- Home

- »

- Biotechnology

- »

-

Bioconjugation Market Size And Share, Industry Report, 2030GVR Report cover

![Bioconjugation Market Size, Share & Trends Report]()

Bioconjugation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Services (Consumables, Instruments, Services), By Technique, By Biomolecule Type, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-537-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioconjugation Market Summary

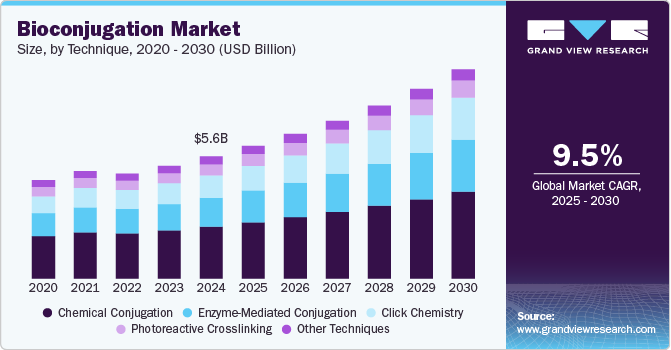

The global bioconjugation market size was estimated at USD 5.64 billion in 2024 and is projected to reach USD 9.67 billion by 2030, growing at a CAGR of 9.54% from 2025 to 2030. The market growth is driven by rising demand for targeted drug delivery, biopharmaceutical advancements, and increasing R&D investments in healthcare and biotechnology.

Key Market Trends & Insights

- The North America dominated the bioconjugation market with the largest revenue share of 43.75% in 2024.

- Based on product & services, the consumables segment led the market with the largest revenue share of 45.45% in 2024.

- Based on technique, the chemical conjugation segment led the market with the largest revenue share of 42.46% in 2024.

- Based on application, the therapeutics segment led the market with the largest revenue share of 57.77% in 2024.

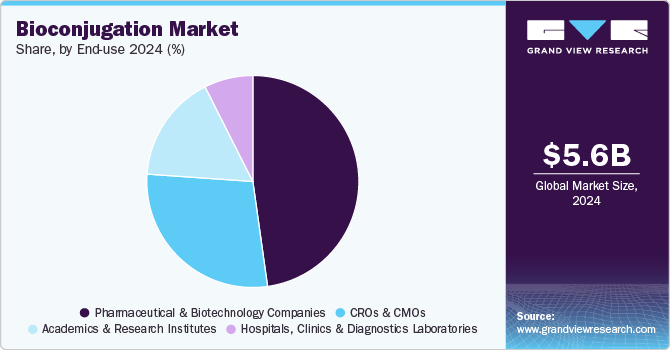

- Based on end use, the pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 47.78% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.64 Billion

- 2030 Projected Market USD 9.67 Billion

- CAGR (2025-2030): 9.54%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Expanding applications in diagnostics, therapeutics, and biomaterials further fuel market expansion. In addition, growing collaborations between biotech firms and pharmaceutical companies accelerate innovation, positioning bioconjugation as a critical component in next-generation medical treatments.

COVID-19 has accelerated the growth of the bioconjugation industry owing to the increased demand for advanced therapeutics, vaccines, and diagnostic solutions. The pandemic underscored the importance of bioconjugation in drug delivery systems, antibody-drug conjugates (ADCs), and rapid diagnostic test development. Pharmaceutical and biotech companies ramped up R&D investments, driving protein and antibody conjugation technology innovation. Additionally, the surge in government funding and public-private partnerships further boosted market expansion. As a result, the pandemic heightened awareness of bioconjugation applications and reinforced its role in addressing emerging infectious diseases and future healthcare challenges.

In addition, rising demand for targeted drug delivery is fueling the market growth. Advances in antibody-drug conjugates (ADCs), nanomedicine, and personalized medicine drive innovation, enabling more precise and effective treatments with reduced side effects. The increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, is further accelerating the need for bioconjugation technologies in drug development. Pharmaceutical and biotech companies invest heavily in research to enhance drug efficacy and safety. Furthermore, regulatory support and strategic collaborations between industry players foster market expansion, positioning bioconjugation as a key component in next-generation therapeutics.

