- Home

- »

- Medical Devices

- »

-

Biopharmaceutical Cold Chain Third Party Logistics Market, 2033GVR Report cover

![Biopharmaceutical Cold Chain Third Party Logistics Market Size, Share & Trends Report]()

Biopharmaceutical Cold Chain Third Party Logistics Market (2025 - 2033) Size, Share & Trends Analysis Report By Services (Transportation, Inventory Management, Warehousing & Storage, Packaging Solutions), By Temperature Range, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-766-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biopharmaceutical Cold Chain Third Party Logistics Market Summary

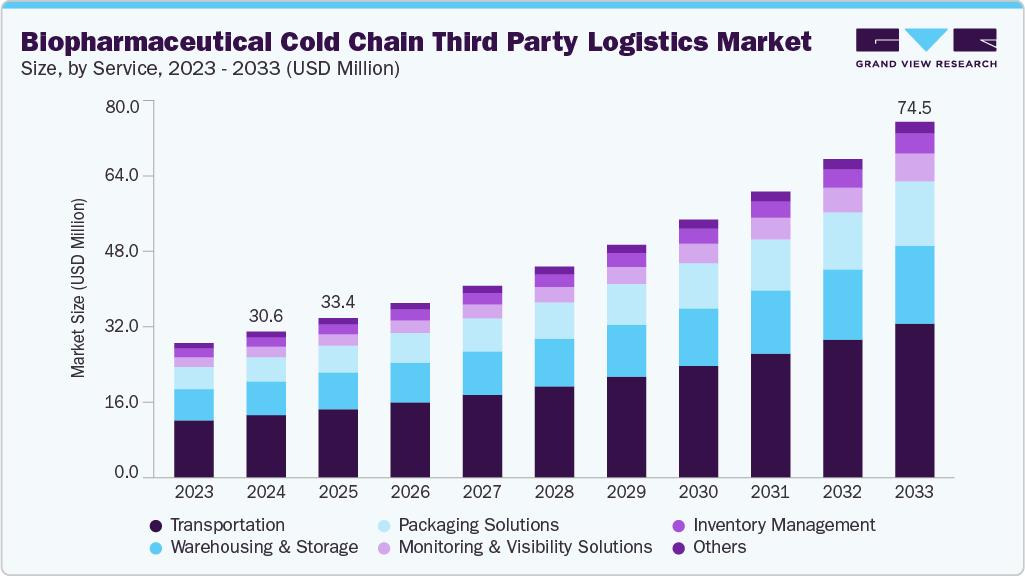

The global biopharmaceutical cold chain third party logistics market size was estimated at USD 30.59 billion in 2024 and is projected to reach USD 74.46 billion by 2033, growing at a CAGR of 10.54% from 2025 to 2033. This market growth is due to the rising demand for temperature-sensitive pharmaceuticals, stringent drug storage and transportation regulatory requirements, and the global expansion of biologics and vaccine distribution.

