- Home

- »

- Medical Devices

- »

-

Catheter Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Catheter Market Size, Share & Trends Report]()

Catheter Market Size, Share & Trends Analysis Report By Product Type (Cardiovascular Catheters, Urology Catheters), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-115-3

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Catheter Market Size & Trends

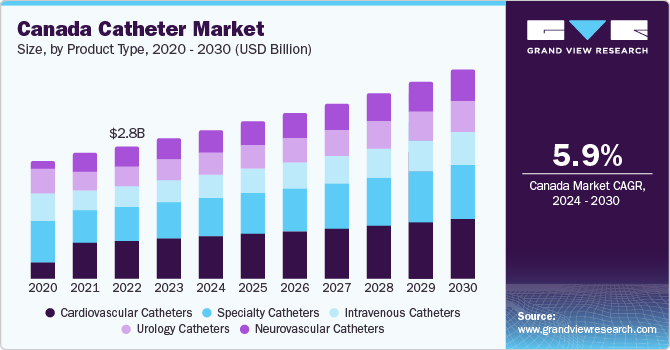

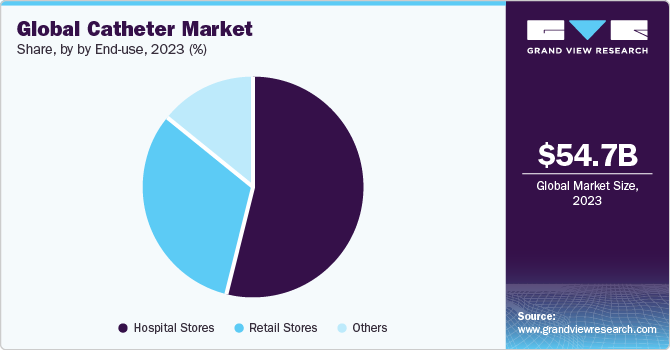

The global catheter market size was estimated at USD 54.68 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.57% from 2024 to 2030. The increasing cases of chronic disorders such as neurological, cardiovascular, and urological disorders requiring hospitalization boosts the expansion of the market. For instance, as per the reports published by the National Library of Medicine in 2023, approximately around 15% of the global population suffer from neurological disorders, which causes physical and cognitive disabilities.

According to the WHO, over 200 million individuals worldwide are affected by various urological disorders. In the U.S., urological disorders impact nearly 25 million people, with women constituting 80% of this population. With the increasing prevalence of conditions such as urinary retention, UI, benign prostatic hyperplasia, and neurogenic bladder dysfunction, there has been a growing demand for catheterization for short-term or long-term management of these ailments. Furthermore, the market is anticipated to experience growth in the forecast period due to a surge in midscale catheter manufacturers competing for a larger market share.

Major market players use advanced materials, such as polyurethanes/polycarbonates, to manufacture catheters. Carbothane, resistant to chemicals such as iodine, hydrogen peroxide, or alcohol is used to make catheters to increase their longevity. For instance, MAHURKAR Chronic Carbothane catheter, manufactured by Medtronic, is easy to insert with a single technique and ensuring top-notch resistance to kinks. This catheter provides impressive flow rates with minimal pressure on both arterial and venous systems.

Moreover, catheters made of Durathane offer resistance and strength. For example, the DuraFlow 2 chronic hemodialysis catheter, offered by AngioDynamics, is made of Durathane, which offers advantages of both silicone and polyurethane. This catheter material offers strength and is resistant to a variety of commonly used site care agents. Thus, the use of advanced materials to manufacture catheters is increasing their demand among end users.

The increasing awareness of controlling catheter-related bloodstream infections (CRBSI) among the people will contribute to a greater demand for catheters in the coming forecast period. A significant factor leading to catheter-related bloodstream infections (CRBSI) is the lack of proper care and maintenance for these devices. Healthcare professionals are preferring the use of catheters that pose minimal infection risks due to their increased awareness and emphasis on infection control. For instance, in May 2023, BD introduced a convenient prefilled flush syringe for customers. This innovative BD PosiFlush SafeScrub syringe is designed to enhance patient care by expediting the flushing and disinfection of IV catheters during clinical procedures. Ensuring the cleanliness and disinfection of catheters is crucial in preventing CRBSIs. As a result, healthcare professionals are becoming more aware of the significance outlined in infection prevention guidelines, enhancing the need for the proper flushing, and disinfecting of catheters.

Moreover, treatment of Peripheral Artery Disease (PAD) is usually followed by a minimally invasive procedure that involves the use of catheters to clear the blocked arteries. Growing preference for angioplasty over conventional surgeries has resulted in a rise in the demand for this procedure among patients. As peripheral angioplasty is a minimally invasive procedure and offers better outcomes, it has gained significant popularity over the past decade. The growing demand for minimally invasive procedures can also be attributed to the recent technological innovations, for instance, use of antimicrobial coating and miniaturized catheters to prevent the risk of restenosis. These procedures have higher adoption rates and are becoming standard techniques in general surgery due to the use of advanced technologies and innovative coated catheters available in the market. Thus, the growing preference for minimally invasive surgeries is expected to drive the growth of the catheters market during the forecast period.

