- Home

- »

- Clinical Diagnostics

- »

-

Cannabis Testing Services Market, Industry Report, 2033GVR Report cover

![Cannabis Testing Services Market Size, Share & Trends Report]()

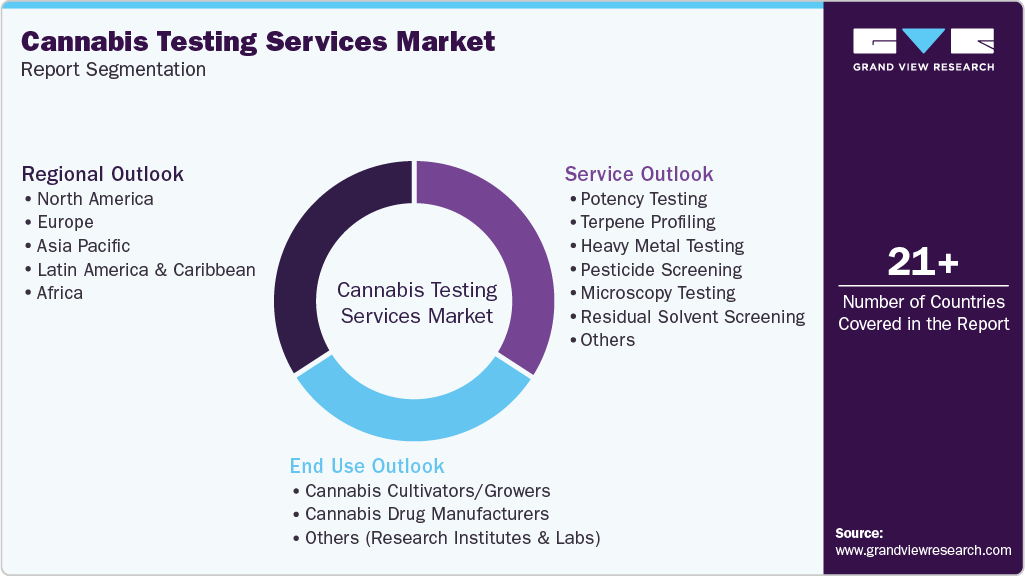

Cannabis Testing Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-658-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabis Testing Services Market Summary

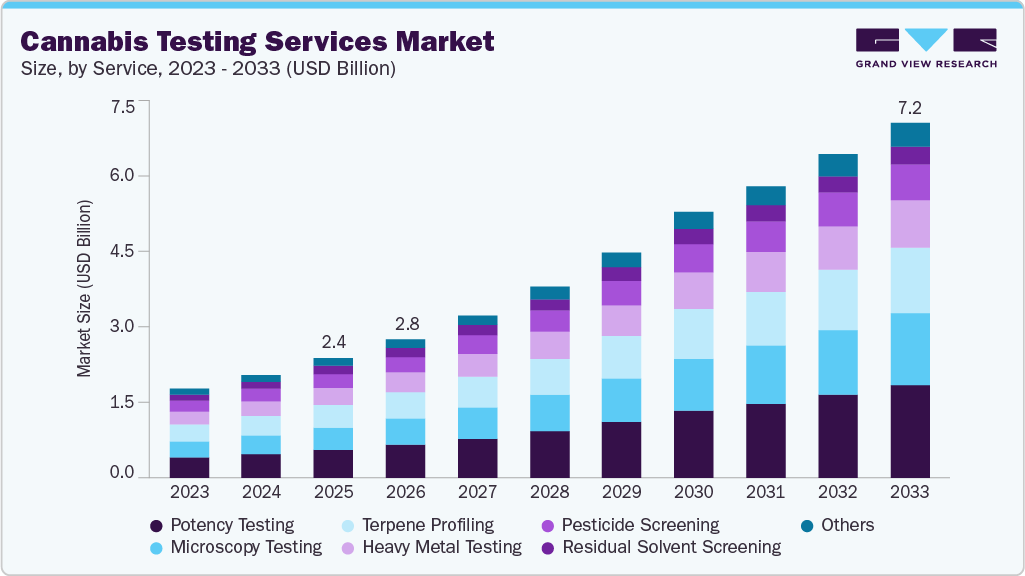

The global cannabis testing services market size was estimated at USD 2.42 billion in 2025 and is projected to reach USD 7.19 billion by 2033, growing at a CAGR of 14.36% from 2026 to 2033. Factors such as increasing legalization of cannabis for recreational and medical purposes, rising use of cannabis in medicinal applications, the launch of technologically advanced instruments for cannabis testing, and growing focus on ensuring product quality and safety boost the market growth.