Key Market Trends & Insights

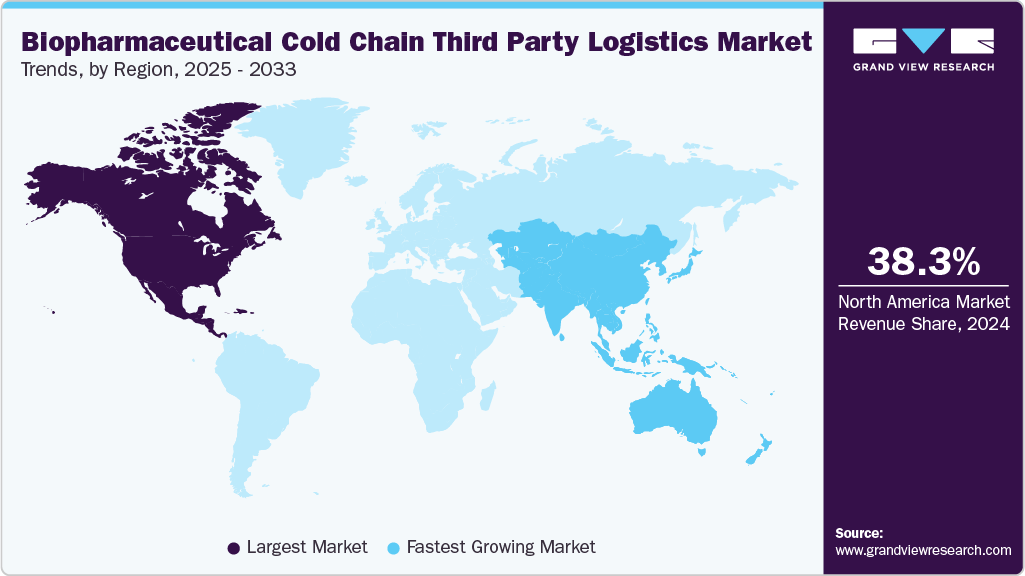

- North America biopharmaceutical cold chain third party logistics market held the largest share of 38.33% of the global market in 2024.

- The biopharmaceutical cold chain third party logistics industry in the U.S. is expected to grow significantly over the forecast period.

- By service, the transportation segment led the market with the largest revenue share of 42.80% in 2024.

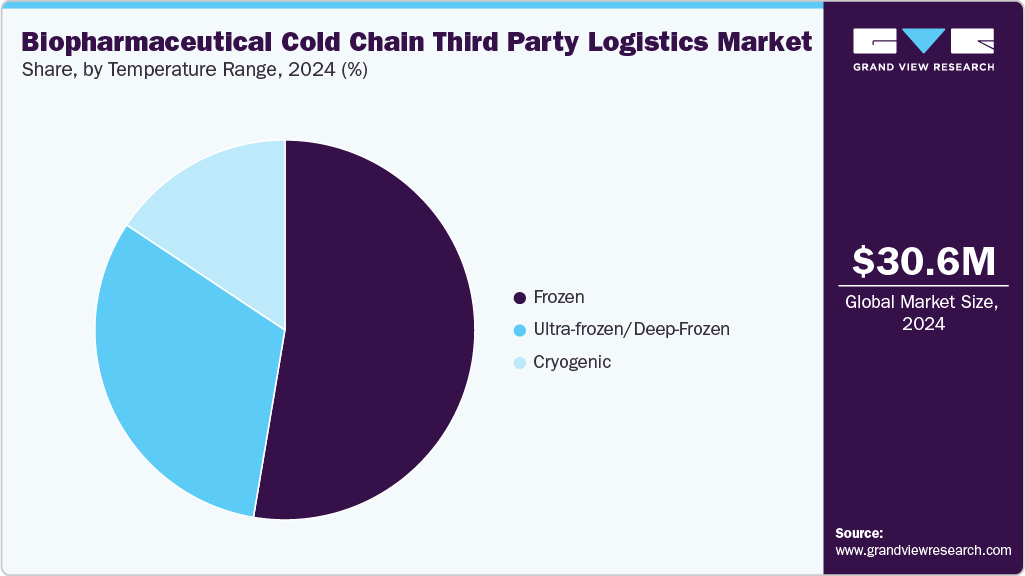

- Based on temperature range, the frozen segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 30.59 Billion

- 2033 Projected Market Size: USD 74.46 Billion

- CAGR (2025-2033): 10.54%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, increasing outsourcing of logistics services by pharmaceutical companies is further driving market expansion. Furthermore, increasing demand for biologics, vaccines, and temperature-sensitive drugs has significantly expanded the need for reliable cold chain logistics solutions. Biologics, including monoclonal antibodies, gene therapies, and recombinant proteins, require stringent temperature control, typically between 2°C and 8°C, with some requiring ultra-low storage at -70°C or lower-to maintain their efficacy.

Moreover, the growing trend towards personalized medicine has further boosted the need for specialized logistics solutions to ensure product integrity throughout the supply chain.

Opportunity Analysis

Continuous expansion of the biopharmaceutical sector and emerging markets in Asia-Pacific, Latin America, and the Middle East are creating significant growth opportunities for cold chain logistics providers. The increasing trend of biopharmaceutical companies outsourcing their logistics operations to 3PL providers allows for cost optimization and operational efficiency. In addition, the rise of cell & gene therapies, which require ultra-cold storage, is creating new opportunities for logistics service providers.

Companies offering end-to-end cold chain solutions, from warehousing to last-mile delivery, are projected to gain a competitive advantage in this evolving landscape. For instance, in May 2023, DHL invested approximately USD 1.5 million in introducing a temperature-controlled air freight service based in Indianapolis. This service explicitly supports transporting sensitive medical and biopharmaceutical products across the U.S. and Puerto Rico, enhancing the network's robustness in handling life sciences logistics. This initiative is part of DHL's broader strategy to boost cold chain logistics infrastructure, addressing growing needs for biologics and other temperature-sensitive medicines.

