Brazil Draught Beer Market Summary

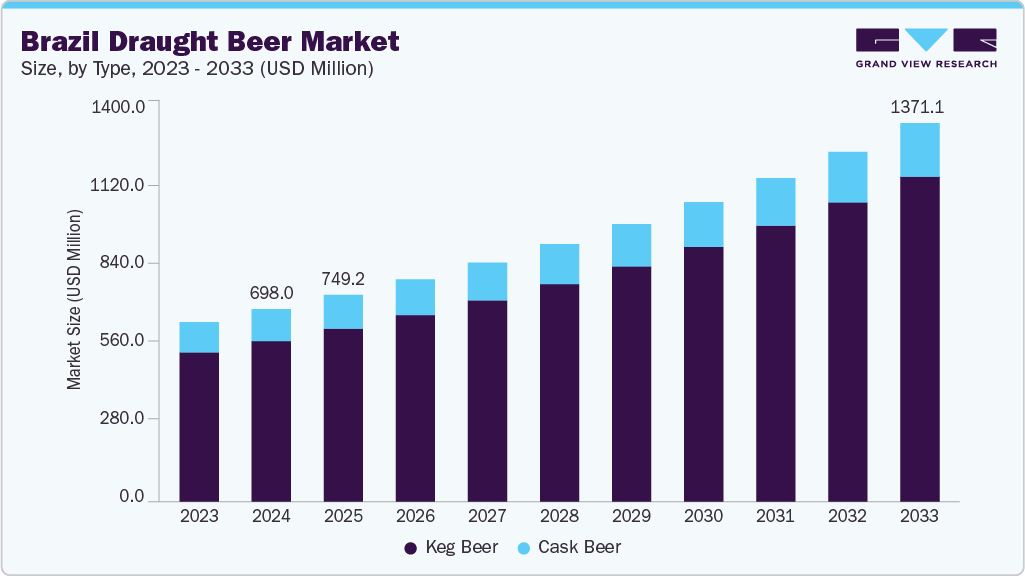

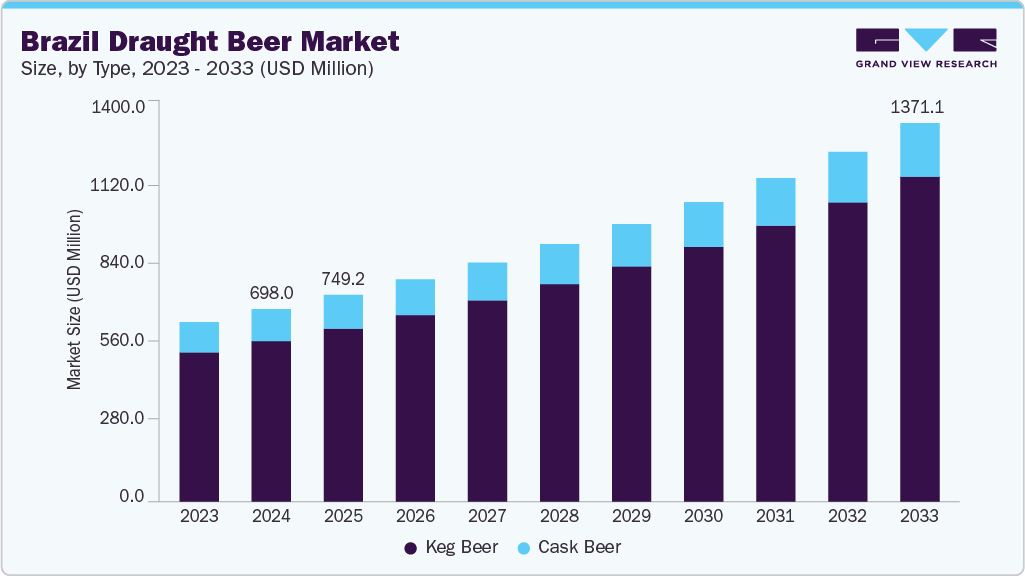

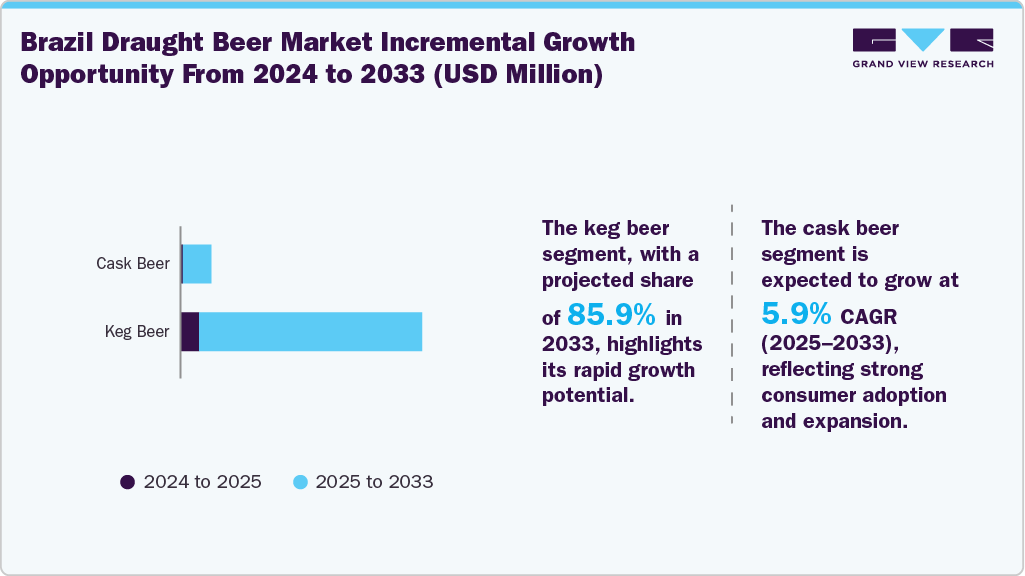

The Brazil draught beer market size was estimated at USD 698.0 million in 2024 and is projected to reach USD 1,371.1 million by 2033, growing at a CAGR of 7.8% from 2025 to 2033. The rising popularity of premium and craft beer among Brazilian consumers is expected to drive market growth.

Key Market Trends & Insights

- By type, the keg draught beer segment held the highest market share of 83.3% in 2024.

- Based on category, the premium segment held the highest market share in 2024.

- Based on end use, the commercial segment accounted for the largest share of 86.5% in 2024.