Moreover, expanding applications in diagnostics, therapeutics, and biomaterials are driving the market growth. Bioconjugation is crucial in developing advanced imaging agents, biomarker detection, and precision therapeutics, enhancing disease diagnosis and treatment. The increasing adoption of bioconjugation in regenerative medicine and biomaterial engineering is further fueling innovation. In addition, growing collaborations between biotech firms, pharmaceutical companies, and research institutions accelerate technological advancements, broadening the market scope. As demand for high-precision medical solutions rises, bioconjugation continues to be a pivotal technology in modern healthcare and biotechnology.

Growth of Antibody-Drug Conjugates (ADCs) Driving Market Expansion

The increasing adoption of antibody-drug conjugates (ADCs) is significantly fueling the market growth, particularly in oncology and other therapeutic areas. ADCs combine the specificity of monoclonal antibodies with the potency of cytotoxic drugs, offering a highly targeted approach to treating cancers while minimizing systemic toxicity. This precision has led to a surge in R&D investments, with pharmaceutical and biotech companies focusing on developing next-generation ADCs with improved stability, linker technologies, and payload efficacy.

The global oncology market remains a key driver, as ADCs are increasingly approved for various cancer types, including breast, lung, and hematologic malignancies. Additionally, the potential application of ADCs in autoimmune diseases and infectious diseases is expanding their market footprint. Furthermore, advancements in bioconjugation technologies, including site-specific conjugation and novel linker chemistries, are enhancing ADC development, improving drug efficacy, and reducing immunogenicity. Moreover, strategic partnerships between pharmaceutical companies, contract research organizations (CROs), and contract manufacturing organizations (CMOs) are accelerating ADC commercialization.

Regulatory agencies are also supporting ADC innovation by providing streamlined approval pathways, further boosting market adoption. With rising demand for targeted therapies and continuous innovation in bioconjugation services, the ADC segment is expected to witness robust growth, solidifying its role in next-generation therapeutics.

Antibody-Drug Conjugates (ADCs) Analysis

Antibody-drug conjugates (ADCs) have significantly impacted the bioconjugation industry, exemplifying the successful integration of targeted therapy with potent cytotoxic agents. In 2023, global sales of ADCs surpassed USD 10 billion, marking a notable milestone in the biopharmaceutical industry.

Key ADCs and Their Market Performance in 2023:

-

Enhertu (Trastuzumab deruxtecan): Developed by Daiichi Sankyo and AstraZeneca, Enhertu targets the HER2 antigen. Approved in 2019, it achieved sales of approximately USD 2.566 billion in 2023, positioning it as the top-selling ADC.

-

Kadcyla (Trastuzumab emtansine): Produced by Roche, Kadcyla also targets HER2 and has been on the market since 2013. In 2023, it generated sales of around USD 2.280 billion, maintaining its strong market presence.

-

Adcetris (Brentuximab vedotin): A collaboration between Seagen and Takeda, Adcetris targets the CD30 antigen. Approved in 2011, its sales reached approximately USD 1.732 billion in 2023.

-

Padcev (Enfortumab vedotin): Jointly developed by Astellas and Seagen, Padcev targets Nectin-4. Since its approval in 2019, it has seen significant growth, with 2023 sales reaching USD 1.465 billion.

-

Trodelvy (Sacituzumab govitecan): Developed by Gilead Sciences, Trodelvy targets Trop-2 and was approved in 2020. Its sales in 2023 were approximately USD 1.180 billion.

