- Home

- »

- Pharmaceuticals

- »

-

B2B Sports Nutrition Market Size & Share Report, 2021-2028GVR Report cover

![B2B Sports Nutrition Market Size, Share & Trends Report]()

B2B Sports Nutrition Market Size, Share & Trends Analysis Report By Application (Weight Management, Immunity Enhancement, Strength Training), By Distribution Channel (Fitness Studio, Gyms), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-365-9

- Number of Report Pages: 134

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

Report Overview

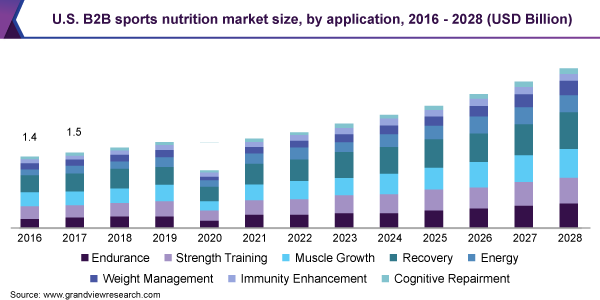

The global B2B sports nutrition market size was valued at USD 2.0 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 9.8% from 2021 to 2028. The rising demand for nutrition products in the form of protein bars, sports supplements, energy drinks, and other dietary supplements amongst athletes and recreational fitness enthusiasts is one of the key factors driving the market. Additionally, there has been a surge in the number of gyms and fitness centers across the globe, which is attributable to a rising inclination toward a healthy and physically active lifestyle amongst the consumers, thereby positively influencing the market growth.

Moreover, gyms, fitness centers, and wellness centers endorse sports nutrition products and other well-being products which would significantly contribute to growth and development. Rapid urbanization coupled with an increase in disposable income and healthcare expenditure is another driving factor. Easy availability and accessibility to business-to-business (B2B) sports nutrition products across online and offline distribution channels are also propelling the market growth. The Covid-19 pandemic breakout resulting in temporary lockdowns, closure of gyms and fitness clubs, and postponement of sporting events has negatively impacted the growth of the market for B2B sports nutrition.

The rising inclination towards pursuing an active lifestyle among consumers is positively impacting the adoption of sports nutrition products. The surge in the number of fitness centers and gyms globally is aligning against consumers’ active lifestyle goals. The number of consumers actively participating in sporting and fitness events is rising and boosting demand for sports nutrition products. As per the “Physical Activity Council” study in 2018, nearly 64% of the U.S. population aged 6 and above is associated with physical activities. Consumers are focusing on self-care and are consciously tracking nutrition and health.

The global population is focusing on health and is adopting an active lifestyle. As per estimates of the International Health Racquet and Sportsclub Association (IHRSA), in 2010 the number of health club consumers was 58.0 million, which has increased exponentially to 73.6 million in 2019. Additionally, the desire for a perfect physique amongst younger generations is anticipated to drive the market for B2B sports nutrition. Moreover, the shift in the mentality from curative care to preventive care is driving the awareness levels regarding the importance of a healthy lifestyle and consumption of sports nutrition products in the consumers which are expected to positively impact the market for B2B sports nutrition.

Key players are undertaking various initiatives, such as launching new products and constantly innovating different formulations, which is driving the market for B2B sports nutrition. For instance, In December 2020, Abbott announced the launch of a new Pedialyte formulation to support immune health through key nutrient composition. This formulation includes electrolytes, glucose, zinc, and vitamins B12, C, and E. In addition, companies also leverage the growing trend of consuming plant-based or vegan products, to launch similar products in that category. For instance, MuslceBlaze launched Biozyme Immunity Whey containing ashwagandha herb in September 2020. Product innovations in terms of new flavors of sports nutrition products are also driving the market.

Moreover, rapidly changing lifestyles and dietary habits are leading to nutritional deficiencies which in turn is expected to increase the demand for sports nutrition products and dietary supplements. With an increase in the working-class population, there has been a rise in disposable income thereby enlarging the consumer economy of countries. Companies are redesigning their marketing strategies to target recreational fitness enthusiasts to further create growth opportunities. Athletes are focusing on fulfilling their nutritional needs to align with their physical exercise regimes to enhance fitness. Athletes, coaches, trainers, and fitness enthusiasts emphasize meeting nutritional needs, as it influences the training and recovery, thus enhancing performance and boosting demand for B2B sports nutrition products.

