- Home

- »

- Automotive & Transportation

- »

-

Reverse Logistics Market Size, Share, Industry Report, 2033GVR Report cover

![Reverse Logistics Market Size, Share & Trends Report]()

Reverse Logistics Market (2025 - 2033) Size, Share & Trends Analysis Report By Return Type (B2B Returns and Commercial Returns, Repairable Returns), By Service (Transportation, Warehousing), By End User Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-941-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Reverse Logistics Market Summary

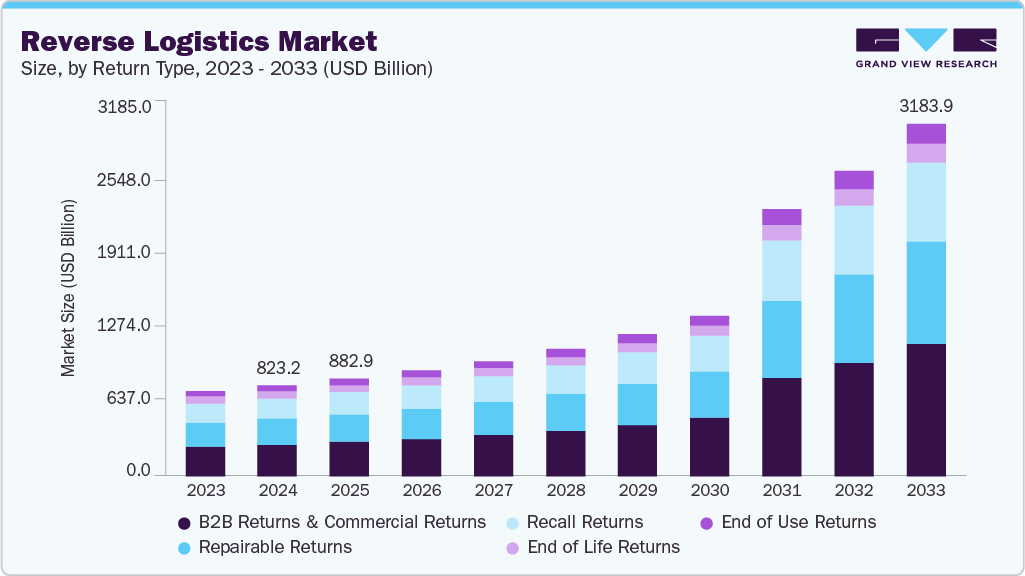

The global reverse logistics market size was estimated at USD 823.21 billion in 2024 and is projected to reach USD 3,183.94 billion by 2033, growing at a CAGR of 17.4% from 2025 to 2033. The global expansion of e-commerce businesses and the increasing frequency of returns and replacements of products have propelled the demand for reverse logistics services.