Key Market Trends & Insights

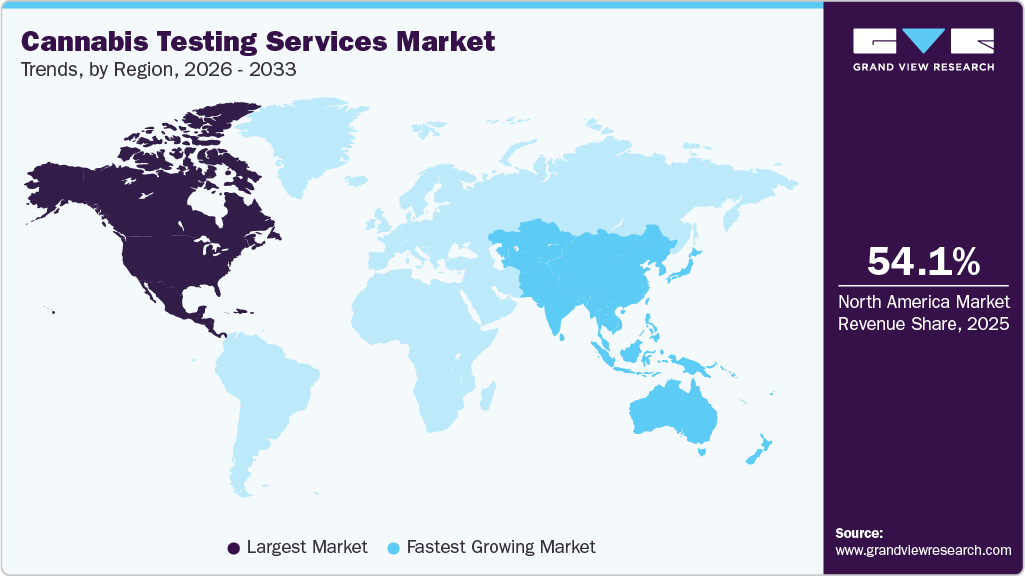

- The North America cannabis testing services market accounted for the largest global revenue share of 54.10% in 2025.

- The Canada cannabis testing services industry is anticipated to register the fastest CAGR from 2026 to 2033.

- By service, the potency testing segment held the largest revenue share in 2025.

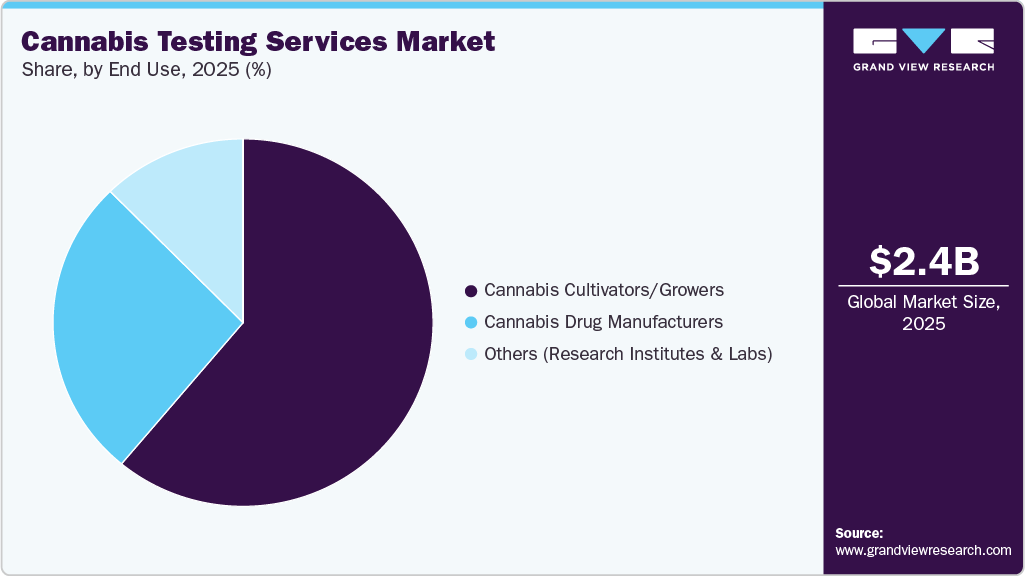

- By end use, the cannabis cultivators/growers segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.42 Billion

