- Home

- »

- Plastics, Polymers & Resins

- »

-

Bioresorbable Polymers Market Size & Share Report, 2030GVR Report cover

![Bioresorbable Polymers Market Size, Share & Trends Report]()

Bioresorbable Polymers Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Proteins, PLA, Polysaccharides, Polyglycolic Acid, Polycaprolactone), By Application (Orthopedics, Drug Delivery), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-345-4

- Number of Report Pages: 81

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioresorbable Polymers Market Summary

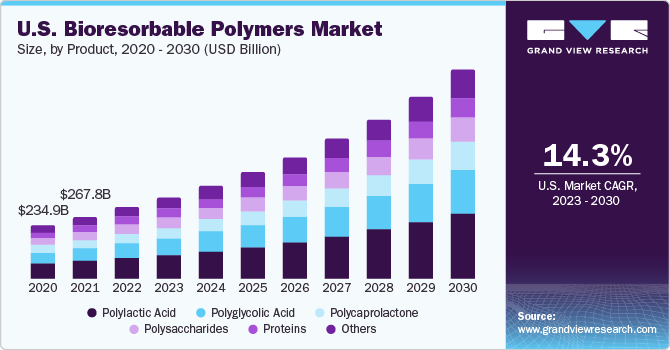

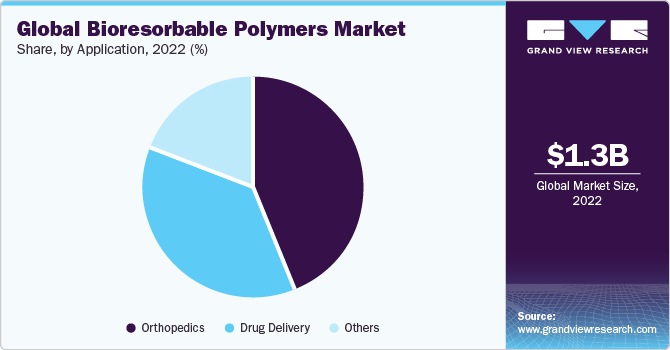

The global bioresorbable polymers market size was estimated at USD 1.30 billion in 2022 and is projected to reach USD 3.63 billion by 2030, growing at a CAGR of 13.8% from 2023 to 2030. The globally increasing consumer health awareness, along with improving healthcare facilities and the rising number of surgical procedures are the primary factors aiding industry expansion.

Key Market Trends & Insights

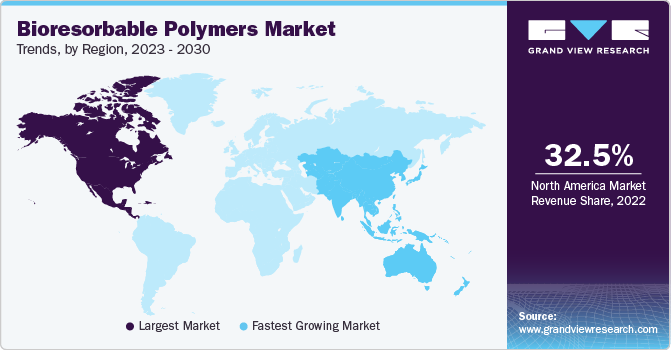

- The North America dominated the global industry and accounted for the largest revenue share of 32.5% in 2022.

- The Asia Pacific is projected to grow at the fastest CAGR of 15.9% from 2023 to 2030.

- Based on product, the polylactic acid (PLA) emerged as the leading segment and accounted for the maximum share of 29.5%.

- Based on application, the orthopedics emerged as the leading segment and accounted for the maximum share of 43.6%

Market Size & Forecast

- 2022 Market Size: USD 1.30 Billion

- 2030 Projected Market USD 3.63 Billion

- CAGR (2023-2030): 13.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

As per data by the National Library of Medicine (NLM) in 2020, globally, approximately 310 million major surgeries are conducted annually. Of these, around 20 million surgeries are performed in Europe and 40 to 50 million in the U.S. Bioresorbable, or bioabsorbable polymers, come from a class of materials that can be broken down and absorbed by the body over time.

These polymers are widely utilized in various fields, with the medical sector being a major one. In medicine, bioresorbable polymers are used in medical devices and implants, such as sutures, screws, tissue scaffolds, plates, and stents. These polymers dissolve in the body gradually, avoiding the need for a second surgery for their removal. Moreover, these polymers are used to create drug delivery systems, such as nanoparticles or microspheres. These systems release medication at a controlled pace and ultimately dissolve in the body, eliminating the need for their removal. Bioresorbable polymers used in medical procedures reduce any post-surgery risks for the patient without harming their body.

