- Home

- »

- Advanced Interior Materials

- »

-

Bromine Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Bromine Market Size, Share & Trends Report]()

Bromine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Elemental Bromine, Calcium Bromide, Sodium Bromide), By Application (Clear Brine Fluids (CBF), Flame Retardants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-649-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bromine Market Summary

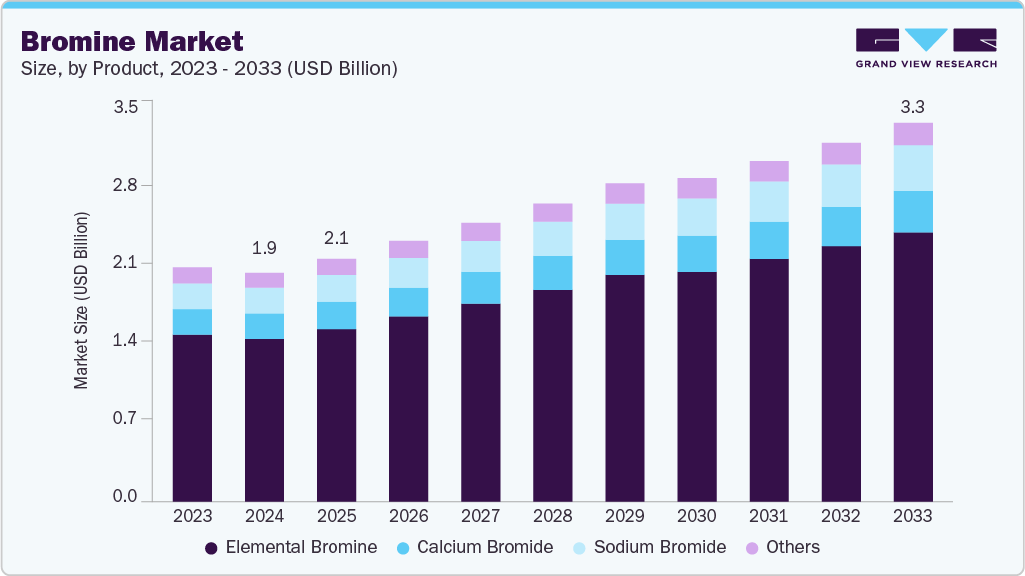

The global bromine market size was estimated at USD 1.98 billion in 2024 and is projected to reach USD 3.28 billion by 2033, at a CAGR of 5.7% from 2025 to 2033. Bromine is widely used in producing flame retardants, particularly brominated flame retardants (BFRs), which are essential in enhancing fire safety across electronics, textiles, and construction materials.

Key Market Trends & Insights

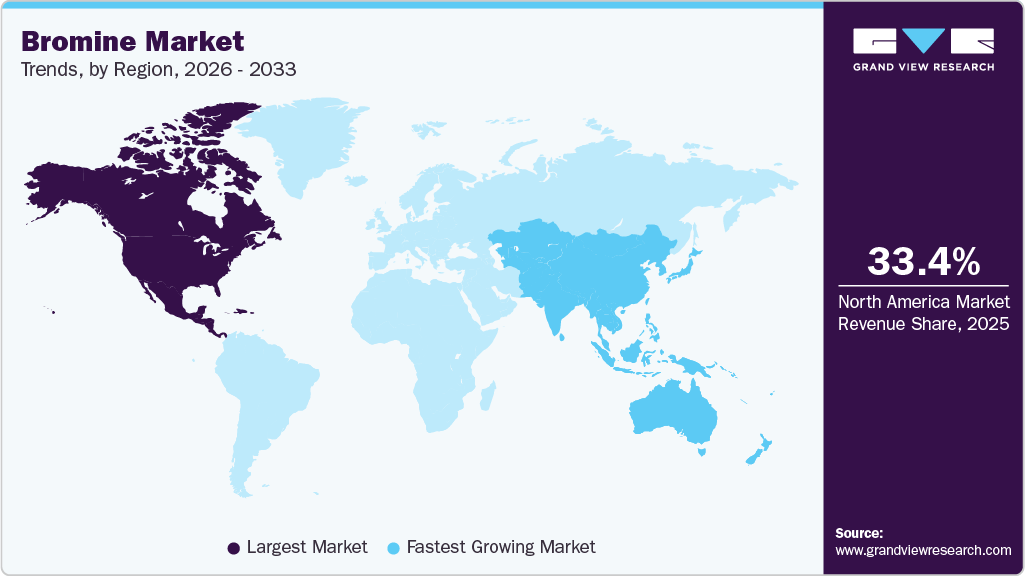

- North America dominated the bromine market with the largest market revenue share of 51.7%.

- Bromine market in the U.S. is expected to grow at a substantial CAGR of 6.3% from 2025 to 2033.

