- Home

- »

- Biotechnology

- »

-

Bioprocess Validation Market Size, Industry Report, 2033GVR Report cover

![Bioprocess Validation Market Size, Share & Trends Report]()

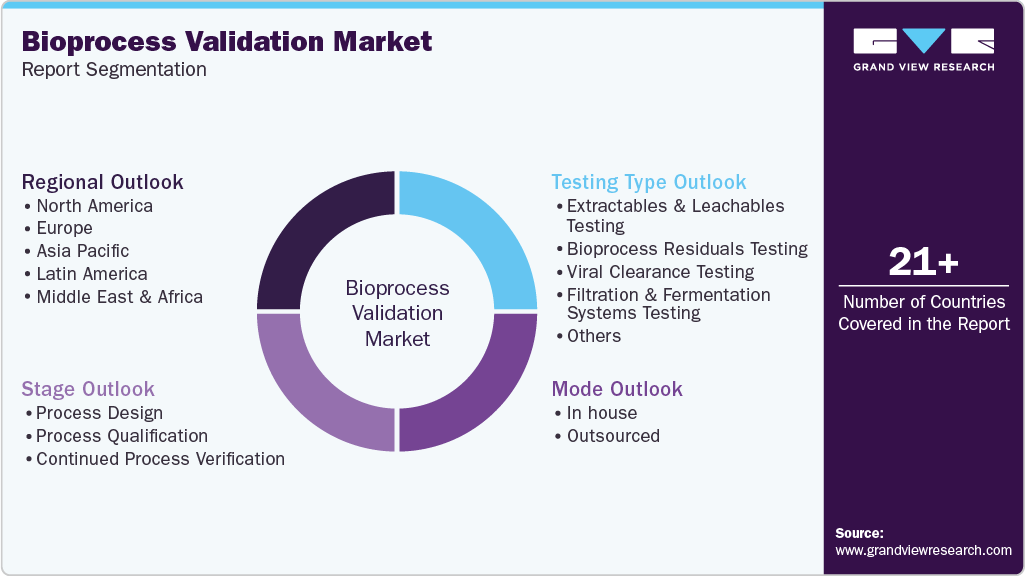

Bioprocess Validation Market (2025 - 2033) Size, Share & Trends Analysis Report By Testing Type (Extractables & Leachables Testing, Bioprocess Residuals Testing), By Stage (Process Design, Process Qualification), By Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-022-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioprocess Validation Market Summary

The global bioprocess validation market size was estimated at USD 485.5 million in 2024 and is projected to reach USD 1.05 billion by 2033, growing at a CAGR of 9.01% from 2025 to 2033. Growth is driven by the rising demand for biologics and biosimilars, stringent regulatory requirements for product safety and efficacy, and the increasing adoption of single-use systems in manufacturing.

