- Home

- »

- Pharmaceuticals

- »

-

Carbapenem Market Size & Share Report, 2030GVR Report cover

![Carbapenem Market Size, Share & Trends Report]()

Carbapenem Market (2023 - 2030) Size, Share & Trends Analysis Report By Drug Class (Meropenem, Imipenem, Ertapenem), By Application (UTI, Blood Stream Infections, Pneumonia), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-118-4

- Number of Report Pages: 236

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global carbapenem market size was valued at USD 3.62 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.78% from 2023 to 2030. The rise in antibiotic-resistant bacterial infections has been a major driver for the demand for carbapenems market. Moreover, the growing geriatric population is anticipated to increase UTIs due to weakened immune systems and other age-related factors. Moreover, carbapenems are often used to treat hospital-acquired infections, which are infections acquired during a patient's stay in a healthcare facility. As the number of hospital-acquired infections rises, the demand for carbapenem antibiotics also increases.

There was an increase in the consumption of antimicrobials (carbapenem) during the COVID-19 first wave, in hospitals, especially in the ICU. COVID-19 patients admitted to ICU care were often severely ill and at a higher risk of developing secondary bacterial inflammation, such as pneumonia or bloodstream infections. Thus, the need to manage these bacterial co-infections has led to increased antibiotic usage, including the use of carbapenems, in ICU settings. Hence, during the COVID pandemic, there was a moderate boost in the market.

In addition, there was a massive increase in bloodstream infections (BSIs) among EU nations during the first two years of the COVID-19 pandemic was observed in clinical laboratory data compiled by the European Antimicrobial Resistance Surveillance Network (EARS-Net). The study revealed that BSIs caused by certain antimicrobial-resistant (AMR) pathogens, referred to as superbugs, were more than doubled in EU hospitals and healthcare facilities in 2020 and 2021.

Urinary tract infection (UTI) is one of the most common inflammation which happens due to bacterial infection, usually from the rectum or skin, entering the urethra, and infecting the urinary tract. UTIs are quite frequent in women; around 25% to 40% of women aged 20-40 in the U.S. have experienced a UTI. According to a Medscape article, published in January 2023, UTIs account for about 6 million patient visits to physicians in the U.S. each year, with around 20% of those visits being to emergency departments. Thus, the rising UTI cases are anticipated to fuel the growth of the market over a period of time.

Furthermore, according to the study released in February 2019, another treatment option for clinicians in managing complicated urinary tract infections (cUTIs) caused by Enterobacteriaceae is provided by Plazomicin. Plazomicin was specifically engineered to circumvent enzymes that lead to resistance against other aminoglycosides in Enterobacteriaceae. The inflammation caused by Enterobacteriaceae has been displaying growing resistance to traditionally used drugs such as fluoroquinolones and cephalosporins, leading clinicians to increasingly rely on carbapenems. Thus, increasing the demand for carbapenem over the forecast period.

In addition, the launch of a generic version in the market is another major factor augmenting the growth in the study period. For instance, in May 2021, Dr. Reddy's Laboratories Ltd. introduced Ertapenem for Injection, 1 g/vial, a generic version of INVANZ (ertapenem for injection) for injection, 1 g/vial, which has received approval from the U.S. Food and Drug Administration (USFDA). Moreover, in June 2023, Venus Remedies obtained regulatory approval from the healthcare authorities in Spain to sell its generic antibiotic in the Spanish market. This approval allows the company to offer a more affordable alternative to the branded version of the antibiotic, which could potentially lead to increased accessibility of the medication for patients in Spain.

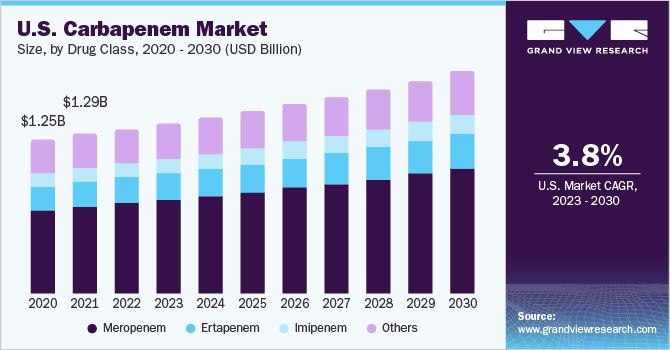

Drug Class Insights

On the basis of product type, meropenem accounted for the largest share of 54.82% of the market in 2022 and is expected to grow at the fastest CAGR over the forecast period. The increasing prevalence of antibiotic-resistant bacteria and the need for effective treatments against severe inflammation fueled the demand for meropenem antibiotics. In addition, meropenem is often included in hospital formularies, which are lists of approved medications for use within the hospital setting. In September 2022, the Menarini Group, and SciClone Pharmaceuticals (Holdings) Limited joined forces through an exclusive licensing agreement to develop and market Vaborem (meropenem and vaborbactam) in China. This strategic collaboration aims to broaden the range of treatment options available to combat the growing public health concern of antimicrobial-resistant infections, with a specific focus on addressing carbapenem-resistant Enterobacterales (CRE) infections.