The product is manufactured through the polymerization of bio-based raw materials via engineered industrial processes. The rising number of medical implants, such as cochlear implants, pacemakers, breast implants, and hip implants, among others, is a leading factor contributing to market growth. As per the National Institute on Deafness and Other Communication Disorders (NIDCD), around 737 thousand cochlear implants were globally implanted as of December 2019. Similarly, the Organization for Economic Cooperation and Development (OECD) states that hip replacement rates increased by an average of 22% between 2009 and 2019, while knee replacement rates increased by 35%.

Product Insights

Polylactic acid (PLA) emerged as the leading product segment and accounted for the maximum share of 29.5% of the overall revenue in 2022. PLA-based product has the advantage of getting naturally converted into lactic acid in the body at low concentrations and can be safely removed by the body’s excretory system. Also, its degradable nature allows it to safely degrade and dissolve, thus eliminating the need for secondary surgery, which requires component removal. The use of bioresorbable polymer materials, such as PLA, is expected to increase in the area of lumbar interbody fusion. Polylactic acid exhibits stiffness, biocompatibility, and relatively high strength and high modulus, making it suitable for use in the manufacturing of fixation devices, such as arrows, washers, pins, and screws, in orthopedic surgeries.

The polyglycolic acid segment is expected to grow at a CAGR of 14.1% over the forecast period. On account of rapid degradation as compared to other biopolymers, polyglycolic acid has witnessed growing demand in drug delivery applications. Polyglycolic acid is used for protein delivery, chemotherapeutics, vaccines, analgesics, antibiotics, siRNA, and anti-inflammatory drugs. Most often, the bioresorbable polymers are categorized into microcapsules, microspheres, nanofibers, and nanospheres to facilitate the controlled delivery of adsorbed or encapsulated payloads.

Application Insights

Orthopedics emerged as the leading application segment and accounted for the maximum share of 43.6% of the overall revenue in 2022. The growing aging population, sedentary lifestyles, obesity, and lack of physical activity have increased the prevalence of orthopedic conditions, such as osteoporosis, arthritis, and degenerative joint diseases. This, in turn, is expected to drive the product demand. According to the National Institute of Health (NIH), total knee arthroplasty (TKA) stands as the most frequently conducted inpatient surgical procedure in the U.S. The number of TKA procedures was recorded at 1.37 million in 2020, and it is expected to reach 3.48 million procedures annually by 2030.

Products like screws, sutures, stents, and pins used in various medical procedures are now available in bio-based polymer forms. Companies, such as Evonik Industries AG, are offering a range of medical products, including screws for the medical sector. The extensive utilization of these products in biomedical settings, such as prostheses and joint repairs, among others, is driving growth in this segment. Resorbable polymer-based implants improve patient care and clinical outcomes while reducing the costs associated with additional procedures and surgeries. The drug delivery application is expected to experience the fastest growth rate during the forecast period.

The drug delivery segment is expected to grow at the fastest CAGR of 15.7% during the forecast period. This growth can be attributed to the rising prevalence of chronic diseases and the growing aging population. In addition, drug delivery also helps in minimizing invasive procedures. Drug delivery systems, such as implantable devices or sustained-release formulations, can reduce the need for frequent invasive procedures, leading to improved patient comfort and lower healthcare costs. Companies are focusing on developing innovative and highly effective delivery systems.

In June 2020, Evonik announced the launch of the RESOMER Precise platform, representing a breakthrough in custom functional polymeric excipients. This innovation empowers pharmaceutical companies to attain an unparalleled level of accuracy and precision in controlling the release profile of their parenteral drug products. The RESOMER platform, created using Evonik's advanced and distinctive process technology, not only enhances drug product stability but also mitigates regulatory risks associated with a variety of complex parenteral drug products.

Regional Insights

North America dominated the global industry and accounted for the largest revenue share of 32.5% in 2022. This is attributed to the increasing product consumption in drug delivery and orthopedics applications in the region. The U.S. is the major hub for research & development in the healthcare industry, further driving the market growth in North America. Moreover, the rising demand for orthopedics and drug delivery applications supports the bioresorbable polymers demand in the region. According to the data provided by the American Joint Replacement Registry (AJRR) in 2022, over 2.8 million knee and hip procedures were performed across 1,250 health institutions in the U.S. This signifies a remarkable 14% increase in cumulative registered procedural volume compared to the previous year, establishing the AJRR as the world's largest arthroplasty registry in terms of volume.

