- Home

- »

- Biotechnology

- »

-

Bioprocess Analyzers Market Size, Industry Report, 2033GVR Report cover

![Bioprocess Analyzers Market Size, Share & Trends Report]()

Bioprocess Analyzers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Type (Substrate Analysis, Metabolite Analysis), By Application (Antibiotics, Recombinant Proteins), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-795-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioprocess Analyzers Market Summary

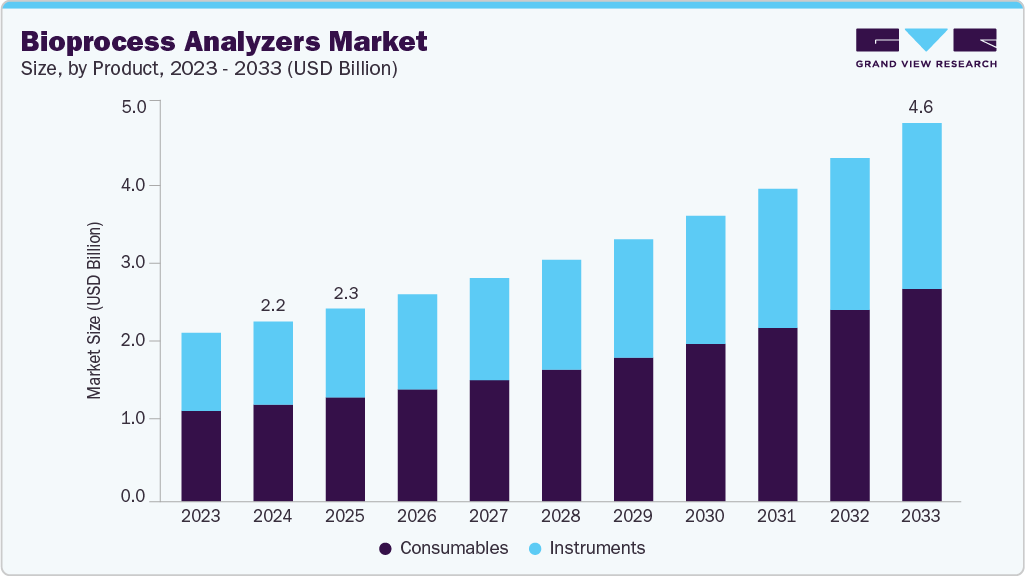

The global bioprocess analyzers market size was estimated at USD 2.17 billion in 2024 and is projected to reach USD 4.57 billion by 2033, growing at a CAGR of 8.81% from 2025 to 2033. The bioprocess analyzers market is witnessing steady growth, primarily driven by the rising demand for biologics, biosimilars, and cell and gene therapies.

Key Market Trends & Insights

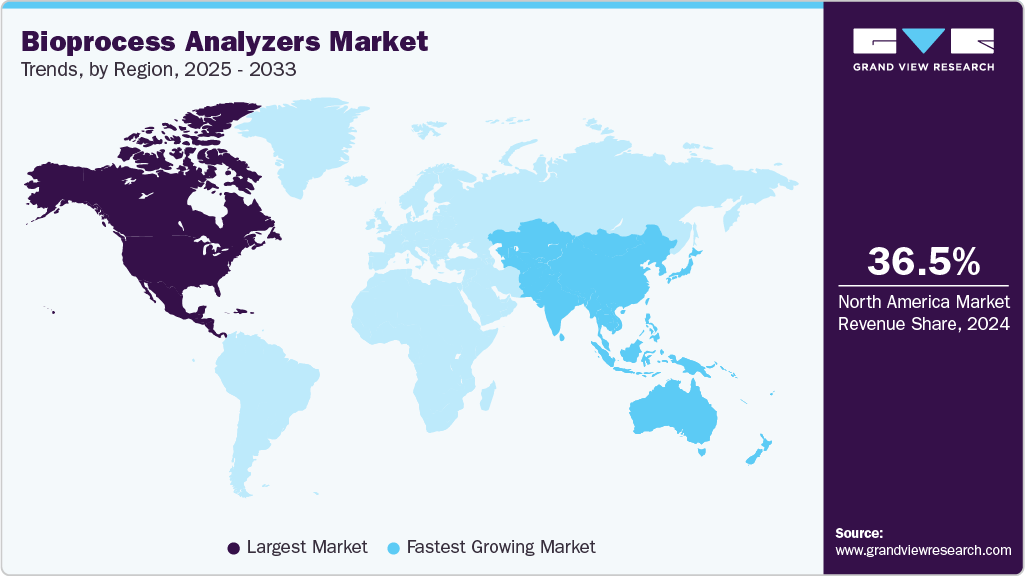

- The North America bioprocess analyzers market held the largest share of 36.54% of the global market in 2024.

