- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Carbon Fiber Tapes Market Size, Industry Report, 2030GVR Report cover

![Carbon Fiber Tapes Market Size, Share & Trends Report]()

Carbon Fiber Tapes Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin Type (Dry Tapes, Prepreg Tapes), By End Use (Aerospace & Defense, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-780-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Fiber Tapes Market Summary

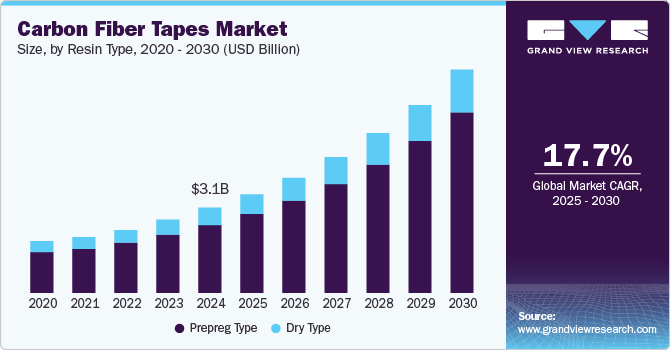

The global carbon fiber tapes market size was estimated at USD 3.09 billion in 2024 and is expected to reach USD 8.13 billion by 2030, growing at a CAGR of 17.7% from 2025 to 2030. This growth can be attributed to the emergence of carbon fiber as one of the critical materials for enabling lightweight construction of automotive and aerospace components.

Key Market Trends & Insights

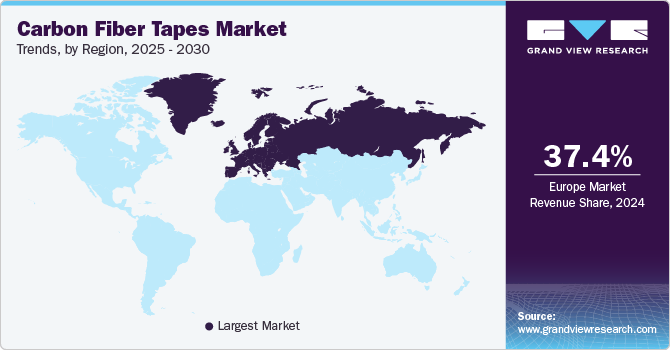

- Europe dominated the global market and accounted for the largest revenue share of 37.4% in 2024.

- Germany led the European market and held for the highest revenue share in 2024.

- By resin type, the prepreg tapes led the market and accounted the largest revenue share of 79.8% in 2024.

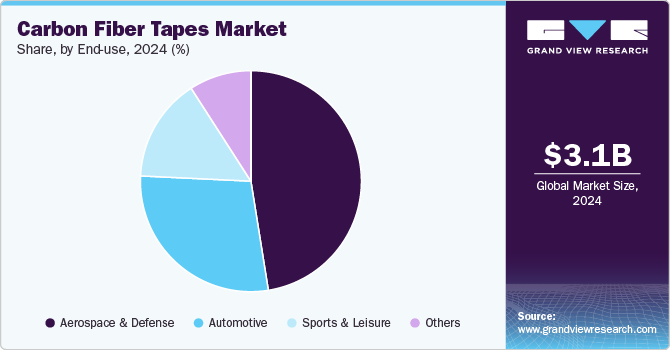

- By end-use, the aerospace and defense segment dominated the ndustry and accounted for the largest revenue share of 47.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.09 Billion

- 2030 Projected Market Size: USD 8.13 Billion

- CAGR (2025-2030): 17.7%

- Europe: Largest market in 2024

In addition, carbon fiber (CF) tape is one of the popular materials used for manufacturing composite parts for automotive and aerospace equipment. Furthermore, advancements in carbon fiber tapes expected to lead the incorporation of other properties such as de-icing, shielding, self-repair, energy storage, and stealth, thereby enabling the manufacturing of multi-functional carbon fiber tapes.

Carbon fiber tapes are recognized as clean energy technologies owing to their position as facilitating materials for several initiatives of the U.S. Department of Energy and Office of Energy and Renewable Energy. In addition, incorporation of this material also enables a weight reduction of vehicles in transportation applications leading to energy reduction through fuel savings.

The automotive industry is increasingly focused on producing low-emission, fuel-efficient vehicles, which has driven the demand for carbon fibers in structural components. These fibers are valued for their strength and cost-efficiency in manufacturing. Although automakers still use a combination of steel, aluminum, and composites based on specific needs, the growing use of carbon fiber in vehicles, especially in structural and semi-structural parts, is expected to accelerate market growth. Especially, cars such as the BMW i3 incorporate carbon-fiber-reinforced plastic. For economic reasons, small-market cars have been the initial focus for carbon fiber application. With advancements in manufacturing processes, the cost of carbon fiber components could decrease, promoting greater adoption in the automotive sector. Lightweight vehicles made with carbon fibers also contribute to energy savings and reduced costs, making the material even more appealing.

