- Home

- »

- Medical Devices

- »

-

Brazil Therapeutic Respiratory Devices Market Report, 2030GVR Report cover

![Brazil Therapeutic Respiratory Devices Market Size, Share & Trends Report]()

Brazil Therapeutic Respiratory Devices Market Size, Share & Trends Analysis Report By Product (Oxygen Concentrator, Nebulizer, Humidifier), By Technology Type, By Filter, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-087-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

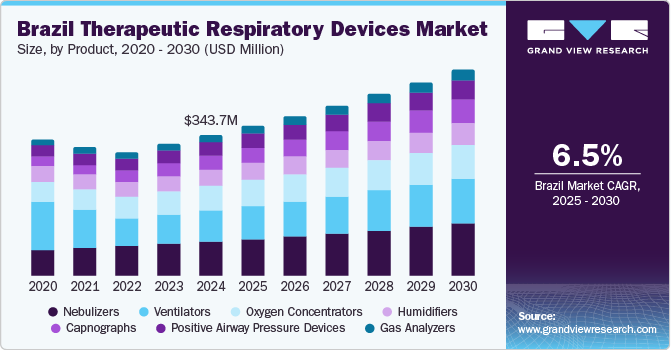

The Brazil therapeutic respiratory devices market size was valued at USD 302.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The use of respiratory devices is primarily focused on treating respiratory diseases such as asthma and COPD. With an increase in patient populations, the sales of respiratory devices have been growing. The aging population is also a contributing factor, as COPD is more common among older adults. According to a BMJ journal article from 2019, Brazil has a high incidence and prevalence of COPD, affecting around 8 million individuals. Over the forecast period, this is expected to drive the demand for therapeutic respiratory devices in the country.

Furthermore, product types such as nebulizers and ventilators have many smaller to large-size competitors relative to other markets because these devices rely less on drug approvals, ultimately leading to supporting the market for further expansion. Market competitors continue to dominate through their strong relationships with physicians and the launch of new devices. For instance, according to April 2022, news event from CAIRE Inc., the company launched two new products, namely, Companion 5 and NewLife Intensity 10 Stationary Concentrators, in Brazil in July after receiving the go-ahead for from ANVISA, the Brazilian health regulatory agency.

The therapeutic respiratory devices market is boosted by government and private initiatives. For instance, in April 2020, Vyaire Medical secured a contract worth USD 50 million from the Brazilian Ministry of Health. The contract aimed to produce 4,300 iX5 ventilators by June 2020 to address the COVID-19 pandemic. This initiative highlights the vital role of respiratory devices in tackling the challenges posed by the COVID-19 pandemic.

The COVID-19 pandemic had a positive impact on the market to some extent. In several ways, the COVID-19 epidemic was beneficial for the market. Non-essential healthcare services and procedures were postponed or canceled initially due to shelter-in-place orders. However, connected care businesses saw an increase in demand, which was advantageous for major players in the industry. For instance, Philips N.V. reported positive growth in its connected care businesses during the first half of 2020, including the ventilator portfolio. The demand for COVID-19 has grown, which has contributed to this development. According to Philips N.V.'s 2020 annual report, despite the pandemic's overall effects on the company, it managed to grow comparable sales by 3% and produce a healthy cash flow of EUR 1.9 billion.

Therapeutic respiratory devices for home healthcare have drawn much attention from notable international manufacturers and growing vendors. For instance, Philips provides home ventilation options to demonstrate their dedication to conveniently serving patients in their homes. This emphasis on home healthcare reflects the rising understanding of the significance of patient access to easy respiratory care.

Product Insights

Based on product, the Brazil therapeutic respiratory devices market is segmented into nebulizers, humidifiers, oxygen concentrators, positive airway pressure devices, ventilators, gas analyzers, and capnographs. The oxygen concentrators segment accounted for a revenue share of 17.2% in 2022. This can be attributed to technological advancements in respiratory devices, increasing prevalence of respiratory diseases, growing demand for home oxygen therapy, a rise in the aging population, and high tobacco consumption, among other factors.