- By product, elemental bromine accounted for the largest market revenue share in 2024.

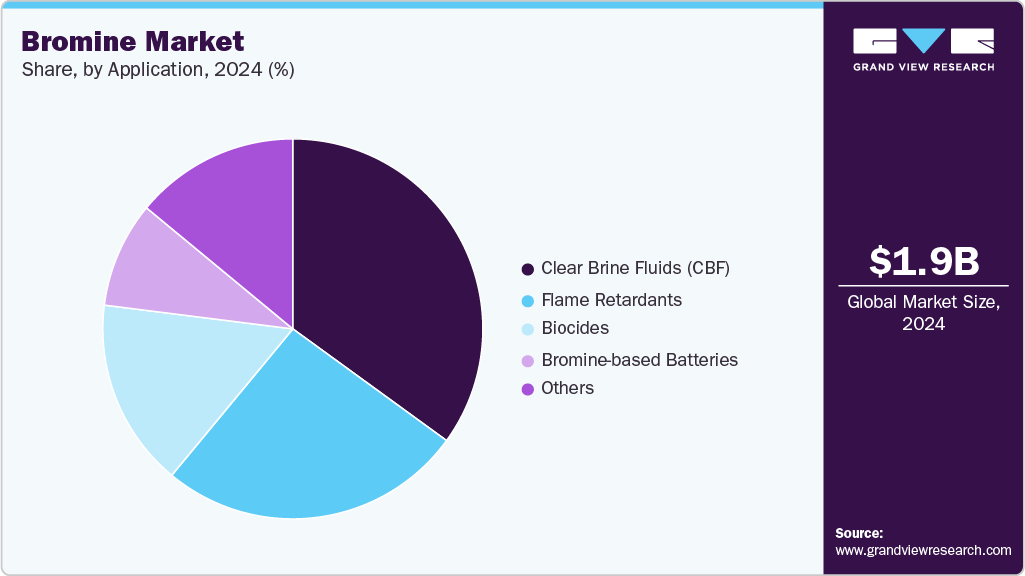

- By application, clear brine fluids accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.98 Billion

- 2033 Projected Market Size: USD 3.28 Billion

- CAGR (2025-2033): 5.7%

- North America: Largest market in 2024

As global safety regulations become more stringent, particularly in developing economies where fire safety norms are being upgraded, the demand for bromine-based flame retardants is increasing steadily. Bromine-based drilling fluids, such as clear brine fluids (CBFs), are essential for deep and high-pressure oil wells. These fluids provide the necessary density to control pressure in the wellbore and are also non-damaging to the reservoir rock. As global energy demand continues to rise and exploration activities expand into more challenging environments, the consumption of bromine in this segment is expected to remain strong, particularly in the Middle East and North America.The pharmaceutical and agrochemical industries also contribute significantly to the demand for bromine. In the pharmaceutical sector, bromine synthesizes several intermediates and active pharmaceutical ingredients (APIs), particularly in sedatives and analgesics. In agriculture, bromine compounds are used in fumigants and pesticides, especially in countries where soil-borne pathogens and pests impact crop productivity. Despite regulatory restrictions in certain regions, innovations in safer bromine-based chemicals continue to support growth in these end use industries.

Water treatment is another important segment propelling the bromine industry. Bromine-based biocides are increasingly preferred over chlorine in cooling towers, swimming pools, and industrial water systems due to their superior effectiveness in a wide pH range and lower odor profile. As industrialization intensifies and concerns over water hygiene rise globally, especially in emerging economies, the adoption of bromine compounds in water treatment is likely to see continued expansion.

Lastly, the market is positively impacted by the rising production and consumption of bromine in the Asia Pacific. China, India, and Southeast Asian countries have emerged as both major producers and consumers due to abundant brine deposits and growing industrial demand. Government initiatives supporting chemical manufacturing and infrastructure development further accelerate bromine consumption in the region. Overall, regulatory shifts, technological advancements, and regional economic growth continue to drive momentum in the global market.

Drivers, Opportunities & Restraints

The increasing demand for brominated flame retardants across the electronics, construction, and automotive sectors primarily drives the bromine industry. With global fire safety regulations becoming more stringent, manufacturers increasingly incorporate brominated compounds in circuit boards, plastic enclosures, textiles, and automotive components to enhance fire resistance. In addition, the oil and gas industry contributes significantly to market growth, as bromine-based clear brine fluids are extensively used in drilling and well-completion processes, particularly in offshore and high-pressure wells. The rising global energy demand and expanded exploration activities in regions like the Middle East and North America further reinforce this upward trend.

