- Home

- »

- Distribution & Utilities

- »

-

Capacitor Banks Market Size, Share & Trends Report, 2030GVR Report cover

![Capacitor Banks Market Size, Share & Trends Report]()

Capacitor Banks Market (2024 - 2030) Size, Share & Trends Analysis Report By Voltage (Low [<10 kV], Medium [10 kV–69 kV], High [>69 kV]), By Application (Power Factor Correction, Harmonic Filter), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-433-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Capacitor Banks Market Size & Trends

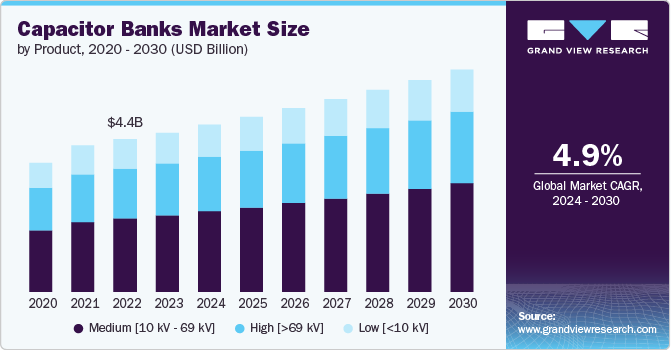

The global capacitor banks market size was estimated at USD 4.61 billion in 2023 and expected to grow at a CAGR of 4.87% from 2024 to 2030. Rising demand for power globally owing to the growing penetration of various electronic devices is fueling the market growth. Additionally, the increasing adoption of renewable energy to tackle climate change and global warming is spurring the demand for capacitor banks.

The capacitor banks market is experiencing significant growth due to the increasing adoption of renewable energy sources, such as solar and wind power. As countries strive to reduce their carbon footprint and meet sustainability goals, the integration of renewable energy into the grid has become a priority. Capacitor banks are essential in stabilizing voltage levels and improving power quality in these renewable energy systems, which are often characterized by variability and intermittency. This growing focus on green energy is driving demand for advanced capacitor banks that can efficiently manage power fluctuations and enhance the reliability of renewable energy grids.

Drivers, Opportunities & Restraints

Energy efficiency is becoming a critical focus for industries and utilities worldwide, driven by both economic and environmental considerations. Capacitor banks play a vital role in improving energy efficiency by reducing power losses, minimizing reactive power, and optimizing power factor. As businesses and governments seek to lower energy costs and reduce greenhouse gas emissions, the demand for capacitor banks is rising. This driver is particularly strong in regions with high energy costs and stringent regulatory frameworks that encourage the adoption of energy-efficient technologies.

Emerging markets present a significant opportunity for the capacitor banks industry. Rapid urbanization, industrialization, and the expansion of electricity infrastructure in developing countries are creating a growing need for stable and efficient power supply systems. These markets are increasingly investing in modernizing their power grids and upgrading electrical infrastructure, which includes the deployment of capacitor banks to improve grid reliability and efficiency. Companies that can offer cost-effective and scalable solutions tailored to the needs of these regions stand to gain a competitive advantage in the expanding global market.

Despite its potential, the capacitor banks market faces challenges that could hinder its growth. One of the primary growth restraints is the high initial capital investment required for their installation and integration. Despite the long-term benefits of improved energy efficiency and power quality, the upfront costs associated with purchasing and installing capacitor banks can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) and in cost-sensitive markets. Additionally, the return on investment (ROI) may take several years to materialize, which can deter businesses with limited budgets from adopting these technologies. This financial challenge can slow down market growth, especially in regions where economic conditions are less favorable.

Voltage Insights

The medium [10 kV - 69 kV] voltage segment led the market with the largest revenue share of 48.16% in 2023, which can be attributed to the growing need for reliable power supply in industrial sectors such as manufacturing, mining, and processing plants. These industries require stable voltage levels and high-quality power to ensure the smooth operation of heavy machinery and equipment. Medium voltage capacitor banks help reduce voltage drops, mitigate power quality issues, and improve overall system efficiency, which is critical in preventing costly downtime and equipment damage. For instance, in regions with fluctuating power supplies, such as parts of Africa and South America, industries are increasingly adopting these capacitor banks to maintain operational continuity and meet production targets, making them an essential component in the modernization of industrial power systems.

