- Home

- »

- Advanced Interior Materials

- »

-

Brushless Motor Power Tools Market, Industry Report, 2033GVR Report cover

![Brushless Motor Power Tools Market Size, Share & Trends Report]()

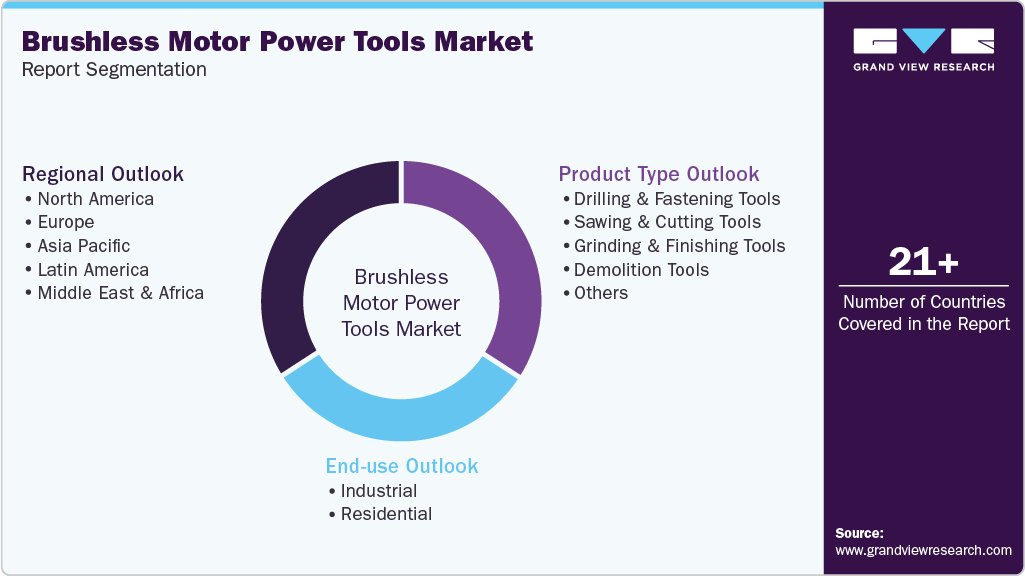

Brushless Motor Power Tools Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Drilling & Fastening Tools, Sawing & Cutting Tools), By End Use (Industrial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-780-8

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - NULL

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Brushless Motor Power Tools Market Summary

