- Home

- »

- Medical Devices

- »

-

Breast Implants Market Size, Share and Growth Report, 2030GVR Report cover

![Breast Implants Market Size, Share & Trends Report]()

Breast Implants Market Size, Share & Trends Analysis Report By Product (Silicone Breast Implants, Saline Breast Implants), By Shape (Round, Anatomical), By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-798-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

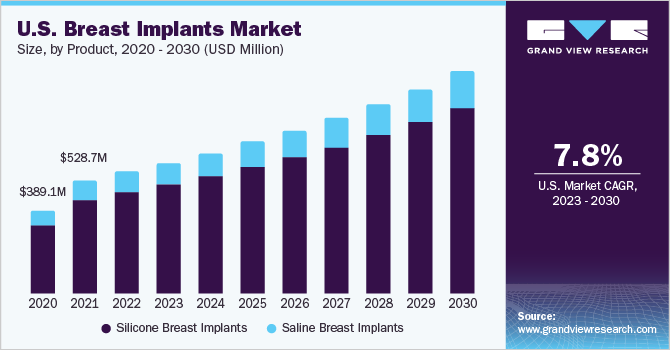

The global breast implants market size was valued at USD 2.31 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. Growing preference for enhancing physical appearance has led to the growth of the market globally. The COVID-19 pandemic impacted the global healthcare sector. The pandemic's impact on the medical equipment industry was enormous. The demand for personal protective equipment (PPE) and ventilators increased rapidly while on the other side, utilization of health devices/products such as implants, injectable, stents, & equipment was observed to be declining. Interruptions in the supply chain, as well as the delay or cancellations of elective surgery were identified as the most significant factors in the post-pandemic era.

Furthermore, cosmetic surgeons had decided to forego breast enhancement surgeries due to the threat of spreading coronavirus infection because the patient would have a compromised immune system against the virus. As a result, the market for both silicone & saline implants has dropped significantly. Over 28.4 million elective surgeries are anticipated to be canceled or postponed worldwide over the 12 weeks following COVID 19 infection, as per CovidSurg, a platform started by researchers to assess the impact of COVID-19. In 2020, this is projected to have a negative influence on the market.

Breast implantation surgery has evolved greatly with growing demand for cosmetic surgeries. Women with high preference for enhancing their esthetic appeal contribute largely to the revenue of breast implantation market. According to the FDA, women above 18 years of age can undergo breast augmentation surgeries.

The rising prevalence of breast cancer is also a significant driver leading to the growth of this market. In severe cases, the prevention of this disease involves mastectomy surgery, which requires the removal of the entire organ. In addition, reconstruction of this organ is considered a useful option for the treatment of such disease. This procedure involves rebuilding the shape of the removed organ. Thus, with a rising number of reconstruction cases, there is a growing demand for breast implantation over the forecast period.

The American Society of Plastic Surgeons (ASPS) stated that breast augmentation is one of the top 5 cosmetic procedures conducted in the U.S. According to the ASPS, 279,143 procedures related to augmentation of this organ had taken place in the U.S. Thus, with a huge number of these cases, the growth of the breast implants market is expected to accelerate over the coming years.

Product Insights

Amongst the product segment, silicone implants held the largest market share with 83.6% in 2022. This is since these devices tend to be like natural breast tissue. For instance, a gummy implant gives a natural shape to the reconstructed breast. This product segment also does not pose a risk for disorders associated with the immune system. Silicone implants are expected to continue their dominance over the forecast period owing to their soft texture. Due to this feature, there is less risk of formation of hard scar tissue around the implantation. In addition, gummy implants also have a low risk of wrinkling.

Saline implants, on the other hand, are anticipated to display significant growth. This is due to fewer complications associated with this type of device during implant rupture. In case of leakage, the saline gets absorbed into the body without causing any harm to the patient. Unlike silicone devices, saline does not require any further follow-up sessions with the doctor. However, women who have undergone silicone breast implantation surgery often suffer from silent implant rupture. Hence, the FDA recommends that such patients need to go for periodic MRI screenings.

Shape Insights

Based on shape, round-shaped implants contributed the largest revenue in 2022 with 80.6% share. Due to their round shape, they are ideal for breast augmentation. These devices tend to look like a compressed sphere. Hence, these products generated huge demand, thereby supporting the growth of the market.

Round-shaped implants are symmetrical and eliminate any problem arising at the time of implant rotation. Therefore, even surgeons prefer round implants over anatomical implants. Laboratoires Arion has an extensive portfolio of round-shaped breast implants. For instance, Monobloc Silicone, a round-shaped implant, is manufactured by this company.

Anatomical-shaped devices, on the other hand, are expected to witness significant growth over the forecast period due to their natural shape. The design of this type of implant mimics the shape of a natural breast. Women undertaking natural-looking breast enhancement, usually opt for this kind of product.

However, anatomical-shaped products have certain limitations. They tend to change the shape of the entire organ, during any shift or rotation of the implant. This could lead to additional surgery for correction. Moreover, due to its natural shape, it requires the assistance of skilled surgeons during implantation, failure of which might pose a risk of flipping.

Application Insights

Based on application, cosmetic surgery contributed toward the largest revenue share in 2022 growing at a CAGR of 7.6%. This is due to the growing emergence of the cosmetic industry in order to enhance the esthetic appeal. Cosmetic surgery involving breast augmentation procedures helps in enhancing the appearance of this organ. Breast implantation is considered a significant procedure in the field of cosmetic surgery. They feel like natural breast tissue when compared to other types of implants, as that is the main reason, they are preferred by the majority of women seeking breast implants over other varieties.