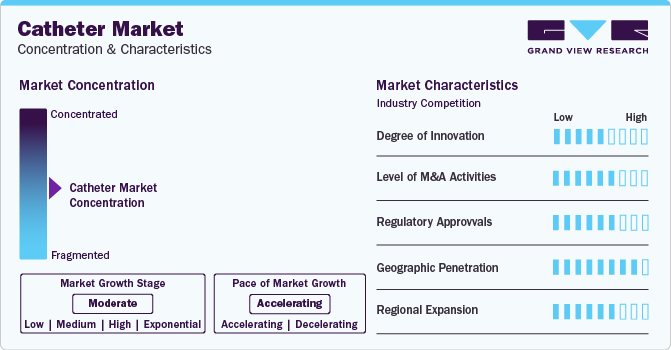

Market Concentration & Characteristics

The market growth stage is moderate, and pace of the market growth is accelerating. The catheter market is characterized by a moderate-to-high degree of growth owing to increasing investment in R&D programs, prevalence of conditions such as urinary incontinence, cardiovascular diseases, and neurovascular disorders has led to a rise in the usage of catheters. Furthermore, the growing recognition among both healthcare professionals and patients regarding the advantages of catheterization in the treatment of diverse medical conditions is contributing significantly to the expansion of the market.

Key strategies implemented by players in the market are new product launches, regulatory approval, acquisitions, partnerships, and other strategies. For instance, in January 2024, Cook Medical's Tip Hydrophilic Selective catheter, the Slip-Cath Beacon, was made available for use in both the Canada and U.S. This hydrophilic angiographiccatheter is specifically designed to cater to a broad spectrum of vascular and non-vascular procedures. It is used during angiographic procedures, working in tandem with vascular access sheaths, wire guides, and various treatment devices.

Development of bioresorbable, biocompatible, and drug-eluting materials for catheters is enabling minimally invasive procedures with improved outcomes and reduced complications influencing the market growth. Companies are investing highly in advanced technologies and effectively utilizing these technologies often gain a competitive edge, driving market growth. Such advancements and innovations in catheters drive market growth.

Mergers and acquisition activities in the market are increasing and witness similar growth during the analysis timeframe. Several companies are acquiring development-stage companies to enhance the company’s product portfolio to cater to a large patient pool. Moreover, these firms are integrating advanced facilities and form strategic alliances to achieve synergies in capabilities and resources, enhancing their competitiveness.

Stringent quality protocols and regulatory norms by several nations to ensure patient safety and data integrity, which highly impact operational capabilities in the market. For the medical device industry, regulations are crucial for ensuring the effectiveness and safety of devices. Medical device manufacturers are bound by stringent quality and safety regulations imposed by regulatory agencies like the European Medicines Agency and the U.S. FDA. For manufacturers to receive regulatory clearance for their intravenous catheters, they must comply with certain guidelines. Thus, the increasing regulatory approval enhances the product portfolio of the market key players with the novel product launch.

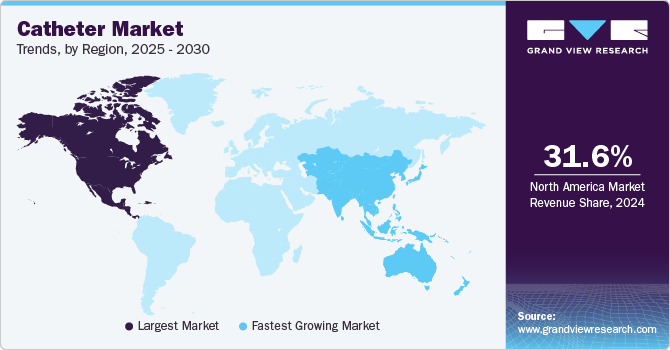

North America holds the largest market share, owing to factors such as a widespread awareness of minimally invasive procedures, and a significant aging population. Moreover, the dominance of the region is reinforced by the presence of leading catheter manufacturers in the U.S.

The market comprises a large number of medical device manufacturers specialized in catheters manufacturing leads to a highly fragmented market scenario.

The heightened recognition of healthcare concerns and the enhanced accessibility to medical services across different areas are driving a surge in the demand for medical devices, such as catheters. With the advancement of healthcare infrastructure, the availability and utilization of catheters are also on the rise in developing countries.

Product Type Insights

Cardiovascular catheter segment led the market and accounted for 27.99% of the total revenue share in 2023. Rising prevalence of cardiovascular disorders and increasing demand for interventional cardiac procedures, coupled with growing adoption of cardiac catheters, are expected to boost the growth of the market for cardiovascular catheters during the forecast period. For instance, according to data released by the American College of Cardiology in July 2023, around 200 million individuals globally, and over 12 million people in the U.S., are dealing with peripheral artery disease (PAD). The increasing demand for these catheters can be attributed to the increasing incidence of cardiac conditions such as coronary artery disease, congenital heart problems, and cardiac arrhythmia. As the occurrence of these conditions rises, there is an increased need for diagnostic and interventional procedures, with cardiovascular catheters playing a pivotal role in performing minimal invasive procedures.

