- Home

- »

- Energy & Power

- »

-

Biomass Gasification Market Size, Industry Report, 2033GVR Report cover

![Biomass Gasification Market Size, Share & Trends Report]()

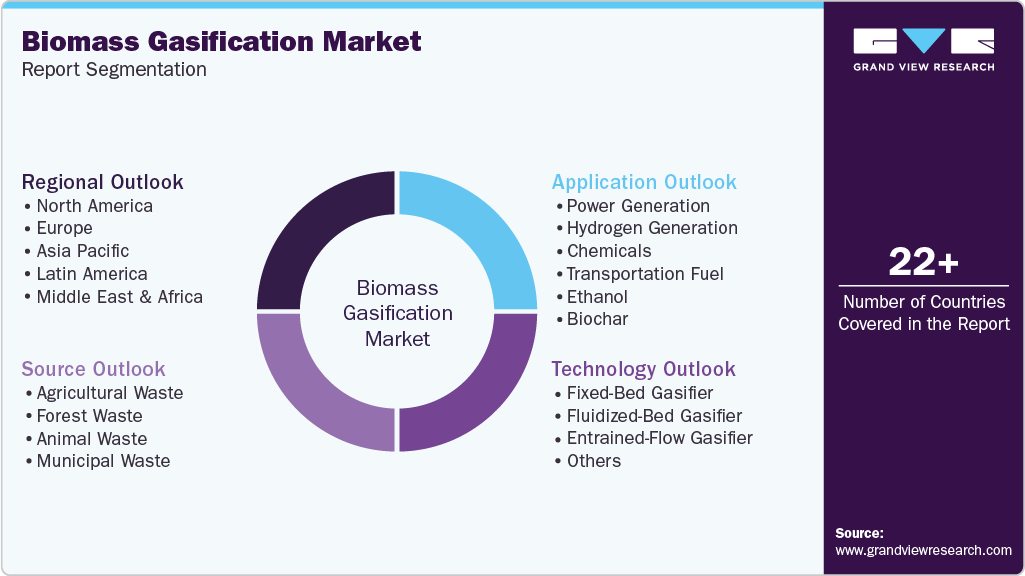

Biomass Gasification Market (2026 - 2033) Size, Share & Trends Analysis Report, By Technology (Fixed-Bed Gasifier, Fluidized-Bed Gasifier, Entrained-Flow Gasifier, Others), By Source, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-850-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biomass Gasification Market Summary

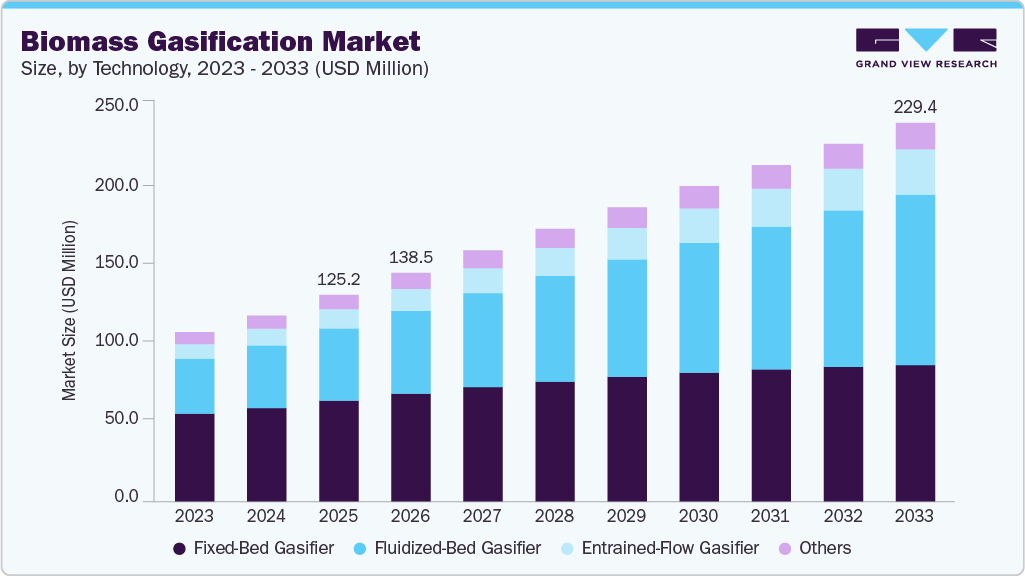

The global biomass gasification market size was estimated at USD 125.22 billion in 2025 and is projected to reach USD 229.45 billion by 2033, growing at a CAGR of 7.5% from 2026 to 2033. Market growth is primarily driven by the rising demand for renewable and low-carbon energy alternatives, increasing focus on waste-to-energy conversion, and growing industrial need for cleaner fuel sources such as syngas for power generation, heating, and chemical production.