Key Market Trends & Insights

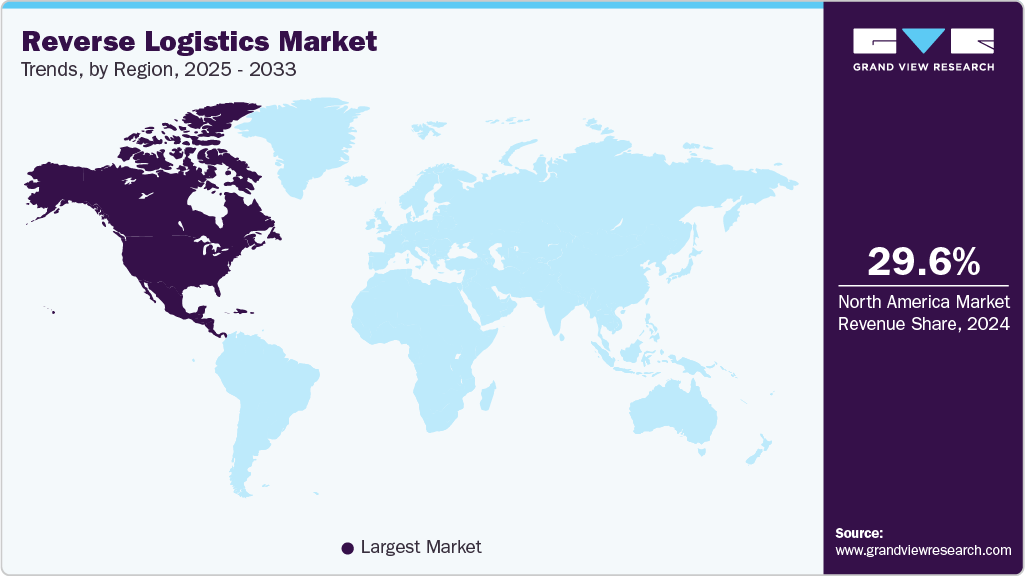

- The North America reverse logistics market held a significant revenue share in 2024.

- The reverse logistics industry in the U.S. held a dominant position in 2024.

- By return type, the B2B returns and commercial returns segment accounted for the largest share of 35.1% in 2024.

- By services, the transportation segment held the largest market share in 2024.

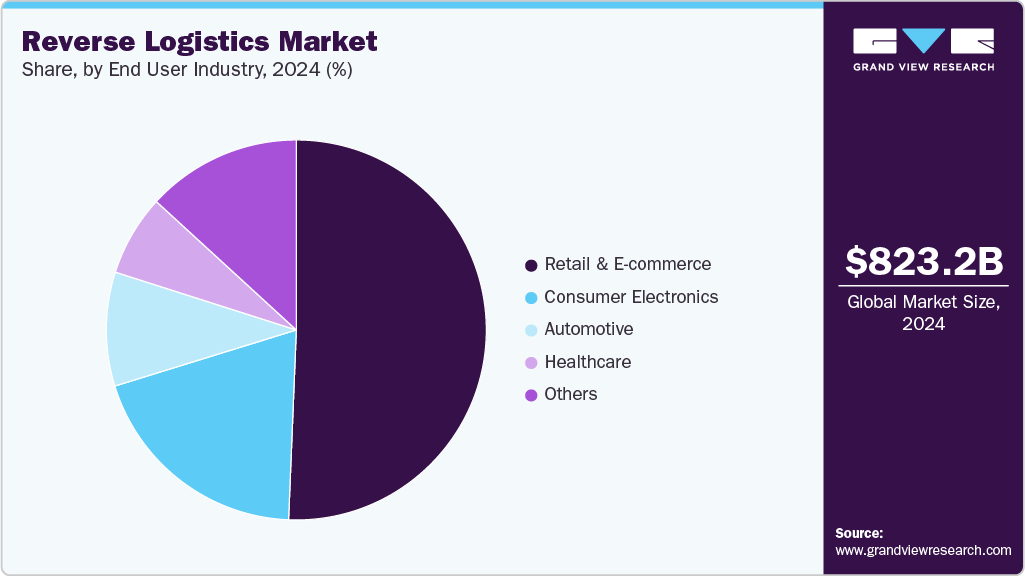

- By end user industry, the retail & e-commerce segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 823.21 Billion

- 2033 Projected Market Size: USD 3,183.94 Billion

- CAGR (2025-2033): 17.4%

- North America: Largest market in 2024

Increasing product recalls due to strict government rules and product quality standards is expected to boost market growth. The e-commerce service providers emphasize reverse logistics as certain customers prefer to initially analyze the ordered products physically and then decide whether to keep them. If the product is not worth buying, customers can return it with the help of reverse logistics. For instance, buyers can only test clothing after making a purchase decision, especially for online shopping.The increasing use of advanced technologies such as Automation, Robotics, and Augmented Reality has enabled e-commerce companies to excel in efficiency and reachability. An increasing number of consumers prefer online purchasing over in-store purchasing owing to benefits such as convenience, lead time, cost, and variety of choices. E-commerce businesses significantly depend on shipping and warehousing capabilities to transfer products from retailers or manufacturing units to end-users in a shorter lead time.

