- Home

- »

- Biotechnology

- »

-

Cell Cryopreservation Equipment Market Size Report, 2033GVR Report cover

![Cell Cryopreservation Equipment Market Size, Share & Trends Report]()

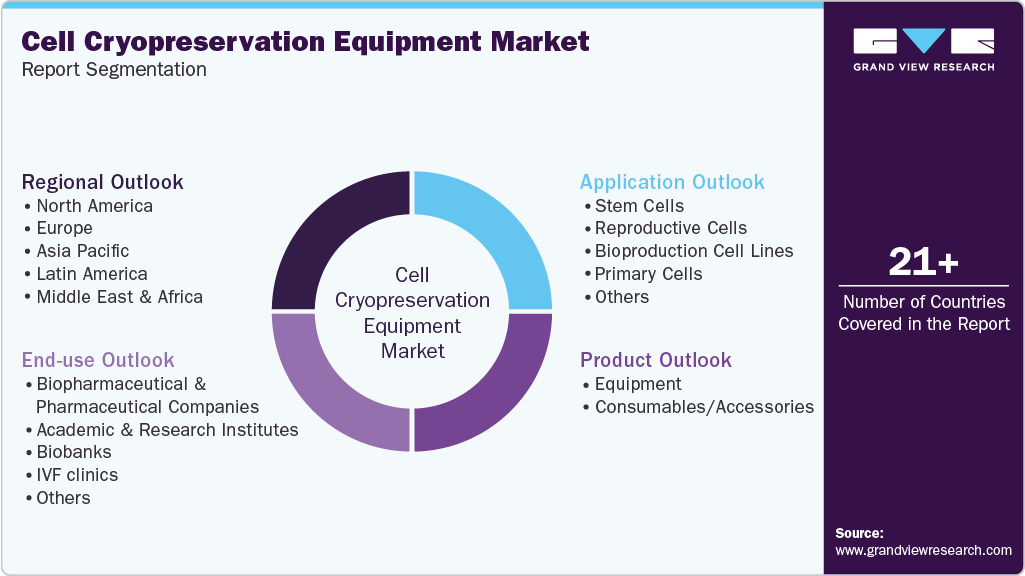

Cell Cryopreservation Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Equipment, Consumables/Accessories), By Application (Stem Cells, Reproductive Cells, Bioproduction Cell Lines), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-831-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Cryopreservation Equipment Market Summary

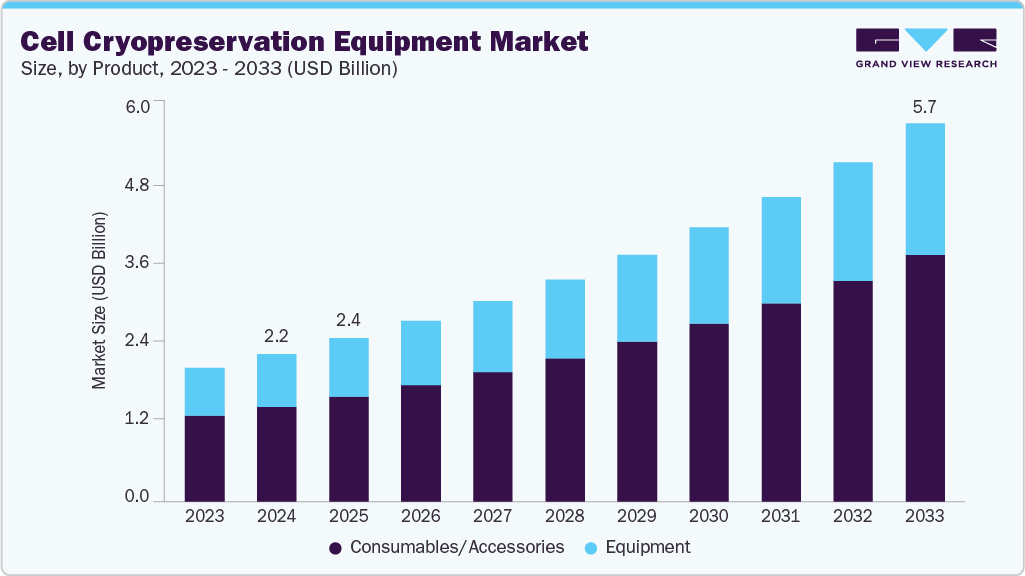

The global cell cryopreservation equipment market size was estimated at USD 2.20 billion in 2024 and is projected to reach USD 5.65 billion by 2033, growing at a CAGR of 11.08% from 2025 to 2033. The growing use of regenerative medicine, the expansion of stem cell banking and biobanking operations, and the rise in cell-based research drive the market growth.