Key Market Trends & Insights

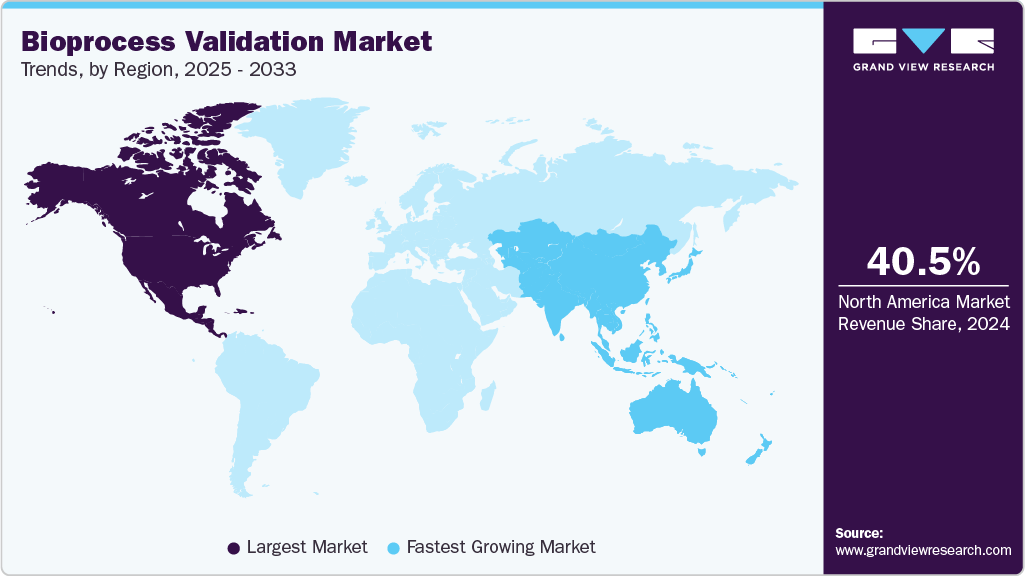

- The North America bioprocess validation market held the largest share of 40.47% of the global market in 2024.

- The bioprocess validation industry in the U.S. is expected to grow significantly over the forecast period.

- By testing type, the bioprocess residuals testing segment held the highest market share of 28.98% in 2024.

- Based on stage, the continued process verification segment held the highest market share in 2024.

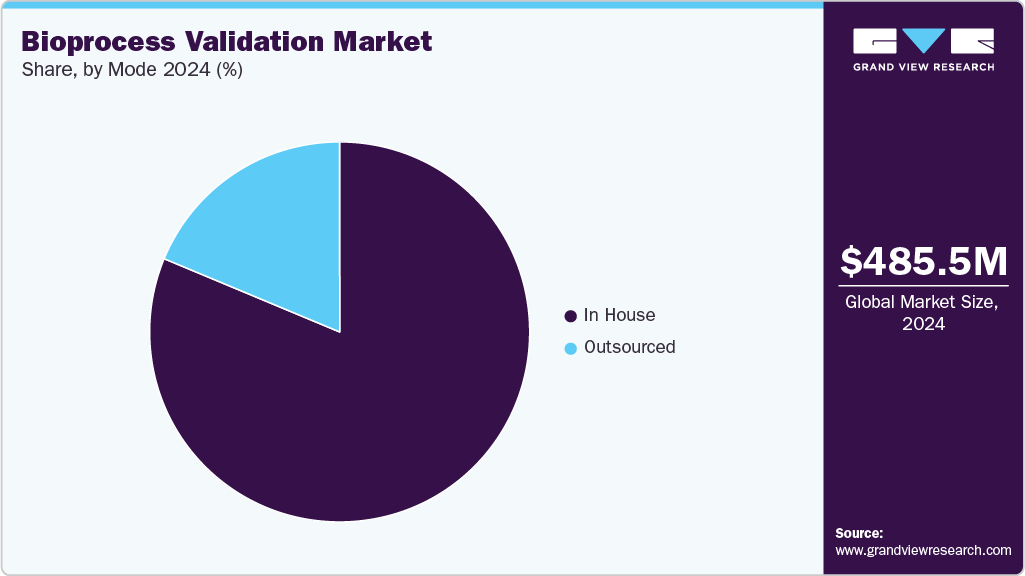

- By mode, the in house segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 485.5 Million

- 2033 Projected Market Size: USD 1.05 Billion

- CAGR (2025-2033): 9.01%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, biopharmaceutical companies' shift toward outsourcing validation services to reduce costs and accelerate time-to-market is expected to support market expansion.

Rising biologics and biosimilars production

The rising production of biologics and biosimilars strongly drives the demand for bioprocess validation. Biologics such as monoclonal antibodies, recombinant proteins, vaccines, and advanced therapies like cell and gene therapies are highly complex and sensitive to manufacturing variations. To ensure product safety, efficacy, and consistency, rigorous validation of every production stage, upstream, downstream, and final fill/finish is critical. Moreover, with the rapid growth of the biosimilars market following the expiration of major biologic patents, manufacturers are under increasing pressure to validate their processes to demonstrate comparability with reference products in line with strict regulatory requirements. This growing biologic pipeline and the global push for more cost-effective therapeutic solutions have made validation an indispensable step in biomanufacturing.

