- Home

- »

- Biotechnology

- »

-

Biologics Manufacturing Market Size, Industry Report, 2033GVR Report cover

![Biologics Manufacturing Market Size, Share & Trends Report]()

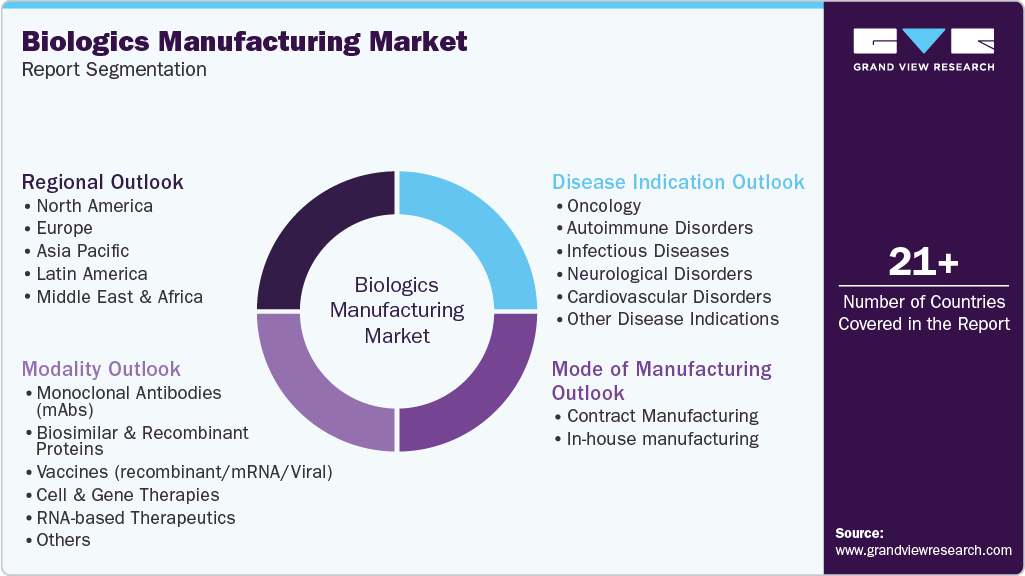

Biologics Manufacturing Market (2025 - 2033) Size, Share & Trends Analysis Report By Mode Of Manufacturing (Contract, In-House), By Modality, By Disease Indication, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-743-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biologics Manufacturing Market Summary

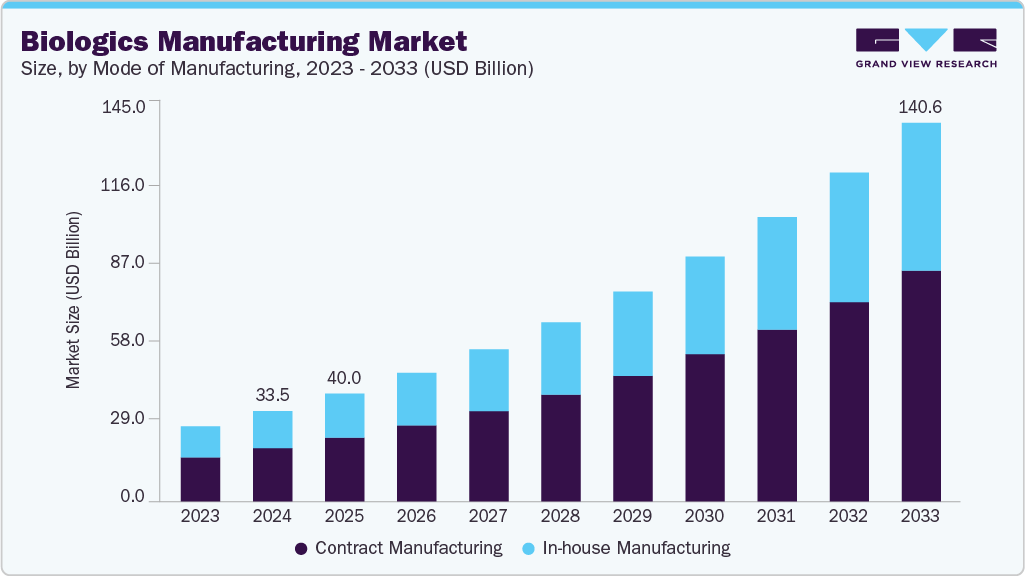

The global biologics manufacturing market size was estimated at USD 33.48 billion in 2024 and is projected to reach USD 140.62 billion by 2033, growing at a CAGR of 17.0% from 2025 to 2033. This growth is primarily driven by increasing demand for biopharmaceuticals, expansion of biologics production capacities, and advancements in cell and gene therapy manufacturing technologies.

