- Home

- »

- Clinical Diagnostics

- »

-

Blood Based Biomarkers Market Size, Industry Report, 2030GVR Report cover

![Blood Based Biomarkers Market Size, Share & Trends Report]()

Blood Based Biomarkers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Genetic Biomarkers), By Application (Cancer), By Technology (Next-Generation Sequencing, Polymerase Chain Reaction), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-519-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Based Biomarkers Market Summary

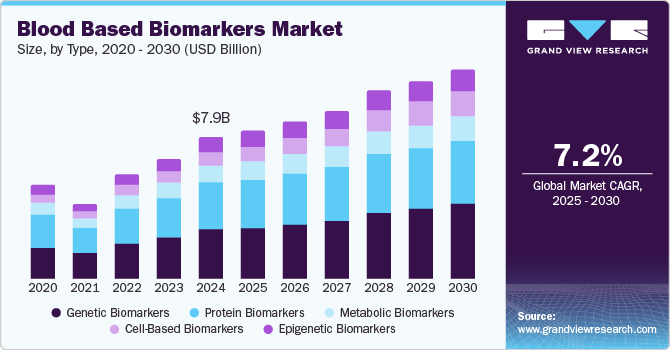

The global blood based biomarkers market size was estimated at USD 7.85 billion in 2024 and is projected to reach USD 11.58 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The market is witnessing growth due to factors such as the rising incidence of diseases such as cardiovascular diseases, diabetes, neurological diseases, and kidney diseases.

Key Market Trends & Insights

- The North America dominated the market and accounted for the largest revenue share of 42.78% in 2024.

- Based on type, the genetic biomarkers segment held the dominant market share of 33.94% in terms of revenue in 2024.

- Based on application, the cancer segment dominated the market and accounted for a revenue share of 38.82% in 2024.

- Based on technology, the next-generation sequencing segment dominated the market and accounted for a revenue share of 35.18% in 2024.

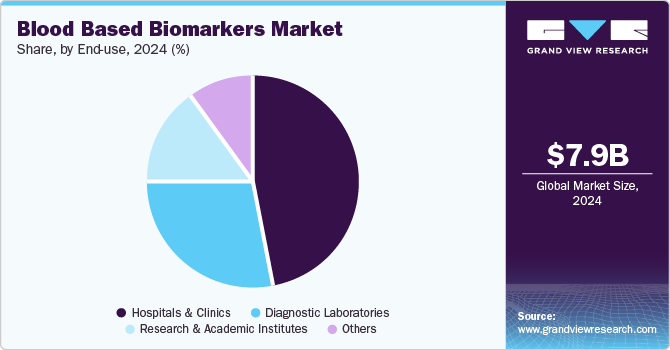

- Based on end use, the hospitals & clinics segment accounted for the highest revenue share of around 46.91% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.85 Billion

- 2030 Projected Market USD 11.58 Billion

- CAGR (2025-2030): 7.2%

- North Americ: Largest market in 2024

With over 697,000 deaths in 2023, accounting for 25% of all fatalities in the U.S., heart disease remains the leading cause of death. Projections estimated thousands of death in 2024 due to heart disease.

Additionally, millions of Americans live with its long-term health effects, increasing the demand for early detection and monitoring tools. Blood-based biomarkers offer a non-invasive, cost-effective solution for diagnosing and managing cardiovascular diseases, helping healthcare providers identify at-risk individuals, personalize treatment plans, and improve patient outcomes. As healthcare spending on heart disease surpasses USD 200.0 billion annually, the need for efficient, early-detection biomarkers continues to grow, further propelling market expansion.

Technological advancements in blood based biomarkers are significantly driving the growth of the market by enhancing accuracy, efficiency, and accessibility of diagnostic testing. Cutting-edge innovations in next-generation sequencing (NGS), artificial intelligence (AI), and multiplex assays have significantly improved the accuracy, sensitivity, and specificity of biomarker detection. For instance, liquid biopsy technologies now enable the early detection of cancers by identifying circulating tumor DNA (ctDNA) and other molecular markers in blood, reducing the need for invasive procedures. The integration of AI-driven biomarker analysis is further enhancing disease prediction and personalized treatment strategies, making diagnostics more efficient. With the global biomarker market projected to exceed USD 11.58 billion by 2030, continuous advancements in omics technologies (genomics, proteomics, and metabolomics) are expected to accelerate biomarker discovery, improving early disease detection, monitoring, and treatment outcomes.

