Borage Oil Market Size & Trends

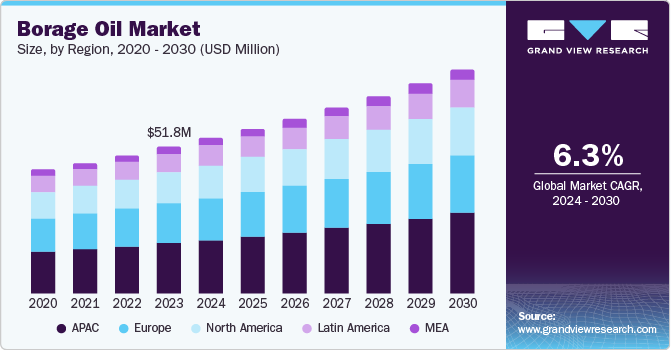

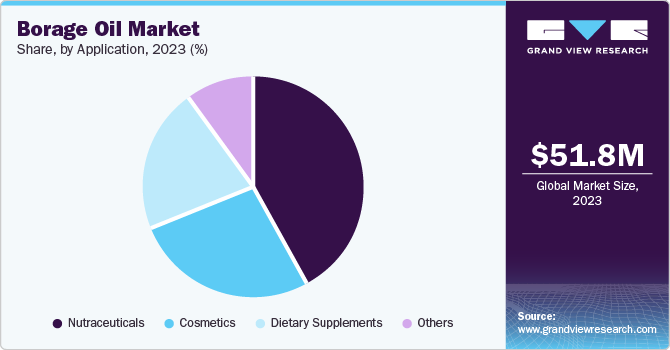

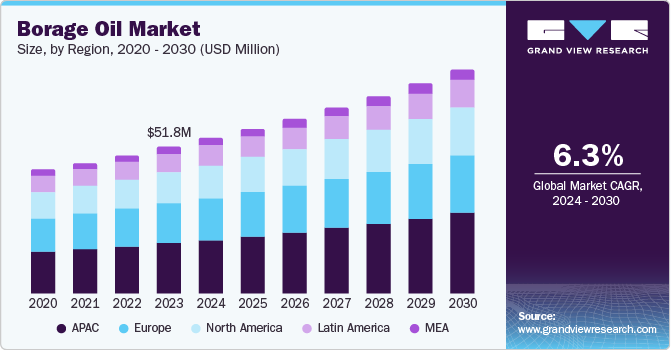

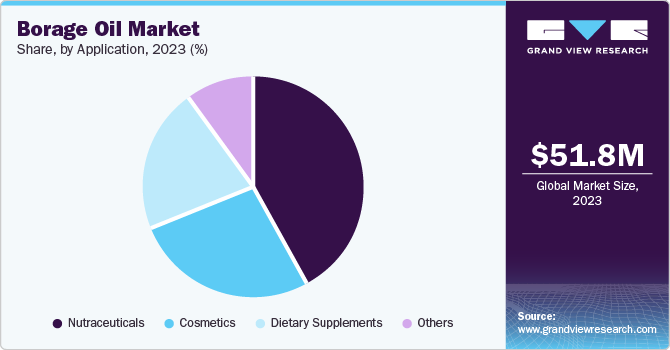

The global borage oil market size was valued at USD 51.8 million in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The market surge is attributable to the increasing demand for natural and organic-based cosmetics. Consumers have become increasingly conscious of the ingredients in their skincare and beauty products, leading to a demand in the popularity of borage oil. This oil is known for its anti-inflammatory and antioxidant properties. It is widely used in the production of skincare, hair treatment, and anti-aging products, making it a sought-after ingredient in the cosmetics industry.

Another major factor propelling the market is the rising awareness of the health benefits associated with borage oil. Borage oil consists of 20% to 25% gamma-linolenic acid (GLA) content and is known for its potential to support skin health, manage conditions including eczema and psoriasis, and promote overall well-being. This characteristic has led to its increased use as a dietary supplement in capsule and liquid forms. Direct or indirect supplementation of borage oil can be effective in treating and preventing health disorders related to fatty acid metabolism. The growing interest in natural and plant-based health supplements has significantly contributed to the market’s expansion.

Furthermore, the pharmaceutical industry has also played a crucial role in the growth of the borage oil market. The oil’s therapeutic properties are valued in developing various pharmaceutical products. Its anti-inflammatory and antioxidant benefits are leveraged in treatments for skin conditions and other health issues, driving demand in this sector. Additionally, the expansion of the global medical sector and the increasing investment in research and development to discover new applications for borage oil have further driven the market.

However, the market faces several challenges such as price fluctuations and supply chain issues. The global supply chain for borage oil can be affected by various factors, including climatic conditions and geopolitical issues, which can impact the availability and cost of the oil. Despite these challenges, the market continues to grow, driven by the strong demand across various industries.

Application Insights

Nutraceuticals dominated the market share in 2023 with the increasing consumer awareness about the health benefits associated with borage oil. Rich in GLA, an omega-6 fatty acid, borage oil is known for its anti-inflammatory and antioxidant properties, which are beneficial for managing conditions such as arthritis, eczema, and cardiovascular health. In this sector, borage oil, used in supplements, including capsules, soft gels, and liquid formulations, has fueled the market demand. In addition, the dominance of nutraceuticals in the borage oil market also aligns with the broader shift towards preventive healthcare and natural remedies as consumers increasingly seek plant-based alternatives to traditional pharmaceuticals.