Key Market Trends & Insights

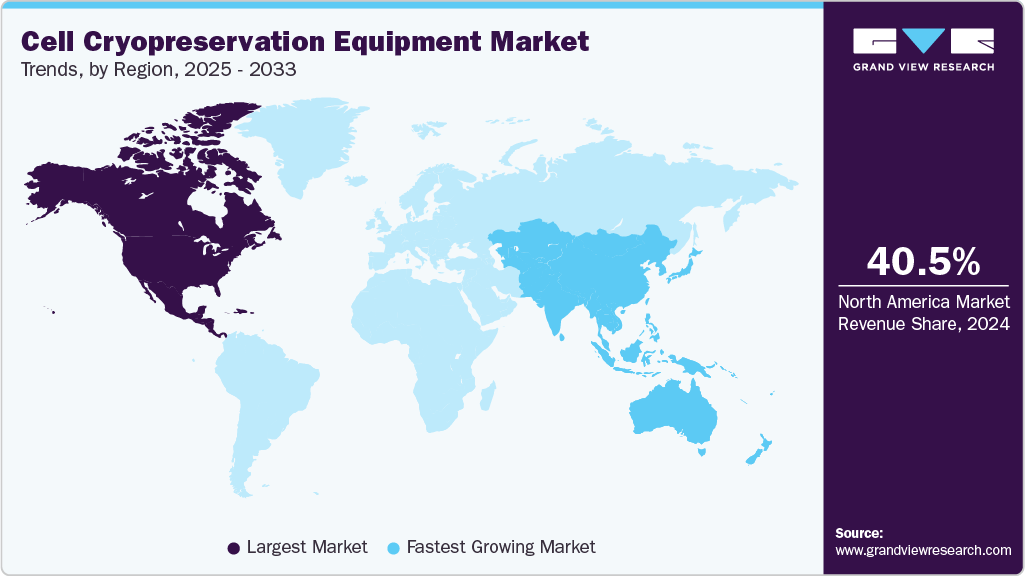

- The North America cell cryopreservation equipment market held the largest global share of 40.46% in 2024.

- The cell cryopreservation equipment industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By product, the consumables /accessories segment held the highest market share of 64.36% in 2024.

- By application, the stem cells segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.20 Billion

- 2033 Projected Market Size: USD 5.65 Billion

- CAGR (2025-2033): 11.08%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing Use of Diverse Cryoprotective Agents

The need for accurate and dependable cryopreservation procedures is highlighted by the growing use of different cryoprotective agents, such as DMSO, Cell Banker series, trehalose, glycerol, and propylene glycol, across a variety of biological specimens, including stem cells, embryos, oocytes, hepatocytes, red blood cells, spermatozoa, and dental/soft tissues. The need for sophisticated cryopreservation equipment with precise temperature control, automation, and compatibility with various preservation media continues to grow as labs and biobanks handle increasingly sensitive and diverse samples that require freezing and vitrification conditions.

Commonly used cryoprotective agents and their uses

Cryoprotective agent

Applied in cryopreservation

Cell Banker series

Adipose tissue-derived stem cells; Amniotic fluid; Bone marrow; Mammalian cells; Synovium

Dimethyl sulfoxide (DMSO)

Adipocyte tissue; Amniotic fluid and umbilical cord; Bone marrow; Dental pulp; Embryo (combined with EG or propylene glycol); Embryonic stem cells (alone or with EG); Hepatocytes; Microorganisms; Oocyte (combined with EG); Platelets; Teeth; Testicular cell/tissue

Ethylene glycol (EG)

Amniotic fluid; Dental pulp

Glycerol

Amniotic fluid; Microorganisms; Red blood cells; Spermatozoa; Teeth

Trehalose

Adipose-derived stem cells (with vitrification); Embryo (with vitrification); Ovarian tissue (with vitrification); Red blood cells; Spermatozoa; Stem cells (with propylene glycol)

Propylene glycol (1,2-propanediol)

Embryo; Hepatocytes

Source: Integrative Medicine Research, Secondary Research, Grand View Research

The need for long-term, high-viability storage of patient-specific biological samples is also being increased by the growing trend toward personalized and cell-based therapies, which is encouraging investment in cryopreservation infrastructure. To ensure consistent cell survival and adherence to evolving standards, end users are increasingly implementing next-generation cryopreservation equipment with enhanced monitoring, automation, and data-logging capabilities, as regulatory bodies emphasize the importance of quality assurance, sample traceability, and standardized preservation protocols.

