- Home

- »

- Automotive & Transportation

- »

-

Brazil Third-party Logistics Market Size, Share, Report, 2030GVR Report cover

![Brazil Third-party Logistics Market Size, Share & Trends Report]()

Brazil Third-party Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (DTM, ITM, VAL), By End-use (Retail, Manufacturing, Automotive), By Transport (Roadways, Railways, Waterways, Airways), And Segment Forecasts

- Report ID: GVR-4-68040-204-8

- Number of Report Pages: 219

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brazil Third-party Logistics Market Trends

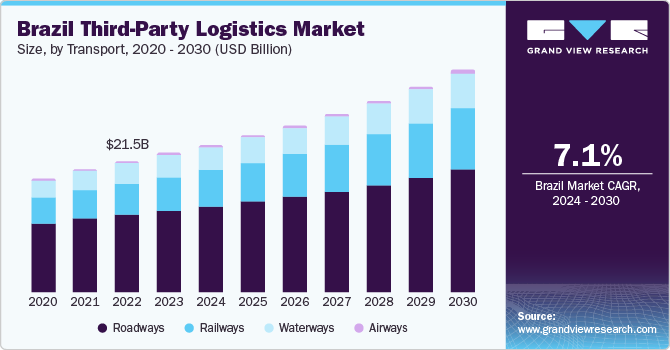

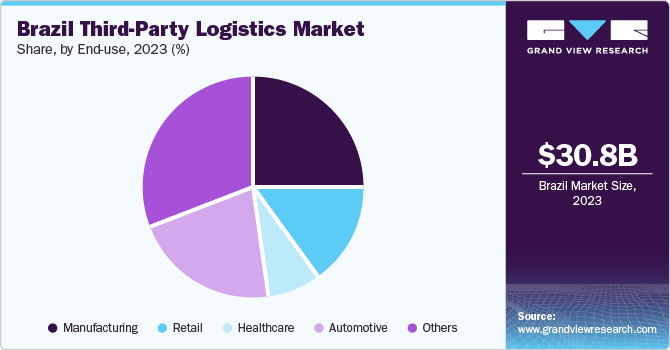

The Brazil third-party logistics market size was estimated at USD 30.75 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. As Brazil is the largest economy as well as geographically the largest and most populous country in South America, it has a range of diverse industries including manufacturing, agriculture, and services sector. These diverse industries demand logistics services across various sectors, which in turn, is driving the growth of the market. The thriving e-commerce industry as well as the development of new technologies are anticipated to contribute to the growth of the market. In 2023, the Brazil third-party logistics market accounted for 2.75% of the global third-party logistics (3PL) market.

The manufacturing sector in Brazil is witnessing growth due to the increasing demand in the automotive and retail sectors. The automobile and retailer companies are taking advantage of the decreased exchange rates by increasing their export leading to an increase in production activity. This has led to an increase in the demand for logistics, which has resulted in the growth of the market. The thriving e-commerce industry in Brazil, which is anticipated to grow at a rapid pace also demands a more diverse logistics network for a geographically vast and diverse country such as Brazil. The younger generation preferring more online purchases has also fueled the market growth.

Brazil has a vast network of highways, the Brazilian Association of Highway Concessionaires (ABCR) report states that truck traffic has increased by 60% in the last 20 years. Truck traffic contributes mainly to the logistics industry and is vital to the logistics industry as railways are used very less relatively. The transportation sector is adopting energy efficiency thereby reducing carbon footprint. The government is investing in transport infrastructure, which is anticipated to fuel the market growth.

The 3PL companies have now switched their attention from long-haul delivery to just-in-time delivery. The suppliers now prefer a single warehouse location rather than different storage facilities. To assist accommodate an increase in last-mile delivery, the 3PL companies are investing in compact-sized trucks and vans, which support more frequent and shorter deliveries. Last-mile delivery is anticipated to be among the important areas of focus for 3PL companies. Fourth-party logistics (4PL) is the next iteration of 3PL that can manage infrastructure, technology, resources, and external 3PL to provide a holistic supply chain solution.