Specialty catheters segment is projected to witness the highest growth rate over the forecast period owing to the increasing demand for minimally invasive procedures, coupled with rising prevalence of target diseases, Moreover, increasing regulatory approvals are likely to contribute to segment growth. For instance, in February 2022, Teleflex Incorporated received U.S. FDA approval for its specialty catheters used for crossing Chronic Total Occlusion (CTO) that occur during Percutaneous Coronary Intervention (PCI). Specialty catheters are equipped with features such as smoother surfaces, reduced friction, and materials that minimize irritation. This customization enhances patient satisfaction and compliance, particularly in cases where long-term catheterization is necessary.

End-Use Insights

Hospital stores segment dominated the market with the largest revenue share in 2023. Hospital stores are situated in the hospital premises where it stores and dispenses a wide range of catheters required for the surgical and minimal invasive procedures. Unlike regular pharmacies catering to outpatients, hospital stores prioritize the needs of patients admitted to the hospital. These cater to specific and often rare medical conditions, requiring precise storage and handling protocols.

Moreover, due to the critical nature of their function, hospital stores operate under strict regulations. These regulations govern everything from storage conditions and dispensing procedures to personnel qualifications and record-keeping practices. This stringent framework ensures patient safety and medication accuracy. Additionally, modern hospital stores leverage cutting-edge technology to streamline operations and optimize medication management. Automated dispensing systems, electronic prescribing platforms, and advanced inventory tracking software are just a few examples. These technologies minimize errors, improve efficiency, and enhance patient care. Time is often of the essence in healthcare, and hospital stores ensure immediate access to the needed catheters. This reduces delays in treatment and potentially improves patient outcomes. These factors boost the demand for catheters in the hospital stores, driving the market growth.

The retail stores segment is projected to witness the highest growth rate over the forecast period. This is attributed to the availability of various e-commerce platforms which sell catheters. These platforms offer convenient, choice-filled, and often cost-effective way to purchase the catheters. For instance, the e-commerce sites that offer warranty, discounts, and prompt customer service for catheters are Shopcatheters, Allegro Medical Supplies Inc., and Amazon. This has a positive impact on the sales of the products through these sales channels. Thus, supporting the segment growth during the forecast period.

Regional Insights

North America accounted for 31.72% of the global market in 2023 and is expected to continue its dominance over the forecast period. This can be ascribed to various factors, including the growing incidence of chronic illnesses and an aging population, as well as the favorable impact of major manufacturers like Teleflex Incorporated, Medtronic, and Boston Scientific Corporation enhancing regional growth. The market for catheters in North America has expanded due to favorable government regulations, rising public awareness, a large number of highly competent health care providers, and the presence of prominent healthcare facilities.

The demand for catheters may be positively impacted by greater patient and healthcare community understanding of the importance of early identification and treatment for chronic illnesses. The Centers for Medicare & Medicaid Services (CMS), for instance, predicted that in 2022, health spending in the U.S. will be 7.5% of GDP. It was predicted to cross $1 trillion in 2023. In addition, high disposable income in developed economies & skilled professionals are some factors responsible for the large share of the market of the country.

Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the presence of large population suffering from kidney & cardiovascular diseases, improvement in medical facilities, and availability of insurance policies. Increased surgical volume, growing government partnerships, and a developing medical device portfolio all contribute to regional growth. Additionally, an increase in government initiatives contributes to market developments in the region.

For instance, in July 2022, the Asia Pacific Society of Infection Control introduced the APSIC guide on the prevention of catheter-linked UI infections. The program focuses on offering practical recommendations provided in a brief format to help healthcare facilities in Asia Pacific maintain high standards of infection prevention & management. Its primary objective was to guide the management and care of patients with a urinary catheter. Moreover, the presence of a large patient pool and the growing need for technologically advanced & cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market.

Indian market is anticipated to grow at a CAGR of 7.7% over the forecast period. The key factors estimated to drive the Indian market are adoption of new technology in catheter manufacturing, growing disease variation and prevalence, and increasing research and development for enhancing the product portfolio.

Key Catheter Company Insights

The catheters market is experiencing several noteworthy trends that are significantly impacting the activities of top players in the industry. Technological advancements play a pivotal role, with ongoing innovations in catheter design, materials, and technologies enhancing the capabilities of these medical devices. Minimally invasive procedures, improved patient outcomes, and reduced recovery times are driving increased demand for catheters across various medical specialties.

The rising prevalence of chronic diseases, coupled with a growing aging population, is influencing market dynamics. As a result, top players in the catheters industry are expanding their product portfolios to address the diverse needs of patients requiring cardiovascular, urological, and neurovascular interventions. Companies are focusing on the development of catheters that are not only effective but also user-friendly, catering to the increasing demand for patient-centric healthcare solutions. In addition, increasing adoption of catheters in home healthcare services is another major factor driving the growth of the market. Patients are now receiving catheter-related treatments at home, prompting top players to explore new business models and service offerings to support this shift. The emphasis on home healthcare is reshaping the market landscape and challenging companies to provide solutions that meet the evolving needs of both healthcare professionals and patients.