Automation can route customer return requests, create packaging and labeling materials, reduce wait times for returning items to physical stores, and offer customers the option to return orders by mail, among others. Companies can use robotic process automation to contact consumers once the return request is initiated or to complete the return process and audit all operations efficiently. Automation can provide transparency in the return process to ensure that customers remain updated on the process once they raise a request for a return, exchange, or submit a warranty claim. Moreover, it helps in preventing fraud in the returns process.

Return Type Insights

The B2B returns and commercial returns segment accounted for the largest revenue share of 35.1% in 2024. B2B returns and commercial returns have experienced significant growth within the realm of reverse logistics. This growth can be attributed to various factors that have influenced the dynamics of the industry. One of the primary drivers behind the rise in B2B returns is the increasing emphasis on sustainability and environmental responsibility. As companies become more aware of their environmental impact, they actively seek ways to reduce waste and adopt sustainable practices. This has led to a greater focus on managing returned products efficiently and responsibly. B2B returns, which involve products being returned from one business to another, have become a critical aspect of reverse logistics as companies strive to minimize their carbon footprint.

The repairable returns segment is expected to grow at a significant CAGR during the forecast period. Repair and return refer to fixing defective merchandise and shipping it back to the buyer. Some clients only desire the repair and return of a damaged item rather than a replacement. If a client does not want the item returned after the repairs are performed, the item can be brought back into circulation; in such cases, the total price of returns is decreased. The rising awareness and emphasis on sustainability have played a significant role in driving the growth of repairable returns. As companies and consumers become more environmentally conscious, minimizing waste and extending the lifecycle of products is greatly desired. Repairable Returns offer a viable solution by allowing returned items to be fixed and put back into circulation, reducing the need for new product manufacturing.

Service Insights

The transportation segment held the largest revenue share of 46.1% in 2024. A reliable transportation network offers improved logistics performance, reduced overall operating costs, and fosters better customer service, which is crucial for dealing with product returns. In reverse logistics, transportation refers to transporting and distributing returned or replaced merchandise. The increase in e-commerce and online shopping has led to a surge in the volume of returned products. Therefore, businesses require reliable transportation services to facilitate the movement of these goods from the customer back to the seller or manufacturer. The transportation service segment is crucial in ensuring that returned products are efficiently collected, sorted, and transported to the appropriate locations for further processing.

The warehousing segment is expected to grow at a significant CAGR during the forecast period. Warehousing in reverse logistics refers to storing returns, replacements, end-of-use or end-of-life products, and unsold merchandise. The increase in product returns, particularly in the e-commerce sector, has necessitated the growth of warehousing services in reverse logistics. With the rise of online shopping, customers can return products they are dissatisfied with or that are damaged or faulty. This surge in returns requires efficient warehousing solutions to accommodate the influx of returned goods. Warehouses play a critical role in providing temporary storage and managing the inventory of these products until they are processed, repaired, or disposed of.

End User Industry Insights

The retail & e-commerce segment dominated the market in 2024. The retail and e-commerce end-user industry segment has experienced significant growth within reverse logistics. This segment specifically focuses on managing product returns within the retail and e-commerce sectors. Several factors have contributed to the expansion of this segment. E-commerce has transformed the retail landscape and significantly impacted reverse logistics. With the increasing popularity of online shopping, customers have the convenience of purchasing products remotely. However, this has also led to a higher volume of product returns.

The automotive segment is projected to grow at a significant CAGR of 17.9% over the forecast period. Many stakeholders are impacted by automotive recalls, including car owners, automakers, component manufacturers, franchised dealers, insurers, and government authorities. However, reverse logistics is essential in the automobile sector for several reasons, including legal policies surrounding ecological and environmental issues. In addition, the vehicle manufacturer is responsible for maintaining the product after its useful life has expired due to the composition of ecologically sensitive components in automobiles. Some factors responsible for automotive recalls include emission recalls, electric vehicle battery defects, and electronic component defects. The significance of reverse logistics in the automotive sector increases due to all these factors and the growing awareness of consumers regarding the environment.

