- Home

- »

- Medical Devices

- »

-

Bionic Ear Market Size, Share, Trends & Growth Report 2030GVR Report cover

![Bionic Ear Market Size, Share & Trends Report]()

Bionic Ear Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Cochlear Implant, Auditory Brainstem Implants, BAHA/BAHS), By End-use, By Region, And Segment Forecast

- Report ID: GVR-4-68040-069-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bionic Ear Market Size & Trends

The global bionic ear market size was valued at USD 2.2 billion in 2023 and is expected to reach USD 3.9 billion by 2030, growingg at a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030. The market has been growing significantly due to the growing geriatric population, increasing prevalence of hearing loss, advancements in technology, and favorable reimbursement policies. Furthermore, there have been significant advancements in bionic ear technology over the past few years. For instance, cochlear implants now have wireless connectivity, allowing them to connect to external devices such as smartphones, televisions, and other audio equipment. This feature enables users to stream audio content directly to their cochlear implants.

Bionic ear technology has significantly improved the quality of life for people with hearing loss. In recent years, bionic ears have become smaller, more discreet, and more powerful. They could be integrated using directional microphones, internet connectivity, artificial intelligence, and hybrid technology, all of which improve user experience and sound quality. These advancements and growing awareness of various audiology devices are driving the bionic ears market growth.

According to WHO, approximately 2.5 billion people would have some kind of hearing loss and at least 700 million people are going to require hearing rehabilitation by 2050. In addition, almost 1 billion young people are at risk of permanent, preventable hearing loss because of unhealthy listening habits. High-volume speakers and exposure to loud sounds among the younger generation are also contributing to the prevalence of hearing loss. This is anticipated to drive the demand for bionic ears in the future.

The COVID-19 pandemic severely impacted the market owing to the disruption in the global supply chain and manufacturing process, affecting the availability and production of bionic ears. Many hospitals postponed elective non-urgent surgery due to a high influx of patients. Hence, many manufacturers witness a decline in their revenue. For instance, the revenue of Cochlear Ltd declined by 6.5% in 2020, as compared to 2019, due to the pandemic. Additionally, economic uncertainty and decreased consumer spending decreased the sales of bionic ear solutions.

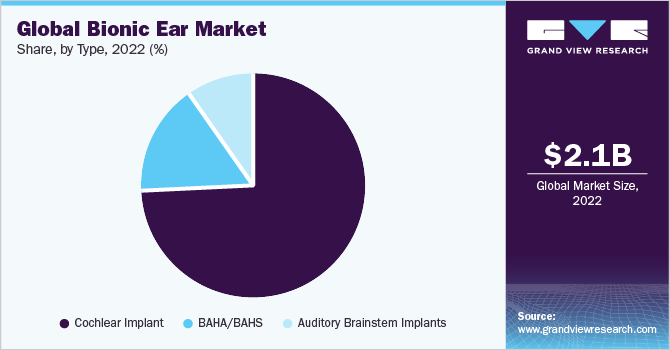

Type Insights

The cochlear implants segment dominated the overall market with the largest revenue share of 74.4% in 2022. The rising number of cochlear implantation surgeries and increasing market penetration are boosting segment growth. Cochlear implants have seen significant advancements and have helped thousands of people around the world regain their hearing ability and improve their quality of life. In January 2022, Cochlear Limited announced FDA approval for Cochlear Nucleus Implants for single-sided deafness and unilateral hearing loss (UHL/SSD).

The auditory brainstem implant segment is expected to grow owing to the increasing prevalence of neurofibromatosis type 2. Over the past few years, auditory brainstem implant devices and electrode design have undergone multiple changes. Moreover, the ABI was initially developed for NF2 (Neurofibromatosis type 2) patients, new research indicates that this technology can also be used to deliver hearing in children and people who do not have tumors.

End-use Insights

Hospitals segment dominated the overall market in 2022. The segment is projected to witness the highest growth during the forecast period.Favoring health reimbursement policies in the high volume of surgeries done in hospitals are prominent factors for the dominant share of the segment. The presence of experts to perform complex cochlear, BAHA, and auditory brainstem implantations in hospitals is favoring segment growth.