Key Market Trends & Insights

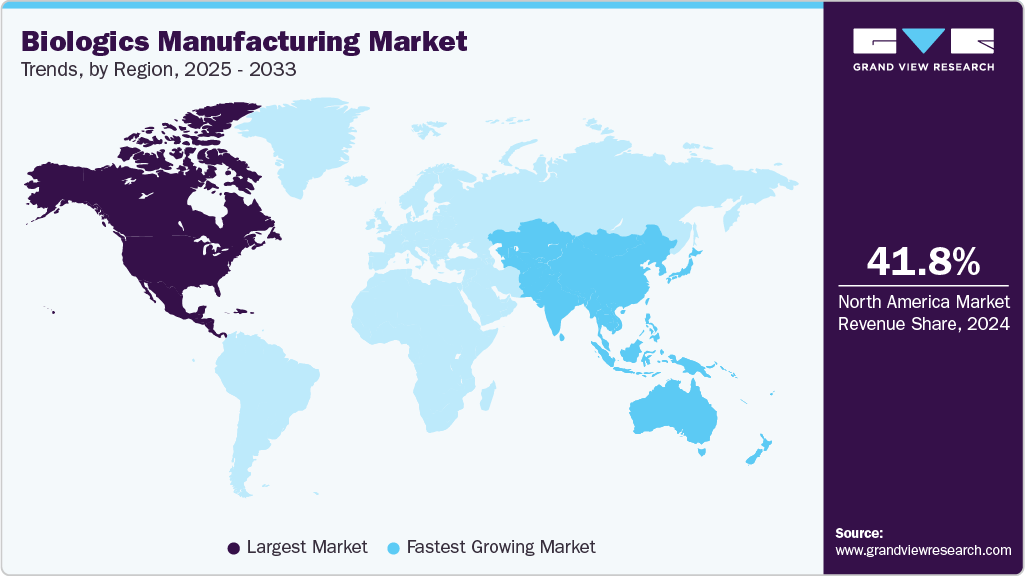

- The North America biologics manufacturing market held the largest share of 41.78% of the global market in 2024.

- The biologics manufacturing industry in the U.S. is expected to grow significantly over the forecast period.

- By mode of manufacturing, the contract manufacturing segment held the highest market share in 2024.

- By modality, the monoclonal antibodies (mAbs) segment held the highest market share of 40.37% in 2024.

- By disease indication, the oncology segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.48 Billion

- 2033 Projected Market Size: USD 140.62 Billion

- CAGR (2025-2033): 17.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising burden of chronic disease

