- Home

- »

- Plastics, Polymers & Resins

- »

-

Biodegradable Plastic Films Market Size, Share Report, 2030GVR Report cover

![Biodegradable Plastic Films Market Size, Share & Trends Report]()

Biodegradable Plastic Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Starch Blends, PA), By Application (Bags, Wrapping Films), By End-use (Food & Beverage, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-116-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biodegradable Plastic Films Market Summary

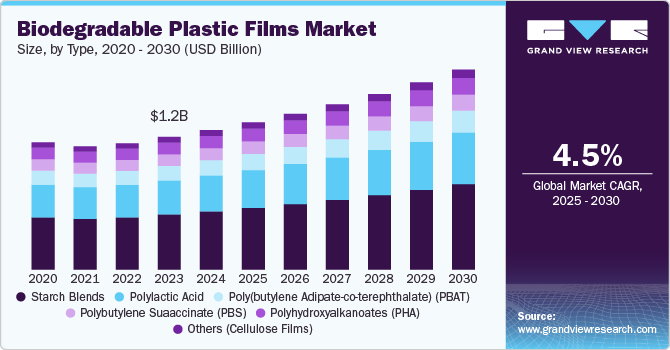

The global biodegradable plastic films market size was estimated at USD 1,215.36 million in 2024 and is projected to reach USD 1,741.13 million by 2030, growing at a CAGR of 4.47% from 2025 to 2030. Growing environmental awareness and rules demanding the reduction of plastic waste are expected to augment the demand for biodegradable plastic films over the forecast period.

Key Market Trends & Insights

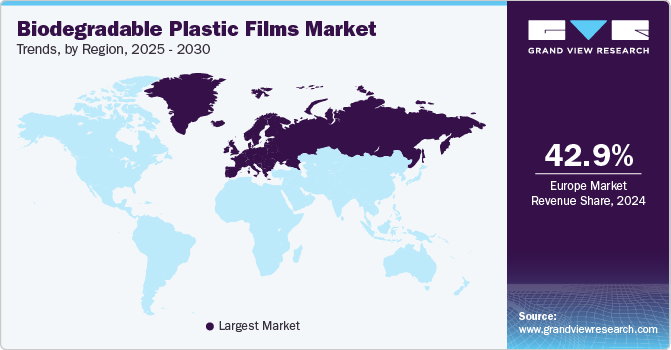

- Europe biodegradable plastic films market dominated globally and accounted for the largest revenue share of 42.87% in 2024.

- The Asia Pacific biodegradable plastic films market is driven by rapid urbanization and growing environmental awareness among middle-income populations.

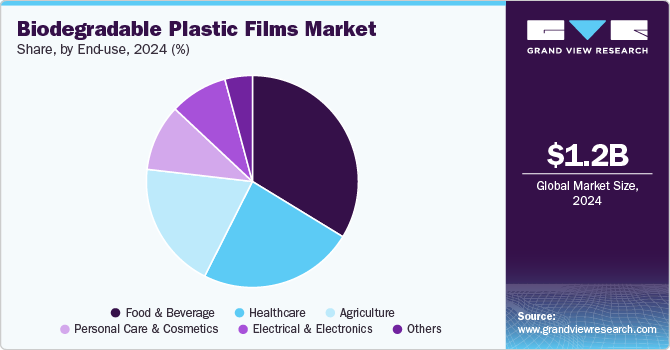

- Based on end-use, the food & beverage segment dominated the market and accounted for the largest revenue share of over 33.72% in 2024.

- In terms of application, the bags application segment dominated the market and accounted for the largest revenue share of 36.24% in 2024.

- Based on type, the starch blends type dominated the market and accounted for the largest revenue share of over 41.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,215.36 Million

- 2030 Projected Market Size: USD 1,741.13 Million

- CAGR (2025-2030): 4.47%

- Europe: Largest market in 2024

These films are gaining popularity as a more environmentally friendly alternative to traditional plastic films, which are not biodegradable and contribute to pollution. The biodegradable plastic films industry is witnessing a significant shift driven by consumer demand for sustainable and eco-friendly packaging solutions. As environmental awareness grows globally, consumers increasingly prioritize products with reduced ecological impact.

This trend is evident in industries such as food packaging, where biodegradable films are replacing conventional plastics. Retailers and brands are adopting these materials to align with customer expectations and regulatory pressures. The trend is further fueled by the integration of innovative designs and functional properties, such as moisture resistance and durability, ensuring the practicality of these films without compromising sustainability.

