- Home

- »

- Renewable Chemicals

- »

-

Bioplastic Packaging Market Size, Industry Report, 2030GVR Report cover

![Bioplastic Packaging Market Size, Share & Trends Report]()

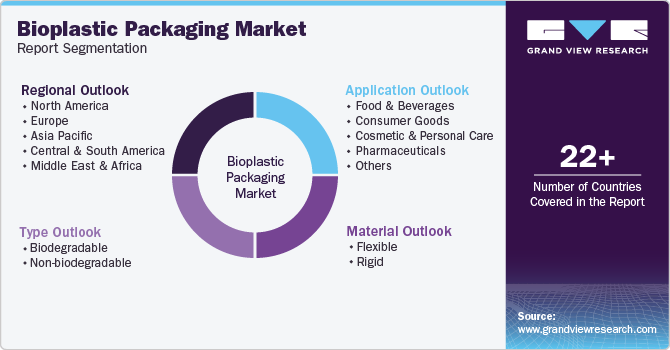

Bioplastic Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Biodegradable, Non-biodegradable), By Type (Flexible, Rigid), By Application (Food & Beverages, Consumer Goods, Cosmetic & Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-992-0

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioplastic Packaging Market Summary

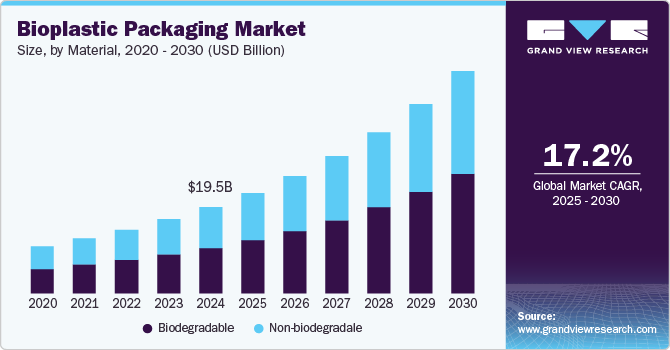

The global bioplastic packaging market size was estimated at USD 19.55 billion in 2024 and is projected to reach USD 50.57 billion by 2030, growing at a CAGR of 17.24% from 2025 to 2030. The factors that drive the market growth include the increasing consumption of renewable and bio-based products, growing demand from the flexible packaging industry, and exceptional properties of bioplastic, such as contributing less to the carbon footprint and decomposing faster than plastic.

Key Market Trends & Insights

- Europe bioplastic packaging market dominated the global industry and accounted for the largest revenue share of 32.73% in 2024, largely attributed to its robust regulatory framework and commitment to achieving a circular economy.

- In the U.S., stringent state-level regulations and federal support for sustainable materials are major drivers for the bioplastic packaging industry.

- Based on material, biodegradable dominated the bioplastic packaging market in terms of revenue, accounting for an industry share of 52.68% in 2024, owing to the rising demand for bio-based plastics in various end-use industries.

- In terms of type, flexible packaging dominated the bioplastic packaging industry across the distribution channel segmentation in terms of revenue, accounting for a market share of 58.11% in 2024.

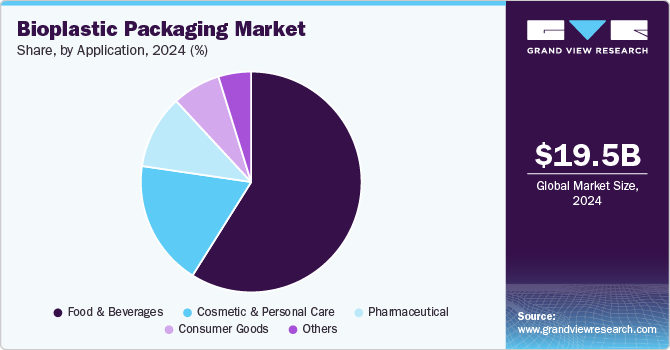

- On the basis of application, food and beverages dominated the market for bioplastic packaging across the distribution channel segment in terms of revenue, accounting for a market share of 58.95% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.55 billion

- 2030 Projected Market Size: USD 50.57 billion

- CAGR (2025-2030): 17.24%

- Europe: Largest market in 2024

However, the price competitiveness of bioplastic packaging over conventional plastics is restraining the market growth to some extent.