Emerging opportunities are shaping a promising future for the bromine industry. For instance, global investments in bromine-based battery technologies have surged, particularly in China, where the Chinese Academy of Sciences announced in April 2024 a bromine-iodine battery prototype achieving energy densities up to 1,200 Wh/L. In addition, bromine imports into Asia rose nearly 30% in 2024 to over 109,000 tons, with China accounting for 78% of this volume. This indicates strong regional growth and opens opportunities for exporters in Jordan, Israel, and Egypt. Furthermore, large-scale investments like the USD 1 billion bromine derivatives facility developed in Egypt’s Suez Canal Economic Zone by Shandong Tianyi Chemical (China) and TEDA Egypt signal major expansion in production capacity and export capabilities in Africa and Europe.

Despite these positive trends, the market faces significant restraints. Global bromine production slightly declined to around 216,000 tons in 2024, down 0.8% from 2023, primarily due to geopolitical instability in key producing nations like Israel. In addition, environmental regulations in the European Union and North America limit the use of specific brominated flame retardants due to concerns over bioaccumulation and toxicity. As a result, companies face rising compliance costs and are pressured to develop safer alternatives.

Product Insights

Elemental bromine is a precursor for brominated flame retardants (BFRs), clear brine fluids, and numerous organic and inorganic bromine compounds. With the electronics industry expanding, the demand for BFRs like TBBPA and hexabromocyclododecane continues to rise, especially in Asia Pacific, where electronics manufacturing hubs in China, South Korea, and Taiwan dominate global output.

Sodium bromide is anticipated to register the fastest CAGR over the forecast period. It is a dense, non-damaging fluid that helps control wellbore pressure in deep and high-temperature wells. As global energy demand grows and exploration moves into more complex geological environments, especially offshore, the demand for sodium bromide continues to increase. In addition, when the element is combined with oxidizing agents like chlorine or ozone, it forms hypobromous acid, a highly effective biocide used to control bacterial growth in cooling towers, municipal water systems, and wastewater treatment plants.

Application Insights

The growth of the clear brine fluids segment in the market is primarily driven by the increasing demand from the oil and gas industry, especially in offshore and deepwater drilling operations. CBFs are critical in maintaining wellbore stability and controlling pressure during high-temperature and high-pressure drilling conditions. As global energy consumption rises, particularly in developing economies, oil exploration activities are expanding into more complex geological formations. This leads to greater use of high-performance drilling fluids like bromine-based CBFs, which offer superior density and thermal stability compared to conventional fluids.

Flame retardants are anticipated to register the fastest CAGR over the forecast period. Brominated flame retardants are widely used in plastic casings, insulation materials, textiles, and electronic components because of their high efficiency in inhibiting or delaying fire spread. With increasing urbanization and infrastructure development, especially in the Asia Pacific and the Middle East, the demand for fire-safe construction materials has surged, directly fueling the consumption of bromine-based flame retardants.

Regional Insights

The bromine industry in North America is growing steadily, driven by strong demand from the oil and gas and electronics sectors. Bromine is widely used to produce clear brine fluids, essential for controlling pressure in deep and high-temperature oil wells. As drilling activity increases in offshore and onshore regions, especially in the U.S., the need for bromine-based fluids has also risen. In addition, brominated flame retardants are commonly used in electronics and construction materials to meet fire safety standards. With strict regulations on fire prevention in place across the region, these flame retardants continue to support bromine consumption.

U.S. Bromine Market Trends

The bromine industry in the U.S. is strongly driven by the country’s continued investment in domestic energy production and infrastructure development. The push for energy independence has increased oil and gas drilling activities, especially in shale-rich regions and offshore basins. These operations create consistent demand for bromine-based inputs that support high-pressure and high-temperature drilling environments. In addition, federal and state-level environmental policies aimed at reducing industrial emissions and improving water quality have encouraged industries to adopt bromine-based solutions, indirectly supporting the chemical demand.

Asia Pacific Bromine Market Trends

Asia‑Pacific bromine industry hosts nearly half of the world’s electronics output and a growing automotive industry, and there is increasing demand for specialty chemicals that support innovation and compliance with environmental standards. Investments in clean technologies, advanced water purification, and energy-related chemical applications contribute to steady growth. Many bromine producers are capitalizing on cost efficiencies and local resource availability, helping anchor Asia‑Pacific’s position at the forefront of the global bromine landscape.

Europe Bromine Market Trends

The Europe bromine industry growth is strongly influenced by the region’s commitment to environmental sustainability and chemical safety. Strict regulatory frameworks encourage developing and using safer, more environmentally friendly bromine compounds. This regulatory environment has pushed manufacturers to innovate in bromine-based solutions that meet evolving safety standards, especially in flame retardants and water treatment applications. The demand for advanced and cleaner chemical formulations has created a favorable landscape for bromine producers who can align with Europe’s sustainability goals.