Drivers, Opportunities & Restraints

Governments worldwide are implementing stringent regulations to curb plastic waste, propelling the demand for biodegradable plastic films. Policies such as single-use plastic bans, plastic taxes, and extended producer responsibility (EPR) frameworks are creating a favorable environment for biodegradable alternatives. In regions like Europe and North America, legislation like the EU Plastics Strategy is accelerating the transition to sustainable materials. In addition, public funding for research and subsidies for manufacturing biodegradable films are making these products more cost-competitive, encouraging widespread adoption across various industries.

The agricultural sector presents a lucrative opportunity for the biodegradable plastic films industry. Biodegradable mulch films, for instance, offer benefits like enhanced soil quality, water conservation, and weed control while eliminating the disposal issues associated with traditional plastic films. With an increasing global focus on sustainable farming practices, there is a growing interest in these materials from farmers and agribusinesses. Emerging markets in Asia-Pacific and Latin America, with vast agricultural economies, provide untapped potential for manufacturers to introduce tailored solutions that cater to regional farming needs.

Despite their environmental benefits, the adoption of biodegradable plastic films is restrained by their high production costs compared to conventional plastics. Factors such as the use of costly raw materials like polylactic acid (PLA) and polyhydroxyalkanoates (PHA), along with complex manufacturing processes, contribute to elevated prices. This cost disparity often makes biodegradable films less attractive to cost-sensitive industries and regions with limited regulatory enforcement. Addressing these challenges through technological advancements and economies of scale remains critical for widespread market penetration.

Type Insights

The starch blends type dominated the market and accounted for the largest revenue share of over 41.72% in 2024.These films are known as more environmentally friendly than traditional polymers due to their qualities, such as renewable and abundant resources. Furthermore, starch blends are considered effective biodegradable fillers due to their thermal stability and minimal interaction with the melt-flow properties of materials.

Polylactic acid is one of the major type of biodegradable plastic films. PLA-based films are biodegradable and compostable alternatives to typical plastics as they are produced from renewable resources such as maize starch and sugarcane.Concerns regarding plastic waste and environmental degradation are driving demand for more sustainable packaging and products.

Cellulose films is another type with a significant market penetration and growth rate.Cellulose films are compostable and biodegradable. It contains agricultural byproducts, water plants, grasses, and other plant compounds. Cellulose films are commonly used in the food & beverage industry for food packaging, which improves both durability and printability.

Application Insights

The bags application segment dominated the market and accounted for the largest revenue share of 36.24% in 2024. Biodegradable film-based bags are designed to break down naturally and reduce their environmental effect compared to conventional plastic bags. The growing awareness of plastic pollution and its adverse impact on ecosystems, wildlife, and oceans is the key driver of the growth of biodegradable bags.

The wrapping films application segment is growing with a significant CAGR owing to the increasing demand for sustainable packaging solutions. Moreover, the use of biodegradable wrapping films aids in waste reduction by ensuring that packaging materials degrade organically, lessening the pressure on landfills and ecosystems.

In addition, biodegradable film-based liners are suited for various uses, including food waste collection and general waste management. Furthermore, they are utilized as liners to safeguard sensitive products such as electronics, delicate objects, or perishable goods.

End-use Insights

The food & beverage segment dominated the market and accounted for the largest revenue share of over 33.72% in 2024. Biodegradable plastic films are commonly used in the food packaging industry for edible coating, wrapping films, egg trays, and food containers. The potential of biodegradable films to improve food quality, shelf life, safety, and usability is expected to propel the demand for biodegradable films in the food & beverage industry.

The use of biodegradable films is expected to grow in the agriculture industry significantly over the forecast period. Due to their ecological benefits, agricultural biodegradable films are extensively utilized in specialized crop production systems. The usage of biodegradable films enhances soil quality, which promotes the worldwide biodegradable films industry. It may be decomposed without damaging the environment by living creatures, such as bacteria or fungi, with or without oxygen.

Furthermore, the healthcare industry is continuously innovating to improve patient care and safety. Biodegradable films are utilized to provide protective barriers, sterile packing, and controlled discharge features for medical devices owing to their properties, such as mechanical strength and barrier characteristics.

Regional Insights

The North America biodegradable plastic films market is driven by environmental awareness and stringent regulations on plastic usage in agriculture. Canadian agricultural regions, in particular, are facing mounting pressure to reduce plastic waste from farming operations, and both government and environmental organizations advocate for eco-friendly alternatives.

U.S. Biodegradable Plastic Films Market Trends

The U.S. biodegradable plastic films market is driven by increasing regulatory actions at the state level, such as California's single-use plastic bans and other waste reduction laws. These policies encourage businesses to transition to biodegradable materials. Moreover, the rapid growth of the organic food industry in the U.S. is creating a strong demand for biodegradable packaging as consumers prioritize eco-conscious brands.

