- Home

- »

- Advanced Interior Materials

- »

-

Zeolite Market Size, Share, Industry Report, 2033GVR Report cover

![Zeolite Market Size, Share & Trends Report]()

Zeolite Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Catalyst, Adsorbent, Detergent Builder Cement, Animal Feed), By Product (Natural, Synthetic), By Region, And Segment Forecasts

- Report ID: 978-1-68038-601-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Zeolite Market Summary

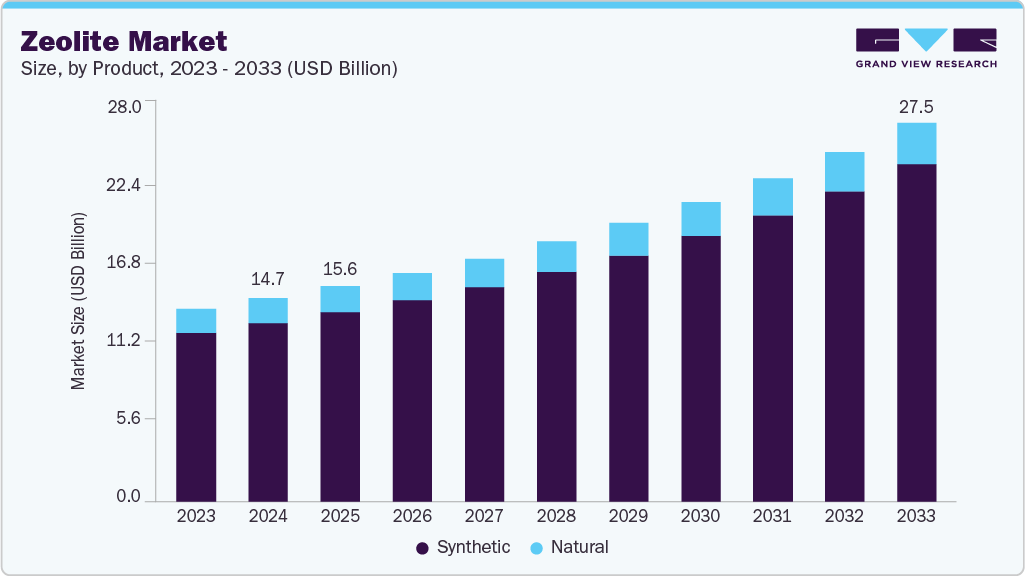

The global zeolite market size was estimated at USD 14.74 billion in 2024 and is projected to reach USD 27.53 billion by 2033, growing at a CAGR of 7.3% from 2025 to 2033. Increasing investments in expanding petrochemicals production and growth in the detergents industry are anticipated to drive market growth over the forecast period.

Key Market Trends & Insights

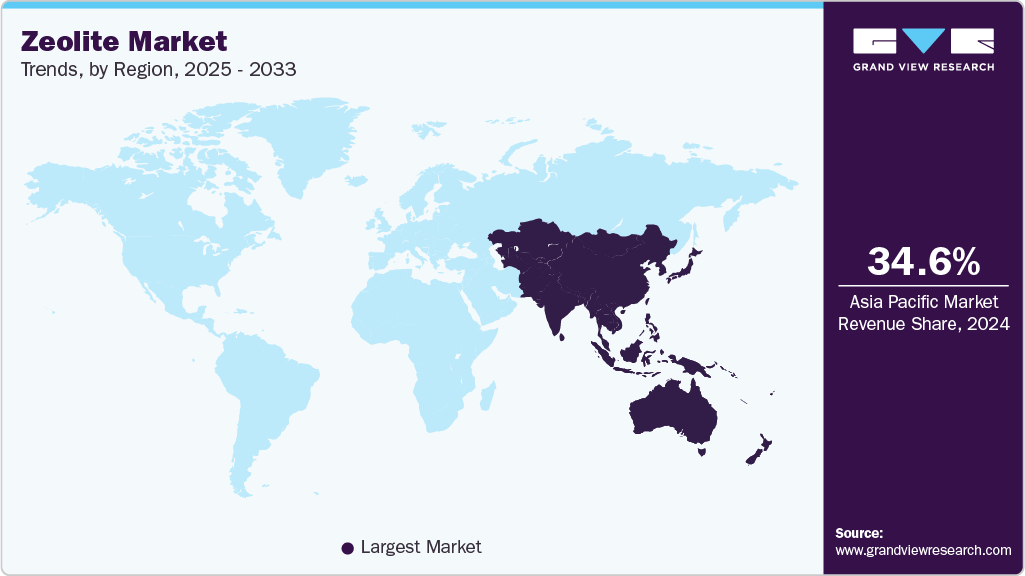

- Asia Pacific dominated the global zeolite market with a revenue share of 34.6% in 2024.