- The bioprocess analyzer industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumables segment held the highest market share in 2024.

- By type, the substrate analysis segment held the highest market share in 2024.

- Based on application, the recombinant proteins segment held the highest market share in 2024.

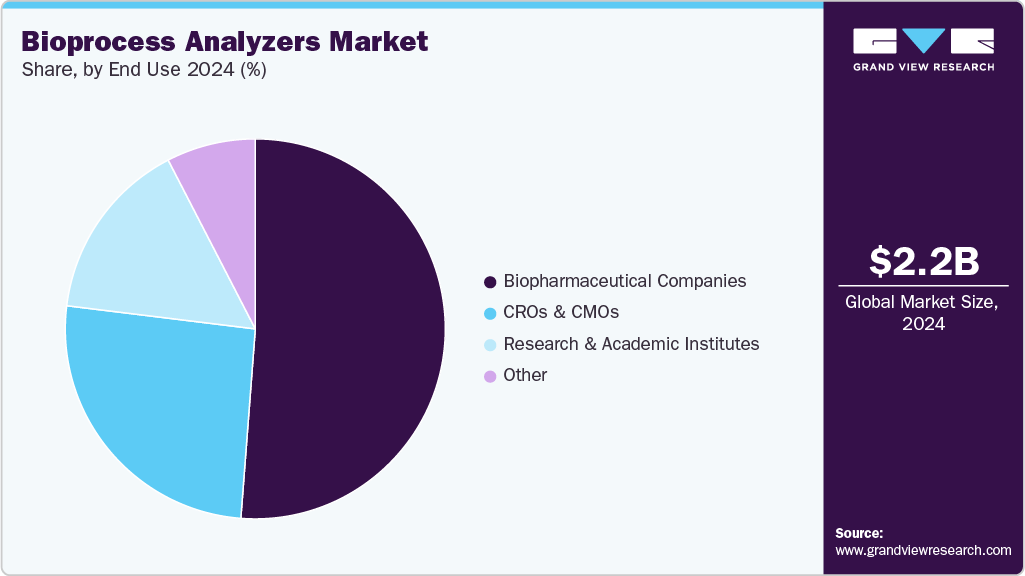

- By end user, the biopharmaceutical companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.17 Billion

- 2033 Projected Market Size: USD 4.57 Billion

- CAGR (2025-2033): 8.81%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As biopharmaceutical production becomes more complex, companies are increasingly focusing on process optimization and real-time quality monitoring. Bioprocess analyzers enable continuous measurement of key parameters such as glucose, lactate, amino acids, and dissolved gases, ensuring higher yield, consistency, and compliance with regulatory standards.

Shift toward automation and digitalization in bioprocessing

The bioprocess monitoring relied on manual sampling and offline measurements, which often introduced variability, delayed decision-making, and limited process control. However, the growing complexity of biologics manufacturing and the increasing need for precision and reproducibility have accelerated the adoption of automated and digitally connected analyzers. These systems enable real-time, continuous monitoring of critical process parameters such as pH, oxygen, glucose, lactate, and metabolites, reducing manual intervention and human error. By integrating with advanced control systems and data management platforms, automated analyzers provide instantaneous feedback that allows for dynamic process adjustments, ensuring optimal culture conditions, improved yield, and consistent product quality.

At the same time, digitalization is redefining how data from bioprocess analyzers is utilized across the production lifecycle. The incorporation of Industry 4.0 technologies such as artificial intelligence (AI), machine learning (ML), and cloud-based analytics platforms allows biopharmaceutical manufacturers to move from reactive to predictive process control. Data collected from analyzers is being leveraged for process modeling, digital twins, and predictive maintenance, enabling faster troubleshooting and reduced downtime. Moreover, regulatory bodies are encouraging digital traceability and real-time quality assurance, further pushing biomanufacturers toward adopting smart, automated analytical tools. As a result, companies are investing heavily in end-to-end digital bioprocessing solutions, where analyzers serve as the backbone of a data-driven ecosystem that enhances efficiency, scalability, and regulatory compliance across both clinical and commercial manufacturing settings.

