- Home

- »

- Next Generation Technologies

- »

-

Cannabis Technology Market Size & Share Report, 2030GVR Report cover

![Cannabis Technology Market Size, Share & Trends Report]()

Cannabis Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Application, By Distribution Channel (Online, Offline), By Component (Hardware, Software), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-083-5

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabis Technology Market Size & Trends

The global cannabis technology market size was valued at USD 3.87 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 25.3% from 2023 to 2030. The increasing research on the use of cannabis and its medicinal properties has led to its increased use to treat various chronic conditions. It is found to be effective in treating chronic pain and nausea caused due to chemotherapy. The increasing legalization of cannabis is expected to drive companies to develop advanced technologies for the consumption of cannabis. Furthermore, a positive attitude of consumers toward the consumption of cannabinoid-based products has led to the increased penetration of cannabis tech.

For instance, according to the Gallup Survey, 2022, approximately 64% of U.S. adults were familiar with cannabis products. Similarly, innovative technology developments for added precision in cannabis diffusion are anticipated to drive market growth. As an example, modern cannabis diffusers are bluetooth enabled for control with paired mobile devices. During the COVID-19 outbreak, various industries were shut down briefly and lockdowns were imposed to reduce the spread of the virus, which impacted business operations across regions.

The factors responsible for the decrease in production include stringent regulation on trade and disruption in the supply chain due to government-imposed lockdowns. In addition, the demand for cannabis technology is anticipated to have increased during the pandemic, as individuals turned towards recreational cannabis consumption to cope with lockdown regulations. This, in turn, drove the demand for the cannabis technology market globally.

The trend of digitization in the cannabis tech industry is expected to drive the growth of the market. For instance, retailers are using technology for inventory management and point-of-sale purposes. Similarly, technology is expected to have a positive impact on the cannabis industry for multiple applications, including cultivation, consumption, and more. For instance, developments in genetic engineering are expected to help cultivators develop their desired strains of cannabis in a controlled environment, seeds developed in labs, and more.

Additionally, the integration of modern technologies such as artificial intelligence in cannabis technology is anticipated to help the market to progress. Using artificial intelligence (AI), growers can predict and prepare for environmental fluctuations to improve the quality of the yield. Additionally, the growing trend of using AI to achieve the desired CBD level by modifying the genetic structure of cannabis plants is anticipated to drive market growth. This, in turn, is expected to push companies to develop customized modern technologies to help develop popular cannabis strains that sell more.

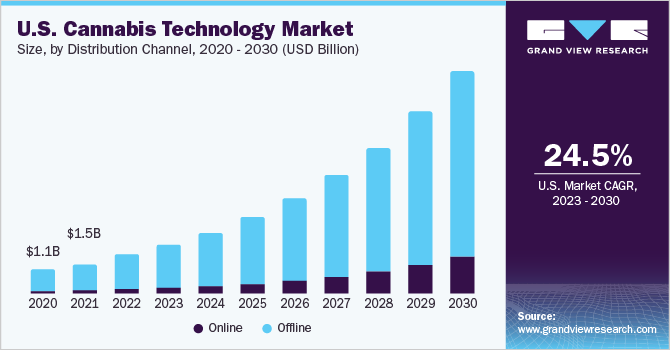

Distribution Channel Insights

The offline segment accounted for the largest market share of 88.7% in 2022. The segment growth can be attributed to the rising number of brick-and-mortar stores for cannabis distribution. Additionally, there has been an increase in cannabis dispensaries in North America post-legalization of the drug. Moreover, the trend of physically checking the product quality before purchasing it is anticipated to be a major factor in the segment’s growth.

The online segment is expected to witness the fastest growth during the forecast period, expanding at a CAGR of 31.2%. This segment’s development can be accredited to the convenience offered by online shopping for cannabis. The trend of online payments and same-day delivery is expected to drive segment growth, as customers can choose the strain type and get it delivered in just a few hours or days. Moreover, the factor of customer privacy and the availability of multiple payment options in online stores is expected to drive segmental growth.

Application Insights

The cultivation segment recorded a market share of over 25% in 2022. The segment growth can be credited to the growing demand for cannabis due to its increasing social acceptance. Cultivators are using innovative technologies for growing cannabis to cater to its strong demand. For instance, growers are using the crop steering method to alter hormonal responses by managing the enclosed environment. Moreover, the growing usage of sensors, tracking tools, and light & water stations in cannabis cultivation for a higher yield is anticipated to drive the segment growth during the forecast period.

The consumption segment is expected to expand at a significant CAGR of 24.5% over the forecast period in the cannabis tech market. The segment growth can be accredited to prominent medical uses of cannabis. Moreover, technological advancements in products aimed at cannabis consumption are expected to help expand the segment. For instance, the Stündenglass Gravity Bong is equipped with an inbuilt vaporizer and the device rotates 360 degrees for efficient consumption.

End-use Insights

The medical segment accounted for the largest market share of over 58% in 2022. The segment demand is driven by the increasing acceptance of cannabis for the treatment of various chronic conditions such as cancer, depression & anxiety, diabetes, and epilepsy, among others. Moreover, the usage authorization of drugs containing cannabis strains for treating various conditions is contributing to the growth. Additionally, the rising number of regions allowing the use of medical cannabis is expected to propel segment growth. For instance, as of April 2022, around 37 U.S. states had legalized the use of medical cannabis.