Biosimilars Approved by FDA (2024-2025)

Approval Date

Biosimilar (Nonproprietary Name)

Reference Product

15-Jul-25

Kirsty (insulin aspart-xjhz)

Insulin Aspart

22-May-25

Starjemza (ustekinumab-hmny)

Ustekinumab

9-Apr-25

Jobevne (bevacizumab-nwgd)

Bevacizumab

25-Mar-25

Conexxence, Bomyntra (denosumab-bnht)

Denosumab

7-Mar-25

Omlyclo (omalizumab-igec)

Omalizumab

28-Feb-25

Stoboclo, Osenvelt (denosumab-bmwo)

Denosumab

14-Feb-25

Merilog (insulin aspart-szjj)

Insulin Aspart

13-Feb-25

Ospomyv, Xbryk (denosumab-dssb)

Denosumab

24-Jan-25

Avtozma (tocilizumab-anoh)

Tocilizumab

17-Dec-24

Steqeyma (ustekinumab-stba)

Ustekinumab

29-Nov-24

Yesintek (ustekinumab-kfce)

Ustekinumab

10-Oct-24

Imuldosa (ustekinumab-srlf)

Ustekinumab

27-Sep-24

Otulfi (ustekinumab-aauz)

Ustekinumab

23-Aug-24

Pavblu (aflibercept-ayyh)

Aflibercept

9-Aug-24

Enzeevu (aflibercept-abzv)

Aflibercept

19-Jul-24

Epysqli (eculizumab-aagh)

Eculizumab

28-Jun-24

Ahzantive (aflibercept-mrbb)

Aflibercept

28-Jun-24

Pyzchiva (ustekinumab-ttwe)

Ustekinumab

28-Jun-24

Nypozi (filgrastim-txid)

Filgrastim

28-May-24

Bkemv (eculizumab-aeeb)

Eculizumab

20-May-24

Yesafili (aflibercept-jbvf)

Aflibercept

20-May-24

Opuviz (aflibercept-yszy)

Aflibercept

25-Apr-24

Hercessi (trastuzumab-strf)

Trastuzumab

16-Apr-24

Selarsdi (ustekinumab-aekn)

Ustekinumab

5-Mar-24

Tyenne (tocilizumab-aazg)

Tocilizumab

5-Mar-24

Jubbonti, Wyost (denosumab-bbdz)

Denosumab

23-Feb-24

Simlandi (adalimumab-ryvk)

Adalimumab

Beyond product innovation, regulatory compliance, and evolving manufacturing technologies further accelerate market growth. Stringent guidelines issued by agencies such as the FDA, EMA, and PMDA require thorough validation of processes, analytical methods, and equipment to safeguard patient safety. The shift toward single-use bioprocessing systems has also intensified demand for extractables and leachable testing to ensure product purity. Moreover, outsourcing validation activities to contract research and manufacturing organizations allows companies to reduce costs, speed up production timelines, and access specialized expertise.

Stringent regulatory requirements

One of the most significant factors driving the bioprocess validation market is the growing emphasis on stringent regulatory frameworks established by global health authorities such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan’s Pharmaceuticals and Medical Devices Agency (PMDA). These agencies mandate comprehensive validation of bioprocesses to ensure that biologics, biosimilars, and vaccines consistently meet the highest safety, efficacy, and quality standards. Regulatory guidelines require manufacturers to thoroughly validate every critical aspect of production, including equipment, sterilization methods, cleaning procedures, analytical assays, and overall process controls. Non-compliance can result in severe consequences such as product recalls, approval delays, hefty fines, and reputational damage, making compliance a top priority for pharmaceutical and biotechnology companies.

With the global expansion of biologics manufacturing, particularly in emerging markets, regulatory bodies are strengthening their oversight and harmonizing standards across regions. This has heightened the demand for advanced validation services and technologies to ensure adherence to Good Manufacturing Practices (GMP) and International Council for Harmonisation (ICH) guidelines. Moreover, the rising focus on patient safety and increasing scrutiny over manufacturing quality have prompted companies to adopt more rigorous and automated validation approaches. As a result, enforcing strict regulatory requirements compels companies to invest in robust validation strategies and serves as a long-term growth driver for the bioprocess validation market.