These figures underscore the growing acceptance and integration of ADCs into therapeutic protocols, driven by their ability to deliver targeted treatment while minimizing systemic toxicity. The success of these ADCs has not only validated the bioconjugation approach but has also spurred further research and development in the field

Table 1 Sales of key ADCs in 2023

Trade Names

Drug Name

Company

Target antigens

Approved Year

2023 Sales (USD Million)

Enhertu

Trastuzumab deruxtecan

Daiichi Sankyo/AstraZeneca

HER2

2019

2,566

Kadcyla

Trastuzumab emtansine

Roche

HER2

2013

2,280

Trodelvy

Sacituzumab govitecan

Gilead

Trop-2

2020

1,063

Polivy

Polatuzumab vedotin

Roche

CD79B

2019

946

Besponsa

Inotuzumab ozogamicin

Pfizer

CD22

2017

236

Blenrep

Belantamab mafodotin

GSK

BCMA

2020

44

Source: Company Website, Investor Presentations, Primary Research

The robust sales and continued growth of ADCs reflect a broader trend in the bioconjugation industry, highlighting the potential for innovative therapies that combine specificity with efficacy. As research advances and more ADCs receive regulatory approval, the bioconjugation industry is poised for sustained expansion, offering new hope for targeted cancer treatments.

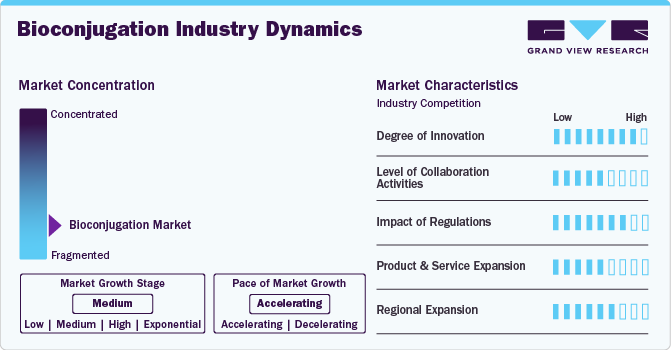

Market Concentration & Characteristics

The bioconjugation industry is set for exponential growth, driven by advancements in targeted drug delivery, rising demand for precision medicine, and increasing applications in diagnostics and biomaterials. Expanding R&D investments, strategic collaborations, and regulatory support further accelerate innovation. The growing prevalence of chronic diseases and the need for more effective therapeutics fuel market expansion. As bioconjugation technologies evolve, they are becoming essential in next-generation drug development, diagnostics, and healthcare solutions.

The bioconjugation industry is growing steadily, with moderate collaboration among industry players. Key drivers include increasing demand for targeted drug delivery, rising adoption of antibody-drug conjugates (ADCs), and advancements in precision medicine. Expanding applications in diagnostics and biomaterials, along with growing R&D investments, are further fueling market growth. While strategic partnerships between pharmaceutical, biotech, and research institutions are shaping innovation, the level of collaboration remains moderate, with companies focusing on proprietary technologies and competitive differentiation.

Regulations have moderately influenced the bioconjugation industry by ensuring product safety, efficacy, and quality while posing compliance and approval timelines challenges. Stringent regulatory frameworks for drug conjugates, biomaterials, and diagnostics impact R&D and commercialization strategies. However, supportive policies, accelerated approvals for innovative therapies, and evolving guidelines for biopharmaceuticals are fostering market growth. As regulatory bodies refine bioconjugation application standards, industry players adapt to meet compliance requirements while driving innovation.

The bioconjugation industry has seen significant growth in product and service expansion, driven by increasing demand for targeted therapeutics, antibody-drug conjugates (ADCs), and advanced diagnostics. Innovations in linker technologies, site-specific conjugation methods, and bioconjugation reagents have enhanced drug efficacy and stability. In addition, the rising outsourcing of bioconjugation services to CROs and CMOs has fueled market expansion. Growing investments in R&D and strategic collaborations between pharmaceutical, biotech, and research institutions continue to drive innovation and market growth.

The bioconjugation industry is expanding strongly, driven by strong growth in North America, Europe, and the rapidly expanding Asia-Pacific region. Factors such as increasing R&D investments, rising demand for targeted therapeutics, and government support for biotech innovation fuel global market expansion. Emerging markets, particularly in Asia-Pacific, are experiencing significant growth due to advancements in healthcare infrastructure and biopharmaceutical manufacturing. This widespread expansion indicates a strong and sustained global market trajectory.