The U.S. FDA has approved silicone breast implants for breast augmentation in women aged 22 and up, as well as breast reconstruction in women of any age. Reconstruction surgery is anticipated to gain significant growth over the forecast period. It usually deals with the defects and deformities of the patient’s chest wall, post-mastectomy procedure. This helps in restoring the natural look and enhancing their esthetic appeal.

Breast implantation involving reconstruction surgery aids in improving symmetry after mastectomy or any other damage caused to the structure of the organ during a cosmetic surgical procedure. This procedure requires a tissue expander before the implant is inserted in order to expand the muscles in the organ.

End-use Insights

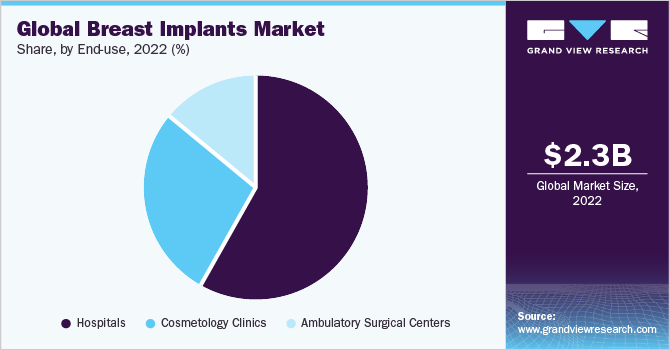

Based on end-use, the hospital segment held the largest market share in 2021 due to the increasing preference for patients to be treated in hospitals by plastic surgeons. Moreover, with growing healthcare expenditure, there is a rise in the number of hospitals being set up in developing regions.

The cosmetology clinics segment, on the other hand, is anticipated to witness significant growth with a CAGR of 7.9% over the forecast period. This is due to the emergence of specialty clinics dealing with cosmetic procedures for enhancement of people’s esthetics. The processes associated with surgical treatments in these clinics are not as cumbersome as those in hospitals.

Regional Insights

In 2022, North America dominated the market with 31.0% share owing to rising healthcare spending in the U.S. and the growing demand for cosmetic surgical procedures associated with the improvement of esthetics in the country. Moreover, the rising prevalence of breast cancer in this region is also expected to support the growth of the market.

The Asia Pacific and Latin America are projected to showcase lucrative growth with a CAGR of 7.8% over the forecast period. This is due to the rising disposable income in the developing countries. Moreover, this region provides a huge opportunity with respect to low-cost treatments in the field of medical tourism. Hence, the aforementioned factors are expected to drive the market growth of this region.

Key Companies & Market Share Insights

The key strategies of these companies include new product development, mergers & acquisitions, and geographical expansions. For instance, in 2016, Allergan plc received U.S. FDA approval for its NATRELLE INSPIRA Cohesive implants, which is a new introduction in gummy breast implants category.

In Oct 2020, GC Aesthetics Inc., a silicone implants manufacturers confirmed the launch of PERLE, a next-generation smooth breast implant with a patented surface technique called BioQ. The market is likely to develop over the forecast period due to the rise in demand for silicone breast implants. Some of the prominent players in the global breast implants market include:

-

ALLERGAN

-

GC Aesthetics

-

GROUPE SEBBIN SAS

-

Mentor Worldwide LLC; Sientra, Inc.

-

Sientra Inc.

-

Polytech Health & Aesthetics GmbH

-

Establishment Labs S.A.

-

Shanghai Kangning Medical Supplies Ltd.

-

Guangzhou Wanhe Plastic Materials Co., Ltd.

-

LABORATOIRES ARION

-

HANSBIOMED CO. LTD.

Breast Implants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.4 billion

Revenue forecast in 2030

USD 4.1 billion

Growth Rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, shape, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; India; China; China; India; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mentor Worldwide LLC; PMT Corporation; Allergan plc; Sientra, Inc.; GROUPE SEBBIN SAS; Guangzhou Wanhe Plastic Materials Co., Ltd.; KOKEN CO., LTD.; GC Aesthetics; POLYTECH Health & Aesthetics GmbH

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Implants Market Report SegmentationThis report forecasts revenue growth at global, regional, & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global breast implants market on the basis of product, shape, application, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Silicone Breast Implants

-

Saline Breast Implants

-

-

Shape Outlook (Revenue, USD Million; 2017 - 2030)

-

Round

-

Anatomical

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Reconstructive Surgery

-

Cosmetic Surgery

-

-

End-use Outlook (Revenue, USD Million; 2017 - 2030)

-

Hospitals

-

Cosmetology Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast implants market size was estimated at USD 2.31 billion in 2022 and is expected to reach USD 2.4 billion in 2023.

b. The global breast implants market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 4.1 billion by 2030.

b. North America dominated the breast implant market with a share of 31.0% in 2022. This is attributable to the rising growing number of reconstruction surgical procedures being conducted in this region.

b. Some key players operating in the breast implants market include Mentor Worldwide LLC; PMT Corporation; Allergan plc; Sientra, Inc.; GROUPE SEBBIN SAS; Guangzhou Wanhe Plastic Materials Co., Ltd.; KOKEN CO., LTD.; GC Aesthetics; and POLYTECH Health & Aesthetics GmbH.

b. Key factors that are driving the breast implants market growth include the rising number of breast augmentation procedures, the increasing incidence of breast cancer, and growing technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."