- Home

- »

- Communications Infrastructure

- »

-

Carrier Aggregation Solutions Market Size Report, 2030GVR Report cover

![Carrier Aggregation Solutions Market Size, Share & Trends Report]()

Carrier Aggregation Solutions Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment, By Frequency Band, By Cell Type, By Spectrum Band, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-039-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carrier Aggregation Solutions Market Summary

The global carrier aggregation solutions market size was estimated at USD 3,186 million in 2022 and is projected to reach USD 15,213 million by 2030, growing at a CAGR of 21.8% from 2023 to 2030. Rising global mobile traffic, the need for faster data speed, and increased focus on research and development activities by government and private research organizations are some of the factors expected to fuel the growth of the market during the forecast period.

Key Market Trends & Insights

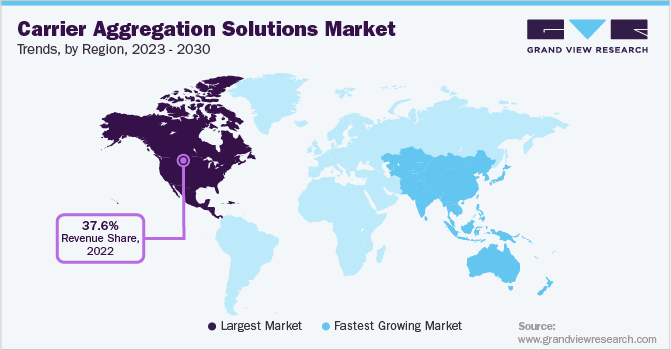

- The North America led the overall market in 2022, with a revenue share of 37.6%.

- Based on frequency band, the mid-band segment held the largest revenue share of 51.6% in 2022.

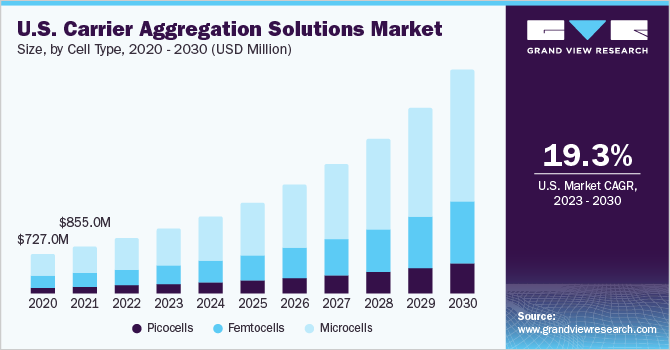

- Based on cell type, the microcells segment held the largest revenue share of 55.7% in 2022.

- Based on spectrum band, the licensed spectrum segment held the largest revenue share of 61.9% in 2022.

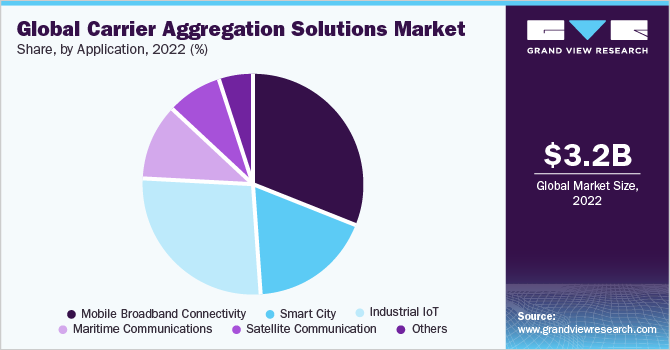

- Based on application, the mobile broadband connectivity segment dominated the overall market with a revenue share of 30.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 3,186 Million

- 2030 Projected Market Size: USD 15,213 Million

- CAGR (2023-2030): 21.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Carrier aggregation solutions enable mobile network operators (MNOs) to combine two or more data carriers with the same or different frequency bands within a single channel to transfer data between base stations and a mobile device. Carrier aggregation solutions enhance data capacity, spectrum efficiency, and backward compatibility. These solutions have also increased cell coverage by aggregating numerous frequency bands for higher rates.

Carrier aggregation solutions enable mobile network operators (MNOs) to combine two or more data carriers with the same or different frequency bands within a single channel to transfer data between base stations and a mobile device. Carrier aggregation solutions enhance data capacity, spectrum efficiency, and backward compatibility. These solutions have also increased cell coverage by aggregating numerous frequency bands for higher rates.

It also allows MNOs to pool their spectrum resources together within the same/different band to achieve higher capacity and peak rates. The industry is expanding at a tremendous growth rate owing to technological innovations, coupled with users’ inclination toward faster data speed.

Carrier aggregation solutions are software functionality in the user device and radio access network (RAN). They allow MNOs to combine the capabilities of radio cells to enhance network efficiency and user experience. Mobile network operators are introducing carrier aggregation 5G standalone with an extremely efficient 5G air interface and 5G core, eliminating the dependency on existing long-term evolution (LTE) networks to provide reliable, efficient, and ultra-low latency capabilities of 5G.

The ongoing rollout of commercial 5G networks has considerably improved the experience of mobile subscribers globally. Moreover, the increasing number of advanced 5G standalone networks delivering ultra-low latency and boosting the performance of homogenous and heterogenous networks has remarkably marked the evolution of wireless infrastructure.

The industry has significantly evolved across the U.S. and Asian countries owing to the accessibility of emerging 5G services, the rollout of commercial 5G deployment networks, technological breakthroughs, and carrier aggregation solutions. The carrier aggregation solutions market is consolidated, with a large number of players dominating and capturing a significant share of the overall market. These companies have invested an enormous amount, as the industry is anticipated to grow exponentially in the near future.

COVID-19 Impact

The outbreak of the COVID-19 pandemic positively affected the networks and digital infrastructure. The emerging concept of online connectivity and remote access by working professionals and for education increased the demand for large data capacity to maintain network resilience, raising the demand for carrier aggregation solutions. The need for high-speed internet spurred during the pandemic, and the pandemic led to a prompt shift of network traffic within the business & residential areas.

Additionally, the growing deployment of 5G network services in developing economies and existing LTE data services are boosting the high-speed network capacity requirements. Furthermore, the rising emphasis on the deployment of 5G worldwide is booming the request for carrier aggregation solutions, propelling the market in the forecast period.

However, network interoperability issues disable smooth end-to-end connectivity and interworking functioning of data services within multi-carrier interconnections. It increases the operation costs and complexity and decreases data speed associated with the management of the configuration of interfaces. The network interoperability within data services is capable of gradually shifting the telecommunication network, reducing the bandwidth bottlenecks in coming years, which is presently restraining the growth of the carrier aggregation solutions market.

For instance, in August 2020, Telefonaktiebolaget LM Ericsson and Qualcomm Technologies, Inc. announced the completion of network interoperability tests for TDD and FDD bands. The network interoperability tests enabled the original equipment manufacturers (OEMs) and mobile network operators (MNOs) to implement 5G carrier aggregation with enhanced coverage, capacity, and performance.

Deployment Insights

The 4G/LTE segment dominated the overall market with a revenue share of 56.2% in 2022 and is expected to witness a CAGR of over 21.0% during the forecast period. The growth of this segment is attributed to the widespread adoption of long-term evolution (LTE) services globally by end-users for commercial and residential purposes. Carrier aggregation solutions for 4G/LTE enable achieving high rates by combining two or more carriers of the same or different frequency bands. Carrier aggregation solutions increase the capacity of the link to be implemented to enable efficient operations.

LTE aggregated carriers are categorized into primary and secondary component carriers. The primary component carrier is the main carrier within different terminals, utilizing different carriers in the downlink and uplink components. The secondary component carrier is an auxiliary carrier comprising one or more secondary carriers boosting data rates.

Additionally, carrier aggregation solutions also enable LTE radio spectrum supported by TDD and FDD variants to meet high data throughput to utilize large bands equally and effectively. Carrier aggregation solutions for LTE can be aggregated in two ways: intra-band and inter-band, utilizing fragmentation of single or multiple bands.

The 5G segment is anticipated to witness the fastest CAGR of 22.3% throughout the forecast period. 5G is further divided into low, mid, and high bands. The low band spectrum consists of a band below 7GHz range on frequency division duplex (FDD) with a limited capacity, and it provides a wide coverage area as it has a lower frequency.

The mid-band accounts below 7GHz range on time division duplex (TDD) and 1.8-2.6 GHz on FDD, offering enhanced throughput and capacity & capacity layer for legacy networks, respectively. The high band comprises a frequency range above 24GHz. It is also called millimeter wave (mmWave), delivering low latency and the highest peak rates, especially for indoor use cases.

Carrier aggregation for 5G deployment increases network capacity and wide coverage extension and enables high-performing & low-latency coordination interfaces for higher peak rates. The growing adoption of 5G technology, owing to the extremely low latency and higher data speeds, enhances the user experience for use cases such as augmented reality (AR), virtual reality (VR), and ultra-high definition (UHD), among others.

Additionally, the demand for high-speed data connectivity for the Internet of Things (IoT) applications, such as smart home energy management, is estimated to propel the adoption of these services over the forecast period. Moreover, the deployment of 5G by developing countries is proliferating the adoption of 5G solutions, propelling the growth of carrier aggregation solutions.

Frequency Band Insights

The mid-band segment held the largest revenue share of 51.6% in 2022 and is expected to witness a CAGR of over 22.0% during the forecast period. Mid-band frequencies, typically ranging from 1 GHz to 6 GHz, have become increasingly important in the Carrier Aggregation Solutions market due to their unique properties.

Mid-band frequencies offer a balanced mix of coverage and capacity. They are well suited for urban environments, where high data traffic density demands a larger capacity, and also for rural areas requiring broader coverage. Additionally, mid-band frequencies are less affected by weather and environmental conditions than high-frequency bands, making them more reliable for providing consistent and high-quality connectivity.

In recent years, the demand for high-speed mobile broadband services has increased, and the deployment of 5G networks has accelerated the need for mid-band frequencies. Therefore, mid-band frequency bands have become a valuable asset for operators in their efforts to provide seamless connectivity and deliver a superior user experience. As a result, the Carrier Aggregation Solutions market has seen significant growth, with various vendors offering solutions that can support mid-band frequency bands.

The high-band segment is anticipated to witness the fastest CAGR of 23.8% throughout the forecast period. High-band frequencies, typically ranging from 24 GHz to 100 GHz, are gaining increasing importance in the Carrier Aggregation Solutions market due to their ability to provide ultra-high-speed data rates and low-latency communication.

The high-band frequencies are particularly attractive for high-capacity applications such as mobile broadband, ultra-high-definition video streaming, virtual reality, and augmented reality. With the increasing demand for data-intensive applications, high-band frequencies provide a solution to meet the growing needs for data rates.

Moreover, high-band frequencies offer more bandwidth than lower-frequency bands, making them suitable for large-scale deployments of IoT devices and next-generation applications requiring a significant amount of data to be transferred in real-time. For example, autonomous vehicles will rely on high-band frequencies to transmit and receive real-time information with low latency.

Cell Type Insights

The microcells segment held the largest revenue share of 55.7% in 2022 and is projected to expand at the fastest CAGR during the forecast period. Microcells provide seamless connectivity to consumers, especially in public areas, up to 1 km of distance. Microcells are installed in densely populated areas/cities to enable uninterrupted higher data rates.

With the advent of public 5G network deployment, the aggregation of data carrier solutions has fueled the carrier aggregation solutions market. These solutions enhance coverage in smaller and dense areas, such as train stations and city blocks, to dispense higher network capacity. The rapid adoption of 5G network services for smart cities and the rise in the number of connected devices is fueling the growth of carrier aggregation solutions.

The picocells segment gained a market share of 15.7% in 2022. Picocells play a crucial role by providing high-speed internet capacity encompassing a significant fraction of the population in places such as concerts, stadiums, and festivals, among others. They are cellular base stations extending wireless services (data and voice connectivity) within in-building coverage areas. These cells are usually managed by cellular carriers that connect internet-enabled devices to LTE/5G, maximizing the capacity of the mobile communications network.

Moreover, telecom service providers are still facing unstable data services across rural areas due to line-of-sight problems. By aggregating data carriers, MNOs can create multiple channels to enable uninterrupted data services in rural areas.

Picocells for LTE & 5G network aggregation enable the installation of cells with a coverage area at lower installation costs. Picocells are best suited for outdoor connection, as they typically offer a range between 100 to 300 meters. The growing adoption of carrier-aggregated 5G services by enterprises to meet higher connectivity requirements is propelling the carrier aggregation solutions market.

Spectrum Band Insights

The licensed spectrum segment held the largest revenue share of 61.9% in 2022 and is anticipated to register the fastest CAGR during the forecast period. The licensed spectrum for the private 5G network delivers enhanced security and safety of customers’ data during the transmission and reception of information from one location to another.

Also, it provides a dedicated frequency band, which would always be available for the client. Therefore, it provides agility and continuity in the overall operations. With the rising penetration of LTE/5G services provided by prominent telecom & mobile network operators, the market for carrier aggregation solutions is anticipated to expand over the forecast period.

Application Insights

The mobile broadband connectivity segment dominated the overall market with a revenue share of 30.9% in 2022 and is expected to witness a CAGR of over 17.0% during the forecast period. The growth is attributed to the shifting patterns of mobile data traffic, mostly observed in populated/urban areas. The rising number of mobile subscribers, mobile networks providing higher data speeds, increasing penetration of internet subscribers, and rapid deployment of 5G networks in developing countries have led to a spike in data traffic.

The growth of mobile data traffic is expected to be volatile in the forecast period, owing to the growth in data consumption, improved device capabilities, performance of deployed networks, and increased data-intensive content. According to Ericsson, the global mobile data traffic reached 67 ExaByte (EB)/month in 2021 and is anticipated to reach 282 EB/month by 2027.

The growth of mobile data traffic is attributed to the adoption of Extended Reality (XR) services, such as mixed reality (MR), AR, VR, and gaming. However, carrier aggregation solutions create wider channels for data transmission and allow mobile networks to use underutilized spectrums. MNOs are focusing on providing higher data traffic volumes, higher data peak rates, and capacities to lower mobile data traffic by aggregating data carriers to enhance user experience.

The smart city segment is anticipated to witness the fastest CAGR of 25.4% throughout the forecast period. The number of connected devices is increasing significantly owing to the advent of smart city projects and advanced technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT).

Smart city-enabled services, such as smart lighting, connected transport, ultra-specific location technology, air quality monitoring, and city analytics & sustainability, are proliferating carrier aggregation solutions. The rising need for uninterrupted and improved communication technology to enable efficient data transfer and better mobile communications connectivity is fueling the growth of the market.

Regional Insights

North America led the overall market in 2022, with a revenue share of 37.6%. The growth is attributed to the increasing penetration of smartphone subscribers, the growing proliferation of high-speed data services, and the increased investments by MNOs in the region. The key factor driving network slicing in North America is the presence of significant players such as Cisco System Inc., Qualcomm Technologies Inc., and Qorvo, Inc., among others, which has fueled growth.

A number of companies operating in this region are developing innovative carrier aggregation solutions to provide increased cell coverage and unique capabilities, such as reliable and efficient frequency bands, contributing to the growth of the carrier aggregation solutions market. For instance, Qualcomm Technologies, Inc. announced a strategic partnership with Telstra and Telefonaktiebolaget LM Ericsson. The partnership aimed to achieve the highest uplink peak speed of 1Gbps on a commercial network, offering a seamless experience in social media content sharing and live video streaming.

Moreover, factors such as promoting the deployment of commercial 5G by a number of companies, increased investment, and early adoption of advanced technologies owing to high digital end-user engagement, are contributing to the growth of the carrier aggregation solutions market. Furthermore, the rapid development of smart cities and the considerable adoption of the Internet of Things (IoT) in North America are expected to provide numerous opportunities for the market in the forecast period.

Asia Pacific is expected to develop substantially during the projection period, at a CAGR of 24.7%. China, India, and Japan have an extensive customer base, driving the demand and creating new opportunities for carrier aggregation solutions. The growth of the market is prominently due to the widespread adoption of LTE, the growing focus on 5G deployment, and the growing adoption of carrier aggregation solutions by several end-users, such as healthcare, government, manufacturing, and financial services.

For instance, in March 2022, ZTE Corporation announced a strategic partnership with Qualcomm Technologies, Inc. and ADVANCED INFO SERVICE PLC. to showcase the first 5G New Radio (NR) Dual Connectivity (DC) for 26GHz and 2.6 GHz. The partnership enabled the companies to achieve a peak uplink speed of 2.17 Gbps and a peak downlink speed of 8.5 Gbps with an individual mobile device.

Furthermore, the region's untapped potential is generating new investment opportunities for mobile network operators in the region. Moreover, a number of companies are expanding their presence across the APAC region, resulting in a broad customer base and internet subscribers, which provides lucrative opportunities for the market.

Key Companies & Market Share Insights

The market is consolidated and is anticipated to witness increased competition due to the presence of several players. Major players are spending heavily on research and development activities to integrate advanced technologies within carrier aggregation solutions, which has intensified the competition. Market aggregation strategies adopted by prominent players are increasing the competition. The key players are focusing on offering an extensive portfolio of carrier aggregation solutions for 4G/LTE and 5G. These companies are also engaging in partnerships, product launches, and collaboration with local & regional players to gain a competitive edge over their peers and capture a significant market share. Some prominent players in the global carrier aggregation solutions market include:

-

Anritsu

-

Artiza Networks, Inc.

-

Cisco Systems Inc.

-

Huawei Technologies

-

Nokia Corporation

-

Qualcomm Technologies, Inc.

-

Rohde and Schwarz GmbH and Co. KG

-

Sprint.com

-

Telefonaktiebolaget LM Ericsson

-

ZTE Corporation

-

Broadcom Inc.

-

Verizon Communications Inc.

-

Qorvo Inc.

Carrier Aggregation Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,826 million

Revenue forecast in 2030

USD 15,213 million

Growth rate

CAGR of 21.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 – 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, frequency band, cell type, spectrum band, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; China; India; Japan; South Korea; Brazil; Mexico

Key companies profiled

Anritsu; Artiza Networks, Inc.; Cisco Systems Inc.; Huawei Technologies; Nokia Corporation; Qualcomm Technologies, Inc.; Rohde and Schwarz GmbH and Co. KG; Sprint.com; Telefonaktiebolaget LM Ericsson; ZTE Corporation; Broadcom Inc.; Verizon Communications Inc.; Qorvo Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carrier Aggregation Solutions Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and offers an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global carrier aggregation solutions market report based on deployment, frequency band, cell type, spectrum band, application, and region:

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

4G/LTE

-

5G

-

-

Frequency Band Outlook (Revenue, USD Million, 2017 - 2030)

-

Low-band

-

Mid-band

-

High-band

-

-

Cell Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Picocells

-

Microcells

-

Femtocells

-

-

Spectrum Band Outlook (Revenue, USD Million, 2017 - 2030)

-

Licensed

-

Non-licensed

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Mobile Broadband Connectivity

-

Smart City

-

Industrial IoT

-

Maritime Communications

-

Satellite Communication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global carrier aggregation solutions market size was estimated at USD 3,186 million in 2022 and is expected to reach USD 3,826 million in 2023.

b. The global carrier aggregation solutions market is expected to grow at a compound annual growth rate of 21.8% from 2023 to 2030 to reach USD 15,213 million by 2030.

b. The 4G/LTE segment dominated the overall market, gaining a market share of 56.2% in 2022 and witnessing a CAGR of 21.4% during the forecast period. The growth of this segment is attributed to the widespread adoption of long-term evolution (LTE) services globally by end-users for commercial and residential purposes.

b. The Mobile Broadband Connectivity segment dominated the overall market, gaining a market share of 30.9% in 2022 and witnessing a CAGR of 17.6% during the forecast period. The growth of this segment is attributed to the shifting patterns of mobile data traffic, mostly observed in populated/urban areas.

b. Some of the key players operating in the carrier aggregation solutions market include Artiza Networks, Inc., Cisco Systems Inc., Huawei Technologies, Nokia Corporation, Qualcomm Technologies, Inc., Rohde and Schwarz GmbH and Co. KG, Sprint.com, Telefonaktiebolaget LM Ericsson, ZTE Corporation, Broadcom Inc., Verizon Communications Inc., Qorvo Inc.

b. North America led the overall market in 2022, with a market share of 37.6%. The growth is attributed to the increasing penetration of smartphone subscribers, the growing proliferation of high-speed data services, and the increased investments by MNOs in the region. .

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.