Rising use of cell-based therapies & regenerative medicine

The accelerating adoption of stem cell therapy, cell-based treatments, and regenerative medicine is a major driver of demand for cell cryopreservation equipment. Since therapeutic cells must remain viable and genetically stable throughout extraction, transport, processing, and clinical administration, cryopreservation is essential for long-term storage without compromising cell integrity. As the pipeline of cellular therapeutics expands, cryopreservation has become a critical step in therapy development, quality control, and delivery.

Growing numbers of clinical trials and commercial-stage cell therapies are prompting research institutions, biobanks, CDMOs, and pharmaceutical companies to scale their cryopreservation capacity. Controlled-rate freezers, ultra-low-temperature systems, smart inventory solutions, and liquid nitrogen-based platforms are therefore central to industrial bioprocessing and global distribution of advanced cell therapies.

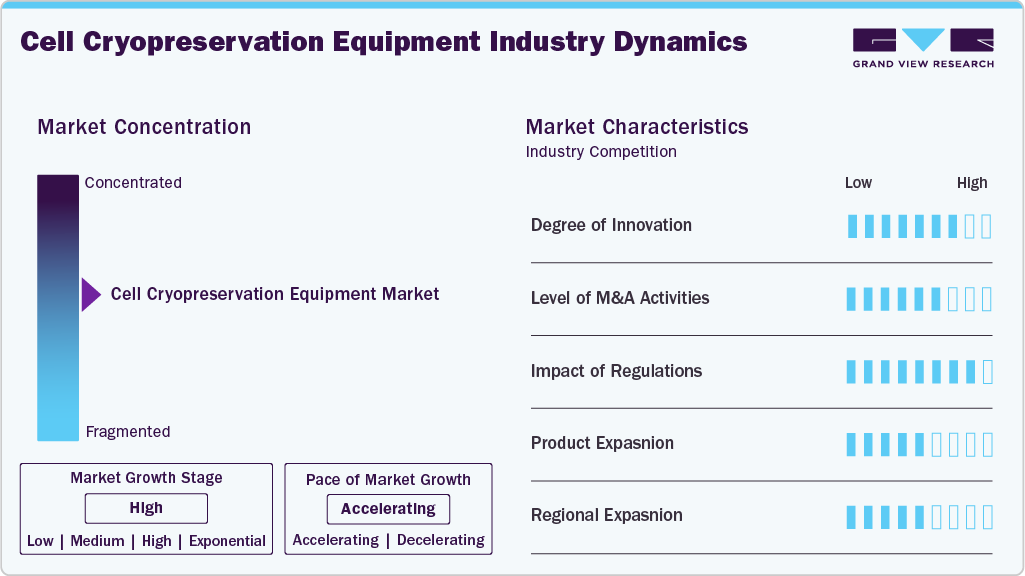

Market Concentration & Characteristics

The cell cryopreservation equipment industry is rapidly evolving with the introduction of automated freezers, ultra-low-temperature storage, and smart IoT monitoring. Novel cryoprotectants and advanced systems improve cell viability, reproducibility, and scalability for clinical and commercial therapies. For instance, in September 2024, CPC launched the MicroCNX ULT aseptic micro-connector for CGT freeze cassettes, strengthening sterile cryogenic workflows and supporting the increasing demand for advanced cryopreservation equipment in the commercialization of therapy.

The cell cryopreservation equipment market has experienced moderate to high M&A activity as businesses seek to increase capacity, acquire cutting-edge cryoprotectant technologies, and strengthen their positions in the expanding cell and gene therapy market. The trend toward combining cutting-edge cryopreservation technologies with innovative solutions to meet the growing demand for scalable, high-performance therapeutic cell storage and transportation is reflected in strategic acquisitions.

Regulatory frameworks significantly impact the market because strict rules ensure the quality, safety, and traceability of biological materials stored. Standards for equipment performance, storage conditions, and handling procedures are established by organizations such as the FDA, EMA, and ISO, particularly for clinical and therapeutic applications.

