- Home

- »

- Advanced Interior Materials

- »

-

Biomass Boilers Market Size & Share, Industry Report, 2030GVR Report cover

![Biomass Boilers Market Size, Share & Trends Report]()

Biomass Boilers Market (2025 - 2030) Size, Share & Trends Analysis Report By Fuel Type (Wood Chip Boilers, Pellet Boilers, Log Boilers), By End-use (Commercial, Residential), By Application (Heating, Power Generation), By Capacity, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biomass Boilers Market Summary

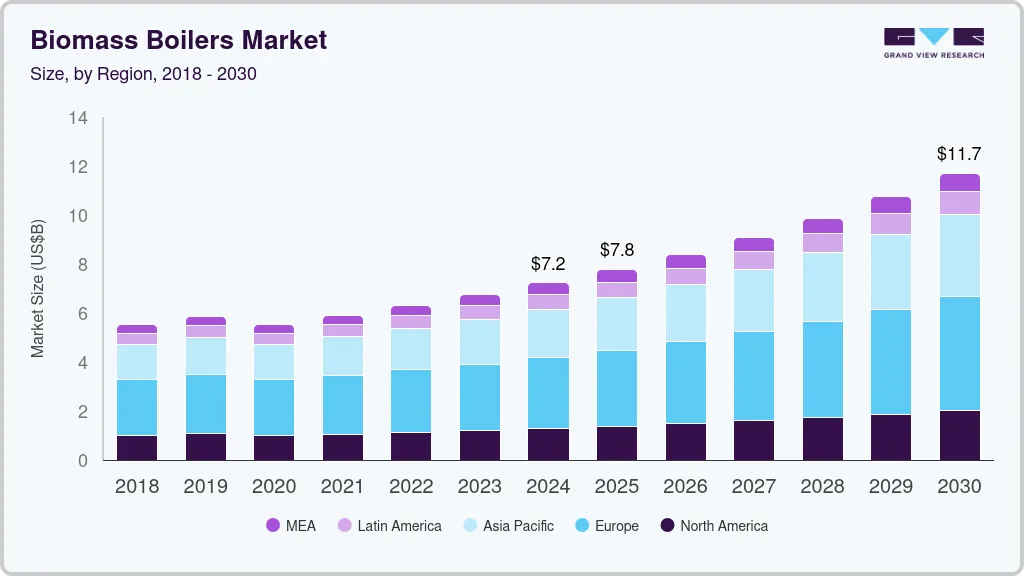

The global biomass boilers market size was estimated at USD 7,242.5 million in 2024 and is projected to reach USD 11,706.5 million by 2030, growing at a CAGR of 8.5% from 2025 to 2030. The growth of the biomass boilers industry is driven by the increasing emphasis on renewable energy sources and the need to reduce carbon emissions.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, pellet boilers accounted for a revenue of USD 3,227.1 million in 2024.

- Pellet Boilers is the most lucrative fuel type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 7,242.5 Million

- 2030 Projected Market Size: USD 11,706.5 Million

- CAGR (2025-2030): 8.5%

- Europe: Largest market in 2024

Governments worldwide are offering incentives, subsidies, and tax rebates to encourage the adoption of biomass boilers as part of their sustainability and energy transition goals.

These boilers provide a cleaner alternative to fossil fuel-based heating systems, aligning with global efforts to promote energy efficiency and combat climate change. Advancements in biomass boiler technology have improved their efficiency, performance, and affordability, making them more accessible to residential, commercial, and industrial users.

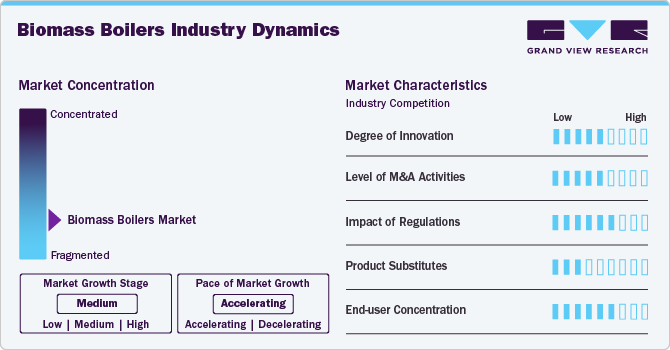

Market Concentration & Characteristics

The biomass boilers industry is moderately fragmented, with a mix of large, established players and smaller, regional companies competing for market share. Leading manufacturers are focusing on offering innovative and efficient biomass heating solutions that cater to a variety of residential, commercial, and industrial applications.