Growing investments in biopharmaceutical R&D and expanding biomanufacturing capacities globally

Over the past decade, the surge in biologics development, particularly monoclonal antibodies, recombinant proteins, vaccines, and cell and gene therapies, has prompted both established pharmaceutical companies and emerging biotech firms to expand their research and production capabilities. Governments and private investors are channeling significant funding into biopharmaceutical innovation to accelerate drug discovery and strengthen supply resilience, especially in the wake of the COVID-19 pandemic. This has led to the construction of new biomanufacturing facilities, pilot-scale laboratories, and innovation hubs across North America, Europe, and Asia-Pacific. Within these settings, bioprocess analyzers have become indispensable tools for optimizing fermentation, purification, and formulation processes, ensuring product consistency and compliance with stringent regulatory standards.

The U.S., Canada, Germany, China, and India, are fueling demand for bioprocess analyzers. With the surge in biologics and biosimilar development, biopharma companies and CROs/CMOs are prioritizing advanced analytical tools to maintain product quality and regulatory compliance. In parallel, government support for life sciences innovation and increased funding for academic and industrial research are expanding the adoption of these systems in early-stage development. Collectively, these factors are reinforcing the role of bioprocess analyzers as essential tools for ensuring efficiency, precision, and scalability across the biomanufacturing value chain.

Market Concentration & Characteristics

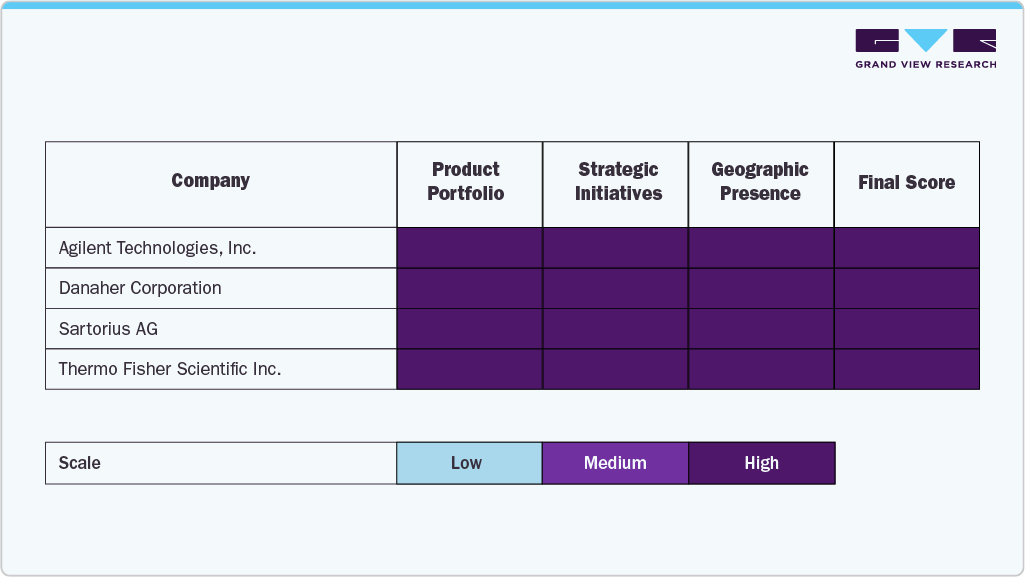

Companies are continuously advancing their analytical technologies to support continuous bioprocessing, digital integration, and single-use system compatibility. Recent innovations include multi-parameter analyzers, microfluidic-based biosensors, and integration with AI-driven process control platforms. Furthermore, the emergence of PAT (Process Analytical Technology) frameworks has accelerated the development of analyzers capable of inline and online measurement, enabling dynamic control of critical quality attributes (CQAs).

The bioprocess analyzers industry has witnessed a moderate to high level of mergers and acquisitions (M&A) as major players look to expand their technological capabilities and strengthen their market footprint. Strategic acquisitions have primarily focused on integrating analytical instrumentation, automation technologies, and data analytics platforms into existing bioprocessing portfolios. For instance, larger corporations like Danaher, Thermo Fisher, and Sartorius have been actively acquiring specialized firms in biosensing, process control, and life sciences automation. These activities aim to broaden product offerings, enhance innovation pipelines, and provide end-to-end bioprocessing solutions.

