- Home

- »

- Plastics, Polymers & Resins

- »

-

Carbon-negative Plastics Market Size, Industry Report, 2030GVR Report cover

![Carbon-negative Plastics Market Size, Share & Trends Report]()

Carbon-negative Plastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (PE, PP, EVA), By End-use (Packaging, Automotive Components, Construction Materials), And Segment Forecasts

- Report ID: GVR-4-68040-578-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon-negative Plastics Market Trends

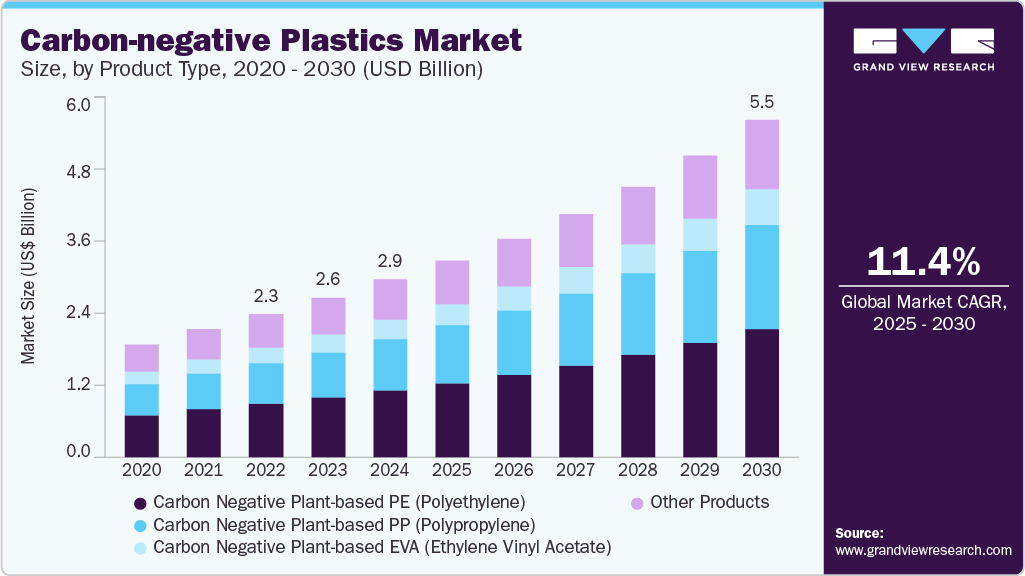

The global carbon-negative plastics market size was estimated at USD 2.93 billion in 2024 and is expected to grow at a CAGR of 11.36% from 2025 to 2030. Growing consumer demand for eco-friendly products is pushing brands to switch to carbon-negative plastics to strengthen their sustainability image.

Key Highlights:

- Europe carbon-negative plastics market dominated the global market and accounted for the largest revenue share of 41.10% in 2024.

- Germany held a dominant position in European market with a revenue share of 33% in 2024

- By product type, the carbon-negative plant-based polyethylene (PE) segment dominated the carbon-negative plastics market with a revenue share of 37.64% in 2024.

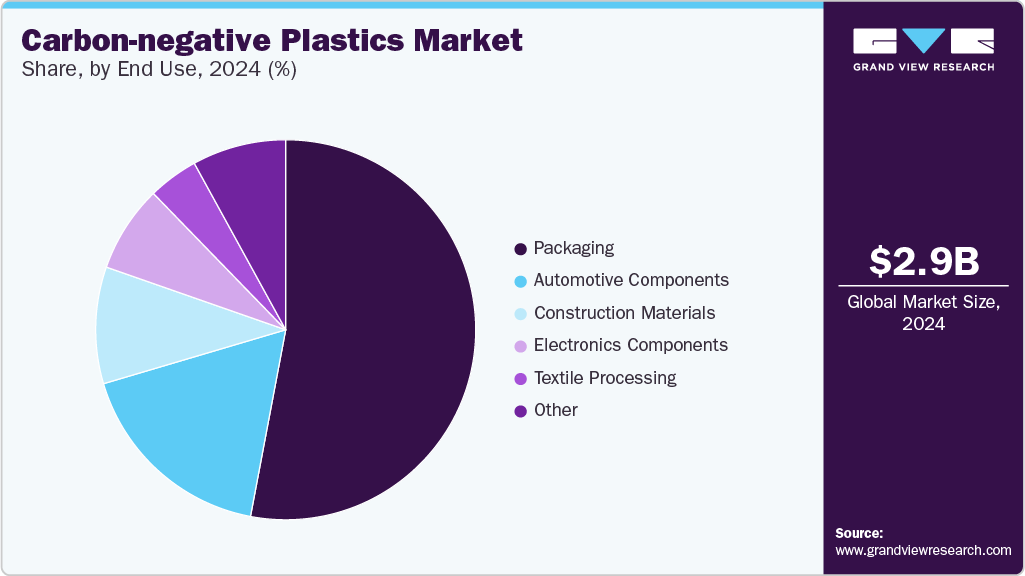

- By end use, packaging dominated the carbon-negative plastics market with a revenue share of 52.97% in 2024