The cell cryopreservation equipment manufacturers are expanding their product portfolios with ultra-low temperature freezers, automated storage systems, portable cryogenic solutions, and integrated monitoring technologies to meet the growing needs of research labs, biopharma, fertility clinics, and biobanks for reliable and scalable cryopreservation.

Companies operating in the cell cryopreservation equipment market are expanding into emerging regions, such as the Asia-Pacific, Latin America, and the Middle East, to establish distribution networks, local services, and partnerships. This enables them to meet the rising demand and capitalize on the growth of cell-based therapies and biobanking.

Product Insights

The consumables/accessories segment dominated the cell cryopreservation equipment market with a share of 64.29% in 2024 and is expected to grow at the fastest CAGR throughout the forecast period, driven by increasing demand for high-quality, reliable products, frequent replacement cycles, growing adoption across end use industries, rising awareness about product efficiency, and advancements in material application, enhancing durability and performance.

The equipment segment is expected to register a significant CAGR over the forecast period. This growth can be attributed to the rising investments in advanced technologies, increasing automation, growing demand for high-performance machinery, and expanding industrial applications across emerging and developed markets.

Application Insights

The stem cells segment dominated the cell cryopreservation equipment industry, with a share of 31.01% in 2024, driven by increasing research and clinical applications, growing adoption in regenerative medicine, rising awareness of therapeutic potential, and supportive government initiatives and funding for advanced cell-based therapies.

The reproductive cells segment is expected to register the fastest CAGR over the forecast period, driven by growing demand for fertility treatments, increasing awareness of reproductive health, advancements in assisted reproductive technologies, and rising investments in research and clinical applications.

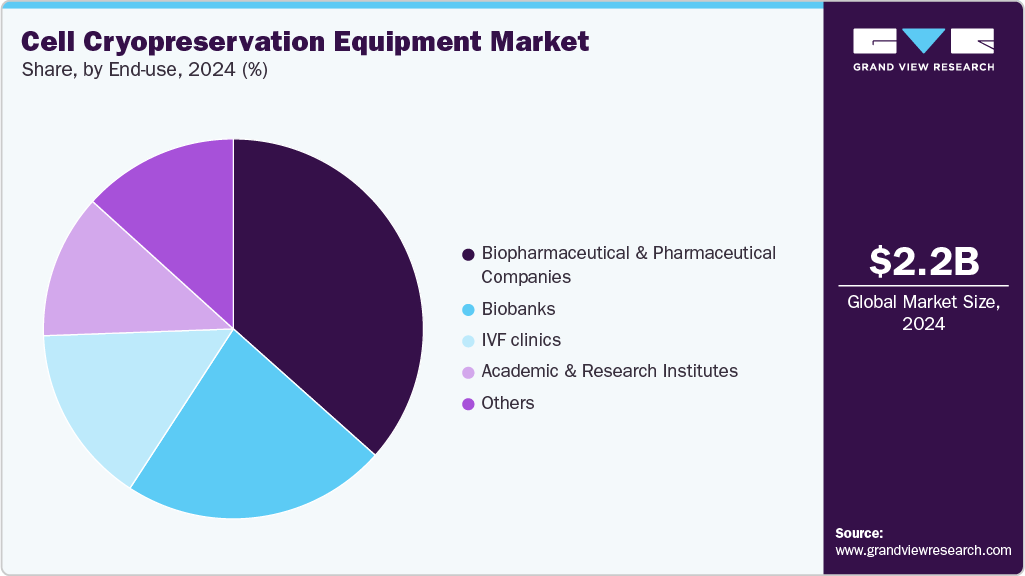

End Use Insights

The biopharmaceutical & pharmaceutical companies segment led the cell cryopreservation equipment market in 2024, with a share of 36.58%, driven by growing R&D spending, increased use of advanced therapies, product pipeline expansion, a growing emphasis on personalized medicine, and strategic partnerships to expand market reach and innovation.

The biobanks segment is expected to grow at the fastest CAGR over the forecast period, driven by increasing demand for stored biological samples in research and clinical trials, rising investments in genomics and personalized medicine, technological advancements in sample preservation, and growing collaborations between research institutions and pharmaceutical companies.

Regional Insights

North America held the largest share of 40.46% in the cell cryopreservation equipment market in 2024, driven by the region’s advanced healthcare infrastructure, high adoption of cell-based therapies, strong biopharmaceutical and research activity, and well-established biobanking and fertility preservation facilities.