Key Catheter Companies:

The following are the leading companies in the catheter market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these catheter companies are analyzed to map the supply network.

- Hollister Incorporated

- Medtronic

- Boston Scientific Corporation

- Edward Lifesciences

- Smith Medical Inc.

- Teleflex Incorporated

- ConvaTec Group Plc

- Cure Medical LLC

Recent Developments

-

In October 2023, B. Braun introduced the Introcan Safety 2 IV Catheter, featuring multi-access blood control, designed to ensure the protection of clinicians each time the hub is accessed

-

In October 2023, the Orchid SRV safety released valves was approved by the U.S. FDA, according to Linear Health Sciences. The purpose of the catheter, which had been authorized to be employed with all IV access procedures, was to reduce the likelihood of IV catheter rupture and repair in hospitals

-

In February 2023, Teleflex Incorporated declared that the U.S. FDA had granted its Triumph Catheter's 510(k) clearance. This innovative device features clear visualization and exact wire progression. Furthermore, the business reported that the UW Medicine Heart Institute in Seattle, Washington, witnessed the first clinical use of its GuideLiner Coast Catheter

-

In December 2022, Boston Scientific declared the goal to acquire a controlling position in Acotec Scientific Holdings Limited, a Chinese medical technology business, through a strategic investment. In addition to thrombus aspiration catheters and radiofrequency ablation technologies, the company is highly renowned in China for its drug-coated balloons (DCBs). With this transaction, Boston Scientific intended to improve its position in this region

-

In February 2022, Medtronic declared that the FDA had approved the use of its Freezor Xtra Cardiac Cryoablation and Freezor and Focal Catheters for the treatment of juvenile Atrioventricular Nodal Reentrant Tachycardia (AVNRT). The catheters are single-use, flexible devices that help treat the problem by freezing cardiac tissue and obstructing any unwanted electrical signals within the heart

Catheter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 58.16 billion

Revenue forecast in 2030

USD 85.19 billion

Growth Rate

CAGR of 6.57% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report Updated

February 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hollister Incorporated; Medtronic; Boston Scientific Corporation; Edward Lifesciences; Smith Medical Inc.; Teleflex Incorporated; ConvaTec Group Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Catheter Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global catheter market report based on product type, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Catheters

-

Electrophysiology Catheters

-

PTCA Balloon Catheters

-

IVUS Catheters

-

PTA Balloon Catheters

-

-

Urology Catheters

-

Hemodialysis Catheters

-

Peritoneal Catheters

-

Foley Catheters

-

Intermittent Catheters

-

External Catheters

-

-

Intravenous Catheters

-

Peripheral Catheters

-

Midline Peripheral Catheters

-

Central Venous Catheters

-

-

Neurovascular Catheters

-

Specialty Catheters

-

Wound/Surgical Catheters

-

Oximetry Catheters

-

Thermodilution Catheters

-

IUI Catheters

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Stores

-

Retail Stores

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global catheter market size was estimated at USD 54.68 billion in 2023 and is expected to reach USD 58.16 billion in 2024.

b. The global catheter market is expected to grow at a compound annual growth rate of 6.57% from 2024 to 2030 to reach USD 85.19 billion by 2030.

b. North America dominated the catheter market with a share of 31.72% in 2023. This is attributable to the presence of multinational manufacturers and sophisticated healthcare infrastructure along with high product awareness levels.

b. Some of the key players operating in the catheter market include Hollister Incorporated, Medtronic, Boston Scientific Corporation, Edward Lifesciences, Smith Medical Inc., Teleflex Incorporated, ConvaTec Group Plc.

b. Key factors that are driving the market growth include rising demand for antimicrobial catheters, increasing prevalence of cardiovascular, neurology, and urology disorders, and growing usage of advanced materials in the catheters.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Catheter Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Ancillary Market Outlook

3.2. Increasing number of clinical trials

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.1.1. Increasing Incidence of Chronic Disorders

3.3.1.2. Increasing Awareness of Controlling Catheter-Related Bloodstream Infections (CRBSI)

3.3.1.3. Growing Use of Advanced Materials in Catheters

3.3.2. Market Restraint Analysis

3.3.2.1. Stringent Regulations for Novel Product Launch

3.3.2.2. Risk and Complications Associated with the Catheters

3.3.3. Market Opportunities Analysis

3.3.3.1. Growing Preference for Minimally Invasive Procedures

3.3.4. Market Challenge Analysis

3.3.4.1. High Cost of Products

3.4. Catheter Market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Bargaining power of suppliers

3.4.1.2. Bargaining power of buyers

3.4.1.3. Threat of substitutes

3.4.1.4. Threat of new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political & Legal Landscape

3.4.2.2. Economic and Social Landscape

3.4.2.3. Technological landscape

Chapter 4. Catheter Market: Product Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Catheter Market: Product Type Movement Analysis & Market Share, 2023 & 2030