The other segments are expected to grow at a significant growth rate during the forecast period. The introduction of newer carbapenems with improved properties, such as extended stability, broader spectrum, or more convenient dosing regimens, could drive higher adoption rates among healthcare providers, resulting in a faster CAGR. For instance, in November 2021, pharmaceutical company BDR Pharma introduced a new generic drug called BIAPENEM, which is suitable for treating lower respiratory infections, intra-abdominal infections, and complicated urinary tract infections. Marketed under the brand name BIAPEN, this drug will be part of BDP Pharma's critical care segment. BIAPENEM stands out for its ability to effectively penetrate various tissues, including lung tissue, and body fluids such as sputum, pleural effusion, and abdominal cavity fluid, allowing it to target persistent inflammation within the body. Moreover, one of the significant advantages of Biapenem is its enhanced stability compared to Imipenem and Meropenem when exposed to human renal dehydropeptidase-I (DHP-I). As a result, it does not necessitate the co-administration of a DHP-I inhibitor like Cilastatin

Application Insights

Urinary tract infections (UTIs) held the largest share of 40.34% of the market in 2022 and is anticipated to grow with the fastest CAGR over the forecast period. UTIs are one of the most frequent bacterial inflammation, affecting millions of people worldwide each year. They are particularly prevalent among women, with about half experiencing a UTI at some point in their lives. This high incidence contributes to their dominant position in terms of overall bacterial inflammation. The growing number of clinical trials focusing on carbapenems for UTI treatment is anticipated to have implications on the market. For instance, according to the study released in April 2022, a phase III study demonstrated that tebipenem pivoxil hydrobromide, an investigational oral antibiotic, exhibited comparable effectiveness to intravenous ertapenem in treating hospitalized patients with complicated urinary tract infections (UTIs) or acute pyelonephritis.

Furthermore, the study suggests that tebipenem pivoxil hydrobromide could serve as a viable treatment option for these conditions caused by antibiotic-resistant uropathogens, particularly in cases where other effective oral agents are unavailable. Thus, the rising prevalence of UTIs and growing clinical trials focusing on UTI treatments is anticipated to propel the growth of the market over the forecast period.

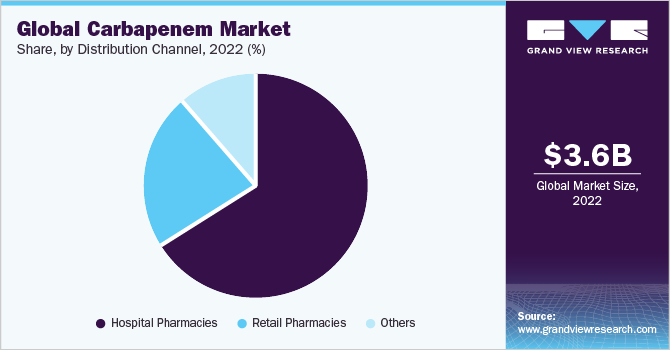

Distribution Channel Insights

Hospital pharmacies dominated the market in terms of revenue in 2022, with a market share of 65.78%, and is anticipated to grow with the fastest CAGR over the forecast period. Carbapenem-based antibiotics are often prescribed by healthcare professionals within the hospital, such as infectious disease specialists or intensivists. Moreover, hospitals have strict infection control protocols to prevent the spread of resistant bacteria and healthcare-associated inflammation. Carbapenems are crucial antibiotic in managing such inflammation, making hospital pharmacies the primary suppliers of these antibiotics.

Moreover, during the COVID-19 pandemic, there was a notable increase in ICU (Intensive Care Unit) admissions. The pandemic caused by the novel coronavirus placed an immense burden on healthcare systems worldwide, leading to a surge in severe cases that required intensive medical care and hospitalization. Patients admitted to the ICU, particularly those severely affected by COVID-19, frequently necessitate intensive medical care and the administration of potent antibiotics such as carbapenems. Thus, the increase in ICU admissions during the COVID-19 pandemic has led to an increased demand for carbapenem antibiotics, which, in turn, has contributed to an increased demand for hospital pharmacies.