U.S. Cell Cryopreservation Equipment Market Trends

The U.S. cell cryopreservation equipment industry is expected to grow due to rising demand for stem cell therapies, expanding biobanking and fertility services, increased R&D investment, and adoption of advanced cryopreservation technologies.

Europe Cell Cryopreservation Equipment Market Trends

Europe’s cell cryopreservation equipment industry is identified as a lucrative region due to the presence of advanced healthcare infrastructure, high adoption of regenerative medicine and cell-based therapies, well-established biobanks, and strong government support for research and development. In addition, growing investments in bioapplications, increasing clinical trials, and the presence of key market players contribute to the region’s significant growth potential.

The UK’s cell cryopreservation equipment market held a significant revenue share in 2024, driven by advancements in healthcare, robust regenerative medicine research, expanding biobanks, supportive government initiatives, and the growing adoption of advanced cryopreservation technologies.

The cell cryopreservation equipment market in Germany is expected to grow significantly over the forecast period, driven by supportive government policies, a robust biopharmaceutical sector, and the rising demand for efficient storage solutions in research and clinical applications.

Asia Pacific Cell Cryopreservation Equipment Market Trends

The Asia Pacific cell cryopreservation equipment industry is expected to grow at the fastest CAGR of 11.83% over the forecast period. This can be attributed to the rapid growth in the bioapplication and healthcare sectors, the increasing adoption of cell-based therapies, the expanding research infrastructure, and rising investments in biobanking and fertility preservation services across countries such as China, India, and Japan. For instance, in July 2025, EPIA launched India’s first pan-India at-home egg freezing program, providing medically supported oocyte cryopreservation services that enhance fertility access and drive demand for advanced cryopreservation equipment nationwide.

The cell cryopreservation equipment market in China is expected to grow over the forecast period, fueled by rising demand for advanced laboratory infrastructure, increasing clinical trials, and the country’s focus on developing cutting-edge cell therapy and regenerative medicine solutions.

The Japan cell cryopreservation equipment market is witnessing rapid growth due to government support for bioapplications, expansion of stem cell research initiatives, and rising demand for efficient storage solutions in fertility and clinical applications.

MEA Cell Cryopreservation Equipment Market Trends

The Middle East and Africa cell cryopreservation equipment industry is expected to witness strong growth, driven by investments in healthcare infrastructure, the increasing use of cell-based therapies, the expansion of biobanks, and a heightened focus on fertility and regenerative treatments. For instance, in May 2025, Iranian knowledge-based companies localized embryo cryopreservation equipment for nationwide IVF use, sharply reducing reliance on imports and boosting regional demand for advanced cell cryopreservation systems in fertility medicine, which further supports the regional market demand.

The cell cryopreservation equipment market in Kuwait is anticipated to grow over the forecast period, driven by government initiatives to modernize healthcare, increasing demand for personalized medicine, and the expansion of clinical and research facilities.

