- Home

- »

- Medical Devices

- »

-

Cardiac Monitoring And CRM Market Size Report, 2020-2027GVR Report cover

![Cardiac Monitoring And Cardiac Rhythm Management Market Size, Share & Trends Report]()

Cardiac Monitoring And Cardiac Rhythm Management Market Size, Share & Trends Analysis Report By Product (CMD (ECG, Event Monitors), CRM (Pacemakers, Defibrillators)), By End Use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-798-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The global cardiac monitoring and cardiac rhythm management market size was valued at USD 29.0 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2020 to 2027. Rising incidence of cardiovascular disorders, treatment costs of cardiac diseases, increasing use of ambulatory and home services, favorable government regulation, and technological advancements are the vital drivers for this market for cardiac monitoring and cardiac rhythm management. The introduction of advanced cardiac devices such as subcutaneous ICDs, Automated External Defibrillators (AEDs), and MRI pacemakers is driving the market for cardiac monitoring and cardiac rhythm management. Cardiovascular Diseases (CVDs) are a major cause of mortality in the U.S. As per WHO, one-fourth of all deaths are estimated to be caused by CVDs.

Ischemic heart disease and stroke accounted for more than 85.0% of all CVD-related deaths worldwide. According to the CDC, CVDs are responsible for about 840,768 lives lost in the U.S. in 2019. Moreover, Coronary Heart Disease (CHD) accounts for the majority of CVD deaths, along with stroke and heart failure. The economic burden of these diseases is likely to be more than USD 1.0 billion by 2030, which highlights the heightened need for preventive devices for cardiac monitoring and cardiac rhythm management.

Increasing demand to enhance patients' lives and improve outcomes of various cardiac procedures, with the most advanced and minimally invasive technologies is the major factor driving the growth of the market for cardiac monitoring and cardiac rhythm management. Moreover, favorable reimbursement policies, such as those introduced by the U.S. Medicare system, are among the major factors boosting the market for cardiac monitoring and cardiac rhythm management.

The COVID-19 outbreak caused due to SARS-CoV-2, already affected millions of people globally as of May 2020. The contagious coronavirus is also having an economic impact and implications on most of the sectors including the medical device industry. According to the World Economic Forum in March 2020, among the 500 people being hospitalized in the U.S., 20.0% were aged between 20 to 44 years and 18.0% were aged between 45-54 years.

The European Society of Cardiology on 21st April 2020, suggested that CVD patients are expected to show vulnerability in case of COVID-19 infection. It is challenging to predict the exact Coronavirus pandemic curve in the world. However, looking at the grim situation, especially in the U.S. and Europe, the peak demand for critical care equipment is anticipated to rise at an exponential rate in 2020.

Product Insights

In terms of revenue, cardiac rhythm management devices dominated the market with around 68.0% share in 2019. The high share is attributable to the introduction of technologically advanced cardiac rhythm management devices such as fitness trackers and smartwatches, which can enhance Atrial Fibrillation (AFib) detection and screening.

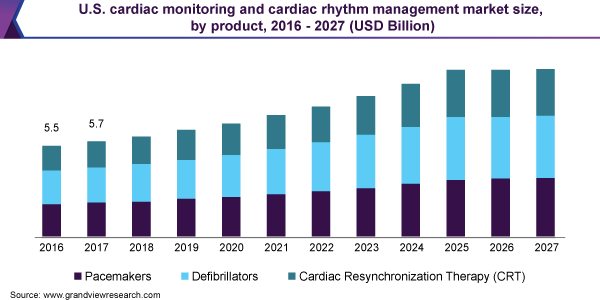

The cardiac rhythm management devices segment is sub-segmented into pacemakers, defibrillators, and cardiac resynchronization devices. The cardiac monitoring devices are further divided into implantable loop recorder (ILR), event monitors, ECG, mobile cardiac telemetry, and others. The Electrocardiography (ECG) segment dominated the cardiac monitoring devices market with around 34.0% share in 2019. Government initiatives, technological advancements, regional expansions, and commercialization of new products, are likely to boost the market for cardiac monitoring and cardiac rhythm management in the forthcoming years.

End-use Insights

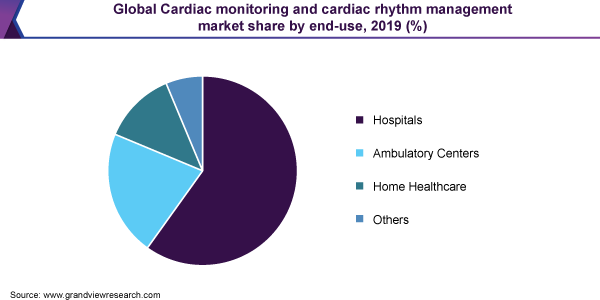

The hospital segment dominated the market and held the highest revenue share of 61.0% in 2019. Hospitals provide optimal care for patients suffering from CVD and enable early diagnosis, thus witnessing tremendous growth. According to the American Heart Association, 209,000 patients suffered from in-hospital cardiac arrest in the U.S in 2016, and this number is expected to rise to more than 23.6 million by 2030.