Product & Services Insights

The consumables segment led the market with the largest revenue share of 45.45% in 2024, driven by the high demand for reagents, linkers, and antibodies in research and drug development. The growing adoption of bioconjugation techniques in diagnostics, therapeutics, and biomaterials has further increased the need for specialized consumables. In addition, continuous advancements in bioconjugation chemistry and increasing R&D investments in biotechnology and pharmaceutical industries fuel segment growth. The expanding use of precision medicine, antibody-drug conjugates (ADCs), and biomarker detection also contribute to the rising demand for high-quality consumables, solidifying their market dominance.

The services segment is expected to grow at the fastest CAGR of 11.73% from 2025 to 2030. This growth is driven by increasing the outsourcing of bioconjugation services by pharmaceutical and biotech companies to enhance efficiency and reduce operational costs. Rising demand for specialized contract research and manufacturing services (CROs and CDMOs) furthers expansion. In addition, advancements in antibody-drug conjugates (ADCs), personalized medicine, and diagnostic applications are boosting the need for expert bioconjugation services. As companies seek scalable and cost-effective solutions, service providers are crucial in accelerating drug development and commercialization.

Biomolecule Type Insights

Based on biomolecule type, the antibodies segment accounted for the largest market revenue share in 2024, driven by the growing adoption of antibody-drug conjugates (ADCs) in targeted cancer therapies. The increasing demand for precision medicine and immunotherapy has further propelled the use of antibodies in drug development. Advancements in bioconjugation techniques, improving antibody stability and specificity, have enhanced their therapeutic applications. In addition, rising R&D investments in biologics and expanding diagnostics and biomarker detection applications have solidified the segment's market leadership.

The oligonucleotides segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by increasing applications in gene therapy, molecular diagnostics, and targeted drug delivery. The rising demand for RNA-based therapeutics, including mRNA vaccines and antisense oligonucleotides, is fueling market expansion. Advancements in bioconjugation techniques enhance oligonucleotide-based therapies' stability, specificity, and delivery efficiency. In addition, growing investments in genomics research and the expanding role of nucleic acid-based diagnostics in personalized medicine further accelerate segment growth.

Technique Insights

Based on technique, the chemical conjugation segment led the market with the largest revenue share of 42.46% in 2024, driven by its widespread use in drug development, diagnostics, and biomaterials. Chemical conjugation offers high stability, efficiency, and versatility in linking biomolecules, making it essential for antibody-drug conjugates (ADCs), protein labeling, and targeted therapeutics. Advancements in linker technologies and site-specific conjugation methods have further enhanced its adoption. In addition, growing R&D investments in biopharmaceuticals and increasing demand for precision medicine have solidified the segment’s market dominance.

The click chemistry segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by its efficiency, specificity, and bioorthogonal nature. Click chemistry enables rapid and stable biomolecular conjugation, making it ideal for drug discovery, diagnostics, and targeted drug delivery applications. The rising adoption of antibody-drug conjugates (ADCs), nucleic acid therapeutics, and biocompatible materials is fueling demand. In addition, advancements in site-specific labeling techniques and increasing R&D investments in precision medicine are accelerating the growth of click chemistry in bioconjugation.

Application Insights

Based on application, the therapeutics segment led the market with the largest revenue share of 57.77% in 2024, driven by the increasing adoption of antibody-drug conjugates (ADCs), targeted drug delivery systems, and precision medicine. The rising prevalence of chronic diseases, particularly cancer, has fueled demand for advanced bioconjugation-based therapies. Advancements in linker technologies, site-specific conjugation, and biopharmaceutical R&D have further strengthened the segment. In addition, growing investments from pharmaceutical and biotech companies, along with regulatory support for innovative biologics, have accelerated the development and commercialization of bioconjugation-based therapeutics.

The diagnostics segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by the increasing demand for advanced biomarker detection, molecular imaging, and rapid diagnostic solutions. The rise in infectious diseases, cancer diagnostics, and personalized medicine has fueled the adoption of bioconjugation techniques in assay development and imaging technologies. In addition, advancements in nanotechnology, biosensors, and point-of-care testing are enhancing diagnostic accuracy and efficiency. Growing R&D investments and collaborations between biotech firms and healthcare providers further accelerate market expansion.

