- Home

- »

- Biotechnology

- »

-

Biochip Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Biochip Market Size, Share & Trends Report]()

Biochip Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (DNA Chips, Protein Chips, Lab-on-chip, Tissue Arrays, Cell Arrays), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-077-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biochip Market Summary

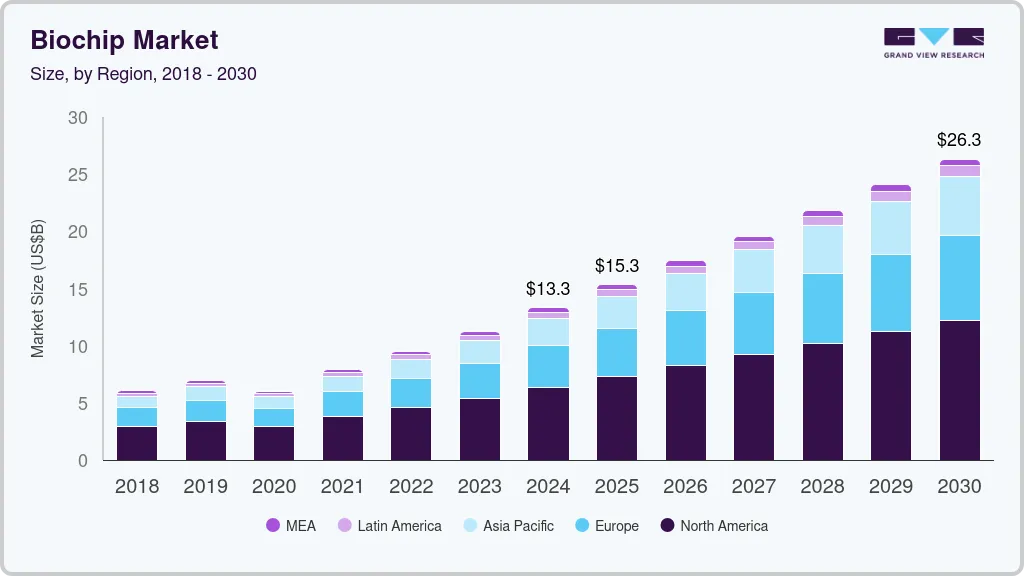

The global biochip market size was estimated at USD 13,312.4 million in 2024 and is projected to reach USD 26,302.3 million by 2030, growing at a CAGR of 11.4% from 2025 to 2030. Biochip is becoming a hotspot segment for emerging players to mature. This can be attributed to the rising drug development, increasing adoption of personalized medicines, and growing applications of Next-generation Sequencing (NGS).

Key Market Trends & Insights

- North America has dominated the biochip market, with a share of 47.71% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR of 12.98% over the forecast period.

- By type, the DNA chips for the biochip market segment accounted for the largest revenue share of 38.77% in 2024.

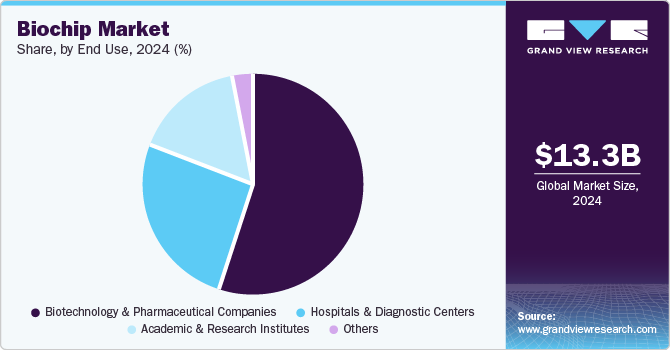

- By end use, the biotechnology & pharmaceutical companies segment dominated the biochip market and accounted for the largest revenue share of 55.90% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 13,312.4 Million

- 2030 Projected Market Size: USD 26,302.3 Million

- CAGR (2025-2030): 11.4%

- North America: Largest market in 2024

Innovation in the lab-on-a-chip offerings and biomedical advancements of microfluidic-based devices are expected to contribute to global market growth.