Regulatory frameworks exert a strong influence on the bioprocess analyzers industry, shaping both technology development and adoption. Agencies such as the FDA, EMA, and ICH emphasize the importance of real-time monitoring, data integrity, and consistent product quality in biologics manufacturing. As part of regulatory compliance, the adoption of Process Analytical Technology (PAT) and Quality by Design initiatives has become integral to bioprocess workflows. This regulatory push has accelerated the integration of advanced analyzers capable of continuous measurement and traceable digital data recording.

The bioprocess analyzers industry is undergoing significant product expansion, as manufacturers introduce a diverse range of analyzers to meet varying scales and process needs across R&D and production. Vendors are extending their portfolios beyond traditional metabolite analyzers to include multi-parameter, automated, and portable bioprocess analyzers. There is also a strong focus on integrating software analytics, cloud connectivity, and AI-based data interpretation to enhance process efficiency.

The bioprocess analyzer industry is experiencing broad regional expansion, driven by global investments in biopharmaceutical manufacturing infrastructure. North America and Europe continue to dominate due to strong R&D ecosystems, high biologics production, and early adoption of automation technologies. However, the most rapid growth is occurring in Asia-Pacific, where countries such as China, India, and South Korea are actively building biomanufacturing capacity and fostering domestic innovation through government initiatives and partnerships with global biotech firms. Additionally, emerging markets in Latin America and the Middle East are beginning to invest in local biologics production capabilities, creating new opportunities for equipment suppliers.

Product Insights

The consumables segment led the market with the largest revenue share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Consumables such as sensors, reagents, filters, calibration kits, and sampling accessories are essential for ensuring consistent and accurate analytical performance across multiple production runs. As biopharma companies and CMOs expand their manufacturing capacities, the recurring need for high-quality consumables to support continuous process monitoring and real-time analysis is growing rapidly.

The instruments segment is expected to grow significantly during the forecast period. As the industry shifts toward continuous bioprocessing and adheres to stricter regulatory standards for process analytical technology (PAT), demand for advanced instruments capable of inline, online, and at-line analysis has surged. These analyzers play a critical role in monitoring key parameters, such as glucose, lactate, oxygen, and cell viability, to ensure optimal culture conditions and consistent product quality. Furthermore, ongoing advancements in automation, digital connectivity, and miniaturization are encouraging the deployment of multi-parameter and user-friendly analyzers across both research and production environments. The expansion of biomanufacturing facilities globally, coupled with the growing focus on reducing manual intervention and improving efficiency, continues to fuel investment in next-generation bioprocess analyzer instruments.

Type Insights

The substrate analysis segment led the market with the largest revenue share in 53.62% 2024. Substrate analyzers are essential for measuring critical components such as glucose, glutamine, and other nutrients that directly impact cell growth, productivity, and product quality. As biopharmaceutical manufacturers shift toward continuous and high-density cell culture systems, maintaining precise control over substrate concentrations has become vital for achieving consistent yields and minimizing process variability. The growing implementation of Process Analytical Technology (PAT) frameworks by regulatory authorities has further accelerated the adoption of advanced substrate analyzers that provide accurate, real-time feedback for feed strategy adjustments.

The concentration detection segment is expected to grow fastest during the forecast period. The market is driven by the increasing need for precise quantification of product concentration and critical quality attributes (CQAs) during biopharmaceutical production. Accurate concentration measurement of proteins, antibodies, and other biologics is essential for maintaining process consistency, ensuring product potency, and meeting stringent regulatory requirements. As biologics manufacturing becomes more complex, real-time concentration detection analyzers enable manufacturers to optimize purification steps, monitor yield, and reduce batch-to-batch variation.

Application Insights

The recombinant proteins segment led the market with the largest revenue share of 38.0% in 2024. Recombinant protein production requires highly controlled bioprocess conditions to ensure optimal yield, stability, and biological activity, making bioprocess analyzers indispensable for monitoring key parameters such as nutrient consumption, metabolite accumulation, and protein expression levels in real time. As manufacturers increasingly adopt continuous and high-density cell culture systems, analyzers that support precise substrate, metabolite, and product concentration monitoring have become critical for process optimization and quality control.

The biosimilars segment is expected to grow at the fastest CAGR over the forecast period. Biosimilar manufacturing demands stringent process monitoring and control to ensure product equivalence in terms of purity, potency, and efficacy, making bioprocess analyzers essential tools in production and quality assurance. These analyzers enable real-time measurement of critical process parameters such as metabolite levels, substrate consumption, and protein concentration, ensuring consistent performance across batches. As regulatory authorities like the FDA and EMA impose rigorous comparability and analytical testing standards for biosimilars, manufacturers are increasingly adopting automated, high-precision analyzers to meet compliance and efficiency requirements.