Strategic initiatives and a growing focus on neurodegenerative disease research significantly boosts the market. For instance , the partnership of ADx NeuroSciences and Alamar Biosciences in October 2024 highlights the industry's focus on developing high-sensitivity immunoassays for neurodegenerative disease biomarkers. By leveraging Alamar’s NULISA immunoassay platform and ARGO HT System, this collaboration aims to provide advanced, tailored biomarker assay solutions for pharmaceutical companies working on Alzheimer’s, Parkinson’s, and ALS treatments. Such strategic alliances enable the development of more precise and scalable diagnostic tools, accelerating biomarker-driven drug discovery and personalized medicine. As pharmaceutical companies continue investing in biomarker-driven precision medicine, such innovations are expected to further propel the blood-based biomarker market.

However, many health insurance providers and national healthcare systems have yet to establish clear reimbursement frameworks for biomarker-driven diagnostics and treatments, limiting patient access to these advanced technologies. For instance, in the United States, while the Centers for Medicare & Medicaid Services (CMS) has expanded coverage for some companion diagnostics, many emerging biomarker assays still lack standardized reimbursement codes, making it difficult for healthcare providers to justify their use. Without comprehensive reimbursement policies, the widespread adoption of blood-based biomarkers for early disease detection and precision medicine remains hindered, slowing down advancements in personalized healthcare.

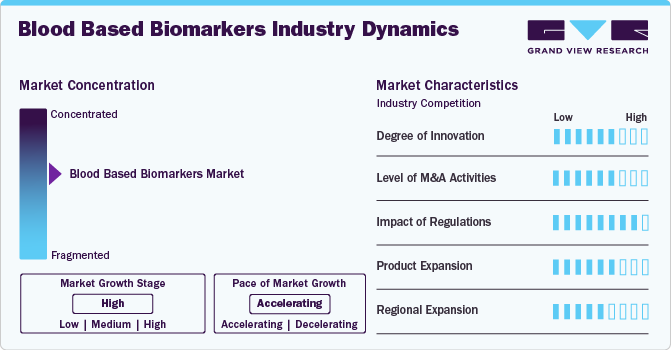

Market Concentration & Characteristics

The degree of innovation in the market is high, driven by advancements in liquid biopsy tests. For instance, tests like Guardant360 and FoundationOne Liquid CDx are revolutionizing cancer diagnostics by detecting circulating tumor DNA (ctDNA) in the bloodstream, offering a noninvasive alternative to traditional tissue biopsies. Additionally, companies like Quanterix and SomaLogic are leveraging ultra-sensitive immunoassays to identify neurological biomarkers for diseases like Alzheimer’s and Parkinson’s at earlier stages.

The blood based biomarkers industry has witnessed a high level of merger and acquisition (M&A) activity. Key players in the market have actively pursued acquisitions to integrate advanced biomarker technologies into their portfolios. For instance, in 2023, Exact Sciences completed the acquisition of Genomic Health, reinforcing its presence in cancer diagnostics through advanced blood-based biomarker tests. Similarly, Bio-Techne acquired Asuragen, enhancing its molecular diagnostic solutions, particularly in RNA-based biomarker detection. Quanterix also has plans to acquire Akoya Biosciences to stay ahead in the rapidly evolving biomarker industry.

The impact of regulation is high, as regulatory bodies like the U.S. FDA and EMA play a critical role in ensuring the safety and effectiveness of diagnostic tests. Stringent regulatory requirements can both encourage innovation by setting high standards and delay the introduction of new products due to the lengthy approval process.

The blood-based biomarker market faces competition from several product substitutes, including tissue-based biomarkers, imaging diagnostics, and liquid biopsy technologies beyond blood tests. Additionally, saliva, urine, and cerebrospinal fluid (CSF) biomarkers are emerging as viable alternatives, particularly in neurological and metabolic disorders. Despite these alternatives, blood-based biomarkers remain a preferred choice due to their non-invasive nature, ease of collection, and potential for early disease detection, keeping them at the forefront of precision medicine advancements.

End User concentration is medium, with hospitals, research laboratories and diagnostic laboratories being the primary users of these diagnostic tests. The growing focus on personalized healthcare and at-home diagnostics may slightly reduce the concentration of end-users in hospitals, but healthcare institutions will continue to dominate overall demand.