Technological Advancements

The market is undergoing a transformation driven by technological innovations. IoT-enabled tracking systems, AI-driven predictive analytics, and blockchain-based supply chain management solutions enhance visibility and efficiency across logistics networks. Real-time temperature monitoring ensures compliance with regulatory standards, reducing risks associated with temperature excursions. Moreover, autonomous refrigerated vehicles and drone-based pharmaceutical deliveries are revolutionizing last-mile distribution. These advancements improve operational efficiency and minimize losses associated with spoilage and regulatory non-compliance.

Comparative Regional Matrix, by Technology

Region

Adoption of IoT & AI

Blockchain Integration

Automated Warehousing

North America

High

Moderate

High

Europe

High

High

Moderate

Asia-Pacific

Moderate

Emerging

High

Latin America

Low

Emerging

Moderate

Middle East & Africa

Moderate

Low

Emerging

North America leads in IoT-based monitoring and automated warehousing, while Europe is rapidly integrating blockchain for secure cold chain management. Asia-Pacific is emerging as a hub due to its vast geography and high demand for fast deliveries.

Pricing Analysis

The pricing structure in the market is influenced by factors such as service model, transportation mode, and storage requirements, with providers offering flexible solutions tailored to client needs. Dedicated cold storage is a high-cost model ideal for large pharmaceutical manufacturers requiring exclusive temperature-controlled warehousing. Pay-per-use warehousing provides a cost-effective, scalable option for mid-sized pharma companies and distributors, allowing them to access cold storage on demand without long-term commitments. Furthermore, integrated supply chain solutions offer end-to-end logistics, covering storage, transportation, and distribution, making them a preferred choice for companies seeking streamlined and cost-efficient operations.

Service Insights

The transportation segment captured the largest revenue share in the biopharmaceutical cold chain third party logistics industry in 2024. The growth is mainly due to the rising global trade of temperature-sensitive pharmaceuticals, including biologics and vaccines, which require stringent cold chain logistics. Furthermore, the expansion of cross-border pharmaceutical distribution, coupled with increasing outsourcing of logistics by pharmaceutical companies, is leading to growing investments in specialized refrigerated transport solutions.

The monitoring & visibility solutions segment is projected to grow at the fastest CAGR due to the increasing need for real-time tracking, compliance, and risk mitigation in cold chain logistics. Adopting advanced technologies ensures product integrity, minimizes spoilage, and enhances supply chain transparency.

Temperature Range Insights

The frozen segment captured the largest revenue share of the biopharmaceutical cold chain third party logistics industry in 2024. The segment’s growth is due to the high volume of biologics, vaccines, and specialty pharmaceuticals that require storage temperatures between -20°C and -80°C. The increasing adoption of frozen storage for cell-based therapies, blood plasma, and insulin has further strengthened demand for reliable cold chain solutions.

The ultra-frozen/deep-frozen segment is projected to grow at the fastest CAGR during the forecast period. The growth is due to the rising demand for temperature-sensitive biopharmaceuticals, such as cell and gene therapies, vaccines, and advanced biologics, which often require storage and transport at ultra-low temperatures to maintain efficacy. In addition, the growing prevalence of chronic and rare diseases has accelerated the development of such therapies, further boosting the need for robust ultra-frozen logistics solutions.

Regional Insights

North America accounted for the largest market share of 38.33% in 2024 due to its advanced biopharmaceutical industry and a well-regulated framework. The region has seen significant investments in temperature-controlled warehouses, IoT-enabled tracking systems, and AI-driven route optimization. The rising demand for biologics, gene therapies, and personalized medicine has further strengthened its cold chain infrastructure.

U.S. Biopharmaceutical Cold Chain Third Party Logistics Market Trends

The biopharmaceutical cold chain third party logistics market in the U.S. is driven by the country’s highly developed regulatory landscape (FDA, GDP, GMP), which mandates strict cold chain compliance. In addition, rising pharmaceutical exports and increased outsourcing of logistics operations to specialized 3PL providers are further accelerating the market growth.

