- Home

- »

- Digital Media

- »

-

Billboard And Outdoor Advertising Market Size Report, 2030GVR Report cover

![Billboard And Outdoor Advertising Market Size, Share & Trends Report]()

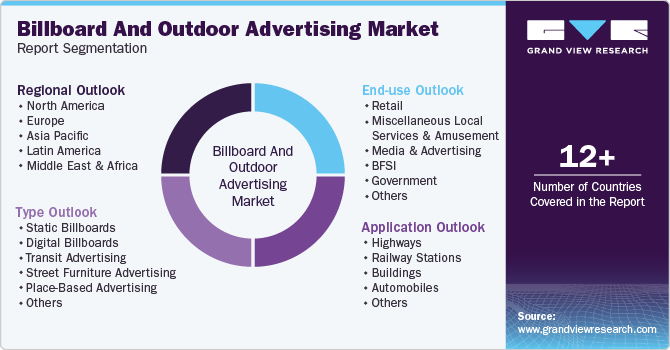

Billboard And Outdoor Advertising Market Size, Share & Trends Analysis Report By Type (Static Billboards, Digital Billboards), By Application (Buildings, Automobiles), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-153-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

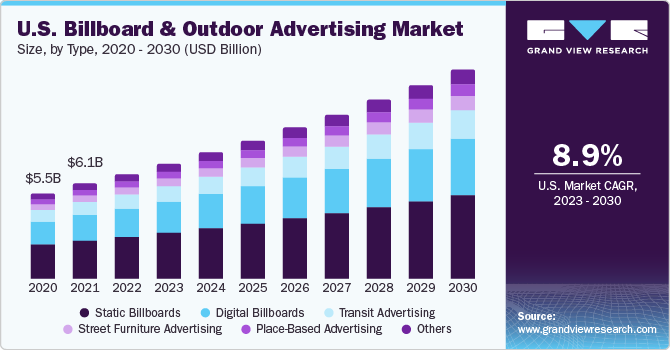

The global billboard and outdoor advertising market size was estimated at USD 32.22 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030, owing to the increasing adoption of digital billboards in outdoor advertisement. Digital billboards offer various advantages such as enhanced visual impact, flexibility & real-time updates, cost-effectiveness, and high efficiency. Factors such as the integration benefits of outdoor advertisement with other media and the rising local advertising through billboards are expected to drive market growth. Moreover, the advancement of technology in outdoor advertisement space and the creativity of marketers present significant growth opportunities for the market.

The COVID-19 pandemic had a negative impact on the market. During the pandemic, Out of home advertising (OOH) experienced a setback as a result of lockdowns and a shift in consumer focus toward digital channels. The Out of Home Advertising Association of America (OAAA) reported a significant drop in outdoor advertising revenue, with a 30.5% decrease in the fourth quarter of 2020 compared to the previous year.

Billboard advertising remains a pivotal component of the advertising landscape, with the proliferation of digital billboards and the adoption of programmatic purchasing mechanisms fueling growth within the industry. In an ever-evolving technological landscape, it becomes imperative for the industry to remain flexible and seize novel prospects to maintain its relevance and efficacy. Programmatic digital out-of-home advertising (pDOOH) is experiencing an increasing surge in popularity, driven by the influential factors of data-driven targeting, versatile procurement choices, and the contextual appropriateness of advertising within specific environments. Digital billboards now often incorporate programmatic advertising, allowing advertisers to target specific demographics, adjust campaigns in real-time, and maximize the efficiency of their ad spend.

New rotating digital billboards are becoming popular. In May 2023, Outdoor Network introduced its first rotating digital billboard in the East London locality. This 3x6 rotating display represents a pioneering addition to the regional advertising landscape, prominently positioned along the Old Transkei Road, a high-traffic volume zone. Given its strategic location, this rotator offers an ideal opportunity for advertisers seeking to engage with specific target audiences.

Type Insights

Based on type, the market is segmented into static billboards, digital billboards, transit advertising, street furniture advertising, place-based advertising, and others. The static billboards segment accounted for the largest revenue share of 37.8% in 2022. Even in the era marked by the ubiquity of digital devices, online advertising, and digital billboards, static billboards maintain their significance and occupy a prominent position within out-of-home (OOH) advertising strategies. A primary factor contributing to the enduring relevance of this medium is its capacity to engage audiences effectively, penetrating the digital noise to leave a lasting impression on viewers. According to the Out of Home Advertising Association of America (OAAA) 2022 report, more than half of urban residents have observed an increased occurrence of OOH messaging and signage compared to the period prior to the pandemic.