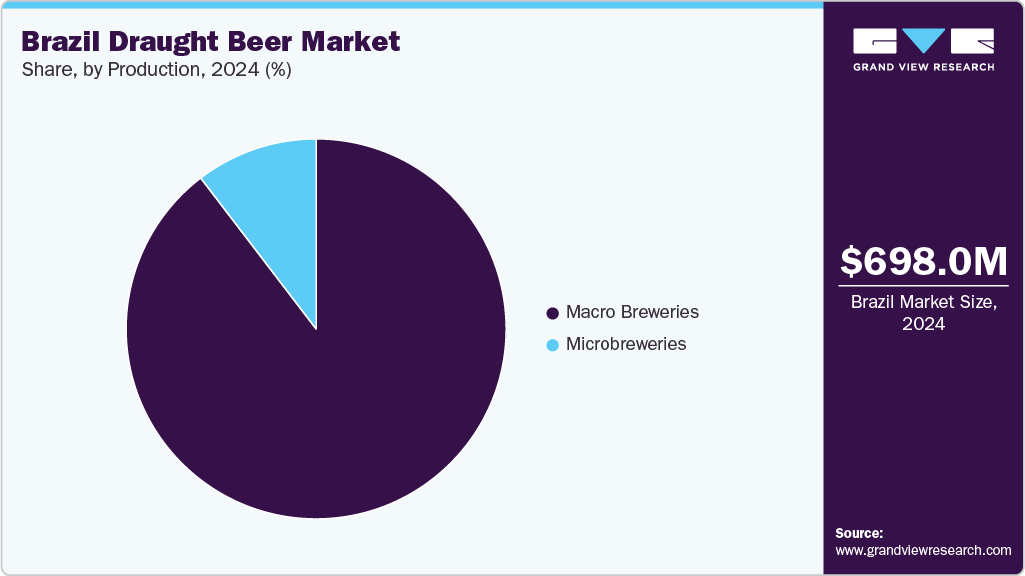

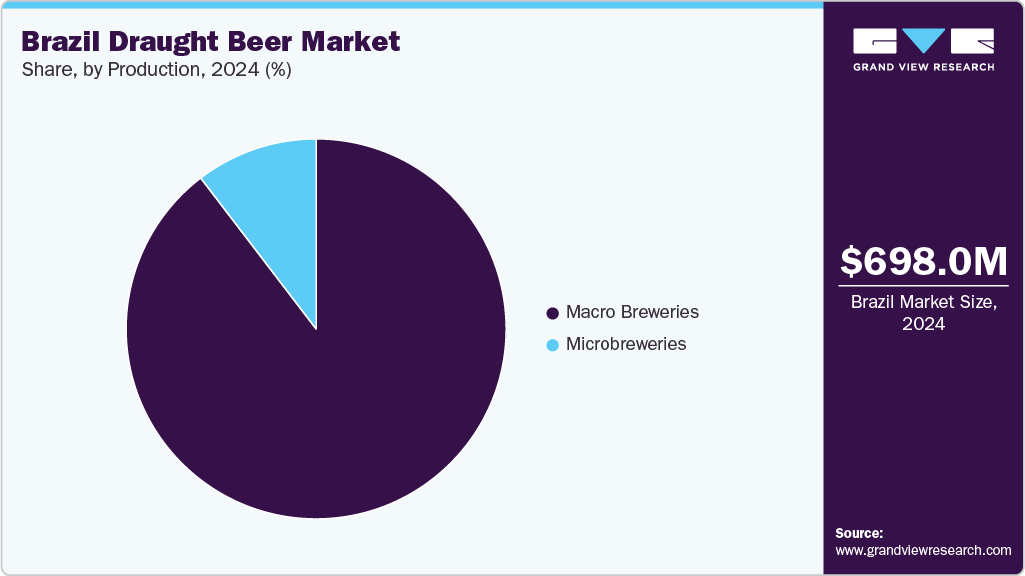

- Based on production, the macro breweries segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 698.0 Million

- 2033 Projected Market Size: USD 1,371.1 Million

- CAGR (2025-2033): 7.8%

As tastes evolve, there is a growing demand for unique flavors and artisanal brewing techniques, especially among younger demographics and urban populations. The expansion of on-trade consumption channels, such as bars, pubs, and restaurants. Draught beer is often associated with social experiences and fresh quality, making it a preferred choice in hospitality venues. The post-pandemic revival of nightlife and dining out has further boosted demand, especially in major cities such as São Paulo and Rio de Janeiro.

Numerous popular beer competitions and events in Brazil serve as platforms for craft brewers to exhibit their unique brewing styles and products. These events attract both enthusiasts and professionals in the brewing industry, providing an opportunity for brewers to gain recognition and exposure for their creations.