The COVID-19 pandemic has a significant impact on the biochip market. Biochip technologies have been utilized to develop high-throughput PCR-based tests, antigen tests, and serological assays, enabling efficient & accurate detection of the virus. The pandemic has spurred intense R&D efforts within the biochip industry. Researchers and biochip companies have collaborated to develop innovative solutions for COVID-19 diagnostics, including portable and point-of-care biochip devices.

Owing to biochip’s rapid and specific analysis in a wide range of applications like detection of aberrant transcription events, DNA methylation profiling by bisulfite DNA sequencing, detection of mosaic mutations, and cancer genome studies, the demand for biochips is increasing. Furthermore, applications such as mapping histone modifications, studying the locations of DNA-binding proteins for DNA accessibility & chromatin structure, and analysis of epigenetic modifications of histones & DNA, among others, are used in genomic & proteomic research along with diagnosing cancer & other diseases. Thus, the growing cancer cases are anticipated to propel the demand for next generation sequencing, thereby driving the biochip market over the forecast period.

In addition, biochips and microarray technologies find significant applications in genomic research pertaining to gene discovery, toxicological research, medical diagnostics, and drug discovery. Moreover, high-density microarray chips can be used to monitor a large number of gene expressions simultaneously in research laboratories. Rapid growth in proteomic and genomic R&D to gain deeper insights into gene expression, protein-protein interactions, protein expression profiling, and the identification & classification of genes associated with different types of cancers is anticipated to boost the demand for biochips.

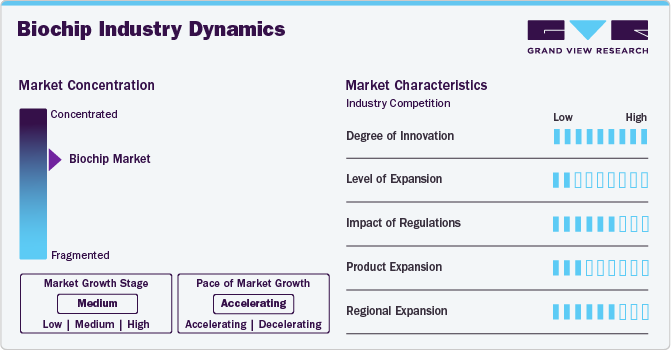

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of the market growth is accelerating. This growth is fueled by increasing demand for faster and more accurate diagnostics, personalized medicine, and advancements in biotechnology. Key drivers include the adoption of biochips in genomics, proteomics, and drug discovery, as well as their potential applications in disease diagnosis and monitoring. As innovation continues, the market is expected to see sustained momentum, attracting investment and expanding its influence in healthcare and life sciences.

In the biochip market, the expansion activities are low to moderate owing to the constrained by high development costs and complex manufacturing processes. Despite these challenges, growth potential remains strong, supported by rising demand in areas like precision medicine, drug discovery, and diagnostics.

There is a significant impact on the biochip industry. Regulatory agencies emphasize the implementation of robust Quality Management Systems (QMS) in biochip manufacturing processes. Compliance with quality standards, such as ISO 13485, is crucial to ensure consistent product quality, traceability, and adherence to regulatory requirements.

The biochip industry currently exhibits a moderate level of product expansion. This is attributed to factors such as high development costs, complex manufacturing processes, and stringent regulatory requirements. Additionally, the need for ongoing innovation in applications like diagnostics and personalized medicine also plays a role in shaping this expansion.

The biochip industry currently demonstrates a moderate level of regional expansion. This is attributed to varying demand across different markets, regional regulatory environments, and differences in healthcare infrastructure. Additionally, factors such as local investments in biotechnology and research initiatives further influence the pace of expansion in specific regions.

Type Insights

The DNA chips for the biochip market segment accounted for the largest revenue share of 38.77% in 2024. This is attributed to the wide range of products available for specified applications that include cancer diagnosis and treatment, gene expression, SNP genotyping, genomics, drug discovery, and agricultural biotechnology, along with other applications like toxicogenomic, proteomics, microbial genotyping, screening & monitoring of patient data in clinical trials, and environmental biology.