The digital billboards segment is anticipated to grow at the fastest CAGR of 10.1% during the forecast period. The latest trend related to digital billboards is the emergence of three-dimensional (3D) billboards. Over the past year, a diverse array of 3D billboards has become increasingly prominent in various regions across the globe, including Japan, China, Taiwan, South Korea, India, and the United Kingdom. For instance, in March 2022, Nike unveiled a three-dimensional (3D) billboard in the Shinjuku district of Tokyo, Japan, as part of its promotional efforts leading up to Air Max Day, featuring a striking 3D activation that garnered the notice of local residents and social media participants.

Application Insights

Based on application, the market is sub-segmented into highways, railway stations, buildings, automobiles, and others. The highways segment held the largest revenue share of 32.9% in 2022 and is estimated to grow at the fastest CAGR during the forecast period. Digital billboards are becoming more prevalent on highways. These high-impact displays allow advertisers to change the content in real-time, display dynamic messages, and provide location-based information. A survey conducted by OAAA-Harris Poll in 2021, revealed a resurgence of mobility, with 83% of respondents noting their awareness of billboards during highway travel and 82% during local driving within town. An overwhelming 83% of consumers expressed their attentiveness to Out-of-Home (OOH) advertising while driving.

The buildings segment is anticipated to grow at a significant CAGR of 8.7% during the forecast period. Billboard advertising on buildings, also known as building wrap advertising, is a dynamic form of outdoor advertising that utilizes the exteriors of tall structures as advertising space. Some buildings are equipped with digital LED screens that serve as dynamic building wraps. These screens allow for real-time content changes, video advertisements, and even interactive elements, providing advertisers with more flexibility and opportunities for engagement. Building wraps have evolved to include 3D elements and interactive features.

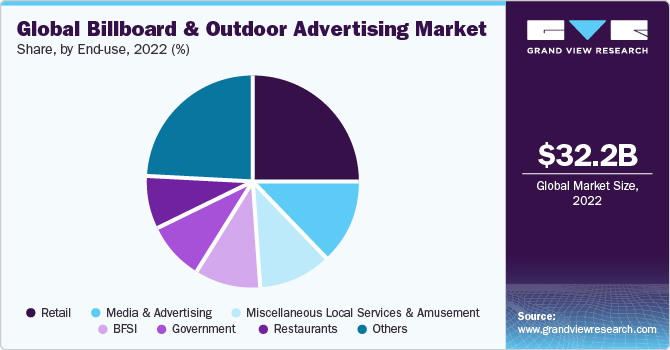

End-use Insights

Based on the end-use, the market is segmented into retail, miscellaneous, local services & amusement, media & advertising, BFSI, government, restaurants, and others. The retail segment held the largest revenue share of 25.0% in 2022. The retail industry is constantly evolving, and outdoor advertising plays a significant role in capturing consumer attention and driving foot traffic to physical stores. Retailers are using AR technology in outdoor ads to allow consumers to virtually try on clothing or accessories or see how furniture or home decor items would look in their own homes. Some retailers are incorporating voice-activated ads into their outdoor campaigns, leveraging voice search and smart assistant technology to provide information, answer questions, or direct shoppers to the nearest store location.

The media & advertising segment is anticipated to grow at a CAGR rate of 10.9% during the forecast period. According to the OAAA, in the U.S., the media & advertising industry ranked third in terms of ad spend value through out-of-home advertisement formats during the first quarter of 2022. Media companies are increasingly using digital billboards and screens for their flexibility and ability to display dynamic content. These screens can promote TV shows, streaming services, news updates, and live broadcasts. Digital billboards allow media companies to deliver real-time content updates, including breaking news, sports scores, or weather forecasts, keeping passersby informed and engaged.

