- Home

- »

- Advanced Interior Materials

- »

-

Modified Bitumen Market Size, Share, Industry Report, 2030GVR Report cover

![Modified Bitumen Market Size, Share & Trends Report]()

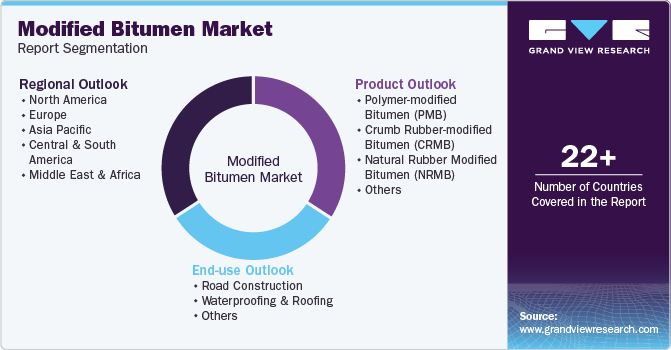

Modified Bitumen Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polymer-modified Bitumen (PMB), Crumb Rubber-modified Bitumen (CRMB)), By End-use (Road Construction, Waterproofing & Roofing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-532-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Modified Bitumen Market Size & Trends

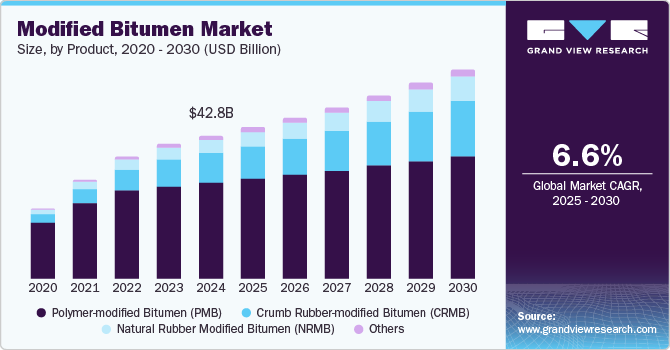

The global modified bitumen market size was estimated at USD 42.76 billion in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2030. The growth is driven by the increasing demand for durable and high-performance road construction materials. Modified bitumen, which is produced by adding polymers or rubber to traditional bitumen, offers enhanced properties such as improved elasticity, resistance to cracking, and better performance in extreme weather conditions. With the growing need for long-lasting and sustainable infrastructure, especially in rapidly developing regions and urbanizing economies, the demand for modified bitumen in road construction is experiencing steady growth. The enhanced properties of modified bitumen make it an ideal choice for highways, airports, and other transportation networks that require a robust and reliable road surface.

Environmental concerns also play a critical role in driving the modified bitumen market. As governments and industries place increasing emphasis on sustainability, modified bitumen is seen as a more environmentally friendly alternative to traditional materials. The use of recycled rubber or plastic in modified bitumen not only enhances the material’s properties but also contributes to waste reduction and resource conservation. Additionally, modified bitumen is known for its longevity, which reduces the need for frequent road repairs and replacements, leading to long-term environmental and economic benefits. The growing adoption of sustainable construction practices has made modified bitumen an attractive choice for infrastructure projects focused on environmental stewardship.

Technological advancements and innovations in the production of modified bitumen are also significant drivers of the market. With ongoing research and development in the field of polymer and rubber modification, manufacturers are continually improving the performance and cost-effectiveness of modified bitumen. Innovations such as the development of more durable and versatile polymers, as well as the increased use of recycled materials in the manufacturing process, have made modified bitumen more affordable and accessible to a broader range of applications.

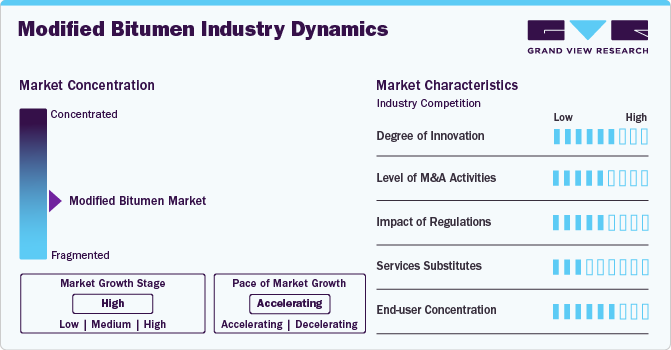

Market Concentration & Characteristics

The global modified bitumen industry exhibits a moderate to high degree of concentration, with several key players dominating the market landscape. Large companies, such as Shell, ExxonMobil, and TotalEnergies, hold significant shares due to their expansive product portfolios and established distribution networks. These major players often engage in strategic mergers, acquisitions, and partnerships to enhance their market position and expand product offerings.