Furthermore, the number of mergers and acquisitions occurring in the market for business-to-business sports nutrition are propelling the growth of the market. For instance, in March 2020 PepsiCo acquired Rockstar Energy Beverages to expand its business offerings. These companies are devising various strategies to expand product offerings, combine expertise and capabilities, and enhance the global business footprint. For instance, in January 2021 Healthspan Elite partnered with British Cycling and is providing product discounts to members of the British Cycling Association. Similarly, in March 2020 Herbalife Nutrition partnered with Inspire Institute of Sports (IIS) and will supply athletes with B2B sports nutrition products. In May 2020, Ghost Lifestyle and Anheuser-Busch InBev collaborated to design and launch a new range of sports drinks.

Application Insights

In 2020, the recovery segment dominated the market for B2B sports nutrition and held the largest revenue share of 24.0%. Rising awareness regarding a healthy and physically fit lifestyle with easy accessibility of commercial sports recovery products on retail shelves and online platforms is one of the major factors driving the segment. Moreover, the surge in fitness centers and gyms across the globe is another significant factor contributing to segment growth. An increase in the endorsement of dietary supplements and nutritional products by gyms and fitness centers is also one of the significant factors contributing to the growth of the segment.

Increasing health consciousness and growing the trend of self-diagnosis amongst consumers is further expected to boost the demand. Companies are focusing on product innovation and constantly enhancing their pipeline with novel ingredients is expected to boost the market growth over the forthcoming years. For instance, NOW Sports launched a whole new range of sports recovery products in May 2020. Additionally, the growing trend for plant-derived and clean-label orientation RTDs to aid fitness goals is also supporting the growth of the market for B2B sports nutrition.

However, the endurance segment is expected to witness a significant growth rate in the market for business-to-business sports nutrition over the forecast period. This growth is attributed to growing participation in sports and fitness activities like cycling, marathon, and endurance activities. Growing health awareness coupled with rising healthcare expenditure is expected to positively impact segment growth over the forthcoming years. As per a New Hope Network survey in April 2020, 44.9% of respondents opted for fitness activities like walking, running, and cycling. Endurance sports was accounted to be one of the strongest growing areas as per the same survey. Additionally, naturally extracted ingredients like ashwagandha and beet juice are gaining popularity in the endurance product range and are expected to contribute to market growth. For instance, First Endurance partnered with Rally Cycling in February 2021 to provide endurance training products to participants in sporting activities.

An increasing number of new product launches in this category is expected to boost the demand for B2B sports nutrition products in the coming years. For instance, in August 2019, Orgain launched Orgain Simple Protein Bars consisting of 12 g protein and 8 g fibers for consumption by on-the-go consumers.

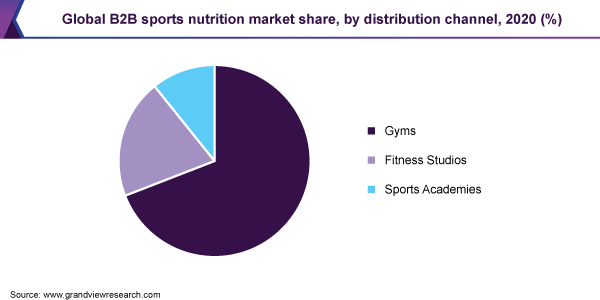

Distribution Channel Insights

In 2020, the gyms segment dominated the market for B2B sports nutrition and held the largest revenue share of 68.2%. Increasing membership numbers at gyms is the key driving factor for the segment. Health consciousness is increasing amongst gym-goers, which in turn is impacting the demand for sports nutrition products. As per studies conducted in 2020, it has been estimated that approximately 50.0% or more gym-goers consume sports supplements. Over the recent years, gyms have been endorsing a large variety of sports nutritional products and additionally providing consultation services to consumers prior to the purchase. Collaborations amidst established gyms and sports nutrition companies to cater to the nutritional needs of their members are contributing positively to segment growth. For instance, Tipton Mills Food and Gold’s Gym partnered to launch pre-workout products and protein supplements in various flavors. Moreover, companies are actively associating with gyms to boost their sales. For instance, in January 2020 Vitamin Shoppe partnered with LA Fitness to introduce retail space in LA Fitness locations.

The fitness studio segment is anticipated to witness a lucrative CAGR over the forecast years. This incremental growth over the forthcoming years is attributable to the rising popularity of fitness studios, providing a wide array of sporting and fitness activities such as personal training, yoga, HIIT, functional cross-training, and children’s fitness programs to align to the health and fitness goals of members. Personalized and customized nutrition plans and counseling are provided at these fitness studios along with 1-1 attention on training members to support their fitness journey. As per International Health, Racquet and Sportsclub Association report in 2018, it was estimated that fitness studio members spend USD 94.0 per month on fitness studio services. Therefore, the rise in demand for nutritional counseling and healthcare spending by fitness studio members is boosting the growth of the segment. The Covid-19 pandemic forced these fitness studios to devise innovative strategies to revise revenue streams through online classes and outdoor training sessions.