4.3. Cardiovascular Catheters

4.3.1. Cardiovascular Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.1.1. Electrophysiology Catheters

4.3.1.1.1. Electrophysiology Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.1.2. PTCA Balloon Catheters

4.3.1.2.1. PTCA Balloon Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.1.3. IVUS Catheters

4.3.1.3.1. IVUS Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.1.4. PTA Balloon Catheters

4.3.1.4.1. PTA Balloon Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Urology Catheters

4.4.1. Urology Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.1.1. Hemodialysis Catheters

4.4.1.1.1. Hemodialysis Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.1.2. Peritoneal Catheters

4.4.1.2.1. Peritoneal Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.1.3. Foley Catheters

4.4.1.3.1. Foley Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.1.4. Intermittent Catheters

4.4.1.4.1. Intermittent Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.1.5. External Catheters

4.4.1.5.1. External Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Intravenous Catheters

4.5.1. Intravenous Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.1. Peripheral Catheters

4.5.1.1.1. Peripheral Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.2. Midline Peripheral Catheters

4.5.1.2.1. Midline Peripheral Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.1.3. Central Venous Catheters

4.5.1.3.1. Central Venous Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Neurovascular Catheters

4.6.1. Neurovascular Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Specialty Catheters

4.7.1. Specialty Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7.1.1. Wound/Surgical Catheters

4.7.1.1.1. Wound/Surgical Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7.1.2. Oximetry Catheters

4.7.1.2.1. Oximetry Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7.1.3. Thermodilution Catheters

4.7.1.3.1. Thermodilution Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7.1.4. IUI Catheters

4.7.1.4.1. IUI Catheters Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Catheter Market: End-Use Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Catheter Market: End-Use Movement Analysis & Market Share, 2023 & 2030

5.3. Hospital Stores

5.3.1. Hospital Stores Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Retail Stores

5.4.1. Retail Stores Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Others

5.5.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Catheter Market: Regional Estimates & Trend Analysis