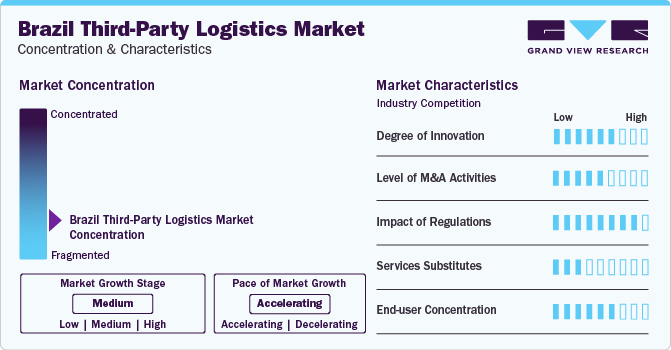

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. The adoption of advanced technologies such as blockchain, artificial intelligence, and predictive analytics significantly marks innovation in the target market. These innovations have streamlined supply chain operations, enhanced visibility, and optimized overall efficiency for both third-party logistics service providers and their clients. Fourth-party logistics (4PL) is the step ahead that can manage resources, infrastructure, technology, and even external 3PL to provide a holistic supply chain solution.

The target market is also witnessing high level of mergers & acquisitions by the key players. The mergers and acquisitions (M&A) in the 3PL market is due to the desire to achieve strategic expansion and market consolidation. These activities enable the key players to expand their service offerings, increase geographical reach, and achieve economies of scale. Through acquisition of complementary competitor businesses, these key players try to strengthen their position in competition, enhance operational efficiency, and profit from synergies within the evolving and dynamic landscape of the market.

The target market is also subject to increasing regulatory scrutiny. The 3PL market faces increasing regulatory scrutiny as the Brazil government has strict regulatory customs laws, which focus on transparency and accountability within supply chain operations. Increased concerns regarding data security, privacy, and compliance with international trade regulations are driving regulatory bodies to monitor the activities of 3PL providers closely. Stricter enforcement measures and evolving legal frameworks are shaping the regulatory landscape, necessitating adaptability and compliance from companies operating in the dynamic 3PL sector.

While there is a restricted availability of direct service substitutes for 3PL, various alternative methods and technologies, such as in-house logistics management, wherein companies internally manage their supply chain functions, and the advent of 4PL providers that deliver enhanced coordination and management throughout the entire supply chain, can impact the 3PL market. Technological advancements have facilitated the growth of digital platforms connecting shippers directly with carriers, offering a more decentralized and flexible transportation solution. Collaborative supply chain networks, involving multiple organizations pooling resources to share transportation, storage, and distribution capabilities, also act as substitutes for conventional 3PL services.

End-user concentration is one of the significant factors in the target market. End-user industry concentration in the 3PL market varies, with sectors such as retail, agriculture, and automotive demonstrating notable dependence on 3PL services for supply chain management (SCM). These industries often leverage 3PL providers to optimize inventory, transportation, and distribution processes, enhancing overall operational efficiency.

Service Insights

The international transportation management (ITM) segment held the largest market share of 36.68% in 2023. The increasing global economic activities and the growth of the e-commerce sector have led to an increase in demand for ITM services. Cross-border transport activities and policies related to trade liberalization have increased international trade, thereby propelling the segment growth. Free Trade Agreements (FTAs) are propelling the international transportation demand. The Mercosur preferential trade agreement is an example of rising multilateral free-trade agreements. Several free-trade agreements such as MERCOSUR-Southern African Customs Union (SACU) and EU-Mercosur Trade agreement are influencing the demand for international transportation services.

The value-added logistics services (VALs) segment is anticipated to witness the fastest CAGR of 9.4% over the forecast period. The value-added services are services that can include order fulfillment, inventory management, packaging, and reverse logistics, which are customized according to the customer’s requirements. As Brazil is diverse, the potential for VALs is high, which is anticipated to result in market growth.

Transport Insights

The roadways segment dominated the Brazil 3PL market with a share of over 58.78% in 2023. The success of the model of private partnerships and increased emphasis on supply chain infrastructure are expected to drive the growth of roadways over the forecast period. In addition, several government initiatives are fueling the growth of the road transportation segment.

The railways segment is anticipated to witness the fastest CAGR of 8.6% over the forecast period. The federal government plans to invest US$32.1 billion to build, repair, and modernize Brazil’s railroads, which account for only 20% of the total cargo transport. The government plans to increase the 20% share by investing in infrastructure and repairing railways.

End-use Insights

The manufacturing sector held the largest revenue share of 24.61% in 2023. Manufacturing and logistics are mutually dependent as the industry has a complex supply chain process. In manufacturing sector, raw materials are procured from different parts and resources from different parts of the country. The logistics activity becomes complex with the participation of different distributors and suppliers. Thereby, the manufacturing sector is outsourcing the logistics activities because of the advantages offered by it such as vendor and inventory management, decreased transportation costs, supply chain visibility, business process development, and enhanced customer services. The buoyant manufacturing sector in Brazil has witnessed an increase in outsourced logistics activities.