Key Market Trends & Insights

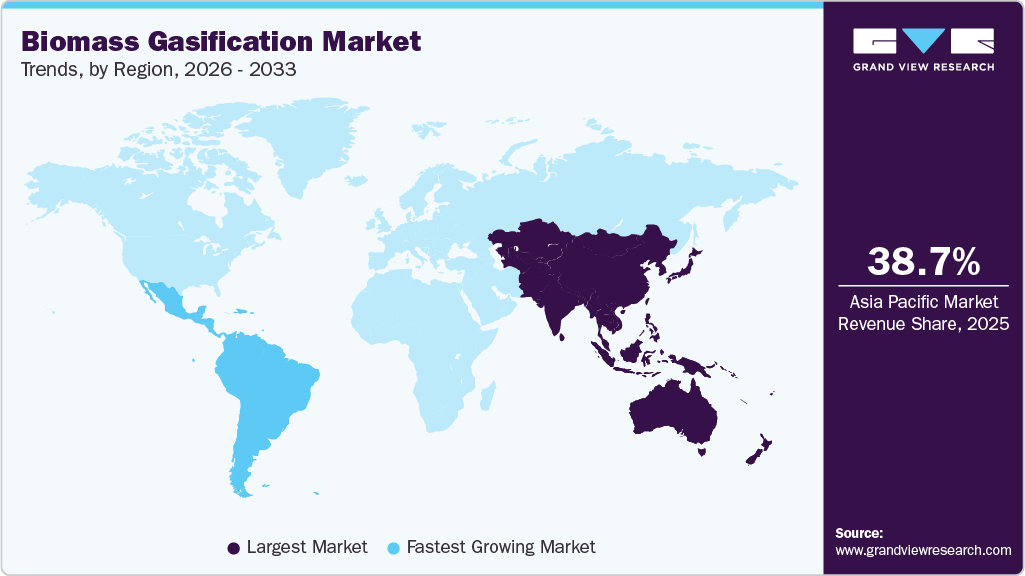

- Asia Pacific dominated the global biomass gasification market with the largest revenue share of 38.8% in 2025.

- Based on technology, the fixed-bed gasifier segment accounted for the largest market revenue share in 2025.

- Based on source, the agricultural waste segment accounted for the largest market revenue share in 2025.

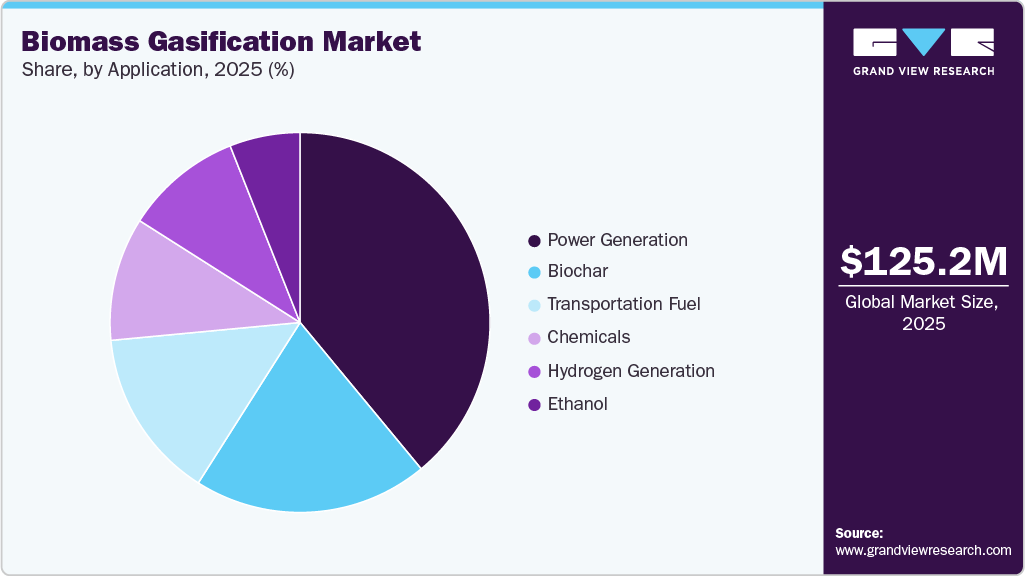

- Based on application, the power generation segment led the market with the largest revenue share of 39.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 125.22 Billion

