- Home

- »

- Pharmaceuticals

- »

-

Biopharmaceutical Excipients Market Size Report, 2030GVR Report cover

![Biopharmaceutical Excipients Market Size, Share & Trends Report]()

Biopharmaceutical Excipients Market Size, Share & Trends Analysis Report By Product (Polyols, Solubilizes & Surfactants/Emulsifiers, Carbohydrates, Specialty Excipients), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-006-4

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global biopharmaceutical excipients market size was valued at USD 2.45 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.50% from 2023 to 2030. Increasing R&D investments in biosimilars, coupled with the patent expiration of top-selling biologics, are projected to propel the market. The chemical and physical instability of biopharmaceuticals and stringent manufacturing requirements need to be fulfilled for consistent yield of biologics and to ensure high cell viability are boosting the market. Moreover, the increasing adoption of multifunctional excipients, patent expiry of biological actives, and growing focus of pharmaceutical players on the generic market are factors expected to offer lucrative opportunities in the market for biopharmaceutical excipients during the forecast period.

COVID-19 Impact: Vital role of excipients in therapeutics is set to propel market demand. Pandemic Impact Post COVID Outlook Multi-functional excipients have gained significant popularity in recent years, expected to drive the market. Biopharmaceutical excipients are expected to gain traction post the pandemic outbreak, with high demand across re-purposing existing drugs & vaccine development for the management of SARS-COV-2 infection. Market participants are focusing on the development of co-processed multifunctional excipient formulations anticipated to propel market expansion. An array of effective excipient formulations are being introduced for the stabilization of vaccines and biologics during storage & processing, which is set to offer new opportunities to the market players, particularly post the pandemic outbreak.

Biopharmaceutical manufacturers are engaged in improving the administration of biologics as compared to conventional dosage forms (currently available in parental formulations). Growing demand for excipients with improved properties for biologic formulations drives the market. Polyols, glycerol, surfactants, and buffers are the most used excipients for the formulation of biologics. Moreover, companies operating in the market are developing new process development technologies.

For instance, in June 2020, Evonik launched the RESOMER Precise platform for custom manufacturing of functional polymeric excipients to allow pharmaceutical companies to control the release of their parenteral drug products with accuracy and precision. The process technology will help in optimizing drug product stability, which will reduce regulatory risk for a wide range of parenteral drug products.

Moreover, operating players are launching innovative biopharmaceutical excipients to maintain the stability of pharmaceutical products. For instance, in May 2023, Roquette introduced the novel excipient PEARLITOL ProTec in Europe . It is a unique, plant-based co-processed blend of maize starch & mannitol and can be used for stabilizing and protecting sensitive active ingredients such as probiotics.

Furthermore, an increasing number of programs to advance innovative biopharmaceutical excipients are expected to open new avenues for the market. For instance, in September 2022, the Office of New Drugs and the Center for Drug Evaluation and Research launched a voluntary Pilot Program for the Review of Innovation and Modernization of Excipients (PRIME). This program is intended to allow biopharmaceutical manufacturers to obtain FDA review of novel excipients. Such initiatives are driving the biopharmaceutical excipients market.

COVID-19 Impact: Vital role of excipients in therapeutics is set to propel market demand.

Pandemic Impact

Post COVID Outlook

Multi-functional excipients have gained significant popularity in recent years, expected to drive the market.

Biopharmaceutical excipients are expected to gain traction post the pandemic outbreak, with high demand across re-purposing existing drugs & vaccine development for the management of SARS-COV-2 infection.

Market participants are focusing on the development of co-processed multifunctional excipient formulations anticipated to propel market expansion.

An array of effective excipient formulations are being introduced for the stabilization of vaccines and biologics during storage & processing, which is set to offer new opportunities to the market players, particularly post the pandemic outbreak.