Latin America Bromine Market Trends

The bromine industry in Latin America is growing steadily, primarily driven by the region’s strong agricultural industry. Countries like Brazil, Argentina, and Mexico rely heavily on crop protection chemicals to support large-scale farming. Bromine derivatives are used in fumigants and pesticides to manage soil-borne pests and diseases. As agricultural exports continue to rise and modern farming practices become more widespread, the need for efficient and reliable bromine-based agrochemicals is expected to grow across the region.

Middle East & Africa Bromine Market Trends

The Middle East & Africa bromine industry is anticipated to grow significantly over the forecast period. Countries like Saudi Arabia and the UAE invest heavily in energy exploration and drilling projects, which require bromine-based fluids for safe and efficient operations. The widespread use of clear brine fluids in these activities drives steady demand for bromine and its derivatives, making the energy sector a key pillar of growth in this region. Beyond oil and gas, infrastructure development and urban expansion are supporting bromine demand. Rapid construction activities, industrialization, and the need for improved water treatment systems have increased the use of bromine-based chemicals in construction materials, flame retardants, and disinfectants. In addition, major bromine producers like Israel and Jordan, with access to natural resources such as the Dead Sea, strengthen the region’s supply capabilities.

Key Bromine Company Insights

Some of the key players operating in the market include ICL Group Ltd., Albemarle Corporation, and others.

-

ICL Group Ltd. is a global specialty minerals and chemicals company headquartered in Israel, known as the world’s largest producer of elemental bromine and bromine compounds. ICL develops a wide array of bromine-based solutions catering to flame retardants, oil and gas, water treatment, and pharmaceuticals as part of its Industrial Products division. The company emphasizes R&D-driven, environmentally safer polymeric and reactive flame retardants that align with global sustainability standards. In addition, ICL has introduced innovative products like BromoQuel, which enables rapid neutralization of bromine spills through complexation methods, enhancing safety and ease of cleanup.

-

Albemarle Corporation, based in the U.S. and listed on the S&P 500, stands as one of the largest global producers of bromine and derivatives, sourcing from brine deposits in Arkansas and via a joint venture in Jordan. Albemarle’s Bromine Specialties business supplies high-performance products for flame retardants, energy storage, pharmaceuticals, agriculture, and water treatment. Their vertically integrated operation, from brine extraction to refining and derivatives production, supports diverse industrial applications, particularly in specialty chemicals.

Key Bromine Companies:

The following are the leading companies in the bromine market. These companies collectively hold the largest market share and dictate industry trends.

- ICL Group Ltd.

- Albemarle Corporation

- LANXESS AG

- Tosoh Corporation

- TETRA Technologies Inc.

- TATA Chemicals Ltd.

- Hindustan Salts Ltd.

- Honeywell International Inc.

- Gulf Resources Inc.

- Agrocel Industries Pvt Ltd.

- Satyesh Brinechem Pvt. Ltd.

Recent Development

-

In April 2025, Tetra Technologies announced the completion of a definitive feasibility study for its Arkansas bromine project, detailing plans for a Phase I plant capable of producing 75 million pounds of bromine annually. The update confirmed the project’s economic viability and marked a significant step forward in expanding U.S.-based bromine capacity.

Bromine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.10 billion

Revenue forecast in 2033

USD 3.28 billion

Growth Rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; Italy; China; India; Japan; South Korea; Brazil; UAE; Saudi Arabia

Key companies profiled

ICL Group Ltd.; Albemarle Corporation; LANXESS AG; Tosoh Corporation; TETRA Technologies Inc.; TATA Chemicals Ltd.; Hindustan Salts Ltd.; Honeywell International Inc.; Gulf Resources Inc.; Agrocel Industries Pvt Ltd.; Satyesh Brinechem Pvt. Ltd.; Others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bromine Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bromine market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Elemental Bromine

-

Calcium Bromide

-

Sodium Bromide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Clear Brine Fluids (CBF)

-

Flame Retardants

-

Biocides

-

Bromine-based Batteries

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players of the global bromine market are ICL Group Ltd., Albemarle Corporation, LANXESS AG, Tosoh Corporation, TETRA Technologies Inc., TATA Chemicals Ltd., Hindustan Salts Ltd., Honeywell International Inc., Gulf Resources Inc., Agrocel Industries Pvt Ltd., Satyesh Brinechem Pvt. Ltd., and others.

b. The key factor that is driving the growth of the global bromine market is driven by the rising demand for bromine-based flame retardants, particularly in electronics, automotive, and construction industries, along with increasing use in water treatment, oil & gas drilling fluids, and pharmaceuticals.

b. The global bromine market size was estimated at USD 1.98 billion in 2024 and is expected to reach USD 2.10 billion in 2025.

b. The global bromine market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 3.28 billion by 2033.

b. The elemental bromine segment dominated the market with a revenue share of 71.1% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.