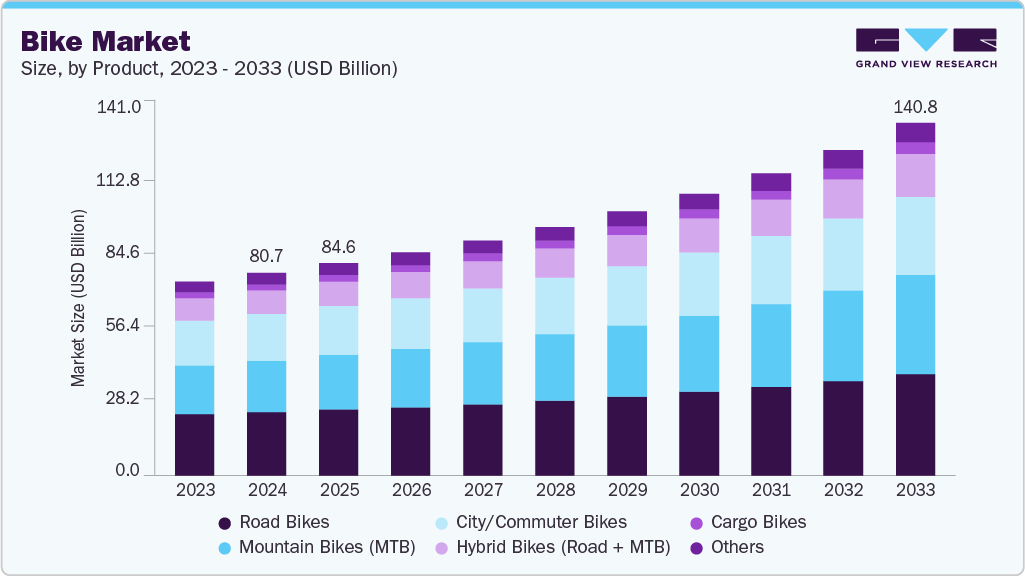

The global bike market size was estimated at USD 80.73 billion in 2024 and is projected to reach USD 140.83 billion by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The industry is being shaped by a sustained transition toward electrified and higher-value product segments, and it is being positioned as a strategic component of urban mobility, last-mile logistics, and leisure demand.

Key Market Trends & Insights

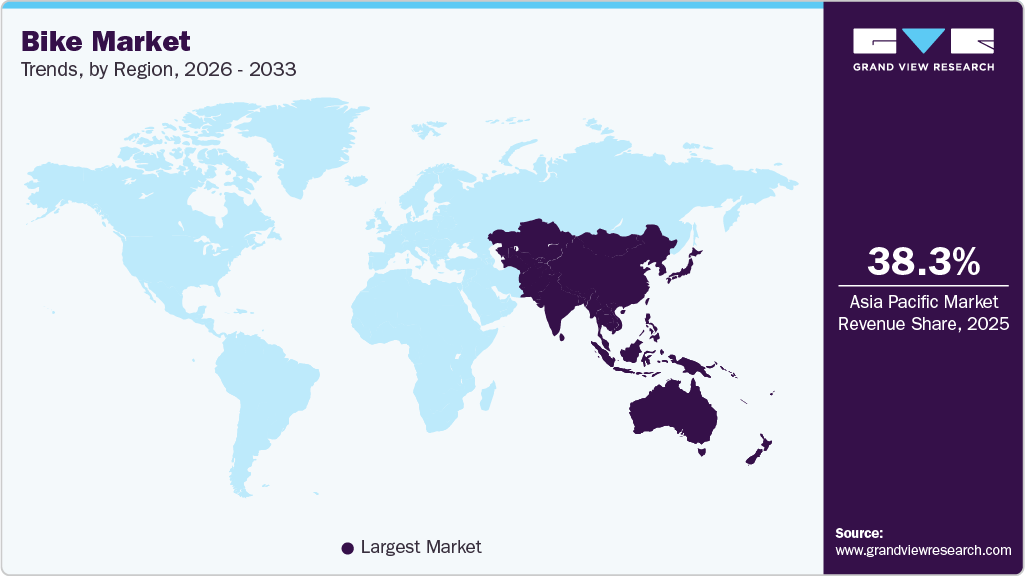

- The Asia Pacific bike market held the largest share of 37.88% in 2024.