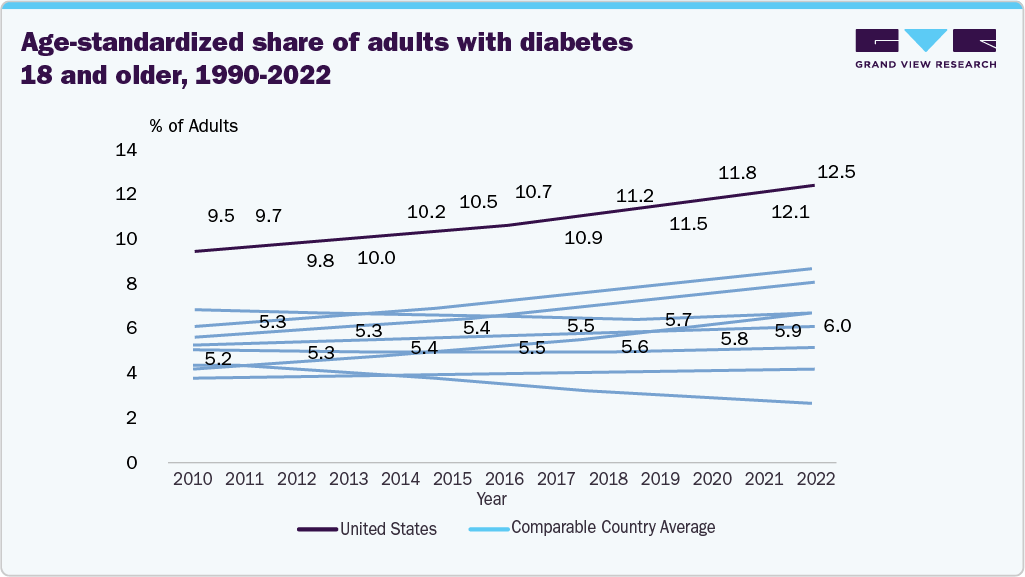

One of the main factors expanding the global biologics manufacturing industry is the rising incidence of chronic illnesses such as diabetes, cancer, autoimmune diseases, and cardiovascular conditions. Biologic therapies from living organisms provide targeted and efficient treatment options for these complex conditions, as conventional treatments frequently prove insufficient. The need for novel biologic medications has increased due to the growing number of patients needing long-term, specialized care, which stimulates producers to increase their production capacity and invest in cutting-edge technologies.

Furthermore, access to high-quality biologic therapies is becoming a top priority for healthcare systems worldwide due to the growing burden of chronic diseases. To enhance patient outcomes and lower the long-term treatment expenses related to managing chronic illnesses, governments and private healthcare providers are increasingly supporting the development and commercialization of biologics. Over the years, the market and regulatory emphasis on biologics production is anticipated to support steady expansion in manufacturing capacity and technological breakthroughs.

Growing Demand for Novel and Targeted Therapies

The rising need for innovative and focused treatments propels the biologics manufacturing market. Targeted biologics, including monoclonal antibodies, antibody-drug conjugates, and cell and gene therapies, differ from conventional medications in that they specifically target the molecular causes of illnesses. These treatments are very appealing for diseases such as cancer, autoimmune disorders, and rare genetic diseases because of their precision, which increases treatment efficacy and reduces side effects. Pharmaceutical and biotechnology companies are making significant investments in research pipelines to launch new targeted biologics.

Regulatory bodies in important markets concurrently establish favorable pathways for their approval to support the adoption of breakthrough biologics in clinical practice. Targeted therapy success has also increased industry competition, forcing producers to increase production capacity, embrace cutting-edge bioprocessing technologies, and form strategic alliances. As businesses work to satisfy the growing demand for novel, patient-specific treatments worldwide, these advancements are greatly accelerating the growth of the biologics manufacturing sector.

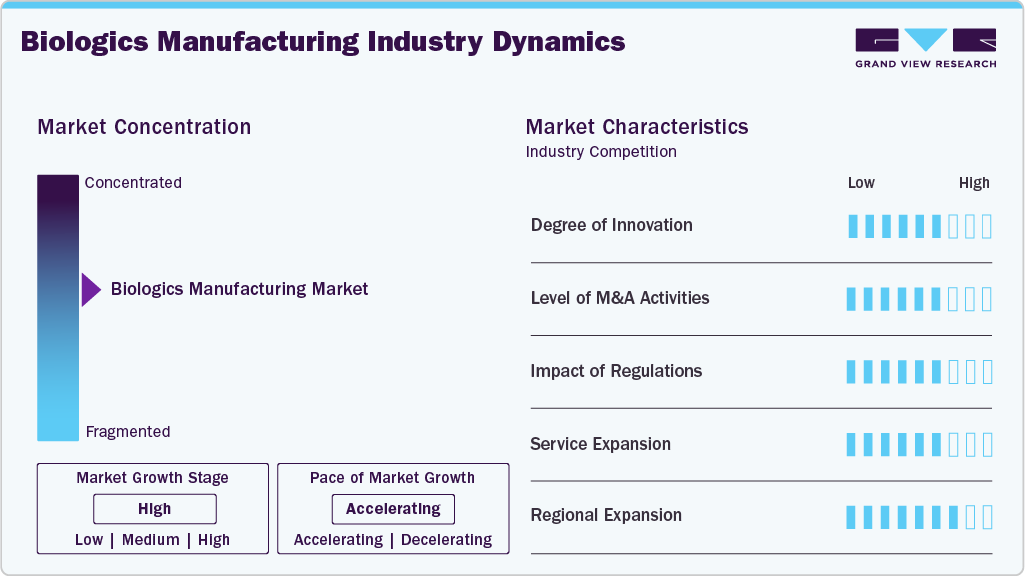

Market Concentration & Characteristics

The biologics manufacturing industry is expanding due to a high level of innovation in the manufacturing process, improvements in bioprocessing technologies, single-use systems, automation, and digital controls allow for increased productivity, scalability, and product quality. The range of biologics is also growing, ranging from customized cell and gene therapies to next-generation monoclonal antibodies, thanks to advancements in formulation and delivery techniques. This constant flow of innovation is a major driver of the biologics manufacturing market's growth since it shortens development timelines and fortifies competitive differentiation.

