- Home

- »

- Advanced Interior Materials

- »

-

Bio-based Construction Materials Market Size Report, 2033GVR Report cover

![Bio-based Construction Materials Market Size, Share & Trends Report]()

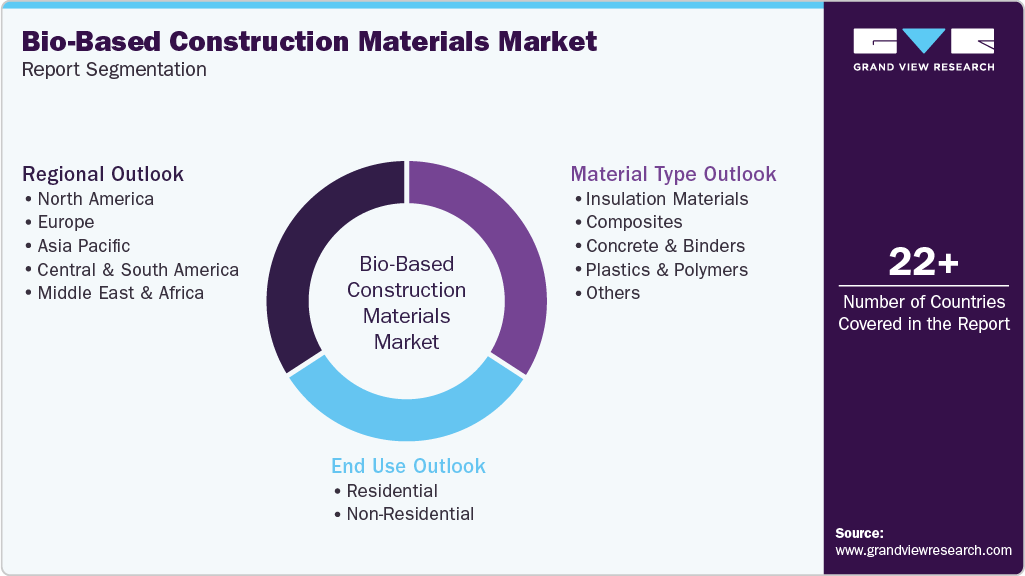

Bio-based Construction Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (Insulation Materials, Composites, Concrete and Binders, Plastics and Polymers), By End Use (Residential, Non-residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-795-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-based Construction Materials Market Summary