Moreover, increasing healthcare expenditure in the U.S. is propelling market growth. According to the American Medical Association, in 2021, healthcare expenditure in the U.S. rose by 2.7% to reach USD 4.3 trillion, equivalent to USD 12,914 per capita.Asia Pacific is projected to grow at the fastest CAGR of 15.9% from 2023 to 2030, in terms of revenue. The growing geriatric population in countries, such as China and Japan, is driving the demand for medical procedures, which, in turn, is expected to propel the market growth. High economic growth in emerging countries and increasing consumer disposable income make APAC an attractive market for bioresorbable polymers.

Other factors contributing to the market growth in APAC include the increasing number of hospitals, supportive reimbursement policies, implementation of favorable government initiatives, rising per capita income, high investments in the healthcare industry, demand for cutting-edge surgery products, and expansion of private-sector hospitals to rural areas. Increased healthcare expenditure and the growing need for polymers in drug delivery and orthopedic applications are expected to drive product demand in the Asia Pacific region. According to the Organization for Economic Cooperation and Development (OECD), countries in the Asia Pacific region, on average, witnessed an annual real health expenditure growth rate of 6.4% per capita in GDP during 2010-2018.

Notably, health expenditure per capita in China, Turkmenistan, and Timor Leste exhibited rapid growth compared to the GDP per capita growth rate. India and the U.S. collaborated to promote orthopedic research and education, which is expected to further drive the product demand. In March 2022, Shalby Advanced Technologies, headquartered in Gujarat, collaborated with Gardner Orthopedics, based in the U.S., to form Advanced Orthopedic Centers of Excellence in India, Fort Myers, and Florida.

Key Companies & Market Share Insights

Companies are rapidly expanding their production capabilities to consolidate their market position. With governmental support in various countries focused on environmental concerns as well as the growing demand for specialized orthopedic and drug delivery applications in the global population, industry players have been compelled to focus on consumer-specific product positioning strategies for higher penetration in the local markets. For instance, in August 2021, Evonik Industries AG acquired a German biotech company, JeNaCell, to expand its biomaterials product portfolio in the healthcare industry. The acquisition will help Evonik’s Nutrition & Care division’s portfolio transformation to system solutions and will expand the division’s natural goods for the medical technology platform. Some of the major participants in the global bioresorbable polymers market include:

-

Corbion NV

-

Evonik Industries AG

-

Poly-Med Inc.

-

Foster Corp.

-

Abbott

-

KLS Martin Group

-

3D Biotek LLC.

-

Sunstar Suisse S.A.

-

DSM

-

Futerro

Bioresorbable Polymers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,472.5 million

Revenue forecast in 2030

USD 3.63 billion

Growth rate

CAGR of 13.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Poland; The Netherlands; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Corbion NV; Evonik Industries AG; Poly-Med Inc.; Foster Corp.; Abbott; KLS Martin Group; 3D Biotek LLC; Sunstar Suisse S.A.; DSM; Futerro

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

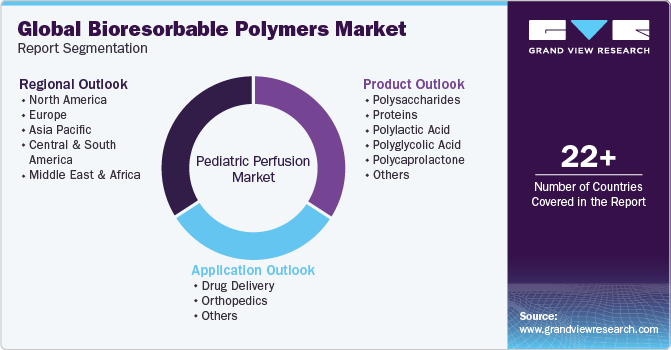

Global Bioresorbable Polymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioresorbable polymers market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, Million, 2018 - 2030)

-

Polysaccharides

-

Proteins

-

Polylactic Acid

-

Polyglycolic Acid

-

Polycaprolactone

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, Million, 2018 - 2030)

-

Drug Delivery

-

Orthopedics

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bioresorbable polymers market size was estimated at USD 1.30 billion in 2022 and is expected to reach USD 1.47 billion in 2023.

b. The global bioresorbable polymers market is expected to grow at a compound annual growth rate of 13.8% from 2023 to 2030 to reach USD 3.63 billion by 2030.

b. North America dominated the bioresorbable polymers market with a share of 32.5% in 2022. This is attributable to a high level of technological sophistication in the healthcare sector in the U.S. and Canada.

b. Some key players operating in the bioresorbable polymers market include Carbion NV, Evonik Industries AG, Poly-Med, Inc., KLS Martin Group, and Foster Corporation.

b. Key factors that are driving the bioresorbable polymers market growth include the biocompatibility and cost-effectiveness of the products coupled with the rising demand in medical applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.