Regional Insights

In 2020, North America dominated the B2B sports nutrition market and held the largest revenue share of 62.4%. The increasing government initiatives promoting sporting activities in the U.S. are contributing to a spike in demand. Rising inclination toward pursuing a healthy and active lifestyle and increasing awareness regarding the importance of sports nutrition products among the population in North America is expected to positively influence the growth of the market for business-to-business sports nutrition. For instance, in 2020 Coca-Cola expanded its Powerade product segment with the launch of Powerade Ultra and Powerade Powder Water to serve rising demands in the sports RTD market.

Additionally, an increase in the number of gyms and fitness centers across the U.S. and Canada is boosting the market growth. Increasing product launches and the presence of key players in the region are some of the important factors driving the market for B2B sports nutrition in the region. For instance, in 2018 Amazon launched 11 sports nutritional products (8 general B2B sports nutrition products and 3 elite pre-workout formulations) under its private-labeled brand OWN PWR. Amazon partnered with IRONMAN to market its sports nutrition brand by bagging title sponsorship rights to the 2018 IRONMAN World Championship.

In Europe, the market for B2B sports nutrition is anticipated to grow fast over the forecast period owing to rising awareness regarding the importance of a healthy lifestyle in the region. An increase in the number of athletes and recreational sports enthusiasts in Europe is positively impacting the demand. The rise in demand for innovative, novel, and proven ingredients that aid in increasing endurance and building muscle is expected to drive demand for sports nutrition products in Europe. Furthermore, online sales channels are developing to provide enhanced accessibility and feasibility to consumers, which, in turn, would significantly drive the market for B2B sports nutrition in the region. The growing trend of outdoor sporting activities is also estimated to drive the market for B2B sports nutrition in the region. According to a European Outdoor Group survey conducted in 2020, 86.0% of respondents from Spain, the U.K., France, Germany, Italy, Poland, and Sweden preferred outdoor activities vital for personal health and well-being. Advancements in digital infrastructure in Europe are supporting growth opportunities for online platforms.

Key Companies & Market Share Insights

Key companies operating in the market for B2B sports nutrition are adopting business strategies including diverse product offerings, partnerships and agreements, and new product launches to gain market share. Some of these market players have recently launched new products in order to extend their product portfolio. Some of the prominent players in the B2B sports nutrition market include:

-

Glanbia Plc.

-

Abbott

-

PepsiCo

-

General Nutrition Centers, Inc.

-

The Bountiful Company

-

Clif Bar & Company

-

Science in Sport

-

The Hut Group

-

Cardiff B2B Sports Nutrition Limited

-

Iovate Health Sciences

-

MUSCLEPHARM

-

Post Holdings, Inc.

-

Herbalife International of America, Inc.

B2B Sports Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 3.1 billion

Revenue forecast in 2028

USD 5.9 billion

Growth Rate

CAGR of 9.8% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application; distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; New Zealand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Glanbia PLC; Abbott; PepsiCo; General Nutrition Centers, Inc; The Bountiful Company; Clif Bar & Company; Science in Sport; The Hut Group; Cardiff B2B Sports Nutrition Limited; Iovate Health Sciences; Musclepharm; Post Holdings, Inc; Herbalife International of America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research, Inc. has segmented the global B2B sports nutrition market report on the basis of application, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Endurance

-

Strength Training

-

Muscle Growth

-

Recovery

-

Energy

-

Weight Management

-

Immunity Enhancement

-

Cognitive Repairment

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Gyms

-

Fitness Studio

-

Sports Academies

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

New Zealand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. In 2020, the recovery segment dominated the market for B2B sports nutrition and held the largest revenue share of 24.0%.

b. In 2020, the gyms segment dominated the market for B2B sports nutrition and held the largest revenue share of 68.2%.

b. The global B2B sports nutrition market size was estimated at USD 2.0 billion in 2020 and is expected to reach USD 3.1 billion in 2020.

b. The global B2B sports nutrition market is expected to grow at a compound annual growth rate of 9.8% from 2020 to 2028 to reach USD 5.9 billion by 2028.

b. In 2020, North America dominated the B2B sports nutrition market and held the largest revenue share of 62.4%.

b. Some key players operating in the B2B sports nutrition market include Glanbia plc; Abbott; PepsiCo; GNC; The Bountiful Company; Clif Bar & Company; Science in Sport; TheHut.com Ltd.; Cardiff B2B Sports Nutrition Limited; Iovate Health Sciences International, Inc.; MusclePharm; Post Holdings, Inc.; and Herbalife International of America, Inc.

b. Key factors that are driving the B2B sports nutrition market growth include surging demand for various kinds of protein bars, energy drinks, and dietary supplements among bodybuilders and athletes, increased awareness about health, well-being, exercise, and supplements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."