End Use Insights

Based on end use, the pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 47.78% in 2024, driven by increasing investments in drug discovery, biologics, and targeted therapeutics. The growing demand for antibody-drug conjugates (ADCs), nucleic acid-based therapies, and precision medicine has fueled the adoption of bioconjugation technologies. In addition, advancements in linker chemistry and site-specific conjugation techniques have enhanced drug efficacy and stability. Strategic collaborations, mergers, and acquisitions among biotech firms and pharmaceutical companies have further accelerated innovation, solidifying their market dominance.

Meanwhile, the CROs & CMOs segment is expected to grow the fastest in the coming years, driven by increasing the outsourcing of bioconjugation services by pharmaceutical and biotechnology companies. Rising R&D costs, the need for specialized expertise, and the demand for scalable manufacturing solutions fuel this growth. CROs and CMOs offer advanced bioconjugation capabilities, including antibody-drug conjugates (ADCs), oligonucleotide conjugation, and custom drug development. Strategic partnerships and expanding global biopharmaceutical pipelines further accelerate the segment’s expansion, making it a key player in the evolving bioconjugation industry.

Competitive Scenario Insights

The bioconjugation industry is highly fragmented, with various players offering bioconjugation services, including biotechnology firms, pharmaceutical companies, contract research organizations (CROs), and academic institutions. This diversity is driven by the growing demand for advanced conjugation technologies in drug development, diagnostics, and precision medicine. Despite the increasing market size, no single entity holds a dominant market share, as companies specialize in different conjugation techniques, linkers, and target biomolecules. The fragmentation also stems from the complexity of the bioconjugation process, requiring specialized expertise and infrastructure, which limits consolidation within the industry.

A critical factor influencing bioconjugation industry trends is the increasing focus on antibody-drug conjugates (ADCs), protein-polymer conjugates, and nanoparticle-based conjugation. Companies differentiate themselves by developing proprietary technologies, improving linker stability, and enhancing biocompatibility to gain a competitive edge. However, this specialization contributes to market segmentation, with firms targeting distinct application areas such as oncology, immunology, and diagnostics. In addition, regional dynamics play a significant role, as North America, Europe, and Asia-Pacific each have distinct regulatory landscapes and innovation ecosystems that shape local market structures.

According to market analysis, the industry's fragmentation is expected to persist due to high barriers to entry, reliance on proprietary technologies, and the need for continuous innovation. Mergers, acquisitions, and strategic partnerships further shape the competitive landscape as companies seek to expand their service portfolios and technological capabilities. While the market grows, pricing pressures and regulatory challenges add complexity to business operations, making differentiation and strategic collaborations crucial for sustained success in this evolving sector.

Regional Insights

North America dominated the bioconjugation market with the largest revenue share of 43.75% in 2024, driven by strong R&D investments, a well-established biopharmaceutical sector, and increasing demand for bioconjugation services. The region's leadership is attributed to the presence of major pharmaceutical and biotech companies actively advancing bioconjugation industry trends, particularly in antibody-drug conjugates (ADCs), gene therapies, and precision medicine. Favorable regulatory frameworks and government funding have further fueled market expansion. Market analysis indicates that North America's dominance is supported by cutting-edge research institutions and strategic collaborations, solidifying its position in global market size and share.

U.S. Bioconjugation Market Trends

The bioconjugation market in the U.S. accounted for the largest market revenue share in North America in 2024, due to strong R&D investments, increasing demand for bioconjugation services, and a well-established biopharmaceutical sector. Advances in antibody-drug conjugates (ADCs), precision medicine, and gene therapies drive market expansion. In addition, favorable regulatory policies and strategic collaborations are accelerating innovation and commercialization.