The lab-on-chip segment is projected to witness the fastest CAGR of 13.19% over the forecast period. The lab-on-chip can be considered a sophisticated way to perform analysis of multiple samples simultaneously with high efficiency and precision. Due to its small sample size, the platform is safe for radioactive, biological, and chemical studies. Thus, propelling the growth of the segment over the forecast period.

End Use Insights

The biotechnology & pharmaceutical companies segment dominated the biochip market and accounted for the largest revenue share of 55.90% in 2024. Biochips find diverse applications within pharmaceutical companies, driving advancements in drug discovery, development, and manufacturing. These companies utilize biochips for high-throughput screening of compound libraries, enabling rapid identification of lead candidates for further development. Biochips also aid in target identification & validation, facilitating the selection of novel therapeutic targets.

The academic & research institutes’ segment is expected to witness the fastest CAGR over the forecast period. Advancements in scientific research drive this growth and contribute to a deeper understanding of biological systems. These institutes utilize biochips for various applications, including genomics, proteomics, diagnostics, drug discovery, and personalized medicine. Thus, it is anticipated that the demand for biochips will increase in research and academic institutes and boost the segment's growth.

Regional Insights

North America has dominated the biochip market, with a share of 47.71% in 2024. The is attributed to several key factors, such as the increasing prevalence of chronic diseases, technological advancements, and the growing demand for personalized medicine. The region's robust healthcare infrastructure and significant investments in research & development foster innovation and adoption of biochip technologies across hospitals and diagnostic centers. Thereby propelling the demand for the biochip in the region over the forecast period.

U.S. Biochip Market Trends

The biochip market in the U.S. is expected to grow over the forecast period. In September 2024, Nomic Bio, a protein profiling company, announced the successful completion of an oversubscribed USD 42 million Series B funding round. The new funding will help the company expand its commercial operations, enhance its cutting-edge protein profiling platform, and broaden its offerings to meet increasing market demand.

Europe Biochip Market Trends

The biochip market in Europe is expected to experience significant growth over the forecast period. The regional growth of the market is driven by advanced infrastructure, which is anticipated to boost clinical research prospects in the region significantly.

The UK biochip market is expected to grow over the forecast period. in October 2024, researchers at the London School of Hygiene & Tropical Medicine (LSHTM) and their collaborators have received £3.7 million (USD 4.03 million) in funding to support genomic surveillance and vaccine development for Klebsiella pneumoniae, a significant human pathogen responsible for infections like pneumonia, urinary tract infections, and sepsis.

The biochip market in France is expected to grow over the forecast period owing to high cancer prevalence and the increasing burden of chronic diseases on the healthcare industry. Moreover, supportive government legislation and funding for research projects are projected to support the country’s market in the coming years.

The Germany biochip market is expected to grow over the forecast period. This growth is attributed to the high burden of cancer and the growing need for rapid diagnostics are anticipated to support the global market for biochip.

Asia Pacific Biochip Market Trends

Asia Pacific is anticipated to grow at the fastest CAGR of 12.98% over the forecast period. The growing adoption of biochip technology by established companies in emerging markets is also a major driver of regional growth. Additionally, the thriving biotechnology sector, numerous research and academic institutions, and substantial investments from market players are expected to boost the region's market further.

The biochip market in China is expected to grow over the forecast period. The growing biotechnological and pharmaceutical sector has a direct positive impact on the growth of the market for biochip. Furthermore, the growth of these industries has boosted biotechnological development in China, increasing the market share of biochips in the country.

The Japan biochip market is expected to grow over the forecast period. In September 2024, Takeda received approval from the Japanese Ministry of Health, Labour and Welfare to manufacture and market FRUZAQLA Capsules (1mg/5mg), containing fruquintinib. This oral inhibitor of VEGFR -1, -2, and -3 is indicated for advanced or recurrent colorectal cancer (CRC) that is not curable or resectable and has progressed after chemotherapy.

The biochip market in India is expected to grow over the forecast period. In recent decades, India has emerged as a hub for the pharmaceutical and biotechnology sectors, gaining global attention for its skilled workforce and low capital investments. The country’s rich resources and numerous R&D institutions make it an attractive location for multinational companies to set up research labs and manufacturing units.