Additionally, advances in bio-based and CO₂-derived polymer technologies are making these alternatives more commercially viable.

The carbon-negative plastics market is witnessing a pivotal transition toward decentralized biomanufacturing models, leveraging regional feedstock availability to minimize carbon footprint across the entire value chain. As companies move away from petroleum-derived inputs, the integration of carbon capture and utilization (CCU) technologies into plastic production is becoming a defining trend.

Notably, advanced startups and established players alike are exploring direct air capture (DAC) and bio-based CO₂ fixation using engineered microorganisms to synthesize polymers. For instance, Climeworks, a Zurich-based carbon removal company, announced a breakthrough in its Generation 3 direct air capture (DAC) technology in 2024, significantly improving efficiency and performance. The new technology doubles CO2 capture capacity per module, halves energy use, and extends material lifespan, cutting costs by 50%.

This emerging convergence of biotechnology and materials science is reshaping competitive dynamics by promoting localized, low-emission production hubs that align with national climate goals and regional sustainability mandates. The trend is further amplified by evolving lifecycle assessments (LCAs) that quantify the net-negative carbon potential, pushing investors and regulators to prioritize scalable, verifiable solutions.

Drivers, Opportunities & Restraints

A key driver accelerating the carbon-negative plastics market is the increasing regulatory and financial pressure on corporations to achieve net-zero emissions targets across their supply chains. Global policies such as the European Green Deal, the U.S. Inflation Reduction Act, and ESG-linked investor mandates are compelling manufacturers to reevaluate the sustainability profiles of their materials. Carbon-negative plastics, derived from CO₂ or agricultural waste and offering cradle-to-gate emissions offsets, are increasingly seen as strategic assets rather than experimental substitutes. Europe is at the forefront of reducing carbon emissions as it aims to achieve carbon neutrality by 2050.

Leading brands in packaging, automotive, and consumer goods are forming strategic alliances with material innovators to secure early access to carbon-negative polymers, signalling a shift from risk mitigation to value creation through sustainable procurement. This heightened demand from top-tier buyers is stimulating both R&D investment and scale-up efforts across the supply ecosystem.

A compelling opportunity lies in the integration of carbon-negative plastics into circular economy models, particularly through the use of biogenic CO₂ and post-industrial carbon streams. By embedding carbon-negative polymers into closed-loop manufacturing systems, companies can achieve dual benefits of emissions reduction and material recovery. This creates value across industries that are traditionally carbon-intensive, such as construction and logistics, which are under mounting pressure to decarbonize material usage.

Despite its long-term promise, the carbon-negative plastics market is constrained by high production costs and scalability limitations of current technologies. Most existing solutions remain confined to pilot or early commercial phases, largely due to complex supply chains for CO₂ sourcing, purification, and polymerization. The absence of standardized certification systems and carbon accounting protocols also presents a barrier to adoption, particularly for large enterprises that require regulatory clarity before overhauling procurement practices.

Market Concentration & Characteristics

The market growth stage of the carbon-negative plastics market is medium, and the pace is accelerating. The market exhibits a significant level of market concentration, with key players dominating the industry landscape. Major companies like Braskem, Neste, LyondellBasell, Mitsui Chemicals, The Dow Chemical Company, Borealis, LanzaTech, UBQ Materials, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Regulations are playing a catalytic role in shaping the carbon-negative plastics market by tightening emission caps and mandating the decarbonization of materials across industrial value chains. Policies such as the European Union’s Carbon Border Adjustment Mechanism (CBAM) and the U.S. Inflation Reduction Act have begun attaching fiscal consequences to carbon intensity, incentivizing manufacturers to shift toward materials with negative or neutral carbon footprints.

Moreover, new plastics legislation in markets like Canada, the UK, and parts of the EU is increasingly focused not only on recyclability but also on embedded carbon emissions. This evolving regulatory landscape is accelerating adoption, particularly among companies looking to future-proof their portfolios against both compliance risk and investor scrutiny.

