- Home

- »

- Plastics, Polymers & Resins

- »

-

California Hot Melt Adhesives Market Size, Report, 2030GVR Report cover

![California Hot Melt Adhesives Market Size, Share & Trends Report]()

California Hot Melt Adhesives Market Size, Share & Trends Analysis Report By Application (Packaging, Disposables, Pressure-sensitive Products, Bookbinding, Furniture), By Product (EVA, SBC), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-620-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

California Hot Melt Adhesives Market Trends

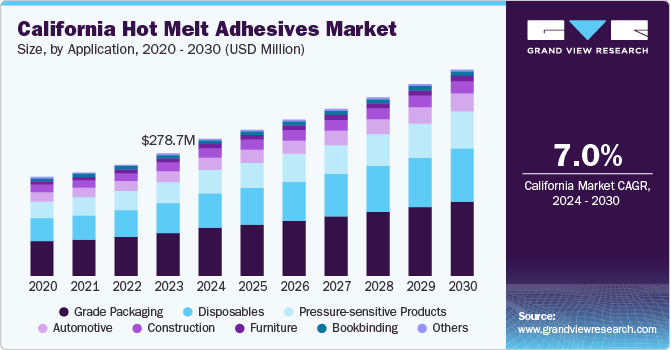

California hot melt adhesives market size was valued at USD 278.7 million in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. This growth is driven by several key factors, including the increasing demand from the packaging industry, particularly for eco-friendly and sustainable packaging solutions. As e-commerce continues to expand, the need for efficient and reliable packaging materials grows, boosting the use of hot melt adhesives.

In addition, the automotive and construction sectors are adopting these adhesives for their superior bonding properties and quick setting times, which enhance production efficiency. Technological advancements and innovations in adhesive formulations are also playing a crucial role, offering improved performance and versatility. Also, the growing emphasis on reducing volatile organic compounds (VOCs) in adhesives aligns with environmental regulations, further propelling market growth.

The rising utilization of lightweight materials in the automotive and aerospace sectors has significantly contributed to market growth. Hot melt adhesives are favored in these industries for their effectiveness in bonding lightweight materials such as composites, plastic, and aluminum. In addition, the increasing use of hot melt adhesives in the construction sector has further propelled market growth. These adhesives are employed to bond various surfaces, including plastics, metals, and wood, during construction.

The growing demand for environmentally friendly adhesives has also driven market expansion. Hot melt adhesives emit no harmful emissions, aligning with government regulations regarding volatile organic compounds (VOCs). As a result, they are a popular choice for manufacturers due to their environmental friendliness and the absence of VOC emissions during the curing process. Moreover, hot melt adhesives are non-flammable and require no ventilation. Their affordability and easy availability have also contributed to the increased demand. Therefore, these factors collectively drive the growth of the hot melt adhesives market in California.

Application Insights & Trends

The packaging segment dominated the market in 2023 with a share of 35.6% attributed to the increasing demand for efficient and sustainable packaging solutions, driven by the growth of e-commerce and the need for reliable packaging materials. Hot melt adhesives are widely used in the packaging industry due to their strong bonding capabilities, quick setting times, and versatility in adhering to various substrates such as paper, cardboard, and plastics. In addition, the shift towards eco-friendly packaging has further boosted the adoption of hot melt adhesives, as they align with stringent environmental regulations.

The disposables (hygiene and medical) segment is expected to grow at a CAGR of 8.2% during the forecast period. This robust growth is driven by the rising demand for disposable hygiene products such as diapers, sanitary napkins, and adult incontinence products, which require reliable and safe bonding solutions. Hot melt adhesives are preferred in this segment due to their non-toxic nature, strong adhesion, and ability to maintain bond integrity under various conditions. In the medical field, hot melt adhesives are used in the manufacturing of medical disposables such as surgical drapes, gowns, and wound dressings, where their quick setting times and strong bonds are crucial. The increasing focus on hygiene and safety, coupled with the growing healthcare sector, is expected to further propel the demand for hot melt adhesives in the disposables segment.

