- Home

- »

- Medical Devices

- »

-

Biomaterial Wound Dressing Market, Industry Report, 2033GVR Report cover

![Biomaterial Wound Dressing Market Size, Share & Trends Report]()

Biomaterial Wound Dressing Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Natural, Synthetic), By Application (Chronic Wounds, Acute Wounds), By End-use (Hospitals, Outpatient Facilities, Home Healthcare, Research & Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-199-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biomaterial Wound Dressing Market Summary

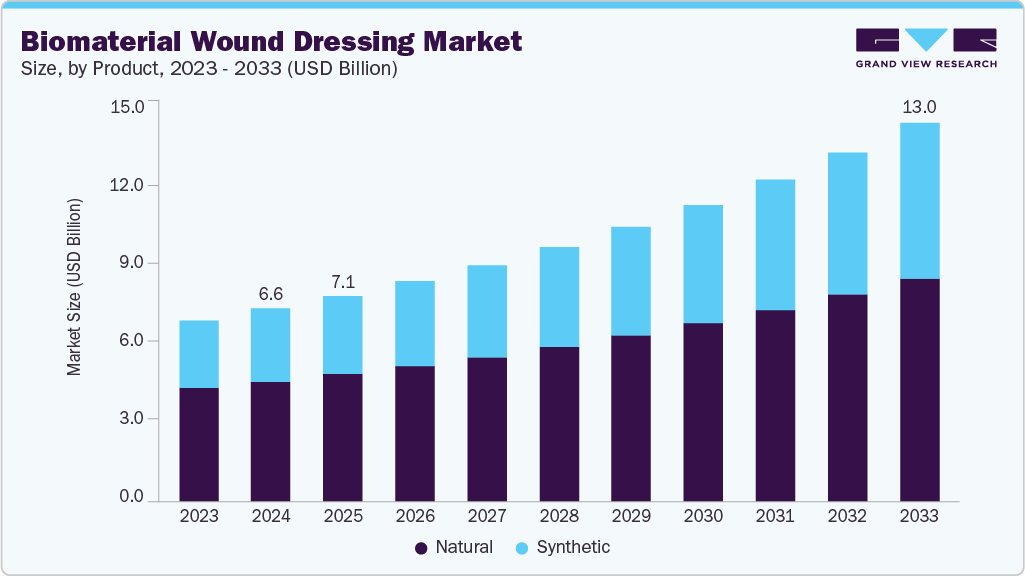

The global biomaterial wound dressing market size was estimated at USD 6.63 billion in 2024 and is projected to reach USD 13.02 billion by 2033, growing at a CAGR of 7.92% from 2025 to 2033. This growth is fueled by the rising burden of chronic and hard-to-heal wounds, including diabetic foot ulcers, venous leg ulcers, and pressure injuries, which require advanced, biocompatible materials for faster healing and infection control.

Key Market Trends & Insights

- North America dominated the biomaterial wound dressing market with the largest revenue share of 45.50% in 2024.

- The biomaterial wound dressing market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the natural segment led the market with the largest revenue share in 2024.

- By application, the chronic wounds segment led the market with the largest revenue share in 2024.