The high [>69 kV] voltage segment is expected to grow at a significant CAGR over the forecast period. The segment growth is driven by the need to support grid stability in expanding power networks, particularly in regions with growing energy demand and large-scale power transmission projects. As countries expand their high-voltage transmission networks to deliver electricity over long distances, especially from remote power generation sites to urban centers, high voltage capacitor banks are essential for maintaining voltage stability and reducing transmission losses. A notable example is India, where the government is heavily investing in upgrading its power transmission infrastructure to meet the rising energy demands of its growing population. High voltage capacitor banks are increasingly being deployed in such projects to enhance grid reliability and ensure efficient power delivery across vast distances.

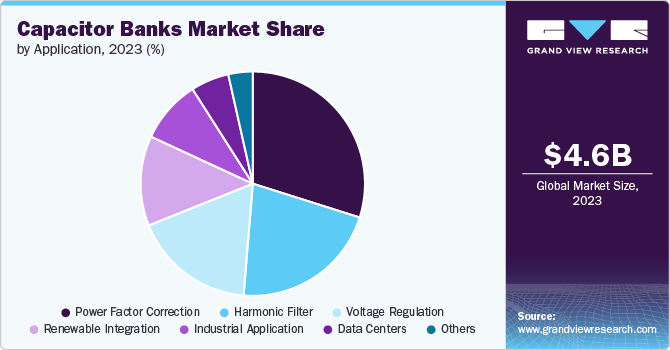

Application Insights

The power factor correction (PFC) segment dominated the market with the largest revenue share of 29.88% in 2023. Capacitor banks are crucial in PFC applications, driven by the need to reduce energy costs and avoid penalties imposed by utilities for low power factors in commercial buildings and industrial facilities. Power factor correction helps optimize the use of electrical power, reducing reactive power and improving overall energy efficiency. For instance, in Europe, where energy prices are among the highest globally, businesses are increasingly implementing PFC capacitor banks to lower their energy bills and improve sustainability. Additionally, regulatory pressures and incentives for energy efficiency are prompting more companies to invest in these systems, leading to a steady increase in demand for capacitor banks designed specifically for power factor correction.

The renewable integration segment is poised to grow at the fastest CAGR from 2024 to 2030. The integration of renewable energy sources into the grid is driving the demand for capacitor banks, particularly as they help manage the variability and intermittency associated with renewable power generation. Capacitor banks play a critical role in stabilizing voltage levels and improving power quality in grids that incorporate solar, wind, and other renewable energy sources. This trend is expected to accelerate as more regions around the world transition to cleaner energy sources, highlighting the importance of capacitor banks in supporting the global shift towards sustainable power generation.

Regional Insights

In North America, the aging power infrastructure is a significant driver for the market growth. Many parts of the region, particularly in the United States and Canada, are dealing with outdated electrical grids that require upgrades to meet current and future energy demands. Capacitor banks are essential for modernizing these grids, improving power quality, and enhancing energy efficiency. As utilities and governments invest in grid modernization projects, the demand for capacitor banks is expected to increase, driven by the need to replace or upgrade existing systems to support more resilient and reliable power networks.

U.S. Capacitor Banks Market Trends

In the U.S., the growing focus on energy storage and the expansion of electric vehicle (EV) charging infrastructure are key drivers for the market growth. As the country accelerates its adoption of renewable energy and electric vehicles, the need for robust energy storage systems and efficient power management is becoming more critical. Capacitor banks play a vital role in stabilizing voltage levels and managing power quality in these applications, ensuring that the grid can accommodate the increased load from EV charging stations and energy storage systems. The U.S. government's commitment to expanding clean energy and EV infrastructure is expected to further boost the demand for capacitor banks in the coming years.

Asia Pacific Capacitor Banks Market Trends

The Asia Pacific region is witnessing a significant increase in renewable energy projects, particularly in countries including China, India, and Australia, which are investing heavily in solar, wind, and hydropower generation. As these countries integrate more renewable energy into their grids, the need for capacitor banks to manage power fluctuations and ensure grid stability is growing.