However, the market also includes regional players that cater to specific local demands, offering customized modified bitumen solutions. This dynamic creates a competitive environment where innovation, cost efficiency, and regulatory compliance are essential for maintaining a leading position. The degree of innovation in the market is high, as manufacturers are continuously developing new formulations and improving the performance characteristics of modified bitumen to cater to evolving demands in the construction and infrastructure industries, particularly for roofing, road construction, and waterproofing applications.

The impact of regulations on the global modified bitumen market is significant, with stringent environmental standards driving innovation and product development. As countries worldwide impose regulations on emissions and sustainability, manufacturers are focusing on producing more environmentally friendly and energy-efficient modified bitumen products. These regulations also encourage the adoption of recyclable and less toxic materials in production.

Regarding service substitutes, the market faces some competition from alternative materials like thermoplastic elastomers and traditional unmodified bitumen; however, the superior performance characteristics of modified bitumen such as enhanced durability, waterproofing, and heat resistance have ensured its continued dominance in key applications. The end-use concentration in the global modified bitumen industry is heavily concentrated in the construction and infrastructure sectors, particularly in road paving and roofing applications, which constitute the largest share of the market. These sectors continue to drive demand, influenced by urbanization trends and infrastructure development projects globally.

Product Insights

The polymer-modified bitumen (PMB) segment led the market and accounted for the largest revenue share of 67.4% in 2024. The global push towards sustainability and the reduction of environmental impacts in construction and infrastructure projects is contributing to the growth of the PMB segment. PMB is often seen as an eco-friendlier alternative to conventional bitumen due to its ability to perform better under varying climate conditions, leading to fewer repairs and less frequent resurfacing.

The crumb rubber-modified bitumen (CRMB) segment is expected to grow at fastest CAGR of 11.2% over the forecast period, driven primarily by the increasing demand for more sustainable and durable road construction materials. CRMB is produced by incorporating recycled rubber, often derived from used tires, into bitumen, which enhances the material’s performance characteristics, such as flexibility, resilience, and resistance to wear and tear. The growing emphasis on sustainability and circular economy principles has made CRMB a popular choice among governments and construction companies aiming to reduce environmental waste while improving the longevity of road infrastructure.

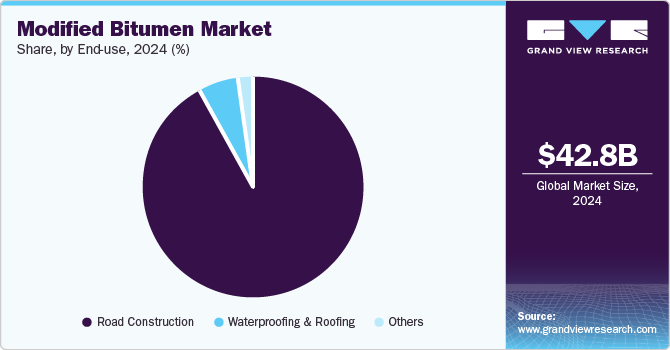

End Use Insights

The road construction segment dominated the market and accounted for the largest revenue share of 91.6% in 2024. As countries around the world continue to invest in the improvement and expansion of road networks, modified bitumen is becoming a preferred material due to its superior durability, resistance to extreme weather conditions, and enhanced load-bearing capacity. The growing need for long-lasting, sustainable road surfaces that can withstand the wear and tear from heavy traffic, adverse weather, and temperature fluctuations is pushing road construction companies to adopt modified bitumen for paving applications.

Waterproofing and roofing segment is expected to grow significantly at CAGR of 5.9% over the forecast period, driven by the increasing demand for durable, cost-effective, and energy-efficient materials in construction projects. Modified bitumen, with its superior waterproofing properties, is highly sought after for roofing applications, especially in commercial and industrial buildings. As urbanization accelerates and infrastructure development expands, the need for reliable roofing systems to protect buildings from harsh weather conditions and water pressure has increased. Modified bitumen's ability to withstand extreme temperatures, resist UV degradation, and offer long-lasting performance makes it a preferred choice for roofing projects, contributing to its dominance in this segment.