Europe Bioconjugation Market Trends

The bioconjugation market in Europe is driven by growing R&D investments, advancements in precision medicine, and increasing demand for bioconjugation services. Strong government support, expanding pharmaceutical and biotechnology sectors, and rising adoption of antibody-drug conjugates (ADCs) fuel market growth. Market analysis highlights Europe’s role in driving innovation and expanding its market share in therapeutics and diagnostics.

The UK bioconjugation market is expanding due to rising investments in biotechnology and pharmaceutical R&D and growing demand for antibody-drug conjugates (ADCs) and targeted therapeutics. Increasing collaborations between academic institutions and industry players drive drug development and diagnostics innovation. In addition, government support and a strong regulatory framework further fuel market growth.

The bioconjugation market in Germany is growing rapidly due to strong biotechnology and pharmaceutical industries, increasing R&D investments, and rising demand for targeted therapeutics like antibody-drug conjugates (ADCs). Advanced manufacturing capabilities, strategic industry collaborations, and government support for biopharmaceutical innovation are further driving market expansion. In addition, Germany's leadership in diagnostics and precision medicine is fueling the adoption of bioconjugation technologies.

Asia Pacific Bioconjugation Market Trends

The bioconjugation market in Asia Pacific is expected to grow at the fastest CAGR of 11.52% from 2025 to 2030, driven by increasing healthcare investments, expanding biotechnology and pharmaceutical sectors, and rising demand for targeted therapeutics. Growing R&D activities, government support, and the presence of emerging biopharma companies are fueling innovation in antibody-drug conjugates (ADCs) and precision medicine. In addition, the region's expanding manufacturing capabilities and increasing adoption of bioconjugation services in drug development and diagnostics are accelerating market growth.

The China bioconjugation market is set for rapid growth, driven by increasing government investments in biotechnology, expanding biopharmaceutical manufacturing, and rising demand for targeted drug therapies. The country’s strong focus on precision medicine, antibody-drug conjugates (ADCs), and advanced diagnostics fuels innovation. In addition, growing collaborations between domestic and international biotech firms and a favorable regulatory environment accelerate market expansion.

The bioconjugation market in Japan accounted for the largest revenue share in Asia Pacific in 2024, driven by advanced pharmaceutical and biotechnology industries, increasing R&D investments, and growing demand for antibody-drug conjugates (ADCs) and precision medicine. Strong government support, a well-established regulatory framework, and collaborations between academic institutions and industry players have further fueled innovation. Japan's biopharmaceutical manufacturing and diagnostics expertise has strengthened its position in the global market.

Middle East & Africa Bioconjugation Market Trends

The bioconjugation market in Middle East & Africais expected to grow at a significant CAGR from 2025 to 2030, driven by increasing healthcare investments, expanding pharmaceutical and biotechnology sectors, and rising demand for targeted therapies. Growing awareness of precision medicine, antibody-drug conjugates (ADCs), and advanced diagnostics are further boosting market adoption. In addition, government initiatives, improving healthcare infrastructure, and collaborations with global biotech firms are accelerating regional growth. As R&D activities expand, the demand for bioconjugation technologies in drug development and diagnostics is expected to rise significantly.

The Kuwait’s bioconjugation market is set for rapid growth, driven by increasing investments in healthcare and biotechnology, rising demand for targeted drug therapies, and the expansion of pharmaceutical R&D. Government initiatives to enhance biopharmaceutical manufacturing, along with growing collaborations with global biotech firms, are further fueling market expansion. In addition, the increasing adoption of precision medicine and antibody-drug conjugates (ADCs) is accelerating the demand for bioconjugation technologies in drug development and diagnostics

Key Bioconjugation Company Insights

Companies in the bioconjugation industry are actively pursuing collaborations, acquisitions, and strategic partnerships to strengthen their market presence and expand technological capabilities. Leading pharmaceutical and biotechnology firms are acquiring bioconjugation technology providers to enhance their antibody-drug conjugate (ADC) pipelines and drug delivery solutions. In addition, increasing partnerships with contract research organizations (CROs) and contract manufacturing organizations (CMOs) are helping companies streamline R&D and production.