Key Cell Cryopreservation Equipment Company Insights

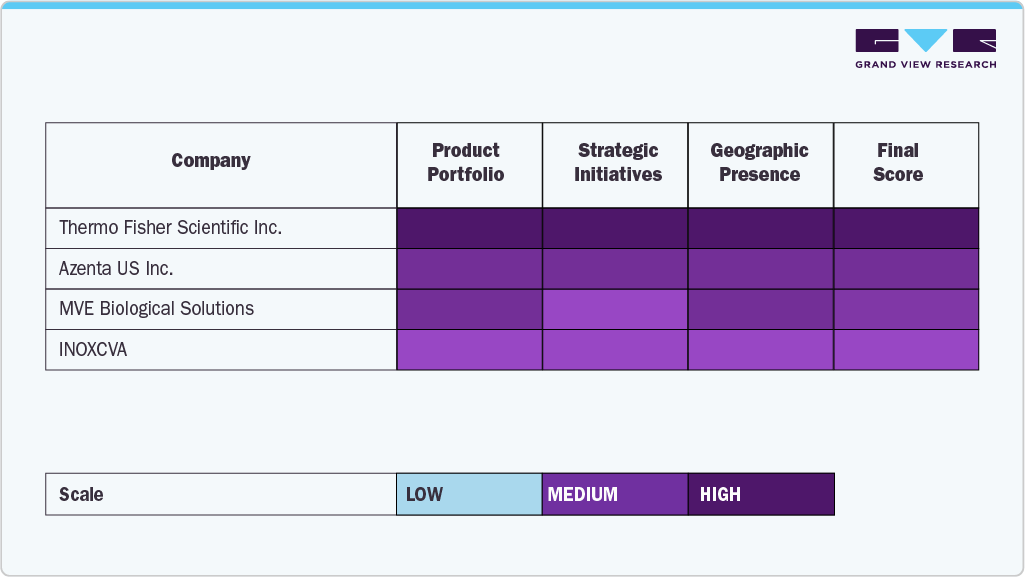

Several well-established companies dominate the cell cryopreservation equipment market thanks to their robust product lines, cutting-edge applications, and calculated R&D expenditures. Prominent firms, such as Thermo Fisher Scientific Inc.; Azenta US Inc.; MVE Biological Solutions; and INOXCVA have gained a sizable portion of the market by providing cutting-edge cryogenic storage systems, broad application coverage, and extensive international distribution networks.

Innovative solutions, such as ultra-low temperature freezers, automated storage systems, and customizable cryogenic platforms for biobanks, research labs, and pharmaceutical companies, are helping companies like Haier Biomedical, Kirsch GmbH, Planer (a Hamilton Thorne company), Eppendorf SE, and Labtron Equipment Ltd. increase their market share.

Key Cell Cryopreservation Equipment Companies:

The following are the leading companies in the cell cryopreservation equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Azenta US Inc.

- MVE Biological Solutions.

- INOXCVA

- Haier Biomedical

- Kirsch GmbH

- Planer, a Hamilton Thorne company

- Eppendorf SE

- Labtron Equipment Ltd.

Recent Developments

-

In May 2025, Azenta Life Sciences launched the sub-150°C Cryo Carrier in the United Kingdom, offering a portable, trackable LN₂ vapor-based solution for safe laboratory-to-laboratory transport of temperature-sensitive biological materials.

-

In April 2025, BioLife Solutions acquired Canada-based PanTHERA CryoSolutions to integrate its IRI cryopreservation technology, strengthening BioLife’s CGT biopreservation portfolio and supporting growing global demand for advanced cell cryopreservation equipment.

-

In March 2025, Cryoport’s MVE Biological Solutions launched the High-Efficiency 800°C cryogenic freezer in the United States, expanding its HE Series to meet the capacity and workflow needs of fertility clinics, biorepositories, and clinical laboratories.

Cell Cryopreservation Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.44 billion

Revenue forecast in 2033

USD 5.65 billion

Growth rate

CAGR of 11.08% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Azenta US Inc.; MVE Biological Solutions.; INOXCVA; Haier Biomedical; Kirsch GmbH; Planer, a Hamilton Thorne company; Eppendorf SE; Labtron Equipment Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cell Cryopreservation Equipment Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cell cryopreservation equipment market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Freezers

-

Liquid Nitrogen Supply Tanks

-

Incubators

-

-

Consumables/Accessories

-

Cryogenic vials

-

Cryogenic tubes

-

Cooler boxes/containers

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Stem Cells

-

Reproductive Cells

-

Bioproduction Cell Lines

-

Primary Cells

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Companies

-

Academic and Research Institutes

-

Biobanks

-

IVF clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell cryopreservation equipment market size was estimated at USD 2.20 billion in 2024 and is estimated to reach USD 2.44 billion in 2025.

b. The global cell cryopreservation equipment market size is projected to reach USD 5.65 billion by 2033, growing at a CAGR of 11.08% from 2025 to 2033,

b. The consumables/accessories segment dominated the market with a share of 64.29% in 2024 and is expected to grow fastest throughout the forecast period, driven by increasing demand for high-quality, reliable products, frequent replacement cycles, growing adoption across end-use industries, rising awareness about product efficiency, and advancements in material application, enhancing durability and performance.

b. Some of the key players of the market include Thermo Fisher Scientific Inc.; Azenta US Inc.; MVE Biological Solutions.; INOXCVA; Haier Biomedical; Kirsch GmbH; Planer, a Hamilton Thorne company; Eppendorf SE; Labtron Equipment Ltd.

b. Factors driving the Cell Cryopreservation Equipment market include the growing use of regenerative medicine, the expansion of stem cell banking and biobanking operations, and the rise in cell-based research.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.