One major factor fueling the biologics manufacturing industry is the rise in mergers and acquisitions (M&A) in the biopharmaceutical sector. Through strategic alliances, acquisitions of specialized biotech companies, and partnerships with contract development and manufacturing organizations (CDMOs), companies can increase their biologics pipelines, gain access to cutting-edge technologies, and fortify global manufacturing networks. For instance, in May 2025, Terumo Corporation acquired WuXi Biologics' drug product manufacturing facility in Germany. This strategic move enhances Terumo's capabilities in biologics production within the European market. These consolidation initiatives also improve economies of scale, increasing the efficiency and competitiveness of biologics production globally.

Regulations significantly influence the biologics manufacturing industry, shaping product design, manufacturing processes, and market access. Compliance with stringent standards such as GMP, ISO certifications, and regional regulatory frameworks such as FDA, EMA, and PMDA guidelines is essential, particularly for media used in clinical and therapeutic applications. Requirements for serum-free, xeno-free, and chemically defined formulations drive innovation toward safer, more consistent products. Regulatory oversight also extends to raw material sourcing, quality control, labeling, and traceability, ensuring product safety and reproducibility. While compliance increases development costs and time-to-market, it enhances product credibility, facilitates global adoption, and supports market growth in highly regulated sectors such as regenerative medicine, cell therapy, and biopharmaceutical manufacturing.

Service expansion in biologics manufacturing is being driven by growing complexity of therapies and the need for flexible, end-to-end solutions. CDMOs are moving beyond traditional large-scale antibody production to offer capabilities in cell and gene therapies, viral vectors, and specialized fill-finish services. Clients increasingly value partners who can provide integrated support across development, clinical, and commercial stages, making breadth of services a key differentiator in winning long-term contracts.

Regional expansion in the biologics manufacturing industry is driven by the growing adoption of regenerative medicine, cell and gene therapies, and biobanking across emerging and established markets. Leading players are strengthening their presence in high-growth regions such as Asia Pacific, the Middle East, and Latin America through partnerships, distribution agreements, and local manufacturing to meet rising demand and comply with regional regulatory standards. Expanding operations into these markets enables companies to tap into expanding research infrastructure, government-backed healthcare initiatives, and increasing clinical trial activity while ensuring faster supply chains and better customer support.

Mode of Manufacturing Insights

The contract manufacturing segment accounted for the largest market share in 2024 and is expected to witness the fastest CAGR during the forecast period. This growth is primarily driven by pharmaceutical and biotechnology companies' rising outsourcing of biologics production to contract development and manufacturing organizations (CDMOs). Companies are turning to CDMOs due to the growing pipeline of complex biologics, the need for large-scale, cost-effective production, and specialized infrastructure, knowledge, and regulatory compliance. Contract manufacturers are also becoming more widely used in biologics production by increasing their capacity, global reach, and use of cutting-edge technologies like continuous bioprocessing and single-use systems.

The in-house manufacturing segment is expected to grow significantly over the forecast period, driven by increasing investments from large pharmaceutical and biotechnology companies to establish or expand their production facilities. This trend is driven by increased control over proprietary processes, supply chain security guarantees, intellectual property protection, and the capacity to tailor production to therapeutic pipelines. Moreover, companies are encouraged to internalize their manufacturing capabilities through government incentives, bioprocessing technological advancements, and the growing demand for specialized and customized biologics.

Modality Insights

The monoclonal antibodies (mAbs) segment dominated the market in 2024 with a 40.37% share because they are widely used to treat infectious diseases, autoimmune disorders, and cancer. Strong clinical success rates, high specificity, and fewer side effects than traditional therapies have fueled their adoption. Moreover, the market is still expanding due to a strong pipeline of mAb-based treatments, a rise in regulatory approvals, and the growing need for targeted biologics. The increasing trend toward biosimilar mAbs and technological developments in bioprocessing and scale-up further reinforce the segment's dominant position.