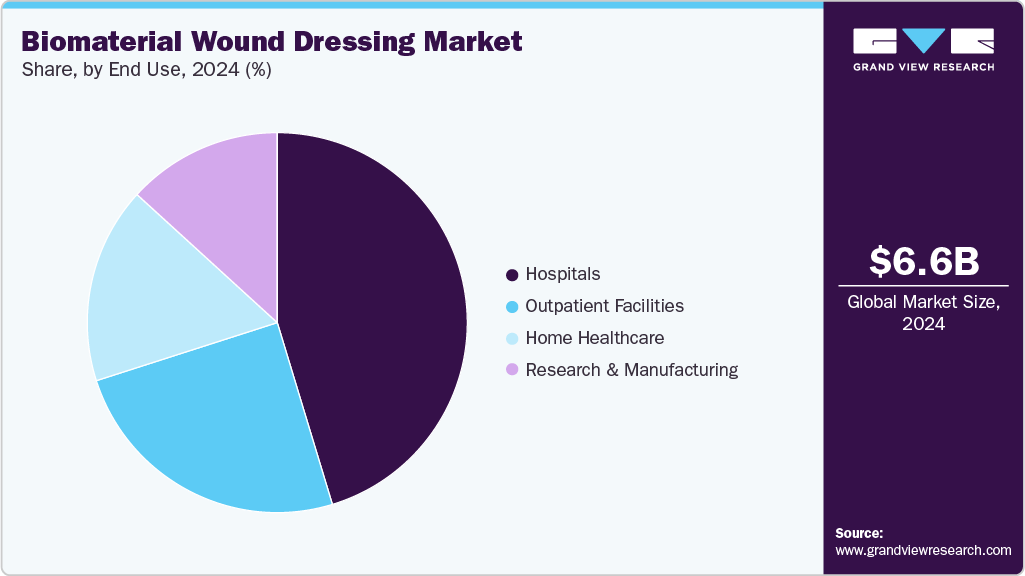

- By end-use, the hospital segment led the market with the largest revenue share of 45.31% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.63 Billion

- 2033 Projected Market Size: USD 13.02 Billion

- CAGR (2025-2033): 7.92%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing numbers of surgical procedures worldwide are also boosting demand, as biomaterial-based dressings support improved postoperative recovery and reduce the risk of complications. Technological advancements, such as bioactive polymers, collagen-based scaffolds, and antimicrobial composites, continue to enhance product effectiveness. The shift toward moisture-balanced and regenerative wound therapies further supports market adoption.The rising prevalence of chronic wounds is a key factor driving the market growth. For instance, as per the data published by Mary Ann Liebert, Inc. in October 2023, chronic wounds are affecting 10.5 million U.S. Medicare beneficiaries. Furthermore, chronic wounds are impacting the quality of life of nearly 2.5% of the total population of the U. S. Similarly, as per the report by the National Library of Medicine (NCBI), in August 2023, about 9.1 to 26.1 million incidences of diabetic foot ulcers occur each year globally. In addition, the rising incidences of burns are expected to propel the demand for collagen wound dressings. For instance, as per a report by Rosenfeld Injury Lawyers LLC, in March 2023, around 450,000 people suffer burn injuries in America each year.

Hip and knee replacement procedures drive the biomaterial wound dressing market because these surgeries involve large incisions and significant tissue disruption, requiring advanced dressings that support faster healing and reduce postoperative complications. As the number of joint replacement surgeries continues to rise, driven by aging populations, osteoarthritis prevalence, obesity, and improved surgical accessibility, the need for effective wound-care solutions grows in parallel. Biomaterial dressings, such as collagen sheets, hydrofiber dressings, and antimicrobial bioactive materials, help manage exudate, prevent surgical site infections, and promote tissue regeneration, all of which are critical for successful recovery after orthopedic procedures. Hospitals and orthopedic centers utilize these advanced dressings to enhance healing outcomes, minimize hospitalization time, and reduce the risk of revisions, making hip and knee replacement surgeries a significant driver of market growth.

In November 2024, the American Joint Replacement Registry (AJRR), a component of the American Academy of Orthopaedic Surgeons (AAOS) Registry Program, announced that its database encompasses over 4 million hip and knee replacement procedures. The 11th Annual Report (2024) highlighted data from more than 3.7 million procedures done between 2012 and 2023.

Burn injuries significantly drive the biomaterial wound dressing market as they require advanced, high-performance dressings that support rapid healing, prevent infection, and minimize scarring. Burns damage multiple layers of skin, making traditional gauze insufficient; this increases the demand for biomaterial-based solutions, such as collagen dressings, hydrogel sheets, bioengineered skin substitutes, and antimicrobial biomaterial films. These products help maintain optimal moisture balance, accelerate tissue regeneration, and reduce pain, which are critical needs in burn care. The rising incidence of thermal burns, electrical burns, chemical burns, and scald injuries, especially in regions with industrial growth and high household accident rates, further accelerates adoption. In addition, specialized burn centers and hospitals prefer biomaterial dressings because they shorten recovery times, lower infection risks, and improve functional and cosmetic outcomes. This growing clinical reliance on advanced materials makes burn injuries a major contributor to overall market growth.