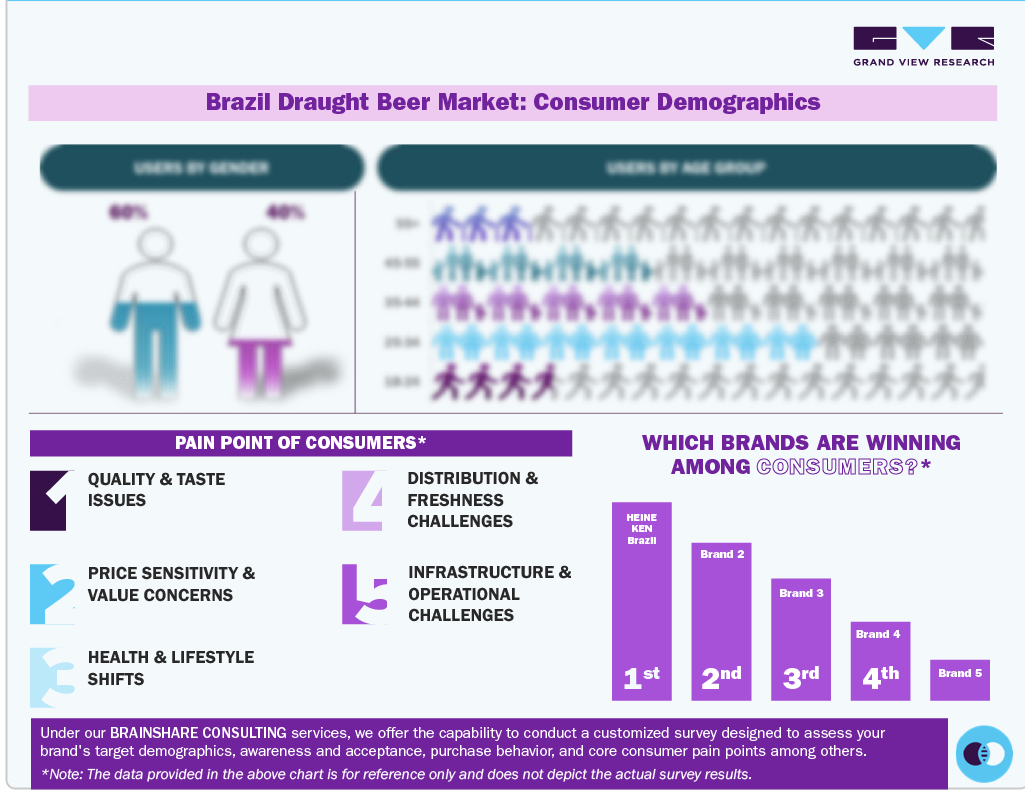

Consumer Insights

In Brazil, draught beer holds a prominent place in the country's vibrant culture, especially in social and on-premise settings such as botecos, bars, and churrascarias. As of 2025, Brazil's population stands at approximately 212.8 million. Surveys indicate that roughly 40-45% of Brazilian adults consume beer regularly, reflecting beer's strong cultural relevance. These regular beer drinkers show a clear preference for draught beer when drinking outside the home, driven by its freshness, flavor, and the communal experience it offers in Brazil's sociable environments.

In Brazil, gender dynamics play a significant role in beer consumption patterns, including preferences for draught beer in social settings. While beer has traditionally been more popular among men, recent trends show a growing number of Brazilian women participating in beer culture, driven by the rise of inclusive marketing, craft beer movements, and changing social norms. Among both men and women who consume beer, draught beer is often favored in bars and restaurants due to its freshness and the social experience it enhances. This shift reflects a broader cultural trend toward gender inclusivity in Brazil’s vibrant beer scene.

Type Insights

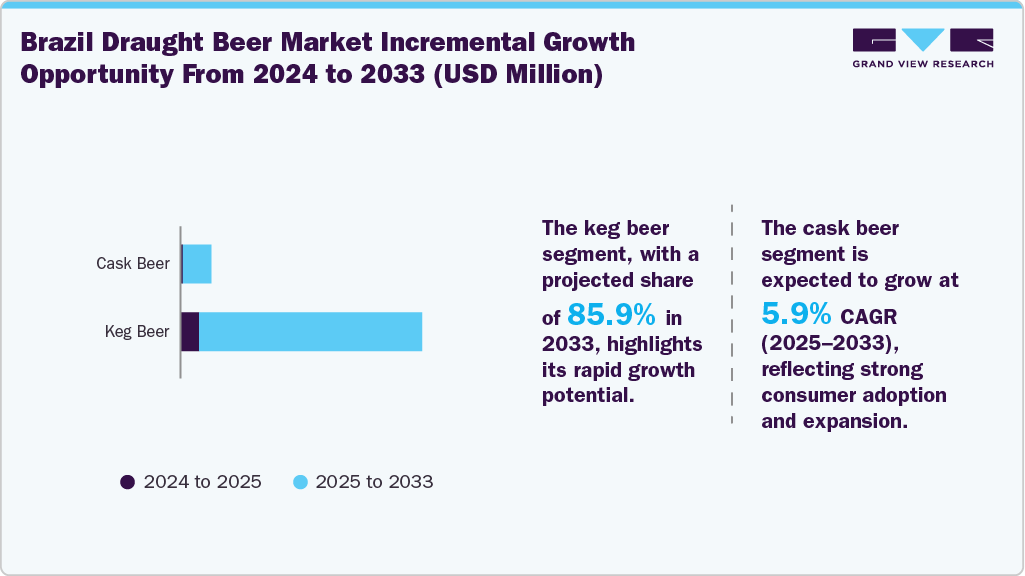

Keg draught beer dominated Brazil’s draught beer market, accounting for a share of 83.3% in 2024, and is expected to be the fastest-growing segment over the forecast period. The segment's growth is attributed to its widespread adoption across on-trade channels, particularly bars, pubs, and restaurants, where its cost-efficiency and consistent quality offer clear advantages over other formats. Additionally, advances in keg technology-such as improved cooling systems and recyclable or lightweight materials-further enhance its appeal among distributors and retailers seeking operational efficiency and sustainability.