6.1. Regional Outlook

6.2. Catheter Market: Regional Movement Analysis & Market Share, 2023 & 2030

6.3. North America

6.3.1. North America Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.2. U.S.

6.3.2.1. Key Country Dynamics

6.3.2.2. Competitive Scenario

6.3.2.3. Regulatory Scenario

6.3.2.4. Reimbursement Scenario

6.3.2.5. U.S. Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.3. Canada

6.3.3.1. Key Country Dynamics

6.3.3.2. Competitive Scenario

6.3.3.3. Regulatory Scenario

6.3.3.4. Reimbursement Scenario

6.3.3.5. Canada Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Europe

6.4.1. Europe Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.2. UK

6.4.2.1. Key Country Dynamics

6.4.2.2. Competitive Scenario

6.4.2.3. Regulatory Scenario

6.4.2.4. Reimbursement Scenario

6.4.2.5. UK Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.3. Germany

6.4.3.1. Key Country Dynamics

6.4.3.2. Competitive Scenario

6.4.3.3. Regulatory Scenario

6.4.3.4. Reimbursement Scenario

6.4.3.5. Germany Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.4. France

6.4.4.1. Key Country Dynamics

6.4.4.2. Competitive Scenario

6.4.4.3. Regulatory Scenario

6.4.4.4. Reimbursement Scenario

6.4.4.5. France Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.5. Italy

6.4.5.1. Key Country Dynamics

6.4.5.2. Competitive Scenario

6.4.5.3. Regulatory Scenario

6.4.5.4. Reimbursement Scenario

6.4.5.5. Italy Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.6. Spain

6.4.6.1. Key Country Dynamics

6.4.6.2. Competitive Scenario

6.4.6.3. Regulatory Scenario

6.4.6.4. Reimbursement Scenario

6.4.6.5. Spain Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.7. Denmark

6.4.7.1. Key Country Dynamics

6.4.7.2. Competitive Scenario

6.4.7.3. Regulatory Scenario

6.4.7.4. Reimbursement Scenario

6.4.7.5. Denmark Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.8. Sweden

6.4.8.1. Key Country Dynamics

6.4.8.2. Competitive Scenario

6.4.8.3. Regulatory Scenario

6.4.8.4. Reimbursement Scenario

6.4.8.5. Sweden Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.9. Norway

6.4.9.1. Key Country Dynamics

6.4.9.2. Competitive Scenario

6.4.9.3. Regulatory Scenario

6.4.9.4. Reimbursement Scenario

6.4.9.5. Norway Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Asia Pacific

6.5.1. Asia Pacific Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.2. Japan

6.5.2.1. Key Country Dynamics

6.5.2.2. Competitive Scenario

6.5.2.3. Regulatory Scenario

6.5.2.4. Reimbursement Scenario

6.5.2.5. Japan Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.3. China

6.5.3.1. Key Country Dynamics

6.5.3.2. Competitive Scenario

6.5.3.3. Regulatory Scenario

6.5.3.4. Reimbursement Scenario

6.5.3.5. China Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.4. India

6.5.4.1. Key Country Dynamics

6.5.4.2. Competitive Scenario

6.5.4.3. Regulatory Scenario

6.5.4.4. Reimbursement Scenario

6.5.4.5. India Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.5. South Korea

6.5.5.1. Key Country Dynamics

6.5.5.2. Competitive Scenario

6.5.5.3. Regulatory Scenario

6.5.5.4. Reimbursement Scenario

6.5.5.5. South Korea Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.6. Australia

6.5.6.1. Key Country Dynamics

6.5.6.2. Competitive Scenario

6.5.6.3. Regulatory Scenario

6.5.6.4. Reimbursement Scenario

6.5.6.5. Australia Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.7. Thailand

6.5.7.1. Key Country Dynamics

6.5.7.2. Competitive Scenario

6.5.7.3. Regulatory Scenario

6.5.7.4. Reimbursement Scenario

6.5.7.5. Thailand Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Latin America

6.6.1. Latin America Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.2. Brazil

6.6.2.1. Key Country Dynamics

6.6.2.2. Competitive Scenario

6.6.2.3. Regulatory Scenario

6.6.2.4. Reimbursement Scenario

6.6.2.5. Brazil Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.3. Mexico

6.6.3.1. Key Country Dynamics

6.6.3.2. Competitive Scenario

6.6.3.3. Regulatory Scenario

6.6.3.4. Reimbursement Scenario

6.6.3.5. Mexico Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.4. Argentina

6.6.4.1. Key Country Dynamics

6.6.4.2. Competitive Scenario

6.6.4.3. Regulatory Scenario

6.6.4.4. Reimbursement Scenario

6.6.4.5. Argentina Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Middle East & Africa

6.7.1. Middle East & Africa Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7.2. South Africa

6.7.2.1. Key Country Dynamics

6.7.2.2. Competitive Scenario

6.7.2.3. Regulatory Scenario

6.7.2.4. Reimbursement Scenario

6.7.2.5. South Africa Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7.3. Saudi Arabia

6.7.3.1. Key Country Dynamics

6.7.3.2. Competitive Scenario

6.7.3.3. Regulatory Scenario

6.7.3.4. Reimbursement Scenario

6.7.3.5. Saudi Arabia Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7.4. UAE

6.7.4.1. Key Country Dynamics

6.7.4.2. Competitive Scenario

6.7.4.3. Regulatory Scenario

6.7.4.4. Reimbursement Scenario

6.7.4.5. UAE Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7.5. Kuwait

6.7.5.1. Key Country Dynamics

6.7.5.2. Competitive Scenario

6.7.5.3. Regulatory Scenario

6.7.5.4. Reimbursement Scenario

6.7.5.5. Kuwait Catheter Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Market Participant Categorization

7.2. Key Company Profiles

7.2.1. Boston Scientific Corporation

7.2.1.1. Company Overview

7.2.1.2. Financial Performance

7.2.1.3. Service Benchmarking

7.2.1.4. Strategic Initiatives

7.2.2. Teleflex Incorporated

7.2.2.1. Company Overview

7.2.2.2. Financial Performance

7.2.2.3. Service Benchmarking

7.2.2.4. Strategic Initiatives

7.2.3. Medtronic

7.2.3.1. Company Overview

7.2.3.2. Financial Performance

7.2.3.3. Service Benchmarking

7.2.3.4. Strategic Initiatives

7.2.4. Hollister Incorporated

7.2.4.1. Company Overview

7.2.4.2. Financial Performance

7.2.4.3. Service Benchmarking

7.2.4.4. Strategic Initiatives

7.2.5. Edward Lifesciences

7.2.5.1. Company Overview

7.2.5.2. Financial Performance

7.2.5.3. Service Benchmarking

7.2.5.4. Strategic Initiatives

7.2.6. Smith Medical Inc.

7.2.6.1. Company Overview

7.2.6.2. Financial Performance

7.2.6.3. Service Benchmarking

7.2.6.4. Strategic Initiatives

7.2.7. ConvaTec Group Plc

7.2.7.1. Company Overview

7.2.7.2. Financial Performance

7.2.7.3. Service Benchmarking

7.2.7.4. Strategic Initiatives

7.2.8. Cure Medical LLC

7.2.8.1. Company Overview

7.2.8.2. Financial Performance

7.2.8.3. Service Benchmarking

7.2.8.4. Strategic Initiatives

7.3. Heat Map Analysis/ Company Market Position Analysis

7.4. Estimated Company Market Share Analysis, 2022

7.5. List of Other Key Market Players

List of Tables

Table 1. List of Secondary Sources

Table 2. List of Abbreviations

Table 3. Global Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 4. Global Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 5. Global Catheter Market, by Region, 2018 - 2030 (USD Million)

Table 6. North America Catheter Market, by Country, 2018 - 2030 (USD Million)

Table 7. North America Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 8. North America Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 9. U.S. Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 10. U.S. Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 11. Canada Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 12. Canada Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 13. Europe Catheter Market, by Country, 2018 - 2030 (USD Million)

Table 14. Europe Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 15. Europe Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 16. Germany Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 17. Germany Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 18. UK Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 19. UK Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 20. France Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 21. France Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 22. Italy Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 23. Italy Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 24. Spain Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 25. Spain Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 26. Denmark Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 27. Denmark Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 28. Sweden Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 29. Sweden Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 30. Norway Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 31. Norway Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 32. Asia Pacific Catheter Market, by Country, 2018 - 2030 (USD Million)

Table 33. Asia Pacific Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 34. Asia Pacific Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 35. China Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 36. China Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 37. Japan Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 38. Japan Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 39. India Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 40. India Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 41. South Korea Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 42. South Korea Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 43. Australia Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 44. Australia Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 45. Thailand Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 46. Thailand Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 47. Latin America Catheter Market, by Country, 2018 - 2030 (USD Million)