-

According to the CDC, burn injuries are a leading cause of accidental death and injury in the U.S., with over 398,000 individuals seeking medical care for burns each year.

-

In the UK, 250,000 people suffer burn injuries each year, with 175,000 seeking accident and emergency care and 16,000 requiring hospital admission.

-

As per a report published by the World Health Organization (WHO) in October 2023, globally around 180,000 deaths each year are caused by burns.

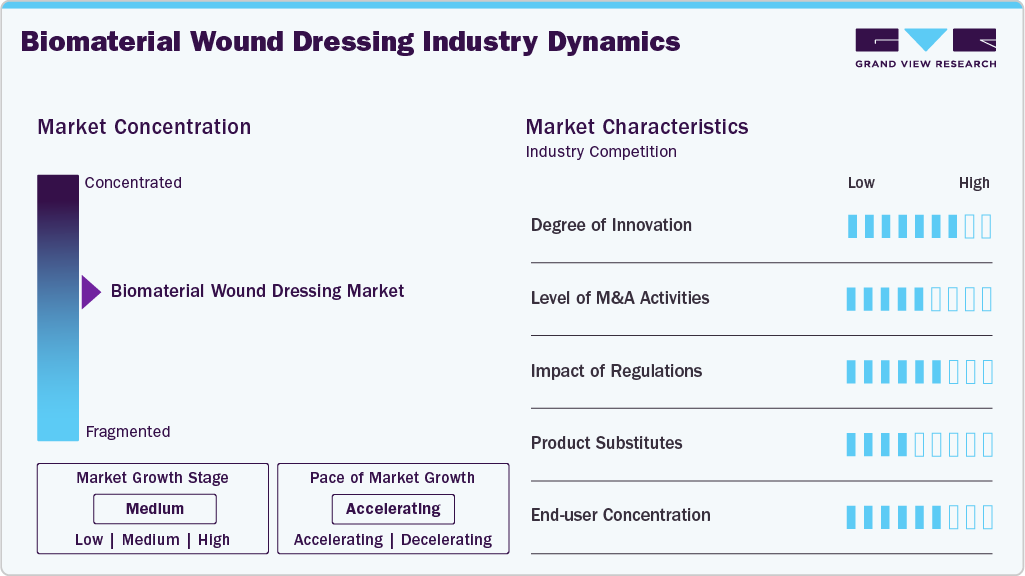

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The biomaterial wound dressing market is characterized by a high degree of innovation owing to the rising prevalence of chronic diseases and increasing demand for advanced wound care products. Manufacturers are constantly developing new and improved materials that provide better performance, comfort, and healing outcomes for patients. Some of the latest innovations in biomaterial wound dressings include the use of nanotechnology, stem cells, and bioactive compounds to enhance the healing process and prevent infections.

The biomaterial wound dressing industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies.

The industry is also subject to increasing regulatory scrutiny. This is due to concerns about the patient’s safety, efficacy, and quality of medical devices and products related to wound dressings. Changes in regulations can impact the market, as companies may need to reformulate or redesign products to meet new standards. Overall, regulations can both protect patients and create challenges for companies in the biomaterial wound dressings market.

Product Insights

The natural segment led the market in 2024,driven by its superior biocompatibility, lower risk of adverse reactions, and strong ability to support natural tissue regeneration. Materials such as collagen, chitosan, alginate, and hyaluronic acid are preferred because they mimic the body’s own healing environment, promote cellular activity, and offer excellent moisture-retention and antimicrobial properties. The growing clinical adoption of natural products in chronic wound management, postoperative care, and burn treatment, combined with rising patient preference for biologically derived, safe, and effective wound-care solutions, continues to strengthen the leadership of the natural segment in the market.