- 2033 Projected Market Size: USD 229.45 Billion

- CAGR (2026-2033): 7.5%

- Asia Pacific: Largest market share in 2025

- Latin America: Fastest growing market

Supportive government policies for decarbonization, energy security, and the reduction of landfill waste are accelerating the adoption of biomass gasification technologies across both developed and emerging economies.

Technological advancements in gasifier design, syngas cleaning systems, and process efficiency optimization are improving overall performance, emissions control, and operational reliability, making biomass gasification more commercially viable across a wide range of feedstocks such as agricultural residues, forestry waste, and municipal solid waste. Governments across North America, Europe, and Asia-Pacific are promoting the market through renewable energy incentives, carbon reduction targets, and funding for advanced bioenergy projects. Strategic collaborations between technology providers, utilities, EPC contractors, and industrial end-users are strengthening the ecosystem, positioning biomass gasification as a key solution for sustainable power generation and circular economy-driven energy production.

Drivers, Opportunities & Restraints

The biomass gasification industry is primarily driven by the increasing global focus on renewable energy generation, decarbonization of industrial operations, and the rising need to convert agricultural residues, forestry waste, and municipal solid waste (MSW) into useful energy. Governments and industries are actively adopting biomass gasification to reduce dependence on fossil fuels, improve energy security, and meet carbon neutrality targets. In addition, growing demand for syngas-based power generation, industrial heating, and bio-based chemical production, along with favorable policies supporting waste-to-energy and circular economy initiatives, is further accelerating market growth.

Despite these drivers, the market faces several restraints. High capital investment for gasification plants, advanced gas cleaning systems, and integrated power generation units can limit adoption, especially for small-scale developers. Operational challenges such as feedstock availability and price volatility, inconsistent biomass quality, logistics and storage issues, and the need for continuous supply can impact project feasibility. Furthermore, technical barriers, including tar formation, syngas purification requirements, and complex maintenance needs, along with regulatory and permitting delays in certain regions, can restrict large-scale deployment.

The biomass gasification industry presents strong opportunities through advancements in gasifier efficiency, modular and small-scale systems, and improved syngas cleaning and tar reduction technologies, which enhance reliability and commercial viability. Rising investments in bioenergy projects, growing adoption of combined heat and power (CHP) systems, and increasing use of syngas for producing green hydrogen, biofuels, and sustainable chemicals are creating new growth avenues. In addition, collaborations between technology providers, EPC companies, utilities, and industrial end-users are enabling integrated solutions for waste conversion and clean energy generation, positioning biomass gasification as a key contributor to the global transition toward low-carbon and sustainable energy systems.

Technology Insights

The fixed-bed gasifier segment led the market with the largest revenue share of 48.7% in 2025, driven by its simple system design, lower capital requirements, and proven performance across small-to-mid scale biomass gasification projects. Fixed-bed gasifiers are widely used in applications such as distributed power generation, combined heat and power (CHP), industrial heating, and rural/off-grid energy supply, where consistent syngas production from locally available feedstocks like wood chips, agricultural residues, and forestry waste is required. Their ease of operation, relatively lower maintenance needs, and suitability for decentralized energy systems continue to support strong adoption globally.

The fluidized-bed gasifier segment is projected to register at the fastest CAGR of 10.9% during the forecast period, supported by rising demand for higher efficiency, improved feedstock flexibility, and scalable syngas output for industrial and utility-scale operations. These systems offer better heat transfer, uniform temperature control, and enhanced mixing, enabling stable gas quality and improved performance across a wider range of biomass and waste feedstocks, including mixed residues and MSW-derived fuels. Increasing investments in advanced waste-to-energy plants, large-scale bioenergy projects, and syngas applications for green hydrogen and sustainable fuels are further accelerating the adoption of fluidized-bed gasification technologies.