- U.S. dominated the North American zeolite market's revenue share of over 78.0% in 2024.

- By product, synthetic zeolite dominated the market with a revenue share of over 88.0% in 2024.

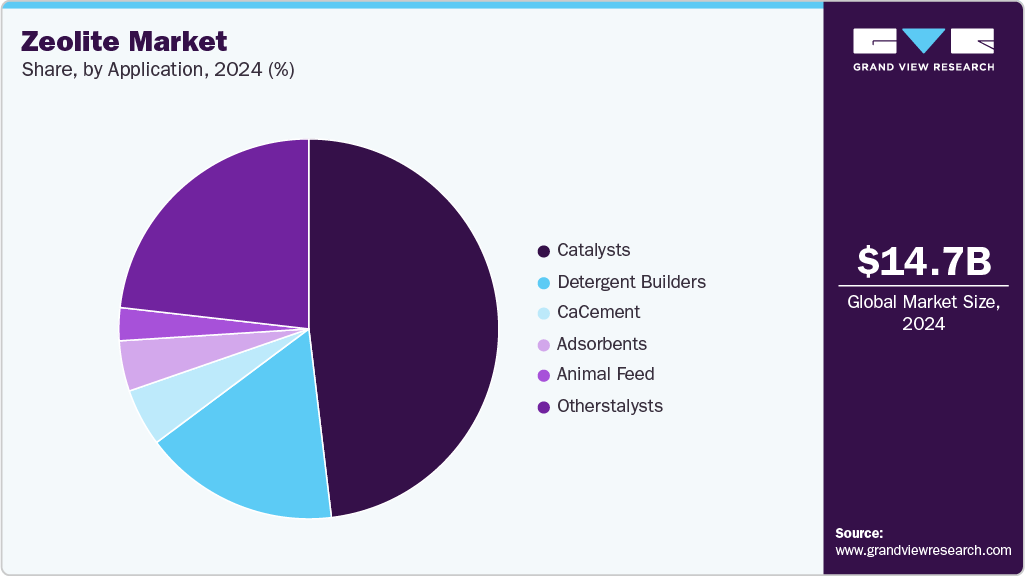

- By application, the catalyst segment held the largest share of over 48.0% of zeolite revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.74 billion

- 2033 Projected Market Size: USD 27.53 billion

- CAGR (2025-2033): 7.3%

- Asia Pacific: Largest market in 2024

Due to their stability, superior activity, and selectivity in conversion processes, zeolites are extensively used in the petrochemical industry as a catalyst for accelerating chemical reactions. Furthermore, owing to their high absorption capacity for liquid components, they are widely used in the production process of detergents. Synthetic zeolites hold the largest share of the zeolite market due to their superior performance, consistency, and versatility across multiple high-demand applications. These engineered materials are preferred for their controlled pore structures, high ion-exchange capacity, and thermal stability, making them ideal for detergents, catalysts, and adsorption systems. It has become the material of choice in phosphate-free detergents, where its environmentally friendly properties and strong water softening capabilities meet stringent regulatory and consumer demands.

The increasing complexity of refining processes and petrochemical production has also driven the adoption of synthetic zeolites in catalyst applications, where precise molecular sieving and high selectivity are critical for improving yield and process efficiency. As industries transition to cleaner and more efficient production technologies, synthetic zeolites play a key role in emission control systems, including selective catalytic reduction (SCR) units for NOx abatement in automotive and industrial exhaust streams.

Furthermore, the growing emphasis on sustainability and resource optimization in sectors like wastewater treatment, gas separation, and air purification continues to expand the use of synthetic zeolites. Their ability to remove heavy metals, volatile organic compounds (VOCs), and greenhouse gases reinforces their value in modern environmental management solutions. As industries embrace advanced material solutions for cleaner production and more intelligent infrastructure, synthetic zeolites remain at the forefront of innovation, driving long-term growth in the global zeolite industry.