- 2033 Projected Market Size: USD 7.19 Billion

- CAGR (2026-2033): 14.36%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

For instance, in April 2024, Germany legalized cannabis for recreational purposes. Under this law, adults in Germany possess 25 grams of marijuana for recreational purposes. Several states and countries are establishing standardized testing and certification programs, which are anticipated to propel the cannabis testing services industry’s growth. These programs are designed to assure quality and regulate product safety and are thus expected to further boost market growth. For instance, in January 2024, Minnesota State Community and Technical College (M State) collaborated with Green Flower, a cannabis education and training center, to offer three new certificate programs for students seeking careers in the cannabis industry. In addition, in April 2023, ACT Laboratories and SC Labs collaborated and launched Trust in Testing Certification, a new set of national standards for cannabis testing.

The growing legalization of cannabis across the globe for medical and recreational purposes fuels the market growth. By opening new markets and increasing consumer access, this trend has a positive impact on the growth trajectory. As of June 2025, forty U.S. states, three territories, and the District of Columbia have legalized cannabis for medical use, while twenty-four states, three territories, and the District of Columbia allow adult recreational use. Several states also permit the use of low-THC, high-CBD products under limited medical programs, providing patients access to cannabidiol-rich formulations with minimal psychoactive effects.

Various countries across Asia and Europe are set to legalize medical cannabis for the growing patient population. This number is anticipated to rise significantly over the forecast period. Due to this increasing patient population, setting up effective testing services becomes essential. For instance, the following table represents the number of medical cannabis patients in the U.S.

Number Of Medical Cannabis Patients In The U.S.

State

State Population (2024)

Patient Numbers

Percentage of State Population Who Are Patients in Program

Arizona

7,582,384

88,598

1.17%

Ohio

11,883,304

151,932

1.28%

California

39,431,263

2,800

0.01%

Colorado

5,957,493

62,320

1.05%

Florida

23,372,215

890,402

3.81%

Many countries operate under stringent policies governing the use of medical cannabis and the specifics of its cannabinoid composition. These nations mandate various types of test results to ensure the quality of the cannabis drugs. With the cannabis industry experiencing growth, there's been a noticeable increase in the need for third-party labs. However, various countries are starting to relax their regulations on medical cannabis. For instance, in December 2023, Japan's parliament passed a bill to legalize cannabis-based medicines, marking a significant change in the country's strict drug regulations. Such factors boost market growth.

The growing adoption of laboratory information management systems (LIMS) in cannabis testing fuels the growth of the cannabis testing services market. The LIMS assists laboratories in managing all aspects of cannabis testing, such as microbial contaminants, potency, aflatoxin, heavy metals, pesticides, and residual solvents. In June 2024, FreeLIMS highlighted the role of AI-powered cannabis LIMS in helping testing labs achieve and maintain ISO 17025 accreditation, ensuring accuracy, consistency, and regulatory compliance. The system enhances lab operations through automated quality control, data-driven insights, and proactive equipment management, strengthening reliability and trust in cannabis testing.

Laboratories play a critical role in the legal cannabis and psychedelic markets by testing products for potency, purity, and safety. They ensure compliance with state and federal regulations, verify cannabinoid and psychoactive compound levels, and detect contaminants such as pesticides, heavy metals, and microbes. Advanced testing also supports research, product development, and quality assurance, helping producers deliver consistent and safe products to consumers. In September 2023, ACS Laboratory began testing magic mushrooms to measure their potency and assess purity, expanding its analytical services beyond cannabis and hemp. The lab provides standardized testing to ensure mushrooms meet safety and quality standards for consumers.

