- Home

- »

- Biotechnology

- »

-

Bispecific Antibodies Market Size And Share Report, 2030GVR Report cover

![Bispecific Antibodies Market Size, Share & Trends Report]()

Bispecific Antibodies Market (2023 - 2030) Size, Share & Trends Analysis Report By Indication (Cancer, Inflammatory & Autoimmune disorders), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-088-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bispecific Antibodies Market Summary

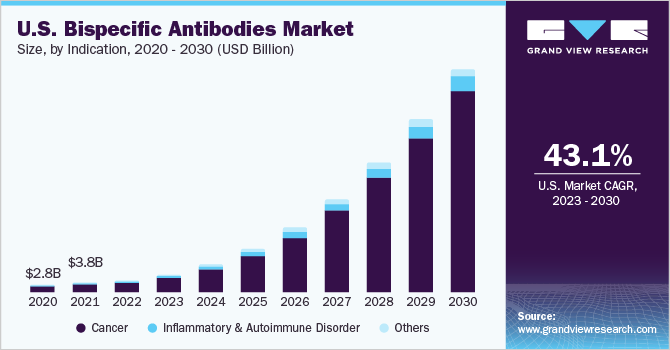

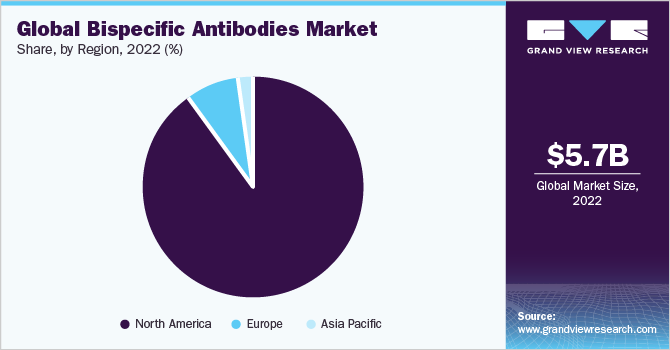

The global bispecific antibodies market size was valued at USD 5.73 billion in 2022 and is projected to reach USD 110.3 billion by 2030, growing at a CAGR of 44.0% from 2023 to 2030. Rising incidences of chronic diseases such as cancer, autoimmune disorders, and infectious diseases, rising demand for targeted therapies as well as advancements in antibody engineering technologies are some major driving factors that propel the market growth.

Key Market Trends & Insights

- North America accounted for the largest market share of 89.46% in 2022.

- Europe is estimated to grow at the fastest CAGR of 52.4% from 2023 to 2030.

- Based on Indication, Cancer segment dominated the market in 2022 with a market share of 70.4%.

Market Size & Forecast

- 2022 Market Size: USD 5.73 Billion

- 2030 Projected Market Size: USD 110.3 Billion

- CAGR (2023-2030): 44.0%

- North America: Largest market in 2024

- Europe: Fastest growing market

According to a report published in 2022 by the National Association of Chronic Disease Directors, over 60% of adult Americans have at least one chronic disease. Furthermore, according to the Centers for Disease Control and Prevention, people with chronic diseases and mental health disorders account for 90% of the nation's $3.8 trillion in annual healthcare expenditure. To deal with such conditions, bispecific antibodies provide a promising avenue for personalized medicine and targeted interventions in these disease areas. Moreover, rising approval for several bispecific antibodies by regulatory bodies has surged the interest and confidence of companies to invest in research and development.

For instance, in October 2022, the FDA approved Teclistamab-cqyv (Tecvayli, Janssen Biotech, Inc.), the first bispecific B-cell maturation antigen for adult patients with relapsed or refractory multiple myeloma. Additionally, companies are actively engaging in collaborations and partnerships to leverage complementary expertise and technologies to develop bispecific antibodies. These collaborations lead to accelerated research and development activities, further boosting the overall market growth.

The COVID-19 pandemic had a neutral effect on the market. The increased emphasis on biologic therapies and their potential for COVID-19 treatment positively influenced the market. However, disruptions in clinical trials, supply chain challenges, diverted resources, and strained healthcare systems posed obstacles.

Indication Insights

Cancer segment dominated the market in 2022 with a market share of 70.4%. Cancer is a leading cause of mortality globally, with a high prevalence in various populations. As per the World Health Organization (WHO) report, cancer accounted for nearly 609,360 deaths in 2022 in the U.S. The significant burden of cancer drives the demand for innovative therapies, including bispecific antibodies, which can target multiple tumor-associated antigens simultaneously, enhancing therapeutic efficacy.