The sudden outbreak of COVID-19 led vaccine manufacturers to extend their collaboration to continue the supply of excipients for vaccine development. For instance, in May 2020, CordenPharma and Moderna extended their manufacturing services agreement to supply lipid excipients used to develop the vaccine for SARS-CoV-2. In addition, the companies further extended the supply relationship by expanding their agreement that was signed in 2016. The new agreement now included CordenPharma Colorado and CordenPharma Chenôve for larger-scale production of lipid excipients to meet Moderna's increasing demand for vaccine development. Thus, the COVID-19 pandemic had a positive impact on the global market for biopharmaceutical excipients.

Product Insights

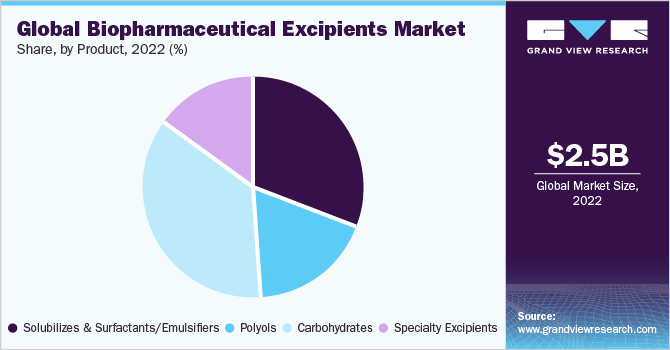

Carbohydrate-based excipient products dominated the market in 2022 with a revenue share of 35.81%, and this trend is expected to continue through the forecast period. The extensive use of starch, sucrose, and dextrose in various drug formulations can be primarily attributed to the dominant share of the segment.

High-purity carbohydrates such as trehalose are being rapidly adopted in the development of biosimilars due to their ability to enhance the yield of the final product, stabilize various biologics, prevent aggregation, and improve the entire process of biopharmaceutical manufacturing. In addition, the increasing adoption of carbohydrates as bulking agents for assisting in the process of lyophilization for biomolecules such as proteins is further contributing to segment growth.

The polyols segment is expected to witness the fastest CAGR over the forecast period. Polyols are sugar alcohols found in certain fruits, vegetables, and sugar-free sweeteners. The growth of this segment can be attributed to the increasing demand for protein therapeutics. Polyols are added in protein formulations for increasing tonicity and stability. Moreover, they have also been shown to offer greater thermodynamic stability, which is essential for protein-based formulations.

Most therapies based on biomolecules are lyophilized to prevent aggregation and degradation. All lyophilized formulations use one or the other polyol. Sorbitol (polysorbate 80 & polysorbate 20) and mannitol are the most widely used polyols. In October 2022, Roquette introduced two next-generation mannitol excipients, PEARLITOL 200 GT and PEARLITOL CR-H, for direct compression and controlled release of mini tabs and tablets.

Regional Insights

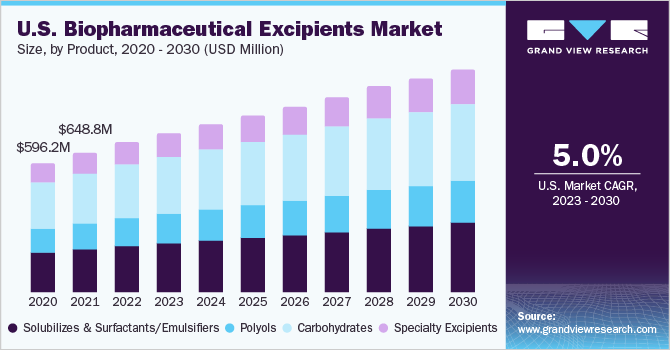

North America accounted for the largest market share of 31.85 % in 2022. The regional growth can be attributed to several large-scale pharmaceutical manufacturing companies operating in this region. The region has witnessed a significant demand for biopharmaceutical production, along with the need to maintain the quality of high-grade raw materials used to develop biopharmaceuticals. This has compelled several regional excipient manufacturers to achieve the required production scalability by using biopharmaceutical excipients that comply with the regulatory standards.

Furthermore, companies operating in the region are conducting new studies for developing efficient excipient solutions. For instance, in February 2021, Innophos released a whitepaper that focused on co-processed multifunctional excipients for enhancing compressibility, increasing manufacturing efficiency, simplifying labels, and reducing tablet size. This technology will continue to grow as it helps in reducing ingredients on the label without compromising efficacy and will help in reducing operational costs for manufacturers.