The retail sector is anticipated to witness the fastest CAGR of 8.8% over the forecast period. Logistics and SCM are the cornerstone of the modern retail industry, playing an important part in same-day fulfillment and delivery capabilities. Dedicated logistics services and E-retailing have enabled medium-scale companies to foray in the 3PL market, thereby aiding the retail companies in the expansion of their offerings and operations in semi-urban areas. Furthermore, 3PL offers flexibility to retail businesses to develop new logistics, enhance capabilities, and expand their presence.

Key Brazil Third-party Logistics Company Insights

Some of the key companies operating in the Brazil third-party logistics market include Fox Brasil, Nippon Express, and FedEx among others.

-

Freight quotes for international shipments have heretofore often been time-consuming and burdensome for customers forced to make inquiries by e-mail or telephone. The newly developed "e-NX Quote" by Nippon Express provides instant freight quotes by online entry of such information as the types and quantities of the goods to be shipped and their origins/destinations.

-

Fox Brasil is a midsize air freight company. Launched in 2002, the company is located in São Paulo SP, Brazil. Their team focuses on air freight, freight forwarding, logistics & supply chain consulting, ocean freight, and more.

BBM Logistica and Panalpina. are some of the emerging market participants in the target market.

-

BBM Logistica SA is a Brazil-based company involved in providing a TMS (Transportation Management System) system as well as monitoring and training tools that allow control of operations, such as steering simulators, internal and external cameras on trucks, and monitoring technology. tires with sensors.

-

Panalpina, a midsize air freight company, is in Sao Paulo, Brazil. Their services include air freight, freight forwarding, logistics & supply chain consulting, ocean freight, and more.

Key Brazil Third-party Logistics Companies:

- Gafor Logistica SA

- Nippon Express

- BBM Logistica

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DSV

- DB Schenker Logistics

- FedEx

- Kuehne + Nagel

- Deutsch Post AG

Recent Developments

-

In November 2023, Nippon Express entered into a strategic partnership with Cryoport Systems, a group company of the US-based specialized pharmaceutical carrier Cryoport, Inc., to provide the global pharmaceutical industry with cryogenic (-150°C or lower) transport services for cellular raw materials and regenerative medicine products.

-

In February 2023, DB Schenker and MSC sealed an important biofuel deal to help reduce supply chain emissions. DB Schenker is expanding its green ocean freight services and has secured an arrangement to use 12,000 metric tons of biofuel components for all of its own consolidated cargo, less-than-container load (LCL), full-container-load (FCL) and refrigerated containers (reefer containers), from MSC Mediterranean Shipping Company, the world’s largest container line.

Brazil Third-party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.62 billion

Revenue forecast in 2030

USD 49.11 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Historical data

2017 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, transport, end-use

Country scope

Brazil

Key companies profiled

Gafor Logistica SA; Nippon Express; BBM Logistica; C.H. Robinson Worldwide, Inc.; CEVA Logistics; DSV; DB Schenker Logistics; FedEx; Kuehne + Nagel; Deutsch Post AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Brazil Third-party Logistics Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Brazil third-party logistics market report based on service, transport, and end-use:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Freight forwarding

-

Domestic Transportation Management (DTM)

-

International Transportation Management (ITM)

-

Warehousing & Distribution (W&D)

-

Value Added Logistics Services (VALs)

-

-

Transport Outlook (Revenue, USD Billion, 2017 - 2030)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Retail

-

Healthcare

-

Automotive

-

Others

-

Frequently Asked Questions About This Report

b. The Brazil third-party logistics market size was estimated at USD 30.75 billion in 2023 and is expected to reach USD 32.62 billion in 2024.

b. The Brazil third-party logistics market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 49.11 billion by 2030.

b. The international transportation management (ITM) segment held the largest market share of 36.68% in 2023. The increasing global economic activities and the growth of the e-commerce sector have led to an increase in demand for ITM services.

b. Some prominent companies in the Brazil 3PL market include: Gafor Logistica SA, Nippon Express, BBM Logistica, C.H. Robinson Worldwide, Inc., CEVA Logistics, DSV, DB Schenker Logistics, FedEx, Kuehne + Nagel, and Deutsch Post AG.

b. The growth of the Brazil third-party logistics market is propelled by the country's various industries, including manufacturing and agriculture, demanding efficient logistics services, coupled with the thriving e-commerce industry and technological advancements. Factors such as increased manufacturing activities, a vast highway network, government investments in transport infrastructure, and a strategic shift towards environmentally conscious transportation practices contribute to the market's expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.