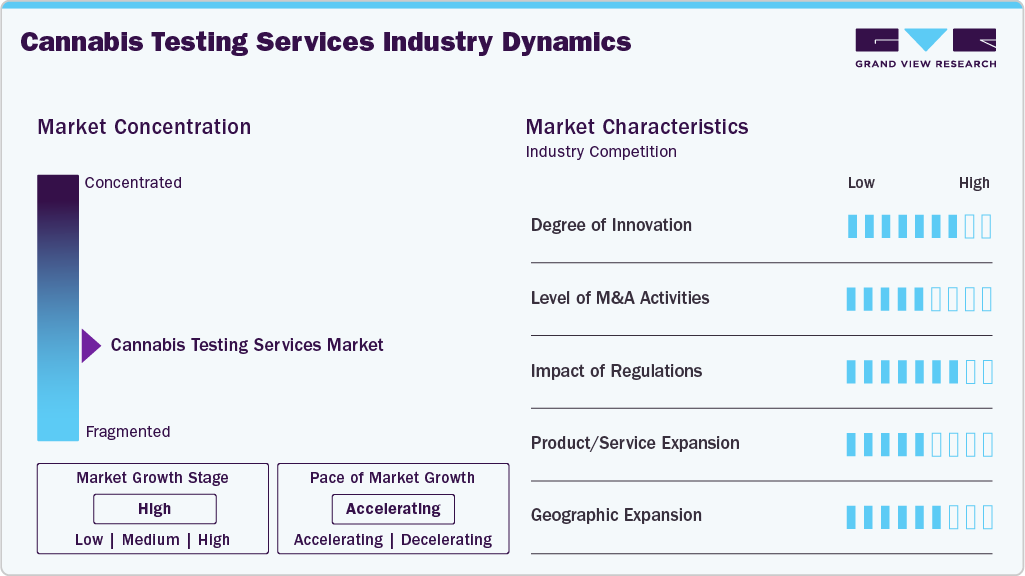

Market Concentration & Characteristics

The cannabis testing services market is characterized by a high degree of innovation owing to the rising demand for cannabis medicine, growing cannabis legalization, increasing R&D activities on the use of cannabis and its medicinal properties, and growing awareness among people regarding the medicinal benefits of cannabis. For instance, in February 2024, in Canada, researchers at the University of British Columbia conducted a new clinical trial to investigate the use of cannabidiol in the treatment of bipolar depression.

The cannabis testing services industry is characterized by a medium level of merger and acquisition (M&A) activity. These mergers and acquisitions facilitate access to complementary technologies, improve operational efficiency, and capture a larger market share. For instance, in August 2023, Smithers, a provider of testing, consulting, and compliance services, acquired the operations of Midway Lab LLC in Ohio. This represents Smithers' entry into the Ohio cannabis testing market.

Regulations play a crucial role in shaping the market for cannabis testing services, ensuring the safety, efficacy, and quality of cannabis-based medicine available to patients. However, each country has its unique testing laws. Furthermore, the testing needs and equipment required by each laboratory may differ. For instance, starting in January 2024, California state-licensed laboratories must use standardized cannabinoid operating procedures and test methods set by the Department of Cannabis Control (DCC) for testing dried flowers and non-infused pre-rolls.

Cannabis testing service providers are expanding their offerings by adding advanced analytical services such as terpene profiling, mycotoxin and heavy metal testing, residual solvent analysis, and stability studies, alongside core compliance testing. This service expansion enables labs to increase revenue per sample, address evolving regulatory requirements, and support medical- and export-grade cannabis production, strengthening their role as comprehensive quality and compliance partners rather than basic testing providers.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their service portfolio. For instance, in April 2023, SC Labs, a U.S.-based cannabis and hemp testing company, expanded its cannabis testing services in Arizona by acquiring C4 Laboratories, based in Scottsdale.

Service Insights

The potency testing segment dominated the cannabis testing services market in 2025, accounting for the largest revenue share of 23.48%. The key factors driving the growth are the rising usage of effective potency testing techniques, such as High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC), for testing samples and the growing demand for analyzing the potency of various cannabinoids, such as Tetrahydrocannabinol (THC) and Cannabidiol (CBD), in cultivated cannabis. Furthermore, the introduction of new cannabis testing services propels the market growth. For instance, in August 2025, Broughton expanded its analytical testing services for medicinal cannabis and CBD, providing cannabinoid potency, minor cannabinoid, and contaminant testing in GMP- and ISO-accredited labs to ensure regulatory compliance, product quality, and faster market entry.