Regional Insights

North America held the largest share of the carbapenem market in 2022, with a share of 40.35%.The growth in the region can be attributed to the prevalence of urinary tract infections & other bacterial inflammation, and the existence of robust healthcare infrastructure and advanced medical facilities are the driving factors that propel the growth of the market. Moreover, the presence of key players is anticipated to further fuel the market growth. For instance, in June 2020, the U.S. FDA approved RECARBIO (imipenem, cilastatin, and relebactam) for treating adults with Hospital-Acquired and Ventilator-Associated Bacterial Pneumonia (HABP/VABP).

The Asia Pacific market is anticipated to grow at the fastest CAGR of 6.79% over the forecast period. With the presence of China and India in the region and a massive population with a high number of bacterial infection patients, the market is expected to witness growing demand. In June 2021, JW Pharmaceutical Corp. made a significant announcement regarding the distribution of its ertapenem API-based antibiotic manufactured by India's Gland Pharma in the U.S. This accomplishment would mark a major milestone for the Korean company and is expected to play a crucial role in driving its future market growth.

Key Companies & Market Share Insights

Market leaders are involved in extensive R&D for manufacturing cost-efficient and technologically advanced testing products. Several strategies, such as mergers & acquisitions, undertaken by these organizations to expand their market presence are anticipated to create significant growth opportunities over the forecast period. For instance, in September 2022, Spero Therapeutics and GSK plc. entered into an exclusive licensing agreement for the commercialization of a late-stage antibiotic Tebipenem HBr worldwide except in Japan and some Asian countries. Some of the key players operating in the global carbapenem market include:

-

Menarini Group

-

Pfizer Inc.

-

Sun Pharmaceutical Industries Ltd

-

Lupin

-

Kopran Limited

-

Aurobindo Pharma

-

Daewoong Pharmaceuticals Co., Ltd.

-

Shenzhen Haibin Pharmaceutical Co. Ltd.

-

Merck & Co., Inc.

-

Venus Remedies Ltd

Carbapenem Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.78 billion

Revenue forecast in 2030

USD 5.24 billion

Growth rate

CAGR of 4.78% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Menarini Group; Pfizer Inc.; Sun Pharmaceutical Industries Ltd; Lupin; Kopran Limited; Aurobindo Pharma; Daewoong Pharmaceuticals Co., Ltd.; Shenzhen Haibin Pharmaceutical Co. Ltd.; Merck & Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

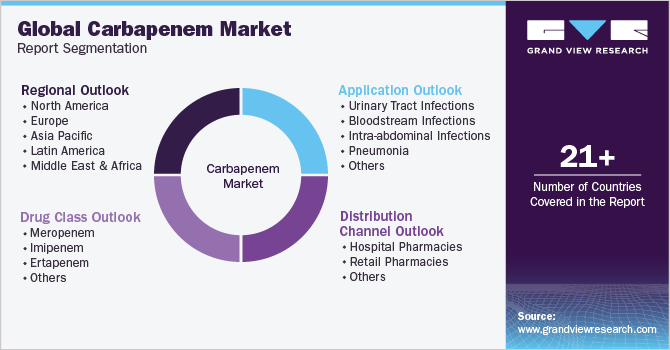

Global Carbapenem Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbapenem market report based on drug class, application, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Meropenem

-

Imipenem

-

Ertapenem

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Urinary Tract Infections

-

Bloodstream Infections

-

Intra-abdominal Infections

-

Pneumonia

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global carbapenem market size was estimated at USD 3.62 billion in 2022 and is expected to reach USD 3.78 billion in 2023.

b. The global carbapenem market is expected to grow at a compound annual growth rate of 4.78% from 2023 to 2030 to reach USD 5.24 billion by 2030.

b. The meripenem segment dominated the global market in 2022 and captured the maximum overall revenue share. The large share can be due to the increasing prevalence of antibiotic-resistant bacteria and the need for effective treatments against severe infections fueled the demand for meropenem antibiotics.

b. Some key players operating in the carbapenem market include Menarini Group, Pfizer Inc., Sun Pharmaceutical Industries Ltd, Lupin, Kopran Limited, Aurobindo Pharma, Daewoong Pharmaceuticals Co., Ltd., Shenzhen Haibin Pharmaceutical Co. Ltd., Merck & Co., Inc.

b. The rise in antibiotic-resistant bacterial infections had been a major driver for the demand for carbapenems market. Moreover, the growing geriatric population is anticipated to increase UTIs due to weakened immune systems and other age-related factors. Moreover, carbapenems are often used to treat hospital-acquired infections, which are infections acquired during a patient's stay in a healthcare facility. As the number of hospital-acquired infections rises, the demand for carbapenem antibiotics also increases

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.