- Home

- »

- Biotechnology

- »

-

Cardiovascular Health Supplements Market Size Report 2030GVR Report cover

![Cardiovascular Health Supplements Market Size, Share & Trends Report]()

Cardiovascular Health Supplements Market Size, Share & Trends Analysis Report By Type (Natural Supplements, Synthetic Supplements), By Form (Liquid, Tablet), By Ingredient, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-132-8

- Number of Report Pages: 135

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global cardiovascular health supplements market size was estimated at USD 10.88 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.06% from 2023 to 2030. There is a growing awareness among consumers about the importance of cardiovascular health, driven by an aging population and an increased prevalence of heart-related diseases. This awareness has led to a heightened interest in preventive healthcare, with individuals actively seeking out supplements that support heart health.

The COVID-19 pandemic positively impacted the market by increasing awareness about the importance of maintaining good health, including cardiovascular health. COVID-19 was found to have a more severe impact on individuals with pre-existing heart conditions, which led many people to become more conscious of their heart health. This increased awareness drove a surge in demand for cardiovascular health supplements as individuals sought ways to mitigate their heart-related problems. Stress is a known risk factor for heart disease, and many individuals turned to supplements containing stress-reducing ingredients like adaptogens and B vitamins to manage their stress levels and support heart health. Moreover, telehealth services and virtual wellness programs gained prominence during the pandemic, enabling healthcare professionals to provide remote consultations and guidance. As part of these virtual health initiatives, doctors and nutritionists recommended dietary supplements for heart-related issues to patients, further boosting the demand.

According to the Centers for Disease Control and Prevention (CDC), in 2021, over 695,000 people in the U.S. died from heart disease, recorded as 1 out of every 5 deaths. Sedentary lifestyles and poor dietary habits have contributed to the rise in cardiovascular issues. As a result, people are increasingly turning to supplements to compensate for nutritional gaps and to support their heart health in an effort to adopt healthier lifestyles. As per MJH Life Sciences, in 2019, researchers published information on the impact of dietary changes and nutritional supplements on cardiovascular events and death in adults. The study concluded that supplementing omega-3 long-chain polyunsaturated fatty acids and folate could reduce the risk of various cardiovascular events in adults.

Several manufacturers are increasingly adding new solutions to their portfolio owing to the increasing demand for cardiovascular health supplements. For instance, in September 2023, Nutrartis launched a natural plant sterol supplement named Cardiosmile, a liquid sachet shape that makes use of water-dispersible phytosterols. A critical trial done at the University of Manitoba in Canada showed Cardiosmile is capable of reducing LDL cholesterol by 12% and triglycerides by 14% within 28 days of regular use. Such factors are expected to drive the market growth over the forecast period.

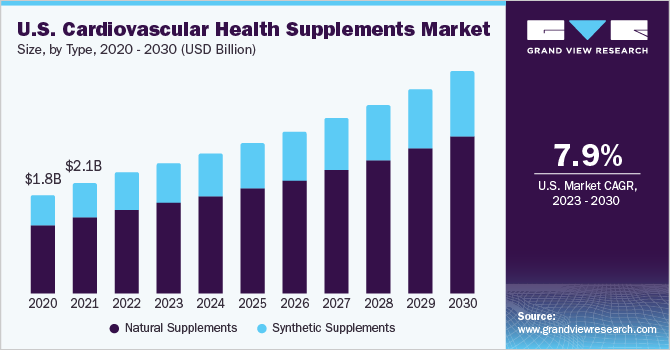

Type Insights

Based on type, the natural supplements segment held the largest market share of 69.29% in 2022 and it is expected to grow at the fastest CAGR of 9.46% over the forecast period. This is attributed to the increasing awareness of the importance of health and wellness that has driven consumers to seek natural alternatives to conventional pharmaceuticals. Many people are adopting a holistic approach to health, focusing on preventive measures and natural solutions, which has boosted the demand for natural supplements.

The synthetic supplements segment is anticipated to grow at a significant CAGR of 8.12% from 2023 to 2030. The demand for synthetic supplements is shaped by a combination of factors, including perceived health benefits, lifestyle choices, aging demographics, nutritional awareness, medical recommendations, and price considerations. Understanding these factors is essential for supplement manufacturers and marketers to effectively meet consumer needs and preferences in the competitive supplement market.

