- Home

- »

- Clinical Diagnostics

- »

-

Breast Cancer Diagnostics Market Size & Share Report 2030GVR Report cover

![Breast Cancer Diagnostics Market Size, Share & Trends Report]()

Breast Cancer Diagnostics Market Size, Share & Trends Analysis Report By Product (Platform-based, Instrument-based), By Type (Imaging, Biopsy, Genomic Tests, Blood Tests), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-694-3

- Number of Pages: 190

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global breast cancer diagnostics market size was valued at USD 4.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The market is anticipated to witness growth due to the rising incidence of breast cancer, which is recognized as one of the most prevalent cancers worldwide. According to the American Cancer Society, it is estimated that approximately 281,550 new cases of breast cancer will be diagnosed in 2021, with an expected 49,290 related deaths in the U.S. alone. Globally, breast cancer has been identified by the WHO as the most common type of cancer, with new cases surpassing 2.3 million in 2021. These statistics highlight the urgent need for advanced breast cancer diagnostic solutions to facilitate early detection, accurate prognosis, and effective treatment strategies.

Aging is one of the greatest risk factors for breast cancer. With age, the immune system is affected. This increases susceptibility to various diseases. Hence, the geriatric population requires better healthcare services, especially for the treatment/management of chronic conditions such as breast cancer. According to Cancer Treatment Centers of America, women above 60 years of age are more likely to be diagnosed with breast cancer. Breast cancer is the most commonly occurring cancer among women and its prevalence is substantially increasing in developing economies, where the maximum number of cases are being diagnosed at later stages. Even though it is considered to be a disease more widespread in developed economies, about 50% of cases and 58% of deaths due to breast cancer occur in developing countries. This is expected to boost the demand for breast cancer diagnostics in developing economies over the forecast period.

Technological advancements have played a crucial role in enhancing breast cancer diagnostics, enabling earlier detection and more precise treatment strategies. Notable advancements include digital mammography, which utilizes X-rays to create detailed breast images, offering improved image quality and visualization through image manipulation. Another innovation is 3D mammography, also known as digital breast tomosynthesis, which provides a more accurate assessment of breast abnormalities. The growing demand for technologically advanced products is expected to drive market growth, as they offer benefits such as accuracy, speed, and cost-effectiveness. One such area witnessing rapid growth is Direct-to-Consumer (DTC) testing in the market. Companies such as 23andMe recently received U.S. FDA approval for the first DTC test for BRCA gene mutations, which increase the risk of breast and ovarian cancers.

Advancements in minimally invasive procedures have revolutionized breast cancer diagnostics, with techniques such as stereotactic and ultrasound-guided biopsies allowing precise tissue sampling without the need for surgery. These procedures can also be utilized for image-guided tumor ablation, effectively destroying cancer cells while minimizing damage to healthy tissues. The demand for cancer diagnosis tools is increasing worldwide due to technological advancements. Support from regulatory bodies such as the FDA for the development of cancer biomarkers & mass cytometry, the launch of innovative flow cytometry reagents for drug discovery & diagnosis, and the development of technologically advanced miniaturized devices for portability & precision are driving the market growth. Moreover, initiatives to develop novel imaging solutions for more accurate cancer diagnosis are fueling market growth, such as the collaboration between Radiopharm Theranostics and The University of Texas MD Anderson Cancer Center to develop radiopharmaceutical products.

Early detection of breast cancer is key to effective management of the disease. It can result in improved quality of life, provide several treatment options, and increase the survival rate. According to a 2021 article published in Research Fast Facts, regular screening and early detection with mammography can decrease breast cancer rates by around 30%. Furthermore, research conducted to develop tests that can detect breast cancer as early as possible is expected to boost market growth. For instance, in November 2019, a study was conducted by researchers at the University of Nottingham to develop a blood test that detects breast cancer 5 years before its occurrence. In this study, screening technology was used to rapidly screen blood samples to determine the presence of antibodies against 40 Tumor-Associated Antigens (TAAs).

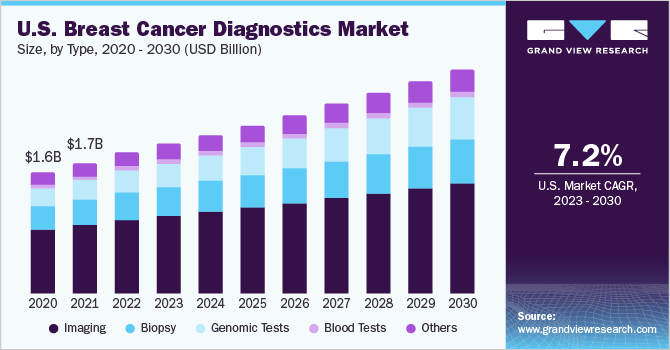

Type Insights

On the basis of type, the market is segmented into imaging, biopsy, genomic tests, blood tests, and others. The imaging segment dominated the overall market with a revenue share of 52.74% in 2022. The breast cancer diagnostics market witnessed significant growth in 2022 due to the widespread adoption of imaging techniques like mammography, ultrasound, and MRI. These modalities have become the primary tools for breast cancer diagnosis, while advanced technologies such as MBI, CT, 3D breast tomosynthesis, and PET show great potential for transforming breast imaging capabilities.