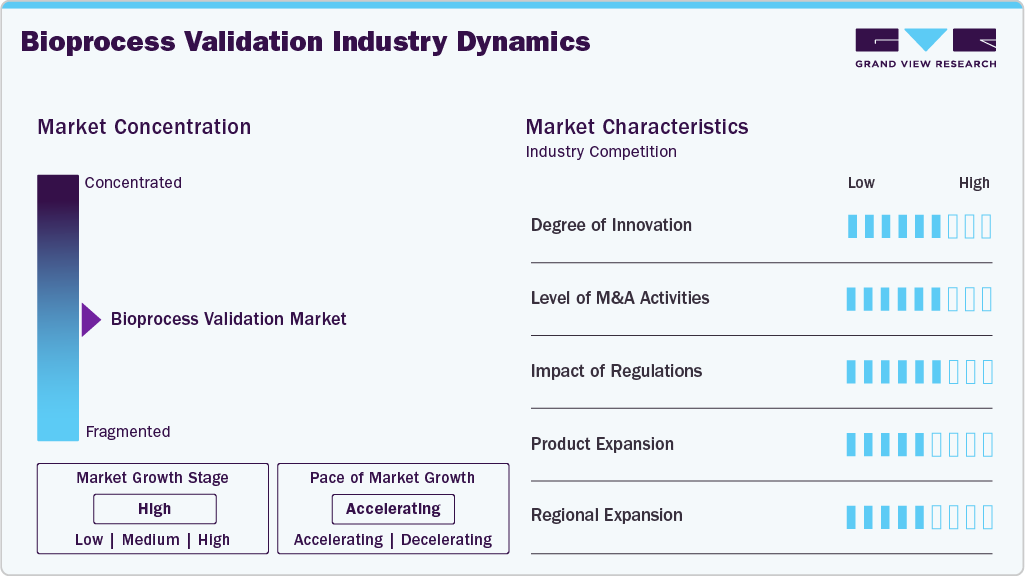

Market Concentration & Characteristics

The bioprocess validation industry is witnessing high innovation, driven by the adoption of advanced analytical technologies, automation, and digital solutions. Traditional validation methods are rapidly being replaced with data-driven approaches such as real-time monitoring, process analytical technology (PAT), and risk-based validation strategies that improve accuracy and reduce time-to-market. Integrating artificial intelligence, machine learning, and cloud-based platforms enables predictive analytics and automated documentation, enhancing regulatory compliance and efficiency. For instance, in November 2024, MilliporeSigma in the United States highlighted an integrated approach to CPV and APQR, emphasizing digitalization to reduce redundancies, automate data collection, and enhance regulatory compliance efficiency. These advancements optimize operational workflows and allow biopharmaceutical companies to scale production with greater flexibility, making innovation a defining factor in the growth and competitiveness of the bioprocess validation market.

M&A activity in the bioprocess validation industry has been moderate to high, driven by the need for portfolio expansion, advanced validation technologies, and broader geographic reach. Key players such as Thermo Fisher Scientific, Merck KGaA, Sartorius, and Danaher have pursued strategic acquisitions of validation service providers and technology innovators to strengthen end-to-end offerings. For instance, in October 2024, Lonza’s USD 1.2 billion Vacaville acquisition expanded US biologics capacity, driving a greater need for bioprocess validation to ensure compliance, consistency, and efficiency in large-scale mammalian manufacturing. These targeted deals and regional collaborations enable companies to meet rising demand for biologics manufacturing and regulatory compliance, a trend likely to continue in the coming years.

Regulations play a decisive role in shaping the industry, as agencies such as the FDA, EMA, and PMDA enforce strict guidelines to ensure product safety, efficacy, and quality. Compliance with Good Manufacturing Practices (GMP) and International Council for Harmonisation (ICH) requires extensive validation of processes, equipment, and analytical methods, making regulatory oversight a key market driver. While these stringent requirements increase operational costs and complexity, they also create steady demand for specialized validation services and technologies. As global regulators harmonize standards and intensify scrutiny, companies are investing more in automated, data-driven validation approaches to achieve compliance efficiently, thereby reinforcing the critical influence of regulations on market growth.