The bioplastic packaging industry is witnessing a strong trend toward the adoption of bio-based materials as businesses and consumers increasingly prioritize sustainability. Packaging made from renewable resources such as corn starch, sugarcane, and cellulose is becoming more common across industries like food and beverage, personal care, and retail. This shift is driven by heightened environmental awareness, stringent regulations on conventional plastics, and the growing demand for eco-friendly alternatives. Companies are also leveraging advanced biopolymer technologies to produce high-performance materials with enhanced durability and barrier properties, enabling broader application across diverse packaging formats.

Drivers, Opportunities & Restraints

Government policies and international regulations aimed at curbing single-use plastic waste are a major driver for the bioplastic packaging market growth. Numerous countries have implemented bans or restrictions on conventional plastic bags, straws, and packaging materials, creating significant opportunities for bioplastic alternatives. For instance, the European Union's Single-Use Plastics Directive and similar initiatives in Asia and North America are encouraging industries to transition to biodegradable and compostable packaging. These regulatory frameworks not only push businesses to adopt sustainable materials but also provide incentives and support for innovation in bioplastic production technologies.

Emerging economies in Asia, Africa, and Latin America present substantial growth opportunities for the bioplastic packaging market. With rapid urbanization, growing middle-class populations, and increased consumer awareness about environmental issues, these regions are shifting toward sustainable packaging solutions.

The high production costs of bioplastic packaging compared to conventional plastics remain a key restraint for the market. Bioplastics often require specialized raw materials and manufacturing processes, which can lead to higher prices. Additionally, inadequate recycling and composting infrastructure in many regions limits the end-of-life management of bioplastics, undermining their environmental benefits. For instance, industrial composting facilities are essential for many biodegradable materials to decompose effectively, but their availability is often limited. Addressing these challenges requires significant investments in technology, scaling production, and developing efficient waste management systems to make bioplastic packaging a more viable and accessible option globally.

Material Insights

Biodegradable dominated the bioplastic packaging market in terms of revenue, accounting for an industry share of 52.68% in 2024, owing to the rising demand for bio-based plastics in various end use industries, which is expected to drive their demand during the assessment period. Biodegradable plastics include polylactic acid, starch blends, PBAT, PBS, PHA, polycaprolactone, and cellulose acetate. Among them, starch blends and PBAT were the largest biodegradable product segment, in terms of revenue, in 2024.

Starch-based plastics are produced from widely available natural resources such as potato, tapioca, wheat, rice, and corn. The abundant availability of resources makes starch blends an ideal alternative to conventional plastics. However, polylactic acid (PLA) is poised to be the fastest-growing segment during the forecast period. The segment growth is anticipated to be driven by the growing product demand in various applications, including packaging, transportation, agriculture, electronics, and textiles.

Low carbon emission by polylactic acid as compared to conventional plastics is significantly fuelling the demand for polylactic acid globally. For instance, producing 1 kg of polylactic acid releases approximately 0.5 kg of carbon footprint, whereas the production of conventional polycarbonate, polystyrene, polyethylene terephthalate, polypropylene, and low-density polyethylene releases 5.0 kg, 2.2 kg, 2.0 kg, 1.7 kg, and 1.7 kg carbon footprint, respectively.

Type Insights

Flexible packaging dominated the bioplastic packaging industry across the distribution channel segmentation in terms of revenue, accounting for a market share of 58.11% in 2024. Developments in the production of bioplastic technologies, the use of case-ready packaging, and improved packaging practices are anticipated to drive the demand for bioplastics in flexible packaging. Furthermore, the demand for flexible packaging is high, especially for snack foods and beverages.