The cell & gene therapies segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing number of FDA and EMA approvals, expanding clinical pipeline, and strong investment inflows from biopharma companies and venture capital firms. Rapid adoption of these treatments is fueled by their potential to cure cancer, rare genetic disorders, and other diseases that were previously incurable. The segment's strong growth is also attributed to the growing emphasis on personalized medicine and the expanding partnerships between CDMOs and biopharmaceutical companies.

Disease Indication Insights

The oncology segment dominated the market in 2024 with a share of 38.46%. It is also expected to grow with the fastest CAGR, because of its high prevalence of disease, robust need for cutting-edge biologics, and ongoing advancements in targeted treatments. The market share has increased dramatically due to the rising incidence of cancer globally and the increased use of immune checkpoint inhibitors, cell and gene therapies, and monoclonal antibodies. Moreover, significant R&D expenditures, a strong pipeline of oncology biologics, and encouraging regulatory approvals maintain this segment's dominance.

The neurological disorders segment is expected to grow at a significant CAGR during the forecast period, driven by the increasing prevalence of neurodegenerative diseases such as Alzheimer’s, Parkinson’s, and multiple sclerosis. The growth is driven by increased demand for advanced biologics, such as gene therapies targeting the central nervous system, enzyme replacement treatments, and monoclonal antibodies. Moreover, developments in targeted delivery systems, rising R&D expenditures, and encouraging regulatory actions for cutting-edge neurological therapies are expected.

Regional Insights

North America dominated the biologics manufacturing market with a share of 41.78% in 2024, driven by advanced healthcare infrastructure, strong biopharmaceutical R&D, and key industry players with well-established supply chains. Strong pipelines in precision oncology, regenerative medicine, cell and gene therapies, cryopreservation, stem cell banking, and personalized medicine have strengthened the U.S. standing as a center for innovation. For instance, in May 2025, Merck began building a USD 1 billion biologics hub in Wilmington, Delaware, boosting domestic supply and job creation while bolstering US manufacturing capacity for Keytruda and next-generation therapies.

U.S Biologics Manufacturing Market Trends

The U.S. biologics manufacturing market is highly competitive and innovation-driven, supported by a strong biopharmaceutical R&D ecosystem and a robust pipeline in cell and gene therapies, regenerative medicine, and precision oncology. Growing adoption of cryopreservation, stem cell banking, immunotherapy, and personalized medicine has reinforced the country’s position as a global innovation hub. For instance, in May 2025, Roche and its Genentech unit announced a USD 700 million investment for a 700,000-sq-ft biologics facility in Holly Springs, North Carolina, to support next-generation obesity therapies.

Europe Biologics Manufacturing Market Trends

Europe’s biologics manufacturing industry is witnessing steady growth, supported by strong government funding for biomedical research, expanding biobanking networks, and rising adoption of cell-based therapies and regenerative medicine. Increasing demand in stem cell banking, immunotherapy development, precision medicine, and cross-border research collaborations strengthens Europe’s position as a key biologics manufacturing hub. For instance, in April 2021, Bristol Myers Squibb announced plans for a new cell therapy manufacturing site in Leiden, Netherlands, its first in Europe, while extending its targeted protein degradation partnership with Evotec.

The UK biologics manufacturing market is expanding, Supported by a robust biomedical research base, sophisticated biobanking infrastructure, and leadership in cell and gene therapies. Government initiatives, including UK Biobank programs, along with strict MHRA regulations, are driving the adoption of GMP-compliant, serum-free, and xeno-free solutions.

Germany’s biologics manufacturing industry is growing steadily, supported by a strong biopharmaceutical ecosystem, advanced research infrastructure, and leadership in regenerative medicine. Government and EU funding, combined with a robust biobanking network, are driving the adoption of GMP-compliant, serum-free, and xeno-free solutions for research and clinical applications.

Asia Pacific Biologics Manufacturing Market Trends

Asia Pacific is expected to witness the fastest growth, with a CAGR of 17.00% during the forecast period, driven by supportive government policies, low labor costs, and expanding biologics production capabilities. The region is a major hub for monoclonal antibodies (mAbs), which rely heavily on mammalian cell culture and advanced cryopreservation technologies. Rising investments in cell and gene therapies, regenerative medicine, and large-scale biomanufacturing facilities fuel growth. For instance, in October 2024, Samsung Biologics in South Korea signed its largest-ever USD 1.24 billion manufacturing deal with an Asia-based pharmaceutical company, running through 2037 and expanding its Songdo production capacity.