The terpene profiling segment is expected to grow at a significant CAGR over the forecast period, driven by increasing demand for detailed product characterization and regulatory compliance. Mandatory potency testing for accurate cannabinoid labeling, stricter regulations on cannabis product labeling, and content disclosure are supporting market growth.In December 2022, SC Labs announced the opening of a new Los Angeles laboratory specializing in cannabis testing, including terpene profiling, potency analysis, and contaminant detection. The facility provides R&D and compliance services, allowing producers to accurately characterize terpene content and ensure product quality.

End Use Insights

The cannabis cultivators/growers segment dominated the cannabis testing services industry in 2025, accounting for a revenue share of 61.05%. Cannabis is gaining traction, as many developed countries are legalizing the cultivation of cannabis after recognizing the levels of CBD present in it, which is leading to an increased demand for cannabis for various applications in several sectors, including pharmaceuticals, nutraceuticals, cosmetics, and food & beverage. Cannabis growers are expanding their facilities to cater to growing demand, and the introduction of new cannabis cultivation facilities drives the market growth. For instance, in March 2024, Minnesota's first cannabis cultivating facility on sovereign land is under construction, just behind Grand Casino Mille Lacs in Onamia. The facility, which spans 50,000 square feet, is expected to yield approximately 1,600 pounds of cannabis per month, while offering job opportunities for Band of Ojibwe members.

The cannabis drug manufacturers segment is anticipated to register the fastest CAGR over the forecast period. Cannabis is used in the manufacturing of various medications for anxiety, pain, spasticity, and antiemetics. It relieves symptoms associated with cancer, Alzheimer’s disease, HIV, AIDS, Crohn’s disease, glaucoma, and epilepsy. Moreover, there is an increasing trend in providing personalized cannabis therapies for each patient, boosting the market growth. Thus, wide applications of medical cannabis have led to an increase in its adoption, which leads rise in the manufacturing of cannabis-based medicine that further fuels the segment growth.

Regional Insights

North America dominated the cannabis testing services market in 2025, accounting for the largest revenue share of 54.10%. A rise in the number of cannabis testing laboratories due to strict government guidelines for cannabis cultivators and the presence of a large number of cannabis cultivators are the key factors driving the regional market growth. In January 2025, Green Health Laboratories announced plans to launch a multimillion-dollar cannabis and hemp testing laboratory in Foley, Alabama, designed to verify product safety and quality for growers, processors, and manufacturers, while creating up to 50 well-paying jobs.

U.S. Cannabis Testing Services Market Trends

The cannabis testing services industry in the U.S. held the largest revenue share in 2025. The states in the U.S. have stringent cannabis testing requirements for potency and contaminants. The local authorities have listed the list of residual solvents, pesticides, and other contaminants to be tested in cannabis samples. In March 2025, Kaycha Labs was chosen by the Massachusetts Cannabis Control Commission to provide statewide testing for cannabis and related products, analyzing cannabinoid profiles, contaminants, and additives to ensure safety and regulatory compliance. Some companies operating in the U.S. cannabis testing market are Green Leaf Lab, CannaSafe, and PharmLabs LLC.

The Canada cannabis testing services market is anticipated to register the fastest CAGR during the forecast period. Canada is one of the leading producers of cannabis, owing to the legalization of cannabis for medical and recreational use and the development of many cannabis-based products such as oils & creamsIn August 2023, Orange Photonics highlighted the impact of its LightLab 3 HS Cannabis Analyzer, a portable HPLC device launched in November 2022 that allows non-technical users to perform rapid, on-site potency testing of cannabis plants, concentrates, and edibles.

Europe Cannabis Testing Services Market Trends

The Europe cannabis testing services industry is anticipated to register a significant CAGR during the forecast period, owing to an increase in consumption, rising awareness & positive attitude toward cannabis and its products, and strategic investments by major companies in Europe; the market is expected to grow at a substantial rate during the forecast period.In May 2025, Neotron expanded its certified cannabis testing services in Italy, offering comprehensive analysis to ensure safety, potency, and compliance with both national and EU standards. The lab offers cannabinoid profiling, terpene analysis, and contaminant testing, enabling producers to meet regulatory requirements and deliver therapeutically reliable products.