- The bike industry in U.S. is expected to grow steadily over the forecast period.

- By type, conventional bikes held the highest market share of 73.12% in 2024.

- In terms of product, road bikes held the highest market share in 2024.

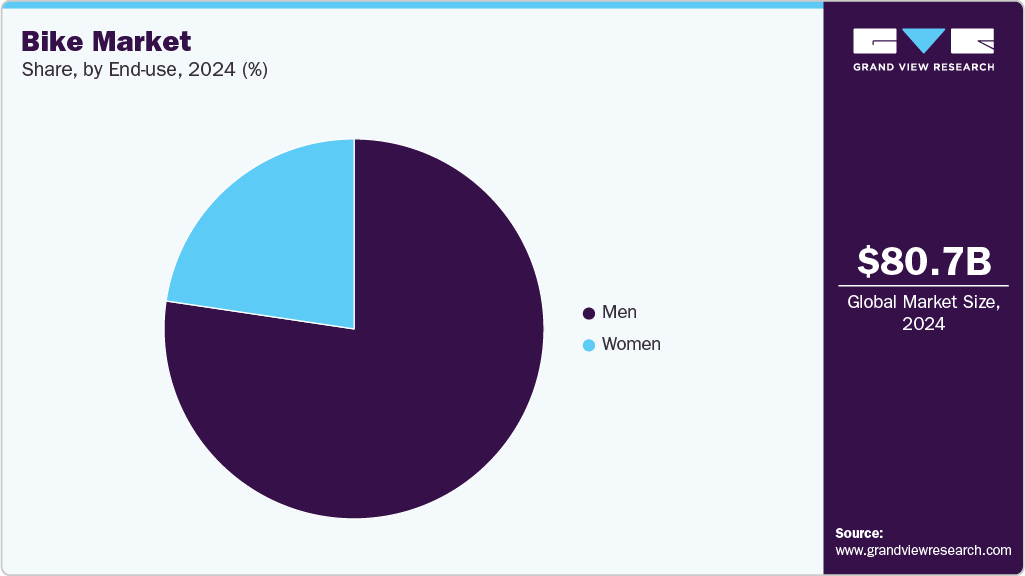

- Based on end use, the men’s category held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 80.73 Billion

- 2033 Projected Market Size: USD 140.83 Billion

- CAGR (2025-2033): 6.6%

- Asia Pacific: Largest market in 2024

Revenue growth has been concentrated in electrically assisted bicycles (e-bikes), while traditional pedal-only categories have continued to service large-volume, lower-price tiers. Manufacturers and distributors have prioritized investment in product differentiation, after-sales services, and digital retail channels to capture expanding addressable markets.Governments worldwide are significantly contributing to efforts to promote cycling. In 2024, the European Union signed the European Declaration on Cycling, formally recognizing the bicycle as a climate-friendly form of transportation and committing to expanded cycling infrastructure across all member states. Simultaneously, cities such as Tokyo, Paris, and Bogotá are redesigning urban spaces with dedicated bicycle lanes, subsidized parking stations, and public bike-sharing systems. India’s “Cycle4Change Challenge,” supported by the Ministry of Housing and Urban Affairs, has also mobilized over 100 cities to implement non-motorized transit initiatives. These policies are not only making cities more bike-friendly but also reinforcing consumer confidence in the bicycle as a long-term transport solution.