Type Insights

The genetic biomarkers segment held the dominant market share of 33.94% in terms of revenue in 2024. The growing adoption of genetic biomarkers in blood-based diagnostics is driven by advancements in comprehensive genomic profiling (CGP) technologies, as demonstrated by the FDA approval of Illumina's TruSight Oncology Comprehensive test in August 2024. This 500+ gene panel enables highly precise tumor profiling, improving the detection of clinically actionable biomarkers for targeted therapies and clinical trial enrollment. The pan-cancer approval of companion diagnostics (CDx) for NTRK and RET fusion-positive cancers highlights the expanding role of genetic biomarkers in precision oncology. As regulatory approvals and industry collaborations with major pharmaceutical companies like Bayer and Lilly continue, the demand for genetic biomarker-driven blood tests is expected to rise, transforming early cancer detection and treatment personalization.

The cell-based biomarker segment is expected to grow with the fastest CAGR of 10.8% during the forecast period. This growth can be attributed to the rising demand for circulating tumor cells, extracellular vesicles, and immune cell profiling in cancer diagnostics and precision medicine. CTCs, in particular, have gained traction as minimally invasive liquid biopsy tools, providing real-time insights into tumor progression, treatment response, and metastasis. The increasing adoption of single-cell sequencing and flow cytometry technologies has further enhanced the sensitivity and specificity of cell-based biomarker detection. Additionally, the expanding role of immune cell biomarkers in immuno-oncology and CAR-T cell therapy monitoring supports the growth of this segment. With ongoing FDA approvals, advancements in cell capture techniques, and rising research investments, the cell-based biomarker segment is set to experience significant expansion in the coming years.

The recent MD Anderson study on Menarini Silicon Biosystems' CELLSEA RCH liquid biopsy demonstrated that CTC detection enables significantly earlier relapse identification in stage III melanoma patients, with a median lead time of over nine months compared to imaging techniques. This capability enhances early intervention and treatment planning, reducing the burden of expensive imaging methods. As precision medicine advances, the demand for minimally invasive, real-time monitoring solutions like CTC-based diagnostics is expected to fuel market growth.

Application Insights

The cancer segment dominated the market and accounted for a revenue share of 38.82% in 2024. Cancer being the most researched disease, several industry players are making efforts to introduce new tests to detect tumors. For instance, the approval of Guardant Health’s Shield blood test in July 2024, by the FDA as a primary screening option for colorectal cancer has opened new avenues for growth in the cancer segment of the blood-based biomarkers market. This test, which offers a non-invasive and convenient alternative to traditional CRC screenings, is a breakthrough in early detection. Additionally, its Medicare reimbursement eligibility will significantly increase its accessibility, encouraging more widespread adoption. The ability to detect colorectal cancer with a simple blood test not only improves patient convenience but also holds the potential to increase screening rates, thereby facilitating earlier diagnosis and better treatment outcomes. This trend is likely to accelerate the market for blood-based biomarkers in cancer.

On the other hand, the neurological diseases segment is expected to expand at the fastest CAGR of 9.0% during the forecast period. This growth is attributed to the increasing research collaborations and growing demand for early and accurate diagnostics. For instance, in December 2024, Fujirebio Holdings partnered with Eisai, highlighting the industry's commitment to developing novel blood-based biomarkers for conditions like Alzheimer’s disease. Their joint efforts aim to commercialize diagnostic methods, including plasma phosphorylated tau 217 (p-Tau217) protein-based diagnostics, which could enable earlier and less invasive detection of neurodegenerative diseases. As the prevalence of dementia-related disorders rises globally, the need for innovative blood-based biomarkers to improve diagnosis and treatment selection will continue to drive market growth.

Technology Insights

The Next-Generation Sequencing segment dominated the market and accounted for a revenue share of 35.18% in 2024. The growth of this segment is driven by advancements like Integrated DNA Technologies' launch of the Archer VARIANTPlex Lymphoma panel in September 2024. This cutting-edge NGS assay is designed to detect a wide range of genetic variations, including single nucleotide variants, insertions, deletions, and copy number variations, across 49 genes linked to B-cell and T-cell lymphoma. For instance, the ability to provide comprehensive, high-resolution genetic profiling enables more precise detection of cancer-related biomarkers, which is essential for personalized medicine and improving patient outcomes. The customization and combinability of the Archer panel with other research tools further enhance its flexibility, positioning NGS technologies as a key driver of innovation and growth in the blood-based biomarker market.

