- Home

- »

- Advanced Interior Materials

- »

-

Carbon Fiber Wrap Market Size, Share, Industry Report 2030GVR Report cover

![Carbon Fiber Wrap Market Size, Share & Trends Report]()

Carbon Fiber Wrap Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin Type (Epoxy Resin, Vinyl Ester Resin), By End Use (Aerospace, Construction & Infrastructure), By Region (North America, Asia Pacific, Europe, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-555-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Fiber Wrap Market Size & Trends

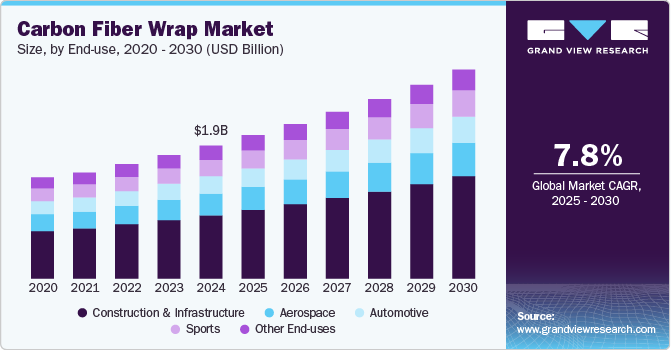

The global carbon fiber wrap market size was estimated at USD 1.91 billion in 2024 and is projected to grow at a CAGR of 7.8% from 2025 to 2030, driven by increasing demand for lightweight and high-strength materials across various industries such as automotive, aerospace, construction, and marine. As manufacturers prioritize fuel efficiency and performance, carbon fiber wraps offer an ideal solution due to their exceptional strength-to-weight ratio. In the automotive sector, these wraps are increasingly used for both structural and aesthetic purposes, supporting vehicle weight reduction strategies that align with stringent emission regulations and fuel economy standards. In addition, the rising popularity of electric vehicles (EVs) is further amplifying the need for advanced lightweight materials, positioning carbon fiber wraps as a critical component in the evolving mobility landscape.

The construction and infrastructure sectors are adopting carbon fiber wraps for structural reinforcement and rehabilitation applications. These materials are particularly valuable in strengthening aging bridges, columns, and beams due to their corrosion resistance, ease of installation, and long-term durability. Governments and civil engineering firms are investing in retrofitting aging infrastructure, especially in seismic-prone regions, which is positively impacting market growth. Alongside this, advancements in carbon fiber manufacturing technologies have led to cost reductions and improved product accessibility, broadening their adoption across small and medium-sized enterprises. The growing emphasis on sustainability and longevity in engineering practices further supports the increased utilization of carbon fiber wraps globally.

In addition, growing awareness of non-invasive and cost-effective repair methods is influencing market adoption. Carbon fiber wraps offer a practical alternative to traditional heavy-duty repairs by allowing external reinforcement without dismantling existing structures or machinery. This is particularly beneficial in time-sensitive or remote operations where access and labor constraints make conventional solutions less feasible.

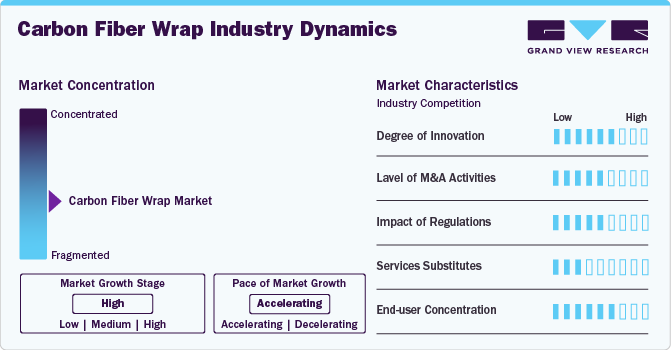

Market Concentration & Characteristics

The global carbon fiber wrap industry demonstrates a moderately concentrated structure, characterized by the presence of a few dominant players alongside numerous regional and specialized manufacturers. The degree of innovation within the market remains high, driven by continuous advancements in resin formulations, fiber architecture, and application techniques to enhance strength, flexibility, and ease of installation. These innovations are crucial for meeting the evolving demands in infrastructure repair, automotive, aerospace, and industrial sectors. Strategic partnerships and collaborative R&D efforts are increasingly common, fostering the development of next-generation materials tailored to specific end uses.

Mergers and acquisitions play a significant role in shaping market dynamics, as leading firms seek to expand their product portfolios and geographical reach. Regulatory impacts are particularly notable in construction and environmental applications, where compliance with building codes and safety standards such as ACI, ASTM, and ISO certifications influence product adoption. While few direct service substitutes match the performance of carbon fiber wraps in structural reinforcement, alternatives such as steel jacketing and traditional concrete repairs persist in price-sensitive regions.