Drivers, Opportunities & Restraints

A combination of environmental regulations, industrial demand, and technological advancements is driving the growth of the market. One of the primary drivers is the rising use of synthetic zeolites in the detergent industry as eco-friendly substitutes for phosphates, particularly in regions with strict environmental regulations such as Europe and North America. In parallel, the expanding petrochemical and refining sectors, especially in Asia Pacific and the Middle East, are increasing demand for zeolites as catalysts in processes like fluid catalytic cracking, hydrocracking, and isomerization.

The market presents several promising growth opportunities driven by global sustainability trends and industrial innovation. One significant opportunity lies in the increasing demand for eco-friendly and phosphate-free detergents, particularly in developed regions with stringent environmental regulations. This shift is expected to drive substantial growth in the use of synthetic zeolites. Additionally, the rising use of zeolites in catalytic converters and SCR systems to reduce harmful emissions from vehicles and industrial facilities aligns with global efforts to combat air pollution and climate change. The market also benefits from the expanding applications of zeolites in water and wastewater treatment, where their ion-exchange and adsorption capabilities support cleaner and more efficient processes.

Despite these opportunities, the market faces certain restraints that could hinder growth. One major challenge is the high production cost of synthetic zeolites, which can limit their adoption in cost-sensitive applications, particularly in developing countries. Additionally, raw material availability and price volatility can impact manufacturing stability and profitability, especially for alumina and silica. The market also faces competition from alternative materials such as activated carbon and silica gel, which are sometimes preferred in similar applications due to lower costs. In some regions, a lack of awareness and limited technological access may restrict the penetration of advanced zeolite products.

Product Insights

In 2024, synthetic zeolites continue to dominate the global market by revenue, holding a share of over 88.0%. Their widespread industrial applications—in petrochemical refining, water treatment, and detergent manufacturing are key growth drivers. Synthetic zeolites, known for their sponge-like structure and high surface area, are favored in fluid catalytic cracking and as phosphate-free detergent builders. The increasing global production of petrochemical derivatives such as plastics, solvents, and cosmetics has significantly increased demand. Furthermore, innovations like antimicrobial and environmentally safer variants of synthetic zeolites are expanding their use in emerging sectors such as healthcare and emissions control.

Natural zeolites, while trailing in revenue, lead the market in terms of volume due to their cost-effectiveness and broad application in construction and agriculture. In the construction sector, they are widely used in pozzolanic cement, lightweight aggregates, and insulating materials, benefiting from ongoing global infrastructure investment. Rising construction spending across Asia-Pacific, North America, and parts of Europe in 2025 has boosted the demand for natural zeolites in green building materials. Additionally, their use in water filtration, soil remediation, and animal feed supplements is gaining traction amid increasing environmental regulations and sustainability goals.

Application Insights

In 2024, the catalyst segment accounted for over 48.0% of the total market revenue, driven by its extensive use across various industrial applications. Zeolites are widely employed in petroleum refining, particularly in fluid catalytic cracking (FCC) processes, where they facilitate the breakdown of large hydrocarbon molecules into more valuable products like gasoline and diesel. Their high surface area and shape-selective properties significantly enhance reaction efficiency and fuel yield. In the petrochemical industry, zeolites are used as catalysts in processes such as methanol-to-olefins (MTO) and methanol-to-propylene (MTP), supporting the production of essential building blocks like ethylene and propylene.

Due to its effectiveness in removing calcium and magnesium ions from hard water, the detergent builder segment remains a central application area for synthetic zeolites, particularly Zeolite-A. In 2025, global demand for phosphate-free, eco-friendly cleaning products continues to rise, prompting companies like BASF and Honeywell to develop advanced detergent formulations incorporating zeolites. Regulatory pressure to eliminate phosphates and growing consumer preference for sustainable cleaning solutions have further accelerated the adoption of zeolite-based builders across household and industrial detergent segments.

Natural zeolites can absorb up to 50% of their weight in liquid without swelling, making them highly effective in moisture control applications. This property makes them a common additive in pet litter products and valuable in soil remediation efforts. Additionally, their ion-exchange capability is crucial in various water treatment processes, including handling radioactive waste from nuclear reactors, gas purification, petroleum refining, and industrial wastewater treatment.