As governments worldwide implement stricter environmental regulations and promote renewable energy adoption, key players in the market are increasingly investing in sustainable technologies that reduce carbon emissions and improve the efficiency of biomass boilers. Regulatory bodies, such as the European Union and various national authorities, are playing a critical role in driving market growth by setting standards for emissions, energy efficiency, and the use of renewable energy sources. Compliance with these regulations is essential for manufacturers to remain competitive and meet the growing demand for eco-friendly heating solutions.

The growing emphasis on sustainability, energy independence, and reducing reliance on fossil fuels is prompting both the public and private sectors to adopt biomass-based heating systems. As a result, manufacturers are also exploring opportunities for technological innovation, such as improving fuel flexibility and enhancing the performance of biomass boilers. Additionally, the rising awareness about climate change and the environmental impact of conventional heating methods is encouraging both consumers and businesses to transition to more sustainable alternatives like biomass boilers. With the ongoing push for cleaner energy solutions, the biomass boilers market is poised for steady growth, particularly in regions with abundant biomass resources and supportive government policies.

Drivers, Opportunities & Restraints

Rising energy prices and growing awareness about the environmental impact of conventional heating methods are further encouraging consumers and businesses to turn to biomass as a sustainable and cost-effective heating solution. As the construction of energy-efficient buildings and sustainable infrastructure increases, the demand for biomass boilers is expected to continue growing, particularly in regions with abundant biomass resources.

While biomass boilers offer long-term cost savings through lower fuel costs, the upfront investment in Fuel Type, installation, and maintenance can be a significant barrier for many consumers, particularly in residential applications.

As governments continue to enforce stricter emissions regulations and offer incentives for renewable energy adoption, the demand for biomass boilers is expected to rise. The growing emphasis on energy independence and reducing reliance on fossil fuels presents an opportunity for biomass boilers, particularly in rural and off-grid areas.

Fuel Type Insights

The demand for wood chip boilers is increasing due to their ability to efficiently utilize locally sourced biomass, making them an attractive option for rural areas and businesses seeking to reduce energy costs. As the focus on sustainable energy solutions grows, wood chip boilers are gaining popularity for their affordability, fuel availability, and lower carbon emissions compared to fossil fuels.

The pellet boilers segment accounted for a 41.3% market share in 2024. Pellet boilers are seeing rising demand due to their convenience, efficiency, and ability to produce consistent heat from compressed wood pellets. With advancements in pellet technology, these systems are becoming more user-friendly and cost-effective, making them a popular choice for residential and small commercial applications looking for a reliable and eco-friendly heating solution.

End-use Insights

The adoption of biomass boilers in both industrial and residential applications is being driven by several key factors. In industrial settings, biomass boilers offer a cost-effective and sustainable alternative to conventional heating systems, helping businesses reduce energy costs and carbon emissions. With industries increasingly facing pressure to meet sustainability goals and comply with stringent environmental regulations, biomass boilers provide an eco-friendly solution by utilizing renewable biomass materials like wood chips, pellets, and agricultural waste.

The residential segment dominated the market in 2024, accounting for a 42.9% market share. For residential applications, the growing awareness of climate change and rising energy costs are encouraging homeowners to seek energy-efficient heating systems. Biomass boilers, which provide a consistent and renewable heat source, offer significant long-term savings by reducing reliance on expensive fossil fuels. Additionally, government incentives and subsidies for renewable energy systems are further driving the adoption of biomass boilers in residential buildings. As technology improves, biomass boilers are becoming more accessible and user-friendly, making them a viable and attractive option for homeowners looking to reduce their environmental impact.

Capacity Insights

The demand for 20 kW to 50 kW systems is increasing due to the growing focus on energy efficiency and sustainability in industries. These systems are ideal for applications that require reliable, medium-scale power generation, such as commercial buildings, industrial facilities, and renewable energy projects. Technological advancements and government incentives for green energy are also fueling this growth. Additionally, the shift toward decentralized power production is driving the adoption of such systems.

The 10 kW to 20 kW segment dominated the market in 2024, accounting for a 31.0% market share in 2024 due to its versatility and cost-effectiveness for small to medium-scale energy needs. This range is ideal for residential, small business, and remote applications, offering a balance between power output and affordability. As energy demands increase in urban and rural areas, these systems provide an efficient solution for a wide variety of users. The availability of supportive policies and incentives for renewable energy further boosts the segment's dominance.