Furthermore, in aerospace, the use of carbon fiber tape has grown significantly in aircraft structures, including both civil and military aviation, as well as space technology. Carbon fibers have been crucial in aerospace applications for decades, starting with programs by NASA and the U.S. Department of Defense, due to their exceptional mechanical properties. Aircraft models such as the Airbus A380 and Boeing 787 primarily rely on carbon fiber. In defense, aircraft and helicopter programs, including the F-35 and Black Hawk, drive stable demand for the material. Moreover, the push for greener technologies and efficient propulsion systems is increasing the demand for carbon fiber in both new and upgraded aircraft structures.

Resin Type Insights

The prepreg tapes led the market and accounted the largest revenue share of 79.8% in 2024. Unidirectional prepreg carbon fiber tapes are ideal for fabricating composite parts that require thick laminate construction and long-layup time. As a result, these tapes are highly suitable for infrastructure, industrial, medical, and sports & leisure applications. The use of prepreg tapes for manufacturing components offer exceptional strength properties and allows part uniformity and repeatability. In addition, the use of prepreg carbon fiber tapes bleeds lesser resin during the curing process, takes lesser curing time, and offers superior aesthetics thereby positively impacting the overall market growth.

The dry tape segment is expected to grow at a CAGR of 16.9% from 2025 to 2030. Dry tapes produce lesser mess during production and cater to tight tolerances for width and aerial weight, thus posing high growth opportunities. In addition, dry carbon fiber tapes offer a cost and production rate optimized taping solutions providing mechanical properties comparable with prepreg tapes without an autoclave. As a result, these tapes are well suited for automated production in a broader range of automotive, winter sports, aerospace & industrial applications.

End Use Insights

The aerospace and defense segment dominated the global carbon fiber tapes industry and accounted for the largest revenue share of 47.4% in 2024. Rising use of CF materials in Boeing Dreamliner and Airbus 350 expected to offer positively influence the demand for carbon fiber tapes, thereby driving the overall market growth over the forecast period. Furthermore, carbon fiber tapes offer exceptional properties such as superior strength to weight ratio, and high impact resistance thus offers utility in manufacturing composite parts for the primary and secondary structure of the aircraft. In addition, the composite parts manufactured through automated laying up of tapes lead to the economical production of parts with superior aesthetics.

The sports & leisure segment is expected to grow at a CAGR of 20.0% over the forecast period, owing to the increasing demand for lightweight, durable, and high-performance materials in sports equipment. In addition, carbon fiber tapes offer strength, flexibility, and reduced weight, making them ideal for use in items such as bicycles, tennis rackets, golf clubs, and other sporting goods. Furthermore, the rising popularity of high-performance sports, along with advancements in carbon fiber technology, is further fueling the adoption of carbon fiber tapes in the sports and leisure industry.

Regional Insights

Europe carbon fiber tapes market dominated the global market and accounted for the largest revenue share of 37.4% in 2024. This growth can be attributed to the expanding automotive and aerospace industries, which increasingly use lightweight, high-strength materials for fuel efficiency and sustainability. In addition, stringent environmental regulations encouraging the use of eco-friendly materials in manufacturing also support demand. Furthermore, European countries are investing in the development of advanced carbon fiber technologies, further accelerating the adoption of carbon fiber tapes in various applications, including sports equipment and construction.

The carbon fiber tapes market in Germany led the European market and held for the highest revenue share in 2024, due to its strong automotive and aerospace sectors. Furthermore, the push for more energy-efficient and lightweight vehicles has driven the demand for carbon fiber components. Moreover, Germany’s extensive research and development initiatives, alongside its focus on sustainable manufacturing practices, are encouraging the use of carbon fiber tapes in industries such as automotive, aviation, and sports equipment, boosting market expansion.

Middle East & Africa Carbon Tapes Market Trends

The Middle East and Africa carbon fiber tapes market is expected to grow at a CAGR of 19.1% over the forecast period, owing to increasing infrastructure development, particularly in the construction and automotive sectors. In addition, the region's focus on sustainable building materials and fuel-efficient vehicles is driving the demand for lightweight materials such as carbon fiber tapes. Furthermore, the region's growing interest in motorsports and high-performance equipment further contributes to the rising adoption of carbon fiber technologies in sports and leisure products.