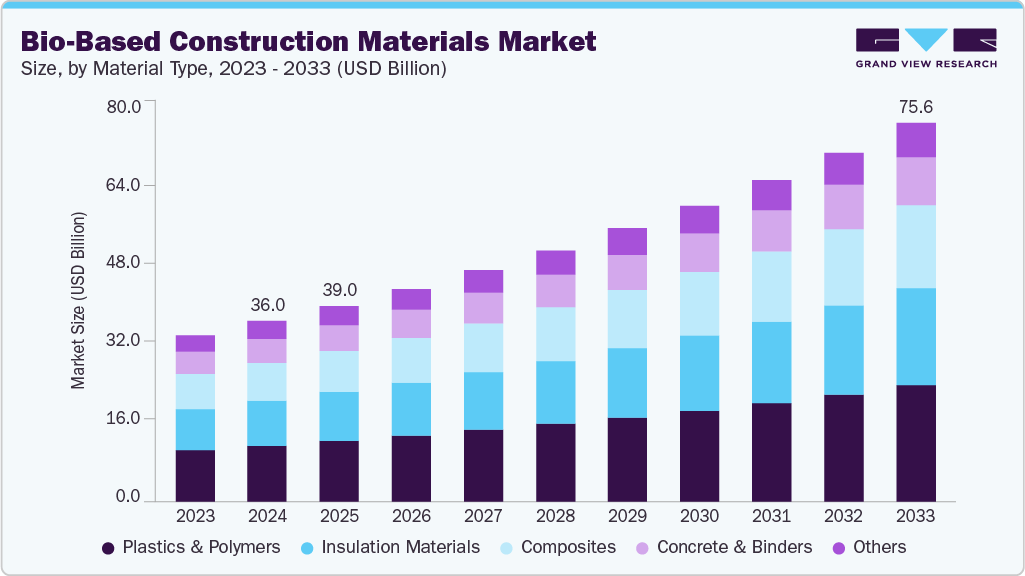

The global bio-based construction materials market size was estimated at USD 36.0 million in 2024 and is expected to reach USD 75.6 million by 2033, expanding at a CAGR of 8.6% from 2025 to 2033. The industry is driven by the increasing emphasis on sustainability within the construction sector.

Key Market Trends & Insights

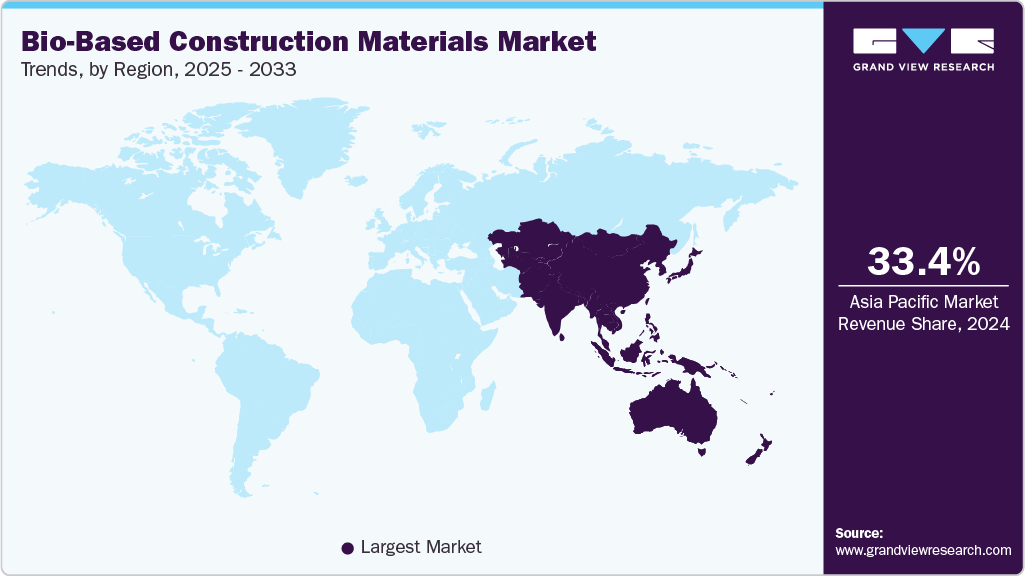

- Asia Pacific dominated the bio-based construction materials market with the largest revenue share of 33.4% in 2024.

- By material type, the composites segment is expected to grow at fastest CAGR of 9.3% over the forecast period.

- By end use, the non-residential segment is expected to grow at fastest CAGR of 8.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 36.0 Million

- 2033 Projected Market Size: USD 75.6 Million

- CAGR (2025-2033): 8.6%

- Asia Pacific: Largest market in 2024

With growing concerns over the environmental impact of conventional materials such as concrete and steel, bio-based alternatives offer a lower carbon footprint and improved eco-friendliness. Many governments worldwide have implemented stringent regulations and incentives to promote the adoption of sustainable building practices, which in turn fuels demand for bio-based materials like timber, hempcrete, and bamboo. This regulatory support is pivotal, as it aligns with wider goals of reducing greenhouse gas emissions and achieving net-zero carbon targets in urban development.

Technological advancements in material science and production methods also play a critical role in expanding the bio-based construction materials market. Innovations such as bio-based resins, engineered wood products, and mycelium-based composites have improved material performance, durability, and cost-efficiency. Furthermore, emerging manufacturing technologies like foam forming and energy-efficient processing facilitate the commercial scalability of these materials, making them more competitive against traditional options. These technological improvements enhance the feasibility of bio-based solutions across a variety of construction applications, accelerating their adoption globally.