The synthetic segment is expected to register the fastest CAGR during the forecast period. Synthetic wound dressings can be used on a variety of wounds, including burns, ulcers, and surgical wounds. They are designed to provide a moist environment for the wound to heal, while also protecting it from bacteria and other contaminants. Some synthetic dressings also contain substances that promote healing, such as silver or honey. In Addition, the rising prevalence of diabetes, skin cancers, and venous and arterial leg ulcers is propelling segment growth. As per IDF, in 2024, an estimated 589 million adults aged 20-79 years are living with diabetes worldwide, highlighting the immense and growing global health burden posed by the disease. This number is projected to surge to 853 million by 2050, driven by rapid urbanization, aging populations, lifestyle changes, and rising obesity rates. More than 4 in 5 adults (81%) with diabetes reside in low- and middle-income countries.

Application Insights

The chronic wounds segment dominated the market in 2024. This segment’s dominance is driven by the rising prevalence of long-lasting, hard-to-heal conditions such as diabetic foot ulcers, venous leg ulcers, and pressure injuries, which require continuous and advanced wound-care solutions. Increasing rates of diabetes, obesity, and vascular diseases further contribute to the growing patient pool requiring chronic wound management.

In addition, the growing elderly population, who are more susceptible to impaired healing, along with increased healthcare awareness and expanded access to advanced biomaterial dressings, is boosting the strong and sustained demand for effective chronic wound treatment options.

End-use Insights

The hospitals segment dominated the market, accounting for 45.31% of the revenue share in 2024. This growth is attributed to the high volume of complex wound cases managed in hospital settings, including surgical wounds, traumatic injuries, burns, and chronic ulcers. Hospitals rely heavily on advanced biomaterial wound dressings to reduce infection risks, enhance healing outcomes, and support postoperative recovery. The presence of specialized wound-care units, skilled medical professionals, and well-established treatment protocols further drives demand for these services. In addition, the rise in surgical procedures, expansion of hospital infrastructure, and increased adoption of evidence-based wound management practices contribute to strengthening the segment’s leading position in the market.

The home healthcare segment is projected to witness the highest growth rate over the forecast period. The increasing need for cost-effective and convenient wound care solutions and the growing prevalence of chronic wounds and diabetes-related ulcers. In addition, the rising demand for advanced wound care products that offer enhanced healing properties and reduced healing time is also expected to drive the growth of the biomaterial wound dressings market in the home healthcare segment.

Regional Insights

The biomaterial wound dressing market in North America held the largest share and accounted for 45.50% of global revenue in 2024, driven by the region’s advanced healthcare infrastructure, high prevalence of chronic wounds, and growing number of surgical procedures. The strong presence of leading wound-care manufacturers, widespread adoption of innovative biomaterial technologies, and higher healthcare spending further support market dominance. Rising rates of diabetes, obesity, and an aging population continue to increase the demand for effective wound-management solutions, supporting North America’s leading position in the global market.

U.S. Biomaterial Wound Dressings Market Trends

The biomaterial wound dressing market in the U.S. held the largest share in North America in 2024. The increased utilization of surgical procedures, the high prevalence of chronic disorders, are some of the major factors fueling the market. For instance, as per a report by the National Center for Chronic Disease Prevention and Health Promotion, last reviewed in May 2023, six in ten people in the U.S. live with at least one chronic disorder, such as cancer, diabetes, stroke, and heart disease. These factors are expected to drive the demand for biomaterial wound dressings.

The rise in sports and recreational injuries is driving the U.S. biomaterial wound dressing market by increasing the demand for advanced wound-care solutions capable of managing a wide range of cuts, abrasions, soft-tissue damage, and post-trauma wounds. As more individuals participate in activities such as exercise, cycling, and basketball, the need for effective dressings that support rapid healing, reduce the risk of infection, and enhance tissue regeneration continues to grow. In 2024, 4.4 million people were treated in emergency departments for injuries involving sports and recreational equipment. The activities most frequently associated with injuries are exercise, cycling, and basketball. According to the National Safety Council, following a record low number of sports and recreational injuries reported in 2020, injuries increased by 20% in 2021, 12% in 2022, 2% in 2023, and 17% in 2024.