On the other hand, capnographs are anticipated to witness rapid growth at a CAGR of 10.5% during the forecast period. The use of capnography in treating respiratory disorders is anticipated to enhance the medical effectiveness of these devices for patient monitoring, owing to their increased reliability and efficacy.

Technology Type Insights

Based on technology type, the Brazil therapeutic respiratory devices market is segmented into electrostatic filtration, HEPA filter technology, hollow fiber filtration, and microsphere separation. The electrostatic filtration segment accounted for the highest revenue share of 35.6% in 2022. The increasing awareness of the importance of protection against air pollution has resulted in higher sales of electrostatic filtration products. Additionally, governments are investing in R&D to develop more advanced technologies suitable for commercial use, which is expected to drive the growth of this segment.

The HEPA filter segment holds the second position in the market. HEPA filters are widely used in various therapeutic respiratory devices for particle removal and retention. Compliance with CDC requirements necessitates the inclusion of HEPA filtration technology in therapeutic equipment for air filtration. The prevalence of respiratory disorders and the way they are transmitted are among the factors contributing to the demand for HEPA filters.

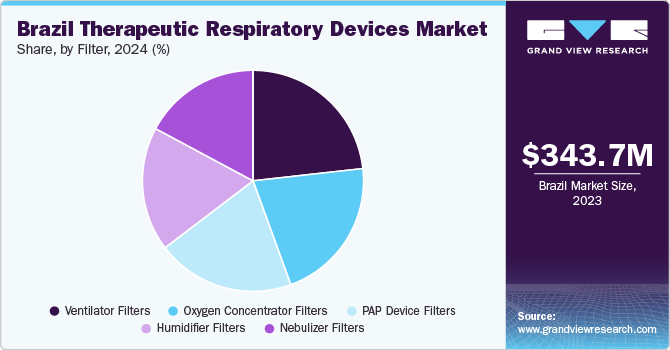

Filter Insights

Based on filter, the Brazil therapeutic respiratory devices market is segmented into nebulizer filters, humidifier filters, positive airway pressure device filters, oxygen concentrator filters, and ventilator filters. The increasing prevalence of respiratory diseases such as COPD and asthma, which are among the major factors driving the use of ventilators, is expected to have a significant impact on the ventilator filter market, accounting for 23.4% of revenue share in 2022. Additionally, it is anticipated that the market for homecare ventilators would benefit from the increase in demand for in-home healthcare, which will eventually have a beneficial impact on the ventilator filter market.

Using a humidifier increases air humidity and offers protection against environmental dryness. Demand for humidifier equipment is expected to rise as consumers become more aware of ailments including sinusitis, asthma, and specific allergies. As a result, it drives the growth of the humidifier filters market.

The humidifier filters segment is expected to grow rapidly with a CAGR of 7.9% during the forecast period. Increasing awareness of sinusitis, asthma, and allergies among consumers is driving the demand for humidifiers. These devices help increase air humidity and protect against dry environments. As a result, the market for humidifier filters is anticipated to expand.

Key Companies & Market Share Insights

In the market for respiratory devices, products like nebulizers and ventilators have a wide range of competitors, varying in size. Unlike other markets, these devices rely less on drug approvals, which supports further market expansion. Competitors in this market maintain dominance through strong physician relationships and the introduction of new devices. For example, in April 2022, CAIRE Inc. launched two new products, Companion 5 and NewLife Intensity 10 Stationary Concentrators, in Brazil. These products received regulatory approval from ANVISA, the Brazilian health regulatory agency, allowing their entry into the market.