While carbon-negative plastics are gaining traction, they face competitive pressure from mature substitutes such as mechanically recycled plastics and biodegradable biopolymers like PLA and PHA. These alternatives are already integrated into industrial ecosystems and benefit from relatively lower production costs and established supply networks. However, they often fall short on lifecycle carbon neutrality or negative carbon metrics, a gap that carbon-negative plastics uniquely address. Still, in price-sensitive applications or geographies where regulatory enforcement is weak, recycled and compostable options continue to dominate, slowing the speed at which carbon-negative solutions can achieve mainstream adoption.

Product Type Insights

The carbon-negative plant-based polyethylene (PE) segment dominated the carbon-negative plastics market with a revenue share of 37.64% in 2024. This is driven by the global shift toward climate-resilient agricultural supply chains. As large Agri-based economies like Brazil and India ramp up the production of sugarcane, which reached and other biomass feedstocks, manufacturers are capitalizing on consistent bio-ethanol streams to produce plant-based ethylene with verifiable carbon-negative attributes.

Major FMCG brands are increasingly preferring bio-PE for flexible and rigid packaging due to its drop-in compatibility with existing PE infrastructure, creating a fast-track commercialization path. The scalability of feedstock availability and downstream conversion efficiency is positioning plant-based PE as a front-runner in decarbonizing mass-market plastic applications.

The carbon-negative plant-based polypropylene (PP) is expected to grow at the fastest CAGR of 12.52% through the forecast period, which can be attributed to the growing demand from high-performance applications that require thermal resistance and mechanical strength, such as automotive and electronics. Unlike PE, PP has traditionally lacked a robust bio-based supply chain; however, recent breakthroughs in biomass-to-propylene technologies, particularly through catalytic pyrolysis and fermentation pathways, are changing that landscape.

Industry leaders in Asia and Europe are piloting proprietary methods to produce bio-propane-derived PP with lifecycle carbon benefits. This technical progress, paired with heightened regulatory focus on circularity and carbon labeling, is accelerating interest in carbon-negative PP as a strategic material for advanced engineering use cases.

End Use Insights

Packaging dominated the carbon-negative plastics market with a revenue share of 52.97% in 2024, owing to the rising influence of Extended Producer Responsibility (EPR) laws and carbon disclosure frameworks that mandate sustainability metrics at the product level.

Consumer brands are under mounting pressure to eliminate fossil-derived plastics from their portfolios while maintaining product safety and durability. Carbon-negative plastics provide a measurable path to reduce Scope 3 emissions, particularly in single-use and secondary packaging formats. As a result, large-scale retail and e-commerce players are shifting procurement strategies to include verified low-carbon or carbon-negative materials, fostering demand across both primary and tertiary packaging layers.

The automotive components segment is projected to witness a substantial CAGR of 13.75% through the forecast period. According to the International Organization of Motor Vehicle Manufacturers (OICA), the total global automotive production reached 92.50 million in 2024. With EV makers and legacy OEMs alike aiming to reduce vehicle lifecycle emissions, bio-based materials with carbon-negative credentials offer dual advantages, i.e., reduced vehicle weight and improved ESG performance.

Furthermore, incentives under green vehicle regulations in Europe and North America are encouraging tier-1 suppliers to adopt such materials to meet sustainability-linked supply chain goals. This push is not just regulatory but reputational, as automakers seek to position themselves as leaders in climate-conscious mobility.

Regional Insights

Europe carbon-negative plastics market dominated the global market and accounted for the largest revenue share of 41.10% in 2024. Europe’s carbon-negative plastics market is primarily driven by stringent environmental regulations, including the European Green Deal, Circular Economy Action Plan, and the Single-Use Plastics Directive. The bloc’s ambitious target to become climate-neutral by 2050 is pushing industries to adopt materials that offer verified emissions savings.

Germany Carbon-negative Plastics Market Trends

Germany carbon-negative plastics market is strongly supported by the country’s leadership in climate innovation and chemical manufacturing, especially within its "Klimaschutzgesetz" (Climate Protection Act) framework. The country is aggressively funding carbon capture and industrial decarbonization projects, including CO₂-to-polymer R&D under the BMBF and EU Horizon programs.