Regional Insights

The North America reverse logistics market held a significant revenue share in 2024. The reverse logistics market in the region is driven by the rapid expansion of online retail, rising customer expectations for seamless returns, and the push for more sustainable supply chains. Furthermore, the integration of AI, blockchain, and IoT technologies is helping companies track returns more accurately, reduce turnaround times, and enhance customer satisfaction while controlling operational costs.

U.S. Reverse Logistics Market Trends

The U.S. reverse logistics market held a dominant position in 2024 due to the high volume of e-commerce transactions and growing consumer expectations for hassle-free returns. Major retailers such as Amazon and Walmart have invested heavily in advanced return management systems, automated warehouses, and data analytics to streamline reverse logistics operations.

Europe Reverse Logistics Market Trends

The Europe reverse logistics market was identified as a lucrative region in 2024. The reverse logistics market in Europe is growing steadily, underpinned by stringent environmental regulations, an increasing focus on sustainability, and the rise of e-commerce. The European Union’s circular economy initiatives, such as the Extended Producer Responsibility (EPR) and Waste Electrical and Electronic Equipment (WEEE) directives, are compelling companies to invest in efficient product return, recycling, and reuse systems.

The UK reverse logistics market is expected to grow rapidly in the coming years due to the business's aim to enhance customer satisfaction and comply with environmental regulations such as the Waste Electrical and Electronic Equipment (WEEE) Directive. The surge in online shopping has amplified the volume of returns, leading retailers and logistics firms to adopt tech-enabled solutions, including smart labeling, AI-based return forecasting, and centralized return hubs.

The Germany reverse logistics market held a substantial revenue share in 2024. The growth in the country is driven by strong regulatory enforcement, high environmental awareness, and advanced industrial infrastructure. The country leads in recycling and re-manufacturing practices, with strict laws on packaging and end-of-life product management.

Asia Pacific Reverse Logistics Market Trends

The Asia Pacific reverse logistics market is anticipated to grow at a CAGR of 18.6% during the forecast period. The region is anticipated to retain its dominance over the forecast period owing to the growing popularity of fashionable apparel among the young population. The growth is also driven by the high proliferation of the e-commerce industry and the rapid growth of e-commerce activities in countries such as India and China. The growing use of e-commerce results in increasing returns, which is expected to contribute to regional market growth.

Japan reverse logistics market is expected to grow rapidly in the coming years due to its strong culture of recycling, high-quality standards, and technological innovation. The country places significant emphasis on efficient product recovery, particularly in the automotive and electronics sectors, where take-back systems and parts reuse are well-established.

China reverse logistics market held a substantial revenue share in 2024. The growth of the market in the country is attributed to the explosive growth of e-commerce and increasing return rates from online shoppers. Leading platforms such as Alibaba and JD.com have developed sophisticated return and refund systems supported by AI and real-time tracking technologies.

Key Reverse Logistics Company Insights

Some key companies in the reverse logistics market include DB SCHENKER, Deutsche Post AG, FedEx Corporation, Kintetsu World Express, Inc., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

FedEx Corporation plays a significant role in reverse logistics by providing comprehensive solutions that transform product returns from a cost center into a strategic advantage. Its reverse logistics services encompass returns management, repair, refurbishment, recycling, and disposition management, helping businesses reduce waste, improve efficiency, and recover value from returned goods. FedEx leverages advanced technology platforms such as ReverseLogix RMS to streamline the returns process, enhance communication with customers, and provide real-time business intelligence.

-

DB Schenker is a logistics company actively advancing reverse logistics within the framework of the circular economy. As a diamond member of the Reverse Logistics Association, the company leverages its extensive expertise in returns management, particularly in the electronics sector, where it annually repairs over 2 million devices. DB Schenker has developed a specialized Circular Economy Logistics product line that integrates return initiation, screening, inspection, repair processing, and smart dispositioning into a modular, one-stop solution for customers worldwide. This service supports manufacturers in achieving their environmental, social, and governance (ESG) goals and enhances operational efficiency through consolidated returns management and low-carbon warehousing.