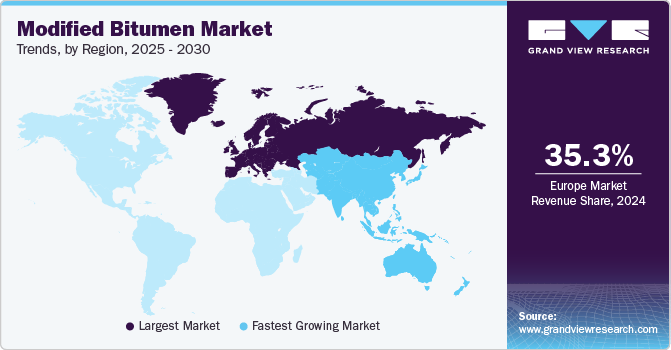

Regional Insights

The North American modified bitumen industry is experiencing significant growth, driven by the region's increasing demand for durable and high-performance construction materials. The ongoing expansion of urban infrastructure, coupled with the need for better-quality roads and roofing systems, has contributed to the widespread adoption of modified bitumen products. Modified bitumen is favored for its ability to provide superior resistance to extreme weather conditions, including high temperatures and heavy rainfall, making it ideal for the diverse climates found across North America. As the construction industry continues to expand, the market for modified bitumen is expected to see sustained demand, particularly in sectors like road construction and roofing.

U.S. Modified Bitumen Market Trends

The increasing emphasis on sustainability and energy efficiency is major driver in the U.S. modified bitumen industry. As environmental concerns grow, there is a heightened focus on reducing the environmental impact of construction materials. Modified bitumen, with its ability to improve energy efficiency through reflective roofing applications, plays an essential role in meeting green building standards. Reflective modified bitumen roofing systems are known to reduce heat island effects, lower energy consumption, and contribute to sustainability goals. As the U.S. construction industry seeks to meet environmental regulations and building standards, the demand for modified bitumen in energy-efficient applications continues to rise.

Europe Modified Bitumen Market Trends

Europe dominated the modified bitumen industry and accounted for the largest revenue share of 35.3% in 2024, driven by the region's expanding construction and infrastructure sectors, which are characterized by a focus on durability, energy efficiency, and environmental sustainability. With the increasing demand for long-lasting, high-performance roofing and waterproofing solutions, modified bitumen has become the material of choice for both new constructions and renovations. The superior properties of modified bitumen, such as its resistance to extreme temperatures, UV degradation, and water infiltration, make it highly suitable for the region's diverse climate conditions. As both residential and commercial buildings prioritize longevity and protection from weather-related damage, the demand for modified bitumen in roofing and waterproofing applications continues to rise.

The Germany modified bitumen market is expected to grow during the forecast period. Stringent environmental regulations in Germany have contributed to the rising demand for more sustainable and energy-efficient construction materials, including modified bitumen. As the country aims to meet its ambitious climate targets, there is an increased focus on energy-efficient building solutions that can reduce carbon footprints. Modified bitumen products with reflective properties help mitigate the urban heat island effect, making them a popular choice for green building projects. This growing awareness of sustainability and energy conservation drives the demand for high-quality, eco-friendly materials in roofing and waterproofing applications, further bolstering the market growth.

Asia Pacific Modified Bitumen Market Trends

The Asia Pacific modified bitumen industry is experiencing significant growth, driven by rapid urbanization and industrialization across the region. Countries such as China, India, Japan, and Southeast Asian nations are witnessing a boom in infrastructure development, including residential, commercial, and industrial projects. This urban expansion is leading to an increased demand for roofing, road paving, and waterproofing solutions, where modified bitumen plays a crucial role due to its durability, resistance to harsh environmental conditions, and superior performance in extreme climates. As these regions continue to urbanize, the demand for robust, long-lasting construction materials, including modified bitumen, is expected to rise, propelling market growth.

The China modified bitumen market is experiencing significant growth, driven by rapid industrialization and urbanization across the country. As China continues to expand its infrastructure and construction sectors, the demand for high-performance materials such as modified bitumen has risen substantially. This material is particularly favored for its superior durability, flexibility, and resistance to extreme temperatures, making it an ideal choice for a variety of applications in road construction, roofing, and waterproofing. With an increasing number of large-scale urban projects underway, modified bitumen is becoming a crucial component for the country’s expanding infrastructure needs.

Latin America Modified Bitumen Market Trends

The growing focus on infrastructure development, particularly in countries such as Brazil, Mexico, and Argentina, is propelling the modified bitumen industry. Governments in the region are investing heavily in infrastructure projects to support economic growth and improve connectivity. Road construction, bridges, airports, and ports are central to these investments, and modified bitumen’s high-performance properties make it an essential material in such projects. With its ability to enhance the durability of roads and infrastructure in areas with challenging weather conditions, modified bitumen plays a crucial role in meeting the increasing demands of infrastructure development across Latin America.