Another major driver is the rising consumer awareness and preference for healthier indoor environments. Bio-based construction materials often enhance indoor air quality by emitting fewer volatile organic compounds compared to synthetic or fossil-based products. Consequently, homeowners, architects, and developers are increasingly prioritizing materials that contribute not only to sustainability but also to occupant health and comfort. This trend is closely linked to the broader movement towards green building certifications and sustainable urban living, which encourage the use of renewable and non-toxic materials in construction projects.

Market Concentration & Characteristics

The industry concentration remains moderate, characterized by a mix of global leaders and innovative niche players. Major corporations such as Braskem, Evonik Industries, and Arkema hold substantial market shares due to their extensive R&D capabilities and advanced production facilities, which give them a competitive edge. These firms primarily focus on strategic mergers, joint ventures, and collaborations to expand their product portfolios and scale manufacturing capacities, further reinforcing their market dominance. The industry exhibits a relatively consolidated structure, with key players driving innovation and market growth while smaller firms contribute through niche and specialty offerings, fostering a dynamic yet somewhat concentrated landscape.

Innovation levels in the bio-based construction materials industry are increasingly high, fueled by advancements in green chemistry, nanotechnology, and bioengineering. Companies are investing heavily in developing next-generation composites, such as mycelium-based insulators and bio-resins, which significantly outperform traditional materials in sustainability and performance metrics. Furthermore, mergers and acquisitions among research-intensive firms are accelerating the commercialization of innovative solutions, aiming to meet evolving regulatory standards and consumer demand for eco-friendly products. The impact of supportive regulations and incentives is also crucial, as they create a favorable environment for sustainable innovations and facilitate market entry for novel bio-based technologies.

Material Type Insights

The plastics and polymers segment led the market and accounted for the largest revenue share of 31.0% in 2024, driven by the increasing shift from petroleum-based to renewable feedstocks in construction and manufacturing. Bio-based polymers such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and bio-polyethylene are gaining traction due to their lower carbon footprint and biodegradability. These materials are being widely adopted in flooring, insulation, and piping applications, supporting green building initiatives.

The composites segment is expected to grow at the fastest CAGR of 9.3% over the forecast period, driven by technological advancements in natural fiber reinforcement and resin development, enhancing the structural and functional properties of bio-based materials. The use of hemp, flax, jute, and bamboo fibers in bio-resins is creating lightweight, durable, and recyclable composites ideal for architectural and structural components. Rising demand for sustainable prefabrication and modular construction is further expanding the use of these materials.

End Use Insights

The residential segment dominated the market and accounted for the largest revenue share of 61.6% in 2024, driven by growing consumer awareness of sustainability, energy efficiency, and healthy living environments. Homeowners are increasingly choosing bio-based materials for their natural, non-toxic, and low-carbon attributes. Products such as bio-based insulation panels, flooring, and wall composites contribute to enhanced indoor comfort and reduced energy consumption.

Non-residential segment is expected to grow at the fastest CAGR of 8.9% over the forecast period, driven by the widespread incorporation of sustainable materials in commercial, industrial, and institutional construction projects. Corporations and developers are increasingly adopting bio-based solutions to meet ESG targets and reduce operational carbon footprints. Bio-composites, resins, and biopolymers are being used in façades, insulation systems, and interior applications for their durability and environmental benefits. Supportive government procurement policies and international sustainability standards are further encouraging adoption in large-scale infrastructure and commercial projects.

Regional Insights

Asia Pacific Bio-Based Construction Materials Market Trends

The bio-based construction materials market in Asia Pacific held the largest revenue market share of 33.4% in 2024, propelled by rapid urbanization and infrastructure growth, paired with increasing environmental awareness among governments and consumers. Countries such as Japan, China, and India are investing heavily in sustainable construction to reduce carbon emissions. The availability of abundant biomass resources supports cost-effective production of bio-based materials. National green building programs, such as India’s GRIHA and China’s Three-Star Green Building System, are fostering material innovation. The expansion of eco-cities and smart urban projects across Southeast Asia is enhancing adoption. Moreover, collaborations between global bio-material firms and local manufacturers are improving scalability in the region.