End-use concentration remains high in the infrastructure and construction segment, particularly for retrofitting aging bridges, buildings, and pipelines, though uptake in high-performance automotive and aerospace applications is steadily increasing.

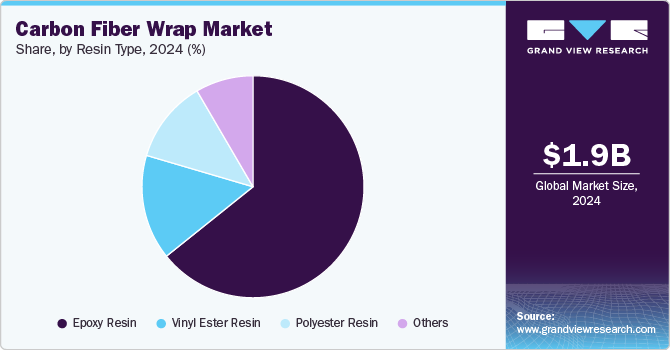

Resin Type Insights

Based on resin type, the epoxy resin segment led the market with the largest revenue share of 68.52% in 2024, driven by its exceptional mechanical properties and versatility. Epoxy resins are renowned for their high strength-to-weight ratio, excellent adhesion to carbon fibers, and superior resistance to chemicals and heat. These characteristics make them particularly suitable for demanding applications in industries such as aerospace, automotive, and wind energy.

The vinyl ester resin segment is expected to grow at a significant CAGR of 7.9% over the forecast period, driven by growing need for lightweight and high-performance materials in the automotive and aerospace industries. The combination of carbon fiber's strength-to-weight ratio and vinyl ester resin's resilience contributes to improved fuel efficiency and performance in vehicles and aircraft.

End Use Insights

Based on end use, the construction & infrastructure segment led the market with the largest revenue share of 47.8% in 2024, driven by increasing demand for structural rehabilitation solutions for aging infrastructure. As buildings, bridges, and pipelines deteriorate over time, there is a growing need for effective reinforcement methods to extend their service life. Carbon fiber wraps offer a lightweight yet robust solution for repairing and strengthening these structures, enhancing structural integrity and preventing further deterioration.

The sports segment is expected to grow at a significant CAGR of 8.0% over the forecast period, driven by the growing health and fitness consciousness among consumers is propelling the demand for advanced sports gear. As more individuals engage in sports and recreational activities, there is a heightened interest in equipment that enhances performance and reduces injury risk. Carbon fiber wraps, known for their shock absorption and ergonomic benefits, align well with these consumer preferences.

Regional Insights

The carbon fiber wrap market in North America is driven by increasing investments in aging infrastructure rehabilitation and disaster resilience initiatives. Governments across the region, particularly in the U.S. and Canada, are prioritizing the use of advanced composite materials for the structural strengthening of bridges, tunnels, pipelines, and public buildings to extend their lifespan and improve safety. Supportive policies, including infrastructure funding packages and adherence to rigorous construction standards such as those set by the American Concrete Institute (ACI), further propel market adoption.

U.S. Carbon Fiber Wrap Market Trends

The carbon fiber wrap market in the U.S. is driven by growing investment in infrastructure rehabilitation, particularly in the maintenance and seismic retrofitting of aging bridges, buildings, and pipelines. Stringent regulatory frameworks such as ACI guidelines and increased federal funding through infrastructure bills have encouraged the adoption of advanced composite materials like carbon fiber wrap. In addition, the rising focus on sustainable construction practices and the need for long-lasting, corrosion-resistant solutions further support market expansion.

Asia Pacific Carbon Fiber Wrap Market Trends

Asia Pacific dominated the carbon fiber wrap market with the largest revenue share of 44.8% in 2024, driven by rapid urbanization, infrastructure development, and industrial growth across emerging economies. Countries such as India, South Korea, and Japan are increasingly adopting carbon fiber wraps for structural reinforcement, especially in earthquake-prone zones. Government initiatives aimed at upgrading civil infrastructure and enhancing resilience against natural disasters are creating significant opportunities. The rising use of lightweight composites in the region’s automotive and aerospace sectors also contributes to market demand.

The carbon fiber wrap market in China benefits from extensive infrastructure modernization and repair programs, especially within the transportation and utilities sectors. The government’s push for high-performance building materials to support long-term durability and energy efficiency has led to growing acceptance of carbon fiber technologies. Furthermore, China’s strong domestic production capacity for carbon fiber and resins reduces dependency on imports, supporting competitive pricing and expanded usage in both public and private sector construction projects.