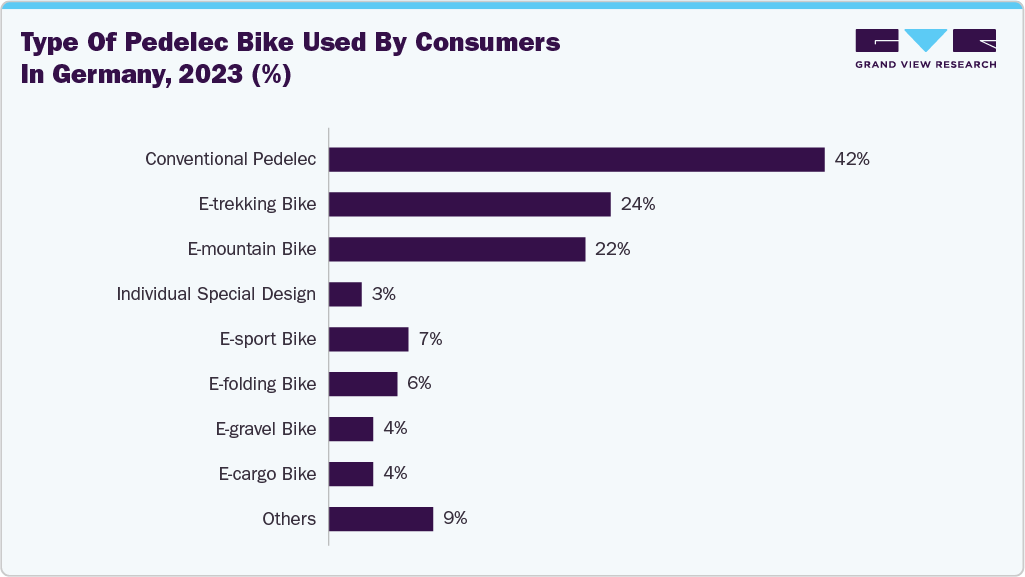

In Germany, more than 11 million bicycles were sold in 2023, with e-bikes making up over 50% of all sales. The U.S. also reported record bicycle imports in the same year, signaling strong domestic demand despite supply chain challenges. The appeal of cycling has expanded well beyond commuting. Recreational cycling, endurance biking, and mountain biking have all experienced substantial growth. Consumers are increasingly investing in high-performance bicycles, advanced gear, and customized accessories, underscoring both a recreational and aspirational product.

Manufacturers are integrating smart technology into bikes, such as app-connected speedometers, built-in lighting systems, anti-theft GPS, and even biometric sensors for performance tracking. Lightweight frame materials like carbon fiber and titanium are becoming standard in both professional and premium lifestyle bicycles, offering better efficiency and durability. Meanwhile, the e-bike category continues to dominate innovation, with foldable electric bicycles, long-range commuter models, and cargo bicycles for family or commercial use driving segment differentiation.

Ownership preferences are also shifting, instead of traditional one-time purchases, many urban consumers prefer bicycle subscription services that include regular maintenance, upgrades, and even theft protection. In cities such as Amsterdam, Copenhagen, and Bengaluru, bike-sharing and micro-leasing platforms have become vital to urban mobility networks, especially for students, freelancers, and commuters. These service-based models reduce entry barriers and support flexible, affordable access to high-quality bicycles.

Brand positioning and marketing have also evolved. The bicycle is part of the broader “wellness lifestyle,” promoted through social media campaigns, fitness influencer endorsements, and urban design narratives. Mobile apps such as Strava, Ride with GPS, and Komoot are building global cycling communities, encouraging digital engagement and long-term brand loyalty. These platforms are especially popular among young professionals and fitness enthusiasts who view bicycles as essential to both physical health and social identity.

Consumer Insights

The adoption of e-bikes across European and other global markets has been influenced not only by mobility requirements but also by shifting consumer lifestyles, attitudes, and personal values. An examination of France, Germany, and the United Kingdom demonstrates how e-bike ownership is strongly associated with behavioral patterns and individual interests that extend beyond basic transportation.