North America Carbon Tapes Market Trends

The carbon fiber tapes market in North America held for the significant revenue share in 2024, primarily driven by expanding primarily due to advancements in the aerospace, automotive, and renewable energy sectors. In the U.S., the emphasis on fuel efficiency, emission reduction, and lightweight construction in vehicles is driving the adoption of carbon fiber tapes. In addition, the region’s strong focus on innovation, coupled with government regulations supporting sustainable materials, is also fueling market growth. Furthermore, the increasing demand for carbon fiber-reinforced products in sports, aerospace, and defense industries is boosting the market.

U.S. Carbon Tapes Market Trends

The U.S. carbon fiber tapes market led the North American market for the highest revenue share in 2024, driven by its robust aerospace, automotive, and defense sectors. In addition, the demand for lightweight, high-strength materials for fuel-efficient and environmentally friendly vehicles is accelerating the adoption of carbon fiber tapes. Moreover, growing investments in renewable energy and infrastructure development are further driving demand. The U.S. is also home to leading research institutions and manufacturing innovations, which continue to enhance the utilization of carbon fiber tapes across industries.

Asia Pacific Carbon Tapes Market Trends

The carbon fiber tapes market in the Asia Pacific is experiencing rapid growth, driven by the booming automotive, aerospace, and manufacturing industries. Countries such as Japan and South Korea have a strong presence in the automotive sector, where carbon fiber is increasingly used for lightweight and energy-efficient vehicles. Furthermore, the growing sports and leisure industry, along with the rise of advanced infrastructure projects in countries such as India and China, is driving the demand for carbon fiber tapes in various applications.

Key Carbon Fiber Tapes Company Insights

The industry is competitive owing to the presence of several well-established market players with a strong foothold in the industry. The industry characterized by the long-term contract of manufacturers with the application industries. Moreover, the industry is witnessing a trend of forward integration, since the raw material suppliers are entering in to tapes manufacturing. The CF tapes industry is currently witnessing a limited production capacity. Key global carbon fiber tapes industry players are employing efforts to expand their production capacity. The rapidly extending scope for application of carbon fiber tapes in the various end-use industry will complemented by the increased production capacity, thereby heightening the overall sales revenue.

-

Evonik Industries manufactures advanced composites used in various industries such as automotive, aerospace, and sports. With a strong focus on innovation, Evonik supplies carbon fiber-based solutions that offer lightweight, high-strength properties, enhancing the efficiency and sustainability of its products. The company operates primarily in the chemicals and materials segment, offering a range of performance products including carbon fibers, composites, and specialty chemicals.

-

Hexcel Corporation produces carbon fiber, prepregs, honeycomb materials, and other composite solutions, catering to the need for lightweight, durable, and high-performance materials. Operating in the aerospace and automotive segments, the company focuses on delivering high-quality composites that contribute to fuel efficiency, reduced emissions, and improved performance in critical applications.

Key Carbon Fiber Tapes Companies:

The following are the leading companies in the carbon fiber tapes market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries

- SABIC

- Solvay

- Hexcel Corporation

- Royal Tencate

- SGL Group

- Teijin Limited

- BASF SE

- Celanese Corporation

- Victrex

- Cristex

- Eurocarbon

- PRF Composite Materials

- TCR Composites

- Sigmatex

Recent Developments

-

In January 2023, Asahi Kasei introduced a breakthrough in carbon fiber recycling with their new technology, which effectively recycles carbon fiber reinforced thermoplastic unidirectional tapes (CFRTP-UD tapes). This innovation aims to address the environmental challenges posed by carbon fiber waste. The company’s process enables the recovery and reuse of carbon fibers, potentially lowering production costs and promoting sustainability in industries such as automotive and aerospace, where carbon fiber tapes are heavily utilized for their lightweight, high-strength properties.

Carbon Fiber Tapes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.60 billion

Revenue forecast in 2030

USD 8.13 billion

Growth Rate

CAGR of 17.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Thousand Sq.M, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, end use, and region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Southeast Asia, Brazil, and Argentina

Key companies profiled

Evonik Industries; SABIC; Solvay; Hexcel Corporation; Royal Tencate; SGL Group; Teijin Limited; BASF SE; Celanese Corporation; Victrex; Cristex; Eurocarbon; PRF Composite Materials; TCR Composites; Sigmatex.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Fiber Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global carbon fiber tapes market report based on resin type, end use, and region.

-

Resin Type Outlook (Volume, Thousand Sq.M; Revenue, USD Million, 2018 - 2030)

-

Dry Tape

-

Prepreg Tape

-

-

End Use Outlook (Volume, Thousand Sq.M; Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Sports & Leisure

-

Others

-

-

Regional Outlook (Volume, Thousand Sq.M; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.