The recreational segment is expected to advance at the highest growth rate from 2023 to 2030. The segment growth can be credited to the growing popularity of cannabis for recreational use during the COVID-19 pandemic. Also, as most recreational products can be sold without a prescription, the segment is expected to grow rapidly. The legalization of cannabis for recreational purposes is fueling the growth of the segment. For instance, 19 states in the U.S., including Colorado, Washington, California, Alaska, Oregon, and Michigan, have legalized the use of cannabis for recreational purposes.

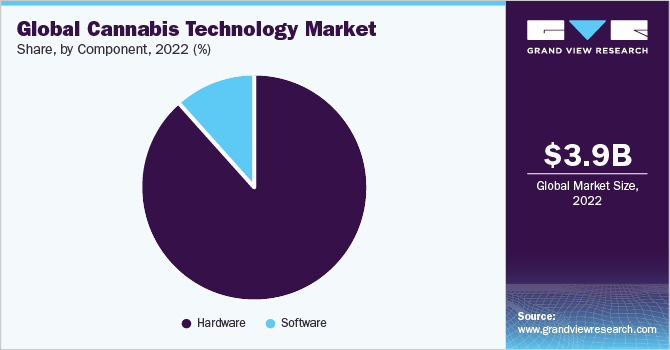

Component Insights

The hardware segment accounted for the dominant market share of over 91% in 2022. The growing usage of sensors, smart lights, humidifiers, and other hardware devices is expected to help the segment grow. For instance, cannabis cultivators are utilizing IoT solutions that include smart soil sensors and smart irrigation systems for monitoring the enclosed cannabis farm environment. Additionally, companies are using modern hardware in their products to develop smart devices that offer smart features for cannabis cultivation, storage, and consumption.

The software segment is expected to register the highest CAGR of 31.9% over the forecast period. This can be attributed to the implementation of software to create smart cannabis consumption devices. Additionally, the prominence of blockchain technology has pushed cannabis companies to develop software that accepts payment in the form of cryptocurrency. Also, companies are developing custom software that will help them to efficiently scale their operations and expand into new markets around the world.

Regional Insights

North America accounted for the largest revenue share of over 56% in 2022, which can be attributed to the growing legalization of cannabis in the region. Moreover, the rising demand for cannabis for recreational use is expected to drive regional demand. Similarly, the growing technological implementations in the cannabis industry, coupled with the increasing trend of vapes is expected to be a significant factor for positive market developments in North America. For instance, companies are developing cannabis-infused vapes to cater to the growing demand.

Asia Pacific is estimated to progress at the fastest CAGR of over 27% during the forecast period. The regional growth can be attributed to the growing social acceptance of cannabis in the region. Moreover, favorable government initiatives in Asian countries are expected to further grow the market. For instance, in June 2022, Thailand legalized cannabis cultivation, along with relaxation in laws regarding cannabis consumption in food and drinks.

Key Companies & Market Share Insights

The key players in the market are using strategies such as partnerships, acquisitions, innovations, R&D, and geographical expansions to solidify their industry position. Companies are also focusing on improving their product offerings to better suit the changing needs of consumers to stay competitive.

For instance, in March 2023, Atlas Global, a cannabis company, and Snoop Dogg, a popular musician who owns multiple cannabis companies, entered into an agreement for representation and brand expansion. The agreement allows Atlas Global to use the artist’s intellectual property in the form of name, logos, images, and more, for a period of five years. Some of the prominent players operating in the global cannabis technology market are:

-

Ardent Life, Inc.

-

Demetrix, Inc.

-

Courier Plus Inc. (Dutchie)

-

Casters Holdings LLC (Fyllo)

-

Green Thumb Industries

-

Jane Technologies, Inc.

-

LeafLink, Inc.

-

Puff Corporation (Puffco)

-

SpringBig

-

Stealth Monitoring

Cannabis Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.84 billion

Revenue forecast in 2030

USD 23.46 billion

Growth rate

CAGR of 25.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, distribution channel, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Australia; South Korea; Thailand; Brazil; Mexico; South Africa; Morocco

Key companies profiled

Ardent Life, Inc.; Demetrix, Inc.; Courier Plus Inc. (Dutchie); Casters Holdings LLC (Fyllo); Green Thumb Industries; Jane Technologies, Inc.; LeafLink, Inc.; Puff Corporation (Puffco); SpringBig; Stealth Monitoring

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabis Technology Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cannabis technology market report based on application, distribution channel, component, end-use, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cultivation

-

Indoor

-

Outdoor

-

-

Processing/Manufacturing

-

Warehousing

-

Consumption

-

Vaporizers

-

Decarb Machine

-

Accessories

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical

-

Recreational

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global cannabis technology market size was estimated at USD 3.87 billion in 2022 and is expected to reach USD 4.85 billion by 2023

b. The global cannabis technology market is expected to grow at a compound annual growth rate of 25.3% from 2023 to 2030 to reach USD 597.54 billion by 2030

b. The consumption segment dominated the cannabis tech market with a share of around 33.0% in 2022. This is attributable to the rise in penetration of vaporizers for medical and recreational applications

b. Some key players operating in the cannabis technology market include Ardent Life, Inc. Demetrix, Inc., Courier Plus Inc. (Dutchie), Casters Holdings LLC. (Fyllo), Green Thumb Industries, Jane Technologies, Inc., among others

b. Rising awareness of cannabis for medical purposes, legalization of the cannabis for cultivation and consumption for personal and industrial use contributes to the growth of the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.