- Home

- »

- Advanced Interior Materials

- »

-

Calcined Shale Market Size & Share Report, 2022-2030GVR Report cover

![Calcined Shale Market Size, Share & Trends Report]()

Calcined Shale Market (2022 - 2030) Size, Share & Trends Analysis Report By End-use (Paint & Coatings, Agrochemicals), By Application (Ceramics, Fillers, Desiccant), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-955-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

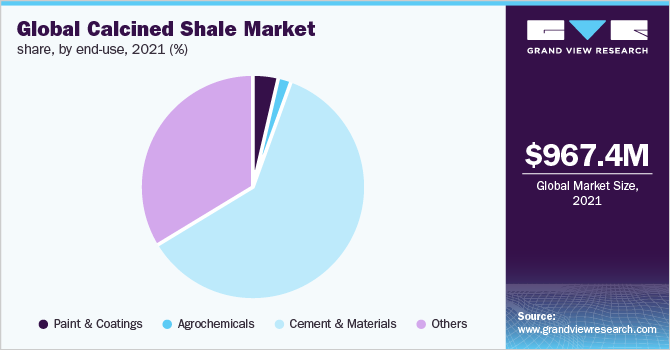

The global calcined shale market size was valued at USD 967.4 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2022 to 2030. The market growth is anticipated to be favorably impacted by the gradual recovery in the construction sector, especially in developing countries of Asia Pacific. Rising investments in construction activities are expected to boost demand for SCM, used in concrete, and hence propel market growth during the forecast period. For instance, in April 2022, Alliance Group, a leading real estate developer, announced its plans to invest USD 1,125.8 million for its construction projects in India in cities including Hyderabad, Chennai, and Bengaluru. Moreover, the Group has plans to build 50,000 homes over the next three years.

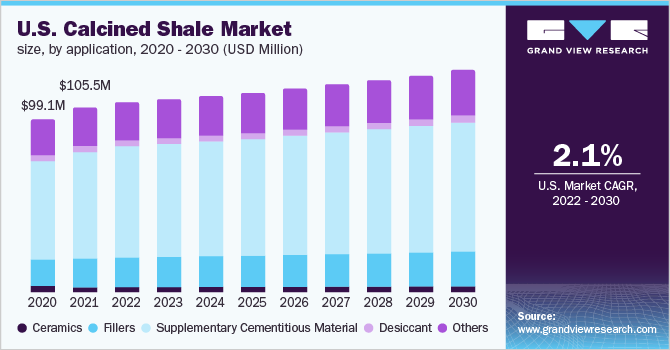

The U.S. was the largest market for calcined shale in North America in 2021 and this trend is anticipated to continue over the forecast period. The product is extensively used in SCM. Compared to 2020, the U.S. construction industry witnessed a gradual recovery in 2021 owing to increased residential demand and modest growth in non-residential demand. Infrastructure activity also picked up during the year, and this is anticipated to improve with the multi-year federal infrastructure package.

Environmental, Social, and Governance (ESG) is steadily gaining importance in the business world, and it has become imperative for companies to adhere to environmental policies and regulations set by the government. For instance, the U.S. federal laws such as National Environmental Policy Act, Resource Conservation and Recovery Act, Clean Water Act, and Toxic Substances Control Act, are aligned toward providing clean and sustainable business practices in the country.

Moreover, regulatory laws that provide favorable investment conditions for companies and investors encourage sustainable practices in the mining industry. This is expected to encourage sustainable mining practices in the region and positively impact the use of calcined shale during the forecast period.

The cement and concrete exports from the U.S. increased by around 28.0% from 2020 to 2021. The increasing trend of exports reflects that the cement and concrete industry has been steadily recovering from the impact of the pandemic. This is likely to improve the consumption of calcined shale during the forecast period.

Application Insights

The SCM segment held the largest revenue share of over 56.0% in 2021 and this trend is anticipated to continue over the forecast period. Calcined shale is used to strengthen concrete in demanding environments, thereby increasing its durability. Rising investments towards expanding concrete production on account of rising demand from developing economies to propel infrastructural developments and boost pandemic recovery are anticipated to positively influence segment growth.

The fillers segment is expected to be one of the fastest-growing application segments of the market for calcined shale across the forecast period. Calcined shale is used as mineral filler in mixtures for asphalt paving. Government initiatives toward developing road infrastructure, such as the ‘Investing in Canada’ infrastructure plan, indicate potential growth prospects for the industry to flourish over the coming years.