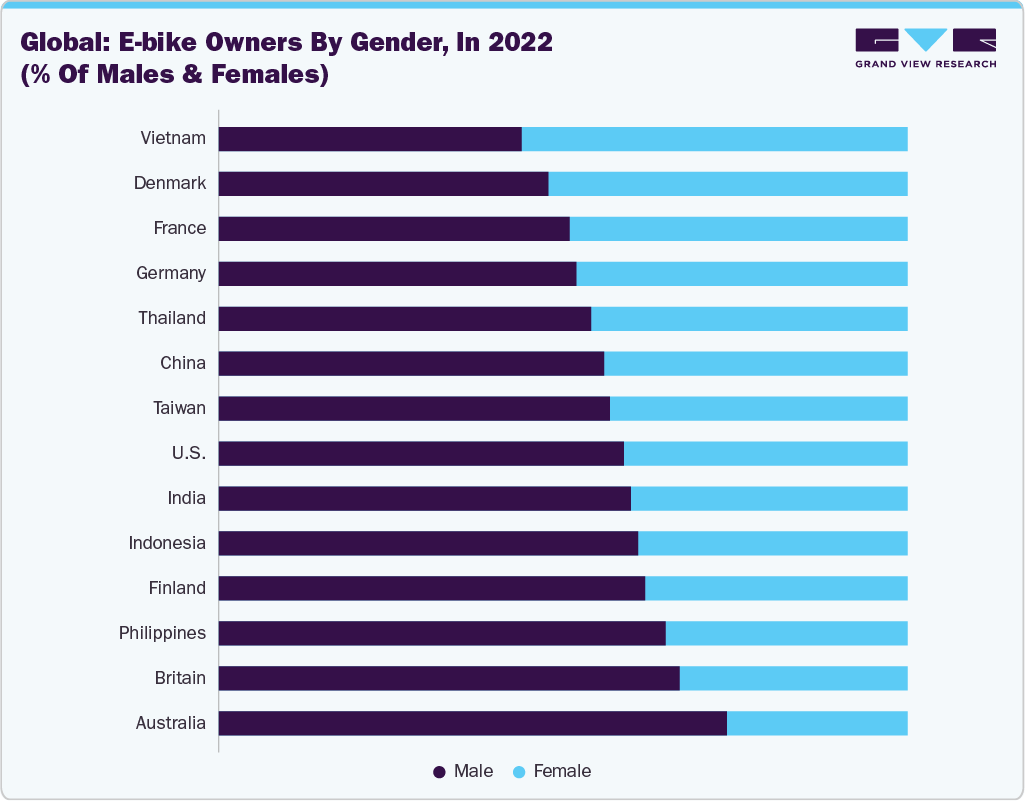

According to the YouGov e-bike survey in 2022, in all 17 markets except Vietnam and Denmark, a majority of e-bike owners were male. In Germany and France, the difference in e-bike ownership between males and females was minor. However, stark differences were observed in the British and Australian markets, albeit among very small ownership groups.

The survey further claimed that 16% of consumers in France reported enjoying cycling during their leisure time. French e-bike owners were found to be more engaged with environmental and sustainability-related news compared to the general population (40% versus 27%). In addition, they were more likely to perceive themselves as financially secure (53% versus 40%), show greater support for local businesses (75% versus 63%), and participate in weekly exercise routines (70% versus 53%).

There has been a notable shift in consumer adoption patterns within the U.S. e-bike market over the past years. According to a YouGov survey, in the U.S., three-quarters (74%) of e-bike owners used their e-bike at least once a week; however, regularity of usage seems to have slid slightly year on year. While daily usage declined from 47% to 40%, there has been an increase in weekly usage, rising by 3% to reach 34%, and slight gains were observed in monthly (12% to 13%) and occasional use (10% to 14%).

This suggests that although the most intensive usage segment (daily riders) contracted, broader consumer engagement with e-bikes has expanded, reflecting a diversification in riding frequency. The trend points to e-bikes transitioning from being a mode of transport dominated by heavy users toward becoming a more mainstream option accessible to casual and lifestyle-driven riders, signaling a maturing stage in consumer adoption.