The Germany cannabis testing services market dominated Europe in 2025. High demand for medical cannabis products, the recent legalization of cannabis for recreational purposes, and rising investments fuel the market growth in the country. For instance, in June 2024, Organigram Holdings invested USD 14.9 million in Sanity Group, a Berlin-based cannabis operator, to broaden its presence within the German market.

The cannabis testing services market in the UK is anticipated to register the fastest CAGR during the forecast period. Factors such as favorable government initiatives, rising awareness regarding therapeutic uses of cannabis, and a growing number of cannabis consumers are expected to grow the market during the forecast period. In July 2024, Broughton launched medicinal cannabis batch testing in the UK, aligned with the European Pharmacopoeia Monograph (Ph. Eur. 3028). The GMP-accredited Schedule 1 laboratory provides identification and potency testing, including quantification of THC, CBD, and CBN, with upcoming analyses for heavy metals, pesticides, terpenes, and microbiology to ensure compliance and expedite product release.

Asia Pacific Cannabis Testing Services Market Trends

The Asia Pacific cannabis testing services industry is expected to grow at the fastest CAGR over the forecast period. Possible legalization of the production and cultivation of cannabis and increasing the patient population eligible for medical marijuana treatments are expected to propel the market growth in the Asia Pacific. The countries in this region are considered emerging markets for cannabis and its derivatives. In February 2021, the NSTDA launched a Cannabis Analytical Testing Laboratory in Buriram, Thailand, in partnership with Play La Ploen Herbal Center Community Enterprise. The ISO/IEC 17025-accredited lab provides potency, terpene, and safety testing to ensure medical cannabis products meet international quality and safety standards.

The China cannabis testing services market dominated the Asia Pacificin 2025.China is the largest cultivator of hemp in Asia, producing nearly half of the world's hemp. However, the number of cultivators and producers is expected to increase to create demand for hemp and CBD extracts such as oil, edibles, and tinctures, thereby propelling the growth of the cannabis and hemp testing services market in the country.In November 2025, Cannformatics and Dr. Laszlo Mechtler announced plans to launch a lab service using Cannabis-Responsive biomarkers to personalize medical cannabis treatment for migraine and neurological patients.

The Australia cannabis testing services market is anticipated to register a significant CAGR during the forecast period.The presence of major producers such as Cann Group, AusCann Group, and BOD Australia in the country is driving the market over the forecast period. In September 2022, the University of Sydney launched the CAN-ACT study in the Australian Capital Territory to provide free testing of home-grown cannabis for medicinal and non-medicinal users. The study analyses cannabinoid content, terpenes, and contaminants to improve safety, inform consumption practices, and evaluate the impact of decriminalization.

Latin America Cannabis Testing Services Market Trends

Latin America and the Caribbean are experiencing significant growth in the cannabis testing services industry. Several countries, including Chile, Argentina, Colombia, Peru, and Brazil, have legalized the use of CBD for medical purposes. Furthermore, other countries in the region allow the home cultivation of cannabis for personal use, with certain restrictions. In November 2025, Brazil’s Embrapa received approval from Anvisa to conduct cannabis testing and research, including potency, contaminants, and genetic improvement, marking a step toward regulated cultivation for medicinal and industrial purposes.

The Uruguay cannabis testing services market is anticipated to register significant growth over the forecast period. Uruguay legalized the sale of medical and recreational cannabis in 2012 and became the first country in the world to legalize it. The government of Uruguay launched a medical marijuana program in 2017, which made registration with the government mandatory for purchasing or growing cannabis. In August 2025, the Journal of Illicit Economies and Development highlighted Uruguay’s legal cannabis market, where licensed producers and pharmacies operate under strict government oversight. All cannabis destined for pharmacies undergoes rigorous testing for THC potency, mould, bacteria, and pesticides, ensuring quality control and consumer safety.