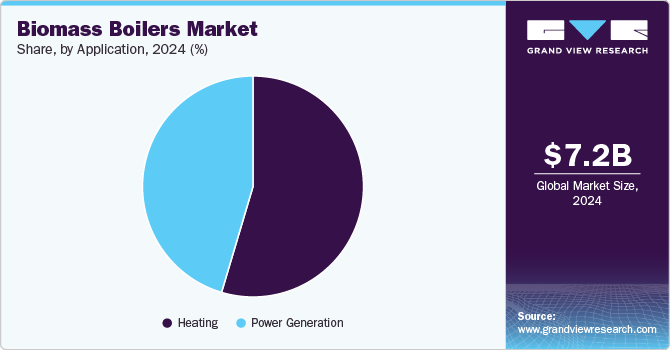

Application Insights

The demand for biomass boilers for generating power is driven by the shift toward renewable energy sources to reduce greenhouse gas emissions and reliance on fossil fuels. Biomass boilers offer a reliable and scalable solution for power generation, enabling the conversion of biomass into electricity while contributing to a cleaner, more sustainable energy mix. As governments implement stricter emissions regulations and offer incentives for renewable energy adoption, biomass boilers are gaining traction in the power generation sector.

The heating segment dominated the market, accounting for 54.6% of the market revenue share, driven by the growing need for energy-efficient and sustainable heating solutions. As global energy prices rise and environmental concerns intensify, biomass boilers provide a cost-effective, renewable alternative to fossil fuel-based heating systems, particularly in residential, commercial, and industrial settings. Their ability to utilize locally sourced biomass materials like wood chips and pellets helps reduce energy costs and supports energy independence.

Regional Insights

North America biomass boilers market is driven by increasing government incentives and regulations promoting renewable energy adoption. The rising emphasis on reducing carbon emissions and the need for more sustainable heating solutions, particularly in industrial and commercial sectors, are also boosting market growth. Furthermore, the region's vast agricultural and forestry resources provide a steady supply of biomass feedstocks, enhancing the feasibility and cost-effectiveness of biomass boilers.

U.S. Biomass Boilers Market Trends

The biomass boiler industry in the U.S. accounted for 72.7% of the regional market share in 2024. In the U.S., the growth of the market is driven by increasing government support for renewable energy technologies and the shift toward sustainable energy solutions. Federal and state-level incentives, such as tax credits and rebates, encourage the adoption of biomass boilers in residential, commercial, and industrial sectors.

Europe Biomass Boilers Market Trends

The biomass boiler market in Europe is increasing due to the region’s focus on reducing its reliance on coal and decreasing air pollution. For example, the Poland government’s incentives, including subsidies for renewable energy systems, are helping to accelerate the adoption of biomass boilers, particularly in residential and district heating applications. With Poland’s abundance of agricultural residues and forestry products, biomass boilers offer an attractive solution for utilizing locally available resources while achieving energy independence and sustainability.

The biomass boilers industry in Germany dominated the regional market in 2024, accounting for 29.5% of the overall revenue share of the regional market. Germany’s biomass boiler market is being driven by the country’s aggressive renewable energy targets and its commitment to reducing greenhouse gas emissions. The country’s policies, including feed-in tariffs and other financial incentives, are encouraging widespread adoption of biomass boilers in both residential and industrial sectors. Germany’s strong commitment to sustainability, coupled with a well-established biomass feedstock supply chain, makes biomass boilers a key component of its renewable energy strategy.

Asia Pacific Biomass Boilers Market Trends

The biomass boiler market in Asia Pacific is driven by rapid urbanization and industrial growth. Countries like China, India, and Japan are focusing on reducing their carbon footprint and improving energy efficiency, which is spurring investments in renewable energy technologies like biomass boilers. Government support in the form of subsidies, regulations promoting clean energy, and the region’s large agricultural sector also contribute to the market's expansion.

India biomass boiler market is projected to expand at a CAGR of 10.1% over the forecast period. The growth of the market in the nation is driven by increasing energy demand and the need for more sustainable energy solutions in rural and industrial areas. The government’s focus on renewable energy, energy efficiency, and waste-to-energy projects is promoting the adoption of biomass boilers as a viable alternative to conventional heating and power generation systems. Biomass boilers are also gaining traction in industries like textiles and agriculture, where biomass feedstocks are abundant and cost-effective.

The biomass boilers market in China accounted for 46.0% of the regional market share in 2024 driven by rapid industrialization, urbanization, and the government’s commitment to reducing air pollution and carbon emissions are driving the demand for biomass boilers. The Chinese government has implemented policies to promote renewable energy adoption and reduce dependence on coal, creating a favorable market for biomass technologies. Additionally, China’s large agricultural sector provides a consistent supply of biomass feedstocks, making biomass boilers an attractive and sustainable energy solution for both heating and power generation.

Middle East & Africa Biomass Boilers Market Trends

The biomass boiler market in the Middle East and Africa is driven by the growing demand for renewable energy solutions to reduce dependence on fossil fuels is driving biomass boiler adoption. Countries in the Middle East are investing in sustainable energy infrastructure, with biomass systems being integrated into broader renewable energy initiatives. In Africa, the potential for off-grid biomass power generation and the availability of biomass feedstocks in agricultural regions are encouraging the adoption of biomass boilers, especially for rural energy needs and small-scale industrial applications.