Regional Insights

Asia Pacific dominated the market with a revenue share of 42.7% in 2022 and is anticipated to dominate the market over the forecast period. The Asia Pacific region's OOH media landscape is evolving beyond traditional ad spots and locations and incorporating a range of advancements from different printing techniques and digital screen technologies to data-informed creative strategies and the inventive use of public spaces and hardware, which contributes significantly to this evolution. OOH advertisers in China are actively exploring avenues to enhance their return on investment (ROI) and the landscape is being reshaped by technological advancements that bring about efficiency gains. The integration of digital screens has emerged as a cost-effective means of delivering timely information through outdoor advertisements.

North America is anticipated to grow at the highest CAGR of 9.6% during the forecast period. The billboard advertising industry is poised for increased effectiveness as a preferred advertising channel for brands in the upcoming year. Findings from a survey conducted by OAAA-Harris Poll in 2021 indicate that a substantial segment of the American population has grown fatigued with mobile device advertising. Consequently, 75% of survey respondents show a preference for outdoor environments where they actively engage with and are influenced by billboard advertising. This trend is even more pronounced in larger urban centers, where the impact of mobile device burnout is particularly noticeable. In these areas, over half of consumers acknowledge a heightened awareness of billboard advertising. In the second quarter of 2023, out of home (OOH) advertising revenue in the U.S. exhibited a noteworthy increase of 2.2% in comparison to the preceding year, as reported by the Out of Home Advertising Association of America (OAAA).

Key Companies & Market Share Insights

The market has a fragmented competitive landscape as it features numerous regional and global market players. Industry players are undertaking strategies such as new developments related to digital billboards, partnerships, mergers & acquisitions, and collaborations to survive the highly competitive environment and expand their business footprints. For instance, in January 2023, Lamar Advertising Company, an outdoor advertising company, announced acquisition of Burkhart Advertising Inc. This acquisition encompasses an extensive portfolio, including over 1,500 billboard structures and 3,200 billboard faces, among which are 23 digital displays. These assets are strategically positioned across 38 counties in northern Indiana. Burkhart stands as the preeminent provider of out-of-home advertising within communities of considerable significance, including Elkhart, South Bend, Muncie, Lafayette, and Fort Wayne.

Key Billboard And Outdoor Advertising Companies:

- JCDecaux SE

- Clear Channel Outdoor

- OUTFRONT Media Inc.

- Lamar Advertising Company

- ADAMS OUTDOOR ADVERTISING

- Capitol Outdoor, LLC.

- Focus Media

- Intersection.

- Ströer

- Global

Billboard And Outdoor Advertising Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.90 billion

Revenue forecast in 2030

USD 59.24 billion

Growth rate

CAGR of 7.9% from 2022 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, And Trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

JCDecaux SE; Clear Channel Outdoor; OUTFRONT Media Inc.; Lamar Advertising Company; ADAMS OUTDOOR ADVERTISING; Capitol Outdoor, LLC.; Focus Media; Intersection; Ströer; Global

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Billboard And Outdoor Advertising Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global billboard and outdoor advertising market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Billboards

-

Digital Billboards

-

Transit Advertising

-

Street Furniture Advertising

-

Place-Based Advertising

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Highways

-

Railway Stations

-

Buildings

-

Automobiles

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Miscellaneous Local Services & Amusement

-

Media & Advertising

-

BFSI

-

Government

-

Restaurants

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global billboard and outdoor advertising market size was estimated at USD 32.22 billion in 2022 and is expected to reach USD 34.90 billion in 2023

b. The global billboard and outdoor advertising market is expected to grow at a compound annual growth rate of 7.9% from 2022 to 2030 to reach USD 59.24 billion by 2030

b. Asia Pacific dominated the billboard and outdoor advertising market with a market share of 42.7% in 2022. This can be attributed to the high penetration of billboards and other outdoor advertisement channels in China and Japan. Also, the increasing adoption in emerging economies such as India and Malaysia contribute to market growth.

b. Some key players operating in the billboard and outdoor advertising market include JCDecaux SE, Clear Channel Outdoor, OUTFRONT Media Inc., Lamar Advertising Company, ADAMS OUTDOOR ADVERTISING, Capitol Outdoor, LLC., Focus Media, Intersection, Ströer, and Global.

b. Factors such as the integration benefits of outdoor advertisement with other media and the rising local advertising through billboards are expected to drive market growth. Moreover, the advancement of technology in outdoor advertisement space and the creativity of marketers present significant growth opportunities for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."