Ingredient Insights

Based on ingredients, the omega fatty acids segment held the largest revenue share of 26.96% in 2022. Scientific research has consistently demonstrated the significant cardiovascular benefits of omega-3 fatty acids, particularly EPA (eicosatetraenoic acid) and DHA (docosahexaenoic acid). These essential fatty acids are known to reduce triglyceride levels, lower blood pressure, and improve overall heart health. As awareness of these health benefits continues to spread, consumer demand for cardiovascular supplements containing omega fatty acids has risen substantially. For instance, according to a study published by the Journal of the American Heart Association in June 2022, consuming 3 grams daily of omega-3 fatty acids via supplements or food has decreased blood pressure.

The herbs & botanicals segment is anticipated to grow at the fastest CAGR of 10.33% from 2023 to 2030. Herbal and botanical supplements, such as garlic, hawthorn, and green tea extracts, have gained popularity for their heart health benefits. Demand for these natural ingredients continues to rise, driven by their traditional use and scientific validation. According to Rupa, Inc. study published in May 2023, garlic is high in allicin, an antioxidant that is responsible for many of its beneficial cardiovascular effects. Supplementation with aged garlic extract (AGE) has been proven to reduce total and LDL cholesterol by 10%, reduce blood clotting, and significantly drop blood pressure in hypertensive patients by 8.4/7.3 mmHg on average.

Form Insights

Based on form, the market is segmented into liquid, tablet, capsules, softgels, powder, and others. The softgels segment held the largest market share of 36.62% in 2022. Softgels are known for their ease of consumption and digestibility, making them a preferred choice for individuals seeking cardiovascular health support. This user-friendly format appeals to a wide range of consumers, including those who may have difficulty swallowing pills or capsules. The bioavailability and absorption rates of nutrients in softgel formulations are often higher than those in other supplement forms. This characteristic is especially advantageous in cardiovascular health supplements, as it can lead to quicker and more effective results. These factors are expected to drive the segment growth over the coming years.

The capsules segment is projected to exhibit the fastest CAGR of 9.94% over the forecast period. Capsules can hold well-formulated combinations of various ingredients that have been clinically studied for their positive effects on heart health. This allows for a comprehensive supplementation approach that aligns with the growing demand for holistic and preventive healthcare solutions. In addition, capsules have an extended shelf life, ensuring the stability and potency of the supplement over time. This factor further bolsters the segment growth.

Distribution Channel Insights

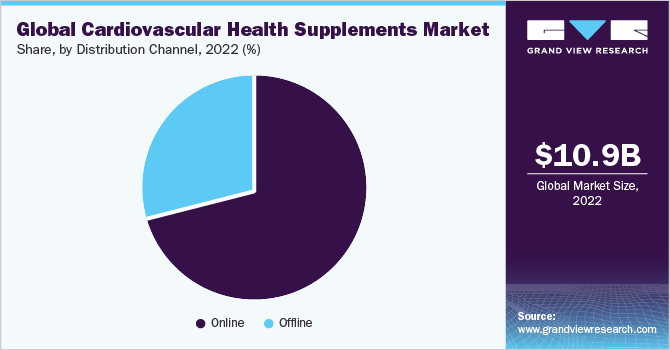

The offline segment held the larger market share of 70.62% in 2022. It includes brick-and-mortar stores, pharmacies, and health food stores, which offer consumers a physical location to explore and purchase health supplements, which makes them a preferred choice among consumers. Moreover, several companies have been investing significantly in opening offline stores to reach a wider customer base. For instance, in May 2023, Nordic Naturals partnered with Walmart to offer its omega-3 supplement in across 2,500 Walmart stores. The aim behind the strategy is to expand the product range and generate awareness about the product availability.

On the contrary, the online segment is projected to register the fastest CAGR of 10.41% from 2023 to 2030. The online distribution channel has skyrocketed during the COVID-19 pandemic. To increase the reach of the products, companies are collaborating with e-commerce platforms or focusing on digital distribution channels. For instance, in November 2020, Amway shifted from offline to online, with online sales doubling to more than 70%.