China's biologics manufacturing industry is growing rapidly, fueled by a booming biopharmaceutical sector, increased investments in regenerative medicine, and expanding biobanking facilities. Government programs such as "Made in China 2025" and increased financing for stem cell and gene therapy research are promoting the use of GMP-compliant, serum-free, and xeno-free products. China is one of the world's fastest-growing markets thanks to strengthened NMPA regulations and partnerships in precision medicine, stem cell banking, and CAR-T therapy.

The market for biologics manufacturing in Japan is growing due to its leadership in regenerative medicine, sophisticated biobanking, and innovative iPSC-based research. Strong industry-academia partnerships and growing demand from precision medicine, immunotherapy, and regenerative therapies solidify Japan's standing as a major Asia Pacific market.

MEA Biologics Manufacturing Market Trends

The MEA biologics manufacturing industry is emerging, supported by growing investments in healthcare infrastructure, expanding biobanking facilities, and rising adoption of regenerative medicine and cell-based therapies. The need for GMP-compliant, serum-free, and xeno-free cryopreservation solutions is rising as stem cell banking, fertility preservation, and precision medicine gain more attention. Establishing specialized research centers and partnerships with international biotech companies increases the region's potential.

Kuwait’s biologics manufacturing industry is emerging, fueled by healthcare modernization, biomedical research, and growing awareness of stem cell banking and fertility preservation. Kuwait is establishing itself as a major player in the regional market through government initiatives, GMP-compliant, serum-free, and xeno-free solutions, and partnerships with international biotech firms.

Key Biologics Manufacturing Company Insights

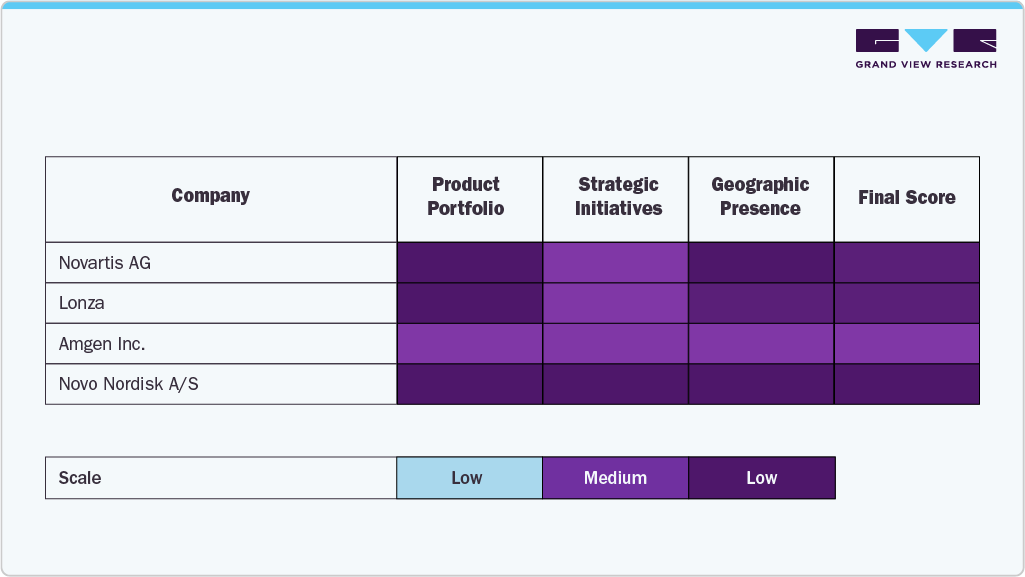

The biologics manufacturing market is characterized by several established players who dominate through broad product portfolios, global scale, and consistent investments in advanced manufacturing technologies. Due to their extensive biologics pipelines, large-scale production capacities, and established distribution networks across global healthcare markets, industry leaders such as Novartis AG, Pfizer Inc., Amgen Inc., Novo Nordisk A/S, AbbVie Inc., Johnson & Johnson, Bristol-Myers Squibb Company, Eli Lilly and Company, and F. Hoffmann-La Roche Ltd. have maintained a significant market share.

By providing end-to-end biologics development and manufacturing services, specialized CDMOs and biomanufacturing leaders such as WuXi Biologics, FUJIFILM Diosynth Biotechnologies, Boehringer Ingelheim, Lonza, and Samsung Biologics are growing their footprint. These businesses meet the changing needs of major pharmaceutical companies and up-and-coming biotech innovators by offering adaptable, scalable solutions for monoclonal antibodies, recombinant proteins, vaccines, and cell and gene therapies.