Europe Biomaterial Wound Dressings Market Trends

The biomaterial wound dressing market in Europe is driven by demographic, clinical, and technological factors that are transforming wound care across the region. A key driver is the rapidly ageing population, which is more prone to chronic wounds such as pressure ulcers, venous leg ulcers, and diabetic foot ulcers, thereby increasing the need for advanced, biocompatible dressings that promote faster and more effective healing. The rising prevalence of diabetes and vascular diseases further fuels the demand for specialized biomaterial dressings that support moisture balance, minimize infection risk, and enhance tissue regeneration. In addition, strong regulatory support for innovative medical devices, expanding clinical research on natural and synthetic biomaterials, and growing investments from European manufacturers are accelerating the market’s technological advancement. Hospitals and outpatient care providers are also prioritizing solutions that reduce healing times and prevent complications, while the shift toward home-based wound care continues to strengthen adoption of biomaterial wound dressings across the region. As per a report by the European Union (EU) population, in January 2024, the EU population was estimated at 449.3 million people and more than one-fifth (21.6%) of it was aged 65 years and over.

The UK biomaterial wound dressing market is growing due to increasing clinical demand, innovation, and the evolving needs of the healthcare system. The country’s rising burden of chronic wounds, driven by an ageing population, higher rates of diabetes, and lifestyle-related vascular issues, is creating strong demand for advanced, biocompatible dressings that support faster healing and reduce complications. Growth is further supported by the NHS’s focus on improving wound-care outcomes and reducing long-term treatment costs, which encourages the adoption of biomaterial dressings that can enhance tissue regeneration and lower infection risks. In addition, the presence of leading wound-care manufacturers and ongoing research into natural and synthetic biomaterials is accelerating product development and clinical acceptance. Diabetes affects more than 4.3 million individuals in the United Kingdom, with 19% to 34% developing diabetes-related foot ulceration during their lifespan, which can lead to an amputation.

The biomaterial wound dressing market in Germany is anticipated to witness significant growth over the forecast period, supported by strong clinical demand, advanced healthcare infrastructure, and continuous innovation. Germany’s ageing population and the rising prevalence of chronic wounds, such as pressure ulcers, venous leg ulcers, and diabetic foot ulcers, are major factors accelerating the need for biocompatible dressings that enhance healing and reduce infection risks. The country’s research ecosystem, combined with the active development of next-generation biomaterials and the presence of established wound-care manufacturers, further strengthens market expansion. In addition, Germany’s structured reimbursement framework and emphasis on evidence-based treatment encourage the adoption of advanced wound-care solutions.

Asia Pacific Biomaterial Wound Dressings Market Trends

The biomaterial wound dressing market in Asia Pacific is expanding rapidly as a mix of demographic pressure, rising clinical need, and stronger health-system investment is accelerating adoption of advanced, biomaterial-based solutions: an ageing population together with growing rates of diabetes and vascular disease are increasing the incidence of chronic and hard-to-heal wounds, while higher surgical volumes and greater awareness of infection control are boosting demand for dressings that improve healing and reduce complications. Improving healthcare infrastructure, rising healthcare spending, and wider access to outpatient and home-based care are opening up distribution channels beyond large hospitals, enabling faster growth in urban and peri-urban areas.

China biomaterial wound dressings market accounted for a significant share of the Asia-Pacific market in 2024, primarily due to the country’s rapidly expanding healthcare infrastructure, a strong domestic manufacturing base, and rising clinical demand for advanced wound care solutions. China’s large ageing population, increasing incidence of diabetes and chronic wounds, and growing surgical volumes have created a substantial need for biocompatible dressings that promote faster healing and reduce complications. In 2024, China had approximately 148 million adults aged 20-79 with diabetes, representing 11.9% of the adult population. The government’s ongoing initiatives to improve hospital quality, expand universal health coverage, and encourage the adoption of innovative medical devices have further supported market growth. In addition, China’s strong presence of local and international wound-care companies, combined with active R&D investment in natural and synthetic biomaterials, has made advanced wound dressings more accessible across hospitals, clinics, and home-care settings.

The biomaterial wound-dressing market in Japan is poised for growth over the coming years, driven by demographic, clinical, and technological trends. Japan’s rapidly aging population is increasing the prevalence of chronic wounds, such as pressure ulcers and diabetic foot ulcers, which in turn is creating a strong demand for more effective, biocompatible dressings.