End Use Insights

Based on end use, the biopharmaceutical companies segment led the market with the largest revenue share of 51.22% in 2024, owing to fueled by the increasing production of biologics, biosimilars, and advanced therapies that demand precise process monitoring and control. As these companies focus on enhancing manufacturing efficiency, reducing batch failures, and maintaining stringent quality standards, the adoption of real-time, automated bioprocess analyzers has become essential. These instruments enable continuous monitoring of critical parameters, such as nutrient levels, metabolite concentrations, and product yield, ensuring optimal process conditions and regulatory compliance under Good Manufacturing Practice (GMP) frameworks.

The CROs & CMOs segment is expected to grow at the fastest CAGR during the forecast period. Contract organizations require flexible, high-throughput, and multi-parameter analyzers to manage diverse client projects while maintaining stringent quality and regulatory compliance across multiple sites. Real-time monitoring of critical process parameters, such as substrate consumption, metabolite levels, and product concentration, is essential to ensure reproducibility, optimize yields, and reduce operational risks in outsourced processes. Additionally, the growing demand for biosimilars, recombinant proteins, and cell & gene therapies has expanded the workload for CROs and CMOs, prompting investment in automated and digitally integrated analytical solutions.

Regional Insights

North America dominated the bioprocess analyzers market with a share of 36.54% in 2024. The growth is primarily driven by the presence of a highly developed biopharmaceutical ecosystem, significant R&D investments, and early adoption of advanced manufacturing technologies. The region benefits from a high concentration of leading biopharma companies, CROs, and CMOs, which increasingly adopt automated, real-time, and multi-parameter analyzers to optimize biologics and biosimilar production. Strong regulatory frameworks, including FDA mandates for Process Analytical Technology (PAT) and Quality by Design (QbD), further encourage the use of advanced analyzers to ensure process control and compliance.

U.S. Bioprocess Analyzers Market Trends

The U.S. market is propelled by the concentration of global biologics R&D and commercial manufacturing facilities. High adoption rates of single-use technologies, inline/online monitoring, and automation solutions make the U.S. a key driver for instrument and consumable sales. Additionally, government funding for biopharmaceutical innovation, coupled with the expansion of contract manufacturing and biosimilar development, is boosting demand for bioprocess analyzers across both large-scale production and early-stage research.

Europe Bioprocess Analyzers Market Trends

Europe’s bioprocess analyzer market is driven by the strong presence of established biopharma hubs in Germany, Switzerland, and France, as well as the implementation of stringent regulatory standards by the EMA. Manufacturers increasingly rely on real-time, at-line, and inline analyzers to ensure consistent quality in biologics and biosimilars. The expansion of contract manufacturing services and investments in modernizing biomanufacturing facilities across the region also support analyzer adoption.

In the UK bioprocess analyzers market, growth is fueled by robust investment in biologics R&D, vaccine manufacturing, and the emergence of biopharma clusters in Cambridge and London. Adoption of automation, process monitoring, and data-integrated analyzers is increasing to support high-throughput development and commercial-scale production. Government initiatives promoting life sciences innovation and regulatory focus on PAT further reinforce market expansion.

The bioprocess analyzers market in Germany is a key European market for bioprocess analyzers, driven by its position as a leading hub for biopharmaceutical manufacturing and engineering expertise. High adoption of advanced metabolite, substrate, and concentration detection analyzers is supported by the country’s strong regulatory environment and focus on quality, efficiency, and innovation in biologics and biosimilars production. Expansion of contract manufacturing and technology partnerships further fuels market growth.

Asia Pacific Bioprocess Analyzers Market Trends

The bioprocess analyzers market in the Asia Pacific is anticipated to grow at the fastest CAGR of 10.96% over the forecast period. The rising biosimilar manufacturing, and government-backed investments in biopharma infrastructure. Countries like China, India, and South Korea are scaling up domestic biologics capacity, driving demand for analyzers that support process optimization, real-time monitoring, and compliance with international standards. Adoption of single-use and modular bioprocessing systems is also accelerating analyzer deployment.