The surge in demand can be attributed to technological improvements, lifestyle changes of consumers, modern retail trades, and the increasing popularity of quick-service restaurants. For example, consumers, particularly in North America and Europe, prefer packaging that is light and aesthetically appealing. This is likely to increase the use of bioplastic-based flexible packaging in the coming years.

Application Insights

Food and beverages dominated the market for bioplastic packaging across the distribution channel segment in terms of revenue, accounting for a market share of 58.95% in 2024. The factors that drive the market are the rising demand for packaged food and the popularity of quick-service restaurants. The growing demand for packaged foods is anticipated to prompt manufacturers to increase production capacity, thereby augmenting the market for flexible packaging during the forecast period.

In addition, the rising prominence of nutritional food, along with the European Commission’s initiatives to regulate the use of polymers in food packaging applications, is projected to propel the growth of the bioplastic packaging market. Bioplastic packaging is widely utilized for manufacturing bottles, jars, and containers, as well as for fresh food packaging.

PLA plastic bottles are durable, disposable, and possess properties such as transparency and gloss. Polylactic acid can be easily composted compared to petroleum-based products and does not emit toxic gases on incineration. Thus, its demand in the food packaging segment is expected to remain significantly high during the forecast period.

Regional Insights

In North America bioplastic packaging market, large corporations and retailers are increasingly adopting bioplastic packaging to meet their sustainability goals and respond to consumer preferences for environmentally friendly products. Initiatives such as the U.S. Plastics Pact and Canada’s zero plastic waste initiatives are encouraging the transition from conventional plastics to biodegradable alternatives. Moreover, the presence of advanced manufacturing infrastructure and investment in biopolymer R&D is enabling the development of high-quality bioplastic materials that meet industry-specific requirements, particularly in sectors like food and beverage, personal care, and healthcare.

U.S. Bioplastic Packaging Market Trends

In the U.S. bioplastic packaging market, stringent state-level regulations and federal support for sustainable materials are major drivers for the bioplastic packaging industry. States like California, New York, and Washington have implemented bans or restrictions on single-use plastics, creating a strong demand for biodegradable alternatives. Furthermore, federal investments in sustainable agriculture and bioplastics R&D, such as through the USDA’s Biopreferred Program, are accelerating the development and commercialization of bio-based packaging solutions. This policy-driven environment, coupled with increasing consumer awareness, is pushing industries to adopt bioplastics at a rapid pace.

Europe Bioplastic Packaging Market Trends

Europe bioplastic packaging market dominated the global industry and accounted for largest revenue share of 32.73% in 2024, which is attributable to its robust regulatory framework and commitment to achieving a circular economy. The European Union’s Green Deal and Plastics Strategy emphasize reducing plastic waste and promoting sustainable packaging solutions. Financial incentives for renewable materials and targets for increasing the use of recycled content in packaging are further supporting the adoption of bioplastics. European consumers, known for their strong environmental awareness, are also driving demand for biodegradable and compostable packaging, particularly in the food and beverage industry.

Asia Pacific Bioplastic Packaging Market Trends

Asia Pacific is a significant growth area for the bioplastic packaging industry due to the rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations. Rising environmental concerns and government initiatives promoting the use of eco-friendly materials are driving the adoption of bioplastics in packaging. Additionally, the booming e-commerce and food delivery sectors in the region have increased the demand for sustainable and durable packaging solutions. With local manufacturers focusing on cost-effective production techniques and international players expanding their footprint, the region is becoming a hub for bioplastic innovation and application.