The cask beer segment is expected to grow significantly over the forecast period. This growth is being driven by increasing consumer demand for authentic, unfiltered beer experiences, particularly among craft beer enthusiasts and premium hospitality venues. Cask beer, often considered a hallmark of artisanal brewing, is gaining traction due to its unique characteristics-such as natural carbonation and room-temperature service, which offer a distinctive taste profile compared to conventional keg or bottled options. Furthermore, the rising popularity of brewpubs and taproom culture in urban centers is contributing to a steady expansion of the cask beer market.

Category Insights

Premium draught beer accounted for the largest share, 49.3%, in 2024. This dominance reflects a significant shift in consumer preferences toward higher-quality, flavor-rich offerings and an increasing willingness to pay a premium for enhanced taste and craftsmanship. The rising popularity of boutique breweries, innovative beer styles, and branded experiences in upscale bars and restaurants has fueled the segment’s growth. Urban consumers, in particular, are driving this trend, seeking artisanal and imported options that align with evolving lifestyle and social consumption patterns.

The super-premium segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by evolving consumer preferences and a rising appetite for ultra-premium beverage experiences. This trend reflects a broader shift toward exclusivity, craftsmanship, and the pursuit of niche, high-quality offerings among affluent and trend-conscious consumers. Moreover, expanding disposable incomes and aspirational consumption behavior in urban centers fuel demand for rare, imported, and limited-edition draught beer offerings.

End Use Insights

Commercial use of draught beer in Brazil accounted for the largest revenue share of 86.5% in 2024. The segment growth is attributed to the widespread adoption of draught beer systems across restaurants, pubs, bars, and entertainment venues where high-volume dispensing, freshness, and efficient service are prioritized. The segment’s strength is further supported by the rise in social and leisure activities, growth in organized hospitality chains, and consumer preference for freshly served beverages. Additionally, commercial establishments continue to benefit from economies of scale and brand partnerships, enabling them to offer a wide range of beer formats-from regular and premium to super-premium and craft variants-at competitive price points.

The home use segment is expected to grow at the fastest CAGR over the forecast period. This growth is fueled by several key factors, including increased adoption of personal keg systems, countertop draft dispensers, and subscription-based craft beer deliveries. Consumers are increasingly seeking to replicate bar-quality experiences in the comfort of their homes, especially amid lifestyle changes emphasizing convenience, personalization, and social entertaining. The surge in e-commerce platforms and digital retailing has made it easier for consumers to access a wide variety of draught beer options, from local microbrews to international labels.

Production Insights

Draught beer manufactured through macro breweries accounted for the largest share of 89.6% in 2024. This substantial market share underscores macro breweries' pivotal role in meeting the country’s high-volume demand, particularly across commercial establishments such as bars, restaurants, and event venues. Macro breweries benefit from strong brand recognition, expansive logistics networks, and economies of scale, allowing them to offer consistent quality at competitive prices. Their ability to supply a wide array of beer formats-including regular, premium, and super-premium variants-has further solidified their position across diverse consumer segments. Additionally, strategic partnerships with hospitality chains and aggressive marketing campaigns have contributed to widespread penetration and brand loyalty.

The microbreweries segment is expected to grow at the fastest CAGR of 10.1% from 2025 to 2033. The segment growth is driven by evolving consumer preferences and the rising popularity of artisanal and locally brewed beverages. This growth reflects a broader cultural shift toward authenticity, craftsmanship, and variety in beer offerings, particularly among younger and urban demographics.