Regional Insights

U.S. dominated the North American zeolite market's revenue share of over 78.0% in 2024. The region's demand is primarily driven by the growth of the petrochemical industry and increased animal feed production. Zeolites are widely used as catalysts in refining operations and as additives in livestock feed due to their ability to enhance nutrient absorption and reduce toxins. The U.S. and Mexico are among the leading animal feed producers globally, supported by expanding livestock industries and rising emphasis on sustainable agriculture. Additionally, environmental regulations favoring phosphate-free detergents and improved wastewater management continue to support zeolite consumption in the region.

U.S. Zeolite Market Trends

The United States continues to be the largest market for zeolites in North America, with strong demand supported by its expanding petrochemical industry and rising consumption in detergents, animal feed, agriculture, and water treatment sectors. A significant development occurred in January 2024, when ExxonMobil announced the commissioning of a USD 2 billion expansion at its Baytown complex in Texas. This project included upgrades to its steam cracker and fluid catalytic cracking units, which are expected to substantially increase the use of synthetic zeolites as key catalysts in processing operations. The combination of industrial investment and regulatory support for environmentally friendly products is anticipated to further drive zeolite demand across the U.S. in the coming years.

Asia Pacific Zeolite Market Trends

The Asia-Pacific region is experiencing rapid growth in zeolite demand, making it one of the fastest-expanding markets globally. This surge is fueled by widespread industrialization, infrastructure development, and the expansion of chemical manufacturing across countries like China, India, and Southeast Asia. Zeolites are increasingly used in cement production, water treatment, petrochemical processing, and eco-friendly detergents. The region’s focus on improving water recycling systems and reducing environmental pollution has further reinforced the adoption of zeolite-based solutions across multiple sectors.

Europe Zeolite Market Trends

Europe remains a key region in the zeolite market, with strong demand driven by its focus on sustainability, environmental compliance, and advanced industrial applications. The area sees widespread use of synthetic zeolites in sectors such as detergents, petrochemicals, and wastewater treatment, supported by strict environmental regulations and a shift toward phosphate-free and eco-friendly alternatives. Countries including Germany, France, and the UK actively incorporate zeolite-based solutions in green construction, clean energy, and water purification technologies. This momentum is further supported by ongoing investments in research, innovation, and circular economy initiatives aimed at reducing the environmental footprint of industrial processes.

Key Zeolite Company Insights

Some key players operating in the market include BASF SE, Honeywell International Inc., Clariant AG, and Albemarle Corporation.

-

BASF SE, established in 1865 and headquartered in Ludwigshafen, Germany, is one of the world’s leading chemical manufacturers. The company plays a prominent role in the zeolite market by producing a wide range of synthetic zeolites used in applications such as fluid catalytic cracking, emission control, and chemical processing.

-

Honeywell International Inc., founded in 1906 and based in Charlotte, North Carolina, is a diversified technology and manufacturing company. Through its UOP division, Honeywell is a key supplier of molecular sieve zeolites used in refining, petrochemical, and gas treatment applications.

-

Clariant AG, established in 1995 and headquartered in Muttenz, Switzerland, is a global specialty chemicals company with a strong focus on sustainable innovation. It offers synthetic zeolites for environmental protection, including air purification, wastewater treatment, and odor control.

-

Albemarle Corporation, founded in 1994 and headquartered in Charlotte, North Carolina, is a major producer of specialty chemicals, including catalysts and lithium compounds. In the zeolite space, Albemarle supplies synthetic zeolites used in hydro processing and FCC units, which are essential for modern refining operations.

Key Zeolite Companies:

The following are the leading companies in the zeolite market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- Arkema Group (incl. CECA)

- BASF SE

- Clariant AG

- Honeywell International Inc.

- PQ Corporation (PQ Group)

- Tosoh Corporation

- W. R. Grace & Co.

- Zeochem AG

- Zeolyst International

Recent Developments

-

On May 22, 2025, Honeywell finalized the acquisition of the catalyst division from Johnson Matthey, broadening its portfolio in refining, petrochemicals, and sustainable fuel production. This move significantly enhances Honeywell UOP's capabilities in zeolite-based catalytic technologies and strengthens its position in the global chemicals sector.