Clinics segment is expected to have the second highest growth rate during the forecast period. In recent years, many clinics are offering cochlear implantation procedures to restore auditory functions in some individuals with advanced sensorineural hearing loss. (SNHL). The increasing number of well-equipped ENT clinics and the prevalence of hearing loss is augmenting the segment growth.

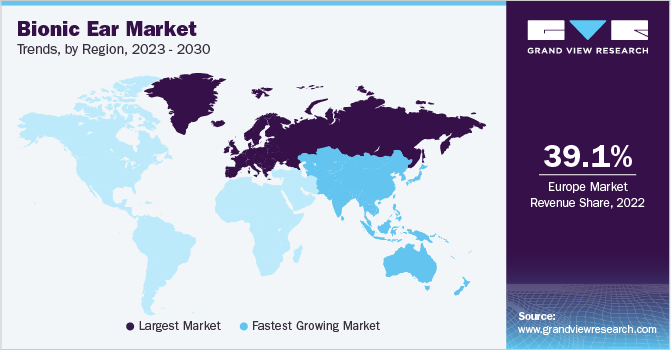

Regional Insights

Europe captured the highest market share of 39.1% in 2022. The bionic ears market growth is primarily driven by the high prevalence of hearing loss in the region, particularly among the elderly population. Additionally, advancements in bionic ear technology, increasing penetration of cochlear implants in adults and pediatrics, and increased awareness about hearing loss treatment options are contributing to the growth of the market.

Asia Pacific is projected to witness significant growth in the coming years.The region has a large and rapidly growing population, which would increase the prevalence of hearing loss. In addition, factors such as rising disposable incomes and increasing healthcare expenditure are contributing to the growth of the market. However, limited healthcare infrastructure in certain countries and the high cost of bionic ear solutions could restrict the region’s growth.

Key Companies & Market Share Insights

Market players are undertaking strategic initiatives, such as product launches, partnerships, and acquisitions, to strengthen their market presence. For instance, in April 2022 Cochlear Ltd. announced to acquire Oticon Medical. Under this agreement, the company would offer assistance to Oticon Medical's base of more than 75,000 users of hearing implants, including both acoustic and cochlear implants. In February 2023, Cochlear Ltd. started offering Audio Streaming for Hearing Aids (ASHA) support for direct Fire TV streaming to the company’s hearing implants. Some of the prominent players in the global bionic ear market include:

-

Cochlear Ltd.

-

MED-EL Medical Electronics

-

Sonova

-

Demant A/S

-

Zhejiang Nurotron Biotechnology Co. Ltd.

-

GAES

-

Amplifon

Bionic Ear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.4 billion

Revenue forecast in 2030

USD 3.9 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Cochlear Ltd.; MED-EL Medical Electronics; Sonova; Demant A/S; Zhejiang Nurotron Biotechnology Co. Ltd.; GAES; Amplifon

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Bionic Ear Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bionic ear market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cochlear Implant

-

Auditory Brainstem Implants

-

BAHA/BAHS

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bionic ears market size was estimated at USD 2.1 billion in 2022 and is expected to reach USD 2.3 billion in 2023.

b. The global bionic ears market is expected to grow at a compound annual growth rate of 8.35% from 2023 to 2030 to reach USD 4.0 billion by 2030.

b. North America dominated the bionic ears market with a share of 74.4% in 2022. Rising number of cochlear implantation surgeries and increasing market penetration are boosting the segment growth.

b. Some key players operating in the bionic ears market include Cochlear Ltd., MED-EL Medical Electronics, Sonova, Demant A/S, Zhejiang Nurotron Biotechnology Co. Ltd., GAES, Amplifon

b. Key factors that are driving the bionic ears market growth include the increasing growing geriatric population, increasing prevalence of hearing loss, advancements in technology, and favorable reimbursement policies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.