Product expansion is a key strategy in the market, with companies introducing new kits, analytical platforms, and single-use testing solutions to meet evolving needs. Innovations in extractables and leachable testing, viral clearance validation, and digital tools such as automation and real-time monitoring enable firms to enhance compliance and efficiency while strengthening their competitive edge.

Regional expansion is emerging as a core growth strategy in the industry, as leading players strengthen their presence in high-growth regions such as Asia-Pacific and Latin America. Rising biologics manufacturing, supportive government initiatives, and expanding clinical research activities in China, India, and Brazil drive demand for localized validation services and facilities. Global companies invest in new laboratories, partnerships, and technology transfers to capture these opportunities, ensuring compliance with regional regulatory standards while broadening their customer base.

Testing Type Insights

The bioprocess residuals testing segment dominated the market with a share of 28.98% in 2024. Residual testing includes impurities such as cell culture-derived upstream and downstream impurities, buffer contents, and anti-foam agents. There is a huge demand for impurity-free, safe, quality drug, vaccine, and therapeutic products manufactured by the biotechnology, biopharmaceutical, and pharmaceutical industries.

The extractables and leachables segment is the fastest-growing bioprocess validation industry, driven by cGMP guidelines and strict FDA regulations that demand certified, high-quality bioproducts. Biopharma companies increasingly focus on identifying hazards from leachables in processing systems and packaging to ensure product safety and integrity, fueling strong market growth.

Stage Insights

The continued process verification segment dominated the market in 2024, accounting for a share of 42.51%. This segment involves systematically collecting, storing, processing, and analyzing data from every production batch to ensure consistent quality and compliance with regulatory standards. The increasing adoption of automation and digital tools in process verification further enhances efficiency, accuracy, and real-time monitoring, thereby driving the growth of this segment.

The process design segment is projected to grow fastest during the forecast period, representing the most critical step in bioprocess validation. Effective process design establishes stringent manufacturing protocols, pathways, and concepts, ensuring efficiency, reproducibility, and compliance with regulatory standards. Strong process design is a key driver behind the segment’s rapid growth by enabling consistent production of high-quality bioproducts.

Mode Insights

The in-house segment accounted for the largest share of the market in 2024. Many biopharmaceutical companies and industries prefer to manufacture raw materials and tools required for the bioprocess validation process internally to maintain control over quality and production. Moreover, increasing funding, mergers, and collaborations to develop advanced life science tools further support this segment's growth.

The outsourced segment is expected to grow at the fastest CAGR during the forecast period. The rising demand for testing services among biopharmaceutical and biotechnology companies engaged in bioproduct manufacturing and validation is a key driver of this growth. Outsourcing has become a preferred strategy in biopharma drug and therapeutics production, as it ensures scalability, quality, and regulatory compliance. For instance, in July 2025, BioPlan Associates (U.S.) reported record levels of outsourcing across bioprocess platforms, highlighting the role of CDMOs as strategic partners in global biomanufacturing. Moreover, increasing healthcare expenditure and the steady supply of raw materials from market players further contribute to the expansion of this segment.

Regional Insights

North America dominated the bioprocess validation market in 2024, accounting for a share of 40.47%. The region’s leadership is attributed to the strong presence of outsourcing services, the rapid growth of life science research, and the rising production of biologics. The concentration of key market players such as Thermo Fisher Scientific Inc., Danaher Corporation, and Eurofins further strengthens the region’s position. For instance, in June 2022, the Jefferson Institute for Bioprocessing expanded US biologics training to Budd Bioworks, offering workforce development in bioprocessing, analytical testing, and cell and gene therapies.

U.S Bioprocess Validation Market Trends

The bioprocess validation market in the U.S. is growing due to the strong presence of FDA-approved biopharma manufacturers, CDMOs, and stringent regulatory standards. Rising investments in biologics and advanced therapies and increasing adoption of automation and digital validation tools are further driving demand.