China bio-based construction materials market is driven by stringent government regulations to reduce carbon intensity in the construction and manufacturing sectors. The nation’s focus on “green transition” and “circular economy” policies supports large-scale integration of bio-based materials. Continuous urban expansion has prompted demand for sustainable concrete alternatives and renewable insulation materials. Chinese companies are increasingly investing in bio-composite technology to meet domestic and export market needs. The Belt and Road Initiative also promotes the use of eco-friendly materials in international infrastructure projects. Moreover, rising environmental concerns among urban populations are reinforcing the demand for sustainable construction solutions.

North America Bio-Based Construction Materials Market Trends

The bio-based construction materials market in North America is driven by the growing emphasis on green building certifications such as LEED and BREEAM, promoting the use of sustainable and renewable materials. Government incentives for energy-efficient buildings and carbon-neutral construction practices are accelerating adoption. Additionally, the region’s strong R&D infrastructure fosters innovations in biocomposites, bio-resins, and natural insulation materials. Increased corporate commitments toward ESG (Environmental, Social, and Governance) standards are also driving market expansion. The presence of leading construction companies integrating bio-based solutions enhances commercialization. Moreover, heightened consumer awareness regarding climate resilience and low-carbon infrastructure supports consistent market growth.

U.S. Bio-Based Construction Materials Market Trends

The bio-based construction materials market in the U.S. is primarily influenced by the Biden administration’s climate policies emphasizing net-zero emissions in infrastructure. The Infrastructure Investment and Jobs Act encourages the adoption of low-carbon and renewable construction materials. Rising demand for sustainable housing, coupled with stringent regulations on construction waste, has bolstered the uptake of bio-based composites and adhesives. The U.S. Green Building Council’s initiatives further encourage the use of renewable raw materials. Strong collaboration between private developers and bio-material startups has led to product diversification. Additionally, consumer preference for eco-friendly and energy-efficient structures continues to fuel market development.

Europe Bio-Based Construction Materials Market Trends

The bio-based construction materials market in Europe is supported by robust regulatory frameworks such as the European Green Deal and Circular Economy Action Plan. The region is leading in sustainable material innovation, driven by strong public-private R&D collaborations. Construction firms are increasingly adopting bio-polymers, wood-based panels, and natural fiber composites to comply with carbon neutrality goals. High energy costs have encouraged the use of efficient, low-impact materials. The growing refurbishment of aging infrastructure using eco-friendly alternatives further stimulates demand. Moreover, consumer preference for sustainable housing and government incentives for carbon labeling are propelling the regional market.

Germany bio-based construction materials market is driven by strict sustainability standards in the building sector and strong government funding for eco-innovation. The German Energy Transition (Energiewende) promotes the use of renewable materials to minimize embodied carbon. A well-developed bioeconomy ecosystem facilitates large-scale production of bioplastics, lignin-based binders, and cellulose composites. The country’s advanced manufacturing capabilities enable precision in bio-material design and performance. Increasing adoption of prefabricated and modular construction enhances efficiency and sustainability. Furthermore, collaboration between research institutions and industry stakeholders ensures continued technological advancements and market maturity.

Central & South America Bio-Based Construction Materials Market Trends

The bio-based construction materials market in the Central & South America is expanding due to rising infrastructure development and environmental sustainability initiatives across emerging economies. Countries like Brazil, Chile, and Mexico are increasingly promoting bio-based materials to reduce construction waste and deforestation. The region’s abundant agricultural resources provide a strong feedstock base for biopolymers and natural composites. International investments in sustainable urban projects are enhancing market penetration. Additionally, government programs focusing on green housing and energy-efficient construction are fostering adoption. Growing awareness among architects and builders about renewable alternatives is expected to drive sustained market growth.