MEA Biomaterial Wound Dressings Market Trends

The biomaterial wound dressing market in the Middle East & Africa is growing. As healthcare systems in the region expand, increasing investments in hospital infrastructure and improved access to advanced care are driving demand for high-performance wound dressings. The prevalence of chronic diseases such as diabetes, combined with increasing surgical volumes and trauma cases, is creating a substantial clinical need for biomaterials that support effective wound healing.

Key Biomaterial Wound Dressings Company Insights

Key players operating in the biomaterial wound dressing market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Biomaterial Wound Dressings Companies:

The following are the leading companies in the biomaterial wound dressing market. These companies collectively hold the largest market share and dictate industry trends.

- ConvaTec Group PLC

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- B. Braun Melsungen AG

- 3M

- URGO

- Coloplast Corp.

- Integra LifeSciences

- Medline Industries, Inc.

- Hollister Incorporated

- MiMedx Group

- Hartmann Group

- Cardinal Health

- Avita Medical

Recent Developments:

-

In July 2025, Convatec received regulatory clearance in the UK, EU, Australia, and the U.S. for Aquacel ConvaFiber, a next-generation Hydrofiber wound dressing designed for a wide range of chronic and acute wounds.

-

In April 2025, Solventum completed its spin-off from 3M and officially began operating as an independent global healthcare company. Its products and technologies play an integral role in healthcare delivery worldwide—supporting millions of dental procedures, treating hard-to-heal wounds, powering hospital information systems, and enabling life-saving dialysis treatments.

-

In October 2023, DuPont launched a novel soft skin adhesive (SSA) DuPont Liveo MG 7-9960 that boasts higher adhesion and lower cyclic silicone. This advanced adhesive has been specifically designed to be used in wound care dressings and for attaching medical devices to the skin, allowing for extended wear time and gentle removal.

-

In June 2023, JeNaCell introduced the epicite balancing wound dressing to the German market. The dressing is especially well-suited and adapted for the management of chronic wounds with low to medium levels of exudation, including soft tissue lesions, diabetic foot ulcers, venous leg ulcers, and arterial leg ulcers.

Biomaterial Wound Dressing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.08 billion

Revenue forecast in 2033

USD 13.02 billion

Growth rate

CAGR of 7.92% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil Mexico; KSA; UAE; South Africa

Key companies profiled

ConvaTec Group PLC; Smith & Nephew PLC; Mölnlycke Health Care AB; B. Braun Melsungen AG; 3M; URGO; Coloplast Corp.; Integra LifeSciences; Medline Industries, Inc.; Hollister Incorporated; MiMedx Group; Hartmann Group; Cardinal Health; Avita Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biomaterial Wound Dressing Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biomaterial wound dressing market report on the basis of product, application, end-use and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Natural

-

Alginate

-

Honey

-

Collagen

-

Chitosan

-

Carboxymethyl Cellulose (CMC)

-

Others

-

-

Synthetic

-

Polyurethane

-

Silicone

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Home Healthcare

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

KSA

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biomaterial wound dressing market size was estimated at USD 6.23 billion in 2023 and is expected to reach USD 6.63 billion in 2024.

b. The global biomaterial wound dressing market is expected to grow at a compound annual growth rate of 7.46% from 2024 to 2030 to reach USD 10.21 billion by 2030.

b. The alginate dressing held the largest market share in the natural segment in 2023, owing to its wide usage in wound healing properties. Alginate dressing is usually made from seed wood, making it highly absorbent and offering a moist wound environment that is favorable for treating dry injuries.

b. Key players operating in the biomaterial wound dressing market include ConvaTec Group PLC; Smith & Nephew PLC; Mölnlycke Health Care AB; B. Braun Melsungen AG; 3M; URGO; Coloplast Corp.; Integra LifeSciences; Medline Industries, Inc.

b. The rising prevalence of chronic wounds, rising geriatric population, and technological advancements in wound dressings are some major factors that drive the growth of the biomaterial wound dressing market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.