The home health care segment is expected to be the fastest-growing sub-segment in the cardiac monitoring and cardiac rhythm management market over the forecast period owing to its cost-effectiveness and ease of treatment. Technological advancements and miniaturization of products are boosting the demand for home healthcare devices. Furthermore, increasing the target population, growing demand to curb the healthcare expenditure, and high incidence of target diseases are expected to be some of the high-impact rendering drivers for home healthcare devices.

Regional Insights

North America dominated the market with a share of around 37.0% in 2019. The growth can be attributed to growing disposable income, increasing elderly population, rapid technological advancements such as long battery life, miniaturization, leadless or biocompatible materials, and improving rate of government regulatory approvals. The incidence of cardiac disorders, such as cardiac arrests, heart failure, and cardiac arrhythmias, is increasing at a rapid rate in the U.S., which is further boosting the growth of the market for cardiac monitoring and cardiac rhythm management in the region.

Asia Pacific is expected to exhibit lucrative growth in the market for cardiac monitoring and cardiac rhythm management over the forecast period. Increasing demand for a better healthcare system and huge untapped opportunities are propelling growth. Organizations such as the China Cardiovascular Association and the American College of Cardiology are working together to develop ground-breaking technologies for cardiac care. The rapidly aging population is a major concern in North Asian countries such as Japan, China, and Korea, which is expected to drive the market for cardiac monitoring and cardiac rhythm management in the region in the coming years due to a higher prevalence of CVDs.

Key Companies & Market Share Insights

Key players undertook various strategic initiatives such as mergers and acquisitions, product launches, and partnerships, and collaborations to gain more penetration. For instance, in April 2019, Stryker launched LIFEPAK CR2 defibrillator installed with LIFELINKcentral AED program manager in the U.S. in order to improve its product portfolio. In January 2020, Medtronic received U.S. FDA approval for Micra AV, the smallest pacemaker with the atrioventricular synchrony. In February 2020, Abbott received CE marking for Gallant ICD and CRT-D devices and allowing the company to have advanced cardiac rhythm management capabilities, resulting in market penetration. Some of the prominent players in the cardiac monitoring and cardiac rhythm management market include:

-

Stryker Corporation

-

Schiller

-

Medtronic

-

Abbott

-

Boston Scientific Corporation

-

Koninklijke Philips N.V.

-

Zoll Medical Corporation

-

BIOTRONIK

-

GE Healthcare

-

Microport Scientific Corporation

-

Hill-Rom Holdings

-

Nihon Kohden Corporation

-

Biotelemetry

-

Spacelabs healthcare

Cardiac Monitoring And Cardiac Rhythm Management Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 31.5 billion

Revenue forecast in 2027

USD 48.9 billion

Growth rate

CAGR of 6.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Australia; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

Boston Scientific; Nihon Kohden Corporation; GE Healthcare; Zoll Medical Corporation; Schiller; Abbott; Microport Scientific Corporation; Phillips Healthcare; Stryker; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global cardiac monitoring and cardiac rhythm management market report on the basis of product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Cardiac monitoring devices

-

ECG

-

Resting ECG

-

Stress ECG

-

Holter Monitors

-

-

Event Monitors

-

Implantable Loop Recorders

-

Echocardiogram

-

Mobile Cardiac Telemetry

-

Others

-

-

Cardiac rhythm management devices

-

Pacemakers

-

Implantable

-

External

-

-

Defibrillators

-

Implantable Cardioverter Defibrillators (ICD)

-

S-ICD

-

T-ICD

-

-

External Defibrillator

-

Manual External Defibrillator

-

Automatic External Defibrillator

-

Wearable Cardioverter Defibrillator

-

-

-

Cardiac Resynchronization Therapy (CRT)

-

CRT-Defibrillator

-

CRT-Pacemakers

-

-

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Hospitals

-

Ambulatory centers

-

Home healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cardiac monitoring and cardiac rhythm management market size was estimated at USD 29.4 billion in 2019 and is expected to reach USD 31.4 billion in 2020.

b. The global cardiac monitoring and cardiac rhythm management market is expected to grow at a compound annual growth rate of 6.5% from 2020 to 2027 to reach USD 48.9 billion by 2027.

b. North America dominated the cardiac monitoring and cardiac rhythm management market with a share of 37.2% in 2019. This is attributable to rising healthcare awareness coupled with the presence of key players and constant research and development initiatives.

b. Some key players operating in the cardiac monitoring and cardiac rhythm management market include Boston Scientific, Nihon Kohden Corporation, GE Healthcare, Welch Allyn, Zoll Medical Corporation, Schiller, Spacelabs Healthcare, Scottcare Corporation, Ecardio Diagnostics, St. Jude Medical CardioNet, Phillips Healthcare, Cardiac Science Corporation, Life Watch, Mortara Instruments, and Medtronic.

b. Key factors driving the cardiac monitoring and cardiac rhythm management market growth include increasing influx of established players, rising patient awareness levels, favorable government regulation, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."