Table 48. Latin America Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 49. Latin America Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 50. Brazil Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 51. Brazil Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 52. Mexico Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 53. Mexico Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 54. Argentina Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 55. Argentina Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 56. Middle East & Africa Catheter Market, by Country, 2018 - 2030 (USD Million)

Table 57. Middle East & Africa Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 58. Middle East & Africa Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 59. South Africa Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 60. South Africa Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 61. Saudi Arabia Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 62. Saudi Arabia Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 63. UAE Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 64. UAE Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 65. Kuwait Catheter Market, by Product Type, 2018 - 2030 (USD Million)

Table 66. Kuwait Catheter Market, by End - Use, 2018 - 2030 (USD Million)

Table 67. Participant’s Overview

Table 68. Financial Performance

Table 69. Service Benchmarking

Table 70. Strategic Initiatives

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain - Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 Catheter Market, Market Segmentation

Fig. 7 Market Driver Analysis (Current & Future Impact)

Fig. 8 Market Restraint Analysis (Current & Future Impact)

Fig. 9 Market Opportunity Analysis (Current & Future Impact)

Fig. 10 Market Challenge Analysis (Current & Future Impact)

Fig. 11 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 12 Porter’s Five Forces Analysis

Fig. 13 Regional Marketplace: Key Takeaways

Fig. 14 Global Catheter Market, for Cardiovascular Catheters, 2018 - 2030 (USD Million)

Fig. 15 Global Catheter Market, for Electrophysiology Catheters, 2018 - 2030 (USD Million)

Fig. 16 Global Catheter Market, for PTCA Balloon Catheters, 2018 - 2030 (USD Million)

Fig. 17 Global Catheter Market, for IVUS Catheters, 2018 - 2030 (USD Million)

Fig. 18 Global Catheter Market, for PTA Balloon Catheters, 2018 - 2030 (USD Million)

Fig. 19 Global Catheter Market, for Urology Catheters, 2018 - 2030 (USD Million)

Fig. 20 Global Catheter Market, for Hemodialysis Catheters, 2018 - 2030 (USD Million)

Fig. 21 Global Catheter Market, for Peritoneal Catheters, 2018 - 2030 (USD Million)

Fig. 22 Global Catheter Market, for Foley Catheters, 2018 - 2030 (USD Million)

Fig. 23 Global Catheter Market, for Intermittent Catheters, 2018 - 2030 (USD Million)

Fig. 24 Global Catheter Market, for External Catheters, 2018 - 2030 (USD Million)

Fig. 25 Global Catheter Market, for Intravenous Catheters, 2018 - 2030 (USD Million)

Fig. 26 Global Catheter Market, for Peripheral Catheters, 2018 - 2030 (USD Million)

Fig. 27 Global Catheter Market, for Midline Peripheral Catheters, 2018 - 2030 (USD Million)

Fig. 28 Global Catheter Market, for Central Venous Catheters, 2018 - 2030 (USD Million)

Fig. 29 Global Catheter Market, for Neurovascular Catheters, 2018 - 2030 (USD Million)

Fig. 30 Global Catheter Market, for Specialty Catheters, 2018 - 2030 (USD Million)

Fig. 31 Global Catheter Market, for Wound/Surgical Catheters, 2018 - 2030 (USD Million)

Fig. 32 Global Catheter Market, for Oximetry Catheters, 2018 - 2030 (USD Million)

Fig. 33 Global Catheter Market, for Thermodilution Catheters, 2018 - 2030 (USD Million)

Fig. 34 Global Catheter Market, for IUI Catheters, 2018 - 2030 (USD Million)

Fig. 35 Global Catheter Market, for Hospital Stores, 2018 - 2030 (USD Million)

Fig. 36 Global Catheter Market, for Retail Stores, 2018 - 2030 (USD Million)

Fig. 37 Global Catheter Market, for Others, 2018 - 2030 (USD Million)

Fig. 38 Regional Outlook, 2021 & 2030

Fig. 39 North America Catheter Market, 2018 - 2030 (USD Million)

Fig. 40 U.S. Catheter Market, 2018 - 2030 (USD Million)

Fig. 41 Canada Catheter Market, 2018 - 2030 (USD Million)

Fig. 42 Europe Catheter Market, 2018 - 2030 (USD Million)

Fig. 43 Germany Catheter Market, 2018 - 2030 (USD Million)

Fig. 44 UK Catheter Market, 2018 - 2030 (USD Million)

Fig. 45 France Catheter Market, 2018 - 2030 (USD Million)

Fig. 46 Italy Catheter Market, 2018 - 2030 (USD Million)

Fig. 47 Spain Catheter Market, 2018 - 2030 (USD Million)

Fig. 48 Denmark Catheter Market, 2018 - 2030 (USD Million)

Fig. 49 Sweden Catheter Market, 2018 - 2030 (USD Million)

Fig. 50 Norway Catheter Market, 2018 - 2030 (USD Million)

Fig. 51 Asia Pacific Catheter Market, 2018 - 2030 (USD Million)