The Asia Pacific market is anticipated to witness the fastest growth rate of around 6.0% during the projection period, owing to the presence of large CMOs involved in drug development. Countries in this region such as South Korea, India, and China are majorly involved in the advancement of biosimilars. There are numerous reasons for the extensive development of biosimilars, including the presence of a large patient pool, cost advantages, affordability, and favorable regulatory framework.

Numerous biopharmaceutical manufacturers, who are potential customers for the market, have their manufacturing units in Asian countries. International biopharma players are involved in shifting their manufacturing and R&D operation sites to these countries owing to the significant cost advantages offered in the value chain. The spiraling demand for biosimilars is, in turn, bolstering the demand for novel excipients. These factors are expected to propel the Asia Pacific region’s growth in the near future.

Key Companies & Market Share Insights

Companies are undertaking strategic initiatives such as product collaborations, acquisitions, mergers, and agreements for product portfolio expansion to maximize their market share. To sustain their presence in the market, industry players are further concentrating on product approvals and geographic expansions. For instance, in March 2023, Evonik Industries AG began the construction of a new facility in Indiana, U.S. The facility expansion is expected to secure the global supply of functional excipients for RNA medicines and fuel the biopharmaceutical excipients industry. Some of the prominent players in the global biopharmaceutical excipients market include:

-

Merck KGaA

-

Colorcon

-

BASF SE

-

Associated British Foods plc

-

Signet Excipients Pvt. Ltd (IMCD)

-

Sigachi Industries Limited

-

Spectrum Chemical Manufacturing Corp.

-

Roquette Frères

-

IMCD

-

Clariant

-

DFE Pharma

-

J. RETTENMAIER & SÖHNE GmbH + Co KG

-

Evonik Industries AG

Biopharmaceutical Excipients Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.60 billion

Revenue forecast in 2030

USD 3.76 billion

Growth rate

CAGR of 5.50% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Revenue in USD million, volume in tons, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck KGaA; Colorcon; BASF SE; Associated British Foods plc; Signet Excipients Pvt. Ltd (IMCD); Sigachi Industries Limited; Spectrum Chemical Manufacturing Corp.; Roquette Frères; IMCD; Clariant; DFE Pharma; J. RETTENMAIER & SÖHNE GmbH + Co KG; Evonik Industries AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopharmaceutical Excipients Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global biopharmaceutical excipients market report on the basis of product, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Solubilizes & Surfactants/Emulsifiers

-

Triglycerides

-

Esters

-

Others

-

-

Polyols

-

Mannitol

-

Sorbitol

-

Others

-

-

Carbohydrates

-

Sucrose

-

Dextrose

-

Starch

-

Others

-

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biopharmaceutical excipients market size was estimated at USD 2.45 billion in 2022 and is expected to reach USD 2.60 billion in 2023.

b. The global biopharmaceutical excipients market is expected to grow at a compound annual growth rate of 5.50% from 2023 to 2030 to reach USD 3.76 billion by 2030.

b. Carbohydrates dominated the biopharmaceutical excipients market with a share of 35.81% in 2022. This is attributed to the wide use of sucrose, starch, and dextrose across drug formulations along with the rapid adoption of carbohydrates as bulking agents.

b. Some key players operating in the biopharmaceutical excipients market include Merck KGaA, Signet Chemical Corporation Pvt. Ltd., Sigachi Industries Pvt. Ltd., Associated British Foods, Spectrum Chemical Manufacturing Corp., Roquette Frères, IMCD, Clariant, DFE Pharma, Colorcon, J. RETTENMAIER & SÖHNE GmbH + Co KG, BASF SE, and Evonik Industries AG.

b. Key factors that are driving the biopharmaceutical excipients market growth include the advent of innovative excipients, an increase in the number of distribution agreements between vendors, and gradual expansion of the application of biopharmaceutical excipients to provide cutting-edge drug formulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."