-

On February 26, 2025, Taiyo Oil Co. selected Honeywell UOP’s Ethanol-to-Jet (ETJ) technology for integration at its Okinawa refinery. The project aims to produce sustainable aviation fuel (SAF) using advanced zeolite-based catalysts, contributing to Japan’s decarbonization efforts in the transport sector.

-

On February 28, 2025, Clariant concluded the 36th German Zeolite Conference in Erlangen, where it presented its latest research on novel zeolite applications. The event highlighted innovations in adsorption, catalysis, and energy storage while promoting academic excellence through a dedicated young scientist award.

-

On June 3, 2025, Albemarle released its latest sustainability performance update, detailing progress in reducing emissions and conserving water across its global operations. The report highlighted improvements in the efficiency of its zeolite-based catalyst production and reaffirmed the company’s commitment to responsible chemical manufacturing.

Zeolite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.61 billion

Revenue forecast in 2033

USD 27.53 billion

Growth rate

CAGR of 7.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK.; Italy; Spain; Turkey; China; India; Japan; Brazil; GCC

Key companies profiled

Albemarle Corporation, Arkema Group (incl. CECA), BASF SE, Clariant AG, Honeywell International Inc., PQ Corporation (PQ Group), Tosoh Corporation, W.R. Grace & Co., Zeochem AG, Zeolyst International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

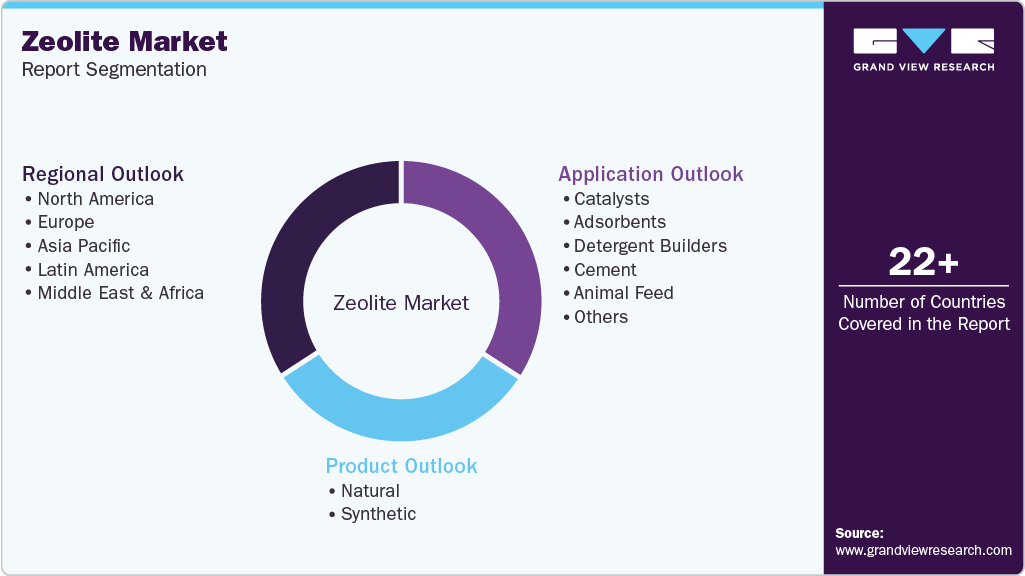

Global Zeolite Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global zeolite market report by product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion; 2021 - 2033)

-

Natural

-

Synthetic

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2021 - 2033)

-

Catalysts

-

Adsorbents

-

Detergent Builders

-

Cement

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global zeolite market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2033, reaching USD 27.53 billion by 2033.

b. By product, synthetic zeolite dominated the market with a revenue share of over 88.0% in 2024.

b. Some of the key vendors in the global zeolite market are Albemarle Corporation, Arkema Group (incl. CECA), BASF SE, Clariant AG, Honeywell International Inc., PQ Corporation (PQ Group), Tosoh Corporation, W. R. Grace & Co., Zeochem AG, Zeolyst International.

b. A combination of environmental regulations, industrial demand, and technological advancements is driving the growth of the zeolite market. One of the primary drivers is the rising use of synthetic zeolites in the detergent industry as eco-friendly substitutes for phosphates.

b. The global zeolite market size was estimated at USD 14.74 billion in 2024 and is expected to reach USD 15.61 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.