Europe Biodegradable Plastic Films Market Trends

Europe biodegradable plastic films market dominated globally and accounted for the largest revenue share of 42.87% in 2024, which is attributed to its comprehensive environmental regulations and a strong emphasis on the European Green Deal. Policies like the EU’s Single-Use Plastics Directive and targets for reducing greenhouse gas emissions push manufacturers to replace conventional plastics with biodegradable alternatives. In addition, the region’s well-developed recycling and composting infrastructure supports the adoption of biodegradable films by ensuring effective disposal. The collaboration between governments, research institutions, and private industries in advancing bio-based materials significantly accelerates market growth.

Germany’s biodegradable plastic films market is fueled by the country’s leadership in environmental innovation and strict waste management laws. Germany’s Packaging Act (VerpackG) and initiatives promoting the circular economy require businesses to reduce their environmental footprint, leading to a surge in demand for biodegradable solutions.

Asia Pacific Biodegradable Plastic Films Market Trends

The Asia Pacific biodegradable plastic films market is driven by rapid urbanization and growing environmental awareness among middle-income populations. Countries like China and India are introducing policies to reduce plastic waste, such as bans on single-use plastics, which are propelling the adoption of biodegradable materials.

Key Biodegradable Plastic Films Company Insights

The biodegradable plastic films industry is highly competitive, with several key players dominating the landscape. The biodegradable plastic films industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Biodegradable Plastic Films Companies:

The following are the leading companies in the biodegradable plastic films market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Cortec Corporation

- Kingfa Sci. & Tech. Co., Ltd.

- Futamura Chemicals Co., Ltd

- BioBag Americas, Inc.

- Plastchim-T

- Shreeji Stretch Film Industries

- Clondalkin Group Holding B.V.

- Tipa Corp. Ltd.

- Brentwood Plastics, Inc.

Recent Developments

-

In September 2024, Pester Pac Automation partnered with Solutum Technologies to launch an eco-friendly packaging film designed to replace traditional materials. This innovative film is fully biodegradable, breaking down in soil and water without leaving harmful microplastics behind. Its strong tear resistance enables the use of thinner materials, leading to significant cost savings. In addition, the film is compatible with Pester's existing stretch wrapping and overwrapping systems, enhancing both cost-effectiveness and energy efficiency.

-

In January 2024, CAMM Solutions launched a biodegradable stretch film that serves as a sustainable alternative to traditional plastic films used in logistics. This innovative product is made from a blend of natural materials and advanced PVOH formulations, providing the same performance as conventional stretch films while preventing microplastic pollution. Key benefits include its quick dissolution in nature, making it harmless if it escapes into the environment and its versatility for stabilizing products on pallets and securely attaching items during transport.

Biodegradable Plastic Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,282.34 million

Revenue forecast in 2030

USD 1,741.13 million

Growth rate

CAGR of 4.47% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, The Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

BASF SE; Cortec Corporation; Kingfa Sci. & Tech. Co.; Ltd.; Futamura Chemicals Co., Ltd; BioBag Americas, Inc.; Plastchim-T; Shreeji Stretch Film Industries; Clondalkin Group Holding B.V.; Tipa Corp. Ltd.; Brentwood Plastics, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biodegradable Plastic Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biodegradable plastic films market report based on type, application, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Starch Blends

-

Polylactic Acid

-

Poly(butylene adipate-co-terephthalate) (PBAT)

-

Polybutylene succinate (PBS)

-

Polyhydroxyalkanoates (PHA)

-

Others (Cellulose Films)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bags

-

Wrapping Films

-

Liners

-

Sheets

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Healthcare

-

Agriculture

-

Personal Care & Cosmetics

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biodegradable plastic films market size was estimated at USD 1,215.36 million in 2024 and is expected to reach USD 1,282.34 million in 2025.

b. The global biodegradable plastic films market is expected to grow at a compound annual growth rate of 4.47% from 2025 to 2030 to reach USD 1,741.13 million by 2030.

b. The starch blends segment led the global biodegradable plastic films market and accounted for more than 41.0% share of the global revenue in 2024.

b. Some key players operating in the biodegradable plastic films market include BASF SE, Cortec Corporation, Kingfa Sci. & Tech. Co., Ltd., Futamura Chemicals Co., Ltd, BioBag Americas, Inc., Plastchim-T, Shreeji Stretch Film Industries, and Clondalkin Group Holding B.V.

b. Key factors that are driving the biodegradable plastic films market growth include growing environmental awareness and rules demanding the reduction of plastic waste.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.