Africa Cannabis Testing Services Market Trends

The Africa cannabis testing services industry is experiencing lucrative growth. Cannabis regulations are quite stringent in Africa. Countries such as Uganda, Zimbabwe, Lesotho, Malawi, South Africa, Morocco, Rwanda, Ghana, Zambia, and Eswatini have legalized cannabis cultivation for scientific research & medicinal purposes. In May 2024, the Journal of Cannabis Research reported that Lesotho’s medicinal cannabis sector faces regulatory challenges, emphasizing the need for quality and safety testing to ensure standardized, compliant products.

Key Cannabis Testing Services Company Insights

Key participants in the cannabis testing services market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Cannabis Testing Services Companies:

The following are the leading companies in the cannabis testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Saskatchewan Research Council (SRC)

- SC Labs

- SGS Société Générale de Surveillance SA (SGS Canada Inc.)

- Dr. Robert Shrewsbury & the UNC Eshelman School of Pharmacy (PharmLabs)

- GREEN LEAF LAB

- Eurofins Scientific

- PhytoVista Laboratories (BRITISH CANNABIS GROUP)

- BRITISH CANNABIS

- ADACT Medical Ltd.

- Laboratorium Dr. Liebich

- AZ Biopharm GmbH

Recent Developments

-

In July 2025, the Missouri Division of Cannabis Regulation launched a statewide cannabis testing and sampling initiative, designating the Missouri State Public Health Laboratory as the reference lab to improve product safety, labeling accuracy, and testing consistency.

-

In December 2025, HIRATA Corporation announced the launch of a new inspection service for CBD products, scheduled to begin in February 2026, focusing on ultra-low-limit detection of Δ9-THC and Δ9-THCA-A using LC-MS/MS methods.

-

In January 2024, the Ontario Cannabis Store introduced a temporary THC testing program. Under the program, the provincial cannabis wholesaler has been choosing cultivars with high THC content to arrive at its warehouse for secondary testing.

-

In October 2023, Nova Analytic Labs (Nova) and Certified Testing & Data (CTND) collaborated and launched a new cannabis testing lab in New York.

Cannabis Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.81 billion

Revenue forecast in 2033

USD 7.19 billion

Growth rate

CAGR of 14.36% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America And Caribbean; Africa

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; Poland; Czech Republic; Switzerland; Croatia; Netherlands; Japan; China; India; Australia; Thailand; New Zealand; Brazil; Mexico; Colombia; Uruguay

Key companies profiled

Saskatchewan Research Council (SRC); SC Labs; SGS Société Générale de Surveillance SA (SGS Canada Inc.); Dr. Robert Shrewsbury & the UNC Eshelman School of Pharmacy (PharmLabs); GREEN LEAF LAB; Eurofins Scientific; PhytoVista Laboratories (BRITISH CANNABIS GROUP); BRITISH CANNABIS; ADACT Medical Ltd.; Laboratorium Dr. Liebich; AZ Biopharm GmbH

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabis Testing Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the cannabis testing services market report based on service, end use, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Potency Testing

-

Terpene Profiling

-

Heavy Metal Testing

-

Pesticide Screening

-

Microscopy Testing

-

Residual Solvent Screening

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Cannabis Cultivators/Growers

-

Cannabis Drug Manufacturers

-

Others (Research Institutes & Labs)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Poland

-

Czech Republic

-

Switzerland

-

Croatia

-

Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

Australia

-

New Zealand

-

-

Latin America and Caribbean

-

Brazil

-

Uruguay

-

Colombia

-

-

Africa

-

Frequently Asked Questions About This Report

b. Some key players operating in the cannabis testing services market include Saskatchewan Research Council (SRC); SC Labs; Steep Hill, Inc.; SGS Canada Inc.; CW ANALYTICAL; PharmLabs; and GreenLeaf Lab.

b. Key factors that are driving the market growth include the growing need for cannabis testing due to a rise in contamination cases and the need to set up effective testing services for assuring the quality of cultivated cannabis.

b. The global cannabis testing services market size was estimated at USD 2.42 billion in 2025 and is expected to reach USD 2.81 billion in 2026.

b. The global cannabis testing services market is expected to grow at a compound annual growth rate of 14.36% from 2026 to 2033 to reach USD 7.19 billion by 2033.

b. North America dominated the cannabis testing services market with a share of 54.10% in 2025. This is attributable to rigorous guidelines set by the government for marijuana cultivators and the presence of a large number of cultivators in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.