Europe Bioprocess Validation Market Trends

The bioprocess validation market in Europe is driven by a strong biopharmaceutical base, supportive EMA regulations, and rising biosimilars production. Growing investments in advanced biomanufacturing facilities and collaborative R&D initiatives across Germany, the U.K., and France are boosting demand for validation services. In addition, increasing adoption of single-use technologies, strict quality compliance requirements, and leading players such as Sartorius, Merck KGaA, and Lonza further strengthen the region’s position as a key hub for bioprocess validation.

The UK bioprocess validation market is growing due to strong government support for life sciences, rising investments in biosimilars and advanced therapies, and the adoption of single-use technologies. Collaboration across academia and industry and strict EMA and MHRA compliance further drive demand for validation services.

The bioprocess validation market in Germany leads the European market with its strong biopharmaceutical manufacturing base, advanced R&D infrastructure, and strict regulatory compliance. Rising biosimilars production, biomanufacturing facility expansion, and major players like Sartorius and Merck KGaA are key drivers of validation demand. Moreover, government support for life science innovation, increased clinical trial activity, and the rapid adoption of automation and single-use systems further strengthen Germany’s position as a hub for bioprocess validation in Europe.

Asia Pacific Bioprocess Validation Market Trends

The bioprocess validation market in Asia-Pacific is expected to witness the fastest CAGR of 9.46% during the forecast period. This growth is driven by rising investments in biopharmaceutical manufacturing, expanding clinical research, supportive government initiatives, and increasing adoption of single-use technologies across countries such as China, India, South Korea, and Japan. The presence of a large patient pool, growing biosimilars demand, and the entry of global players through partnerships and facility expansions further position Asia-Pacific as a high-potential market.

China bioprocess validation market is expanding rapidly, supported by strong government investment in biopharmaceutical manufacturing, growing demand for biosimilars, and a rising focus on cell and gene therapies. The country’s regulatory framework increasingly aligns with global standards, driving higher compliance and validation needs. Moreover, partnerships with global CDMOs, expansion of local manufacturing facilities, and adoption of single-use systems further fuel market growth.

The bioprocess validation industry in Japan is driven by its strong pharmaceutical industry, advanced R&D ecosystem, and strict regulatory oversight by the PMDA. Growing investments in regenerative medicine, cell and gene therapies, and biosimilars production are boosting validation demand. Moreover, collaborations between global players and domestic firms, along with the adoption of automation and continuous bioprocessing technologies, further strengthen Japan’s position as a key market in Asia-Pacific.

Middle East & Africa Bioprocess Validation Market Trends

The bioprocess validation market in the Middle East and Africa is witnessing steady growth, supported by increasing investments in healthcare infrastructure, expanding clinical research, and the rising demand for biologics. Countries such as the UAE, Saudi Arabia, and South Africa focus on developing biomanufacturing capabilities, while collaborations with global players and adopting international regulatory standards drive demand for validation services across the region.

Kuwait bioprocess validation market is growing with rising healthcare investments, government support for biotechnology, and increasing demand for biologics. Collaborations with global players and alignment with international standards further drive validation service adoption.