On the other hand, the Polymerase Chain Reaction segment is expected to expand at a significant CAGR during the forecast period. The segment is experiencing growth driven by its ability to provide precise, fast, and reliable results in various therapeutic areas. For instance, in August 2024, QIAGEN’s expansion of its QIAstat-Dx platform into precision medicine through a collaboration with AstraZeneca is a significant example. This partnership focuses on developing companion diagnostics for chronic diseases, utilizing PCR-based genotyping assays that can be performed during routine clinical examinations. This capability allows specialty care providers to make swift decisions on a patient’s eligibility for genomically targeted therapies, accelerating the adoption of PCR technologies in precision medicine and chronic disease management.

End Use Insights

The hospitals & clinics segment accounted for the highest revenue share of around 46.91% in 2024. This dominance is attributed to the increasing demand for early diagnosis, personalized treatment, and the rising prevalence of chronic and infectious diseases. These healthcare facilities play a central role in offering advanced diagnostic services, such as blood-based biomarker testing, which helps in detecting diseases like cancer, cardiovascular conditions, and neurodegenerative disorders at earlier stages. The ability to perform non-invasive tests in a timely and cost-effective manner, along with advancements in technologies like liquid biopsy and PCR-based assays, is driving their adoption in clinical settings. Additionally, hospitals and clinics are increasingly adopting biomarker-based diagnostics as part of precision medicine initiatives, improving patient outcomes and supporting personalized treatment plans.

The diagnostic laboratories segment is estimated to expand at a significant CAGR over the forecast period. The segment is expanding due to the growing need for accurate, timely, and cost-effective diagnostic solutions. These laboratories are increasingly adopting blood-based biomarker testing due to its non-invasive nature, ability to detect a wide range of diseases, and improve early diagnosis, particularly for cancers, cardiovascular diseases, and infectious conditions. The advancement of technologies like Next-Generation Sequencing (NGS), PCR, and liquid biopsy is also boosting the demand for such tests in diagnostic labs. Additionally, as healthcare systems move toward precision medicine, diagnostic laboratories are leveraging blood-based biomarkers to help identify disease subtypes, monitor disease progression, and evaluate treatment responses, thereby supporting personalized healthcare approaches.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 42.78% in 2024. The North American blood-based biomarkers market is driven by the increasing adoption of innovative diagnostic tests and the growing demand for early disease detection, particularly in complex conditions like Alzheimer's disease. For instance, in March 2024 Labcorp launched pTau217 blood biomarker test and represented a significant milestone in enhancing Alzheimer's diagnosis and treatment monitoring. This test offers a pivotal tool to detect phosphorylated tau 217, a key biomarker, providing physicians with a more efficient method for diagnosing Alzheimer's and monitoring patient response to emerging therapies. The availability of such advanced diagnostic solutions is strengthening the healthcare infrastructure in North America, where there is a growing emphasis on personalized medicine and precision healthcare, further propelling the demand for blood-based biomarker tests.

U.S. Blood Based Biomarkers Market Trends

In the U.S., the blood-based biomarkers market is significantly driven by advancements in diagnostic tools for complex diseases like Alzheimer's. For instance, in April 2024 Roche's Elecsys pTau217 plasma biomarker test, developed in collaboration with Eli Lilly, received Breakthrough Device Designation from the U.S. FDA, highlighting its potential to revolutionize Alzheimer’s diagnosis. This test aids healthcare providers in identifying amyloid pathology, a key feature of Alzheimer's disease, which can lead to earlier, more accurate diagnoses. By improving access to timely diagnosis, the test not only enhances patient care but also facilitates patient participation in clinical trials and access to disease-modifying therapies, further boosting the demand for innovative blood-based biomarker tests in the U.S.

Europe accounted for a significant share of the market. This can be attributed to the rising awareness of liquid biopsies including blood based biomarkers. The increasing adoption of rapid, cost-effective diagnostic solutions in hospitals and outpatient settings is driving demand.