Europe Biopharmaceutical Cold Chain Third Party Logistics Market Trends

The biopharmaceutical cold chain third party logistics market in Europeis experiencing growth. The region has witnessed a surge in investments in GDP-compliant cold storage facilities and last-mile delivery solutions. The European Medicines Agency (EMA) enforces strict guidelines, compelling logistics providers to adopt real-time temperature monitoring and risk mitigation strategies.

The UK biopharmaceutical cold chain third party logistics market held a significant share in 2024. The country’s market growth is due to its robust pharmaceutical supply chain, with high demand for cold chain logistics due to its strong biotech and vaccine production industry. The impact of Brexit has led to increased complexities in cross-border pharmaceutical trade, making efficient cold chain management essential.

The biopharmaceutical cold chain third-party logistics market in France is driven due to the country’s growing biologics and vaccine production sector. The government’s focus on domestic pharmaceutical manufacturing and R&D investments increases the demand for specialized cold chain services.

The biopharmaceutical cold chain third party logistics market in Germany is anticipated to grow significantly over the forecast period. The country’s logistics firms are increasingly adopting automation, AI-driven supply chain analytics, and IoT-based monitoring to enhance efficiency. Sustainability is a major focus, with investments in hydrogen-powered refrigerated trucks and green warehousing solutions.

Asia Pacific Biopharmaceutical Cold Chain Third Party Logistics Market Trends

The biopharmaceutical cold chain third party logistics market in the Asia Pacific is projected to grow at the highest CAGR over the forecast period. The market's growth is due to rising pharmaceutical manufacturing, vaccine exports, and increasing demand for biologics. The region is witnessing massive investments in temperature-controlled warehouses, IoT-based tracking systems, and express cold chain transportation.

The biopharmaceutical cold chain third party logistics market in China is expected to grow over the forecast period. The country is rapidly expanding its cold storage and refrigerated transport infrastructure to meet rising demand. Government regulations on pharmaceutical cold chain compliance are becoming stricter, further driving investments in GDP-certified logistics solutions.

Japan biopharmaceutical cold chain third party logistics market is witnessing significant growth over the forecast period. The country has advanced regulatory compliance, high-tech logistics solutions, and an increasing demand for regenerative medicine. It also has one of the most sophisticated cold chain infrastructures, extensively using robotic cold storage, AI-driven logistics management, and RFID-based tracking.

The biopharmaceutical cold chain third party logistics market in India is witnessing considerable growth due to increasing government support. The government’s "Make in India" initiative is accelerating the development of domestic cold chain infrastructure. The growth of online pharmacy platforms and e-commerce-driven drug deliveries increases the need for last-mile cold chain solutions.

Key Biopharmaceutical Cold Chain Third Party Logistics Company Insights

Key players in the market are actively enhancing their service offerings to meet the growing demand for temperature-sensitive pharmaceutical products. Companies such as Cardinal Health, DHL Group, and Agility are investing in advanced technologies like IoT-enabled tracking systems, real-time temperature monitoring, and automated warehousing solutions. These innovations aim to ensure the integrity and safety of healthcare products during transit. For instance, in October 2024, UPS acquired Frigo-Trans and its sister company BPL. This strategic initiative aims to enhance UPS Healthcare's end-to-end temperature-controlled and time-critical transportation solutions, addressing the growing demands of the pharmaceutical and biotech industries.

Key Biopharmaceutical Cold Chain Third Party Logistics Companies:

The following are the leading companies in the biopharmaceutical cold chain third party logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health

- DHL Group

- Agility

- SF Express

- Kinesis Medical B.V.

- United Parcel Service of America, Inc.

- Barrett Distribution

- Cencora

- DB Schenker

- FedEx

- KUEHNE + NAGEL

- Kerry Logistics Network Ltd.

- Freight Logistics Solutions

Recent Developments

-

In August 2025, UPS Healthcare announced it would expand its global pharmaceutical logistics network with 20 state-of-the-art facilities and aims to open seven more by the end of the year.

-

In February 2024, DHL announced that it would invest 200 million USD in expanding its life sciences and healthcare logistics capabilities in the U.S. This strategic initiative includes constructing five new state-of-the-art warehouse facilities in Pennsylvania and North Carolina. The new state-of-the-art facilities would enhance the company’s ability to provide end-to-end temperature-controlled storage and distribution, particularly for high-growth segments like cryogenic and frozen biologics.