In October 2022, the American College of Radiology (ACR), in collaboration with GE Healthcare and the Breast Cancer Research Foundation, launched the Contrast-Enhanced Mammography Imaging Screening Trial (CMIST). This trial aims to evaluate the effectiveness of contrast-enhanced mammography as a screening tool for breast cancer.

The blood test segment is anticipated to grow at the fastest growth rate over the forecast period with a CAGR of 9.9% driven by extensive research studies conducted by research organizations and major players. The high effectiveness of liquid biopsy tests contributes to the growth in the number of blood tests. In April 2023, Syantra achieved CE Mark approval for its breast cancer test, utilizing the Syantra DX Liquid Biopsy Platform, which offers a blood-based method for breast cancer detection. This milestone signifies significant progress in improving diagnostics for breast cancer screening.

Product Insights

On the basis of product, the market is segmented into platform-based products and instruments-based products. The instrument-based products segment dominated the overall market with a revenue share of 71.8% in 2022. It is further segmented into biopsy and imaging. Breast cancer diagnosis heavily relies on widely utilized techniques and products. To raise awareness about breast cancer, promote early detection, and educate people about treatment options, various organizations, including the National Breast Cancer Foundation, are actively undertaking initiatives. Imaging stands as the preferred method for population-based screening of breast cancer patients.

The platform-based products segment is anticipated to grow at a CAGR of 9.3% over the forecast period. Platform-based products are segmented into Next-generation Sequencing (NGS), PCR, microarrays, and others. This segment is anticipated to exhibit a CAGR of 9.3%, owing to wide application in laboratories and is preferred for low false-positive rates. Moreover, these tests are also useful in directing the patients toward a therapy better suited for their genetic makeup and type of disease.

Application Insights

On the basis of application, the market is segmented into screening, diagnostic & predictive, prognostic, and research. The diagnostic & predictive segment dominated the overall market with a revenue share of 48.4% in 2022. The diagnostic stage of breast cancer involves various tests, such as biopsies, MRI, CT scans, & PET scans, to confirm the presence of breast cancer and assess tumor characteristics. These tests are crucial for guiding treatment decisions and gathering essential information about the disease. As the breast cancer diagnostic market becomes increasingly competitive, there is a growing focus on predictive diagnosis.

The prognostic segment is expected to grow at a CAGR of 8.4% over the forecast period. The increasing importance of prognostic tests in matching patients with appropriate therapies has significantly improved survival rates. Companion diagnostics, such as BRACAnalysis CDx by Myriad Genetic Laboratories, Inc.; PD-L1 IHC 22C3 pharmDx by Dako North America, Inc.; and Foundation One CDx by Foundation Medicine, Inc., play a crucial role in this process. Exact Sciences presented novel long-term patient results in multi-cancer early detection and breast cancer recurrence testing at the American Society of Clinical Oncology (ASCO) 2023. The analysis of the SEER program reaffirms the continued confidence in the prognostic value of the Oncotype DX Breast Recurrence Score 3.

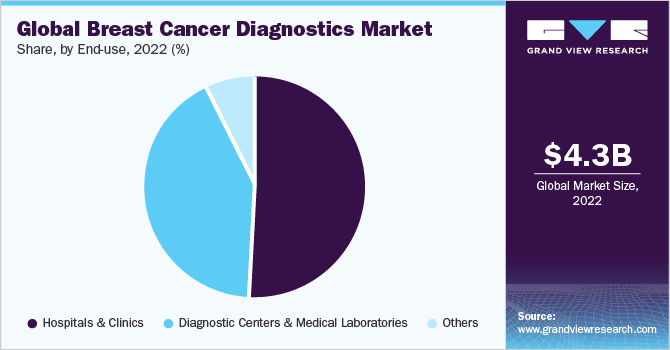

End-use Insights

On the basis of end-use, the market is segmented into hospitals & clinics, diagnostics centers & medical laboratories, and others. The hospitals & clinics segment dominated the overall market with a revenue share of 50.6% in 2022 due to the rising number of hospitalizations and increasing burden of breast cancer. These healthcare facilities play a critical role in conducting biopsy procedures after the initial screening tests, while advanced imaging technologies such as PET, CT, & MRI are utilized for effective disease monitoring and treatment evaluation.

The medical labs & diagnostics centers segment is anticipated to grow at the fastest growth rate over the forecast period with a CAGR of 8.1%. An increase in the number of initiatives undertaken by governments to provide various services, such as reimbursement for diagnostic tests, is expected to boost market growth. Many healthcare institutions are working with laboratories to integrate different tests, such as mammography, ultrasound, and MRI.