Middle East & Africa Biochip Market Trends

The biochip market in the Middle East & Africa is expected to experience substantial growth over the forecast period. Cancer incidence in the Middle East is expected to increase significantly in the coming years. The presence of unmet medical needs has fueled the demand for robust cancer diagnostics, increasing the demand for biochip solutions and array-based diagnostics.

The Saudi Arabia biochip market is expected to grow over the forecast period. The government is increasingly involved and raising awareness about the benefits of noninvasive diagnostic procedures. In addition, rapid advancements in diagnostic technologies have improved the accuracy of diagnostic techniques over the years.

The biochip market in Kuwait is expected to grow over the forecast period. The rising prevalence of target diseases in the country is a major factor driving the market. Furthermore, being a world leader in oil production, the country often faces the challenge of various genetic & rare disorders, and the local government is making enough efforts to tackle the threat of rare diseases by promoting diagnosis rates and facilitating treatment rates.

Key Biochip Company Insights

The market players operating in the biochip market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Biochip Companies:

The following are the leading companies in the biochip market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies

- PerkinElmer, Inc

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

- Standard BioTools

- GE HealthCare

- IBIOCHIPS

- LI-COR, Inc.

- Cellix Ltd

- Randox Laboratories Ltd.

Recent Developments

-

In August 2023, Illumina Inc. opened a new office and cutting-edge Solutions Center in Bengaluru, India. This expansion aims to boost access to genomics in the region, driving advancements in healthcare and addressing climate change challenges in South Asia.

-

In June 2023, Randox Laboratories Ltd announced the acquisition of Cellix Limited, an Ireland-based company that develops impedance flow cytometers and microfluidic tools for cell analysis.

-

In March 2023, Mekonos, Inc announced a collaboration with bit.bio to advance and leverage cell engineering. The partnership aims to improve bit.bio's technology for converting stem cells into various cell types, accelerating research, drug discovery, and advanced cell therapies.

Biochip Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.32 billion

Revenue forecast in 2030

USD 26.30 billion

Growth rate

CAGR of 11.41% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Agilent Technologies; PerkinElmer, Inc.; Illumina, Inc.; Bio-Rad Laboratories, Inc.; Standard BioTools; GE HealthCare; IBIOCHIPS; LI-COR, Inc.; Cellix Ltd; Randox Laboratories Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biochip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biochip market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

DNA Chips

-

Cancer Diagnosis And Treatment

-

Gene Expression

-

SNP Genotyping

-

Genomics

-

Drug Discovery

-

Agricultural Biotechnology

-

Others

-

-

Protein Chips

-

Proteomics

-

Expression Profiling

-

Diagnostics

-

HTS

-

Drug Discovery

-

Others

-

-

Lab-on-chip

-

Genomics

-

IVD & POC

-

Proteomics

-

Drug discovery

-

Others

-

-

Tissue Arrays

-

Cell Arrays

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biotechnology and Pharmaceutical Companies

-

Academic & Research Institutes

-

Hospitals and Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biochip market size was estimated at USD 13.31 billion in 2024 and is expected to reach USD 15.32 billion in 2025.

b. The global biochip market is expected to grow at a compound annual growth rate of 11.41% from 2025 to 2030 to reach USD 26.30 billion by 2030.

b. DNA chips dominated the biochip market with a share of 38.77% in 2024. DNA chips are projected to replace traditional medical diagnostics tasks, including cancer detection. Since they are inexpensive, rapid, and widely available, hence enable advanced detection of cancer to occur in numerous locality

b. Some of the key market players operating in biochip are Agilent Technologies; PerkinElmer, Inc; Illumina, Inc.; Bio-Rad Laboratories, Inc.; Standard BioTools; GE HealthCare; IBIOCHIPS; LI-COR, Inc.; Cellix Ltd; and Randox Laboratories Ltd. among others

b. Key factors driving the biochip market growth include an increase in the adoption of next-generation sequencing, growing R&D in proteomics and genomics, the presence of an extensive drug-development pipeline, increasing adoption of personalized medicine, and rapid technological advances in biochip technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.