Investments in new product development and innovation are further intensifying competition, with firms focusing on advancing linker technologies, site-specific conjugation methods, and precision medicine applications to gain a competitive edge.

Key Bioconjugation Companies:

The following are the leading companies in the bioconjugation market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Danaher

- Lonza Group

- Merck KGaA (MilliporeSigma)

- Sartorius AG

- Abbvie, Inc.

- Agilent Technologies, Inc.

- Bio-rad Laboratories, Inc.

- Catalent, Inc.

- BD

Recent Developments

-

In March 2025, Axplora launched a new GMP payload manufacturing workshop at its Le Mans site in France, reinforcing its position in ADC commercial manufacturing. As part of the France 2030 program, the facility expands Axplora’s capabilities to meet the rising global demand for ADCs, representing 40% of the world's marketed ADCs and 50% of FDA-approved ADCs.

-

In November 2024, Lonza announced an expansion of its bioconjugation capabilities in Visp, Switzerland, adding two 1,200L manufacturing suites and supporting infrastructure. The investment aimed to enhance commercial supply capacity and create approximately 200 new jobs, with operations expected to begin in 2028.

-

In March 2024, Abzena announced a USD 5 million expansion of its Bristol, PA, bioconjugate development and cGMP manufacturing site. The investment enhanced laboratory space, upgraded facilities, and added new equipment, strengthening existing bioconjugation capabilities and increasing capacity for integrated biopharmaceutical drug programs.

Bioconjugation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.13 billion

Revenue forecast in 2030

USD 9.67 billion

Growth rate

CAGR of 9.54% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, biomolecule type, technique, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

Thermo Fisher Scientific; Danaher; Lonza Group; Merck KGaA (MilliporeSigma); Sartorius AG; Abbvie, Inc.; Agilent Technologies, Inc.; Bio-rad Laboratories, Inc.; Catalent, Inc.; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioconjugation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioconjugation market report based on product and services, biomolecule type, technique, application, end use, and region.

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Reagents & Kits

-

Linker & Crosslinking Reagents & Kits

-

Labeling Reagents & Kits

-

Modification Reagents & Kits

-

Other Reagents & Kits

-

-

Labels

-

Fluorescent Tags

-

Enzymes

-

Haptens

-

Polymers

-

Bead Coupling

-

Other Labels

-

-

Other Consumables

-

-

Instruments

-

Chromatography Systems

-

Spectroscopy Instruments

-

Mass Spectrometers

-

Flow Cytometers

-

Electrophoresis Equipment

-

Filtration Systems

-

Mixers & Shakers

-

Incubators

-

Other Instruments

-

-

Service

-

Custom Synthesis & Conjugation Services

-

Analytical & Characterization Services

-

Scale-up & Manufacturing Services

-

Other Services

-

-

-

Biomolecule Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibodies

-

Proteins

-

Peptides

-

Oligonucleotides

-

Other Biomolecules

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical Conjugation

-

Enzyme-Mediated Conjugation

-

Click Chemistry

-

Photoreactive Crosslinking

-

Other Techniques

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutics

-

Antibody-drug Conjugates

-

Protein-drug Conjugates

-

Peptide-drug Conjugates

-

Other Therapeutic Applications

-

-

Research & Development

-

Diagnostics

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Hospitals, Clinical & Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioconjugation market size was estimated at USD 5.64 billion in 2024 and is expected to reach USD 6.13 billion in 2025.

b. The global bioconjugation market is expected to grow at a compound annual growth rate of 9.54% from 2025 to 2030 to reach USD 9.67 billion by 2030.

b. North America dominated the bioconjugation market with a share of 43.75% in 2024. This is attributable to rising scientific awareness coupled with increasing acceptance of advanced therapeutics in the region.

b. Some key players operating in the bioconjugation market include Thermo Fisher Scientific, Danaher, Lonza Group, Merck KGaA (MilliporeSigma), Sartorius AG, Abbvie, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Catalent, Inc., BD

b. Key factors driving market growth include the increasing interest in advanced therapeutics, the rising incidence of chronic diseases, and expanded opportunities for biopharmaceutical development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.