Fig. 52 Japan Catheter Market, 2018 - 2030 (USD Million)

Fig. 53 China Catheter Market, 2018 - 2030 (USD Million)

Fig. 54 India Catheter Market, 2018 - 2030 (USD Million)

Fig. 55 Australia Catheter Market, 2018 - 2030 (USD Million)

Fig. 56 South Korea Catheter Market, 2018 - 2030 (USD Million)

Fig. 57 Thailand Catheter Market, 2018 - 2030 (USD Million)

Fig. 58 Latin America Catheter Market, 2018 - 2030 (USD Million)

Fig. 59 Brazil Catheter Market, 2018 - 2030 (USD Million)

Fig. 60 Mexico Catheter Market, 2018 - 2030 (USD Million)

Fig. 61 Argentina Catheter Market, 2018 - 2030 (USD Million)

Fig. 62 Middle East and Africa Catheter Market, 2018 - 2030 (USD Million)

Fig. 63 South Africa Catheter Market, 2018 - 2030 (USD Million)

Fig. 64 Saudi Arabia Catheter Market, 2018 - 2030 (USD Million)

Fig. 65 UAE Catheter Market, 2018 - 2030 (USD Million)

Fig. 66 Kuwait Catheter Market, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Catheter Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- U.S.

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Canada

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Europe

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- UK

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Germany

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- France

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Italy

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Spain

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Denmark

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Sweden

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Norway

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Asia Pacific

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Japan

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- China

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- India

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Thailand

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- South Korea

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Australia

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Latin America

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Brazil

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Mexico

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Argentina

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Middle East & Africa

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- South Africa

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Saudi Arabia

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- UAE

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- Kuwait

- Catheter Product Type Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Catheters

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

- Urology Catheters

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

- Intravenous Catheters

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

- Catheter End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Stores

- Retail Stores

- Others

- North America

Catheter Market Dynamics

Driver: Rising Demand for the Antimicrobial Catheters

Patients who undergo elective operations under general anesthesia require catheterization. Repeated use of catheters can lead to Catheter-associated Urinary Tract Infections (CAUTIs) and Central line-associated bloodstream infections (CLABSIs). Patients suffering from chronic disorders usually have weak immune systems and require frequent hospitalization. They are at a high risk of infection due to the frequent use of catheters to access the blood vessels. Therefore, companies are increasingly focusing on introducing antimicrobial catheters to reduce the incidence of catheter-associated infections and thrombosis. Palindrome his-heparin coated & silver ion antimicrobial catheters by Medtronic are among the notable antimicrobial catheters available in the market. The heparin coating and silver ion sleeve help reduce the likelihood of clot formation and microbial colonization on the catheters’ surface. In addition, catheters are coated with silver ions or antibiotics (mupirocin or povidone-iodine), using antibiotic ointment at the exit site or antimicrobial solution. Similarly, to reduce the incidence of CLABSIs, Teleflex introduced ARROW acute hemodialysis catheters based on ARROWg+ard Antimicrobial Technology, known for its broad spectrum of antimicrobial protection.

Driver: Increasing Prevalence of Cardiovascular, Neurology, and Urology Disorders

Cardiovascular, urologic, and neurologic diseases are among the major causes of mortality and morbidity in the world over the past three decades. People with a sedentary lifestyle are more susceptible to conditions such as diabetes, Cardiovascular Disorders (CVDs), urologic disorders (including ESRD), and other chronic conditions. High blood pressure & diabetes are the two prime factors contributing to the increasing prevalence of chronic disorders, such as kidney failures. Most kidney disorders are due to conditions such as urinary infections, glomerulonephritis, polycystic kidney problems, lupus, and other malformations. ESRD is more prevalent in people aged 70 years & above. Negative lifestyle habits, such as lack of physical activity & high consumption of alcohol, coupled with rising cases of obesity due to dietary irregularities and growing number of smokers, are a few factors that can cause cardiovascular & neurovascular diseases. With the increasing prevalence of these diseases, the use of catheters is likely to grow.

Restraint: Risks and Complications Associated with Catheters

Catheters are associated with vein thrombosis, which may lead to pulmonary embolism and, in some cases, can be life-threatening. Thrombosis can lead to catheter occlusions, including a mural, venous, or intraluminal thrombosis and/or a fibrin sheath around the catheter tip. Repeated use of catheters has led to an increase in the incidence of Catheter-related Bloodstream Infection (CABSI) and associated complications & risks in patients who underwent catheter insertions. A urinary catheter is an elongated tube inserted into the bladder to drain the urine. Prolonged use of urinary catheters is one of the most common causes of CAUTIs. Malfunction of a dialysis catheter may lead to infections, kinking, and clotting. In some cases, it might also result in the admixing of blood from the catheter. Other adverse effects associated with dialysis include peritonitis, hernia, itching, weight gain, fluid drainage, and bone diseases. The onset of peritonitis is caused by microbial invasion of the peritoneal cavity through dialysis catheter.

What Does This Report Include?

This section will provide insights into the contents included in this catheter market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Catheter market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Catheter market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the catheter market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for catheter market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of catheter market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-