The cosmetics sectoris projected to emerge as the fastest-growing segment at a CAGR of 6.2% during the forecast period. This growth can be attributed to the increasing consumer demand for natural and plant-based ingredients in skincare and beauty products. Borage oil consists of hydration, anti-inflammatory, and skin-regenerating properties which make it useful in this sector. Additionally, the natural oil's potential to improve problem-prone skin, and skin elasticity, reduce fine lines, and soothe conditions including eczema and rosacea and alignment with clean beauty trend has driven its adoption in premium skincare products.

Regional Insights

The North America borage oil market held 21.3% of the share in 2023. Continuous efforts by research institutions to identify the medical potential of borage oil are expected to enhance overall consumption levels over the forecast period. The region has also starflower (borage) oil consumption for food applications including dietary supplements and functional food additives.

U.S. Borage Oil Market Trends

The U.S. borage oil market was primarily driven by the clean beauty movement. Consumers have increasingly sought transparency and sustainability in their beauty products. Borage oil, being a natural and sustainable ingredient, aligns with these values and is being incorporated into a wide range of skincare and cosmetic products. This trend is further supported by advancements in extraction and formulation technologies, which have enhanced the efficacy and appeal of borage oil-based products.

Asia Pacific Borage Oil Market Trends

The Asia Pacific borage oil market secured the dominant share with 34.9% of the global revenue in 2023 owing to increasing consumer demand for natural and organic products. As consumers in the region become more health-conscious and environmentally aware, the market observed a growing preference for products that are free from synthetic chemicals and additives. Borage oil with its high GLA content, is highly valued for its anti-inflammatory and antioxidant properties, making it a popular ingredient in natural skincare and health products.

China Borage Oil Market Trends

China borage oil market was driven by the rising awareness of health benefits. Consumers have increasingly sought dietary supplements of borage oil as preventive healthcare to support skin health, reduce inflammation, and manage conditions such as eczema and arthritis. In addition, the growing interest in self-care has driven the demand for borage oil-based nutraceuticals.

Europe Borage Oil Market Trends

The borage oil market in Europe held 27.0% of the global revenue share in 2023 owing to its favorable weather and soil conditions. UK-grown starflower is considered to be the best quality seed on account of its high oil and GLA content. The region is expected to witness high demand from cosmetic applications owing to the presence of large skincare and haircare manufacturers including L’Oréal and Unilever. These companies have focused more on bio-based cosmetic development which is expected to affect product demand.

Key Borage Oil Company Insights

The global borage oil market is fragmented in nature due to the presence of numerous small-scale manufacturers. The product quality primarily depends on the GLA content. Seeds obtained from the UK and Canada are considered as the best quality. Manufacturers strive to obtain high-quality seeds to gain a competitive advantage with premium applications. Key market participants such as AOS Products Private Limited, Connoils LLC., K.K. Enterprise,Avestia Pharma, and others have undertaken several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

AOS Products Pvt. Ltd. is an Indian company that deals with the production and distribution of essential oils, aromatic chemicals, and natural extracts. The company offers cold-pressed, organic borage oil, which is known for its purity and quality. The company focuses on sustainable sourcing and extraction methods to produce high-grade borage oil that meets international standards.

-

ConnOils By Kraft is a global supplier of specialty ingredients, including a wide range of nutritional oils.The company specializes in the sourcing, processing, and distribution of high-quality oils and oil powders for various industries, including dietary supplements, food and beverage, and personal care.

Key Borage Oil Companies:

The following are the leading companies in the borage oil market. These companies collectively hold the largest market share and dictate industry trends.

- AOS Products Pvt. Ltd.

- ConnOils By Kraft

- Icelandirect, LLC

- K.K. ENTERPRISE

- Parchem

- William Hodgson and Co

- Avestia Pharma

- Nordic Naturals

- Kerfoot Group

- Soyatech International

- USANA Health Sciences Inc.

Recent Development

-

In 2023, USANA launched the Celavive Postbiotic Barrier Balm, a new addition to their skincare line that features borage oil as a key ingredient. This product is designed to enhance skin health by leveraging the anti-inflammatory and moisturizing properties of borage oil, which is rich in GLA.

Borage Oil Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 54.9 million

|

|

Revenue forecast in 2030

|

USD 79.0 million

|

|

Growth rate

|

CAGR of 6.3% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD Thousand and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India

|

|

Key companies profiled

|

AOS Products Pvt. Ltd.; ConnOils By Kraft; Icelandirect, LLC; K.K. ENTERPRISE; Parchem; William Hodgson and Co; Avestia Pharma; Nordic Naturals; Kerfoot Group; Soyatech International; USANA Health Sciences Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Borage Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global borage oil market report based on application, and region:

-

Application Outlook (Revenue, USD Thousand, 2018 - 2030) (Volume in Tons)

-

Cosmetics

-

Nutraceuticals

-

Dietary Supplements

-

Others

-

Regional Outlook (Revenue, USD Thousand, 2018 - 2030) (Volume in Tons)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

MEA