-

In October 2024, UPS announced that it would expand its healthcare logistics business through internal growth and strategic acquisitions to enhance profitability. The company aims to reduce reliance on volatile sectors by strengthening its presence in healthcare logistics.

Biopharmaceutical Cold Chain Third Party Logistics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 33.40 billion

Revenue forecast in 2033

USD 74.46 billion

Growth rate

CAGR of 10.54% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, temperature range, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait, Oman; Qatar

Key companies profiled

Cardinal Health; DHL Group, Agility; SF Express; Kinesis Medical B.V.; United Parcel Service of America, Inc.; Barrett Distribution; Cencora; DB Schenker; FedEx; KUEHNE + NAGEL; Kerry Logistics Network Ltd.; Freight Logistics Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopharmaceutical Cold Chain Third Party Logistics Market Report Segmentation

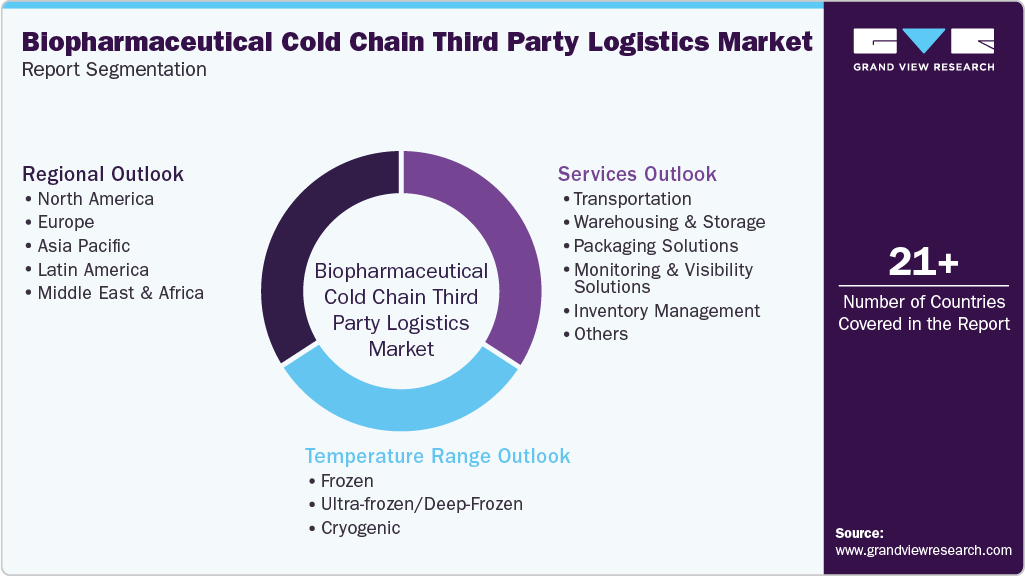

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global biopharmaceutical cold chain third party logistics market based on service, temperature range, and region:

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland

-

-

Warehousing & Storage

-

Packaging Solutions

-

Monitoring & Visibility Solutions

-

Inventory Management

-

Others

-

-

Temperature Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Frozen

-

Ultra-frozen/Deep-Frozen

-

Cryogenic

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global biopharmaceutical cold chain third-party logistics market size was estimated at USD 30.59 billion in 2024 and is expected to reach USD 33.40 billion in 2025.

b. The global biopharmaceutical cold chain third-party logistics market is expected to grow at a compound annual growth rate of 10.54% from 2025 to 2033, reaching USD 74.46 billion by 2033.

b. North America dominated the biopharmaceutical cold chain third-party logistics market, with a share of 38.33% in 2024. This is attributable to its advanced biopharmaceutical industry and well-regulated framework. The region has seen significant investments in temperature-controlled warehouses, IoT-enabled tracking systems, and AI-driven route optimization.

b. Some key players operating in the biopharmaceutical cold chain third-party logistics market include Cardinal Health, DHL Group, Agility, SF Express, Kinesis Medical B.V., United Parcel Service of America, Inc., Barrett Distribution, Cencora, DB Schenker, FedEx, KUEHNE + NAGEL, Kerry Logistics Network Ltd., Freight Logistics Solutions

b. Key factors that are driving the market growth include rising demand for temperature-sensitive pharmaceuticals, stringent regulatory requirements for drug storage and transportation, and the expansion of biologics and vaccine distribution globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.