Latin America Biomass Boilers Market Trends

The biomass boiler market in Latin America is fueled by the region's push for sustainable energy solutions and reliance on local biomass resources, such as agricultural residues and wood. Government incentives aimed at reducing carbon emissions and increasing the share of renewable energy are creating a favorable environment for biomass adoption. Additionally, growing industrialization and increasing energy demands in the region make biomass boilers an attractive option for both heating and power generation.

Key Biomass Boilers Company Insights

Some of the key players operating in the market include Caterpillar Inc. and XCMG Group among others.

-

ANDRITZ is a global supplier of solutions to the metals, environment & energy, pulp & paper, and hydropower sectors. The company has a diverse range of sustainable products and solutions offered by operations spread across over 280 locations in over 80 countries.

-

Thermax Limited specializes in the production and sale of products related to water and waste management, specialty chemicals, and heating. The company is also involved in the design, construction, and commission of large boilers for power and steam generation, waste heat recovery systems, air pollution control projects, turnkey power plants, and industrial and municipal wastewater treatment facilities.

Key Biomass Boilers Companies:

The following are the leading companies in the biomass boiler market. These companies collectively hold the largest market share and dictate industry trends.

- ANDRITZ

- Thermax Limited

- Isgec Heavy Engineering Ltd.

- HARGASSNER Ges mbH

- INNASOL GROUP LTD.

- TATANO s.n.c.

- ÖkoFEN

- Justsen Energiteknik A/S

- ATMOS

- Säätötuli Canada Enterprises inc.

- Fink Machine Inc

- Fröling Heizkessel

- Evergreen

- Heizomat Canada Inc.

- Maanya Group

Recent Developments

-

In October 2024, INNASOL GROUP LTD. acquired Y Pellets, a prominent UK biomass heat company, to bolster the UK's renewable energy initiatives. The acquisition, valued at USD 4.3 million, allows Innasol to enhance its offerings in the biomass sector while retaining the Y Pellets brand.

-

In September 2024, Boccard acquired Leroux & Lotz Technologies (LLT), a well-established French industrial boiler manufacturer, positioning itself as a European leader in renewable thermal energy. This merger combines Boccard's extensive experience in industrial equipment with LLT's expertise in biomass and waste recovery systems, facilitating the construction of integrated renewable thermal power plants.

Biomass Boilers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.77 billion

Revenue forecast in 2030

USD 11.70 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Fuel type, end-use, capacity, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S., Canada, Mexico, Poland, Austria, Germany, France, Italy, China, India, Japan, Indonesia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

ANDRITZ, Thermax Limited, Isgec Heavy Engineering Ltd., HARGASSNER Ges mbH, Innasol Group ltd., TATANO s.n.c., ÖkoFEN, Justsen Energiteknik A/S, ATMOS, Säätötuli Canada Enterprises inc., Fink Machine Inc, Fröling Heizkessel, Evergreen, Heizomat Canada Inc., Maanya Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biomass Boilers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biomass boilers market report on the basis of fuel type, end-use, capacity, application, and region:

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood Chip Boilers

-

Pellet Boilers

-

Log Boilers

-

Organic Waste Boilers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 10kW

-

10kW to 20kW

-

20kW to 50kW

-

Above 50kW

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Heating

-

Power Generation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Poland

-

Austria

-

France

-

Germany

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global biomass boilers market size was estimated at USD 7.24 billion in 2024 and is expected to reach USD 7.77 billion in 2025.

b. The global biomass boilers market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.5% from 2025 to 2030 to reach USD 11.70 billion by 2030.

b. The pellet boiler segment dominated the market in 2024 accounting for 41.3% of the market share driven by their efficiency, ease of use, and ability to deliver consistent heating from compressed wood pellets. As pellet technology continues to improve, these systems are becoming more affordable and user-friendly, making them a preferred choice for both residential and small commercial users seeking sustainable and reliable heating solutions.

b. Some of the key players operating in the biomass boilers market are ANDRITZ, Thermax Limited, Isgec Heavy Engineering Ltd., HARGASSNER Ges mbH, Innasol Group ltd., TATANO s.n.c., ÖkoFEN, Justsen Energiteknik A/S, ATMOS, Säätötuli Canada Enterprises inc., Fink Machine Inc, Fröling Heizkessel, Evergreen, Heizomat Canada Inc., and Maanya Group.

b. Key factors driving the biomass boilers market include increasing government support for renewable energy adoption and growing demand for sustainable heating solutions. Additionally, rising energy costs and the push for carbon emission reduction are encouraging businesses and homeowners to invest in biomass boilers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.