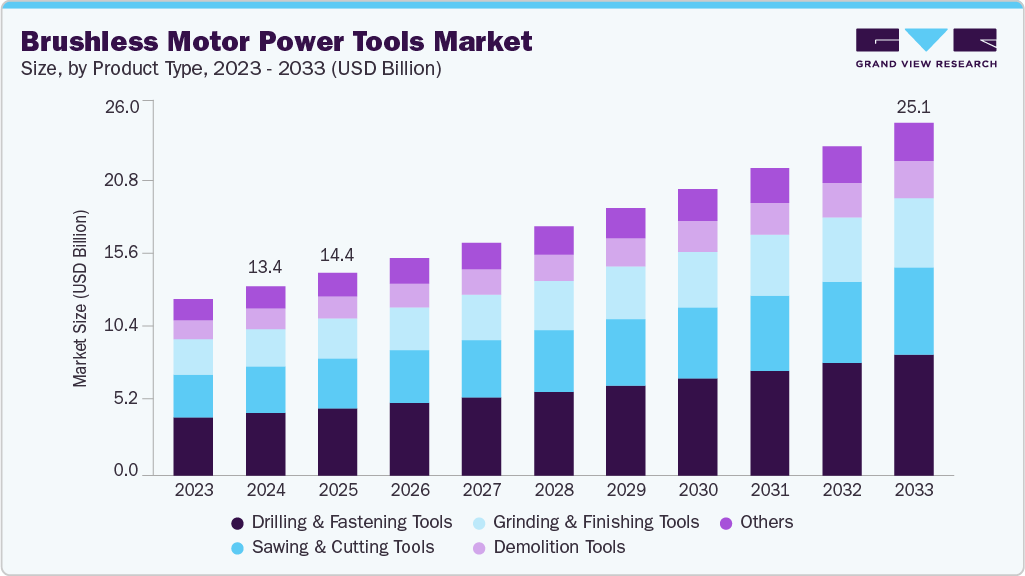

The global brushless motor power tools market size was estimated at USD 13.40 billion in 2024 and is expected to reach USD 25.05 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033, driven by the growing demand for high-performance and energy-efficient tools across industrial, automotive, and construction sectors. Brushless motor technology offers superior torque control, longer lifespan, and reduced maintenance compared to brushed motors, making it increasingly preferred for both professional and DIY users.

Key Market Trends & Insights

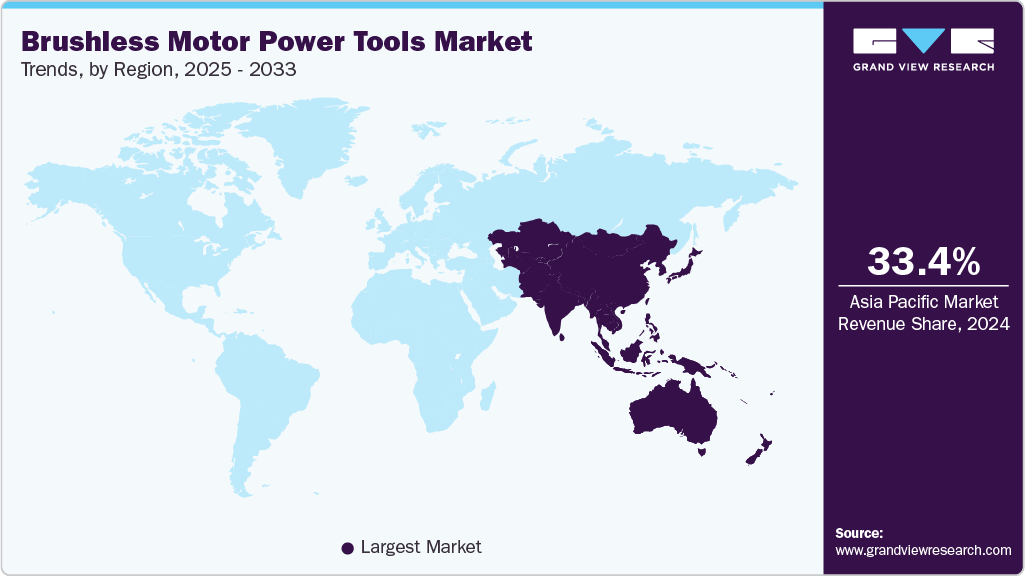

- Asia Pacific dominated the brushless motor power tools market with the largest revenue share of 33.4% in 2024.

- By product type, the drilling & fastening tools segment led the market and accounted for the largest revenue share of 33.1% in 2024.

- By end use, residential segment is expected to grow at the fastest CAGR of 7.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 13.40 Billion

- 2033 Projected Market Size: USD 25.05 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

The expansion of smart infrastructure projects and the growing emphasis on productivity in manufacturing environments have further accelerated the adoption of cordless, brushless tools that deliver consistent output with enhanced precision and safety. Rising investments in residential and commercial construction globally are another major driver fueling the demand for brushless motor power tools. The surge in renovation, infrastructure modernization, and home improvement activities has increased the need for reliable, low-noise, and high-efficiency tools. Moreover, ongoing urbanization in emerging economies and the expansion of housing initiatives have encouraged manufacturers to introduce compact, user-friendly brushless products that meet both professional and consumer needs.

Technological innovation and the integration of IoT and AI-enabled monitoring systems into brushless power tools have further enhanced market growth. Manufacturers increasingly focus on connected tools with data analytics capabilities, allowing users to track performance, manage tool health, and optimize energy consumption. These advancements, coupled with rapid battery innovations and improvements in lithium-ion technology, have led to higher adoption of cordless brushless power tools, strengthening their market penetration across multiple sectors.

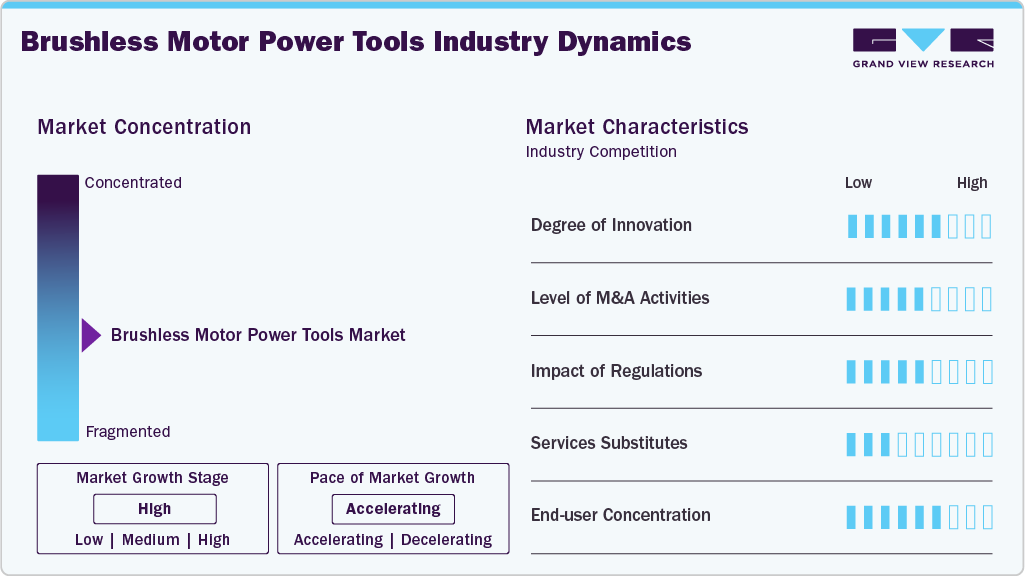

Market Concentration & Characteristics

The brushless motor power tools market exhibits a moderate to high degree of innovation, primarily driven by rapid advancements in motor efficiency, battery chemistry, and smart connectivity features. Manufacturers are increasingly focusing on developing intelligent, IoT-enabled power tools that allow real-time performance monitoring and predictive maintenance. The integration of AI for torque optimization and energy management has significantly enhanced tool precision and durability. In terms of market dynamics, the industry has witnessed a steady rise in mergers and acquisitions, as established players seek to expand their product portfolios, strengthen distribution networks, and gain access to new technologies. Collaborations between motor manufacturers, battery developers, and digital technology firms have also become common, fostering cross-industry innovation.

Regulatory frameworks emphasizing energy efficiency, worker safety, and reduced environmental impact are shaping product design and production strategies. These regulations have encouraged manufacturers to adopt sustainable materials and improve motor performance while minimizing energy loss. Although service substitutes such as pneumatic and hydraulic tools exist, their usage is gradually declining due to higher maintenance and lower energy efficiency than brushless power tools. End user concentration remains diversified, with strong demand across construction, automotive, aerospace, and manufacturing sectors. However, professional contractors and industrial users account for a significant share, driven by the growing preference for durable, high-torque, and maintenance-free equipment that ensures long-term operational reliability.

Product Type Insights

The drilling & fastening tools segment led the market and accounted for the largest revenue share of 33.1% in 2024, driven by the growing adoption of cordless and high-torque tools across industrial and construction sectors. These tools offer superior energy efficiency, longer runtime, and low maintenance compared to brushed alternatives. Increasing demand for precision fastening in automotive assembly and infrastructure development further fuels market growth. Manufacturers are integrating smart sensors and battery management systems to enhance tool performance.

The sawing & cutting tools segment is expected to witness a significant CAGR of 7.3% over the forecast period, driven by advancements in brushless motor technology that provide consistent power output and reduced vibration during operation. Growing usage in woodworking, metal fabrication, and renovation projects supports market expansion. The rising trend of automation and the need for high precision cutting in industrial applications are further accelerating demand.

End Use Insights

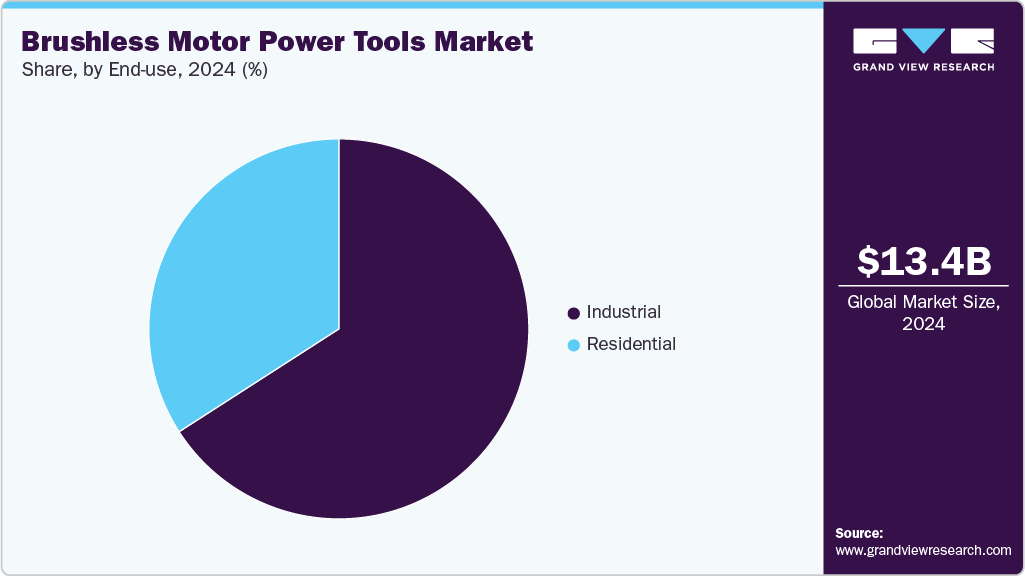

The industrial segment dominated the market and accounted for the largest revenue share of 65.9% in 2024, driven by the increasing need for reliable, heavy-duty tools capable of withstanding continuous operations in manufacturing, automotive, and construction industries. Brushless motor power tools are preferred due to their extended lifespan, reduced downtime, and minimal maintenance costs. The integration of digital connectivity for tool tracking and performance analytics enhances productivity and safety in industrial environments. Furthermore, the global emphasis on automation and energy optimization is encouraging industries to transition from pneumatic to electric brushless systems.

Residential segment is expected to grow at the fastest CAGR of 7.6% over the forecast period, driven by the rising trend of home improvement, renovation, and DIY activities among consumers. The convenience of cordless, lightweight, and energy-efficient brushless tools makes them ideal for residential use. Increasing awareness about sustainability and user safety also drives demand for these low-noise, low-emission tools. Manufacturers are introducing user-friendly designs with interchangeable batteries to attract household consumers.

Regional Insights

Asia Pacific brushless motor power tools market held the largest revenue market share of 33.4% in 2024, driven by rapid urbanization, industrialization, and the growth of the construction and electronics manufacturing sectors. Increasing labor costs and the need for efficient, durable, and low-maintenance tools are encouraging adoption across China, Japan, India, and Southeast Asia. The surge in residential construction and commercial infrastructure projects further enhances regional demand. Additionally, the proliferation of small-scale industries and rising disposable incomes are fueling the DIY and home improvement segments. Local manufacturers are emphasizing affordable, high-performance brushless tools to meet diverse end-user needs, making Asia Pacific a global production hub.

China Brushless Motor Power Tools Market Trends

China’s brushless motor power tools market is driven by massive manufacturing capacity, extensive construction activity, and government policies encouraging energy-efficient technologies. The country has become a major exporter of brushless power tools, with companies increasingly focusing on smart, connected solutions. The rapid growth of e-commerce platforms has also expanded accessibility for both professionals and consumers. Moreover, the shift toward automation in industrial settings has amplified the demand for precision power tools with minimal maintenance. Domestic R&D efforts and foreign collaborations are improving quality standards and helping Chinese brands compete with established global players.

North America Brushless Motor Power Tools Market Trends

The North America Brushless Motor Power Tools market is driven by strong industrial automation trends, advanced manufacturing practices, and rising demand for cordless and energy-efficient tools. The region’s construction and automotive sectors are key contributors, supported by ongoing infrastructure upgrades and housing projects. In addition, U.S. government initiatives promoting energy efficiency and worker safety have accelerated the adoption of smart and brushless technologies. The presence of leading manufacturers and technological innovators ensures rapid product development and distribution. Consumers are increasingly favoring tools that offer longer runtimes, reduced maintenance, and precision performance. Together, these factors sustain steady market expansion across both professional and DIY user segments.

In the U.S. brushless motor power tools market is propelled by growing construction and renovation activities alongside the adoption of digital and connected tools. The shift toward cordless equipment for both residential and industrial applications is enhancing operational convenience and safety. Manufacturers are investing in R&D to develop brushless motors with optimized torque control and extended battery life. Federal infrastructure funding programs, such as those under the Infrastructure Investment and Jobs Act, have further boosted industrial demand. The market also benefits from a mature distribution network and increasing e-commerce sales. This environment supports continuous innovation and strong brand competitiveness.

Europe Brushless Motor Power Tools Market Trends

The Europe brushless motor power tools market is driven by stringent environmental regulations, strong industrial automation initiatives, and growing preference for sustainable and ergonomic designs. European consumers and industries prioritize efficiency, safety, and low noise emissions, leading to higher adoption of brushless technology. The construction and automotive refurbishment sectors are key growth contributors, supported by the region’s green building initiatives. Moreover, the circular economy framework in the EU is encouraging manufacturers to focus on recyclability and energy conservation. Rising innovation in cordless tool platforms and battery systems further strengthens market penetration across industrial and residential domains.

Germany brushless motor power tools market is fueled by its advanced manufacturing base, technological innovation, and emphasis on quality engineering. The country’s strong automotive and construction industries generate substantial demand for precision tools. Integration of Industry 4.0 practices and smart factory automation is accelerating the shift toward connected and high-efficiency power tools. German manufacturers are at the forefront of R&D investments, creating brushless solutions that enhance torque, efficiency, and operational lifespan. The focus on eco-friendly production and compliance with EU energy directives is further driving innovation. As a result, Germany serves as both a technology hub and export leader in this market.

Latin America Brushless Motor Power Tools Market Trends

The Latin America brushless motor power tools market is driven by the revival of construction activities, infrastructure investments, and industrial expansion. Countries such as Brazil and Mexico are witnessing increased adoption of cordless and battery-operated tools due to their convenience and reliability. Growing DIY culture and small-scale construction enterprises are contributing to market growth. However, high import costs and limited local manufacturing capacity pose challenges. Despite this, international brands are strengthening their presence through strategic partnerships and distribution networks. The market’s growth potential remains significant as modernization efforts and labor efficiency demands increase.

Middle East & Africa Brushless Motor Power Tools Market Trends

The Middle East & Africa market for brushless motor power tools is driven by robust construction activity, particularly in large-scale urban development and infrastructure projects. Countries such as Saudi Arabia and the UAE are heavily investing in smart city and housing projects, creating strong demand for durable and efficient tools. The region’s oil and gas, mining, and manufacturing sectors further support market adoption due to the need for reliable and low-maintenance solutions. Increasing diversification efforts toward non-oil industries are also promoting industrial tool usage. Additionally, the growing presence of global power tool manufacturers and expanding retail channels are enhancing product accessibility across emerging markets.

Key Brushless Motor Power Tools Company Insights

Some of the key players operating in market include Stanley Black & Decker, Inc., Robert Bosch GmbH

-

Stanley Black & Decker, Inc. is a global leader in industrial tools, household hardware, and security products headquartered in the United States. The company’s brushless motor power tools are marketed under renowned brands such as DEWALT, Craftsman, and Black+Decker. Its portfolio includes cordless drills, impact drivers, rotary hammers, and saws designed for high efficiency and durability.

-

Robert Bosch GmbH, based in Germany, is a prominent multinational engineering and technology company specializing in power tools, automotive components, and industrial equipment. Bosch’s brushless motor power tools range includes professional-grade cordless drills, screwdrivers, and angle grinders designed for heavy-duty applications. The company integrates innovative features like Electronic Motor Protection (EMP) and enhanced battery management systems for optimal performance.

Makita Corporation, Hilti Corporation are some of the emerging market participants in brushless motor power tools market.

-

Makita Corporation, headquartered in Japan, is one of the leading manufacturers of industrial power tools and outdoor equipment. The company’s brushless motor tools, such as impact drivers, angle grinders, and circular saws, are designed for superior torque, longer run time, and low maintenance. Makita’s LXT and XGT cordless platforms highlight its innovation in high-capacity lithium-ion battery technology.

-

Hilti Corporation, based in Liechtenstein, is known for its premium-quality tools serving the construction and industrial sectors. The company’s brushless motor power tool range includes rotary hammers, impact wrenches, and drilling systems built for endurance and reliability in demanding environments. Hilti emphasizes productivity, safety, and digital integration through its connected tool management solutions.

Key Brushless Motor Power Tools Companies:

The following are the leading companies in the brushless motor power tools market. These companies collectively hold the largest market share and dictate industry trends.

- Stanley Black & Decker, Inc.

- Robert Bosch GmbH

- Makita Corporation

- Hilti Corporation

- Techtronic Industries Co. Ltd.

- Hitachi Koki Co., Ltd. (HiKOKI)

- Festool GmbH

- Snap-on Incorporated

- Panasonic Corporation

Recent Developments

- In October 2025, Bosch Power Tools expanded its 18V System lineup with the launch of new brushless tools, including a 23-gauge Pin Nailer, Compact Reciprocating Saw, and High Torque Right Angle Drill. This expansion reflects the company’s commitment to enhancing performance, precision, and ease of use in the brushless motor power tools market.

Brushless Motor Power Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.36 billion

Revenue forecast in 2033

USD 25.05 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2033

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

Stanley Black & Decker, Inc.; Robert Bosch GmbH; Makita Corporation; Hilti Corporation; Techtronic Industries Co. Ltd.; Hitachi Koki Co., Ltd. (HiKOKI); Festool GmbH; Snap-on Incorporated; Panasonic Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Brushless Motor Power Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global brushless motor power tools market report based on product type, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Drilling & Fastening Tools

-

Sawing & Cutting Tools

-

Grinding & Finishing Tools

-

Demolition Tools

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

LatinAmerica

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global brushless motor power tools market size was estimated at USD 13.40 billion in 2024 and is expected to reach USD 14.36 billion in 2025.

b. The brushless motor power tools market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 25.05 billion by 2033.

b. The industrial segment dominated the market and accounted for the largest revenue share of 65.9% in 2024, driven by the increasing need for reliable, heavy-duty tools capable of withstanding continuous operations in manufacturing, automotive, and construction industries.

b. Stanley Black & Decker, Inc., Robert Bosch GmbH, Makita Corporation, Hilti Corporation, Techtronic Industries Co. Ltd., Hitachi Koki Co., Ltd. (HiKOKI), Festool GmbH, Snap-on Incorporated, and Panasonic Corporation.

b. The key factors driving the brushless motor power tools market include increasing demand for energy-efficient, low-maintenance tools, technological advancements in motor design, and the rising adoption of cordless solutions across industrial and residential applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.