Product Insights & Trends

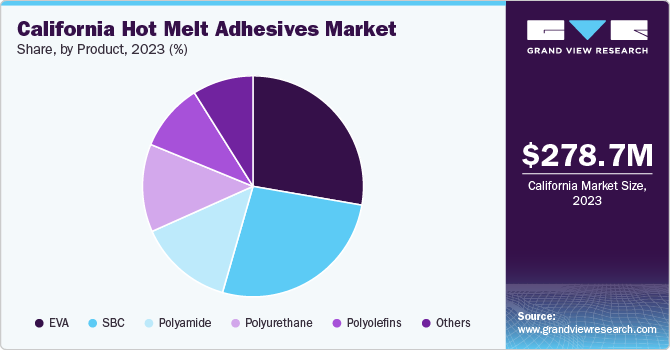

The Ethylene Vinyl Acetate (EVA) segment dominated the California hot melt adhesives market in 2023. EVA adhesives are widely favored due to their excellent bonding properties, versatility, and cost-effectiveness. They are extensively used in various applications, including packaging, bookbinding, woodworking, and footwear manufacturing. The dominance of the EVA segment can be attributed to its strong adhesion to a wide range of substrates, including paper, cardboard, plastics, and metals. In addition, EVA adhesives offer good thermal stability and resistance to environmental factors, making them suitable for both indoor and outdoor applications. The segment's growth is further supported by continuous innovations and improvements in EVA formulations, enhancing their performance and expanding their application scope.

The polyurethane (PU) segment is expected to grow at the fastest rate over the forecast period. PU hot melt adhesives are known for their superior bonding strength, flexibility, and durability, making them ideal for demanding applications in the automotive, construction, and electronics industries. The growth of the PU segment is driven by the increasing demand for high-performance adhesives that can withstand extreme conditions and provide long-lasting bonds. In the automotive sector, PU adhesives are used for bonding various components, including interior trims, exterior panels, and structural parts, due to their ability to absorb vibrations and resist impact. In the construction industry, PU adhesives are favored for their strong adhesion to diverse materials such as wood, concrete, and metal, as well as their resistance to moisture and temperature fluctuations.

Key California Hot Melt Adhesives Company Insights

Some of the major companies in the California hot melt adhesives market are Bostik Evonik Industries AG, 3M, Ashland, and others. Companies are focusing on increasing product portfolios with the help of technological advancements, collaborations, mergers, and more. The companies are also focusing on the integration of biodegradable ingredients in order to promote sustainability.

-

Evonik Industries AG is a company that deals with specialty chemicals. The company produces and distributes products such as resins, polymers, additives, surfactants, and more. It also caters to domains such as paints, coatings, renewable energy, metal and oil, paper, and more.

-

Bostik is a company specializing in the production of adhesives and sealants. The company offers its services to industries such as construction, industrial, consumer markets, and more. The company provides products such as adhesives, resins, sealants, admixtures, and more.

Key California Hot Melt Adhesives Companies:

- Bostik

- Evonik Industries AG

- 3M

- Ashland

- AVERY DENNISON CORPORATION.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Palmetto Adhesives

- Pacific Adhesives Systems

- Evans Adhesive.

- Warren Adhesives

Recent Developments

-

In September 2023, Bostik announced the launch of its range of Bio-based specialty hot melt adhesives. The launch was aimed at mitigating the demand for sustainable materials in the production of textiles, filters, automotive interiors, footwear, electronics, and more. The product was launched in the form of pellets, powders, webs, and films. They comprise 90% and more bio-based content.

-

In March 2023, Evonik Industries AG announced the launch of a new product named DYNACOLL eCO to transition from fossil fuels to renewable resources. The new polyester product line helped the company enable a cost-effective and fast change of production on a large scale. This product launch was targeted to help Evonik meet its environmental and sustainability goals.

California Hot Melt Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 312.1 million

Revenue forecast in 2030

USD 468.4 million

Growth Rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product

Key companies profiled

Bostik; Evonik Industries AG; 3M; Ashland; AVERY DENNISON CORPORATION.; H.B.; Fuller Company; Henkel AG & Co. KGaA; Palmetto Adhesives; Pacific Adhesives Systems; Wisdom Adhesives Worldwide; Evans Adhesive.; American Standard Adhesives; Warren Adhesives

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

California Hot Melt Adhesives Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the California hot melt adhesives market report based on application and product.

-

Application Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Grade Packaging

-

Disposables (Hygiene & Medical)

-

Pressure-sensitive Products

-

Bookbinding

-

Furniture

-

Automotive

-

Construction

-

Others

-

-

Product Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

EVA

-

SBC

-

Polyolefins

-

Polyamide

-

Polyurethane

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."