Regional Insights

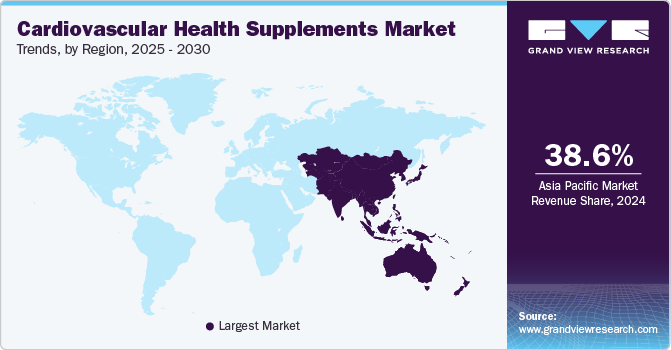

Asia Pacific dominated the market in 2022 with a revenue share of 38.40%. This is attributed to the rising awareness of heart health and the increasing prevalence of cardiovascular diseases in the region that have fueled the demand for supplements aimed at promoting cardiovascular well-being. Consumers are becoming more health-conscious and proactive in managing their heart health, leading to a surge in the consumption of dietary supplements containing ingredients like omega-3 fatty acids, coenzyme Q10, and antioxidants, which are believed to support heart health. Moreover, factors such as the increasing focus of market players on developing nations such as India and China are anticipated to support regional growth over the forecast period.

Europe is expected to grow at a significant CAGR of 8.87% from 2023 to 2030. This is attributed to the growing aging population in Europe. This demographic trend has created a significant market for cardiovascular health supplements, as older individuals often turn to dietary supplements to complement their heart-healthy lifestyle choices. Moreover, regulatory agencies in many European nations have approved nutritional supplements and functional foods, which has boosted industry growth. The regulatory process for approving such supplements has been simplified due to reforms and adjustments to the regulatory process.

Key Companies & Market Share Insights

The key participants in the market are implementing various strategic initiatives including new product launches, geographical expansion, mergers & acquisitions, and collaborations to retain their market presence. In addition, numerous strategic initiatives help market participants to strengthen their industry position. For instance, in September 2023, Nutrartis launched Cardiosmile, a supplement made with natural plant sterols, in the U.S. The liquid form contains water-dispersible phytosterols that help with cholesterol management and daily heart health. Similarly, in March 2023, Life Extension launched new omega-3 fish oil-based gummy bites. These are sugar-free, tropical fruit-flavored chews that pack powerful omega-3 acids, offering a high centering of DHA and EPA fatty acids in each serving. Some prominent players in the global cardiovascular health supplements market include:

-

NOW Health Group, Inc.

-

Bright Lifecare Pvt Ltd (Truebasics.com)

-

Natural Organics, Inc.

-

DaVinci Laboratories of Vermont

-

Nordic Naturals

-

Thorne HealthTech, Inc.

-

Nestle (Pure Encapsulations, LLC.)

-

Amway

-

InVite Health

-

GNC Holdings, LLC

Cardiovascular Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.74 billion

Revenue forecast in 2030

USD 21.54 billion

Growth rate

CAGR of 9.06% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, ingredient, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

NOW Health Group, Inc.; Bright, Lifecare Pvt Ltd (Truebasics.com); Natural Organics, Inc.; DaVinci Laboratories of Vermont; Nordic Naturals; Thorne HealthTech, Inc.; Nestle (Pure Encapsulations, LLC); Amway; InVite Health; GNC Holdings, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiovascular Health Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global cardiovascular health supplementsmarket based on type, ingredient, form, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Supplements

-

Synthetic Supplements

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins & Minerals

-

Herbs & Botanicals

-

Omega Fatty Acids

-

Coenzyme Q10 (CoQ10)

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Tablet

-

Capsules

-

Softgels

-

Powder

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

RegionalOutlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular health supplements market size was estimated at USD 10.88 billion in 2022 and is expected to reach USD 11.74 billion in 2023.

b. The global cardiovascular health supplements market is expected to grow at a compound annual growth rate of 9.06% from 2023 to 2030 to reach USD 21.54 billion by 2030.

b. Asia Pacific dominated the cardiovascular health supplements market with a share of 38.40% in 2022. This is attributable to rising healthcare awareness and increasing prevalence of cardiovascular diseases in the region.

b. Some key players operating in the cardiovascular health supplements market include NOW Health Group, Inc., Bright, Lifecare Pvt Ltd (Truebasics.com), Natural Organics, Inc., DaVinci Laboratories of Vermont, Nordic Naturals, Thorne HealthTech, Inc., Nestle (Pure Encapsulations, LLC.), Amway, InVite Health, GNC Holdings, LLC.

b. Factors such as the rising awareness about healthcare, growing population suffering from cholesterol, obesity, and others diseases, and poor dietary habits are driving the demand for cardiovascular supplements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."