Trump Tariff Impact

In 2025, the steep tariffs imposed by the U.S. government on imported bikes and bike components, especially those originating in China, are having substantial ripple effects across the global bicycle industry. Duties on e-bikes and regular bicycles have reportedly surged, in some cases reaching over 70%-80% when stacked with earlier tariffs and additional “reciprocal” levies.

These measures are raising costs for importers and domestic retailers, forcing many brands to hike consumer prices, delay or cancel shipments, and reconfigure supply chains. For firms that rely heavily on Chinese components, frames, drivetrains, wheels, among others, this has meant serious margin compression or even questions of viability in certain product lines.

Type Insights

Conventional bikes accounted for a revenue share of 73.12% of the global market in 2024, due to their affordability, widespread availability, and strong consumer preference across both developed and developing regions. These bicycles continue to be the go-to choice for everyday commuting, fitness, and recreational use, especially in countries where cycling is a key mode of transportation. Their simple mechanical structure, ease of repair, and low ownership costs make them especially appealing to cost-conscious and practical users. Furthermore, the rising awareness around health, sustainability, and eco-friendly mobility has further reinforced the demand for traditional bicycles.

Electric bikes are projected to grow at a CAGR of 7.1% over the forecast period. With rising urban congestion and growing environmental concerns, electric bicycles offer a sustainable alternative to traditional vehicles, especially for short to medium-distance travel. Technological advancements in battery performance, lightweight materials, and smart features have enhanced their appeal among commuters and recreational riders alike. Government incentives, infrastructure development, and a shift toward low-emission transportation are further accelerating adoption. As a result, electric bicycles are becoming a preferred choice for modern urban mobility across diverse age groups.

Product Insights

Road bikes accounted for a revenue share of 31.25% in 2024 in the global bike industry. Lightweight frames, aerodynamic design, and efficiency on paved surfaces make them ideal for high-speed and endurance riding. The price range for road bicycles varies significantly, catering to different consumer segments. Low-range models like the Schwinn Volare 1400 start around USD 500, mid-range options such as the Specialized Allez or Trek Domane AL 2 fall between USD 1,000 to USD 2,000, while high-end models like the Cervélo R5 or Pinarello Dogma F can exceed USD 10,000. This wide pricing spectrum enables road bicycles to appeal to both casual riders and professional athletes, contributing to their substantial market share.

Cargo bikes are projected to grow at a CAGR of 8.0% over the forecast period, driven by the rise of sustainable urban logistics solutions. In recent years, U.S. cities such as New York, Portland, and Chicago have encouraged the adoption of eco-friendly delivery modes to reduce congestion and carbon emissions caused by traditional vans and trucks. Cargo bikes offer a cost-efficient, zero-emission alternative for last-mile delivery, which is increasingly valued as e-commerce volumes continue to grow. Companies like UPS and Amazon have piloted cargo bike fleets in dense urban areas, demonstrating their practicality in navigating traffic-congested zones while aligning with corporate sustainability commitments.

Application Insights

Bikes for personal/individual application accounted for a revenue share of 85.78% in 2024. With increasing awareness of health and sustainability, more individuals are turning to cycling as a cost-effective, eco-friendly, and convenient mode of transport. The widespread availability of various bike types, such as road, mountain, hybrid, and city bicycles, caters to diverse riding needs and personal preferences. In addition, the growing influence of social fitness trends, cycling communities, and wellness-focused lifestyles has encouraged more people to incorporate biking into their daily routines, fueling demand in this segment.

Bikes for commercial application are projected to grow at a CAGR of 5.9% over the forecast period, driven by their expanding role across various industries such as logistics, tourism, public bike-sharing, food delivery, and corporate mobility programs. Businesses are increasingly using bicycles for last-mile delivery in congested urban areas, while electric cargo bikes are gaining traction among courier and postal services for their ability to carry heavy loads efficiently. In the tourism sector, guided city bike tours and rental services are becoming popular, especially in eco-conscious travel destinations. Furthermore, many organizations are introducing bicycles into their workplace wellness or green commuting initiatives. These diverse and growing applications are making bikes an essential tool in commercial operations.