UK Blood Based Biomarkers Market Trends

The UK blood-based biomarkers market is experiencing significant growth, driven by the increasing need for efficient, non-invasive diagnostic tools for diseases such as Alzheimer's. For instance, according to the news published in December 2023 , Sysmex Corporation is expanding the availability of its reagents for blood-based amyloid β (Aβ) testing, used to identify Aβ accumulation in the brain, a leading cause of Alzheimer’s disease. These reagents, which received CE-IVD marking in May 2022, enable minimally invasive testing with the HISCL-5000/HISCL-800 Automated Immunoassay System, enhancing the ability to diagnose Alzheimer's earlier and more efficiently. Sysmex’s strategic efforts, including collaborations with key opinion leaders and the completion of regulatory compliance under the European IVD Regulation (IVDR), position these assay kits to support widespread clinical adoption in European countries, addressing the growing need for rapid and simple diagnostic solutions for dementia.

Germany Blood Based Biomarkers Market Trends

In Germany, the blood-based biomarkers market is being driven by advancements in early diagnostic methods for diseases like Alzheimer's. For instance, in September 2024 , a German-American research team highlighted the potential of using microRNAs in blood to detect Alzheimer's disease and its preliminary stages. These findings are a step toward more accessible and less invasive diagnostic options, which is crucial in a country with a growing aging population and increasing demand for effective early detection tools for Alzheimer's and other neurodegenerative diseases.

The Asia-Pacific market is expected to witness the fastest CAGR over the projected period ,driven by increasing healthcare investments, rising awareness of chronic diseases, and improving diagnostic capabilities. Growing populations, especially in countries like China and India, are contributing to higher demand for diagnostic solutions in both urban and rural areas. Additionally, the adoption of affordable, rapid diagnostic tests and the expansion of healthcare infrastructure are accelerating market growth in the region.

China Blood Based Biomarkers Market Trends

The blood based biomarkers market in China is expected to grow over the forecast period due to the rapidly aging population, which is contributing to a notable rise in Alzheimer's disease prevalence. As the number of elderly individuals continues to grow, the burden of age-related cognitive disorders such as Alzheimer's is becoming more pronounced, highlighting the critical need for early and precise diagnostic solutions. This demographic change has spurred efforts to enhance diagnostic resources and capabilities in both urban and rural areas. Additionally, rising government investments and increased research and development activities are further fueling market growth.

Japan Blood Based Biomarkers Market Trends

In Japan, the blood-based biomarkers market is expanding due to strategic partnerships and advancements in diagnostic technologies for Alzheimer’s disease. For instanc e, in April 2024, C₂N Diagnostics entered into a partnership with Mediford Corporation, a prominent provider of clinical research services in Japan, to offer its highly sensitive Precivity blood tests. These tests enable the early detection, diagnosis, and monitoring of Alzheimer's disease by identifying key biomarkers such as Aβ42/40, p-tau217, and MTBR-tau, which can detect tau protein tangles in the brain. This collaboration not only enhances access to advanced diagnostic tools but also supports the growing demand for non-invasive, cost-effective alternatives to traditional methods like tau PET scans. As Japan faces an aging population with a rising incidence of neurodegenerative diseases, this expansion represents a key development in improving early diagnosis and patient care.

Latin America Blood Based Biomarkers Market Trends

Latin America blood based biomarkers market was identified as a lucrative region in this industry owing to improving healthcare infrastructure and increasing awareness about several diseases. As governments invest more in healthcare and diagnostic technologies, demand for affordable and accessible blood based biomarkers is rising.

Brazil Blood Based Biomarkers Market Trends

The blood based biomarkers market in Brazil is expected to grow over the forecast period. Presence of favorable government initiatives and programs is projected to fuel the biomarkers market growth in Brazil. For instance, the International Society of Oncology and Biomarkers organizes programs on new therapies and biomarkers for breast & other cancers. In addition, the increasing prevalence of cancers, such as gastric carcinoma, in this region is expected to boost the market. Furthermore, VEGF, HGF, and c-MET are used as biomarkers for the treatment of gastric and intestinal cancers in Brazil.

Middle East & Africa (MEA) Blood Based Biomarkers Market Trends

MEA blood based biomarkers market was identified as a lucrative region in this industry, fueled by rising prevalence of chronic diseases, such as cancer and diabetes, is driving the demand for blood-based biomarkers. Additionally, increasing healthcare investments, expanding diagnostic infrastructure, and growing awareness of early disease detection are contributing to the market's growth. Collaborative research and advancements in biomarker technologies are also boosting the region's diagnostic capabilities.