Europe Carbon Fiber Wrap Market Trends

The carbon fiber wrap market in Europe is driven by stringent environmental and safety regulations, as well as the region’s commitment to sustainable infrastructure development. Countries across the EU are prioritizing the maintenance and retrofitting of existing structures to extend their service life and meet carbon reduction targets. The market also benefits from advanced R&D capabilities and the presence of several major aerospace and automotive manufacturers incorporating carbon fiber wrap in structural components and reinforcement.

The Germany carbon fiber wrap market is propelled by the country’s engineering-focused approach to construction and infrastructure management. Emphasis on preventive maintenance and energy-efficient building practices has led to the early adoption of carbon fiber wrapping technologies. Germany’s robust automotive and manufacturing sectors also contribute to demand, as carbon fiber wraps are increasingly utilized in vehicle body reinforcement, lightweight design solutions, and industrial machinery maintenance.

Latin America Carbon Fiber Wrap Market Trends

The carbon fiber wrap market in Latin America is gaining momentum due to increasing awareness of the benefits of composite materials in infrastructure preservation and seismic strengthening. Countries such as Brazil, Mexico, and Chile are investing in retrofitting aging public infrastructure, particularly bridges and water pipelines. Although cost sensitivity remains a challenge, growing support from international development programs and rising construction activity are expected to drive future growth.

Middle East & Africa Carbon Fiber Wrap Market Trends

The carbon fiber wrap market in Middle East & Africa is driven by efforts to enhance the durability and resilience of critical infrastructure exposed to harsh environmental conditions such as extreme heat, humidity, and corrosion. Investment in water management systems, oil & gas infrastructure, and smart city development projects is fueling demand for high-performance materials like carbon fiber wrap. In addition, increasing government focus on long-term infrastructure sustainability is creating favorable conditions for market expansion.

Key Carbon Fiber Wrap Company Insights

Some of the key players operating in market includeAvery Dennison, Hexis

-

Avery Dennison offers high-performance wrap films under its Supreme Wrapping Film and Conform Chrome series. These films are designed for superior conformability, durability, and ease of installation, and include realistic carbon fiber finishes that are widely used for automotive customization and commercial vehicle branding.

-

Hexis is a French manufacturer specializing in self-adhesive vinyl films for visual communication, vehicle wraps, and surface protection. In the carbon fiber wrap segment, Hexis provides a variety of textured and realistic carbon fiber films within its HX30000 and HX20000 series. These wraps are recognized for their high conformability, UV resistance, and long-lasting finishes, catering to automotive and industrial applications.

Ritrama, Oracal are some of the emerging market participants in carbon fiber wrap industry.

-

Ritrama, a part of the Fedrigoni Group, is an Italian company known for its production of pressure-sensitive films for various applications including automotive and promotional graphics. The company’s carbon fiber wrap offerings include textured films that replicate the look and feel of real carbon fiber, suitable for both full vehicle wraps and accent applications.

-

Oracal, a brand under ORAFOL Group, is a globally recognized manufacturer of adhesive vinyl films used in signage, automotive customization, and industrial labeling. In the carbon fiber wrap industry, Oracal offers premium textured films such as the ORACAL 975 Premium Structure Cast series. These films provide an authentic carbon fiber appearance and are engineered for durability, dimensional stability, and high conformability on curved surfaces.

Key Carbon Fiber Wrap Companies:

The following are the leading companies in the carbon fiber wrap market. These companies collectively hold the largest market share and dictate industry trends.

- Avery Dennison

- Hexis

- Ritrama

- Oracal

- MetroWrapz

- Xpel

- Vvivid Vinyl

- TeckWrap

Carbon Fiber Wrap Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.06 billion

Revenue forecast in 2030

USD 3.0 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Avery Dennison; Hexis; Ritrama; Oracal; MetroWrapz; Xpel; Vvivid Vinyl; TeckWrap

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Fiber Wrap Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon fiber wrap market report based on resin type, end use and region.

-

Resin Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy Resin

-

Vinyl Ester Resin

-

Polyester Resin

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Construction & Infrastructure

-

Automotive

-

Sports

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global carbon fiber wrap market size was estimated at USD 1.91 billion in 2024 and is expected to reach USD 2.06 billion in 2025.

b. The global carbon fiber wrap market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 3.0 billion by 2030.

b. The epoxy resin segment led the market and accounted for the largest revenue share of 63.4% in 2024, driven by its exceptional mechanical properties and versatility.

b. Some of the key players operating in the carbon fiber wrap market include Avery Dennison, Hexis, Ritrama, Oracal, MetroWrapz,Xpel, Vvivid Vinyl, and TeckWrap

b. The key factors that are driving the carbon fiber wrap market include rising demand for lightweight and high-strength materials, growth in automotive and aerospace sectors, and increasing use in sports equipment and infrastructure reinforcement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.