- Home

- »

- Pharmaceuticals

- »

-

Burn Ointment Market Size & Share, Industry Report, 2030GVR Report cover

![Burn Ointment Market Size, Share & Trends Report]()

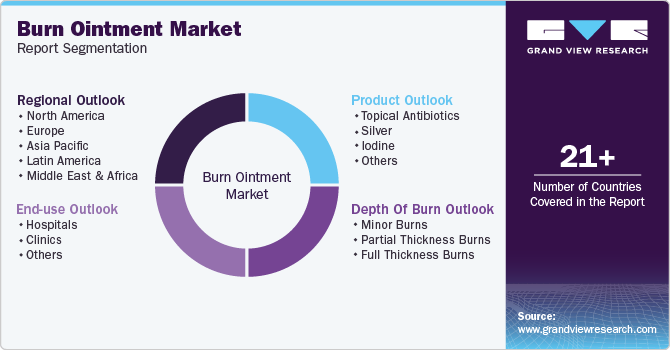

Burn Ointment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Topical Antibiotics, Silver, Iodine), By Depth Of Burn (Minor Burns, Partial Thickness Burns), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-040-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Burn Ointment Market Size & Trends

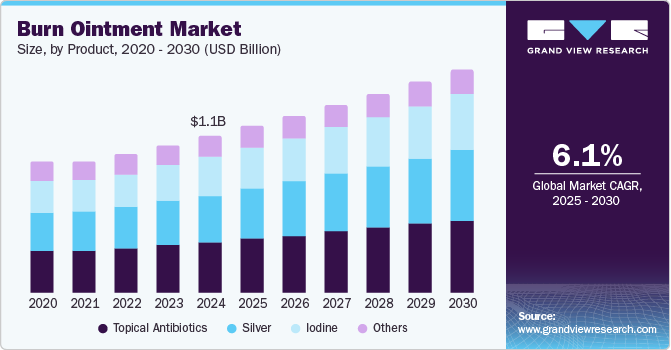

The global burn ointment market size was estimated at USD 1.08 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. The increasing prevalence of burn injuries worldwide can drive this growth. Accidental burns, industrial accidents, and household incidents contribute to the rise in the need for effective burn care products. As burn-related injuries grow, the demand for burn ointments and other topical treatments continues to rise, creating a substantial market opportunity. Increased awareness of burn treatment and more healthcare facilities offering burn care support the burn ointment industry.

New products that accelerate healing, reduce infection risks, and minimize scarring are gaining popularity among healthcare professionals and consumers. The shift towards more effective and specialized treatments is enhancing the effectiveness of burn care, further boosting the market. In addition, growing consumer preference for natural and organic ingredients in burn ointments contributes to developing safer, more innovative products. For Instance, according to the World Health Organization (WHO), burns cause globally approximately 180,000 deaths annually, with a substantial number occurring in low- and middle-income countries.

Furthermore, increasing awareness of burn prevention and improved healthcare infrastructure, particularly in emerging economies, are making burn care more accessible. Public education campaigns on prompt and proper burn treatment encourage quicker responses to burn injuries. As more people in developing regions have access to burn care, the market for burn ointments is expanding. The growing use of burn ointments in cosmetic treatments for scar reduction supports the market growth.

Product Insights

The topical antibiotics segment dominated the market with a revenue share of 32.5% in 2024, driven by a key role in preventing infections in burn wounds. Burns, especially second and third-degree, are prone to bacterial infections that complicate recovery. Topical antibiotics are essential for reducing infection risk, promoting healing, and preventing sepsis. Their ease of application and effectiveness make them popular in clinical and home care. As infection control becomes a priority in burn care, demand for these topical antibiotics grows. Advanced formulations with enhanced antimicrobial properties further support the segment growth.

The silver segment is projected to grow at a CAGR of 6.8% over the forecast period, driven by its broad clinical adoption and effectiveness in burn care. Its strong antibacterial properties help reduce infection risk, which is a key concern in burn treatment. The cream's ability to ease pain and speed up healing makes it a preferred choice for burn management. Its cost-effectiveness and ease of application enhance its use in hospitals and outpatient settings. The versatility in treating various burn types further strengthens its market position. Increasing awareness of wound care and burn prevention boosts its demand. Ongoing advancements in formulation are witnessed in driving segment growth.