Currently, several treatment options are available to treat cancer-related diseases; however, despite several treatment choices, certain types of cancer still have limited treatment options. Bispecific antibodies offer a promising approach for addressing this challenge by targeting multiple pathways or antigens involved in cancer progression, potentially leading to improved patient outcomes. Bispecific antibodies specifically target cancer cells or tumor-associated antigens while sparing healthy cells. This high target specificity minimizes off-target effects and reduces toxicity compared to traditional therapies, making bispecific antibodies an attractive option for cancer treatment.

The inflammatory and autoimmune disorders segment is expected to grow at a significant CAGR of 35.7% during 2023-2030. Inflammatory and autoimmune disorders encompass various conditions, such as rheumatoid arthritis, psoriasis, Crohn's disease, and multiple sclerosis. These disorders often have a significant impact on a patient's quality of life and can lead to chronic inflammation, tissue damage, and organ dysfunction. Many patients with these conditions experience inadequate response or intolerance to existing therapies, creating significant unmet medical needs.

For instance, per the National Center for Biotechnology Information report published in 2022, rheumatoid arthritis is one of the most popular chronic diseases, with a prevalence of 460 per 10,000 people. Inflammatory and autoimmune disorders have complex and multifaceted mechanisms, including dysregulated immune responses, cytokine imbalances, and abnormal cell signaling pathways. Traditional therapies often target a single molecular target or pathway, limiting their efficacy. Bispecific antibodies, such as tibulizumab, Ozoralizumab, and others can engage multiple targets. These provide a more comprehensive approach to modulating these complex disease mechanisms, potentially leading to better outcomes. Bispecific antibodies are designed to simultaneously target two relevant molecules involved in the disease process, allowing for greater flexibility and specificity in addressing the diverse range of targets necessitated by the disorder.

Regional Insights

North America accounted for the largest market share of 89.46% in 2022. The presence of several market players and various developments done by them are some key factors driving the region’s growth. Moreover, technological advancements, high investment in R&D, and rising demand for bispecific antibodies are other factors supporting the regional market.

Furthermore, rising approval for several bispecific antibodies by regulatory bodies has surged the interest and confidence of companies to invest in research and development. For instance, in October 2022, the FDA approved teclistamab-cqyv (Tecvayli, Janssen Biotech, Inc.), the first bispecific B-cell maturation antigen. Additionally, companies are actively engaging in collaborations and partnerships to leverage complementary expertise and technologies to develop bispecific antibodies. These collaborations have led to accelerated research and development activities, further boosting the overall market growth.

Europe is estimated to grow at the fastest CAGR of 52.4% from 2023 to 2030. The region benefits from a favorable regulatory environment and a focus on precision medicine, which aligns with the unique capabilities of bispecific antibodies. Collaborations and partnerships between local and international stakeholders further contribute to the region's growth. These factors collectively position the region as a promising market with significant growth potential for bispecific antibodies.

Key Companies & Market Share Insights

Several major companies are vying for a higher market share in the very competitive bispecific antibodies market. Major Key companies are undertaking strategic activities like mergers, acquisitions, and alliances to elevate their market position. For instance, in January 2023, Genentech got approval from the FDA for bispecific antibodies for treating lymphoma. Some prominent players in the global bispecific antibodies market include:

-

Amgen

-

Roche

-

Genentech

-

Akeso, Inc.

-

Janssen

-

Taisho Pharmaceutical

-

Immunocore

Bispecific Antibodies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.60 billion

Revenue forecast in 2030

USD 110.3 billion

Growth rate

CAGR of 44.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Rest of the World

Country scope

The U.S.; Canada; Germany; U.K.; China; Japan

Key companies profiled

Amgen; Roche; Genentech; Akeso, Inc.; Janssen; Taisho Pharmaceutical; Immunocore

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Bispecific Antibodies Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global bispecific antibodies market report based on indication, and region:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Inflammatory & Autoimmune Disorder

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global bispecific antibodies market size was estimated at USD 5.73 billion in 2021 and is expected to reach USD 8.60 billion in 2022.

b. The global bispecific antibodies market is expected to grow at a compound annual growth rate of 44.0% from 2023 to 2030 to reach USD 110.3 billion by 2030.

b. North America dominated the bispecific antibodies market with a share of 89.46% in 2022. This is attributable to a high number of approved drugs and the large number of clinical trials in the U.S.

b. Some key players operating in the bispecific antibodies market include Amgen; F. Hoffmann-La Roche AG; Janssen Pharmaceuticals; Immunocore; Genentech, Inc; Akeso, Inc.; and Taisho Pharmaceutical

b. Key factors that are driving the market growth include the increasing prevalence of autoimmune diseases and various rare cancers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.