Key Reverse Logistics Companies:

The following are the leading companies in the reverse logistics market. These companies collectively hold the largest market share and dictate industry trends.

- DB SCHENKER (Deutsche Bahn AG)

- Deutsche Post AG

- FedEx Corporation

- Kintetsu World Express, Inc.

- United Parcel Service, Inc.

- Yusen Logistics Co., Ltd.

- RLG Systems AG

- Core Logistic Private Limited

- Safexpress Pvt. Ltd.

- C.H. Robinson Worldwide, Inc.

Recent Developments

-

In December 2024, RapidShyp formed a partnership with Delhivery to strengthen its reverse logistics capabilities, significantly enhancing its last-mile delivery services across India. Through this collaboration, RapidShyp now offers Delhivery’s express services to 18,700 pin codes, providing e-commerce sellers with a comprehensive, end-to-end logistics solution that includes both outgoing and return shipments. The integration of advanced reverse logistics ensures that businesses can efficiently manage product returns, minimizing operational disruptions and streamlining the entire delivery process.

-

In February 2024, Loop, a returns management platform, launched a suite of new reverse logistics offerings designed to transform retail operations and improve profit margins for merchants and logistics partners. These enhancements include expanded integrations with over 35 third-party logistics providers (3PLs), enabling faster and more transparent returns processing in warehouses.

Reverse Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 882.94 billion

Revenue forecast in 2033

USD 3,183.94 billion

Growth rate

CAGR of 17.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report service

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Return type, service, end user industry, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Argentina; GCC; and South Africa

Key companies profiled

DB SCHENKER (Deutsche Bahn AG); Deutsche Post AG; FedEx Corporation; Kintetsu World Express, Inc.; United Parcel Service, Inc.; Yusen Logistics Co., Ltd.; RLG Systems AG; Core Logistic Private Limited; Safexpress Pvt. Ltd.; C.H. Robinson Worldwide, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reverse Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global reverse logistics market report based on return type, service, end user industry, and region.

-

Return Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Recall Returns

-

B2B Returns and Commercial Returns

-

Repairable Returns

-

End of Use Returns

-

End of Life Returns

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Transportation

-

Warehousing

-

Reselling

-

Replacement Management

-

Refund Management

-

Others

-

-

End User Industry Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail & E-commerce

-

Clothing

-

Electronic Devices

-

Footwear

-

Home Décor

-

Others

-

-

Automotive

-

Spare Parts

-

Lubricants

-

Vehicle Accessories

-

-

Consumer Electronics

-

Refrigerator

-

Television

-

Air-Conditioner

-

Grinder

-

Others

-

-

Healthcare

-

Medicine

-

Personal Care Products

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reverse logistics market size was estimated at USD 823.21 billion in 2024 and is expected to reach USD 882.94 billion in 2025.

b. The global reverse logistics market is expected to grow at a compound annual growth rate of 17.4% from 2025 to 2033 to reach USD 3,183.94 billion by 2033.

b. The Asia Pacific dominated the reverse logistics market with a share of 53.7% in 2024. This is attributable to the increasing usage of e-commerce and increasing demand for reverse logistics for electric vehicles.

b. Some key players operating in the reverse logistics market include DB SCHENKER (Deutsche Bahn AG); Deutsche Post AG; FedEx Corporation; Kintetsu World Express, Inc.; United Parcel Service, Inc.; Yusen Logistics Co., Ltd.; RLG Systems AG; Core Logistic Private Limited; Safexpress Pvt. Ltd.; C.H. Robinson Worldwide, Inc.

b. Key factors that are driving the reverse logistics market growth include the increasing adoption of reverse logistics by numerous companies, rising awareness of the benefits of reverse logistics, and growing awareness towards the environment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.