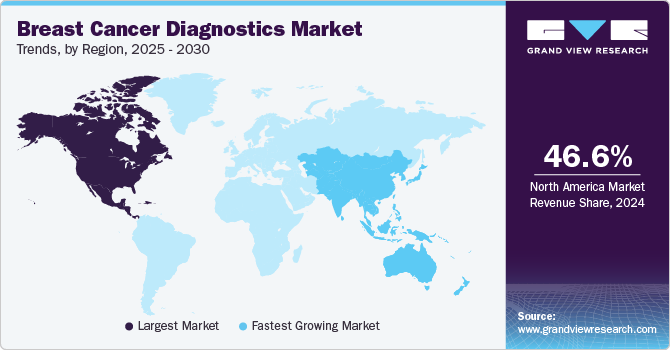

Regional Insights

North America dominated the market with a revenue share of 45.8% in terms of revenue in 2022. The growth can be attributed to the increasing prevalence of breast cancer and rising government initiatives to increase the screening & diagnostic rate. For instance, according to the American Cancer Society, there were approximately 49,290 breast cancer-related fatalities in the U.S. in 2021, with an expected 281,550 new cases of breast cancer being diagnosed. The U.S. held the largest market share of the market in North America. The growth can be attributed to the increasing prevalence of breast cancer and rising government initiatives aimed at enhancing screening & diagnostic rates in the country. There is a growing demand for technologically advanced products that offer improved accuracy, speed, and cost-effectiveness, which is expected to drive market growth over the forecast period.

Asia Pacific market is expected to grow at a lucrative rate owing to various factors, such as increasing healthcare reforms, rising incidence of breast cancer, significant R&D investments in breast cancer therapies, and advancements in breast imaging technologies. Breast cancer is the most commonly diagnosed cancer in most Asian countries, with incidence rates rising at a faster rate compared to Western countries due to lifestyle and dietary changes. The CDC highlights breast cancer as a prevalent cancer among women, regardless of ethnicity or race. The rising prevalence of breast cancer, coupled with the development of healthcare infrastructure in Asia Pacific, is expected to drive overall market growth.

Key Companies & Market Share Insights

The key companies are adopting strategies such as mergers and acquisitions and partnerships, to acquire a larger market share, globally. In May 2023, Thermo Fisher Scientific and Pfizer entered into a strategic partnership to enhance the global availability of NGS-based testing for cancer patients. This partnership aims to expand localized access to advanced genomic diagnostics, empowering international markets with improved capabilities for precision cancer care.

In June 2023, Paige AI, Inc. launched its AI-powered “Paige Breast Suite”, which contains a set of products that can help pathologists with a breast cancer diagnosis. In February 2023, HALO Breast Care Center launched the new HALO PathWay, a breast cancer screening approach that can provide diagnostic processes such as genetic testing and advanced imaging under one roof.

In September 2023, Hologic responded to the recently issued breast cancer screening guidelines by the U.S. Preventive Services Task Force (USPSTF). The company provided a statement acknowledging the importance of early detection and emphasizing the continued need for regular mammography screenings in reducing breast cancer mortality rates. In April 2023, Myriad Genetics and SimonMed collaborated on a genetic cancer risk program, combining their expertise in genetics & medical imaging. This partnership aims to provide comprehensive risk assessment and personalized screening strategies for individuals at high risk of developing hereditary cancers. Some of the prominent players in the global breast cancer diagnostics market include:

-

Genomic Health (Exact Sciences Corporation)

-

BD

-

Danaher

-

Koninklijke Philips N.V.

-

QIAGEN

-

Thermo Fisher Scientific Inc.

-

Myriad Genetics, Inc.

-

Argon Medical Devices, Inc.

-

F. Hoffmann-La Roche Ltd.

-

Hologic Inc.

Breast Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.7 billion

Revenue forecast in 2030

USD 7.7 billion

Growth Rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait;

Key companies profiled

Hologic Inc.; Genomic Health (Exact Sciences Corporation); BD; Danaher; Koninklijke Philips N.V.; QIAGEN; Thermo Fisher Scientific Inc.; Myriad Genetics, Inc.; Argon Medical Devices, Inc.; F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breast cancer diagnostics market report based on type, product, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Imaging

-

Biopsy

-

Genomic Tests

-

Blood Tests

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Platform-based Products

-

Next-generation Sequencing

-

Microarrays

-

PCR

-

Others

-

-

Instrument-based Products

-

Imaging

-

Biopsy

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Screening

-

Diagnostic and Predictive

-

Prognostic

-

Research

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Centers and Medical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast cancer diagnostics market size was estimated at USD 4.3 billion in 2022 and is expected to reach USD 4.7 billion in 2023.

b. The global breast cancer diagnostics market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 7.7 billion by 2030.

b. The diagnostics and predictive application segment dominated the global breast cancer diagnostics market and accounted for the largest revenue share of around 48.80% in 2022.

b. The hospitals and clinics segment dominated the global breast cancer diagnostics market and accounted for the largest revenue share of around 50.55% in 2022.

b. The imaging segment dominated the global breast cancer diagnostics market and accounted for the largest revenue share of 52.74% in 2022.

b. North America dominated the global breast cancer diagnostics market and accounted for the largest revenue share of 45.83%, in 2022.

b. Based on product, the instrument-based products segment dominated the breast cancer diagnostics market with a share of 71.75% in 2022. This is attributable to the high preference of patients for screening mammography, diagnostic mammography, ultrasonography, and breast MRI.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."