End-use Insights

Men accounted for a revenue share of 77.35% in 2024 in the global bike industry. Traditionally, male consumers have shown a strong inclination toward performance-oriented bicycle categories such as road bikes and mountain bikes, which typically command higher price points and drive greater revenue. Besides, men are more likely to invest in premium models and cycling accessories, further boosting overall sales. Marketing strategies and product designs from leading brands also tend to target male preferences, contributing to their dominant share in the bicycle market.

The women segment is projected to grow at a CAGR of 7.1% over the forecast period, driven by increasing health awareness, rising interest in outdoor activities, and the growing availability of women-specific bicycle designs. As more cities invest in cycling infrastructure and promote safe, inclusive commuting, women are adopting bicycles not only for fitness but also for daily travel and leisure. The industry has responded with ergonomically designed frames, lightweight builds, and enhanced comfort features tailored to female riders, which is encouraging greater participation. Notably, social fitness trends and community riding events have further contributed to the growing appeal of bicycling among women, boosting market growth in this segment.

Regional Insights

The North America bike market held 24.47% of the global revenue in 2024. Increased investment in cycling lanes, bike-sharing programs, and sustainable urban transport initiatives across major cities has encouraged more people to adopt cycling. In addition, rising health consciousness, the popularity of outdoor activities, and a surge in e-bike adoption have further fueled sales across various segments. The presence of established brands, wide product availability, and strong retail networks also contributed to the region’s substantial market share.

U.S. Bike Market Trends

The U.S. bike industry registered a revenue share of 74.66% in 2024. Urban development projects promoting alternative transportation have led to increased bicycle usage for commuting and leisure. The rise in popularity of electric bicycles, coupled with demand for performance-oriented models like mountain and road bikes, has further boosted sales. Moreover, strong distribution channels, brand presence, and a shift toward eco-conscious travel have made bicycles a preferred choice among a wide demographic, driving the industry's dominant revenue share within the region.

Europe Bike Market Trends

The Europe bike industry accounted for a revenue share of around 26.09% in 2024, supported by the region's strong cycling culture, government-backed green mobility initiatives, and advanced urban infrastructure. Many European cities have integrated bicycle-friendly policies, including dedicated cycling lanes, subsidies for e-bike purchases, and restrictions on car usage in city centers, all of which have encouraged more people to adopt cycling for daily commutes and leisure. The popularity of both traditional and electric bicycles continues to rise, driven by environmental awareness and a growing preference for sustainable transportation. Predominantly, high-quality manufacturing, a well-established retail network, and widespread participation in cycling activities have helped maintain Europe’s leading position in the global market.

Asia Pacific Market Trends

The Asia Pacific bike industry logged a revenue share of 37.88% in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2033, driven by rapid urbanization, rising population, and increasing demand for affordable, efficient transportation. Many countries such as China, India, and Indonesia are witnessing a surge in bicycle usage for commuting and recreational purposes due to traffic congestion and rising fuel costs. Government initiatives promoting eco-friendly mobility, along with infrastructure improvements like dedicated cycling lanes, are further supporting market growth. Besides, the rising popularity of electric bicycles and the expansion of domestic manufacturing capabilities are making bikes more accessible to a broader population, fueling sustained industry expansion across the Asia Pacific.

Key Bike Company Insights

The global industry for bikes features a combination of well-established manufacturers and emerging brands that continue to innovate in design, performance, and sustainability to meet evolving consumer demands. Leading companies prioritize quality, durability, and rider comfort while integrating advanced materials and technology to enhance cycling experience. By partnering with large-scale retailers, sporting goods stores, and mobility service providers, and strengthening their presence on e-commerce platforms, these players ensure wide accessibility and market penetration. Furthermore, strategic collaborations and agile manufacturing capabilities allow key industry participants to develop specialized bicycles, such as electric, folding, or cargo bikes, and effectively cater to niche segments and emerging urban mobility markets across the globe.