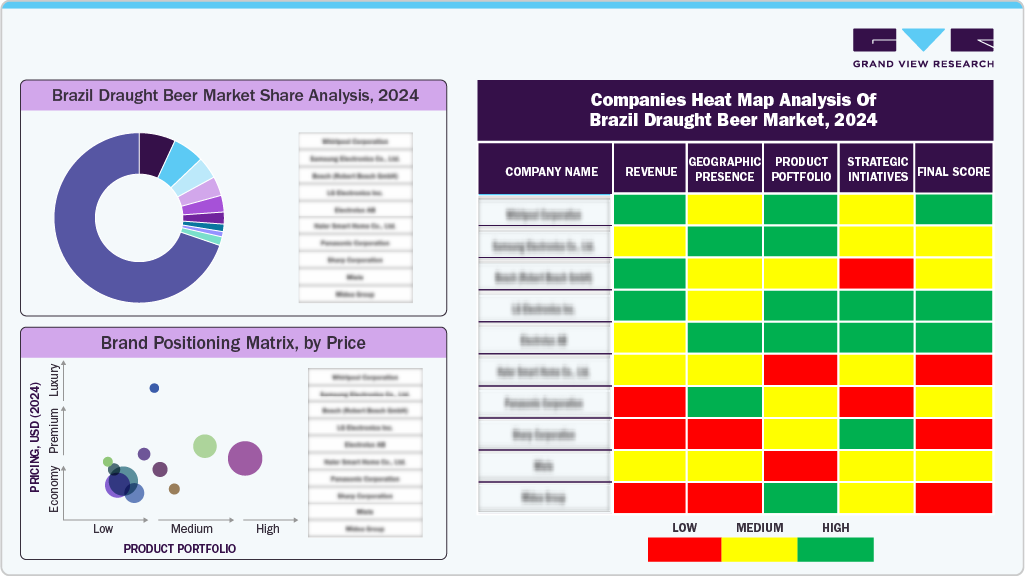

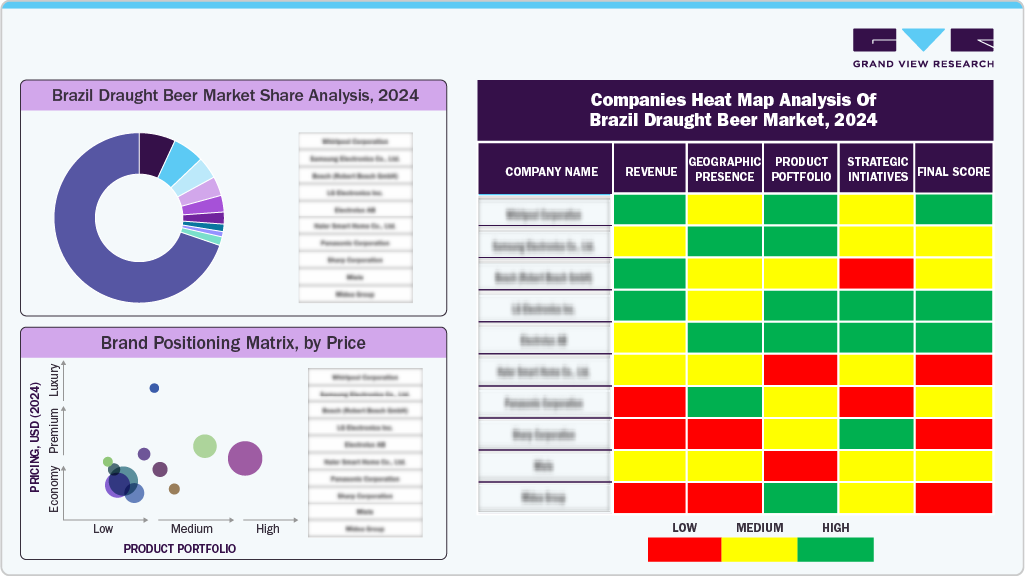

Key Brazil Draught Beer Company Insights

Some of the key companies operating in Brazil draught beer industry include Anheuser-Busch Companies LLC, HEINEKEN Brazil, Carlsberg Breweries A/S, Way Beer, Dama Bier, and others.

-

HEINEKEN Brazil has rapidly expanded its footprint, notably with the 2017 acquisition of Brasil Kirin. Today, it operates 15 breweries across 11 Brazilian states, supplying a diverse range of beer brands with a strong focus on premium products.

Key Brazil Draught Beer Companies:

- Anheuser-Busch Companies LLC

- HEINEKEN Brazil

- Carlsberg Breweries A/S

- Way Beer

- Novo Brazil Brewing & Nova Kombucha

- Dama Bier

Brazil Draught Beer Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 749.2 million

|

|

Revenue forecast in 2033

|

USD 1,371.1 million

|

|

Growth rate

|

CAGR of 7.8% from 2025 to 2033

|

|

Actuals

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, category, end use, production

|

|

Key companies profiled

|

Anheuser-Busch Companies LLC, HEINEKEN Brazil; Carlsberg Breweries A/S; Way Beer; Novo Brazil Brewing & Nova; Kombucha; Dama Bier

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Brazil Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Brazil draught beer market report based on type, category, end use, and production:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Production Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries