- Home

- »

- Plastics, Polymers & Resins

- »

-

Building And Construction Plastics Market Size Report, 2030GVR Report cover

![Building And Construction Plastics Market Size, Share & Trends Report]()

Building And Construction Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Roofing, Insulation, Pipes & Ducts, Doors, Windows, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-729-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

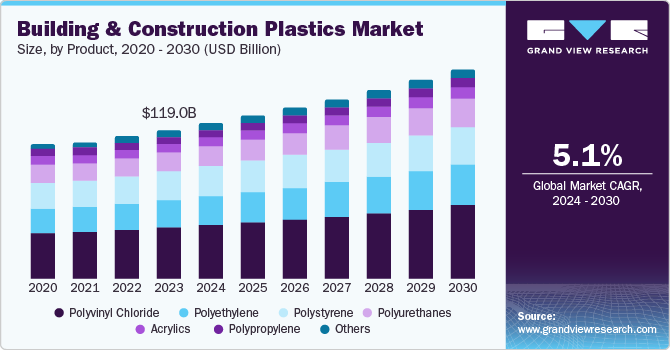

The global building and construction plastics market size was valued at USD 119.0 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The factors for the growth of the market are attributed to the overall growth of the building & construction industry, especially in the developing and developed countries that have impacted the demand for the products positively. The increasing integration of plastics across diverse end-use applications within this industry is a key contributing factor. Moreover, advancements in polymer production have yielded materials with enhanced properties such as strength, durability, and corrosion resistance, significantly stimulating market growth.

The construction of green buildings emphasizes the use of resources that minimize environmental pollution. Plastics such as PET, low-density polyethylene (LDPE), polyvinyl chloride (PVC), polypropylene (PP), high-density polyethylene (HDPE), and polystyrene (PS) are recyclable, durable, and possess high strength, making them increasingly utilized in green building construction. This trend is expected to drive demand for plastics in construction as the popularity of green buildings continues to grow.

Plastics are favored over other construction materials due to their low maintenance requirements. The demand for plastics in construction and decoration is projected to rise as more companies offer fire-resistant and cost-effective plastics

Key players in the global market, including BASF SE, Borealis AG, The Dow Chemical Company, DuPont, Solvay SA, and Trinseo, produce plastics for various applications in the infrastructure sector. These companies are highly integrated across the value chain, managing operations from production to sales and distribution to diverse locations.

Volatile crude oil prices heavily influence the prices of raw materials such as ethylene, propylene, and styrene. Since plastic manufacturing relies on 4.0% of crude oil, fluctuations in crude oil prices are expected to impede market growth in the forecast period.

Product Insights

Thepolyvinyl chloride (PVC) product segment accounted for a share of 34.3% in 2023. PVC’s dominance can be attributed to its versatile properties, making it a preferred material for various construction applications. Its high durability, resistance to environmental degradation, and cost-effectiveness make it ideal for use in pipes, fittings, window frames, and flooring. Additionally, PVC’s ability to be easily molded into different shapes and sizes enhances its utility in both residential and commercial construction projects. The segment’s substantial market share reflects the widespread adoption of PVC in infrastructure development, driven by ongoing urbanization and the need for sustainable building materials. Furthermore, advancements in PVC formulations have led to the development of fire-resistant and low-maintenance variants, further boosting its demand in the construction industry.

Thepolyethylene (PE) product segment is anticipated to grow at a CAGR of 5.5% from 2024 to 2030. This growth is driven by the increasing demand for lightweight and durable materials in the construction sector. PE’s excellent chemical resistance, flexibility, and ease of installation make it suitable for a wide range of applications, including insulation, vapor barriers, and geomembranes. The rising focus on energy-efficient buildings and the growing trend of green construction are expected to propel the demand for PE products further. Additionally, innovations in PE manufacturing processes have led to the production of high-density polyethylene (HDPE) and low-density polyethylene (LDPE) variants, each catering to specific construction needs. The segment’s anticipated growth underscores the expanding role of PE in modern construction practices, as it offers a sustainable and cost-effective alternative to traditional building materials.

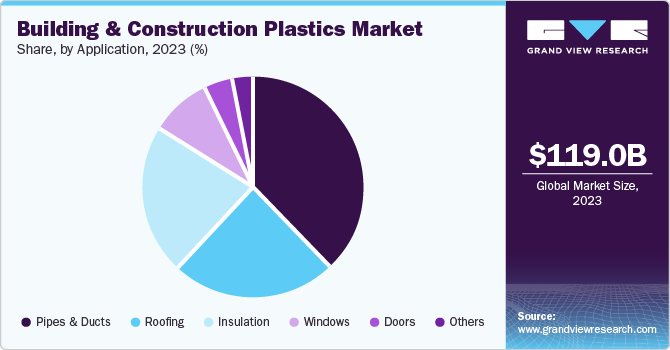

Application Insights

The pipes & ducts application segment dominated the market with a share value of 38.2% in 2023. This segment’s prominence can be attributed to the extensive use of plastic pipes and ducts in various construction activities. Plastic pipes, particularly those made from PVC HDPE and PEX (cross-linked polyethylene), are favored for their durability, corrosion resistance, and cost-effectiveness. These materials are widely used in plumbing, water supply systems, sewage and drainage systems, and HVAC (heating, ventilation, and air conditioning) ducts. The ability of plastic pipes to withstand harsh environmental conditions and their ease of installation have further fueled their adoption. Additionally, the growing emphasis on sustainable construction practices has increased the preference for plastic pipes due to their recyclability and lower environmental impact compared to traditional materials like metal.

The roofing application segment is expected to grow fastest with a CAGR of 5.5% from 2024 to 2030. The increasing demand for lightweight, durable, and energy-efficient roofing materials drives this growth. Plastics, such as polycarbonate, PVC, and TPO (thermoplastic olefin), are gaining traction in the roofing industry due to their excellent weather resistance, UV stability, and thermal insulation properties. These materials are particularly popular in regions with extreme weather conditions, as they provide superior protection against harsh elements. Moreover, the trend toward green building practices and energy-efficient construction is boosting the adoption of plastic roofing materials. These materials can be designed to reflect sunlight and reduce heat absorption, contributing to lower energy consumption for cooling purposes. As a result, the roofing application segment is expected to witness significant growth, driven by the need for sustainable and high-performance roofing solutions.

Regional Insights

The North America building and construction plastic market held a significant market share in 2023. North America is among the largest consumers of building and construction plastics in the globe. Canada's expanding industrial base, along with the increasing product availability and rising usage of plastics based on PVC, PP, and PE, will be a significant factor in the construction business. These factors are estimated to expand the market in the region significantly in the upcoming years.

U.S. Building And Construction Plastics Market Trends

The U.S. building and construction plastics market dominated the North American region with a share in 2023 due to technological advancements such as enhanced polymer technologies to improve the performance of the products and cost-effective measures taken by the building and construction industries, which are increasing the adoption of plastics over other traditional materials. Additionally, the versatile application of plastics in insulation, windows, flooring, and other applications has been attracting manufacturers to use plastics in different sectors and thus propelling the market in the country.

Canada building and construction plastics market is expected to grow significantly from 2024 to 2030. Canada's growing population has driven the demand for housing development, thus increasing the demand for construction materials such as plastics that can be utilized in modern designs. Moreover, the growing awareness about energy usage and climatic awareness is expanding the focus on building energy-efficient buildings, thus increasing the demand for the products. These factors are fueling the country's market growth.

Europe Building And Construction Plastics Market Trends

Europe building and construction plastics market growth can be attributed to favorable macroeconomic conditions and improved regional industrial facilities, driving increased demand for products. The demand for vinyl in Europe has also surged, leading to a rise in production, with organizations such as the European Council of Vinyl Manufacturers (ECVM) producing approximately 85% of PVC resins in the region.

The UK building and construction plastics market has dominated the European market with 66.7% of the regional market share in 2023. Factors driving this growth include urbanization, a focus on green buildings, technological advancements, and sustainable government policies, superior physical properties compared to other products, evolving application requirements, and changing population preferences for modern architectural structures.

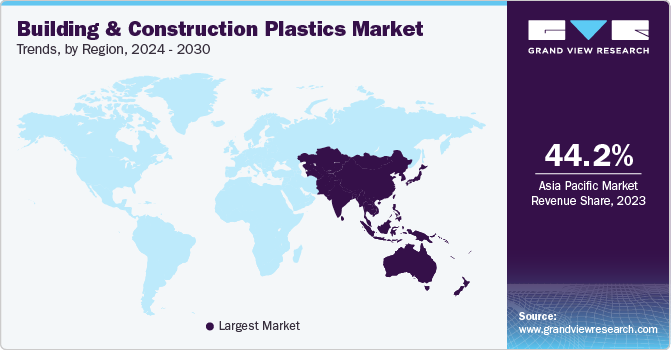

Asia Pacific Building And Construction Plastics Market Trends

Asia Pacific dominated the building & construction plastics market in 2023 with a revenue share of 44.2% and is also expected to witness the fastest CAGR of 6.1% over the forecast period. Due to the growing construction sector, the demand for building and construction plastics in the region is expected to grow in the coming years. Owing to the affordability of labor and closeness to the sources of materials, industrial and manufacturing areas of Asia-Pacific have been attracting large-scale investments from global giants. Therefore, the region's construction industry is on the rise through the manufacturing and industrial sectors. This is seen as pushing up the need to build and construct plastics in the future.

China building and construction plastics market held the largest market share of the region in 2023, owing to government initiatives and policies to promote sustainable practices in infrastructure development, such as adopting eco-friendly materials such as recycled plastics and shifting trends towards lightweight and durable construction materials, thus surging the demand for PVC, Polyethylene, and other plastic materials. Technological advancements have improved product performance, such as better thermal insulation properties, an aesthetic look in the building, fire-resisting qualities, and others.

The building and construction plastics market in India is expected to grow fastest over the forecast period. The growth of the market in the country is influenced by rapid urbanization, which leads to government initiatives and investments in the construction industry, thus driving the demand for construction plastics. Increasing investments in real estate and infrastructure projects by private players to build efficient buildings are fueling the demand for the products.

Key Building And Construction Plastics Company Insights

Some of the key companies in the building and construction plastics market include BASF, Dupont, Dow, LG Chem, and many others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

BASF is a chemical company based in Ludwigshafen, Germany; that offers hi-tech solutions for many industries such as building and construction. BASF offers polyurethane, styrenics, and engineering plastics, which are used in building & construction plastics that improve energy efficiency, durability, and design engineering for construction.

-

The Dow Company offers a well-developed portfolio of innovative plastic products that allow improving energy efficiency and lifespan of buildings, as well as using heat-shielded sealants and adhesives in construction.

Key Building & Construction Plastics Companies:

The following are the leading companies in the building & construction plastics market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- DuPont

- Dow

- LG Chem

- SABIC

- Arkema

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Solvay

- Evonik Industries AG

- Covestro AG

- Eastman Chemical Company

- Huntsman Corporation

- Teknor Apex

- Avient Corporation

Recent Developments

-

In May 2024, Clariant introduced Liocolub PED 1316 which is a new oxidized high-density polyethylene (HDPE) that can be of internal and external USE in PVC processing for windows, pool steps, non-potable pipes and others.

-

In December 2023, Arkema acquired Arc Building products in Ireland which has strengthened in position in Ireland’s construction adhesives market.

Building And Construction Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 124.4 billion

Revenue forecast in 2030

USD 167.4 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, Kuwait, UAE

Key companies profiled

BASF; DuPont.; Dow; LG Chem.; SABIC; Arkema; LyondellBasell Industries Holdings B.V.; Borealis AG.; Solvay; Evonik Industries AG; Covestro AG; Eastman Chemical Company; Huntsman Corporation; Teknor Apex; Avient Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Building And Construction Plastics Market Report Segmentation

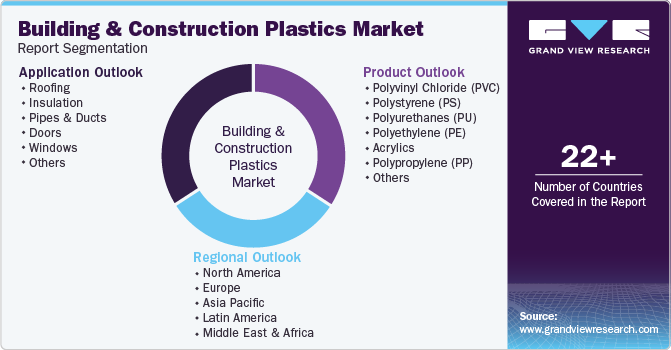

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global building and construction plastics market report based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polyurethanes (PU)

-

Polyethylene (PE)

-

Acrylics

-

Polypropylene (PP)

-

Others

-

-

Application Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Roofing

-

Insulation

-

Pipes & Ducts

-

Doors

-

Windows

-

Others

-

-

Regional Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.