Germany bioplastic packaging market plays a pivotal role as a leader in innovation and manufacturing. The country’s strong focus on environmental sustainability is reflected in its comprehensive waste management policies and support for renewable materials. German companies are at the forefront of developing advanced bioplastic solutions with improved performance characteristics, such as enhanced barrier properties and extended shelf life. Furthermore, partnerships between academic institutions, research organizations, and industry players are fostering breakthroughs in biopolymer technology, solidifying Germany’s position as a key driver of bioplastic adoption in Europe.

Key Bioplastic Packaging Company Insights

The bioplastic packaging industry is highly competitive, with several key players dominating the landscape. Major companies include Amcor plc; Novamont S.p.A; NatureWorks, LLC; Coveris; Sealed Air; Alpha Packaging; Constantia Flexibles Group GmbH; Mondi plc; Transcontinental Inc.; and ALPLA. The bioplastic packaging market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Bioplastic Packaging Companies:

The following are the leading companies in the bioplastic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor Plc.

- Novamont S.p.A

- NatureWorks, LLC.

- Coveris

- Sealed Air

- Alpha Packaging

- Constantia Flexibles

- Mondi

- Transcontinental Inc.

- ALPLA

Recent Developments

-

In November 2024, Walki and Lactips formed a strategic partnership aimed at developing fully biodegradable and plastics-free food packaging. This collaboration focuses on using natural polymers, specifically a casein-based polymer provided by Lactips, which is derived from milk processing. The goal is to create packaging that is not only biodegradable but also recyclable within the paper stream, aligning with European regulations targeting single-use plastics

-

In October 2024, SK Leaveo, a company under SKC, announced its plans to build the world's largest biodegradable plastic plant in Hai Phong, Vietnam, starting construction in the first half of 2024. This facility is expected to produce polybutylene adipate terephthalate (PBAT) with an annual capacity of 70,000 tons. Hai Phong is strategically chosen for its excellent logistics and commitment to renewable energy, which aligns with sustainability goals.

Bioplastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.82 billion

Revenue forecast in 2030

USD 50.57 billion

Growth rate

CAGR of 17.24% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; UK; France; Russia; Italy; China; Japan; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Amcor Plc.; Novamont S.p.A; NatureWorks, LLC.; Coveris; Sealed Air; Alpha Packaging; Constantia Flexibles ;Mondi; Transcontinental Inc.; ALPLA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioplastic Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented Bioplastic packaging market report based on material, type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biodegradable

-

Polylactic Acid

-

Starch Blends

-

Polybutylene Adipate Terephthalate (PBAT)

-

Polybutylene Succinate (PBS)

-

Others

-

-

Non-biodegradable

-

Bio Polyethylene

-

Bio Polyethylene Terephthalate

-

Bio Polyamide

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible

-

Rigid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Consumer Goods

-

Cosmetic & Personal Care

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bioplastic packaging market was estimated at USD 19.55 billion in the year 2024 and is expected to reach USD 22.82 billion by the year 2025.

b. The global bioplastic packaging market is expected to witness high revenue growth of 17.24% from 2025 to 2030 to reach USD 50.57 billion by 2030 owing to increasing environmental concern due to petroleum-based plastic, rising awareness toward sustainable packaging, and government initiatives to support a sustainable packaging approach

b. The food and beverages application commanded the largest share of 58.95% in the year 2024. The factors attributed to driving the market are the rising trend of snacking in developed nations, rising disposable income coupled with the convenience of having packaged food without the hustle of food preparation, and expanding middle-class households in emerging economies.

b. Some key players operating in the bioplastic packaging market include Amcor plc; Novamont S.p.A; NatureWorks, LLC. Coveris; Sealed Air; Alpha Packaging; Constantia Flexibles Group GmbH; Mondi plc; Transcontinental Inc.; ALPLA

b. The factors attributed to driving the market are increasing consumption of renewable and bio-based products, growing demand from the flexible packaging industry, and bioplastic contributes less to carbon footprint and decomposes faster than plastic. Thus, preventing the environment from the toxic effect of petroleum-based plastic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.