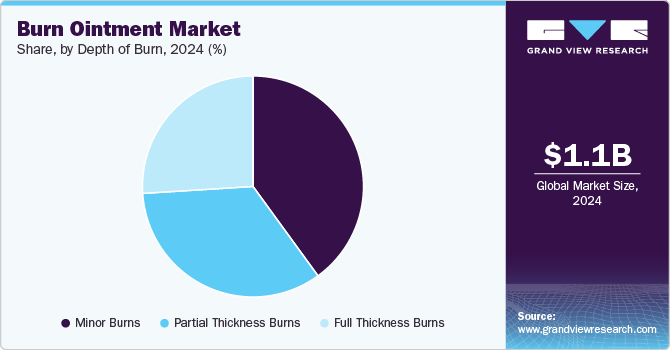

Depth Of Burn Insights

The minor burns segment dominated the market, with the largest revenue share in 2024, attributed to the high incidence of minor burn injuries in daily life. These burns, often caused by kitchen accidents, household chores, or outdoor activities, are typically less severe but still require effective treatment. The increasing availability of over-the-counter burn ointments and creams makes it easier for individuals to manage minor burns at home. The rising awareness of first-aid and burn prevention contributes to the demand for ointments specifically targeting minor burns. The affordability and convenience of these products make them widely accessible, driving their market share. As minor burn cases continue to rise, the segment is expected to maintain its dominant position.

The partial thickness burns segment is projected to grow at the fastest CAGR over the forecast period due to the increasing incidence of these burns, which are more severe than minor burns and often require specialized treatment. The effectiveness of new treatment options, such as growth factor therapies, has been shown to significantly reduce healing time and improve scar formation outcomes, making them a preferred choice among healthcare providers. Moreover, the prevalence of burn injuries in both domestic and industrial settings continues to increase, necessitating effective solutions for partial-thickness burns.

End-use Insights

The hospital segment dominated the market with the largest revenue share in 2024, driven by the increasing number of burn cases requiring advanced medical treatment. For instance, according to the Centers for Disease Control and Prevention (CDC), over 40,000 severely burned patients are hospitalized each year in the U.S., highlighting the critical role hospitals play in managing severe burn injuries. In addition, hospitals provide access to specialized burn care ointments and a wide range of treatment options that are crucial for effectively treating significant burns. The rising incidence of burn injuries, particularly among vulnerable populations such as children and the oldest people, further fuels the demand for hospital-based care. These factors contribute to the hospital segment's dominance in the burn ointment market.

The other segment is projected to grow at the fastest CAGR over the forecast period, fueled by the increasing adoption of alternative treatments and the expansion of non-traditional burn care solutions. Products include herbal and natural ointments and Over-the-Counter (OTC) solutions for minor burns and first aid. Growing consumer preference for organic and plant-based ingredients and the rising demand for home care remedies drive the segment's growth. As awareness of alternative burn treatments grows, the "others" segment is expected to gain traction, attracting consumers and healthcare providers looking for new solutions.

Regional Insights

North America burn ointment market dominated the global market with a revenue share of 41.9% in 2024, driven by the increasing incidence of burn injuries and a growing awareness of effective treatment options. The rise in burn cases, particularly in industrial and urban settings, necessitates advanced burn care solutions. Well-established healthcare infrastructure and favorable reimbursement policies enhance access to burn treatments. The burn ointment industry benefits from ongoing product formulation innovations, improving healing times and patient outcomes. Moreover, public health initiatives to educate the population about burn prevention and care are expected to boost demand further.

U.S. Burn Ointment Market Trends

The U.S. burn ointment market dominates North America, with a significant revenue share in 2024, due to the country has a high prevalence of burn injuries. This is exacerbated by factors such as household accidents and workplace incidents. The advanced healthcare system in the U.S. ensures that patients have access to a wide range of effective burn treatments, including specialized ointments. Furthermore, pharmaceutical companies' ongoing research and development efforts are resulting in innovative products catering to diverse patient needs. The strong government support for healthcare initiatives and a robust distribution network facilitate the widespread availability of burn care products. These elements collectively contribute to the U.S. dominant position in the North American market.

Asia Pacific Burn Ointment Market Trends

Asia Pacific burn ointment market is expected to register the fastest CAGR of 6.8% over the forecast period, attributed to rapid urbanization and industrialization leading to an increase in burn incidents. The region's growing population and economic development have resulted in more households using hazardous materials, raising the risk of burns. The improvements in healthcare infrastructure and increased awareness regarding burn management are propelling market growth. Governments also invest in public health campaigns to educate communities about fire safety and proper burn care practices. As a result, there is a rising demand for effective burn treatment options across Asia Pacific countries.