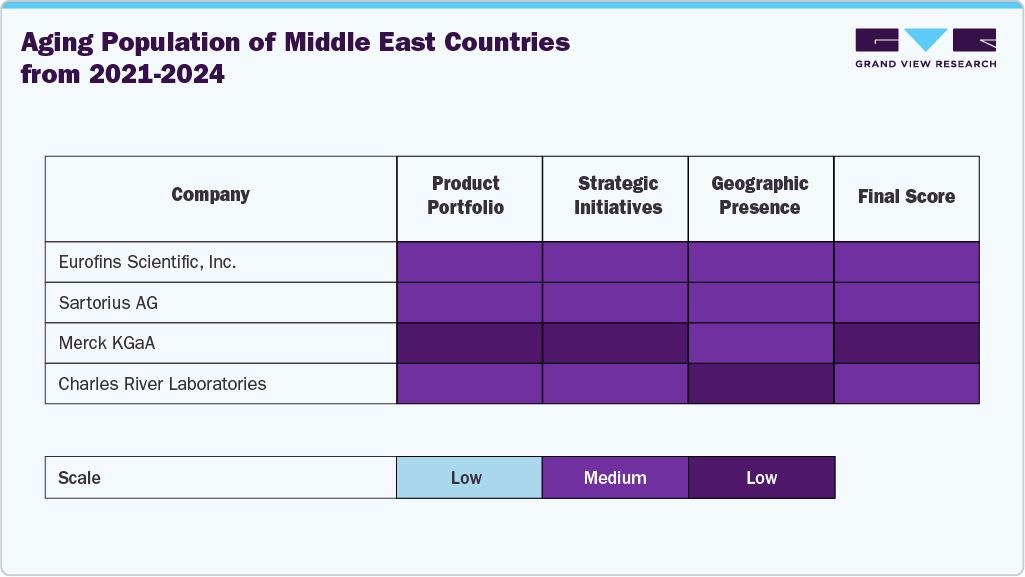

Key Bioprocess Validation Companies Insights

Key players operating in the bioprocess validation market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Bioprocess Validation Companies:

The following are the leading companies in the bioprocess validation market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific, Inc.

- Sartorius AG

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Lonza

- Danaher Corporation

- Charles River Laboratories

- SGS S.A.

- Toxikon Corporation

- Cobetter Filtration Equipment Co., Ltd.

Recent Developments

-

In December 2024, Eppendorf (Germany) partnered with DataHow to integrate DataHowLab AI analytics with BioNsight, enhancing bioprocess development by streamlining data management, collaboration, and workflow efficiency.

-

In November 2024, Thermo Fisher Scientific launched a 10,000 sq. ft. bioprocess design center in Hyderabad, India, enhancing regional biopharma capabilities through advanced manufacturing, validation services, and strategic industry collaborations.

-

In November 2024, Sartorius Stedim Biotech opened a 5,853 sq. m. bioprocess innovation centre in Marlborough, Massachusetts, US, providing process development, validation services, training, and collaborative innovation with clients and partners.

Bioprocess Validation Market Report Scope

Attribute

Details

Market size value in 2025

USD 528.0 million

Revenue forecast in 2033

USD 1.05 billion

Growth rate

CAGR of 9.01% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Testing type, stage, mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Eurofins Scientific, Inc.; Sartorius AG; Merck KGaA; Thermo Fisher Scientific Inc.; Lonza; Thermo Fisher Scientific Inc.; Danaher Corporation; Charles River Laboratories; SGS S.A.; Toxikon Corporation; Cobetter Filtration Equipment Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioprocess Validation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bioprocess validation market report on the basis of testing type, stage, mode, and region

-

Testing Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Extractables & Leachables Testing

-

Bioprocess Residuals Testing

-

Viral Clearance Testing

-

Filtration & Fermentation Systems Testing

-

Others

-

-

Stage Outlook (Revenue, USD Million, 2021 - 2033)

-

Process Design

-

Process Qualification

-

Continued Process Verification

-

-

Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

In house

-

Outsourced

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioprocess validation market size was estimated at USD 485.5 million in 2024 and is expected to reach USD 528.0 million in 2025.

b. The global bioprocess validation market is expected to grow at a compound annual growth rate of 9.01% from 2025 to 2033 to reach USD 1.05 billion by 2033.

b. North America dominated the bioprocess validation market with a share of 40.47% in 2024. This is attributable to an established healthcare sector and rising demand for biopharmaceuticals in the region.

b. Some key players operating in the bioprocess validation market include Eurofins Scientific, Inc.; Sartorius AG; Merck KGaA; Thermo Fisher Scientific, Inc.; Lonza; Danaher Corporation; Charles River Laboratories; SGS S.A.; Toxikon Corporation; and Cobetter Filtration Equipment Co., Ltd.

b. Key factors driving the bioprocess validation market include the increasing stringency in the U.S. FDA guidelines and cGMP regulation for biopharmaceutical production as well as the rising demand for high-quality biopharmaceuticals for the treatment of chronic and infectious diseases

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.