Furthermore, the market is anticipated to see fierce rivalry due to the huge number of startups looking for opportunities in this sector. For instance, according to April 2020 news event, a startup based in São Paulo, Magnamed, will produce 6,500 ventilators by August 2020 for use in treating COVID-19 patients, working in partnership with a pool of leading Brazilian and multinational corporations supported by FAPESP. An increase in such initiatives supporting the startup's entry into the market is anticipated to bring in competition. Some prominent players in the Brazil therapeutic respiratory devices market include:

-

Koninklijke Philips NV

-

Medtronic

-

Masimo

-

Chart Industries

-

Hamilton Medical

-

BD (Becton, Dickinson and Company)

-

ResMed Inc.

-

General Electric Company (GE HealthCare)

-

Drägerwerk AG & Co. KGaA

-

Fisher & Paykel Healthcare Limited

Brazil Therapeutic Respiratory Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 502.7 million

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology type, filter

Country scope

Brazil

Key companies profiled

Koninklijke Philips NV; Medtronic; Masimo; Chart Industries; Hamilton Medical; BD (Becton, Dickinson and Company); ResMed Inc.; General Electric Company (GE HealthCare); Drägerwerk AG & Co. KGaA; Fisher & Paykel Healthcare Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options.

Brazil Therapeutic Respiratory Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Brazil therapeutic respiratory devices market report based on product, technology type, and filter:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizers

-

Compressor-based

-

Piston-based hand-held

-

Ultrasonic

-

-

Humidifiers

-

Heated

-

Passover

-

Integrated

-

Built-in

-

Standalone

-

-

Oxygen Concentrators

-

Fixed

-

Portable

-

-

Positive Airway Pressure Devices

-

Continuous PAP

-

Auto-titrating PAP

-

Bi-level PAP

-

-

Ventilators

-

Adult

-

Neonatal

-

-

Gas Analyzers

-

Capnographs

-

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrostatic Filtration

-

HEPA Filter Technology

-

Hollow Fiber Filtration

-

Microsphere Separation

-

-

Filter Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizer Filters

-

Inlet Filters

-

Replacement Filters

-

Cabinet Filters

-

-

Humidifier Filters

-

Wick Filters

-

Permanent Cleanable Filters

-

Mineral Absorption Pads

-

Demineralization Cartridges

-

-

PAP Device Filters

-

Ultra Fine Foam Inlet Filters

-

Polyester Non-Woven Fiber Filters

-

Acrylic & Polypropylene Fiber Filters

-

-

Oxygen Concentrator Filters

-

HEPA Filters

-

Cabinet Filters

-

Pre-Inlet Filters

-

Inlet Filters

-

Felt Intake Filters

-

Bacterial Filters

-

Hollow Membrane Filters

-

Micro Disk Filters

-

-

Ventilator Filters

-

Mechanical Filters

-

HEPA Filters

-

ULPA Filters

-

Activated Carbon Filters

-

-

Electrostatic Filters

-

Tribocharged Filters

-

Fibrillated Filters

-

-

-

Frequently Asked Questions About This Report

b. The Brazil therapeutic respiratory devices market size was estimated at USD 302.4 million in 2022 and is expected to reach USD 322.6 million in 2023.

b. The Brazil therapeutic respiratory devices market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 502.7 million by 2030.

b. The electrostatic filtration segment accounted for the highest revenue share of 35.6% in 2022. The increasing awareness of the importance of protection against air pollution has resulted in higher sales of electrostatic filtration products. Additionally, governments are investing in research and development to develop more advanced technologies suitable for commercial use, which is expected to drive the growth of this segment.

b. Some key players operating in the Brazil therapeutic respiratory devices market include Koninklijke Philips NV; Medtronic; Masimo; Chart Industries; Hamilton Medical; BD (Becton, Dickinson and Company); ResMed Inc.; General Electric Company (GE HealthCare); Drägerwerk AG & Co. KGaA; and Fisher & Paykel Healthcare Limited.

b. Key factors that are driving the market growth include technological advancements in respiratory devices, rising prevalence of respiratory diseases, increasing demand for home oxygen therapy, growing aging population, high tobacco consumption, and government and private initiatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."