- Home

- »

- Organic Chemicals

- »

-

Bitumen Emulsifier Market Size, Share, Industry Report 2030GVR Report cover

![Bitumen Emulsifier Market Size, Share & Trends Report]()

Bitumen Emulsifier Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Cationic, Anionic, Non-icon), By Application (Unmodified Bitumen, Modified Bitumen), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-539-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bitumen Emulsifier Market Summary

The global bitumen emulsifier market size was estimated at USD 58.26 million in 2024 and is anticipated to reach USD 89.80 million in 2030, growing at a CAGR of 7.5% from 2025 to 2030. Bitumen emulsifiers are chemical agents used to create stable emulsions of bitumen and water, which are essential in applications such as road construction, asphalt paving, and surface treatments.

Key Market Trends & Insights

- Bitumen emulsifier market in Asia Pacific held the largest share of 50.7%.

- Bitumen emulsifier market in Europe is a significant and mature segment of the global bitumen market.

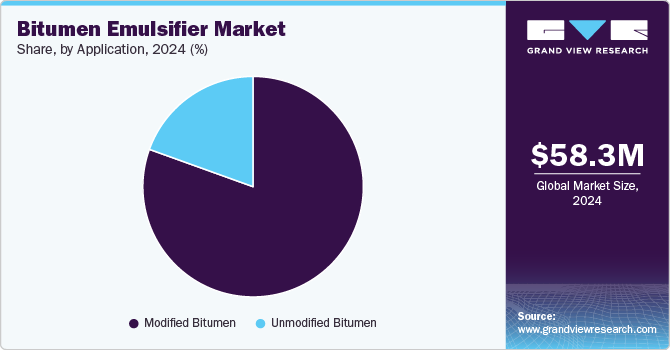

- Based on application, the modified bitumen segment dominated the market with a revenue share of 80.5% in 2024.

- Based on type, cationic bitumen emulsifiers segment are the most commonly used in the road construction and maintenance sectors.

Market Size & Forecast

- 2024 Market Size: USD 58.26 Million

- 2030 Projected Market Size: USD 89.80 Million

- CAGR (2025-2030): 7.5%

- Asia Pacific: Largest market in 2024

Emulsifiers help improve the performance and efficiency of bitumen in emulsified form, which is often easier to transport, handle, and apply than raw bitumen. Manufacturers are focusing on the development of "green" or eco-friendly bitumen emulsifiers, which have minimal impact on the environment. These products can help companies meet sustainability targets while satisfying the growing demand for environmentally conscious construction solutions. Companies are also exploring alternative raw materials and bio-based emulsifiers as a way to reduce dependency on petrochemical resources and align with the global move towards sustainability.

As countries, particularly in emerging economies, continue to urbanize and develop, the demand for better and more extensive road networks increases. Bitumen emulsions, which are made with bitumen emulsifiers, are widely used in road construction, maintenance, and repair. The rise in infrastructure projects such as highways, expressways, and rural roads is one of the primary drivers of the bitumen emulsifiers market.

Drivers, Opportunities & Restraints

The bitumen emulsifiers market is driven by several key factors such as ongoing infrastructure development and urbanization, especially in emerging economies. As these regions invest heavily in road construction and maintenance, the demand for bitumen emulsifiers used in road paving, surface dressing, and repair grows steadily. Furthermore, the growing emphasis on environmental sustainability provides another key driver.

Opportunities in the bitumen emulsifiers market are abundant. One significant opportunity lies in the continued adoption of sustainable solutions, as there is a growing preference for eco-friendly construction materials. Bio-based emulsifiers and low-emission, energy-efficient products are increasingly in demand, creating room for innovation. The expansion of infrastructure in emerging markets, particularly in Asia-Pacific, Latin America, and the Middle East, presents a large opportunity for manufacturers of bitumen emulsifiers.

However, the bitumen emulsifiers market also faces several restraints. One of the primary challenges is the fluctuating prices of raw materials, especially crude oil, from which bitumen is derived. This volatility can impact production costs, leading to price instability and affecting both manufacturers and end-users. Additionally, strict environmental and regulatory requirements governing the production and application of bitumen emulsifiers can limit market growth, especially in regions with stringent chemical regulations. In particular, health and safety concerns related to the chemicals used in emulsifier production could result in higher compliance costs and regulatory hurdles.

Type Insights

Cationic bitumen emulsifiers are the most commonly used in the road construction and maintenance sectors due to their excellent performance in bonding bitumen to aggregates with a negative charge, which is typical of many mineral surfaces. These emulsifiers allow for stable emulsions that are highly effective in asphalt paving and surface treatments, as they provide better adhesion to road surfaces, making them ideal for road repair, resurfacing, and waterproofing applications. Cationic emulsions also perform well in cold climates and are widely favored due to their fast-setting properties and compatibility with aggregates.

On the other hand, anionic bitumen emulsifiers are used less frequently but are still crucial in certain applications where bitumen needs to bond with aggregates that have a positive charge. Anionic emulsifiers produce emulsions that are generally more stable under acidic conditions and are often used in specific types of road construction where their characteristics can be fully utilized. While they are less common than cationic emulsifiers, they remain important in certain regional and industrial applications due to their unique properties, such as better performance in particular pH environments.

Application Insights

The modified bitumen segment dominated the market with a revenue share of 80.5% in 2024, during the forecast period. Unmodified bitumen is the traditional form of bitumen, primarily used in standard road construction and paving. It is made by refining crude oil and consists of a mixture of hydrocarbons without the addition of any polymers or other additives. Unmodified bitumen is typically used for surface courses, base courses, and sub-base layers in road construction. It is widely used due to its cost-effectiveness and the simplicity of its application. However, it tends to have limitations in terms of temperature susceptibility, stiffness, and durability under extreme weather conditions.

On the other hand, modified bitumen is altered by the addition of various additives, such as polymers, rubber, or other chemicals, these modification enhances the properties of the bitumen, particularly its durability, flexibility, and resistance to both high and low temperatures. Modified bitumen is ideal for applications where increased performance is required, such as in heavy traffic areas, areas with extreme weather conditions, or roads that experience frequent thermal expansion and contraction. The most common forms of modified bitumen include polymer-modified bitumen (PMB), which is often used for high-performance road construction, particularly in regions with hot climates or where roads are subject to heavy vehicular loads. Rubber-modified bitumen (RMB), which is derived from recycled rubber, is also widely used for its enhanced elasticity and durability.

Regional Insights

Bitumen emulsifier market in North America is an essential segment of the broader bitumen industry. It is driven by infrastructure development, road maintenance, and the growing demand for environmentally friendly construction solutions.

U.S. Bitumen Emulsifier Market Trends

Bitumen emulsifiers are essential additives in the construction industry, facilitating the stable dispersion of bitumen in water for applications such as road construction and maintenance. In the U.S., the market for these emulsifiers is influenced by factors including infrastructure development, urbanization, and technological advancements in road construction materials.

Asia Pacific Bitumen Emulsifier Market Trends

Bitumen emulsifier market in Asia Pacific held the largest share of 50.7% and is one of the fastest-growing segments within the global bitumen emulsifier market. It is driven by rapid infrastructure development, increased urbanization, and significant government investments in road construction and maintenance across the region.

Europe Bitumen Emulsifier Market Trends

Bitumen emulsifier market in Europe is a significant and mature segment of the global bitumen market, characterized by increasing demand for sustainable construction solutions, advanced infrastructure projects, and the adoption of innovative technologies in road construction and maintenance.

Latin America Bitumen Emulsifier Market Trends

Bitumen emulsifier market in Latin Amercia is an emerging and dynamic segment of the global bitumen industry, driven by the increasing demand for infrastructure development, road construction, and repair activities across the region. While the market is still developing, it presents significant growth potential due to ongoing investments in urbanization, road maintenance, and sustainable construction technologies. Countries such as Brazil, Mexico, Argentina, and Colombia are major contributors to the market, as they invest in improving their road networks, particularly in the wake of economic growth and rising urbanization.

Middle East & Africa Bitumen Emulsifier Market Trends

Bitumen emulsifier market in Middle East & Africa (MEA) is witnessing steady growth due to increasing demand for road construction, maintenance, and infrastructure development across the region. While the market is diverse and varies greatly from country to country, nations like Saudi Arabia, UAE, South Africa, Nigeria, and Egypt are key players. .

Key Bitumen Emulsifier Company Insights

Some of the key players operating in the market include Evonik Industries Ltd., Arkema Group, Macismo International Limited Ingevity Corporation and BASF SE.

-

Evonik Industries Ltd. is a leading global specialty chemicals company based in Essen, Germany. With a presence in over 100 countries, Evonik is known for its innovations in the fields of high-performance materials, chemicals, and specialty products. The company is committed to driving sustainable growth through a diversified portfolio, including significant investments in advanced materials, life sciences, and sustainable technologies.

-

Arkema Group is a global leader in the specialty chemicals and advanced materials sector. Headquartered in Colombes, France, Arkema operates in over 55 countries, offering a wide range of innovative solutions across various industries, including construction, automotive, electronics, and agriculture. With a strong focus on sustainability, innovation, and technology, Arkema is committed to providing high-performance products that meet the needs of modern industries, including bitumen emulsifiers for road construction and infrastructure projects.

Key Bitumen Emulsifier Companies:

The following are the leading companies in the bitumen emulsifier market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries Ltd.

- Arkema Group

- Macismo International Limited

- Ingevity Corporation

- Zydex Industries

- BASF SE

- Kao Corporation

- McAsphalt Industries Limited

- Croda International Plc

- Akzo Nobel N.V

- Opal Paints Products Pvt Ltd.

- Petrochem Specialties

Recent Developments

-

In June 2024, Ingevity Corporation of specialty chemicals and performance materials, with a strong focus on innovation and sustainability. Ingevity serves a wide range of industries including automotive, consumer goods, construction, and infrastructure. The company is known for its advanced solutions in environmental protection, energy efficiency, and high-performance road construction materials.

-

In April 2024, BASF’s launch of EcoBind and its corresponding investment in expanding production facilities reflect a strong alignment with global trends towards sustainability and green infrastructure. As governments around the world implement stricter environmental regulations and as construction industries move towards greener solutions, BASF’s investment in eco-friendly emulsifiers positions the company as a key player in the future of road construction.

Bitumen Emulsifier Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 62.47 million

Revenue forecast in 2030

USD 89.80 million

Growth rate

CAGR of 7.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; Brazil; Mexico; and Saudi Arabia.

Key companies profiled

Evonik Industries Ltd.; Arkema Group; Macismo International Limited; Ingevity Corporation; Zydex Industries; BASF SE; Kao Corporation; McAsphalt Industries Limited; Croda International Plc; Akzo Nobel N.V; Opal Paints Types Pvt Ltd.; Petrochem Specialties

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bitumen Emulsifier Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bitumen emulsifier market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cationic

-

Anionic

-

Non-icon

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Unmodified Bitumen

-

Modified Bitumen

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bitumen emulsifier market was valued at USD 58.26 million in 2024 and is expected to reach USD 62.47 billion in 2025.

b. The global bitumen emulsifier market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 89.80 million by 2030.

b. The Asia-Pacific Bitumen Emulsifier Market is one of the fastest-growing segments within the global bitumen emulsifier market.

b. Some of the key players operating in the market include Evonik Industries Ltd., Arkema Group, Macismo International Limited Ingevity Corporation and BASF SE.

b. The bitumen emulsifiers market is driven by several key factors. The most significant of these is the ongoing infrastructure development and urbanization, particularly in emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.