North America Carbon-negative Plastics Market Trends

The North America carbon-negative plastics market is driven by the growing alignment between federal climate policy and private sector decarbonization strategies. Initiatives such as the U.S.-Canada Clean Energy Dialogue and the push for cross-border carbon standards are creating a favorable environment for the development of low-carbon materials. Multinational firms headquartered in the region are committing to science-based targets, and carbon-negative plastics offer a pathway to reduce Scope 3 emissions across packaging and logistics.

The U.S. carbon-negative plastics market is specifically driven by the Inflation Reduction Act (IRA), which allocates significant tax credits and subsidies for carbon capture, clean manufacturing, and sustainable feedstock development. This legislation has catalyzed a surge in investment in biomanufacturing hubs, particularly in states like Texas, California, and Iowa, where bioethanol and CO₂ conversion technologies are scaling rapidly. The Department of Energy’s support for CO₂-derived materials through grant funding and public-private partnerships is further propelling domestic innovation in carbon-negative plastics, particularly in sectors like consumer goods, automotive, and building materials.

Asia Pacific Carbon-negative Plastics Market Trends

The Asia Pacific carbon-negative plastics market is projected to grow rapidly at 12.60% CAGR over the forecast period. In the region, the primary driver stems from industrial-scale biomass availability and rapidly expanding clean manufacturing capacity, especially in countries like China, India, and Thailand. Governments are investing in bio-economy strategies and encouraging the use of agricultural waste, algae, and CO₂-rich flue gases as feedstocks for polymer production. Regional players are entering joint ventures with Western technology firms to produce carbon-negative plastics at scale, targeting export-oriented markets with strict sustainability standards.

Key Carbon-negative Plastics Company Insights

The carbon-negative plastics market is highly competitive, with several key players dominating the landscape. Major companies include Braskem, Neste, LyondellBasell, Mitsui Chemicals, The Dow Chemical Company, Borealis, LanzaTech, Dama Bioplastics, and UBQ Materials.The carbon-negative plastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Carbon-negative Plastics Companies:

The following are the leading companies in the carbon-negative plastics market. These companies collectively hold the largest market share and dictate industry trends.

- Braskem

- Neste

- LyondellBasell

- Mitsui Chemicals

- Dow

- Borealis

- LanzaTech

- UBQ Materials

- Dama Bioplastics

Recent Developments

-

In February 2025, Dama Bioplastics showcased its new carbon-negative material, DAMA Black, at the JEC World Composites Expo. The company aimed to expand its market presence in 2025 by promoting this innovative material, which is made from renewable resources and designed to help industries reduce their carbon footprint.

-

In July 2024, Mango Materials, a California-based biomanufacturing company, developed a technology that uses methane-eating bacteria to convert methane emissions from sources like wastewater treatment into biodegradable plastics called polyhydroxyalkanoate (PHA). This process not only reduces greenhouse gases but also produces 100% biodegradable polyester pellets for various sustainable products.

Carbon-negative Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.24 billion

Revenue forecast in 2030

USD 5.55 billion

Growth rate

CAGR of 11.36% from 2024 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Braskem, Neste, LyondellBasell, Mitsui Chemicals, Dow, Borealis, LanzaTech, UBQ Materials, Dama Bioplastics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon-negative Plastics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon-negative plastics market report based on product type, end use, and region:

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon Negative Plant-based PE (Polyethylene)

-

Carbon Negative Plant-based PP (Polypropylene)

-

Carbon Negative Plant-based EVA (Ethylene Vinyl Acetate)

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive Components

-

Construction Materials

-

Electronics Components

-

Textile Processing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global carbon-negative plastics market size was estimated at USD 2.93 billion in 2024 and is expected to reach USD 3.24 billion in 2025.

b. The global carbon-negative plastics market is expected to grow at a compound annual growth rate of 11.36% from 2025 to 2030 to reach USD 5.55 billion by 2030.

b. Packaging dominated the carbon-negative plastics market across the end use segmentation in terms of revenue, accounting for a market share of 52.97% in 2024, owing to the rising influence of Extended Producer Responsibility (EPR) laws and carbon disclosure frameworks that mandate sustainability metrics at the product level.

b. Some key players operating in the carbon-negative plastics market include Braskem, Neste, LyondellBasell, Mitsui Chemicals, The Dow Chemical Company, Borealis, LanzaTech, Dama Bioplastics, and UBQ Materials.

b. Growing consumer demand for eco-friendly products is pushing brands to switch to carbon-negative plastics to strengthen their sustainability image. Additionally, advances in bio-based and CO₂-derived polymer technologies are making these alternatives more commercially viable.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.