Asia Pacific dominated global capacitor banks market and accounted for largest revenue share of 32.66% in 2023, owing to the rapid industrialization and urbanization, particularly in countries like China, India, and Southeast Asian nations. This economic growth is driving the need for stable and efficient power supply systems to support expanding industrial sectors and growing urban populations. Capacitor banks are increasingly in demand as they help improve power quality, reduce losses, and stabilize voltage levels in both industrial and urban power grids. The expansion of manufacturing hubs and the development of smart cities across the region are key drivers of capacitor bank adoption, as these systems are crucial for ensuring reliable and efficient power delivery.

Europe Capacitor Banks Market Trends

In Europe, strong regulatory support for energy efficiency and sustainability is driving the market growth. The European Union's stringent energy efficiency directives and carbon reduction goals are pushing industries and utilities to adopt technologies that enhance power quality and reduce energy losses. Capacitor banks are being widely implemented as part of efforts to meet these regulatory requirements, particularly in industries with high energy consumption. Additionally, the region's focus on renewable energy integration is further increasing the demand for capacitor banks, as they are essential for maintaining grid stability and ensuring efficient power distribution in a low-carbon energy system.

Key Capacitor Banks Market Company Insights

The market is highly competitive, with several key players dominating the landscape. The market for capacitor banks is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Capacitor Banks Companies:

The following are the leading companies in the capacitor banks market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton

- Comar Condensatori S.p.A

- ABB Ltd.

- Siemens

- Schneider Electric SE

- General Electric Company

- Toshiba Corporation

- Hitachi Ltd.

- Larsen & Toubro

- Bharat Heavy Electricals Limited

Recent Developments

-

In February 2024, Powerside introduced Pole-MVar, a compact pole-mounted tuned-filter capacitor bank aimed at addressing power system challenges related to harmonic distortion and resonance. This innovative solution is particularly beneficial for utilities and commercial customers facing stability issues as they integrate modern technologies with aging infrastructure. The Pole-MVar unit combines reactive energy compensation with inductors to effectively dampen harmonic currents, preventing resonance that can damage equipment. This is crucial as the rise of renewable energy sources and other non-linear loads increases the risk of harmonic distortion, which can lead to equipment failure and higher energy costs.

-

In August 2022, Hitachi Energy inaugurated a new manufacturing plant for Power Quality Products in Doddaballapur, Bengaluru, significantly expanding its production capacity. The new plant is expected to produce advanced capacitor units and power electronic compensators, which are essential for improving power stability and reducing energy losses.

Capacitor Banks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.84 billion

Revenue forecast in 2030

USD 6.43 billion

Growth rate

CAGR of 4.87% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in MW, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Voltage, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Eaton; Comar Condensatori S.p.A; ABB Ltd.; Siemens; Schneider Electric SE; General Electric Company; Toshiba Corporation; Hitachi Ltd.; Larsen & Toubro; Bharat Heavy Electricals Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Capacitor Banks Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented capacitor banks market report based on type, application, and region:

-

Voltage Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Low [<10 kV]

-

Medium [10 kV - 69 kV]

-

High [>69 kV]

-

-

Application Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Power Factor Correction

-

Harmonic Filter

-

Voltage Regulation

-

Renewable Integration

-

Industrial Application

-

Data Centers

-

Others

-

-

Regional Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

The Netherlands

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global capacitor banks market size was estimated at USD 4.61 billion in 2023 and is expected to reach USD 4.84 billion in 2024.

b. The global capacitor banks market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 6.43 billion by 2030.

b. Medium [10 kV – 69 kV] dominated the voltage segment of the Capacitor Banks market with a share of 48.16% in 2023, which can be attributed to the growing need for reliable power supply in industrial sectors such as manufacturing, mining, and processing plants.

b. Some key players operating in the capacitor banks market include Eaton; Comar Condensatori S.p.A; ABB Ltd.; Siemens; Schneider Electric SE; General Electric Company, and others.

b. Rising demand for power globally owing to the growing penetration of various electronic devices is fueling the growth of the market. Additionally, the increasing adoption of renewable energy to tackle climate change and global warming is spurring the demand for capacitor banks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.