Source Insights

The agricultural waste segment led the market with the largest revenue share of 37.0% in 2025, driven by the abundant availability of feedstocks such as rice husk, wheat straw, corn stover, sugarcane bagasse, and other crop residues across major agricultural economies. These materials are increasingly utilized in biomass gasification projects due to their low-cost sourcing, strong energy potential, and alignment with waste-to-energy and circular economy initiatives. In addition, supportive government policies promoting renewable power generation, residue management, and reduction of open-field burning are further strengthening the adoption of agricultural waste as a preferred source for syngas and power production.

The animal waste segment is projected to witness at the fastest CAGR of 10.0% over the forecast period, supported by rising focus on livestock waste management, methane emission reduction, and sustainable energy recovery from manure and organic waste streams. Increasing investments in integrated bioenergy systems, growing adoption of rural and decentralized power generation, and stricter environmental regulations related to waste disposal are encouraging farms and industrial operators to adopt gasification-based solutions. Technological improvements in feedstock preprocessing, moisture handling, and gas-cleaning systems are also increasing the feasibility of converting animal waste into usable syngas, accelerating market expansion.

Application Insights

The power generation segment led the market with the largest revenue share of 39.0% in 2025, driven by the increasing adoption of biomass-based systems for renewable electricity production and grid support. Biomass gasification enables the efficient conversion of agricultural residues, forestry waste, and other organic feedstocks into syngas, which can be used in engines and turbines to provide reliable power. The segment is further supported by rising investments in waste-to-energy infrastructure, growing demand for distributed and off-grid power solutions, and government initiatives to promote renewable energy integration and reduce dependency on fossil-fuel-based generation.

The hydrogen generation segment is expected to register at the fastest CAGR of 17.9% over the forecast period, supported by the global push toward clean hydrogen production and decarbonization of hard-to-abate sectors such as industrial manufacturing, refining, chemicals, and heavy transport. Biomass gasification-based hydrogen offers a pathway for low-carbon or potentially carbon-negative hydrogen when combined with carbon capture technologies. Increasing investments in hydrogen infrastructure, supportive policies for green and renewable hydrogen, and advancements in syngas upgrading and purification technologies are accelerating the adoption of biomass gasification for hydrogen generation globally.

Regional Insights

The biomass gasification market in North America holds a considerable share in 2025, driven by rising demand for renewable power, increasing waste-to-energy investments, and strong availability of biomass feedstocks such as forest residues and agricultural waste. The region is seeing adoption across power generation, industrial heating, and CHP applications, supported by clean energy initiatives and decarbonization efforts. The presence of established technology providers and increasing focus on energy security are supporting steady market growth.

U.S. Biomass Gasification Market Trends

The biomass gasification market in the U.S. is supported by growing interest in renewable electricity generation, landfill diversion, and sustainable waste management. Strong feedstock availability, including forestry waste, crop residues, and MSW, is enabling project development for power and industrial applications. Federal and state-level clean energy programs, along with advancements in gasification efficiency and syngas cleaning technologies, are contributing to market expansion.

Asia Pacific Biomass Gasification Market Trends

Asia Pacific dominated the global biomass gasification market with the largest revenue share of 38.7% in 2025, driven by the abundant availability of agricultural residues, forestry waste, and municipal solid waste, along with rising demand for renewable and decentralized power generation. Countries such as China, India, Japan, and Southeast Asia are investing in bioenergy and waste-to-energy projects to reduce reliance on fossil fuels and improve energy security. Supportive policies for clean energy adoption and residue management continue to strengthen the region’s market leadership.

Europe Biomass Gasification Market Trends

The biomass gasification market in Europe held a significant share in 2025, supported by stringent emissions regulations, strong renewable energy adoption, and ambitious carbon-neutrality targets. The region is witnessing growing deployment of biomass gasification for combined heat and power (CHP), industrial heating, and waste-to-energy applications. Countries including Germany, the UK, France, and the Netherlands are key contributors due to strong government support and advanced project development capabilities.

Latin America Biomass Gasification Market Trends

The biomass gasification market in Latin America is expected to register at the fastest CAGR of 12.7% over the forecast period, driven by increasing utilization of biomass resources such as sugarcane bagasse, agricultural residues, and forestry waste. Countries such as Brazil and Mexico are key contributors due to growing industrial energy demand and increasing investments in renewable energy diversification. Improving regulatory frameworks and rising private-sector participation are accelerating adoption across the region.