Market leaders continue to dominate the landscape by combining cutting-edge bioprocessing platforms such as single-use technologies, continuous manufacturing, and advanced cell culture systems with comprehensive service offerings and strategic global expansions. Their leadership is reinforced by strong regulatory compliance, high production efficiency, and collaborations aimed at accelerating the time to market for innovative therapies.

Specialized CDMOs and well-known pharmaceutical behemoths are dynamically merging in the biologics manufacturing market. Technological advancements in upstream and downstream processing, mergers, acquisitions, and strategic alliances fuel increased competition. Businesses can create long-term value and leadership in this quickly changing industry by combining scientific innovation with flexible, customer-focused manufacturing models.

Key Biologics Manufacturing Companies:

The following are the leading companies in the biologics manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- Pfizer Inc

- Amgen Inc.

- Novo Nordisk A/S

- AbbVie Inc.

- Johnson & Johnson (Johnson & Johnson Services, Inc.)

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann La-Roche Ltd.

- Wuxi Biologics

- FUJIFILM Holdings Corporation (FUJIFILM Diosynth Biotechnologies)

- Boehringer Ingelheim International GmbH

- Lonza

- Samsung Biologics

Recent Developments

-

In May 2025, Samsung Biologics secured a USD 518 million biologics manufacturing contract with an undisclosed U.S. pharmaceutical company, extending its CDMO dealmaking streak through 2031.

-

In May 2025, Pfizer secured an exclusive global licensing agreement with China’s 3SBio for the bispecific antibody SSGJ-707, paying a USD 1.25 billion upfront plus up to USD 4.8 billion in milestones, while planning manufacturing in North Carolina and Kansas.

-

In March 2025, Johnson & Johnson commenced construction of a 500,000 ft² biologics facility in Wilson, North Carolina, part of a USD 55 billion U.S. investment plan, creating 5,000 construction and 500+ permanent high-skilled jobs.

Biologics Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.05 billion

Revenue forecast in 2033

USD 140.62 billion

Growth rate

CAGR of 17.00% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of manufacturing, modality, disease indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Novartis AG; Pfizer Inc; Amgen Inc.; Novo Nordisk A/S; AbbVie Inc.; Johnson & Johnson (Johnson & Johnson Services, Inc.); Bristol-Myers Squibb Company; Eli Lilly and Company; F. Hoffmann La-Roche Ltd.; Wuxi Biologics; FUJIFILM Holdings Corporation (FUJIFILM Diosynth Biotechnologies); Boehringer Ingelheim International GmbH; Lonza; Samsung Biologics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Biologics Manufacturing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global biologics manufacturing market on the basis of mode of manufacturing, modality, disease indication, and region.

-

Mode of Manufacturing Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Manufacturing

-

In-house manufacturing

-

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal Antibodies (mAbs)

-

Biosimilar & Recombinant Proteins

-

Vaccines (recombinant/mRNA/Viral)

-

Cell & Gene Therapies

-

RNA-based Therapeutics

-

Others

-

-

Disease Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Autoimmune Disorders

-

Infectious Diseases

-

Neurological Disorders

-

Cardiovascular Disorders

-

Other Disease Indications

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biologics manufacturing market size was estimated at USD 33.48 billion in 2024 and is expected to reach USD 40.05 billion in 2025.

b. The global biologics manufacturing market is expected to witness a compound annual growth rate of 17.00% from 2025 to 2033 to reach USD 140.62 billion in 2033.

b. The oncology segment held the largest share of the biologics manufacturing market. This is attributed to the rising prevalence of cancer and the increasing development of targeted biologic therapies, including monoclonal antibodies and immunotherapies, to address growing treatment needs.

b. The key players competing in the biologics manufacturing market include Novartis AG; Pfizer Inc; Amgen Inc.; Novo Nordisk A/S; AbbVie Inc.; Johnson & Johnson Services, Inc.; Bristol-Myers Squibb Company; Eli Lilly and Company; F. Hoffmann La-Roche Ltd.; Wuxi Biologics; FUJIFILM Diosynth Biotechnologies.; Boehringer Ingelheim International GmbH; Lonza; and Samsung Biologics among others.

b. The rising demand for targeted therapies and advancements in bioprocessing technologies are the major factors likely to drive the biologics manufacturing market. Additionally, increasing investments in R&D and expanding biopharmaceutical production capacities further support market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.