The China bioprocess analyzers market growth is fueled by government initiatives to boost domestic biologics production, expand biosimilar manufacturing, and attract foreign biopharma investment. Companies are increasingly implementing automated, inline, and multi-parameter analyzers to enhance process efficiency, yield, and regulatory compliance. The country’s expanding contract manufacturing and vaccine production capabilities further stimulate demand for bioprocess analytical tools.

The bioprocess analyzer market in Japan is driven by its strong pharmaceutical and biotechnology sector, high regulatory standards, and adoption of cutting-edge automation and digital integration. Manufacturers focus on real-time monitoring, inline sensors, and multi-parameter analyzers to maintain product quality, optimize yields, and comply with GMP and PAT guidelines. The presence of leading biologics developers and contract manufacturing operations supports steady market growth.

Middle East & Africa Bioprocess Analyzers Market Trends

In the Middle East, growth is primarily fueled by investments in biopharmaceutical infrastructure and vaccine production as countries seek to develop local biologics capabilities. Governments are promoting technology adoption and establishing manufacturing hubs, driving demand for analyzers that ensure process standardization, quality control, and regulatory compliance. Increasing partnerships with global biopharma players further support market expansion.

The Kuwait bioprocess analyzer market is emerging, driven by government initiatives to diversify the healthcare sector and invest in local biologics and vaccine production. The adoption of modern analytical instruments, including automated and real-time monitoring systems, is being encouraged to improve process efficiency and maintain quality standards. Collaborations with international firms and educational institutions are also helping to expand analyzer deployment in research and pilot-scale production.

Key Bioprocess Analyzers Company Insights

The bioprocess analyzer market is highly competitive and moderately consolidated, dominated by a few global players such as Thermo Fisher Scientific, Danaher Corporation, Sartorius AG, Agilent Technologies, & others. These companies leverage strong R&D capabilities, extensive product portfolios, and global distribution networks to maintain market leadership.

They focus on innovative, multi-parameter analyzers, automated and real-time monitoring systems, and integrated digital solutions to meet the growing demands of biopharmaceutical manufacturers, CROs, and CMOs. Mid-sized and niche players, compete by offering specialized analyzers, cost-effective solutions, or flexible instruments tailored to emerging markets and smaller-scale operations. Market dynamics are further influenced by strategic mergers and acquisitions, product expansions, and regional diversification, as companies aim to strengthen their technological capabilities, capture high-growth regions like Asia-Pacific, and address evolving regulatory standards in North America and Europe. Overall, the competitive landscape is shaped by continuous innovation, regulatory compliance requirements, and the increasing need for automation and digital integration in modern bioprocessing workflows.

Key Bioprocess Analyzers Companies:

The following are the leading companies in the bioprocess analyzers market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Danaher Corporation

- Eppendorf AG

- F. Hoffmann-La Roche Ltd.

- Nova Biomedical

- Randox Laboratories Ltd.

- Sartorius AG

- Solida Biotech GmBH

- SYSBIOTECH GmbH

- Thermo Fisher Scientific Inc.

Recent Developments

-

In September 2025, Shanghai Duoning Biotech Co., Ltd. and Beijing Upstream Biotech Co., Ltd. officially entered into a strategic partnership. Under the agreement, Duoning Biotech obtained the exclusive global rights to Upstream Biotech’s full range of biochemical analyzers. This collaboration expanded Duoning Biotech’s product portfolio in upstream cell culture and strengthened its position as a comprehensive one-stop bioprocess solutions provider.

-

In March 2025, Repligen Corporation and 908 Devices Inc. announced that Repligen had purchased 908 Devices’ desktop portfolio of four devices for bioprocessing process analytical technology (PAT) applications. 908 Devices remained focused on the growth of its newly expanded handheld device portfolio for vital health and safety applications.

Bioprocessing Analyzers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.33 billion

Revenue forecast in 2033

USD 4.57 billion

Growth rate

CAGR of 8.81% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Agilent Technologies, Inc.; Danaher Corporation; Eppendorf AG; F. Hoffmann-La Roche Ltd.; Nova Biomedical; Randox Laboratories Ltd.; Sartorius AG; Solida Biotech GmBH; SYSBIOTECH GmbH; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Bioprocessing Analyzers Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global bioprocess analyzers market on the basis of product, type, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Substrate analysis

-

Metabolite analysis

-

Concentration detection

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Antibiotics

-

Recombinant proteins

-

Biosimilars

-

Other applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical companies

-

CROs & CMOs

-

Research & academic institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.