South Africa Blood Based Biomarkers Market Trends

The market for blood-based biomarkers in South Africa is driven by the increasing recognition and support for innovative research. For instance, according to the data published in January 2025, Dr. Nompumelelo Lebogang Malaza’s groundbreaking study on biochemical and epigenetic markers in diabetic pregnancies underscores the potential of biomarkers to improve healthcare outcomes, particularly in the management of chronic conditions like diabetes. As South Africa continues to build on its growing research ecosystem, with partnerships like those seen in the Mars Awards, the demand for advanced diagnostic tools, including blood-based biomarkers, is increasing. This, coupled with rising healthcare awareness and improving infrastructure, is creating favorable conditions for the expansion of the biomarker market.

Key Blood Based Biomarkers Company Insights

Some of the leading players operating in the market include Abbott, F. Hoffmann-La Roche Ltd., and Siemens Healthineers AG, who are known for their advanced diagnostic solutions and strong market presence. These companies offer a wide range of blood based biomarkers products, catering to hospitals, diagnostic labs, and point-of-care settings.

Emerging players such as Sunbird Bio are leveraging advances in blood based tests, to create next-generation diagnostic tools that promise enhanced sensitivity and convenience to detect neurological diseases.

Key Blood Based Biomarkers Companies:

The following are the leading companies in the blood based biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- BIOMÉRIEUX

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc

- Cleveland Diagnostics, Inc.

- Sysmex Corporation

Recent Developments

-

In January 2025, Quanterix Corporation announced a merger agreement to acquire Akoya Biosciences, combining their expertise to create the first integrated solution for ultra-sensitive detection of blood- and tissue-based protein biomarkers. The merger will accelerate biomarker translation, expand customer relationships, and deliver significant cost synergies.

-

In November 2024, Harbinger Health unveils breakthroughs in blood-based cancer screening with the presentation of three abstracts at the AACR Special Conference, showcasing its proprietary biomarkers that enable cost-effective, highly accurate early-stage cancer detection using liquid biopsy technology.

-

In July 2024, Biogen Inc., Beckman Coulter, Inc., and Fujirebio have announced a strategic collaboration aimed at identifying and developing minimally invasive, blood-based biomarkers specific to tau pathology in Alzheimer’s disease (AD). This partnership seeks to advance the development of novel diagnostic tests that could be used to stratify patients and monitor treatment responses for the next generation of therapies targeting tau pathology.

-

In January 2024, Cleveland Diagnostics, Inc. raised over USD 75 million in growth capital, led by Novo Holdings, to accelerate the development of its non-invasive, blood-based diagnostic tests, including the IsoPSA prostate cancer test, aimed at improving early detection and reducing overdiagnosis and overtreatment.

Blood Based Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.17 billion

Revenue forecast in 2030

USD 11.58 billion

Growth Rate

CAGR of 7.2% from 2025 to 2030

Actual Data

2024

Historical Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait

Key companies profiled

Abbott, BIOMÉRIEUX, F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Cleveland Diagnostics, Inc., Sysmex Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Based Biomarkers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood based biomarkers market report based on type, application, technology, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Genetic Biomarkers

-

Protein Biomarkers

-

Metabolic Biomarkers

-

Cell-Based Biomarkers

-

Epigenetic Biomarkers

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Cardiovascular Diseases

-

Neurological Diseases

-

Immunological Diseases

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Next-Generation Sequencing

-

Polymerase Chain Reaction

-

Immunoassays

-

Mass Spectrometry

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood based biomarkers market size was estimated at USD 7.85 billion in 2024 and is expected to reach USD 8.17 billion in 2025.

b. The global blood based biomarkers market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 11.58 billion by 2030.

b. North America dominated the blood based biomarkers market with a share of 42.8% in 2024. This is attributable to rising healthcare awareness along with a large number of test approvals in the region

b. Some key players operating in the blood based biomarkers market include Abbott; BIOMÉRIEUX; F. Hoffmann-La Roche Ltd.; Siemens Healthineers AG; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc

b. Key factors that are driving the market growth include the increasing prevalence of neurological disorders and cancer across the globe along with growing acceptance of biomarker-based tests

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.