Middle East & Africa Bio-Based Construction Materials Market Trends

The bio-based construction materials market in the Middle East & Africa is driven by increasing government focus on sustainability and diversification away from oil-based economies. Initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s Green Building Regulations are fostering the use of renewable construction inputs. The region’s large-scale infrastructure projects and smart city developments encourage demand for bio-based insulation, coatings, and composites. International collaborations with European and Asian firms are improving technology transfer and production capacity. The scarcity of natural resources also motivates the shift toward sustainable material sourcing. Furthermore, growing awareness of climate adaptation and desertification control reinforces adoption in the region.

Key Bio-Based Construction Materials Companies Insights

Key players operating in the bio-based construction materials market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the industry include BASF SE, DuPont de Nemours, Inc.

-

BASF offers a range of eco-friendly construction solutions, including bio-based polyurethane foams, biopolymers, and natural fiber composites. BASF’s products enhance energy efficiency and reduce embodied carbon, supporting green certification standards.

-

DuPoint provides bio-based resins, adhesives, and insulation solutions designed for green building applications. DuPont’s Sorona polymer, derived partly from renewable plant-based ingredients, is used in carpeting and interior applications.

LafargeHolcim Ltd., Sika AG are some of the emerging market participants in bio-based construction materials market.

-

LafargeHolcim Ltd produces bio-based concrete additives and green cements designed to reduce CO₂ emissions. Its ECOPact range incorporates renewable and recycled content, offering a lower carbon footprint compared to traditional concrete.

-

Sika AG specializes in advanced chemical products for construction and industrial applications, with an increasing focus on bio-based innovation. The company’s product range includes bio-based sealants, adhesives, and coatings derived from renewable raw materials. Sika’s sustainable construction solutions enhance structural durability while minimizing environmental impact.

Key Bio-based Construction Materials Companies:

The following are the leading companies in the bio-based construction materials market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- DuPont de Nemours, Inc.

- LafargeHolcim Ltd.

- Sika AG

- Cargill, Incorporated

- NatureWorks LLC

- Interface, Inc.

- Saint-Gobain S.A.

- Green Building Materials LLC

Recent Developments

- In October 2025, Braskem unveiled its latest bio-based product innovations at K 2025, emphasizing sustainable material development. The company’s collaboration with Dutch innovators Bottle Up and Eurobottle integrates bio-based polymers into durable and reusable bottle designs.

Bio-Based Construction Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.0 million

Revenue forecast in 2033

USD 75.6 million

Growth rate

CAGR of 8.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, material type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

BASF SE; DuPont de Nemours, Inc.; LafargeHolcim Ltd.; Sika AG; Cargill, Incorporated; NatureWorks LLC; Interface, Inc.; Saint-Gobain S.A.; Green Building Materials LLC.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-Based Construction Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bio-based construction materials market report based on material type, end use and region.

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Insulation Materials

-

Composites

-

Concrete and Binders

-

Plastics and Polymers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bio-based construction materials market size was estimated at USD 36.0 million in 2024 and is expected to reach USD 39.0 million in 2025.

b. The bio-based construction materials market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 75.6 million by 2033.

b. Residential segment dominated the market and accounted for the largest revenue share of 61.6% in 2024, driven by growing consumer awareness of sustainability, energy efficiency, and healthy living environments.

b. Some of key players in the bio-based construction materials market are BASF SE, DuPont de Nemours, Inc., LafargeHolcim Ltd., Sika AG, Cargill, Incorporated, NatureWorks LLC, Interface, Inc., Saint-Gobain S.A., and Green Building Materials LLC.

b. The key factors driving the bio-based construction materials market include increasing demand for sustainable building solutions, advancements in green material technologies, stringent environmental regulations, and rising adoption of circular economy practices in the construction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.