The China burn ointment market dominates the Asia Pacific, with a significant revenue share in 2024, due to its vast population and high incidence of burn injuries related to industrial accidents and domestic mishaps. Rapid urbanization has increased exposure to fire hazards, necessitating effective treatment solutions such as specialized burn ointments. Furthermore, the government has been proactive in enhancing healthcare services, which include improving access to advanced medical treatments for burns. The growing middle class is becoming more aware of health issues, driving demand for quality healthcare products. Consequently, these factors position China as a leader in the Asia Pacific burn ointment market.

Europe Burn Ointment Market Trends

Europe burn ointment market held a substantial market share in 2024, driven by the aging population linked with increasing incidences of burns from domestic and occupational hazards. The advanced healthcare systems facilitate access to innovative treatment options that improve recovery outcomes for patients with burns. In addition, strong regulatory frameworks ensure that only high-quality products are available on the market, fostering consumer trust and driving sales. Public health initiatives to educate citizens about fire safety increase the demand for burn care products. Moreover, continuous advancements in medical technology enhance treatment efficacy, supporting overall market growth across Europe.

German burn ointment market dominates Europe, with a significant revenue share in 2024, due to its robust healthcare infrastructure and high standards of medical care. The country has established itself as a leader in medical research and innovation, resulting in advanced treatment options for burns that healthcare providers widely adopt. Furthermore, its strong emphasis on occupational safety regulations contributes to lower incidences of work-related burns but still necessitates effective treatment solutions for those that occur. The presence of major pharmaceutical companies within Germany also facilitates continuous product development and availability of new formulations tailored for various types of burns. These factors collectively reinforce Germany's position in the European burn ointment market.

Key Burn Ointment Company Insights

Some key companies operating in the market include 3M, Hollister Incorporated, Cardinal Health, Integra LifeSciences Corporation, and Coloplast Corp. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands through burn ointment market.

-

Integra LifeSciences Corporation offers advanced burn care solutions, including the Integra Burn Matrix and Integra Dermal Regeneration Template. These products are designed for treating severe burns, promoting tissue regeneration, and reducing scarring. The Burn Matrix supports faster healing by stimulating skin growth, while the Dermal Regeneration Template is used for complex burn injuries to aid skin reconstruction.

-

Mölnlycke Health Care AB offers advanced burn care products, including Mepitel and Mepilex dressings. These dressings use silicone technology to protect wounds, reduce pain, and promote faster healing. They also create a moist environment, minimize infection, and reduce scarring. The company provides Granudacyn, a wound cleansing solution that aids in cleaning and moisturizing burn wounds.

Key Burn Ointment Companies:

The following are the leading companies in the blood screening market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Hollister Incorporated

- Cardinal Health

- Integra LifeSciences Corporation

- Coloplast Corp.

- DeRoyal Industries, Inc.

- Smith & Nephew

- ConvaTec Inc.

- Mölnlycke Health Care AB.

- Johnson & Johnson

Recent Developments

-

In October 2024, Mölnlycke Health Care AB. acquired P.G.F. Industry Solutions GmbH, known for its effectiveness in wound cleansing and moisturizing. Granudacyn solutions will strengthen Mölnlycke’s offerings in advanced wound management.

-

In March 2024, Integra LifeSciences Corporation launched the product MicroMatrix Flex, which aimed at enhancing surgical procedures in complex cases. The product is designed to provide surgeons with a flexible solution that adapts to various soft tissue reconstruction needs. The product is engineered to improve integration and support during surgeries, addressing the challenges in intricate surgical environments.

Burn Ointment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.15 billion

Revenue forecast in 2030

USD 1.55 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product,depth of burn, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden,Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

3M; Hollister Incorporated; Cardinal Health; Integra LifeSciences Corporation; Coloplast Corp.; DeRoyal Industries, Inc.; Smith & Nephew; ConvaTec Inc.; Mölnlycke Health Care AB.; Johnson & Johnson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Burn Ointment Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global burn ointment market report based on product, depth of burn, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Topical Antibiotics

-

Silver

-

Iodine

-

Others

-

-

Depth Of Burn Outlook (Revenue, USD Billion, 2018 - 2030)

-

Minor Burns

-

Partial Thickness Burns

-

Full Thickness Burns

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.