Middle East & Africa Modified Bitumen Market Trends

The availability of advanced technologies in the production of modified bitumen is enhancing its adoption in the MEA region. With ongoing advancements in polymer modification techniques and the development of new additives, manufacturers are able to offer higher-performing modified bitumen products that are more resilient to environmental factors such as heat, UV exposure, and mechanical stress. This technological evolution has made modified bitumen an even more attractive solution for the construction and infrastructure sectors in the region, as it provides improved product performance and lower maintenance costs over time. The ability to customize the properties of modified bitumen for specific applications further drives its market growth in the MEA region.

Key Modified Bitumen Company Insights

Some of the key players operating in market includeSika, Carlisle Companies

-

Carlisle Companies is a major player in the global modified bitumen market, known for its expertise in roofing and construction materials. The company provides high-performance modified bitumen membranes and roofing systems that are highly resistant to heat, UV radiation, and water, ensuring long-lasting and reliable roofing solutions. Bauder is a prominent European provider of innovative roofing solutions, offering modified bitumen products that include roof membranes, underlays, and waterproofing systems.

-

Sika is a global leader in the production of construction and industrial materials, with a strong presence in the modified bitumen market. The company offers a wide range of bitumen-based products, including roofing membranes, waterproofing solutions, and road construction materials. Sika's modified bitumen products are designed for durability, performance, and long-term protection against extreme weather conditions, making them ideal for use in both commercial and residential roofing applications.

Bauder, Icopal are some of the emerging market participants in Modified Bitumen market.

-

Bauder’s product range includes modified bitumen membranes, underlays, and waterproofing systems designed to meet the needs of both new constructions and renovation projects. Bauder’s modified bitumen membranes offer excellent thermal insulation, water resistance, and protection against harsh environmental conditions. Their solutions are tailored to enhance building performance while contributing to sustainability goals, making them a preferred choice for eco-friendly and energy-efficient building projects.

-

Icopal, a part of the BMI Group, is a well-established brand in the roofing and waterproofing market, offering a wide range of modified bitumen products. Their portfolio includes high-performance roofing membranes designed to withstand the harshest environmental conditions, including extreme temperatures, UV exposure, and heavy rainfall. Icopal’s modified bitumen membranes are known for their longevity, ease of application, and ability to provide superior protection for both flat and pitched roofs.

Key Modified Bitumen Companies:

The following are the leading companies in the modified bitumen market. These companies collectively hold the largest market share and dictate industry trends.

- Sika

- Carlisle Companies

- Bauder

- Icopal

- Nynas

- Kibok

- GAF

- Mackay Consolidated

- BASF

Recent Developments

-

In February 2025, the new bitumen flat roofing association was launched by Icopal, a prominent player in the global modified bitumen market. This association aims to provide a unified platform for the promotion of bitumen-based flat roofing systems, focusing on enhancing industry standards, innovation, and best practices. Through this initiative, Icopal seeks to address the growing demand for durable, high-performance roofing solutions, while supporting the adoption of advanced modified bitumen technologies.

Modified Bitumen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.36 billion

Revenue forecast in 2030

USD 62.56 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil

Key companies profiled

Sika; Carlisle Companies; Bauder; Icopal; Nynas; Kibok; GAF, Mackay Consolidated; BASF

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modified Bitumen Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global modified bitumen market report based on product, end use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Polymer-modified Bitumen (PMB)

-

Crumb Rubber-modified Bitumen (CRMB)

-

Natural Rubber Modified Bitumen (NRMB)

-

Others

-

-

End use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Road Construction

-

Waterproofing & Roofing

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global modified bitumen market size was estimated at USD 42.76 billion in 2024 and is expected to reach USD 45.36 billion in 2025.

b. The global modified bitumen market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 62.56 billion by 2030.

b. The polymer-modified bitumen (PMB) segment led the market and accounted for the largest revenue share of 67.4% in 2024. The global push towards sustainability and the reduction of environmental impacts in construction and infrastructure projects is contributing to the growth of the PMB segment.

b. Some of the key players operating in the modified bitumen market include Sika, Carlisle Companies, Bauder, Icopal, Nynas, Kibok, GAF, Mackay Consolidated, BASF

b. The key factors that are driving the modified bitumen market include increasing infrastructure development, growing demand for durable and weather-resistant roofing and waterproofing solutions, advancements in bitumen modification technologies, and rising investments in road construction and rehabilitation projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.