Middle East & Africa Biomass Gasification Market Trends

The biomass gasification market in the Middle East & Africa (MEA) is in its early stages, supported by growing focus on renewable energy integration and waste-to-energy opportunities. Several countries are exploring biomass gasification to address waste management challenges and improve access to decentralized power solutions. While adoption remains limited due to infrastructure and financing constraints, sustainability initiatives and clean energy transition goals are expected to support gradual market growth.

Key Biomass Gasification Company Insights

Some of the key players operating in the global biomass gasification industry include Valmet Corporation, Mitsubishi Heavy Industries, Ltd., EQTEC plc, Thyssenkrupp AG, KASAG Swiss AG, Ankur Scientific Energy Technologies Pvt. Ltd., SynTech Bioenergy, LLC, Beltran Technologies, Inc., Vaskiluoto Voima Oy, and Chanderpur Works Private Limited, among others. These companies are actively involved in the development, manufacturing, and deployment of biomass gasification technologies for converting agricultural residues, forestry waste, and other organic feedstocks into syngas for power generation, industrial heating, and sustainable fuel production.

Market participants are focusing on improving gasifier efficiency, feedstock flexibility, emissions control, and syngas cleaning systems, as well as expanding project execution capabilities through EPC partnerships and technology collaborations. In addition, government-supported renewable energy programs and waste-to-energy initiatives are helping these players strengthen their market presence and accelerate the adoption of biomass gasification solutions globally.

Key Biomass Gasification Companies:

The following key companies have been profiled for this study on the biomass gasification market.

- Ankur Scientific Energy Technologies Pvt. Ltd.

- Beltran Technologies, Inc.

- Chanderpur Works Private Limited

- EQTEC plc

- KASAG Swiss AG

- Mitsubishi Heavy Industries, Ltd.

- SynTech Bioenergy, LLC

- Thyssenkrupp AG

- Valmet Corporation

- Vaskiluoto Voima Oy

Recent Developments

- In December 2025, Valmet Corporation announced the launch of an advanced biomass gasification system in California, designed to optimize high-efficiency syngas production from agricultural residues, support local renewable energy grids, and reduce landfill waste, marking a significant step forward in commercial biomass gasification deployment and reinforcing Valmet’s commitment to scalable and sustainable energy solutions.

Biomass Gasification Market Report Scope

Report Attribute

Details

Market Definition

The Biomass Gasification market size represents the global revenue generated from the development, manufacturing, and deployment of biomass gasification systems that convert biomass feedstocks into syngas for power generation, industrial heating, and fuel production across commercial and industrial applications worldwide.

Market size value in 2026

USD 138.50 billion

Revenue forecast in 2033

USD 229.45 billion

Growth rate

CAGR of 7.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, source, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Valmet Corporation; Mitsubishi Heavy Industries, Ltd.; EQTEC plc; Thyssenkrupp AG; KASAG Swiss AG; Ankur Scientific Energy Technologies Pvt. Ltd.; SynTech Bioenergy, LLC; Beltran Technologies, Inc.; Vaskiluoto Voima Oy; Chanderpur Works Private Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biomass Gasification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biomass gasification market report based on the technology, source, application, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Fixed-Bed Gasifier

-

Fluidized-Bed Gasifier

-

Entrained-Flow Gasifier

-

Others

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Agricultural Waste

-

Forest Waste

-

Animal Waste

-

Municipal Waste

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Power Generation

-

Hydrogen Generation

-

Chemicals

-

Transportation Fuel

-

Ethanol

-

Biochar

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global biomass gasification market is expected to grow at a compound annual growth rate of 7.5% from 2026 to 2033 to reach USD 229.45 billion by 2033.

b. Some of the key vendors operating in the global Biomass Gasification market include Valmet Corporation; Mitsubishi Heavy Industries, Ltd.; EQTEC plc; Thyssenkrupp AG; KASAG Swiss AG; Ankur Scientific Energy Technologies Pvt. Ltd.; SynTech Bioenergy, LLC; Beltran Technologies, Inc.; Vaskiluoto Voima Oy; and Chanderpur Works Private Limited, among others.

b. The key factors driving the biomass gasification market include the rising demand for renewable and low-carbon energy generation, increasing focus on waste-to-energy conversion, and growing adoption of biomass gasification for syngas production used in power generation, industrial heating, and sustainable fuel applications.

b. Based on the source segment, agricultural waste held the largest revenue share of over 37% in the biomass gasification market in 2025.

b. The global biomass gasification market size was estimated at USD 125.22 billion in 2025 and is expected to reach USD 138.50 billion in 2026.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.