Key Bike Companies:

The following are the leading companies in the bike market. These companies collectively hold the largest market share and dictate industry trends.

- Giant Manufacturing Co. Ltd.

- Trek Bicycle Corporation

- Merida Industry Co., Ltd.

- Specialized Bicycle Components

- Accell Group N.V.

- Hero Cycles Ltd.

- Pon Holdings (Pon.Bike)

- Scott Sports SA

- Cube Bikes (Cube GmbH)

- Avon Cycles Ltd.

Recent Developments

-

In October 2024, Shimano announced the release of its Q’Auto automatic shifting system, slated for launch in 2025. This innovative technology enables fully automatic, battery-free shifting on mechanical bikes, eliminating the need for manual gear changes. The system utilizes a dynamo-powered freehub that generates electricity as the rider pedals, storing energy in a capacitor to power the shifting mechanism.

-

In April 2024, Giant introduced updated versions of its Trance X and Trance X Advanced models, equipped with reach-adjustable headsets, enhanced rear travel, and wireless T-Type drivetrains for improved trail versatility. Suspension specialist Cane Creek revealed the Tigon shock, designed to combine the suppleness of coil shocks with the responsiveness of air-sprung systems.

Bike Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.58 billion

Revenue forecast in 2033

USD 140.83 billion

Growth rate

CAGR of 6.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in thousand units, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, price range, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Giant Manufacturing Co. Ltd.; Trek Bicycle Corporation; Merida Industry Co., Ltd.; Specialized Bicycle Components; Accell Group N.V.; Hero Cycles Ltd.; Pon Holdings (Pon.Bike); Scott Sports SA; Cube Bikes (Cube GmbH); Avon Cycles Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bike Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bike market report on the basis of type, product, price range, end-use, application, and region.

-

Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Conventional

-

Electric

-

-

Product Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

City/Commuter Bikes

-

Road Bikes

-

Mountain Bikes (MTB)

-

Hybrid Bikes

-

Cargo Bikes

-

Others

-

-

Price Range Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

City/Commuter Bikes

-

Low (USD 200 to 500)

-

Mid-Range (USD 500 to USD 1,000)

-

High End (Above USD 1,000)

-

-

Road Bikes

-

Low (USD 400 to 1,000)

-

Mid-Range (USD 1,000 to USD 2,500)

-

High End (Above USD 2,500)

-

-

Mountain Bikes (MTB)

-

Low (USD 300 to 7,00)

-

Mid-Range (USD 700 to USD 1,800)

-

High End (Above USD 1,800)

-

-

Hybrid Bikes (Road & MTB)

-

Low (USD 300 to 700)

-

Mid-Range (USD 700 to USD 1,500)

-

High End (Above USD 1,500)

-

-

Cargo Bikes

-

Low (USD 500 to 2,500)

-

Mid-Range (USD 2,500 to USD 4,500)

-

High End (Above USD 4,500)

-

-

Others

-

Low (USD 200 to 800)

-

Mid-Range (USD 800 to USD 1,200)

-

High End (Above USD 1,200)

-

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Men

-

Women

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

Personal/Individual

-

Commercial

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bike market was estimated at USD 80.73 billion in 2024 and is expected to reach USD 84.58 billion in 2025.

b. The global bike market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 140.83 billion by 2033.

b. Road bikes accounted for the largest share of 31.25% of the bike market in 2024. Lightweight frame, aerodynamic design, and efficiency on paved surfaces make them ideal for high-speed and endurance riding.

b. Key players in the bike market are Giant Manufacturing Co. Ltd., Trek Bicycle Corporation, Merida Industry Co., Ltd., Specialized Bicycle Components, Accell Group N.V., Hero Cycles Ltd., Pon Holdings (Pon.Bike), Scott Sports SA, Cube Bikes (Cube GmbH), Avon Cycles Ltd., among others.

b. Key factors driving the bike market growth include a sustained transition toward electrified and higher-value product segments. It is being positioned as a strategic component of urban mobility, last-mile logistics, and leisure demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.