Desiccants is another vital application of calcined shale. Calcined shale is used as an odor adsorbent in oil refineries. It is also used in water treatment facilities for the removal of copper, nickel, manganese, and other heavy metals such as lead and chromium from industrial waste waters and mine water effluents. Desiccants are of significance due to the growing emphasis on addressing environmental pollution caused due to the discharge of untreated effluents containing toxic metals into water bodies.

End-use Insights

The cement and material segment held the largest revenue share of over 61.0% in 2021. This end-use segment is anticipated to grow at a steady rate over the forecast period. Due to the need for increased building and construction activity owing to urbanization, the demand for cement has been increasing. This is anticipated to boost the consumption of calcined shale during the forecast period.

The paints and coatings segment is anticipated to witness a CAGR of 3.3% in terms of revenue during the forecast period. Calcined shale is used as a pigment-grade filler in the paint and coatings industry. It helps control product cost by displacing more expensive materials such as titanium dioxide. It aids in extending resin life, increases stiffness and strength, improves product performance, and provides opacity and conductivity to the paint/coating compound.

Agrochemicals is another significant end-use industry of the market, where the product finds use as fillers, especially in fertilizers as anti-caking agents. According to the United Nations, agriculture production will have to be increased by 70% to support a population of 9.70 billion by 2050. Fertilizer is essential to meeting the world’s current and future food requirements. The growing need for crops worldwide is thus, expected to benefit segment growth over the forecast period.

Regional Insights

Asia Pacific dominated the market and held the largest revenue share of more than 48.0% in 2021. The growing demand from the building and construction industry is anticipated to propel product demand. For instance, in November 2021, the Malaysian government announced its plans to construct 500,000 affordable houses under the 12th Malaysian plan which is likely to be completed by 2025. Similar trends are observed across the region, which is likely to augment calcined shale demand over the forecast period.

North America anticipated to register a growth rate of 2.7%, in terms of revenue, across the forecast period. The demand for calcined shale in North America is mainly dependent upon its usage in ceramics, as fillers, and as SCM. Technical ceramics are increasingly being used in numerous emerging energy storage technologies. Such ceramics are used in gas turbines of wind energy systems; in nuclear power plants, ceramics are used as moderators and barriers, among other applications.

Europe held the second-largest revenue share in 2021. The industry is anticipated to witness sluggish growth in 2022 and 2023. This can be attributed to various factors such as low economic growth, the COVID-19 impact, and the Russia-Ukraine conflict. These reasons have impacted the manufacturing and construction activities of the region along with trade scenario as well.

Key Companies & Market Share Insights

The market for calcined shale is competitive in nature. The product is a type of natural pozzolan. Natural pozzolans are being preferred to substitute clinker in cement, on account of rising concerns towards adopting sustainable building materials. As a result, market players are focusing on calcined shale production amidst growing construction activities and rising demand for environmental-friendly cementitious materials. Some of the prominent players in the calcined shale market include:

-

CemGreen

-

EICL Limited.

-

FLSmidth

-

HeidelbergCement

-

Hoffmann Mineral GmbH

-

Holcim

-

Thiele Kaolin Company

-

Kirkland Mining Company

-

RK Minerals

-

Ash Grove Cement Company

Calcined Shale Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.0 billion

Revenue forecast in 2030

USD 1.3 billion

Growth Rate

CAGR of 3.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, company profiles, and trends

Segments covered

End-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Turkey; China; India; Japan; Brazil

Key companies profiled

CemGreen; EICL Limited.; FLSmidth; HeidelbergCement; Hoffmann Mineral GmbH; Holcim; Thiele Kaolin Company; Kirkland Mining Company; RK Minerals; Ash Grove Cement Company

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Calcined Shale Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global calcined shale market report on the basis of application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Ceramics

-

Fillers

-

Supplementary Cementitious Material (SCM)

-

Desiccant

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Paint & Coatings

-

Agrochemicals

-

Cement & Materials

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global calcined shale market was estimated at USD 967.4 million in 2021 and is expected to reach USD 1.0 billion in 2022.

b. The calcined shale market is expected to grow at a compound annual growth rate of 3.4% from 2022 to 2030 to reach USD 1.3 billion by 2030.

b. Supplementary cementitious material was the key application segment of the global market with a revenue share of more than 56.0% in 2021.

b. Some of the key players operating in the calcined shale market CemGreen, EICL Limited., FLSmidth, HeidelbergCement, Hoffmann Mineral GmbH, Holcim, Thiele Kaolin Company, Kirkland Mining Company, RK Minerals, and Ash Grove Cement Company, among others.

b. Increasing demand from building & construction industry across the world, owing to urbanization, and growing population, are anticipated to drive the growth of the calcined shale market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.